Key Insights

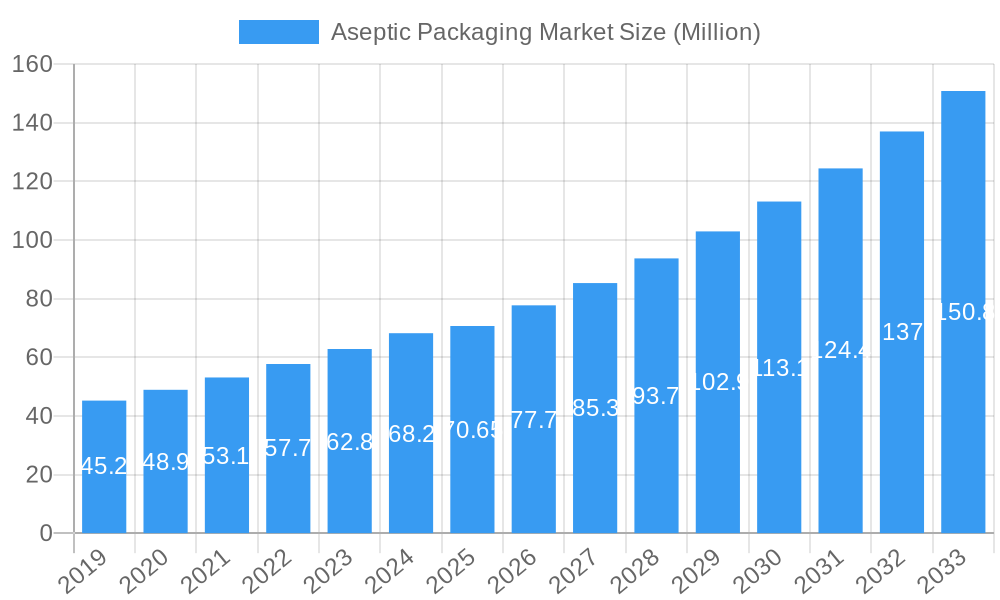

The global aseptic packaging market is projected for robust expansion, reaching an estimated market size of $70.65 million and exhibiting a Compound Annual Growth Rate (CAGR) of 10.47% over the forecast period of 2025-2033. This significant growth is primarily propelled by an increasing consumer demand for convenience, extended shelf life, and reduced food waste, particularly within the beverage and processed food sectors. The ready-to-drink (RTD) beverage segment, encompassing juices, dairy drinks, and innovative functional beverages, is a key driver, benefiting from its portability and convenience. Similarly, the demand for processed foods, fruits and vegetables, and dairy products that require long shelf lives without refrigeration further fuels the market. The pharmaceutical industry also contributes substantially, relying on aseptic packaging for sterile and safe delivery of liquid medications, injectables, and diagnostic kits. Technological advancements in material science, such as improved barrier properties of films and the development of sustainable packaging solutions, are also playing a crucial role in market expansion.

Aseptic Packaging Market Market Size (In Million)

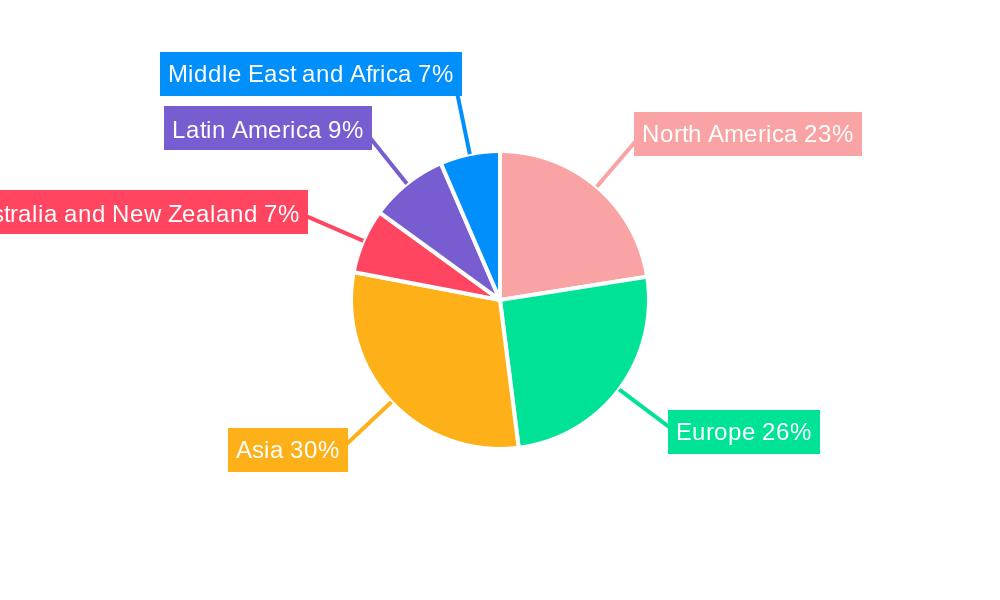

The market's trajectory is further shaped by emerging trends like the growing preference for single-serving and smaller package formats, catering to individual consumption patterns and reducing spoilage. The integration of smart packaging technologies, offering traceability and enhanced product integrity, is also gaining traction. Geographically, Asia is expected to witness the fastest growth due to a burgeoning middle class, rapid urbanization, and increasing adoption of modern retail formats, leading to higher demand for packaged goods. While the market presents substantial opportunities, it also faces certain restraints, including the initial high cost of aseptic packaging machinery and the environmental concerns associated with certain packaging materials, though the industry is actively addressing these through increased adoption of recyclable and biodegradable options. Companies like Tetra Pak International SA, Amcor Ltd, and Smurfit Kappa are at the forefront of innovation, shaping the competitive landscape through product development and strategic collaborations.

Aseptic Packaging Market Company Market Share

Aseptic Packaging Market: Revolutionizing Shelf-Stable Product Preservation – Comprehensive Report 2025-2033

The aseptic packaging market is experiencing significant growth, driven by increasing demand for convenient, shelf-stable food and beverage products, coupled with advancements in packaging technology. This report provides an in-depth analysis of the global aseptic packaging market, covering market structure, competitive landscape, trends, opportunities, dominant segments, product analysis, key drivers, barriers, challenges, major players, industry milestones, and future outlook. The study period spans from 2019 to 2033, with a base year and estimated year of 2025, and a forecast period from 2025 to 2033, encompassing historical data from 2019 to 2024.

Aseptic Packaging Market Market Structure & Competitive Landscape

The aseptic packaging market is characterized by a moderate to high level of concentration, with a few dominant global players holding substantial market share. Innovation remains a key differentiator, with companies continuously investing in research and development to enhance material sustainability, barrier properties, and filling technologies. Regulatory landscapes, particularly concerning food safety and environmental impact, play a crucial role in shaping market dynamics and driving adoption of compliant packaging solutions. The threat of product substitutes, such as retort packaging and traditional canning, is present but often outweighed by the superior shelf-life and reduced processing requirements offered by aseptic packaging. End-user segmentation is diverse, spanning beverages, food, and pharmaceuticals, each with unique requirements and growth trajectories. Merger and acquisition (M&A) activities are observed as companies seek to expand their geographic reach, product portfolios, and technological capabilities, further consolidating the market. For instance, an estimated XX billion dollars in M&A value was recorded in the historical period, indicative of strategic consolidation. Concentration ratios for the top 3 players are estimated at XX%, highlighting the market's competitive intensity.

Aseptic Packaging Market Market Trends & Opportunities

The global aseptic packaging market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033, reaching an estimated market size of XXX Billion dollars by 2033. This expansion is fueled by a confluence of evolving consumer preferences for convenience and longer shelf-life, alongside significant technological advancements in materials science and filling machinery. The increasing global urbanization and the resulting demand for ready-to-consume food and beverages are major contributors to market growth. Furthermore, the heightened awareness regarding food waste reduction and the need for efficient supply chains are bolstering the adoption of aseptic packaging solutions. Technological shifts are focused on enhancing sustainability, with a growing emphasis on renewable and recyclable materials, reducing the reliance on fossil fuel-based plastics. Opportunities abound in emerging economies, where improving disposable incomes and expanding retail infrastructure are creating new markets for packaged goods. Competitive dynamics are intensely driven by product innovation, cost-efficiency, and the ability to offer customized packaging solutions for diverse product applications. Market penetration rates for aseptic packaging are expected to rise significantly across various food and beverage categories, driven by its inherent advantages in preserving product quality and nutritional value without refrigeration. The rising demand for plant-based beverages and alternative dairy products also presents a significant growth avenue, as these products often benefit from aseptic processing and packaging to maintain freshness and stability. The pharmaceutical sector's increasing reliance on sterile, single-dose packaging for injectables and biologics further contributes to the market's upward trajectory. The market is also seeing a trend towards smaller, on-the-go packaging formats, catering to the busy lifestyles of modern consumers.

Dominant Markets & Segments in Aseptic Packaging Market

The global aseptic packaging market is dominated by the Beverage application segment, which is expected to hold a significant market share of approximately XX% in 2025. Within beverages, Ready-to-drink Beverages are leading the charge, driven by their widespread popularity and convenience, contributing an estimated XX Billion dollars to the market in 2025. Dairy-based Beverages also represent a substantial and growing sub-segment. The Food application segment follows closely, with Processed Food being a key contributor, benefiting from extended shelf-life and reduced spoilage. Fruits and Vegetables and Dairy Food are also witnessing increased adoption of aseptic packaging. The Cartons product type holds the largest market share, estimated at XX% in 2025, owing to their cost-effectiveness, light weight, and excellent barrier properties, particularly for liquid products. Bags and Pouches are also gaining traction due to their flexibility and sustainability advantages. Geographically, Asia Pacific is emerging as the fastest-growing region, driven by a burgeoning middle class, rapid urbanization, and increasing demand for packaged foods and beverages. Countries like China, India, and Southeast Asian nations are key growth engines, supported by favorable government policies promoting food processing and packaging infrastructure development. North America and Europe remain mature markets, with a strong focus on sustainable and high-barrier packaging solutions. Key growth drivers in these dominant segments include:

- Beverage:

- Growing consumer preference for convenience and on-the-go consumption.

- Expansion of the ready-to-drink (RTD) beverage market.

- Increased demand for nutritional beverages and plant-based alternatives.

- Improvements in cold chain logistics and a need for ambient storage solutions.

- Food:

- Rising demand for processed and convenient food options.

- Emphasis on food safety and extended shelf-life to reduce spoilage.

- Growth in the ready-to-eat meal market.

- Increasing adoption of aseptic packaging for fruits, vegetables, and sauces.

- Cartons:

- Cost-effectiveness and recyclability.

- Excellent barrier properties against light, oxygen, and moisture.

- Ideal for high-volume liquid packaging like milk, juices, and soups.

- Technological advancements in carton design and material composition.

Aseptic Packaging Market Product Analysis

Aseptic packaging encompasses a range of products including cartons, bags and pouches, cans, and bottles, each offering unique advantages. Cartons, often multilayered structures, dominate the market for liquid products due to their excellent barrier properties and cost-effectiveness. Bags and pouches are gaining popularity for their flexibility, reduced material usage, and suitability for various food products and single-serving formats. Cans, while traditional, are also being adapted for aseptic filling, particularly for products requiring robust protection. Bottles, especially in plastic, are increasingly incorporating aseptic filling technologies for beverages and pharmaceuticals. Innovations focus on enhancing barrier performance, reducing material weight, improving recyclability, and integrating smart features. The competitive advantage lies in offering tailored solutions that balance product protection, cost, sustainability, and consumer convenience.

Key Drivers, Barriers & Challenges in Aseptic Packaging Market

The aseptic packaging market is propelled by several key drivers, including the escalating global demand for shelf-stable food and beverages, the need to reduce food waste through extended product shelf-life, and increasing consumer preference for convenient, ready-to-consume products. Technological advancements in material science and filling machinery, leading to enhanced product integrity and reduced processing costs, are also significant drivers. Furthermore, growing investments in food processing infrastructure, particularly in emerging economies, are fueling market expansion.

However, the market faces certain barriers and challenges. High initial investment costs for aseptic processing and filling equipment can be a restraint for smaller manufacturers. Regulatory complexities and evolving standards for food contact materials can also pose challenges. Fluctuations in raw material prices, especially for polymers and aluminum, can impact profitability. Competitive pressures from alternative packaging solutions and the ongoing debate around the recyclability and environmental impact of certain aseptic packaging materials present ongoing challenges. Supply chain disruptions and the need for specialized logistics for aseptic products can also affect market growth.

Growth Drivers in the Aseptic Packaging Market Market

Several key growth drivers are shaping the aseptic packaging market. The relentless global demand for extended shelf-life food and beverage products remains a primary catalyst. This demand is directly linked to reducing food spoilage and improving supply chain efficiency. Technological advancements in polymer science and barrier materials are continuously enhancing the protective qualities of aseptic packaging, enabling longer storage times and better preservation of nutritional value. Economic growth in emerging markets, coupled with rising disposable incomes, is leading to increased consumption of packaged goods, thereby driving the adoption of aseptic solutions. Furthermore, a growing consumer consciousness around health and wellness is fueling demand for nutritious, ready-to-consume products that benefit from aseptic processing. Government initiatives promoting food safety standards and investments in food processing infrastructure also play a vital role in market expansion.

Challenges Impacting Aseptic Packaging Market Growth

Despite its robust growth, the aseptic packaging market encounters several challenges. The significant capital investment required for aseptic filling lines and processing equipment presents a substantial barrier, particularly for small and medium-sized enterprises (SMEs). The complex multi-layer composition of some aseptic packaging materials can also lead to challenges in recycling and waste management, raising environmental concerns. Fluctuations in the prices of key raw materials, such as aluminum foil, plastic resins, and paperboard, can create cost volatility and impact profit margins for manufacturers. Stringent and evolving regulatory frameworks governing food contact materials and packaging safety necessitate continuous adaptation and compliance efforts. Moreover, intense competition from alternative preservation and packaging technologies, including traditional canning and retort pouches, continues to exert pressure on market share. The need for specialized infrastructure for aseptic product distribution and storage also adds a layer of complexity.

Key Players Shaping the Aseptic Packaging Market Market

- Mondi PLC

- Elopak AS

- Uflex Limited

- CDF Corporation

- DS Smith PLC

- SIG Combibloc Group

- IPI SRL (Coesia Group)

- BIBP SP ZOO

- Smurfit Kappa

- Tetra Pak International SA

- Amcor Ltd

Significant Aseptic Packaging Market Industry Milestones

- November 2023: Tetra Pak and Lactogal introduced a new aseptic beverage carton featuring a paper-based barrier. This initiative, part of a validation program in Portugal involving approximately 25 million packages, utilizes a carton with about 80% paperboard, boosting renewable content to 90%. The carton demonstrated a 33% reduction in its carbon footprint and achieved Carbon Neutral certification from the Carbon Trust. Industrial-scale production of this solution is targeted for 2025.

- October 2023: SIG launched SIG DomeMini, an on-the-go aseptic carton pack combining the convenience of a plastic bottle with reduced size and enhanced recyclability. The associated SIG DomeMini 12 Aseptic filling machine operates at 12,000 packages per hour and allows for volume changes in just 15 minutes, aiming to boost efficiency and flexibility for beverage manufacturers.

Future Outlook for Aseptic Packaging Market Market

The future outlook for the aseptic packaging market remains exceptionally positive, driven by ongoing innovation and evolving consumer demands. The market is poised for continued expansion, with a strong emphasis on sustainability and the development of advanced packaging materials. Growth catalysts include the increasing integration of renewable and biodegradable components in packaging, alongside the development of smart packaging solutions that offer enhanced traceability and shelf-life monitoring. Opportunities lie in catering to the growing demand for specialized aseptic packaging for medical foods, infant nutrition, and pharmaceuticals. The expansion of e-commerce and direct-to-consumer (DTC) models for food and beverages will also further propel the adoption of reliable and convenient aseptic packaging. Strategic collaborations between packaging manufacturers, food and beverage companies, and research institutions will be crucial in driving technological advancements and addressing environmental concerns, ensuring the long-term viability and growth of the aseptic packaging market. The market is expected to witness a sustained CAGR of approximately XX% from 2025 to 2033.

Aseptic Packaging Market Segmentation

-

1. Product

- 1.1. Cartons

- 1.2. Bags and Pouches

- 1.3. Cans

- 1.4. Bottles

-

2. Application

-

2.1. Beverage

- 2.1.1. Ready-to-drink Beverages

- 2.1.2. Dairy-based Beverages

-

2.2. Food

- 2.2.1. Processed Food

- 2.2.2. Fruits and Vegetables

- 2.2.3. Dairy Food

- 2.3. Pharmaceuticals

-

2.1. Beverage

Aseptic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 4. Australia and New Zealand

-

5. Latin America

- 5.1. Brazil

- 5.2. Argentina

-

6. Middle East and Africa

- 6.1. United Arab Emirates

- 6.2. Saudi Arabia

- 6.3. South Africa

Aseptic Packaging Market Regional Market Share

Geographic Coverage of Aseptic Packaging Market

Aseptic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Beverages; Commodity Value of Glass Increased With Recyclability

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Regulations in the Region

- 3.4. Market Trends

- 3.4.1. The Growing Demand for Beverages is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Cartons

- 5.1.2. Bags and Pouches

- 5.1.3. Cans

- 5.1.4. Bottles

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.1.1. Ready-to-drink Beverages

- 5.2.1.2. Dairy-based Beverages

- 5.2.2. Food

- 5.2.2.1. Processed Food

- 5.2.2.2. Fruits and Vegetables

- 5.2.2.3. Dairy Food

- 5.2.3. Pharmaceuticals

- 5.2.1. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Cartons

- 6.1.2. Bags and Pouches

- 6.1.3. Cans

- 6.1.4. Bottles

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Beverage

- 6.2.1.1. Ready-to-drink Beverages

- 6.2.1.2. Dairy-based Beverages

- 6.2.2. Food

- 6.2.2.1. Processed Food

- 6.2.2.2. Fruits and Vegetables

- 6.2.2.3. Dairy Food

- 6.2.3. Pharmaceuticals

- 6.2.1. Beverage

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Cartons

- 7.1.2. Bags and Pouches

- 7.1.3. Cans

- 7.1.4. Bottles

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Beverage

- 7.2.1.1. Ready-to-drink Beverages

- 7.2.1.2. Dairy-based Beverages

- 7.2.2. Food

- 7.2.2.1. Processed Food

- 7.2.2.2. Fruits and Vegetables

- 7.2.2.3. Dairy Food

- 7.2.3. Pharmaceuticals

- 7.2.1. Beverage

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Cartons

- 8.1.2. Bags and Pouches

- 8.1.3. Cans

- 8.1.4. Bottles

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Beverage

- 8.2.1.1. Ready-to-drink Beverages

- 8.2.1.2. Dairy-based Beverages

- 8.2.2. Food

- 8.2.2.1. Processed Food

- 8.2.2.2. Fruits and Vegetables

- 8.2.2.3. Dairy Food

- 8.2.3. Pharmaceuticals

- 8.2.1. Beverage

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Australia and New Zealand Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Cartons

- 9.1.2. Bags and Pouches

- 9.1.3. Cans

- 9.1.4. Bottles

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Beverage

- 9.2.1.1. Ready-to-drink Beverages

- 9.2.1.2. Dairy-based Beverages

- 9.2.2. Food

- 9.2.2.1. Processed Food

- 9.2.2.2. Fruits and Vegetables

- 9.2.2.3. Dairy Food

- 9.2.3. Pharmaceuticals

- 9.2.1. Beverage

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Latin America Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Cartons

- 10.1.2. Bags and Pouches

- 10.1.3. Cans

- 10.1.4. Bottles

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Beverage

- 10.2.1.1. Ready-to-drink Beverages

- 10.2.1.2. Dairy-based Beverages

- 10.2.2. Food

- 10.2.2.1. Processed Food

- 10.2.2.2. Fruits and Vegetables

- 10.2.2.3. Dairy Food

- 10.2.3. Pharmaceuticals

- 10.2.1. Beverage

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Middle East and Africa Aseptic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product

- 11.1.1. Cartons

- 11.1.2. Bags and Pouches

- 11.1.3. Cans

- 11.1.4. Bottles

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Beverage

- 11.2.1.1. Ready-to-drink Beverages

- 11.2.1.2. Dairy-based Beverages

- 11.2.2. Food

- 11.2.2.1. Processed Food

- 11.2.2.2. Fruits and Vegetables

- 11.2.2.3. Dairy Food

- 11.2.3. Pharmaceuticals

- 11.2.1. Beverage

- 11.1. Market Analysis, Insights and Forecast - by Product

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Mondi PLC*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Elopak AS

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Uflex Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 CDF Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 DS Smith PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 SIG Combibloc Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 IPI SRL (Coesia Group)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 BIBP SP ZOO

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Smurfit Kappa

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Tetra Pak International SA

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Amcor Ltd

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Mondi PLC*List Not Exhaustive

List of Figures

- Figure 1: Global Aseptic Packaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 9: Europe Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 15: Asia Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 21: Australia and New Zealand Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Australia and New Zealand Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Australia and New Zealand Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Australia and New Zealand Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 27: Latin America Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 28: Latin America Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Aseptic Packaging Market Revenue (Million), by Product 2025 & 2033

- Figure 33: Middle East and Africa Aseptic Packaging Market Revenue Share (%), by Product 2025 & 2033

- Figure 34: Middle East and Africa Aseptic Packaging Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Aseptic Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Aseptic Packaging Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Aseptic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Aseptic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: India Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 23: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 26: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: Brazil Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Argentina Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Aseptic Packaging Market Revenue Million Forecast, by Product 2020 & 2033

- Table 31: Global Aseptic Packaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Aseptic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: United Arab Emirates Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Saudi Arabia Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Aseptic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aseptic Packaging Market?

The projected CAGR is approximately 10.47%.

2. Which companies are prominent players in the Aseptic Packaging Market?

Key companies in the market include Mondi PLC*List Not Exhaustive, Elopak AS, Uflex Limited, CDF Corporation, DS Smith PLC, SIG Combibloc Group, IPI SRL (Coesia Group), BIBP SP ZOO, Smurfit Kappa, Tetra Pak International SA, Amcor Ltd.

3. What are the main segments of the Aseptic Packaging Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 70.65 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Beverages; Commodity Value of Glass Increased With Recyclability.

6. What are the notable trends driving market growth?

The Growing Demand for Beverages is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Dynamic Nature of Regulations in the Region.

8. Can you provide examples of recent developments in the market?

November 2023: Tetra Pak and Lactogal introduced a new aseptic beverage carton featuring a paper-based barrier. As a component of a substantial technology validation initiative in Portugal, encompassing around 25 million packages, this carton comprises approximately 80% paperboard and elevates the renewable content to 90%. Notably, it diminished its carbon footprint by a third (33%) and attained Carbon Neutral certification from the Carbon Trust. The company aspires to achieve industrial-scale production of the solution by 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aseptic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aseptic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aseptic Packaging Market?

To stay informed about further developments, trends, and reports in the Aseptic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence