Key Insights

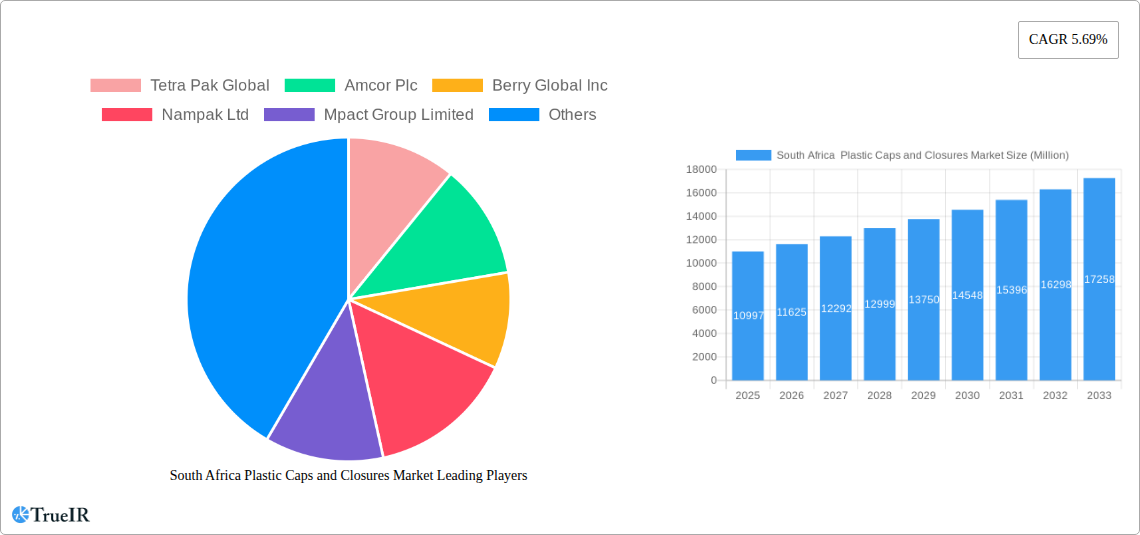

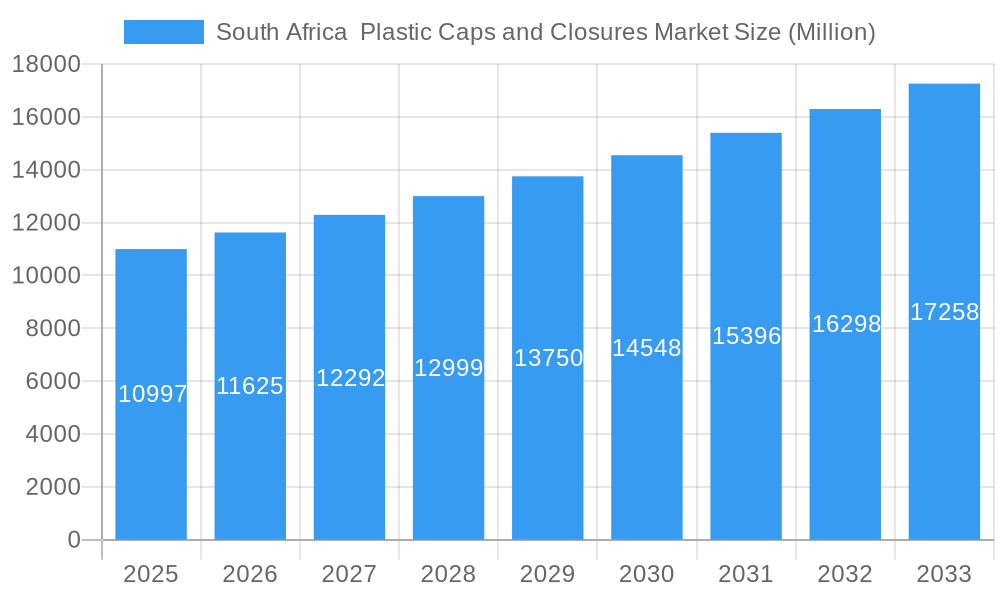

The South African plastic caps and closures market is poised for significant growth, with an estimated market size of R10,997 million in 2025 and projected to expand at a Compound Annual Growth Rate (CAGR) of 5.69% through 2033. This expansion is largely driven by the robust demand from the food and beverage sector, particularly bottled water and carbonated soft drinks, which are core to daily consumption patterns in South Africa. The increasing preference for convenient and safe packaging solutions, coupled with the growing middle class and evolving consumer lifestyles, further fuels this demand. Key resin types like Polyethylene (PE) and Polypropylene (PP) are anticipated to dominate the market due to their cost-effectiveness and versatile properties, making them ideal for a wide array of cap and closure applications. Child-resistant closures are also gaining traction, especially in the personal care and household chemicals segments, reflecting a heightened focus on consumer safety and regulatory compliance.

South Africa Plastic Caps and Closures Market Market Size (In Billion)

Emerging trends in the South African market include a growing emphasis on sustainable packaging solutions and the adoption of innovative designs that enhance user experience and product integrity. Manufacturers are increasingly exploring lightweighting techniques and the use of recycled content to meet environmental regulations and consumer preferences for eco-friendly products. While the market benefits from strong demand drivers, potential restraints include fluctuating raw material prices, particularly for polymers derived from crude oil, and the ongoing global supply chain disruptions which can impact production costs and availability. However, the inherent necessity of caps and closures across diverse end-user industries, from essential food and beverages to personal care and household items, ensures a resilient market outlook, with opportunities for innovation in material science and manufacturing processes to overcome these challenges and capitalize on market expansion.

South Africa Plastic Caps and Closures Market Company Market Share

South Africa Plastic Caps and Closures Market: Comprehensive Market Analysis & Growth Forecast (2019-2033)

This in-depth report provides a dynamic, SEO-optimized analysis of the South Africa plastic caps and closures market. Leveraging high-volume keywords like "South Africa plastic caps," "plastic closures market," "PET caps," "PE closures," and "beverage packaging," this report is designed to enhance search rankings and engage key industry stakeholders. Covering the historical period from 2019 to 2024, the base year of 2025, and a comprehensive forecast period extending to 2033, this study delves into market structure, trends, dominant segments, product innovations, growth drivers, challenges, key players, and future outlook. With a market size estimated at xx Million in 2025, the market is projected to grow at a CAGR of xx% during the forecast period.

South Africa Plastic Caps and Closures Market Market Structure & Competitive Landscape

The South Africa plastic caps and closures market exhibits a moderately concentrated structure, with key players actively engaging in strategic initiatives to maintain and expand their market share. Innovation remains a critical driver, fueled by evolving consumer demands for convenience, safety, and sustainability. Regulatory frameworks, particularly those concerning plastic waste management and recycled content, are increasingly influencing product development and market entry strategies. Substitutes like metal caps, while present, face challenges in cost-effectiveness and material versatility for many applications. End-user segmentation analysis reveals strong reliance on the food and beverage sectors, with robust growth anticipated in bottled water and carbonated soft drinks. Mergers and acquisitions (M&A) activity is expected to play a role in market consolidation, with an estimated xx M&A deals in the historical period, valued at approximately R xxx Million. Key companies like Tetra Pak Global, Amcor Plc, and Berry Global Inc. are at the forefront of competitive strategies, focusing on technological advancements and expanding their product portfolios. The market's competitive intensity is further shaped by the presence of established local manufacturers such as Nampak Ltd and Mpact Group Limited.

South Africa Plastic Caps and Closures Market Market Trends & Opportunities

The South Africa plastic caps and closures market is experiencing robust growth, driven by increasing demand from the food and beverage industries, coupled with a rising emphasis on sustainable packaging solutions. The market size, estimated at xx Million in the base year 2025, is projected to expand significantly throughout the forecast period. Technological advancements are playing a pivotal role, with a notable trend towards lightweighting of caps and closures to reduce material consumption and associated costs. Innovations in dispensing closures, offering enhanced user convenience and product control, are gaining traction across various end-user segments. Furthermore, the growing consumer awareness regarding environmental impact is accelerating the adoption of recycled plastic content in caps and closures. This presents a substantial opportunity for manufacturers who can develop and offer high-quality, cost-effective solutions incorporating post-consumer recycled (PCR) materials. The market is also witnessing an increased demand for child-resistant closures, driven by stringent safety regulations in the pharmaceutical and household chemical sectors. Competitive dynamics are characterized by a blend of global players and strong local manufacturers, each vying for market share through product differentiation, pricing strategies, and efficient supply chain management. The overall market penetration rate for plastic caps and closures is expected to climb, reflecting their indispensable role in product packaging across diverse industries. The CAGR for the forecast period is projected to be xx%, indicating a healthy growth trajectory. Emerging opportunities lie in the development of smart caps with integrated tracking or authentication features, catering to the evolving needs of the supply chain and consumer engagement. The trend towards smaller pack sizes and single-serve formats, particularly in the beverage sector, also fuels the demand for a higher volume of caps and closures.

Dominant Markets & Segments in South Africa Plastic Caps and Closures Market

The South Africa plastic caps and closures market is dominated by the Beverage end-user industry, with specific sub-segments like Bottled Water and Carbonated Soft Drinks exhibiting the highest growth potential. The extensive consumption of these beverages across South Africa, coupled with increasing urbanization and disposable incomes, directly translates to a higher demand for plastic caps and closures. In terms of resin, Polyethylene (PE) and Polyethylene Terephthalate (PET) are the leading materials, owing to their excellent sealing properties, durability, and cost-effectiveness. PET is particularly dominant in beverage applications due to its clarity and barrier properties. The Threaded product type holds the largest market share, driven by its widespread application in screw-top bottles and jars. However, Dispensing closures are witnessing a surge in demand due to their convenience and controlled flow, especially in household chemicals and personal care products.

Key growth drivers for the Beverage segment include:

- Increasing bottled water consumption due to health consciousness and concerns over tap water quality.

- Steady demand for carbonated soft drinks driven by marketing initiatives and diverse product offerings.

- Growth in the Juices & Energy Drinks sub-segment, reflecting changing lifestyle patterns.

The Food industry also represents a significant market, with caps and closures essential for maintaining freshness and safety in dairy products, sauces, and dry goods. The Personal Care & Cosmetics and Household Chemicals sectors are also substantial contributors, with a growing demand for specialized closures that offer ease of use and prevent spillage. The Child-resistant product type, while a niche segment, is experiencing robust growth due to stringent safety regulations, particularly in household chemicals and pharmaceuticals. The Polypropylene (PP) resin is also gaining traction due to its versatility and chemical resistance, finding applications across various end-user industries. The market's dominance is further bolstered by ongoing infrastructure development and favorable government policies promoting local manufacturing and packaging innovation.

South Africa Plastic Caps and Closures Market Product Analysis

Product innovation in the South Africa plastic caps and closures market is largely centered on enhancing functionality, sustainability, and safety. Lightweighting initiatives are a prominent trend, focusing on reducing material usage without compromising on sealing integrity. The development of advanced dispensing closures, offering precise dosage control and drip-free functionality, is catering to the increasing demand for convenience in the personal care and household chemical sectors. Furthermore, there's a significant push towards incorporating recycled content, with advancements in processing technologies enabling the production of high-quality caps and closures from post-consumer recycled resins, meeting both environmental goals and regulatory requirements. The competitive advantage lies with manufacturers who can deliver innovative, sustainable, and cost-effective solutions that align with the evolving needs of diverse end-user industries.

Key Drivers, Barriers & Challenges in South Africa Plastic Caps and Closures Market

Key Drivers: The South Africa plastic caps and closures market is propelled by several key drivers, including the burgeoning demand from the rapidly expanding food and beverage sectors, particularly for bottled water and carbonated soft drinks. Technological advancements leading to lighter, more functional, and tamper-evident closures are also significant growth catalysts. Growing consumer preference for convenience and single-serve packaging formats further fuels demand. Supportive government policies promoting domestic manufacturing and the increasing adoption of sustainable packaging solutions, such as those incorporating recycled content, are also crucial growth enablers.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. Fluctuations in raw material prices, particularly for PET and PE resins, can impact profitability and pricing strategies. Stringent environmental regulations concerning plastic waste management and the mandate for increased recycled content, while driving innovation, can also pose compliance challenges and require significant investment in new technologies. Intense competition from both domestic and international players exerts pressure on profit margins. Supply chain disruptions, as observed in recent global events, can affect the availability of raw materials and finished goods. The cost of implementing advanced recycling technologies and ensuring the quality of recycled materials remains a barrier for some smaller manufacturers.

Growth Drivers in the South Africa Plastic Caps and Closures Market Market

The South Africa plastic caps and closures market is experiencing robust growth driven by several interconnected factors. Technologically, the development of innovative dispensing closures and tamper-evident seals enhances product safety and user convenience, appealing to consumers across various segments. Economically, the rising disposable incomes in South Africa and the increasing urbanization are leading to a higher consumption of packaged goods, especially in the food and beverage sectors, thereby directly boosting demand for caps and closures. Policy-wise, government initiatives aimed at promoting local manufacturing and recycling, coupled with the growing corporate emphasis on sustainability, are creating a favorable environment for the adoption of advanced and eco-friendly packaging solutions.

Challenges Impacting South Africa Plastic Caps and Closures Market Growth

The growth of the South Africa plastic caps and closures market is significantly impacted by several challenges. Regulatory complexities surrounding plastic waste management and the evolving requirements for recycled content can necessitate substantial investment in compliance and process adaptation. Supply chain vulnerabilities, including the availability and cost volatility of raw petrochemical feedstocks, pose a constant threat to production schedules and pricing stability. Intense competitive pressures from a fragmented market landscape can lead to price wars and squeezed profit margins, particularly for smaller players. Furthermore, public perception and the ongoing debate around single-use plastics can indirectly influence consumer choices and brand strategies, requiring manufacturers to proactively demonstrate their commitment to sustainability.

Key Players Shaping the South Africa Plastic Caps and Closures Market Market

- Tetra Pak Global

- Amcor Plc

- Berry Global Inc

- Nampak Ltd

- Mpact Group Limited

- Polyoak Packaging

- Nioro Plastics (Pty) Ltd

- Cherry & Co

Significant South Africa Plastic Caps and Closures Market Industry Milestones

- December 2023: Switch Energy Drink launched G-Force, a limited-edition energy drink, through a pioneering partnership with Biogen South Africa, showcasing an integration of energy technology with wellness branding and highlighting innovative beverage packaging.

- October 2023: Safripol introduced a new rPET product, incorporating 15% to 25% post-consumer recycled plastic resin. This "one bag" solution simplifies compliance for customers, enabling the creation of products that meet and exceed South Africa's Waste Act stipulations for recycled post-consumer waste content.

Future Outlook for South Africa Plastic Caps and Closures Market Market

The future outlook for the South Africa plastic caps and closures market is promising, driven by continued innovation and a strong focus on sustainability. Growth catalysts include the increasing demand for convenient and safe packaging solutions in the food, beverage, and personal care sectors. The market is poised to benefit from advancements in recycling technologies and the wider adoption of recycled content, aligning with global environmental goals and regulatory mandates. Opportunities for expansion lie in developing smart packaging solutions, lightweight designs, and specialized closures catering to niche applications. Strategic collaborations between raw material suppliers, manufacturers, and end-users will be crucial for navigating market complexities and unlocking new growth avenues. The market is expected to witness a steady upward trajectory, with a particular emphasis on eco-friendly and performance-driven packaging products.

South Africa Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-resistant

-

3. End-User Industry

- 3.1. Food

-

3.2. Beverage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices & Energy Drinks

- 3.2.5. Other Bevrages

- 3.3. Personal Care & Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-use Industries

South Africa Plastic Caps and Closures Market Segmentation By Geography

- 1. South Africa

South Africa Plastic Caps and Closures Market Regional Market Share

Geographic Coverage of South Africa Plastic Caps and Closures Market

South Africa Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth

- 3.3. Market Restrains

- 3.3.1. Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Plastic Caps and Closures Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices & Energy Drinks

- 5.3.2.5. Other Bevrages

- 5.3.3. Personal Care & Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-use Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tetra Pak Global

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Plc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nampak Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mpact Group Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polyoak Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nioro Plastics (Pty) Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cherry & Co

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Tetra Pak Global

List of Figures

- Figure 1: South Africa Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Plastic Caps and Closures Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 2: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 3: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 5: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 6: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 7: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2020 & 2033

- Table 10: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2020 & 2033

- Table 11: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 13: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 14: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by End-User Industry 2020 & 2033

- Table 15: South Africa Plastic Caps and Closures Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: South Africa Plastic Caps and Closures Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Plastic Caps and Closures Market?

The projected CAGR is approximately 5.69%.

2. Which companies are prominent players in the South Africa Plastic Caps and Closures Market?

Key companies in the market include Tetra Pak Global, Amcor Plc, Berry Global Inc, Nampak Ltd, Mpact Group Limited, Polyoak Packaging, Nioro Plastics (Pty) Ltd, Cherry & Co.

3. What are the main segments of the South Africa Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Witness Growth.

7. Are there any restraints impacting market growth?

Plastic Industry is Driving the Market Growth; Need for Recycled Plastic to Witness Growth.

8. Can you provide examples of recent developments in the market?

December 2023: Switch Energy Drink, a player in the energy beverage sector, unveiled G-Force, a limited-edition energy drink from a pioneering partnership with Biogen South Africa, a distinguished wellness brand known for its top-tier vitamin and supplement offerings. G-Force epitomizes the fusion of cutting-edge energy tech and Biogen South Africa's wellness ethos. This joint effort promises a potent energy kick but guarantees a revitalizing drinking experience, showcasing both brands' dedication.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the South Africa Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence