Key Insights

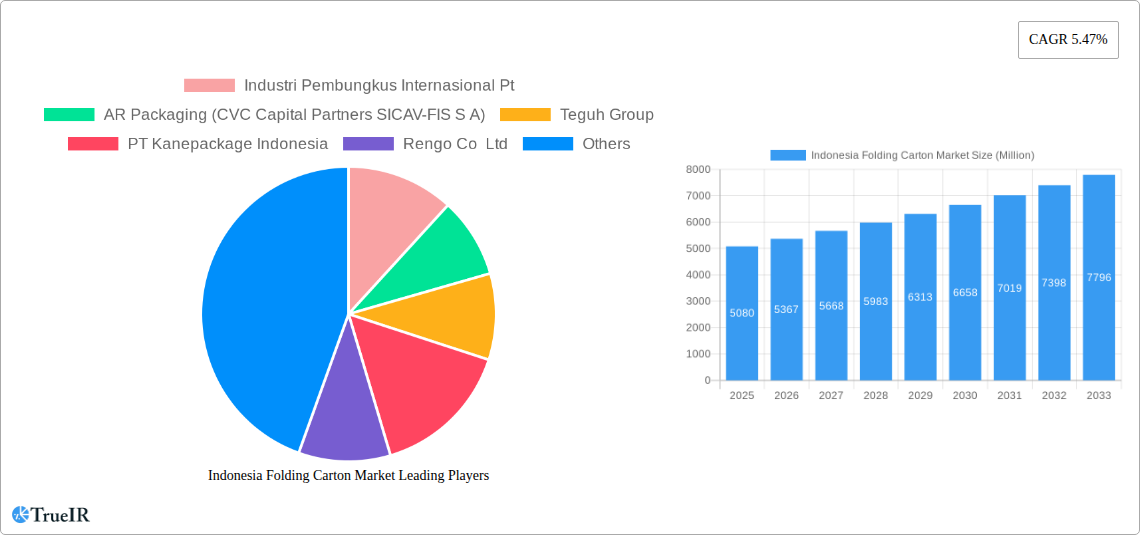

The Indonesian folding carton market is poised for robust expansion, projected to reach a significant market size with a Compound Annual Growth Rate (CAGR) of 5.47% over the forecast period of 2025-2033. This growth is underpinned by burgeoning demand across diverse end-user industries, most notably Food and Beverages, which represents a substantial segment due to the country's large population and evolving consumer lifestyles. The Healthcare sector is another key driver, fueled by an increasing focus on public health, pharmaceutical packaging needs, and the growing elderly population. Furthermore, the Household and Personal Care segment is experiencing a surge in demand for attractive and functional packaging solutions, driven by brand proliferation and consumer purchasing power. Industrial applications, while perhaps a smaller segment, also contribute to the overall market dynamism, encompassing packaging for electronics, automotive parts, and various manufactured goods. The market's trajectory is further supported by innovative trends in sustainable packaging, with a growing preference for recyclable and biodegradable materials, aligning with global environmental initiatives and governmental regulations.

Indonesia Folding Carton Market Market Size (In Billion)

Key players within the Indonesian folding carton landscape, including established entities like PT. Industri Pembungkus Internasional, AR Packaging, Teguh Group, and Rengo Co. Ltd., are actively investing in technological advancements and capacity expansion to meet this rising demand. The market is characterized by a competitive environment where companies are differentiating themselves through superior product quality, customized packaging solutions, and efficient supply chain management. While the market exhibits strong growth potential, certain restraints could influence its pace. These might include fluctuations in raw material prices, particularly for paper and pulp, and potential disruptions in the supply chain. Additionally, stringent environmental regulations, while a driver for sustainable solutions, can also present compliance challenges for some manufacturers. However, the overarching positive sentiment, driven by India's economic growth and increasing disposable incomes, positions the folding carton market for sustained and significant development in the coming years.

Indonesia Folding Carton Market Company Market Share

Indonesia Folding Carton Market: Comprehensive Market Analysis and Forecast 2019-2033

This in-depth report offers an exhaustive analysis of the Indonesia Folding Carton Market, providing crucial insights into its structure, trends, opportunities, and competitive landscape. Leveraging extensive data and expert analysis, this report caters to industry stakeholders seeking to understand the present dynamics and future trajectory of the Indonesian folding carton sector. Covering the historical period from 2019 to 2024, the base year of 2025, and a robust forecast period extending to 2033, this study is an indispensable resource for strategic planning and investment decisions.

The report delves into key segments, including Food and Beverages, Healthcare, Household and Personal Care, Industrial, and Other End-user Industries, offering detailed breakdowns of market penetration and growth drivers. With a focus on SEO optimization, this report incorporates high-volume keywords such as "Indonesia folding carton market," "folding carton packaging Indonesia," "paper packaging solutions," "sustainable packaging Indonesia," and "food packaging market" to enhance search visibility and attract relevant industry audiences.

Study Period: 2019–2033 Base Year: 2025 Estimated Year: 2025 Forecast Period: 2025–2033 Historical Period: 2019–2024

Indonesia Folding Carton Market Market Structure & Competitive Landscape

The Indonesia Folding Carton Market exhibits a moderately concentrated structure, with several key players vying for market share. Innovation serves as a primary driver, fueled by the demand for sustainable and visually appealing packaging solutions. Regulatory impacts, though present, are largely geared towards promoting environmental responsibility and product safety, fostering a more sustainable market. Product substitutes, while existing in the form of rigid boxes and other flexible packaging options, are continually being challenged by the cost-effectiveness and versatility of folding cartons. The end-user segmentation reveals a dominant presence of the Food and Beverages sector, followed by Healthcare and Household and Personal Care, each presenting unique packaging requirements and growth opportunities. Mergers and Acquisitions (M&A) trends are observed as companies seek to expand their production capacity, technological capabilities, and market reach. For instance, the acquisition of smaller, specialized carton manufacturers by larger entities aims to consolidate market influence and achieve economies of scale. Concentration ratios are estimated to be around XX% for the top five players, with ongoing consolidation efforts expected to further shape the competitive landscape. Innovation in materials and printing techniques remains crucial for differentiation and capturing market share within this dynamic sector.

Indonesia Folding Carton Market Market Trends & Opportunities

The Indonesia Folding Carton Market is poised for significant growth, driven by evolving consumer preferences, technological advancements, and favorable economic conditions. The market size is projected to reach an estimated USD X Million by 2033, expanding at a Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. A key trend is the increasing demand for sustainable and eco-friendly packaging solutions, directly influencing the adoption of recycled paperboard and biodegradable materials. This shift is propelled by growing environmental awareness among Indonesian consumers and stricter government regulations promoting circular economy principles.

Technological shifts are revolutionizing the folding carton landscape, with advancements in digital printing enabling shorter print runs, enhanced customization, and quicker turnaround times, particularly beneficial for small and medium-sized enterprises (SMEs). High-resolution printing, advanced finishing techniques, and integrated smart features are also gaining traction, adding value beyond basic containment.

Consumer preferences are leaning towards convenience, portability, and visually appealing packaging that enhances brand recall. This translates into a demand for lightweight, easy-to-open, and aesthetically pleasing folding cartons, especially within the Food and Beverages and Household and Personal Care sectors. The e-commerce boom in Indonesia further amplifies the need for robust and protective folding cartons that can withstand the rigors of shipping and handling, creating a substantial market opportunity.

Competitive dynamics are characterized by a blend of established global players and growing domestic manufacturers. Companies are increasingly focusing on supply chain optimization and vertical integration to enhance efficiency and reduce costs. The growing disposable income and rising middle class in Indonesia are also contributing to increased consumption of packaged goods, thereby bolstering the demand for folding cartons. Opportunities lie in developing innovative packaging designs that cater to specific product needs, such as extended shelf-life solutions for perishable goods or tamper-evident features for pharmaceuticals. Furthermore, the expanding healthcare sector presents a significant growth avenue, demanding high-quality, sterile, and compliant packaging for medical devices and pharmaceuticals. The industrial sector, while less visible, also represents a steady demand for robust folding cartons for the packaging of various components and finished goods.

Dominant Markets & Segments in Indonesia Folding Carton Market

The Food and Beverages segment stands as the undisputed leader within the Indonesia Folding Carton Market. This dominance is attributed to several interconnected factors, including the vast and growing population, increasing urbanization, and the rising disposable incomes of Indonesian consumers, which fuel a consistently high demand for packaged food and beverages. The sheer volume of products requiring protection, branding, and safe transit makes this sector the largest consumer of folding cartons. Key growth drivers within this segment include the proliferation of convenience foods, ready-to-eat meals, snacks, and beverages, all of which rely heavily on folding cartons for primary and secondary packaging. The need for eye-catching designs to attract consumers in a competitive retail environment further propels the demand for innovative folding carton solutions.

Following closely, the Healthcare segment represents another significant and rapidly expanding market for folding cartons. This growth is underpinned by an aging population, increased healthcare expenditure, and a rising awareness of health and wellness. The stringent regulatory requirements for pharmaceutical and medical device packaging necessitate high-quality, secure, and tamper-evident folding cartons. Key growth drivers include the expanding pharmaceutical manufacturing base in Indonesia and the increasing availability of over-the-counter (OTC) medications and medical supplies. Policies aimed at improving public health infrastructure and access to healthcare services further bolster this segment's demand.

The Household and Personal Care segment also demonstrates robust growth, driven by increasing consumer spending on personal hygiene products, cosmetics, detergents, and other household essentials. The trend towards premiumization within this segment, with consumers seeking more sophisticated and aesthetically pleasing packaging, creates opportunities for specialized folding carton designs.

While smaller in comparison, the Industrial segment contributes a steady demand for folding cartons, primarily for the packaging of electronic components, machinery parts, and automotive supplies. The need for durable and protective packaging to prevent damage during transit and storage is paramount in this sector.

The Other End-user Industries encompass a diverse range of applications, including electronics, textiles, and stationery, collectively contributing to the overall market demand. The overall market penetration rate for folding cartons across all these sectors is estimated to be around XX%. The government's focus on developing domestic manufacturing capabilities and promoting e-commerce logistics infrastructure also acts as a significant catalyst for increased folding carton utilization across various industries. Strategic investments in modern paper mills and converting facilities are further supporting the growth and supply capabilities for the folding carton market in Indonesia.

Indonesia Folding Carton Market Product Analysis

The Indonesia Folding Carton Market is characterized by a continuous evolution of product innovations focused on enhancing functionality, aesthetics, and sustainability. Folding cartons are primarily manufactured from paperboard, including virgin fiberboard and recycled paperboard, with advancements in material science leading to lighter yet stronger options. Applications are diverse, ranging from primary packaging for consumer goods to secondary packaging for product display and transport. Competitive advantages are increasingly being derived from unique structural designs, advanced printing techniques (such as high-fidelity graphics and tactile finishes), and integrated features like easy-open tabs, resealable closures, and tamper-evident seals. The growing emphasis on eco-friendliness has spurred the development of biodegradable and compostable folding cartons, offering a significant market advantage. Technological advancements in die-cutting and creasing ensure precise folding and assembly, improving efficiency for end-users. The market fit is strong due to the cost-effectiveness, recyclability, and versatility of folding cartons, making them a preferred choice across various industries.

Key Drivers, Barriers & Challenges in Indonesia Folding Carton Market

Key Drivers:

- Growing Consumer Demand for Packaged Goods: An expanding middle class and increasing urbanization in Indonesia are fueling higher consumption of packaged food and beverages, household items, and personal care products.

- E-commerce Growth: The rapid expansion of online retail necessitates robust and protective packaging solutions, with folding cartons playing a crucial role in e-commerce logistics.

- Sustainability Initiatives: Growing environmental awareness and government policies promoting sustainable packaging are driving demand for recycled, recyclable, and biodegradable folding carton options.

- Technological Advancements: Innovations in printing, finishing, and structural design are enhancing the appeal and functionality of folding cartons, creating new market opportunities.

- Healthcare Sector Expansion: Increased healthcare spending and a growing pharmaceutical industry are driving demand for high-quality, compliant packaging solutions.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of pulp and paper, the primary raw materials, can impact production costs and profit margins.

- Logistical Complexities: The archipelago nature of Indonesia presents logistical challenges in terms of transportation and distribution, potentially increasing lead times and costs.

- Competition from Alternative Packaging: Flexible packaging and rigid plastic containers pose competitive threats in certain product categories.

- Regulatory Compliance: Adhering to evolving food safety and environmental regulations requires continuous investment in compliance and updated manufacturing processes.

- Skilled Labor Shortage: A potential shortage of skilled labor in specialized printing and converting operations can hinder production efficiency and innovation.

Growth Drivers in the Indonesia Folding Carton Market Market

The Indonesia Folding Carton Market is propelled by a confluence of robust growth drivers. Technologically, the adoption of advanced printing capabilities, including digital printing for personalization and short runs, is enhancing product appeal and efficiency. Economically, the rising disposable income and a burgeoning middle class are significantly boosting consumer spending on packaged goods, from groceries to personal care items. Policy-driven factors, such as government initiatives promoting domestic manufacturing and export of paper products, alongside stringent environmental regulations favoring sustainable packaging, are creating a conducive environment for growth. For instance, incentives for adopting recycled content in packaging directly benefit folding carton manufacturers. Furthermore, the substantial investment in infrastructure development across Indonesia, particularly in logistics and warehousing, is improving supply chain efficiency and reducing distribution costs, thereby stimulating demand.

Challenges Impacting Indonesia Folding Carton Market Growth

Several challenges can impact the growth trajectory of the Indonesia Folding Carton Market. Regulatory complexities surrounding food contact materials and waste management can pose hurdles, requiring continuous adaptation of manufacturing processes and materials. Supply chain issues, including the availability and cost of raw materials like high-quality paperboard, can create price volatility and affect production schedules. Competitive pressures from both domestic and international players, as well as from alternative packaging materials like flexible films and rigid plastics, necessitate constant innovation and cost optimization. Moreover, achieving consistent quality and meeting the diverse demands of a wide array of end-user industries across a geographically dispersed nation like Indonesia can present significant operational challenges for manufacturers.

Key Players Shaping the Indonesia Folding Carton Market Market

- Industri Pembungkus Internasional Pt

- AR Packaging (CVC Capital Partners SICAV-FIS S A)

- Teguh Group

- PT Kanepackage Indonesia

- Rengo Co Ltd

- APP (Asia Pulp & Paper)

- PT Pura Barutama

- PT Fajar Surya Wisesa Tbk

- Pt Metaform (Kompas Gramedia)

- PT Asia Carton Lestari

- PT Pabrik Kertas Indonesia (PT Pakerin)

Significant Indonesia Folding Carton Market Industry Milestones

- November 2023: The Indonesia International Paper Chain Industry Exhibition (Paper Chain Indonesia) was launched at the JIEXPO Exhibition Center in Jakarta. This event, organized by CCCME and CNCIC, highlighted the rapid development and investment attention within the Indonesian paper industry, covering pulp, paper, and packaging equipment and products. The exhibition underscored the increasing demand for paper-based solutions and showcased advancements in automatic intelligent equipment and paper product manufacturing.

- December 2023: Siegwerk partnered with the Indonesian Packaging Federation (IPF) to elevate safe packaging standards across Indonesia. This collaboration aimed to address critical food packaging safety concerns and raise awareness among brand owners, regulators, converters, printers, and other stakeholders about the paramount importance of adopting safe and compliant packaging practices.

Future Outlook for Indonesia Folding Carton Market Market

The future outlook for the Indonesia Folding Carton Market is exceptionally promising, driven by sustained economic growth, evolving consumer lifestyles, and an intensifying focus on sustainability. Strategic opportunities lie in leveraging advanced printing technologies for customized and high-value packaging, particularly for premium consumer goods and pharmaceuticals. The increasing penetration of e-commerce will continue to fuel demand for protective and efficient folding cartons. Furthermore, the growing emphasis on the circular economy presents a significant opportunity for manufacturers to innovate with recycled and biodegradable materials, aligning with both consumer expectations and regulatory mandates. Investments in automation and smart packaging solutions will also play a crucial role in enhancing competitiveness and meeting the evolving demands of diverse end-user industries. The market is expected to witness further consolidation and strategic partnerships as companies seek to expand their capabilities and market reach.

Indonesia Folding Carton Market Segmentation

-

1. End-User Industry

- 1.1. Food and Beverages

- 1.2. Healthcare

- 1.3. Household and Personal Care

- 1.4. Industrial

- 1.5. Other End-user Industries

Indonesia Folding Carton Market Segmentation By Geography

- 1. Indonesia

Indonesia Folding Carton Market Regional Market Share

Geographic Coverage of Indonesia Folding Carton Market

Indonesia Folding Carton Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Eco Friendly Packaging; Increase in Adoption of Folding Carton by Different Industries

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power

- 3.4. Market Trends

- 3.4.1. The Food and Beverages Segment Occupies the Largest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Folding Carton Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Food and Beverages

- 5.1.2. Healthcare

- 5.1.3. Household and Personal Care

- 5.1.4. Industrial

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Industri Pembungkus Internasional Pt

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AR Packaging (CVC Capital Partners SICAV-FIS S A)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Teguh Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Kanepackage Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rengo Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 APP (Asia Pulp & Paper)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Pura Barutama*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT Fajar Surya Wisesa Tbk

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pt Metaform (Kompas Gramedia)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Asia Carton Lestari

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Pabrik Kertas Indonesia (PT Pakerin

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Industri Pembungkus Internasional Pt

List of Figures

- Figure 1: Indonesia Folding Carton Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Folding Carton Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Folding Carton Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 2: Indonesia Folding Carton Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Indonesia Folding Carton Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Indonesia Folding Carton Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Folding Carton Market?

The projected CAGR is approximately 5.47%.

2. Which companies are prominent players in the Indonesia Folding Carton Market?

Key companies in the market include Industri Pembungkus Internasional Pt, AR Packaging (CVC Capital Partners SICAV-FIS S A), Teguh Group, PT Kanepackage Indonesia, Rengo Co Ltd, APP (Asia Pulp & Paper), PT Pura Barutama*List Not Exhaustive, PT Fajar Surya Wisesa Tbk, Pt Metaform (Kompas Gramedia), PT Asia Carton Lestari, PT Pabrik Kertas Indonesia (PT Pakerin.

3. What are the main segments of the Indonesia Folding Carton Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Eco Friendly Packaging; Increase in Adoption of Folding Carton by Different Industries.

6. What are the notable trends driving market growth?

The Food and Beverages Segment Occupies the Largest Share.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Cost Due to Suppliers Bargaining Power.

8. Can you provide examples of recent developments in the market?

November 2023 - The Indonesia International Paper Chain Industry Exhibition (Paper Chain Indonesia), jointly organized by the China Chamber of Commerce for Import and Export of Mechanical and Electrical Products (CCCME) and the China Chemical Information Center (CNCIC), was launched at the JIEXPO Exhibition Center in Jakarta, Indonesia, on November 24, 2023. The rapid development of the Indonesian paper industry with higher demand has attracted a lot of investment and trade attention. The exhibition covers pulp and paper equipment, paper products and equipment, packaging products and equipment, paper chemicals, automatic intelligent equipment, paper machine accessories and equipment, and various paper product manufacturers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Folding Carton Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Folding Carton Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Folding Carton Market?

To stay informed about further developments, trends, and reports in the Indonesia Folding Carton Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence