Key Insights

The Latin America Dairy Packaging Market is projected for significant expansion, anticipating a market size of USD 56.74 billion by the base year of 2025, with a Compound Annual Growth Rate (CAGR) of 4.5% through 2033. This growth is primarily driven by escalating consumer demand for convenient and hygienic dairy products across the region. Increased disposable incomes and a burgeoning middle class in key economies such as Brazil and Mexico are fostering higher consumption of milk, yogurt, and cheese. Concurrently, heightened awareness regarding food safety and product integrity is accelerating the adoption of advanced packaging solutions that enhance shelf life and prevent spoilage. Key market drivers include the growing appeal of ready-to-drink dairy options, the expansion of cold chain logistics, and a rising preference for sustainable packaging materials among manufacturers and consumers. Packaging innovations, including enhanced barrier properties and tamper-evident features, are also instrumental in shaping market trends.

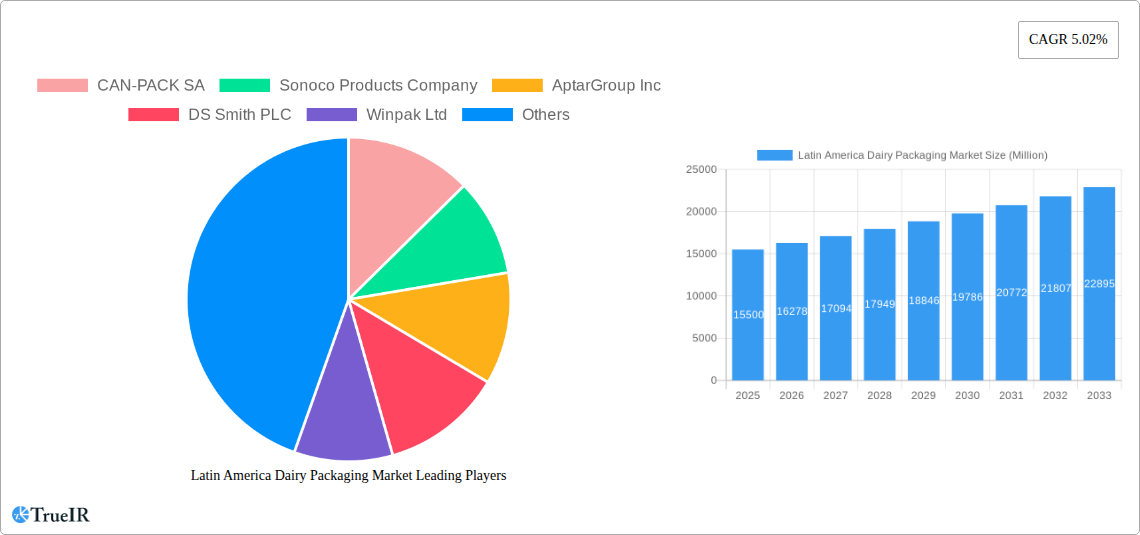

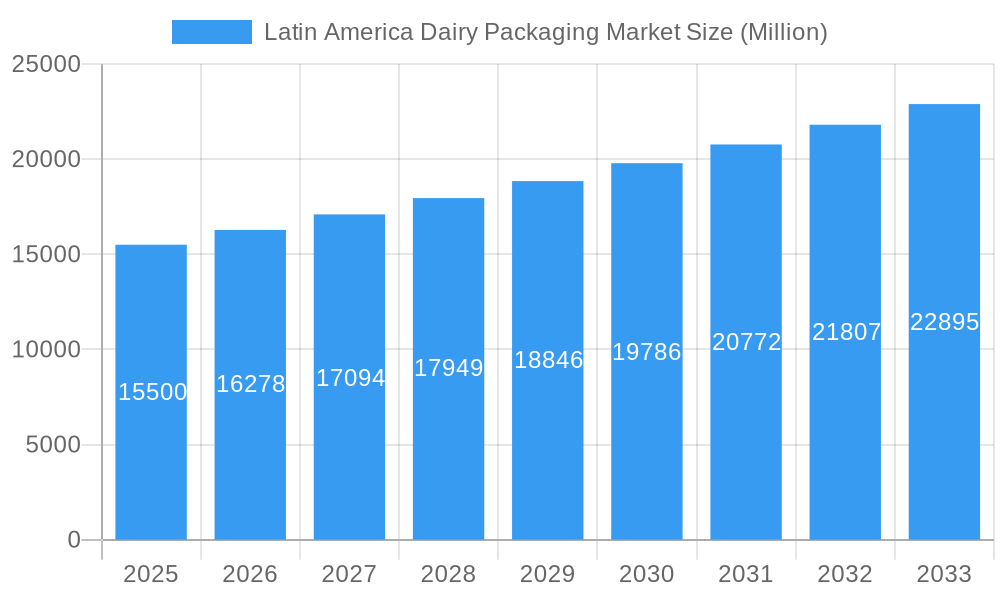

Latin America Dairy Packaging Market Market Size (In Billion)

Market segmentation highlights substantial opportunities across diverse categories. In terms of material type, plastic packaging is anticipated to maintain dominance due to its versatility, cost-efficiency, and superior barrier properties, although a significant shift towards sustainable materials such as paper and other eco-friendly alternatives is evident. For product categories, milk and cheese packaging are expected to retain the largest market share, reflecting their status as dietary staples in Latin America. However, notable growth is observed in yogurt and soy beverage packaging, indicative of evolving consumer preferences for healthier and plant-based alternatives. Regarding package types, cartons and boxes are projected to lead, offering efficiency in storage and transportation, while bottles remain crucial for liquid dairy products. Leading companies such as Amcor PLC, Mondi PLC, and Tetra Laval Group are strategically investing in innovation and capacity expansion to leverage these expanding opportunities in the Latin American dairy packaging sector.

Latin America Dairy Packaging Market Company Market Share

Latin America Dairy Packaging Market Analysis: Trends, Growth & Competitive Landscape (2019-2033)

This comprehensive report provides an in-depth analysis of the Latin America dairy packaging market, covering historical performance, current trends, and future projections. With a study period spanning from 2019 to 2033 and a base year of 2025, this report offers critical insights into market dynamics, segmentation, competitive strategies, and key growth drivers. Explore the evolving landscape of dairy packaging solutions, from innovative materials and package types to the growing demand for sustainable and convenient options across the region. Understand the influence of industry developments and the strategic moves of leading players shaping the future of dairy packaging in Latin America.

Latin America Dairy Packaging Market Market Structure & Competitive Landscape

The Latin America dairy packaging market exhibits a moderately consolidated structure, with key players investing significantly in technological advancements and sustainable solutions to capture market share. Innovation drivers are primarily fueled by the increasing consumer demand for convenience, extended shelf life, and eco-friendly packaging options. Regulatory impacts, such as waste management policies and single-use plastic bans in various countries, are compelling manufacturers to explore recyclable and compostable materials, thereby influencing product development and market entry strategies. The presence of viable product substitutes, including plant-based milk alternatives and alternative packaging formats, necessitates continuous innovation to maintain competitive advantage. End-user segmentation reveals a strong reliance on the Milk and Yogurt categories, driving demand for various packaging types like Cartons and Boxes and Bottles. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their geographical reach, diversify their product portfolios, and enhance their production capacities. For instance, the consolidation trend in the broader packaging industry suggests potential M&A activities to gain economies of scale and strengthen market presence. The market concentration is estimated to be around 60-70% among the top 5-7 players, highlighting a significant but not fully saturated competitive environment.

Latin America Dairy Packaging Market Market Trends & Opportunities

The Latin America dairy packaging market is on a robust growth trajectory, driven by a confluence of favorable economic conditions, evolving consumer preferences, and technological advancements. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033, reaching an estimated value of over XXX Million USD by the end of the forecast period. This expansion is fueled by the increasing demand for dairy products, particularly milk, yogurt, and cheese, across the region’s burgeoning middle class. Technological shifts are playing a pivotal role, with a pronounced emphasis on sustainable packaging solutions. The development and adoption of recyclable materials like PET and advanced barrier technologies are gaining traction, addressing growing environmental concerns and regulatory pressures. Opportunities abound for manufacturers who can offer innovative, lightweight, and cost-effective packaging that also enhances product shelf life and consumer appeal.

Consumer preferences are evolving rapidly, with a growing inclination towards single-serve, on-the-go packaging formats, particularly for yogurt and ready-to-drink dairy beverages. This trend presents a significant opportunity for the expansion of pouches and smaller-sized cartons and boxes. Furthermore, the surge in demand for plant-based milk alternatives, such as soy beverages, is creating new avenues for specialized packaging solutions that can cater to the unique requirements of these products, including enhanced barrier properties to preserve freshness and prevent oxidation. The competitive dynamics are characterized by intense innovation in material science and packaging design. Companies are investing in research and development to create packaging that is not only functional but also aesthetically pleasing and communicates brand values effectively.

The expanding e-commerce landscape and the increasing penetration of modern retail formats across Latin America are also creating new distribution channels and demanding packaging solutions that can withstand the rigors of logistics and maintain product integrity during transit. The demand for aseptic packaging solutions is also on the rise, particularly for milk and juices, as it extends shelf life without the need for refrigeration, thereby reducing cold chain costs and waste. Digitalization of the supply chain and the integration of smart packaging technologies, such as QR codes for traceability and consumer engagement, represent emerging opportunities for value-added services. The rising disposable incomes in several Latin American countries are directly translating into higher consumption of dairy products, thereby creating a sustained demand for dairy packaging. The increasing awareness about health and wellness is also contributing to the demand for fortified dairy products, which often require specialized packaging to maintain the efficacy of added nutrients. The market penetration of advanced packaging technologies, while still developing, is expected to accelerate as manufacturers and consumers become more aware of their benefits in terms of sustainability and product quality.

Dominant Markets & Segments in Latin America Dairy Packaging Market

The Latin America dairy packaging market is characterized by the dominance of specific regions and segments, driven by diverse economic, demographic, and consumption patterns.

Leading Region: Brazil stands out as the largest and most dynamic market for dairy packaging in Latin America. Its substantial population, a well-established dairy industry, and a growing middle class with increasing purchasing power contribute to its leading position. The country’s strong agricultural base and significant production of milk and dairy derivatives create a sustained demand for packaging solutions. Mexico follows closely, with its own sizable population and a robust dairy processing sector. Argentina, known for its dairy exports, also represents a significant market, particularly for packaging that meets international quality and safety standards.

Dominant Material Type: Plastic dominates the Latin America dairy packaging market, accounting for an estimated market share of over 55%. This is attributed to its versatility, cost-effectiveness, lightweight properties, and ability to offer excellent barrier protection, crucial for preserving the freshness of dairy products. Polyethylene Terephthalate (PET) and High-Density Polyethylene (HDPE) are widely used for bottles and containers. Paper, particularly in the form of cartons and boxes, holds a significant share, especially for milk and juices, driven by its recyclability and branding opportunities. Metal cans are primarily used for specific products like condensed milk and coffee whiteners. Glass, while offering premium appeal, faces challenges due to its weight and breakability, limiting its widespread adoption in high-volume dairy product packaging. Other material types, including flexible laminates for pouches, are gaining traction for convenience-oriented products.

Dominant Product: Milk is the undisputed leader within the product segmentation, representing the largest volume of dairy packaging consumed across Latin America. Its widespread consumption as a staple dietary item drives consistent demand. Yogurt is another major segment, witnessing significant growth due to its popularity as a healthy snack and breakfast option, leading to increased demand for various packaging formats, including cups, pouches, and multi-packs. Cheese also contributes substantially to the market, with a variety of packaging needs depending on the type and shelf life required. Soy beverages are emerging as a rapidly growing segment, catering to the increasing demand for plant-based alternatives.

Dominant Package Type: Cartons and Boxes are paramount in the dairy packaging market, especially for liquid milk and juices, owing to their excellent printability for branding, stackability for efficient logistics, and the availability of aseptic options that extend shelf life. Bottles, predominantly made from plastic (PET and HDPE), are extensively used for milk, flavored milk drinks, and ready-to-drink dairy beverages, offering convenience and portability. Pouches are witnessing a rise in demand for yogurt, dairy desserts, and smoothies due to their flexibility, lightweight nature, and ease of use for on-the-go consumption. Other packaging types, including tubs and tubs with lids, are essential for products like butter and certain cheese varieties.

Latin America Dairy Packaging Market Product Analysis

The Latin America dairy packaging market is witnessing continuous innovation driven by the need for enhanced functionality, sustainability, and consumer appeal. Product innovations are focused on improving barrier properties to extend shelf life, reduce spoilage, and maintain the nutritional integrity of dairy products like milk, yogurt, and cheese. Advanced materials, such as multilayer plastics with improved oxygen and moisture barriers, and the increasing use of recycled PET (rPET) are key trends. Applications span a wide range, from traditional liquid milk cartons and yogurt cups to sophisticated pouches for ready-to-drink beverages and resealable containers for cheese. Competitive advantages are being gained through the development of lightweight, cost-effective, and aesthetically pleasing packaging that offers superior performance and aligns with growing environmental consciousness. For example, Amcor’s DairySeal line with ClearCor PET offers a more sustainable and high-performance option for RTD and alternative dairy markets.

Key Drivers, Barriers & Challenges in Latin America Dairy Packaging Market

Key Drivers: The Latin America dairy packaging market is propelled by several key drivers. The increasing consumption of dairy products, driven by population growth and rising disposable incomes, forms the bedrock of market expansion. A significant driver is the escalating demand for convenient and on-the-go packaging solutions, catering to the busy lifestyles of consumers. Technological advancements in packaging materials and machinery are enabling the development of more sustainable, functional, and cost-effective options. Furthermore, growing environmental awareness and stringent regulations promoting recyclability and reduced waste are pushing manufacturers towards eco-friendly packaging alternatives. The expansion of modern retail formats and e-commerce further stimulates the need for robust and appealing packaging.

Barriers & Challenges: Despite the robust growth, the market faces several challenges. Fluctuations in raw material prices, particularly for plastics and paper, can impact manufacturing costs and profitability. The existence of informal waste management systems in some regions poses challenges for effective recycling and collection of packaging waste. Regulatory complexities and varying environmental standards across different Latin American countries can create operational hurdles for companies operating in multiple markets. Intense price competition among packaging manufacturers and the availability of lower-cost alternatives can exert downward pressure on profit margins. Supply chain disruptions, exacerbated by logistical complexities and geopolitical factors, can affect the timely delivery of raw materials and finished products. The slow adoption of advanced recycling technologies in some areas also presents a barrier to achieving circular economy goals.

Growth Drivers in the Latin America Dairy Packaging Market Market

The growth drivers for the Latin America dairy packaging market are multifaceted. Economically, rising disposable incomes across several nations in the region are fueling increased per capita consumption of dairy products, directly translating into higher demand for packaging. Technologically, innovations in material science are leading to the development of lighter, more durable, and highly functional packaging, such as those offering enhanced barrier properties against oxygen and moisture, thereby extending shelf life. Regulatory frameworks that encourage sustainability, like extended producer responsibility (EPR) schemes and incentives for recycled content, are pushing for the adoption of eco-friendly packaging solutions. The expanding middle class and urbanization are leading to greater demand for convenient, ready-to-drink dairy beverages and single-serve yogurt portions, driving the growth of flexible packaging and smaller carton formats. Government initiatives promoting food safety and quality standards also indirectly support the demand for high-quality, compliant packaging.

Challenges Impacting Latin America Dairy Packaging Market Growth

Several challenges are impacting the growth of the Latin America dairy packaging market. Regulatory complexities and inconsistencies across different countries can hinder streamlined market entry and operations. Supply chain vulnerabilities, including logistical bottlenecks and dependency on imported raw materials for certain specialty packaging, can lead to delays and increased costs. Competitive pressures from local and international players often result in price wars, impacting profitability for manufacturers. The slow development of robust waste management and recycling infrastructure in certain areas limits the effective collection and reprocessing of used packaging. Consumer education regarding proper disposal and the benefits of sustainable packaging is still an ongoing process, which can slow down the adoption of certain eco-friendly options. Economic volatility and currency fluctuations in some Latin American countries can also affect investment decisions and consumer spending power.

Key Players Shaping the Latin America Dairy Packaging Market Market

- CAN-PACK SA

- Sonoco Products Company

- AptarGroup Inc

- DS Smith PLC

- Winpak Ltd

- Amcor PLC

- Mondi PLC

- Smurfit Kappa

- Berry Global Inc

- Silgan Holdings Inc

- Huhtamaki Oyj

- Tetra Laval Group

- Prolamina Packagin

Significant Latin America Dairy Packaging Market Industry Milestones

- September 2022: Amcor Rigid Packaging (ARP) launched its DairySeal line, featuring ClearCor, an advanced polyethylene terephthalate (PET) barrier. This innovation caters to the rapidly growing ready-to-drink (RTD), nutritional, and alternative dairy markets, offering more environmentally friendly packaging choices applicable across all retail channels.

- May 2022: SIG, a prominent Swiss aseptic packaging provider, partnered with Frimesa, a Brazilian-based meat and dairy distributor, to introduce the first combi-style carton packaging in the Americas. This innovative packaging, showcased at the APAS Show 2022 in Sao Paulo, features a distinctive corner panel designed for enhanced on-shelf presence and consumer appeal.

Future Outlook for Latin America Dairy Packaging Market Market

The future outlook for the Latin America dairy packaging market is highly promising, driven by sustained demand for dairy products and an increasing focus on sustainability and innovation. The market is expected to witness continued growth fueled by demographic shifts, including a growing young population and an expanding middle class with enhanced purchasing power. Opportunities lie in the development of advanced sustainable packaging solutions, such as biodegradable and compostable materials, as well as increased adoption of recycled content. The demand for convenience-oriented packaging, including pouches and single-serve formats, will likely surge, catering to evolving consumer lifestyles. Furthermore, the growing popularity of plant-based dairy alternatives will create new avenues for specialized packaging. Strategic investments in efficient recycling infrastructure and a greater emphasis on circular economy principles will be crucial for long-term success. Companies that can offer integrated solutions, from packaging design to end-of-life management, are poised to capture significant market share. The adoption of smart packaging technologies for enhanced traceability and consumer engagement also presents a future growth catalyst.

Latin America Dairy Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

- 1.5. Other Material Types

-

2. Product

- 2.1. Cheese

- 2.2. Milk

- 2.3. Soy Beverages

- 2.4. Yogurt

- 2.5. Coffee Whiteners

- 2.6. Cream

- 2.7. Butter

- 2.8. Juices

- 2.9. Other Products

-

3. Package Type

- 3.1. Bottles

- 3.2. Cans

- 3.3. Cartons and Boxes

- 3.4. Pouches

- 3.5. Others

Latin America Dairy Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Dairy Packaging Market Regional Market Share

Geographic Coverage of Latin America Dairy Packaging Market

Latin America Dairy Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Consumers' Rising Health Consciousness is Driving Demand For Dairy Nutrition; Growing Dairy Product Distribution Channels Supported by an Increase in the Number of Supermarkets and Hypermarkets in the Region

- 3.2.2 Drives the Market

- 3.3. Market Restrains

- 3.3.1. Regular Feed Shortage Owing to the Transporters' Protest Due to Higher Fuel Prices; Concerns About Recycling and the Environment

- 3.4. Market Trends

- 3.4.1. Milk Segment is Expected to Account for Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Dairy Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.1.5. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Cheese

- 5.2.2. Milk

- 5.2.3. Soy Beverages

- 5.2.4. Yogurt

- 5.2.5. Coffee Whiteners

- 5.2.6. Cream

- 5.2.7. Butter

- 5.2.8. Juices

- 5.2.9. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Package Type

- 5.3.1. Bottles

- 5.3.2. Cans

- 5.3.3. Cartons and Boxes

- 5.3.4. Pouches

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CAN-PACK SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AptarGroup Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Winpak Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Smurfit Kappa

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Berry Global Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Holdings Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huhtamaki Oyj

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tetra Laval Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Prolamina Packagin

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 CAN-PACK SA

List of Figures

- Figure 1: Latin America Dairy Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Dairy Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Dairy Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Latin America Dairy Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 3: Latin America Dairy Packaging Market Revenue billion Forecast, by Package Type 2020 & 2033

- Table 4: Latin America Dairy Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Latin America Dairy Packaging Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: Latin America Dairy Packaging Market Revenue billion Forecast, by Product 2020 & 2033

- Table 7: Latin America Dairy Packaging Market Revenue billion Forecast, by Package Type 2020 & 2033

- Table 8: Latin America Dairy Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Brazil Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Argentina Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Chile Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Colombia Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Peru Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Venezuela Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ecuador Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Bolivia Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Paraguay Latin America Dairy Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Dairy Packaging Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Latin America Dairy Packaging Market?

Key companies in the market include CAN-PACK SA, Sonoco Products Company, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Mondi PLC, Smurfit Kappa, Berry Global Inc, Silgan Holdings Inc, Huhtamaki Oyj, Tetra Laval Group, Prolamina Packagin.

3. What are the main segments of the Latin America Dairy Packaging Market?

The market segments include Material Type, Product, Package Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 56.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Consumers' Rising Health Consciousness is Driving Demand For Dairy Nutrition; Growing Dairy Product Distribution Channels Supported by an Increase in the Number of Supermarkets and Hypermarkets in the Region. Drives the Market.

6. What are the notable trends driving market growth?

Milk Segment is Expected to Account for Significant Market Share.

7. Are there any restraints impacting market growth?

Regular Feed Shortage Owing to the Transporters' Protest Due to Higher Fuel Prices; Concerns About Recycling and the Environment.

8. Can you provide examples of recent developments in the market?

September 2022: The DairySeal line of packaging from Amcor Rigid Packaging (ARP) includes ClearCor, an advanced polyethylene terephthalate (PET) barrier. With the launch of DairySeal, the rapidly growing ready-to-drink (RTD), nutritional, and alternative dairy markets will have access to more environment-friendly packaging choices used in all retail channels.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Dairy Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Dairy Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Dairy Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Dairy Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence