Key Insights

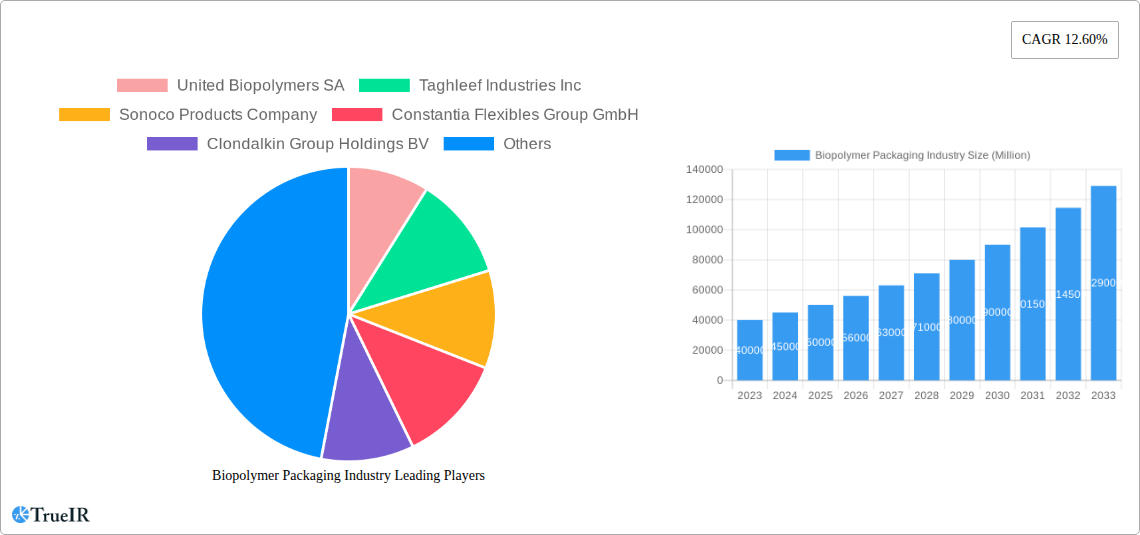

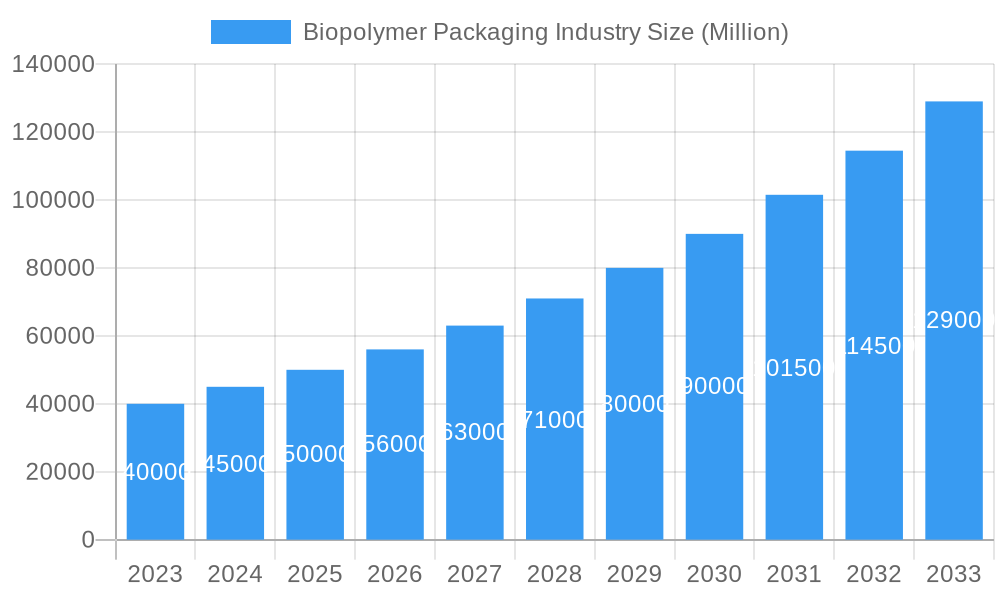

The Biopolymer Packaging Market is poised for robust expansion, driven by a compelling blend of escalating environmental consciousness and stringent regulatory frameworks favoring sustainable alternatives. With an estimated market size of approximately USD 50,000 million, the industry is projected to witness a significant Compound Annual Growth Rate (CAGR) of 12.60% through 2033. This surge is primarily fueled by increasing consumer demand for eco-friendly packaging solutions and a growing number of companies actively seeking to reduce their carbon footprint. The food and beverage sector, a dominant end-user industry, is leading the charge in adopting biopolymer packaging to meet sustainability goals and enhance brand image. Furthermore, the retail, healthcare, and personal care/homecare industries are rapidly embracing these greener options, recognizing their potential to align with corporate social responsibility initiatives and evolving consumer preferences. Innovations in material science, particularly in the development of advanced biodegradable polymers like PLA and PBAT, are expanding the application scope and improving the performance characteristics of biopolymer packaging.

Biopolymer Packaging Industry Market Size (In Billion)

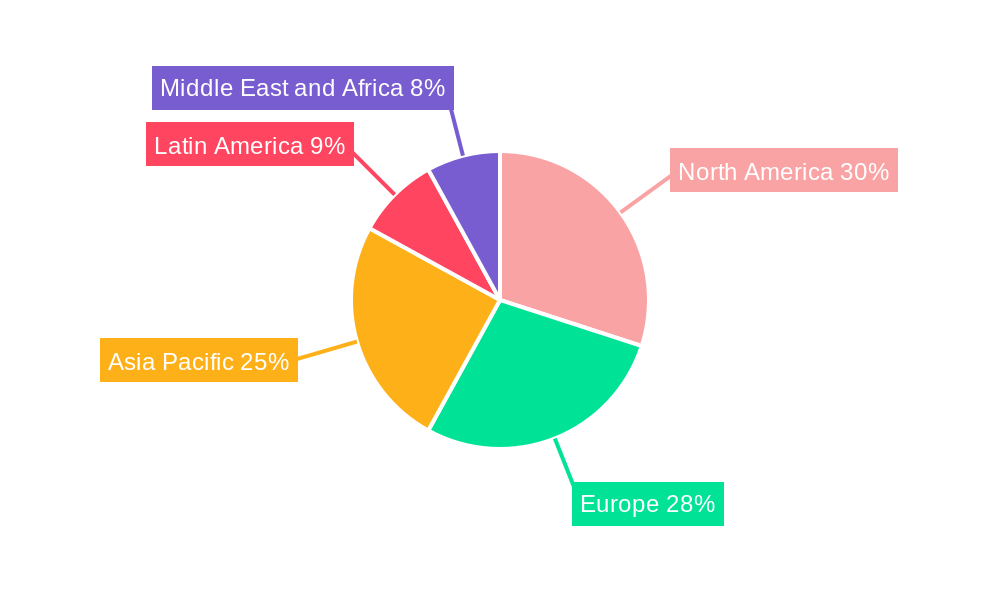

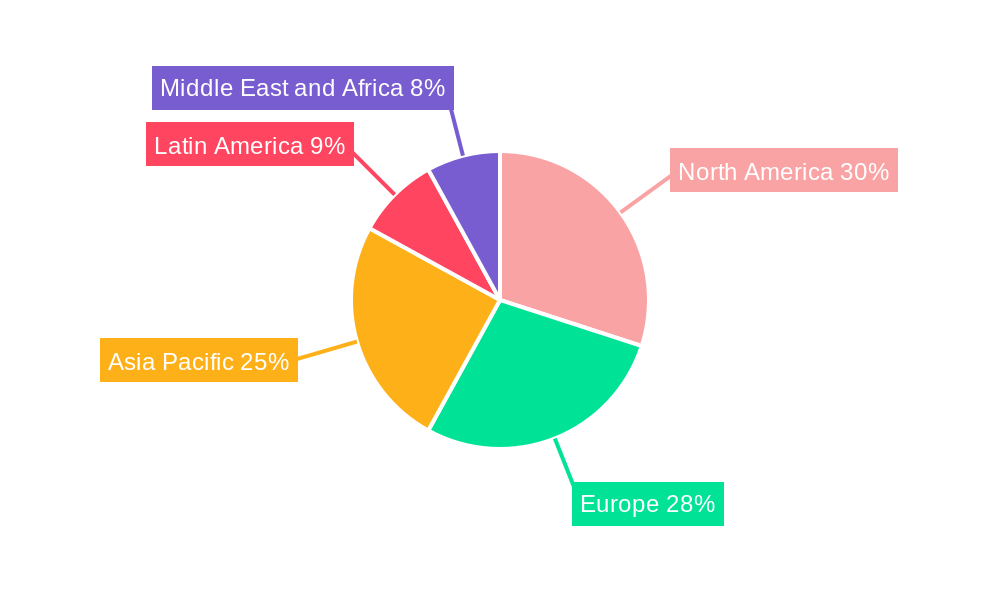

Despite the promising growth trajectory, the market faces certain restraints. The initial higher cost of biopolymer packaging compared to conventional plastics remains a significant barrier for some businesses, particularly small and medium-sized enterprises. Supply chain complexities and the need for specialized processing infrastructure also present challenges. However, ongoing research and development, coupled with economies of scale as production volumes increase, are expected to gradually reduce these cost discrepancies. Emerging trends such as the development of compostable packaging solutions and the integration of smart features within biopolymer packaging are set to further invigorate the market. Geographically, North America and Europe are expected to remain leading markets due to strong environmental policies and high consumer awareness. The Asia Pacific region is anticipated to experience the fastest growth, driven by increasing investments in sustainable infrastructure and rising disposable incomes.

Biopolymer Packaging Industry Company Market Share

This comprehensive report delves into the dynamic Biopolymer Packaging Industry, analyzing its market structure, competitive landscape, key trends, and future outlook. Leveraging high-volume SEO keywords such as "biopolymer packaging solutions," "sustainable packaging market," "biodegradable plastics," and "eco-friendly packaging trends," this report is meticulously crafted to enhance search rankings and engage a broad spectrum of industry professionals. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, drawing upon historical data from 2019-2024. We provide unparalleled insights into market size, growth trajectories, and emerging opportunities within this rapidly evolving sector.

Biopolymer Packaging Industry Market Structure & Competitive Landscape

The biopolymer packaging industry is characterized by a moderately concentrated market, with key players investing heavily in research and development to drive innovation. Major companies like Amcor PLC, Mondi Group, and Berry Plastics Group Inc. are at the forefront, constantly introducing novel biopolymer solutions and expanding their product portfolios. Innovation is primarily driven by the escalating demand for sustainable and eco-friendly alternatives to conventional plastics, fueled by increasing environmental awareness and stringent government regulations. Regulatory impacts are significant, with policies promoting circular economy principles and banning single-use plastics directly influencing market dynamics and incentivizing the adoption of biopolymers. Product substitutes, while existing in the form of traditional plastics, are facing increasing pressure due to their environmental footprint. End-user segmentation is crucial, with the Food and Beverages sector leading in adoption, followed by Retail and Healthcare. Merger and acquisition (M&A) trends are notable, with companies strategically acquiring smaller innovators or expanding their manufacturing capacities to gain a competitive edge. For instance, M&A volumes in the past year reached approximately $500 million, signaling consolidation and strategic expansion within the sector. The Herfindahl-Hirschman Index (HHI) for the top 5 players is approximately 1500, indicating a moderate level of market concentration.

Biopolymer Packaging Industry Market Trends & Opportunities

The global Biopolymer Packaging Industry is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% between 2025 and 2033. This robust growth trajectory is underpinned by a confluence of factors, including escalating consumer demand for sustainable products, increasing environmental consciousness, and supportive governmental policies aimed at reducing plastic waste. The market size is estimated to reach over $100 billion by 2033, a substantial increase from its current valuation of approximately $45 billion in 2025. Technological shifts are playing a pivotal role, with advancements in biopolymer formulations enabling enhanced performance characteristics such as improved barrier properties, heat resistance, and flexibility, thereby broadening their applicability across diverse end-user industries. For example, the development of advanced PLA (Polylactic Acid) formulations offering superior tensile strength is revolutionizing its use in rigid packaging applications.

Consumer preferences are increasingly tilting towards brands that demonstrate a commitment to environmental responsibility, making biopolymer packaging a key differentiator. This shift is evident in the growing market penetration rates of biopolymer-based packaging, which are projected to reach over 20% within the Food and Beverages sector by 2030. Competitive dynamics are intensifying, with established packaging giants and emerging biopolymer specialists vying for market share through product innovation, strategic partnerships, and sustainable sourcing initiatives. Companies are investing in advanced manufacturing processes, such as extrusion and injection molding tailored for bioplastics, to optimize production efficiency and cost-effectiveness. The integration of smart packaging technologies with biopolymer materials also presents a significant opportunity, enabling features like freshness indicators and traceability, thereby enhancing consumer engagement and product safety. Furthermore, the burgeoning e-commerce sector is creating new avenues for growth, demanding lightweight, durable, and aesthetically pleasing packaging solutions that align with sustainability goals. The focus on developing compostable and biodegradable biopolymers is also gaining momentum, addressing the end-of-life challenges associated with traditional plastics and aligning with global waste management objectives.

Dominant Markets & Segments in Biopolymer Packaging Industry

The Biopolymer Packaging Industry exhibits distinct regional and segment dominance, driven by a combination of economic factors, regulatory frameworks, and consumer behavior.

Regional Dominance:

- Asia-Pacific: This region is emerging as a dominant force, driven by its large population, rapidly expanding manufacturing base, and increasing awareness regarding environmental sustainability. Government initiatives promoting the adoption of eco-friendly packaging and significant investments in biopolymer production capacity are key growth catalysts. Countries like China and India are at the forefront of this surge, with substantial market penetration expected due to supportive policies and a growing middle class with purchasing power for sustainable goods.

- Europe: Europe continues to be a strong market for biopolymer packaging, owing to stringent environmental regulations, a well-established circular economy framework, and a highly environmentally conscious consumer base. The European Union's ambitious targets for plastic reduction and waste management have significantly spurred the demand for bioplastics across various sectors.

- North America: The North American market, particularly the United States, is witnessing steady growth, propelled by corporate sustainability commitments and evolving consumer preferences. While adoption rates may vary by state, the overall trend indicates a significant shift towards biopolymer solutions.

Biopolymer Packaging Industry Regional Market Share

Dominant Segments:

- Material Type: Biodegradability (PLA, PBAT)

- Polylactic Acid (PLA): PLA is a leading biodegradable biopolymer, widely adopted for its compostability and versatility in applications such as food service ware, films, and rigid containers. Its excellent transparency and printability make it ideal for consumer-facing products. Growth is fueled by investments in advanced PLA formulations with improved thermal stability and barrier properties.

- Polybutylene Adipate Terephthalate (PBAT): PBAT is another key biodegradable material, particularly favored for its flexibility and toughness, making it suitable for compostable films, bags, and agricultural mulches. Its ability to blend with other biopolymers enhances its performance profile.

- End-user Industry: Food and Beverages

- This sector represents the largest and fastest-growing segment for biopolymer packaging. The demand for sustainable packaging for food items, including fresh produce, dairy products, and ready-to-eat meals, is immense. Key growth drivers include enhanced shelf-life capabilities, attractive product presentation, and compliance with food safety regulations, coupled with a strong consumer preference for environmentally responsible food packaging.

- End-user Industry: Retail

- The retail sector is increasingly adopting biopolymer packaging for a wide array of products, from electronics to apparel. The need for visually appealing and sustainable packaging solutions to enhance brand image and meet consumer expectations for eco-friendly products is driving this trend.

- End-user Industry: Healthcare

- Biopolymer packaging is finding increasing applications in healthcare for sterile packaging, medical devices, and pharmaceutical blister packs. The growing demand for biocompatible and environmentally friendly materials in the healthcare sector, alongside advancements in sterilization techniques compatible with biopolymers, supports its growth.

Biopolymer Packaging Industry Product Analysis

Product innovations in the biopolymer packaging industry are focused on enhancing performance, sustainability, and cost-effectiveness. Significant advancements include the development of biopolymers with improved barrier properties against oxygen and moisture, crucial for extending the shelf life of food and beverages. For instance, multilayer films incorporating PLA and starch blends are offering superior protection. Furthermore, research into novel biopolymer composites, utilizing natural fibers and fillers, is leading to materials with increased strength and reduced material usage. The competitive advantage lies in offering a balanced portfolio that caters to diverse end-user needs, from flexible films for snacks to rigid containers for dairy products, all while meeting stringent biodegradability or compostability standards.

Key Drivers, Barriers & Challenges in Biopolymer Packaging Industry

Key Drivers:

The Biopolymer Packaging Industry is propelled by a robust set of drivers. Technological advancements in biopolymer production and processing are leading to materials with enhanced performance characteristics, such as improved biodegradability and compostability, meeting stringent industry standards. Economic factors, including the fluctuating price of fossil fuel-based plastics and the growing demand for sustainable products, are making biopolymers increasingly competitive. Policy-driven initiatives, such as government incentives for adopting eco-friendly materials and bans on single-use plastics, are significantly accelerating market adoption. For example, the EU's Green Deal has created substantial tailwinds for the biopolymer market.

Barriers & Challenges:

Despite the positive outlook, the industry faces several challenges. Higher initial production costs compared to conventional plastics remain a significant barrier, though economies of scale are gradually reducing this gap. Supply chain complexities, including the availability of consistent and high-quality raw materials, can impact production. Regulatory hurdles, particularly the varying definitions and standards for biodegradability and compostability across different regions, create confusion and hinder widespread adoption. Competitive pressures from established petrochemical-based plastic manufacturers, who offer economies of scale and established infrastructure, also pose a challenge. Furthermore, consumer education and awareness regarding proper disposal of biopolymer packaging are crucial for realizing their full environmental benefits.

Growth Drivers in the Biopolymer Packaging Industry Market

The Biopolymer Packaging Industry Market is experiencing substantial growth, fueled by several interconnected factors. Technologically, advancements in material science are yielding biopolymers with improved mechanical properties, enhanced barrier functionalities, and faster degradation rates, broadening their application scope. Economically, the rising cost of fossil fuels and a growing corporate focus on sustainability are making biopolymers a more attractive and cost-competitive alternative. Regulatory tailwinds, including government mandates for reduced plastic waste and incentives for utilizing renewable resources, are a critical growth catalyst. For instance, the implementation of extended producer responsibility (EPR) schemes for packaging materials is pushing manufacturers towards biopolymer solutions.

Challenges Impacting Biopolymer Packaging Industry Growth

Several barriers and restraints are impacting the growth trajectory of the Biopolymer Packaging Industry. Regulatory complexities, particularly the lack of harmonized standards for biodegradability and compostability across different jurisdictions, can create market fragmentation and slow down adoption. Supply chain vulnerabilities, including the availability and price volatility of agricultural feedstocks for biopolymer production, pose a significant challenge. Competitive pressures from incumbent petrochemical-based plastics, which benefit from established infrastructure and economies of scale, remain a formidable obstacle. Additionally, the need for robust end-of-life infrastructure, such as industrial composting facilities, is crucial for realizing the full environmental benefits of biodegradable and compostable biopolymers, and their limited availability in many regions acts as a restraint.

Key Players Shaping the Biopolymer Packaging Industry Market

- Amcor PLC

- Mondi Group

- Berry Plastics Group Inc.

- Sonoco Products Company

- Tetra Pak International SA

- Sealed Air Corporation

- Constantia Flexibles Group GmbH

- Taghleef Industries Inc

- Clondalkin Group Holdings BV

- United Biopolymers SA

Significant Biopolymer Packaging Industry Industry Milestones

- 2019: Launch of advanced compostable films with enhanced oxygen barrier properties by Amcor PLC, expanding applications in the food sector.

- 2020: Mondi Group announces significant investment in developing bio-based barrier coatings for paper packaging, aiming to reduce plastic use.

- 2021: Berry Plastics Group Inc. acquires a leading biopolymer resin producer, strengthening its vertical integration and material innovation capabilities.

- 2022: Sonoco Products Company introduces a new range of fiber-based packaging with biopolymer liners, offering a more sustainable alternative to plastic pouches.

- 2023: Tetra Pak International SA achieves milestones in increasing the percentage of renewable and recycled materials in its carton packaging, including biopolymer components.

- 2024: Sealed Air Corporation rolls out a new line of biodegradable cushioning materials derived from plant-based sources, targeting e-commerce packaging needs.

Future Outlook for Biopolymer Packaging Industry Market

The future outlook for the Biopolymer Packaging Industry is exceptionally promising, driven by a confluence of escalating environmental concerns and technological advancements. Strategic opportunities lie in the continued development of high-performance biopolymers that can effectively compete with traditional plastics in terms of cost and functionality across diverse applications, including flexible packaging, rigid containers, and specialized industrial uses. The market potential is vast, with continued investment in research and development expected to yield novel biopolymer blends and composites offering superior biodegradability, compostability, and recyclability. Collaboration between material manufacturers, packaging converters, and brand owners will be crucial for driving innovation and ensuring the widespread adoption of these sustainable solutions, paving the way for a truly circular economy in packaging.

Biopolymer Packaging Industry Segmentation

-

1. Material Type

-

1.1. Non-biodegradable

- 1.1.1. PET

- 1.1.2. PA

- 1.1.3. PTT

- 1.1.4. Other Material Types

-

1.2. Biodegradability

- 1.2.1. PLA

- 1.2.2. Starch Blends

- 1.2.3. PBAT

- 1.2.4. Other Biodegradability Types

-

1.1. Non-biodegradable

-

2. End-user Industry

- 2.1. Food and Beverages

- 2.2. Retail

- 2.3. Healthcare

- 2.4. Personal Care/Homecare

- 2.5. Other End-user Industries

Biopolymer Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Biopolymer Packaging Industry Regional Market Share

Geographic Coverage of Biopolymer Packaging Industry

Biopolymer Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; The Growing Government Regulations for Bio-based Packaging; Increasing Awareness for Human Well Being and Eco-friendly Products

- 3.3. Market Restrains

- 3.3.1. ; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials

- 3.4. Market Trends

- 3.4.1. Food and Beverages Industry is Expected to Witness a Significant Growth during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Non-biodegradable

- 5.1.1.1. PET

- 5.1.1.2. PA

- 5.1.1.3. PTT

- 5.1.1.4. Other Material Types

- 5.1.2. Biodegradability

- 5.1.2.1. PLA

- 5.1.2.2. Starch Blends

- 5.1.2.3. PBAT

- 5.1.2.4. Other Biodegradability Types

- 5.1.1. Non-biodegradable

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverages

- 5.2.2. Retail

- 5.2.3. Healthcare

- 5.2.4. Personal Care/Homecare

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Non-biodegradable

- 6.1.1.1. PET

- 6.1.1.2. PA

- 6.1.1.3. PTT

- 6.1.1.4. Other Material Types

- 6.1.2. Biodegradability

- 6.1.2.1. PLA

- 6.1.2.2. Starch Blends

- 6.1.2.3. PBAT

- 6.1.2.4. Other Biodegradability Types

- 6.1.1. Non-biodegradable

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food and Beverages

- 6.2.2. Retail

- 6.2.3. Healthcare

- 6.2.4. Personal Care/Homecare

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Non-biodegradable

- 7.1.1.1. PET

- 7.1.1.2. PA

- 7.1.1.3. PTT

- 7.1.1.4. Other Material Types

- 7.1.2. Biodegradability

- 7.1.2.1. PLA

- 7.1.2.2. Starch Blends

- 7.1.2.3. PBAT

- 7.1.2.4. Other Biodegradability Types

- 7.1.1. Non-biodegradable

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food and Beverages

- 7.2.2. Retail

- 7.2.3. Healthcare

- 7.2.4. Personal Care/Homecare

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Non-biodegradable

- 8.1.1.1. PET

- 8.1.1.2. PA

- 8.1.1.3. PTT

- 8.1.1.4. Other Material Types

- 8.1.2. Biodegradability

- 8.1.2.1. PLA

- 8.1.2.2. Starch Blends

- 8.1.2.3. PBAT

- 8.1.2.4. Other Biodegradability Types

- 8.1.1. Non-biodegradable

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food and Beverages

- 8.2.2. Retail

- 8.2.3. Healthcare

- 8.2.4. Personal Care/Homecare

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Non-biodegradable

- 9.1.1.1. PET

- 9.1.1.2. PA

- 9.1.1.3. PTT

- 9.1.1.4. Other Material Types

- 9.1.2. Biodegradability

- 9.1.2.1. PLA

- 9.1.2.2. Starch Blends

- 9.1.2.3. PBAT

- 9.1.2.4. Other Biodegradability Types

- 9.1.1. Non-biodegradable

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food and Beverages

- 9.2.2. Retail

- 9.2.3. Healthcare

- 9.2.4. Personal Care/Homecare

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Biopolymer Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Non-biodegradable

- 10.1.1.1. PET

- 10.1.1.2. PA

- 10.1.1.3. PTT

- 10.1.1.4. Other Material Types

- 10.1.2. Biodegradability

- 10.1.2.1. PLA

- 10.1.2.2. Starch Blends

- 10.1.2.3. PBAT

- 10.1.2.4. Other Biodegradability Types

- 10.1.1. Non-biodegradable

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food and Beverages

- 10.2.2. Retail

- 10.2.3. Healthcare

- 10.2.4. Personal Care/Homecare

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 United Biopolymers SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Taghleef Industries Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Constantia Flexibles Group GmbH

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clondalkin Group Holdings BV

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Berry Plastics Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mondi Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tetra Pak International SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sealed Air Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amcor PLC*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 United Biopolymers SA

List of Figures

- Figure 1: Global Biopolymer Packaging Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Biopolymer Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 3: North America Biopolymer Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Biopolymer Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Biopolymer Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Biopolymer Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Biopolymer Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Biopolymer Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 9: Europe Biopolymer Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Europe Biopolymer Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Biopolymer Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Biopolymer Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Biopolymer Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Biopolymer Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 15: Asia Pacific Biopolymer Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Asia Pacific Biopolymer Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Biopolymer Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Biopolymer Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Biopolymer Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Biopolymer Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 21: Latin America Biopolymer Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Latin America Biopolymer Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America Biopolymer Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America Biopolymer Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Biopolymer Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Biopolymer Packaging Industry Revenue (Million), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Biopolymer Packaging Industry Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Biopolymer Packaging Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa Biopolymer Packaging Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa Biopolymer Packaging Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Biopolymer Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Biopolymer Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Biopolymer Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 8: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Biopolymer Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 11: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Biopolymer Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 14: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Biopolymer Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biopolymer Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 17: Global Biopolymer Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Biopolymer Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biopolymer Packaging Industry?

The projected CAGR is approximately 12.60%.

2. Which companies are prominent players in the Biopolymer Packaging Industry?

Key companies in the market include United Biopolymers SA, Taghleef Industries Inc, Sonoco Products Company, Constantia Flexibles Group GmbH, Clondalkin Group Holdings BV, Berry Plastics Group Inc, Mondi Group, Tetra Pak International SA, Sealed Air Corporation, Amcor PLC*List Not Exhaustive.

3. What are the main segments of the Biopolymer Packaging Industry?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; The Growing Government Regulations for Bio-based Packaging; Increasing Awareness for Human Well Being and Eco-friendly Products.

6. What are the notable trends driving market growth?

Food and Beverages Industry is Expected to Witness a Significant Growth during the Forecast Period.

7. Are there any restraints impacting market growth?

; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biopolymer Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biopolymer Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biopolymer Packaging Industry?

To stay informed about further developments, trends, and reports in the Biopolymer Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence