Key Insights

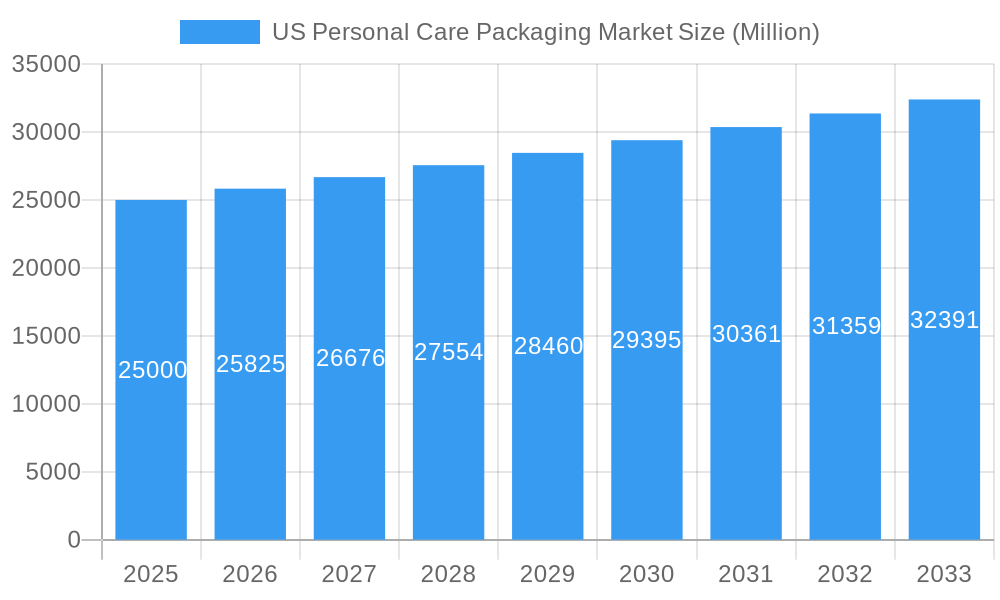

The US personal care packaging market is poised for steady growth, projected to reach an estimated $XX million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.30% from 2019 to 2033. This expansion is largely fueled by escalating consumer demand for premium and innovative beauty and personal care products, particularly within the skincare and makeup segments. Trends such as the increasing adoption of sustainable packaging solutions, including recycled plastics and biodegradable materials, are significantly influencing market dynamics. Consumers are becoming more environmentally conscious, driving manufacturers to invest in eco-friendly alternatives. Furthermore, the rise of direct-to-consumer (DTC) brands and the continued growth of e-commerce are reshaping packaging requirements, favoring smaller, more durable, and aesthetically pleasing designs that can withstand shipping while maintaining brand appeal. Technological advancements in material science and packaging design are also contributing to market expansion, enabling the creation of specialized packaging that enhances product functionality and user experience.

US Personal Care Packaging Market Market Size (In Billion)

Key drivers of this market include the growing emphasis on product safety and shelf-life extension, leading to the development of advanced barrier materials and tamper-evident packaging. The burgeoning demand for personalized and custom beauty products also necessitates flexible and adaptable packaging solutions. While the market benefits from these growth factors, it also faces certain restraints. The increasing cost of raw materials, coupled with stringent regulatory compliances related to packaging safety and environmental impact, can pose challenges for manufacturers. However, strategic collaborations between packaging providers and beauty brands, alongside a focus on research and development for novel and sustainable packaging technologies, are expected to mitigate these challenges. The market segmentation reveals a strong preference for plastic as a material type, with bottles and pumps/dispensers dominating product types, reflecting their widespread use across major applications like skincare, haircare, and makeup.

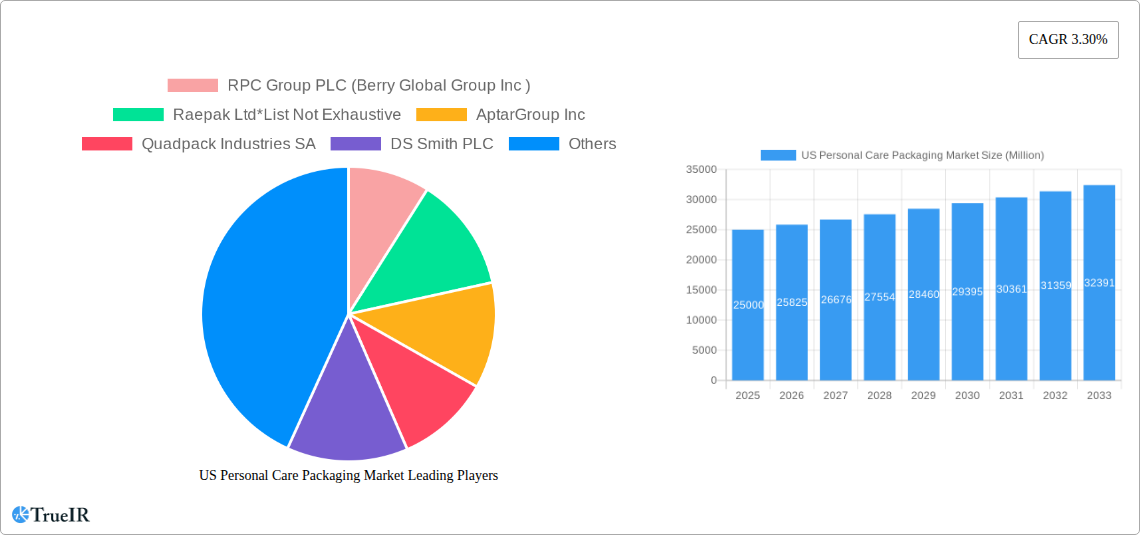

US Personal Care Packaging Market Company Market Share

Here is a dynamic, SEO-optimized report description for the US Personal Care Packaging Market, designed for immediate use without modification.

US Personal Care Packaging Market: Comprehensive Analysis (2019–2033)

Report Overview:

This in-depth report provides a granular analysis of the US Personal Care Packaging Market, offering critical insights into market dynamics, trends, opportunities, and the competitive landscape. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this research is essential for stakeholders seeking to understand and capitalize on the evolving demands of the US personal care industry. With a base year of 2025 and an estimated year of 2025, the report delves into material types, product categories, and application segments, supported by extensive quantitative data and qualitative analysis.

US Personal Care Packaging Market Market Structure & Competitive Landscape

The US Personal Care Packaging Market exhibits a moderately concentrated structure, with key players vying for market share through innovation and strategic expansion. Innovation drivers are primarily fueled by increasing consumer demand for sustainable packaging solutions, enhanced product functionality, and premium aesthetics. Regulatory impacts, particularly those related to environmental sustainability and material safety, are shaping packaging designs and material choices. Product substitutes, while present, are often differentiated by performance, cost, and perceived value. End-user segmentation reveals a significant focus on the growing demand from the skincare and haircare sectors, driven by an aging population and increased disposable income. Mergers and acquisitions (M&A) are a notable trend, with companies consolidating to gain economies of scale, expand product portfolios, and enter new market segments. For instance, the market has witnessed numerous strategic partnerships and acquisitions aimed at strengthening capabilities in areas like flexible packaging and sustainable materials. The concentration ratio is estimated to be between 45-55%, with the top 5 players holding a significant portion of the market. M&A volumes in the past three years have been in the range of 15-20 significant transactions annually, indicating a dynamic consolidation phase. The influence of private label brands also contributes to market fragmentation in certain product categories.

US Personal Care Packaging Market Market Trends & Opportunities

The US Personal Care Packaging Market is projected to experience robust growth driven by several converging trends and significant opportunities. Market size is expected to reach an estimated USD 75,000 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period of 2025–2033. Technological shifts are prominently featuring the adoption of advanced materials, including biodegradable plastics and recycled content, to meet growing environmental consciousness among consumers. Innovations in smart packaging, offering enhanced product authentication and consumer engagement, are also gaining traction. Consumer preferences are increasingly leaning towards minimalistic designs, convenience, and personalized packaging experiences. The demand for on-the-go formats and single-use sachets for travel-sized products is also on the rise, particularly within the skincare and haircare segments. Competitive dynamics are characterized by intense product differentiation, with companies focusing on unique dispensing mechanisms, ergonomic designs, and eye-catching aesthetics to capture consumer attention. The growing influence of e-commerce necessitates packaging that ensures product integrity during transit while also providing an appealing unboxing experience. Opportunities abound in the development of refillable and reusable packaging systems, aligning with circular economy principles. Furthermore, the expanding market for men's grooming products and the increasing demand for natural and organic personal care items are creating new avenues for specialized packaging solutions. The penetration rate of sustainable packaging solutions is steadily increasing, projected to reach 35% of the market by 2033, presenting substantial growth prospects for eco-friendly materials and designs. The rise of direct-to-consumer (DTC) brands also offers opportunities for agile and customized packaging solutions.

Dominant Markets & Segments in US Personal Care Packaging Market

The US Personal Care Packaging Market is characterized by the dominance of certain segments, driven by application needs, material properties, and consumer behavior.

Material Type Dominance:

- Plastic: This segment holds the largest market share, estimated at over 65% of the total market value in 2025. Its dominance is attributed to its versatility, cost-effectiveness, durability, and the wide range of plastic types available, including PET, HDPE, and PP, which are crucial for various personal care products.

- Glass: While having a smaller share (approximately 18% in 2025), glass remains a premium choice for high-end skincare and fragrance products, offering excellent barrier properties and a perceived sense of luxury.

- Metal: Accounting for around 8% of the market in 2025, metal packaging, primarily aluminum, is favored for its recyclability and suitability for aerosols and certain skincare formulations like creams and lotions.

- Paper and Paperboard: This segment, representing about 9% in 2025, is experiencing growth due to increasing demand for sustainable and eco-friendly packaging. It is increasingly used for secondary packaging and smaller product containers.

Product Type Dominance:

- Bottles: This remains the leading product type, commanding over 40% of the market in 2025, essential for liquids in skincare, haircare, and oral care.

- Pumps and Dispensers: Significant in value and functionality, this category holds approximately 25% of the market in 2025, crucial for controlled dispensing of lotions, serums, and sanitizers.

- Tubes and Sticks: Occupying around 20% of the market in 2025, these are vital for products like toothpaste, creams, and lip balms.

- Pouches: Growing in popularity for single-use and travel-sized products, pouches represent about 10% of the market in 2025.

Application Dominance:

- Skin Care: This is the largest application segment, projected to account for over 35% of the market value in 2025. The increasing focus on anti-aging, sun protection, and specialized treatments drives this dominance.

- Hair Care: Following closely, hair care accounts for approximately 28% of the market in 2025, driven by a wide array of shampoos, conditioners, styling products, and treatments.

- Makeup Products: This segment represents around 15% of the market in 2025, with a continuous demand for innovative and visually appealing packaging.

- Deodorants and Fragrances: These segments collectively hold about 12% of the market in 2025, often featuring aerosol cans, spray bottles, and roll-ons.

Growth drivers for plastic packaging include its unparalleled versatility and cost-effectiveness. For glass, its premium appeal and inertness are key. The growth in paper and paperboard is directly linked to the sustainability movement. In product types, bottles’ ubiquity in liquid formulations ensures continued dominance. Pumps and dispensers offer convenience and precise application, crucial for premium products. For applications, the ever-expanding wellness and beauty consciousness fuels skincare and haircare demand.

US Personal Care Packaging Market Product Analysis

Product innovations in the US Personal Care Packaging Market are primarily driven by a dual focus on functionality and sustainability. Advanced dispensing systems, such as airless pumps and precision droppers, offer enhanced product preservation and controlled application, directly impacting consumer experience and reducing waste. The integration of mono-material designs in plastic packaging is a significant trend, facilitating easier recyclability. Furthermore, the development of lightweight yet robust packaging, coupled with the increasing use of post-consumer recycled (PCR) content, showcases a commitment to environmental responsibility. Competitive advantages are being carved out through aesthetically pleasing designs, tactile finishes, and customizable options that resonate with brand identity and consumer aspirations.

Key Drivers, Barriers & Challenges in US Personal Care Packaging Market

Key Drivers:

- Growing Consumer Demand for Sustainable Packaging: This is a paramount driver, pushing for recycled content, biodegradability, and refillable options, with an estimated 60% of consumers now prioritizing eco-friendly packaging.

- Evolving Consumer Lifestyles and Preferences: Increased demand for on-the-go formats, personalized products, and premium experiences fuels innovation in packaging design and functionality.

- Technological Advancements: Innovations in material science and manufacturing processes enable lighter, more durable, and aesthetically superior packaging solutions.

- E-commerce Growth: The rise of online retail necessitates robust and attractive packaging that ensures product integrity during shipping and enhances the unboxing experience.

Barriers & Challenges:

- Regulatory Hurdles and Compliance Costs: Stringent regulations concerning material safety, recyclability, and labeling can increase development and production costs.

- Supply Chain Volatility and Material Costs: Fluctuations in the availability and price of raw materials, particularly plastics and specialized components, can impact profit margins.

- Consumer Education and Awareness: While sustainability is a priority, effective communication about the recyclability and environmental impact of packaging is crucial for widespread adoption.

- Competition and Price Sensitivity: The market is highly competitive, with constant pressure to balance innovation and quality with cost-effectiveness.

Growth Drivers in the US Personal Care Packaging Market Market

The US Personal Care Packaging Market is propelled by a confluence of powerful growth drivers. Technologically, the continuous development of advanced materials, such as high-barrier plastics and innovative biodegradable polymers, is expanding design possibilities and environmental credentials. Economically, rising disposable incomes and an increasing consumer focus on self-care and wellness are directly translating into higher spending on personal care products, necessitating more sophisticated and appealing packaging. Policy-driven factors, including government initiatives promoting circular economy principles and Extended Producer Responsibility (EPR) schemes, are accelerating the adoption of sustainable packaging solutions. For instance, state-level legislation mandating recycled content is actively shaping material sourcing and design strategies. The booming e-commerce sector also acts as a significant growth catalyst, demanding packaging that is both protective and aesthetically pleasing for online consumers.

Challenges Impacting US Personal Care Packaging Market Growth

Several challenges are impacting the growth trajectory of the US Personal Care Packaging Market. Regulatory complexities, including evolving labeling requirements and the fragmented landscape of plastic waste management policies across different states, create compliance burdens for manufacturers. Supply chain issues, exacerbated by global events, have led to increased lead times and raw material price volatility, particularly for specialized resins and components. Competitive pressures are intense, with a constant need to innovate while maintaining cost-effectiveness, leading to potential commoditization in certain segments. The significant investment required for transitioning to fully sustainable packaging solutions, including new machinery and material sourcing, presents a financial hurdle for smaller players. Furthermore, ensuring consistent quality and performance of recycled materials at scale remains an ongoing challenge.

Key Players Shaping the US Personal Care Packaging Market Market

- RPC Group PLC (Berry Global Group Inc)

- AptarGroup Inc

- Quadpack Industries SA

- DS Smith PLC

- Graham Packaging Company

- Amcor PLC

- Cosmopak Ltd

- Libo Cosmetics Company Ltd

- HCP Packaging Co Ltd

- Rieke Packaging Systems Ltd

- Albea SA

- Silgan Holdings Inc

- Gerresheimer AG

- Raepak Ltd

Significant US Personal Care Packaging Market Industry Milestones

- September 2022: Amcor announced a further strategic investment of up to USD 45 million in ePac Flexible Packaging, increasing its minority shareholding in ePac Holdings LLC. This investment underscores confidence in ePac's digitally enabled business model and presents opportunities for Amcor to expand its addressable markets in flexible packaging.

- August 2022: Quadpack announced the establishment of a new US lab service to provide value-added testing for regional personal brands, aiding brands during the packaging development stage with high-tech equipment for leakage, weight loss, torque, decoration resistance, tube sealing, and formula aging tests.

Future Outlook for US Personal Care Packaging Market Market

The future outlook for the US Personal Care Packaging Market is exceptionally promising, fueled by a sustained drive towards sustainability, personalization, and enhanced consumer experience. Strategic opportunities lie in the continued development and adoption of circular economy models, including the widespread implementation of refillable and reusable packaging systems, which are projected to see a market penetration of over 20% by 2033. Innovations in biodegradable and compostable materials will continue to gain traction, aligning with evolving consumer expectations and stricter environmental regulations. The integration of smart technologies for product authentication and traceability will also play a crucial role in building consumer trust and brand loyalty. Furthermore, the market will witness a growing demand for customized and niche packaging solutions tailored to specific product formulations and target demographics, particularly within the rapidly expanding indie beauty and wellness sectors. The US market is poised for significant growth, driven by a blend of conscious consumerism and cutting-edge packaging technology.

US Personal Care Packaging Market Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Paper and Paperboard

-

2. Product Type

- 2.1. Bottles

- 2.2. Tubes and Sticks

- 2.3. Pumps and Dispensers

- 2.4. Pouches

- 2.5. Other Pr

-

3. Application

- 3.1. Skin Care

- 3.2. Hair Care

- 3.3. Oral Care

- 3.4. Makeup Products

- 3.5. Deodorants and Fragrances

- 3.6. Other Ap

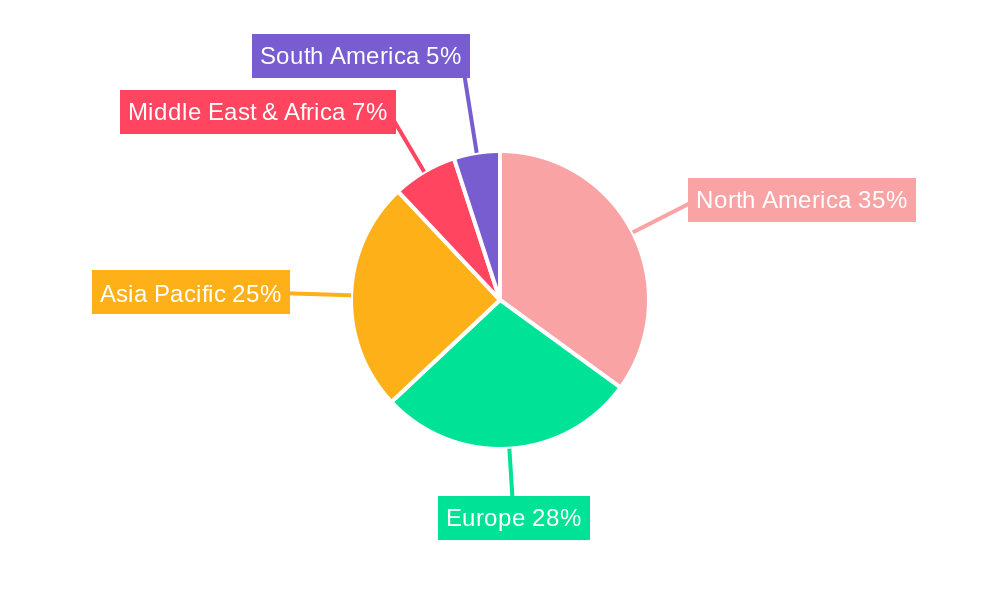

US Personal Care Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Personal Care Packaging Market Regional Market Share

Geographic Coverage of US Personal Care Packaging Market

US Personal Care Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Personal Care Products With Growing Disposable Income; Growing Focus on Innovative and Attractive Packaging

- 3.3. Market Restrains

- 3.3.1. High Costs of R&D and Manufacturing of New Packaging Solution

- 3.4. Market Trends

- 3.4.1. Plastic Material is expected to witness significant growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Paper and Paperboard

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Tubes and Sticks

- 5.2.3. Pumps and Dispensers

- 5.2.4. Pouches

- 5.2.5. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Skin Care

- 5.3.2. Hair Care

- 5.3.3. Oral Care

- 5.3.4. Makeup Products

- 5.3.5. Deodorants and Fragrances

- 5.3.6. Other Ap

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Plastic

- 6.1.2. Glass

- 6.1.3. Metal

- 6.1.4. Paper and Paperboard

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bottles

- 6.2.2. Tubes and Sticks

- 6.2.3. Pumps and Dispensers

- 6.2.4. Pouches

- 6.2.5. Other Pr

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Skin Care

- 6.3.2. Hair Care

- 6.3.3. Oral Care

- 6.3.4. Makeup Products

- 6.3.5. Deodorants and Fragrances

- 6.3.6. Other Ap

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. South America US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Plastic

- 7.1.2. Glass

- 7.1.3. Metal

- 7.1.4. Paper and Paperboard

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bottles

- 7.2.2. Tubes and Sticks

- 7.2.3. Pumps and Dispensers

- 7.2.4. Pouches

- 7.2.5. Other Pr

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Skin Care

- 7.3.2. Hair Care

- 7.3.3. Oral Care

- 7.3.4. Makeup Products

- 7.3.5. Deodorants and Fragrances

- 7.3.6. Other Ap

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Europe US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Plastic

- 8.1.2. Glass

- 8.1.3. Metal

- 8.1.4. Paper and Paperboard

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bottles

- 8.2.2. Tubes and Sticks

- 8.2.3. Pumps and Dispensers

- 8.2.4. Pouches

- 8.2.5. Other Pr

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Skin Care

- 8.3.2. Hair Care

- 8.3.3. Oral Care

- 8.3.4. Makeup Products

- 8.3.5. Deodorants and Fragrances

- 8.3.6. Other Ap

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Middle East & Africa US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Plastic

- 9.1.2. Glass

- 9.1.3. Metal

- 9.1.4. Paper and Paperboard

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bottles

- 9.2.2. Tubes and Sticks

- 9.2.3. Pumps and Dispensers

- 9.2.4. Pouches

- 9.2.5. Other Pr

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Skin Care

- 9.3.2. Hair Care

- 9.3.3. Oral Care

- 9.3.4. Makeup Products

- 9.3.5. Deodorants and Fragrances

- 9.3.6. Other Ap

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Asia Pacific US Personal Care Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Plastic

- 10.1.2. Glass

- 10.1.3. Metal

- 10.1.4. Paper and Paperboard

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bottles

- 10.2.2. Tubes and Sticks

- 10.2.3. Pumps and Dispensers

- 10.2.4. Pouches

- 10.2.5. Other Pr

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Skin Care

- 10.3.2. Hair Care

- 10.3.3. Oral Care

- 10.3.4. Makeup Products

- 10.3.5. Deodorants and Fragrances

- 10.3.6. Other Ap

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 RPC Group PLC (Berry Global Group Inc )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Raepak Ltd*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 AptarGroup Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Quadpack Industries SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Graham Packaging Company

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amcor PLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cosmopak Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Libo Cosmetics Company Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 HCP Packaging Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Rieke Packaging Systems Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Albea SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Silgan Holdings Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Gerresheimer AG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 RPC Group PLC (Berry Global Group Inc )

List of Figures

- Figure 1: Global US Personal Care Packaging Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America US Personal Care Packaging Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 3: North America US Personal Care Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America US Personal Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 5: North America US Personal Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America US Personal Care Packaging Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America US Personal Care Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America US Personal Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America US Personal Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America US Personal Care Packaging Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 11: South America US Personal Care Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 12: South America US Personal Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 13: South America US Personal Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America US Personal Care Packaging Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America US Personal Care Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America US Personal Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America US Personal Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe US Personal Care Packaging Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 19: Europe US Personal Care Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 20: Europe US Personal Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 21: Europe US Personal Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe US Personal Care Packaging Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe US Personal Care Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe US Personal Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe US Personal Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa US Personal Care Packaging Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 27: Middle East & Africa US Personal Care Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East & Africa US Personal Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa US Personal Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa US Personal Care Packaging Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East & Africa US Personal Care Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa US Personal Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa US Personal Care Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific US Personal Care Packaging Market Revenue (undefined), by Material Type 2025 & 2033

- Figure 35: Asia Pacific US Personal Care Packaging Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 36: Asia Pacific US Personal Care Packaging Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 37: Asia Pacific US Personal Care Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific US Personal Care Packaging Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: Asia Pacific US Personal Care Packaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific US Personal Care Packaging Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific US Personal Care Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 2: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 3: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global US Personal Care Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 6: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global US Personal Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 13: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global US Personal Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 20: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 21: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global US Personal Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 33: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 34: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global US Personal Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global US Personal Care Packaging Market Revenue undefined Forecast, by Material Type 2020 & 2033

- Table 43: Global US Personal Care Packaging Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 44: Global US Personal Care Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 45: Global US Personal Care Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific US Personal Care Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Personal Care Packaging Market?

The projected CAGR is approximately 5.5%.

2. Which companies are prominent players in the US Personal Care Packaging Market?

Key companies in the market include RPC Group PLC (Berry Global Group Inc ), Raepak Ltd*List Not Exhaustive, AptarGroup Inc, Quadpack Industries SA, DS Smith PLC, Graham Packaging Company, Amcor PLC, Cosmopak Ltd, Libo Cosmetics Company Ltd, HCP Packaging Co Ltd, Rieke Packaging Systems Ltd, Albea SA, Silgan Holdings Inc, Gerresheimer AG.

3. What are the main segments of the US Personal Care Packaging Market?

The market segments include Material Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Personal Care Products With Growing Disposable Income; Growing Focus on Innovative and Attractive Packaging.

6. What are the notable trends driving market growth?

Plastic Material is expected to witness significant growth.

7. Are there any restraints impacting market growth?

High Costs of R&D and Manufacturing of New Packaging Solution.

8. Can you provide examples of recent developments in the market?

September 2022 - Amcor has announced a further strategic investment of up to USD 45 million in ePac Flexible Packaging ('ePac'), a quality, flexible packaging. The acquisition will increase Amcor's minority shareholding in ePac Holdings LLC, which Reflects confidence in ePac's unique, digitally enabled business model, providing excellent opportunities to expand Amcor's addressable markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Personal Care Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Personal Care Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Personal Care Packaging Market?

To stay informed about further developments, trends, and reports in the US Personal Care Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence