Key Insights

The South Africa metal packaging market is projected for robust growth, driven by escalating demand from the food and beverage sector, an expanding consumer base, and rising disposable incomes. Key market segments include material type (steel and aluminum), product type (cans, closures, and other containers), and end-user industries. Anticipating a Compound Annual Growth Rate (CAGR) of 4.1%, the market is estimated at 108.6 billion in the base year 2025. The historical period (2019-2024) likely witnessed consistent expansion, supported by prominent players such as Hulamin Limited and Nampak Bevcan. Future expansion will be fueled by sustained demand from established industries and potential diversification into emerging sectors, such as premium personal care products. However, market growth may be moderated by fluctuating raw material prices, environmental sustainability concerns, and competition from alternative packaging materials. The forecast period (2025-2033) offers opportunities for market consolidation through mergers and acquisitions to boost efficiency and market share.

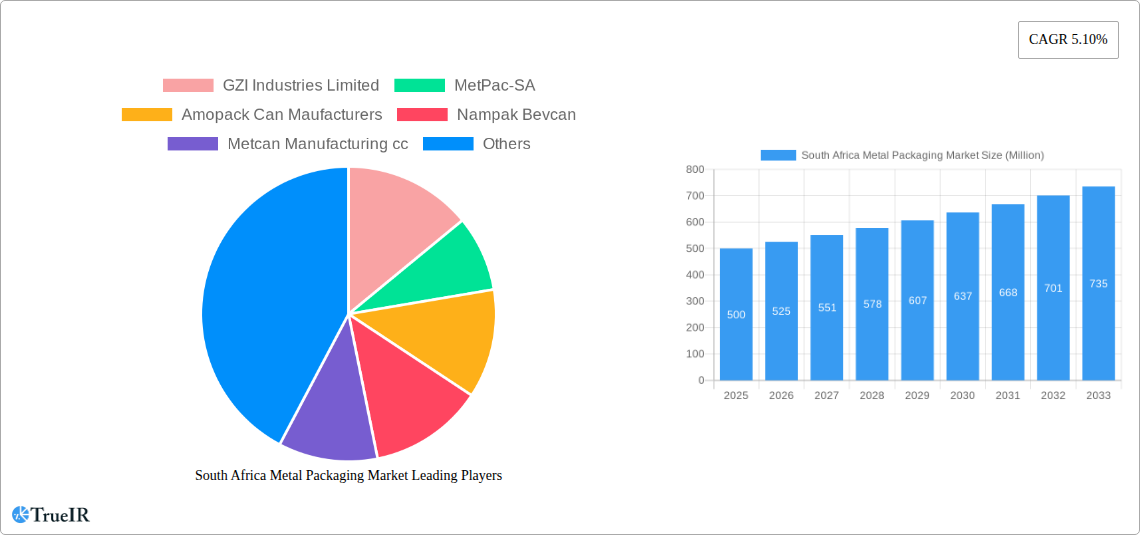

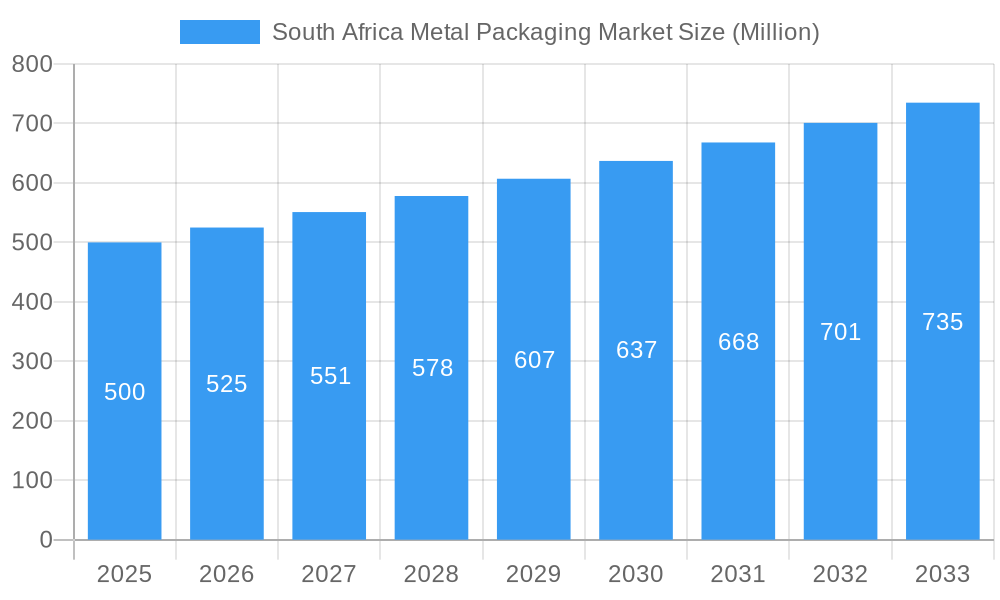

South Africa Metal Packaging Market Market Size (In Billion)

The South Africa metal packaging market is anticipated to achieve moderate expansion, influenced by domestic consumption and regional trade. While precise market sizing data is not available, projections based on the broader GCC context indicate substantial market value. The presence of established players like Hulamin Limited and Nampak Bevcan signifies a mature and competitive landscape. Furthermore, trends toward premiumization and sustainability in the food and beverage industry are expected to encourage the adoption of advanced metal packaging solutions, thereby stimulating market growth. Government initiatives supporting local manufacturing and environmental sustainability may also positively impact market trajectory. Nevertheless, challenges related to raw material costs and the necessity for enhanced recycling infrastructure remain critical considerations for effective market entry and strategic planning.

South Africa Metal Packaging Market Company Market Share

South Africa Metal Packaging Market: A Comprehensive Report (2019-2033)

This dynamic report offers a deep dive into the South Africa metal packaging market, providing a detailed analysis of its structure, trends, opportunities, and future outlook from 2019 to 2033. With a focus on key players like GZI Industries Limited, MetPac-SA, Amopack Can Manufacturers, Nampak Bevcan, Metcan Manufacturing cc, Hulamin Limited, Ardgh Group S.A., and Can-It, this report is essential for businesses operating in or seeking to enter this lucrative market. The report leverages extensive market research, incorporating historical data (2019-2024), a base year of 2025, and a forecast period spanning 2025-2033, providing invaluable insights for strategic decision-making.

South Africa Metal Packaging Market Structure & Competitive Landscape

The South African metal packaging market exhibits a moderately concentrated structure, with a few major players commanding significant market share. The market's competitive landscape is shaped by several factors, including continuous innovation in materials and manufacturing processes, evolving regulatory frameworks impacting sustainability and material sourcing, and the emergence of substitute packaging materials like plastic and paper. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with a total estimated volume of xx M&A deals in the period 2019-2024. End-user segmentation is a key factor influencing market dynamics, with the food and beverage sectors being primary drivers. Further insights into concentration ratios and other quantitative data are detailed within the full report.

- Market Concentration: Moderate, with a few dominant players.

- Innovation Drivers: Sustainability concerns, lightweighting, improved barrier properties.

- Regulatory Impacts: Focus on recyclability and reduced environmental footprint.

- Product Substitutes: Growing competition from plastic and paper-based packaging.

- End-User Segmentation: Food & Beverage, Pharmaceutical & Medical, Household & Personal Care dominate.

- M&A Trends: Moderate activity, with xx deals observed in the historical period.

South Africa Metal Packaging Market Market Trends & Opportunities

The South African metal packaging market is experiencing steady growth, driven by increasing consumer demand for packaged goods, particularly in the food and beverage sector. The market size is projected to reach xx Million by 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, including the adoption of advanced coating technologies and improved printing techniques, are enhancing the appeal of metal packaging. Consumer preferences are shifting towards sustainable packaging options, driving demand for recyclable and eco-friendly metal containers. The competitive landscape is dynamic, with existing players focusing on innovation and expansion to maintain market share, while new entrants seek to capitalize on emerging opportunities. Market penetration rates vary by product type and end-user industry, with the beverage sector showing the highest penetration.

Dominant Markets & Segments in South Africa Metal Packaging Market

The metal segment dominates the South African packaging market by material type. Within this, the food and beverage end-user industries are the leading consumers of metal packaging, owing to its superior barrier properties and suitability for preserving various products. The "Other Product Types" category is experiencing significant growth, driven by diversification across various sectors.

By Material Type: Metal significantly outweighs plastic and paper.

By Product Type: Cans and closures remain dominant, but other product types are growing.

By End-user Industry: Food and beverage represent the largest segment.

Key Growth Drivers:

- Strong growth in the food and beverage sector.

- Increased demand for convenient and shelf-stable products.

- Technological advancements leading to improved packaging solutions.

South Africa Metal Packaging Market Product Analysis

Metal packaging innovation focuses on enhancing recyclability, improving barrier properties, and reducing material usage. This includes lighter-weight designs, improved coatings for extended shelf life, and innovative printing techniques to enhance branding and consumer appeal. These improvements are crucial for maintaining competitiveness against substitute materials, meeting consumer demand for sustainability, and creating a superior product offering for various applications.

Key Drivers, Barriers & Challenges in South Africa Metal Packaging Market

Key Drivers: The growing food and beverage sector, increasing demand for convenient packaging, and technological improvements driving enhanced product offerings are key drivers. Strong government support for sustainable packaging solutions is also a significant boost.

Key Challenges: Fluctuations in raw material prices, intense competition from substitute packaging, and the complexities of waste management and recycling infrastructure pose challenges to market growth. Regulatory changes related to sustainability can also disrupt supply chains. These factors may impact the overall growth rate by approximately xx% annually.

Growth Drivers in the South Africa Metal Packaging Market Market

Expanding food and beverage sector, rising consumer preference for convenient and safe packaging, technological advancements, and supportive government regulations toward sustainability are all driving market growth.

Challenges Impacting South Africa Metal Packaging Market Growth

Fluctuations in raw material costs, competition from alternative packaging materials (plastic & paper), waste management and recycling infrastructure limitations, and stringent regulatory requirements represent significant hurdles to market growth.

Key Players Shaping the South Africa Metal Packaging Market Market

- GZI Industries Limited

- MetPac-SA

- Amopack Can Manufacturers

- Nampak Bevcan

- Metcan Manufacturing cc

- Hulamin Limited

- Ardgh Group S.A.

- Can-It

Significant South Africa Metal Packaging Market Industry Milestones

- December 2022: Oceana's sales (including Lucky Star canned fish) increased by double digits, reaching SAR 8.44 billion (USD 480 Million), showcasing strong demand for canned goods in South Africa.

- November 2022: South African canned fruit exports surged due to a poor harvest in Greece, boosting sales for companies like RFG Holdings.

Future Outlook for South Africa Metal Packaging Market Market

The South Africa metal packaging market is poised for continued growth, driven by rising demand, technological advancements focused on sustainability, and a supportive regulatory environment. Strategic opportunities exist for companies to innovate in sustainable packaging solutions, expand into emerging sectors, and leverage technological advancements to optimize their supply chains and increase efficiency. The market is expected to see a consistent increase in the coming years, though the exact growth rate will be subject to various economic and geopolitical factors.

South Africa Metal Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South Africa Metal Packaging Market Segmentation By Geography

- 1. South Africa

South Africa Metal Packaging Market Regional Market Share

Geographic Coverage of South Africa Metal Packaging Market

South Africa Metal Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Food and Baverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Metal Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 GZI Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MetPac-SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amopack Can Maufacturers

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nampak Bevcan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Metcan Manufacturing cc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hulamin Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ardgh Group S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Can It

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 GZI Industries Limited

List of Figures

- Figure 1: South Africa Metal Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Metal Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: South Africa Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South Africa Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South Africa Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South Africa Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South Africa Metal Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 7: South Africa Metal Packaging Market Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: South Africa Metal Packaging Market Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South Africa Metal Packaging Market Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South Africa Metal Packaging Market Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South Africa Metal Packaging Market Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South Africa Metal Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Metal Packaging Market?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the South Africa Metal Packaging Market?

Key companies in the market include GZI Industries Limited, MetPac-SA, Amopack Can Maufacturers, Nampak Bevcan, Metcan Manufacturing cc, Hulamin Limited, Ardgh Group S, Can It.

3. What are the main segments of the South Africa Metal Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Food and Beverage Industry in South Africa; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Growing Food and Baverage Industry.

7. Are there any restraints impacting market growth?

Growing Concerns Regarding the Environment and Recycling; Fluctuations in Raw Material Prices may Restrict the Market Growth.

8. Can you provide examples of recent developments in the market?

December 2022: Sales at Oceana, which owns the canned fish brand Lucky Star, have increased in South Africa. The strong demand for canned fish enabled a lift of Oceana's sales by double digits in the second part of the year. Sales for the global fishing company rose 11% to SAR 8.44 billion (USD 480 million), with operating profit rising 4% to SAR 1.25 billion (USD 71.0 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Metal Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Metal Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Metal Packaging Market?

To stay informed about further developments, trends, and reports in the South Africa Metal Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence