Key Insights

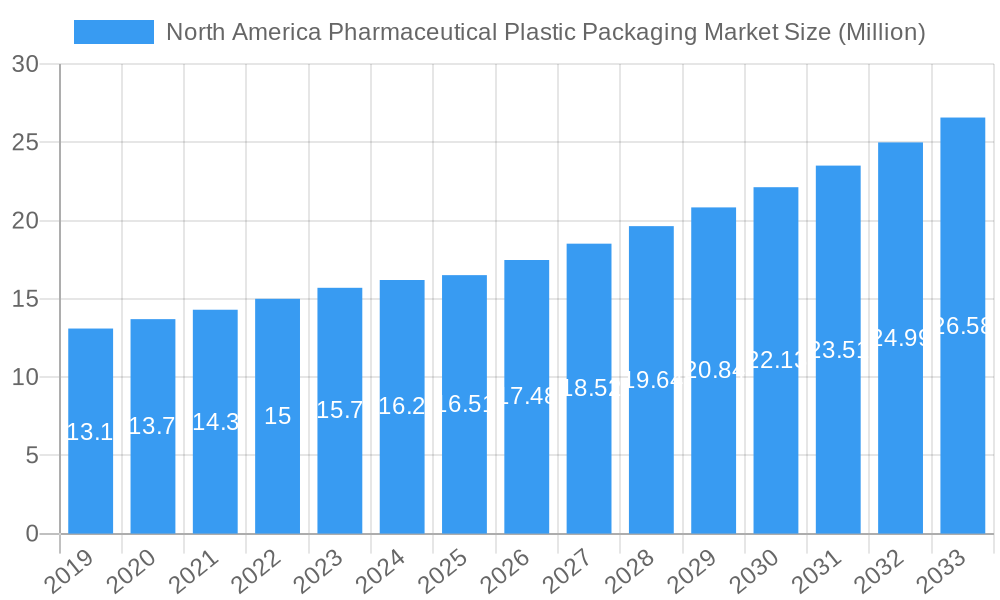

The North American pharmaceutical plastic packaging market is poised for robust growth, projected to reach an estimated $16.51 million in 2025. Driven by an increasing demand for advanced drug delivery systems and a growing focus on patient safety and convenience, the market is expected to expand at a Compound Annual Growth Rate (CAGR) of 5.97% throughout the forecast period. This expansion is fueled by key factors such as the rising prevalence of chronic diseases, the development of novel pharmaceutical formulations, and stringent regulatory requirements that favor high-quality, reliable packaging solutions. The market's strength is further bolstered by continuous innovation in materials science, leading to the development of specialized plastics like polypropylene (PP) and polyethylene terephthalate (PET) that offer superior barrier properties, chemical resistance, and recyclability, aligning with the industry's sustainability goals. The increasing preference for single-dose packaging and pre-filled syringes also contributes significantly to market dynamism, enhancing user compliance and minimizing contamination risks.

North America Pharmaceutical Plastic Packaging Market Market Size (In Million)

The market is segmented across various product types, with solid containers, dropper bottles, and liquid bottles holding substantial share due to their widespread application in oral and topical medications. However, emerging segments like nasal spray bottles and vials and ampoules are witnessing accelerated growth driven by advancements in drug delivery technologies. The raw material landscape is dominated by polypropylene (PP) and polyethylene terephthalate (PET), favored for their versatility and cost-effectiveness. North America, encompassing the United States, Canada, and Mexico, represents a significant market due to its well-established pharmaceutical industry, high healthcare spending, and strong presence of key players. Despite this positive outlook, potential restraints such as volatile raw material prices and the increasing competition from alternative packaging materials like glass and advanced composites could influence market dynamics. Nevertheless, the unwavering commitment to innovation and the escalating healthcare needs are expected to sustain the market's upward trajectory.

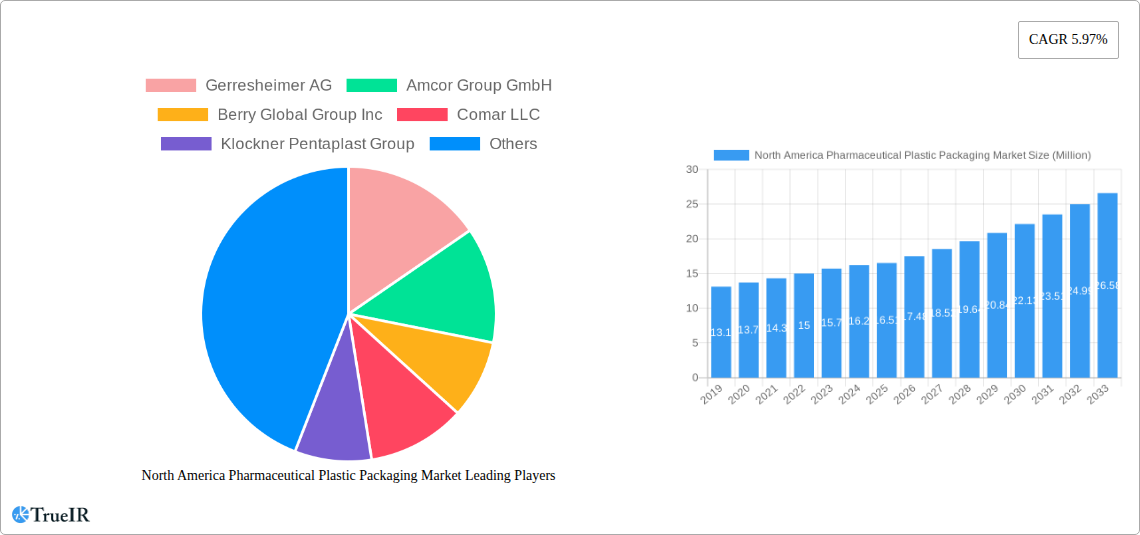

North America Pharmaceutical Plastic Packaging Market Company Market Share

North America Pharmaceutical Plastic Packaging Market: Comprehensive Market Analysis 2019-2033

This report delivers an in-depth analysis of the North America Pharmaceutical Plastic Packaging Market, providing crucial insights into market dynamics, key trends, competitive landscape, and future outlook. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period up to 2033, this study is an indispensable resource for stakeholders seeking to understand and capitalize on the evolving pharmaceutical plastic packaging sector. The market is segmented by raw material (Polypropylene (PP), Polyethylene Terephthalate (PET), Low Density Polyethylene (LDPE), High Density Polyethylene (HDPE), Other Raw Materials) and product type (Solid Containers, Dropper Bottles, Nasal Spray Bottles, Liquid Bottles, Oral Care, Pouches, Vials and Ampoules, Cartridges, Syringes, Caps and Closure, Other Product Types).

North America Pharmaceutical Plastic Packaging Market Market Structure & Competitive Landscape

The North America pharmaceutical plastic packaging market is characterized by a moderately consolidated structure, with several key players holding significant market share. Innovation is a primary driver, fueled by the continuous need for advanced drug delivery systems, enhanced product shelf-life, and patient safety. Regulatory impacts, such as stringent FDA guidelines and evolving sustainability mandates, play a critical role in shaping product development and market entry strategies. The presence of effective product substitutes, including glass and metal packaging, necessitates ongoing innovation and cost-effectiveness from plastic packaging manufacturers. End-user segmentation reveals a strong reliance on the pharmaceutical industry, with emerging opportunities in the biotechnology and nutraceutical sectors. Merger and acquisition (M&A) trends are evident, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the past few years have seen strategic acquisitions aimed at consolidating market positions and enhancing R&D in areas like advanced barrier properties and sustainable materials. The market concentration is estimated to be around XX% by top 5 players, indicating a competitive yet manageable landscape.

- Innovation Drivers: Advanced barrier technologies, child-resistant packaging, tamper-evident features, and sustainable material development.

- Regulatory Impacts: FDA approval processes, GMP compliance, and evolving environmental regulations influencing material choices and manufacturing processes.

- Product Substitutes: Glass vials and ampoules, metal containers, and advanced composite materials.

- End-User Segmentation: Pharmaceutical manufacturing, biotechnology, generic drug producers, and over-the-counter (OTC) product manufacturers.

- M&A Trends: Acquisitions focused on expanding product lines, acquiring new technologies, and gaining market share in specialized segments.

North America Pharmaceutical Plastic Packaging Market Market Trends & Opportunities

The North America pharmaceutical plastic packaging market is poised for robust growth, driven by a confluence of factors including an aging population, increasing prevalence of chronic diseases, and a surge in pharmaceutical research and development. The market size is projected to expand significantly, with an estimated Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025-2033). Technological shifts are a major trend, with a growing emphasis on lightweight, durable, and sterile packaging solutions that enhance drug stability and patient compliance. The adoption of advanced materials like high-density polyethylene (HDPE) and innovative barrier coatings are becoming standard. Consumer preferences are increasingly leaning towards convenient, easy-to-use packaging, especially for oral medications and self-administration devices. This trend is pushing manufacturers to develop novel designs such as pre-filled syringes, auto-injectors, and specialized dropper bottles. Competitive dynamics are intensifying, with companies focusing on vertical integration, strategic partnerships, and the development of sustainable and eco-friendly packaging options to meet evolving market demands and regulatory pressures. The growing demand for biologics and personalized medicine is also creating new opportunities for specialized plastic packaging solutions, such as temperature-controlled packaging and advanced delivery systems. Market penetration rates for specialized plastic packaging in emerging therapeutic areas are expected to rise, offering significant growth potential for agile and innovative market players. The continued investment in novel drug formulations and the expanding pharmaceutical pipeline will further fuel the demand for high-quality, reliable plastic packaging solutions across North America. The development of smart packaging with integrated sensors for tracking temperature and humidity is also emerging as a key trend, offering enhanced product integrity and supply chain visibility.

Dominant Markets & Segments in North America Pharmaceutical Plastic Packaging Market

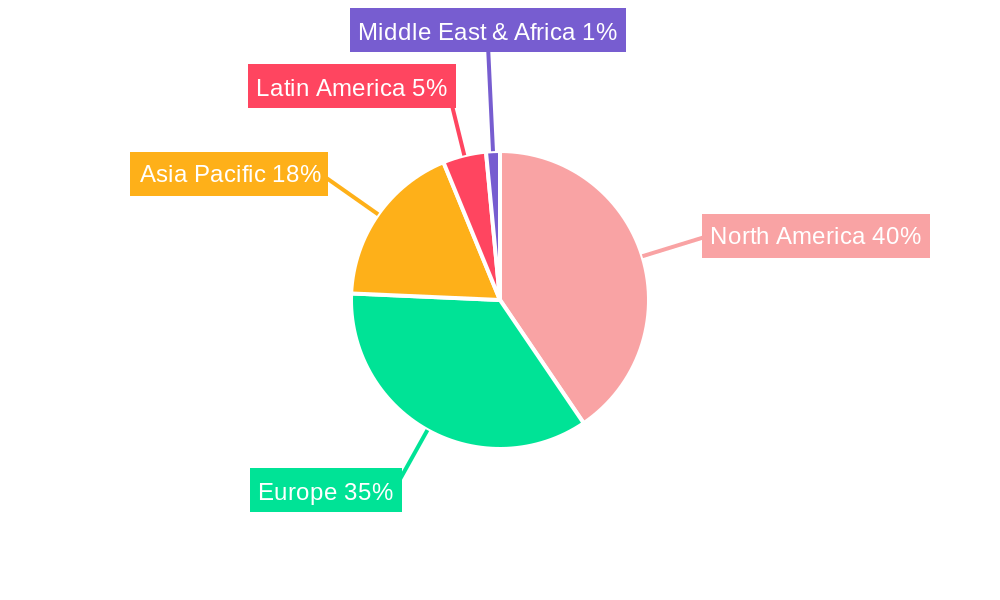

The North America pharmaceutical plastic packaging market exhibits distinct regional and segment dominance. The United States consistently leads in terms of market share and consumption, owing to its large pharmaceutical industry, high healthcare spending, and extensive R&D infrastructure. Canada and Mexico follow, with their respective pharmaceutical sectors contributing significantly to the regional market.

Within the Raw Material segment, Polypropylene (PP) and High-Density Polyethylene (HDPE) are the dominant materials. PP is favored for its excellent chemical resistance and heat stability, making it ideal for a wide range of pharmaceutical applications, including vials, bottles, and closures. HDPE offers a good balance of rigidity, strength, and chemical resistance, widely used for solid dosage form containers and liquid bottles. Polyethylene Terephthalate (PET) is increasingly utilized for its clarity and barrier properties, particularly for liquid formulations where visual inspection is critical. Low Density Polyethylene (LDPE) finds applications in flexible packaging and certain types of dropper bottles due to its flexibility.

In terms of Product Type, Solid Containers and Liquid Bottles represent the largest segments, driven by the sheer volume of oral solid dosage forms and liquid medications. Dropper Bottles and Nasal Spray Bottles are experiencing substantial growth, fueled by an increase in ophthalmic, otic, and nasal drug formulations, as well as a rising demand for over-the-counter (OTC) remedies. Vials and Ampoules, while traditionally associated with glass, are seeing increased adoption of plastic alternatives, especially for single-use applications and in regions where breakage is a concern. Cartridges and Syringes, particularly pre-filled syringes, are rapidly expanding segments due to the rise of biologics, vaccines, and self-administered therapies, demanding precision and sterility. Caps and Closures, a critical component for any pharmaceutical packaging, are also a significant market, with innovations focusing on child-resistance, tamper-evidence, and ease of use.

- Dominant Region: United States, Canada, Mexico.

- Leading Raw Materials: Polypropylene (PP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET).

- Key Growth Drivers (PP & HDPE): Cost-effectiveness, recyclability, chemical inertness, versatility in manufacturing processes.

- Dominant Product Types: Solid Containers, Liquid Bottles, Dropper Bottles, Nasal Spray Bottles.

- Key Growth Drivers (Dropper Bottles & Nasal Spray Bottles): Rising prevalence of allergies and eye conditions, increased use of OTC medications, demand for precise dosing.

- Fastest Growing Segments: Cartridges, Syringes (especially pre-filled), Vials and Ampoules (plastic alternatives).

- Key Growth Drivers (Cartridges & Syringes): Growth of biologics and biosimilars, increasing demand for self-injection devices, advancements in drug delivery technology.

- Critical Segment: Caps and Closures.

- Key Growth Drivers (Caps & Closures): Stringent regulatory requirements for child-resistance and tamper-evidence, demand for user-friendly designs.

North America Pharmaceutical Plastic Packaging Market Product Analysis

Innovations in North America pharmaceutical plastic packaging are primarily focused on enhancing drug safety, efficacy, and patient convenience. The development of advanced barrier materials, such as multi-layer films and coatings, is crucial for extending the shelf-life of sensitive medications by preventing oxidation and moisture ingress. Technologies enabling tamper-evident seals and child-resistant closures are paramount for regulatory compliance and consumer safety. Furthermore, the trend towards single-use, sterile packaging, including pre-filled syringes and vials made from high-purity plastics, is gaining momentum, particularly for biologics and vaccines. The competitive advantage lies in offering customizable solutions that meet specific drug requirements, ensuring optimal compatibility and preventing leaching.

Key Drivers, Barriers & Challenges in North America Pharmaceutical Plastic Packaging Market

Key Drivers: The North American pharmaceutical plastic packaging market is propelled by several significant drivers. Technological advancements in polymer science are leading to the development of lighter, stronger, and more sustainable packaging materials. The increasing global demand for pharmaceuticals, driven by an aging population and the rising prevalence of chronic diseases, directly translates into higher demand for packaging. Furthermore, stringent regulatory requirements for drug safety and efficacy necessitate the use of reliable and compliant packaging solutions. Government initiatives promoting healthcare access and the growth of the biopharmaceutical sector also contribute significantly to market expansion. The convenience and cost-effectiveness of plastic packaging compared to traditional materials like glass also play a crucial role.

Barriers & Challenges: Despite the growth, the market faces several challenges. The fluctuating prices of raw materials, primarily petrochemical derivatives, can impact manufacturing costs and profit margins. Stringent and evolving regulatory landscapes, while driving innovation, also present hurdles in terms of compliance and approval processes. Environmental concerns and increasing pressure for sustainable packaging solutions are driving a shift towards recycled and biodegradable plastics, which can be complex and costly to implement. Supply chain disruptions, as witnessed in recent global events, can lead to material shortages and production delays. Competitive pressures from established players and the threat of alternative packaging materials also pose challenges. The complexity of ensuring product integrity and sterility for highly sensitive drugs requires sophisticated manufacturing processes and quality control.

Growth Drivers in the North America Pharmaceutical Plastic Packaging Market Market

The growth of the North America pharmaceutical plastic packaging market is fundamentally driven by the burgeoning pharmaceutical industry itself. An escalating global demand for medicines, spurred by demographic shifts such as an aging populace and the rising incidence of chronic conditions, directly fuels the need for packaging. Technological advancements are continuously introducing new polymer grades with enhanced barrier properties, improved chemical resistance, and greater durability, enabling better drug preservation and extended shelf life. Regulatory mandates from bodies like the FDA, emphasizing drug safety, tamper-evidence, and child-resistance, compel manufacturers to adopt compliant and sophisticated packaging solutions. The significant investments in research and development within the biopharmaceutical sector, particularly in areas like biologics and personalized medicine, are creating a demand for specialized, high-performance plastic packaging, including pre-filled syringes and advanced delivery systems.

Challenges Impacting North America Pharmaceutical Plastic Packaging Market Growth

The North America pharmaceutical plastic packaging market growth is considerably impacted by regulatory complexities. Evolving environmental regulations push for the adoption of sustainable materials, requiring substantial investment in new technologies and processes for recycling and biodegradability, which can be cost-prohibitive for some manufacturers. Supply chain volatility, including fluctuating raw material costs and potential disruptions, poses a significant risk to production schedules and profitability. Intense competitive pressures necessitate continuous innovation and cost optimization, as numerous players vie for market share. The inherent need for absolute sterility and product integrity for pharmaceuticals presents a constant challenge, requiring rigorous quality control measures and advanced manufacturing techniques. Furthermore, the public perception and increasing consumer awareness regarding plastic waste can influence purchasing decisions and put pressure on companies to adopt more eco-friendly alternatives.

Key Players Shaping the North America Pharmaceutical Plastic Packaging Market Market

- Gerresheimer AG

- Amcor Group GmbH

- Berry Global Group Inc

- Comar LLC

- Klockner Pentaplast Group

- Nipro Medical Corporation

- James Alexander Corporation

- Drug Plastics Group

- Pretium Packaging

- Bormioli Pharma United States Inc (Bormioli Pharma S p A )

- Silgan Plastics (Silgan Holdings Inc )

Significant North America Pharmaceutical Plastic Packaging Market Industry Milestones

- July 2024: Amcor Group GmbH received recognition for its AmSky™ and AmPrima™ solutions, leading to its inclusion on Walmart’s Circular Connector platform. AmSky, a PVC and aluminum-free recycle-ready blister pack for pharmaceuticals, utilizes HDPE, disrupting traditional OTC packaging. AmPrima offers recycle-ready packaging for both solid and liquid contents.

- April 2024: Berry Global Group, Inc. launched a lightweight tube closure solution. Crafted from virgin PE/PP or food-safe rPE/rPP, this closure significantly reduces greenhouse gas emissions and is suitable for personal care and pharmaceutical applications.

Future Outlook for North America Pharmaceutical Plastic Packaging Market Market

The future outlook for the North America pharmaceutical plastic packaging market is exceptionally promising, driven by ongoing advancements in material science, evolving patient needs, and a robust pharmaceutical pipeline. The increasing adoption of sustainable packaging solutions, including recycled and bio-based plastics, will be a key growth catalyst. Innovations in drug delivery systems, such as advanced pre-filled syringes, auto-injectors, and smart packaging with integrated tracking capabilities, will create significant market opportunities. The growing demand for personalized medicine and biologics will further propel the need for specialized, high-performance plastic packaging that ensures sterility and optimal drug stability. Strategic collaborations between packaging manufacturers and pharmaceutical companies will be crucial for developing bespoke solutions that meet stringent regulatory requirements and cater to specific therapeutic needs. The market is poised for continued expansion, offering substantial potential for companies that can innovate and adapt to the dynamic healthcare landscape.

North America Pharmaceutical Plastic Packaging Market Segmentation

-

1. Raw Material

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Low Density Polyethylene (LDPE)

- 1.4. High Density Polyethylene (HDPE)

- 1.5. Other Raw Materials

-

2. Product Type**

- 2.1. Solid Containers

- 2.2. Dropper Bottles

- 2.3. Nasal Spray Bottles

- 2.4. Liquid Bottles

- 2.5. Oral Care

- 2.6. Pouches

- 2.7. Vials and Ampoules

- 2.8. Cartridges

- 2.9. Syringes

- 2.10. Caps and Closure

- 2.11. Other Product Types

North America Pharmaceutical Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pharmaceutical Plastic Packaging Market Regional Market Share

Geographic Coverage of North America Pharmaceutical Plastic Packaging Market

North America Pharmaceutical Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Child-resistant Packaging Solutions Drive the Demand for Pharmaceutical Plastic Packaging; Transitioning from Glass to Plastics Packaging Significantly Driving the Sales

- 3.3. Market Restrains

- 3.3.1. Demand for Child-resistant Packaging Solutions Drive the Demand for Pharmaceutical Plastic Packaging; Transitioning from Glass to Plastics Packaging Significantly Driving the Sales

- 3.4. Market Trends

- 3.4.1. Rising Demand for Sealed and Protective Caps and Closure for Pharmaceutical Containers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pharmaceutical Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Low Density Polyethylene (LDPE)

- 5.1.4. High Density Polyethylene (HDPE)

- 5.1.5. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type**

- 5.2.1. Solid Containers

- 5.2.2. Dropper Bottles

- 5.2.3. Nasal Spray Bottles

- 5.2.4. Liquid Bottles

- 5.2.5. Oral Care

- 5.2.6. Pouches

- 5.2.7. Vials and Ampoules

- 5.2.8. Cartridges

- 5.2.9. Syringes

- 5.2.10. Caps and Closure

- 5.2.11. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gerresheimer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Berry Global Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Comar LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Klockner Pentaplast Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nipro Medical Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 James Alexander Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Drug Plastics Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pretium Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bormioli Pharma United States Inc (Bormioli Pharma S p A )

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Silgan Plastics (Silgan Holdings Inc )*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Gerresheimer AG

List of Figures

- Figure 1: North America Pharmaceutical Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Pharmaceutical Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 2: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 3: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2020 & 2033

- Table 4: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2020 & 2033

- Table 5: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Raw Material 2020 & 2033

- Table 9: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Product Type** 2020 & 2033

- Table 10: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Product Type** 2020 & 2033

- Table 11: North America Pharmaceutical Plastic Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Pharmaceutical Plastic Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Pharmaceutical Plastic Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Pharmaceutical Plastic Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pharmaceutical Plastic Packaging Market?

The projected CAGR is approximately 5.97%.

2. Which companies are prominent players in the North America Pharmaceutical Plastic Packaging Market?

Key companies in the market include Gerresheimer AG, Amcor Group GmbH, Berry Global Group Inc, Comar LLC, Klockner Pentaplast Group, Nipro Medical Corporation, James Alexander Corporation, Drug Plastics Group, Pretium Packaging, Bormioli Pharma United States Inc (Bormioli Pharma S p A ), Silgan Plastics (Silgan Holdings Inc )*List Not Exhaustive.

3. What are the main segments of the North America Pharmaceutical Plastic Packaging Market?

The market segments include Raw Material, Product Type**.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Child-resistant Packaging Solutions Drive the Demand for Pharmaceutical Plastic Packaging; Transitioning from Glass to Plastics Packaging Significantly Driving the Sales.

6. What are the notable trends driving market growth?

Rising Demand for Sealed and Protective Caps and Closure for Pharmaceutical Containers.

7. Are there any restraints impacting market growth?

Demand for Child-resistant Packaging Solutions Drive the Demand for Pharmaceutical Plastic Packaging; Transitioning from Glass to Plastics Packaging Significantly Driving the Sales.

8. Can you provide examples of recent developments in the market?

July 2024: Amcor Group GmbH completed nine months of receiving recognition for its AmSky™ and AmPrima™, which helped the company earn a place on Walmart’s Circular Connector platform. AmSky is a polyvinyl chloride (PVC) and aluminum-free recycle-ready blister pack for pharmaceuticals. Disrupting the decades-long, over-the-counter standard drug pack, it uses high-density polyethylene (HDPE). AmPrima is a portfolio of recycle-ready packaging solutions for both solid and liquid content.April 2024: Berry Global Group, Inc. completed six months since the launch of a lightweight tube closure solution. This innovative closure, crafted from either virgin polyethylene (PE) and polypropylene (PP) or food-safe post-consumer recycled plastics (rPE and rPP), significantly contributes to reducing greenhouse gas emissions. It is particularly suited for personal care and pharmaceutical applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pharmaceutical Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pharmaceutical Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pharmaceutical Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the North America Pharmaceutical Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence