Key Insights

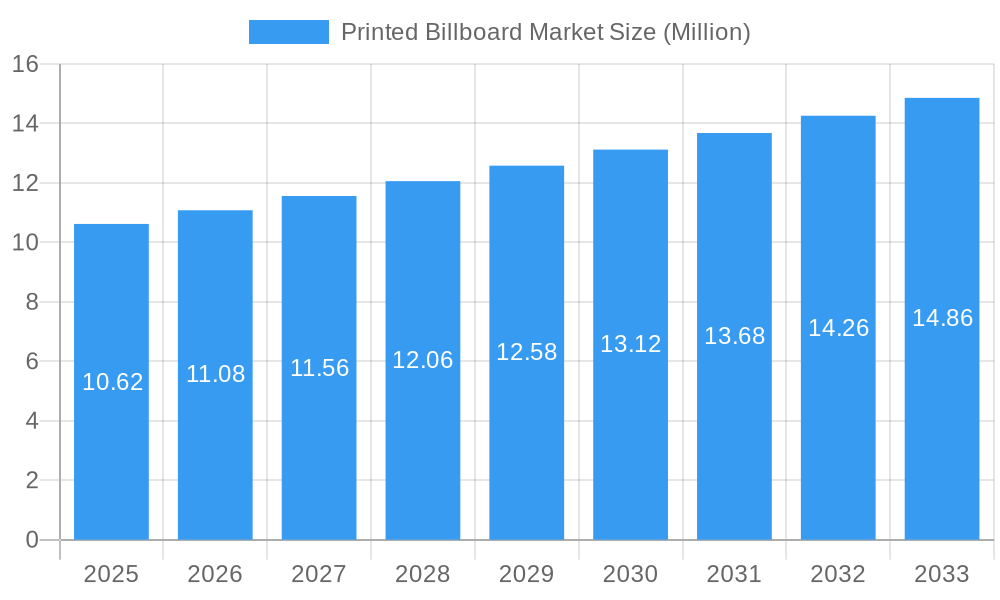

The global Printed Billboard Market is poised for robust expansion, projected to reach USD 10.62 million with a Compound Annual Growth Rate (CAGR) of 4.45% over the forecast period of 2025-2033. This growth is propelled by several key drivers, including the increasing demand for Out-of-Home (OOH) advertising as a cost-effective and impactful medium, especially among SMEs seeking broad reach. The digital transformation within the OOH sector, while dominant in some areas, still leaves substantial room for high-quality printed billboards to capture attention with their tangible presence and aesthetic appeal. Emerging economies, with their burgeoning retail and infrastructure development, present significant opportunities, further fueling market expansion. The versatility of printed billboards, catering to diverse applications from local business promotions to large-scale brand campaigns, underpins their sustained relevance.

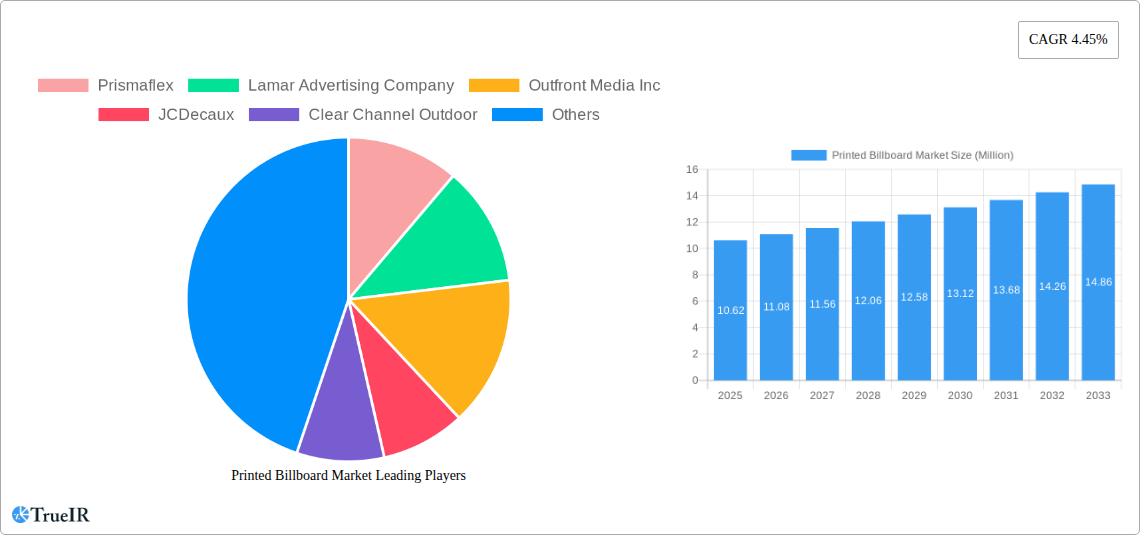

Printed Billboard Market Market Size (In Million)

However, the market is not without its restraints. The growing digital advertising landscape and the increasing adoption of programmatic OOH advertising pose a competitive challenge, potentially diverting some advertising budgets. Furthermore, the evolving regulatory landscape concerning outdoor advertising, including zoning laws and environmental concerns, can impact deployment and operational costs. Despite these challenges, the market is actively adapting through innovations in printing technology, sustainable materials, and integrated campaigns that combine physical billboards with digital elements. The Retail and Banking & Finance sectors are expected to remain dominant end-use industries, leveraging printed billboards for their ability to generate immediate local awareness and brand visibility. The product segments, particularly Vinyl Billboards and Bulletin Billboards, are anticipated to witness steady demand, catering to various campaign objectives and budget considerations.

Printed Billboard Market Company Market Share

This in-depth report provides a definitive analysis of the global Printed Billboard Market, offering critical insights for advertisers, agencies, manufacturers, and investors. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, growth trajectories, and competitive strategies within the dynamic OOH advertising landscape. Explore the immense potential of printed billboards, from traditional vinyl to innovative bulletin formats, and their strategic role across diverse end-use industries.

Printed Billboard Market Market Structure & Competitive Landscape

The Printed Billboard Market is characterized by a moderately concentrated structure, with a few key global players holding significant market share, alongside a robust network of regional and local operators. Innovation drivers are primarily fueled by advancements in printing technology, material science (e.g., eco-friendly inks and substrates), and creative campaign execution. Regulatory impacts, while varied by region, often focus on zoning laws, aesthetic guidelines, and safety standards, shaping installation feasibility and advertising content. Product substitutes, such as digital billboards and other digital out-of-home (DOOH) media, present a constant competitive pressure, forcing printed billboard providers to emphasize their cost-effectiveness, broad reach, and tangible impact. End-user segmentation reveals a strong reliance on sectors like Retail, Insurance, Banking and Finance, indicating their consistent investment in mass-market brand visibility. Mergers and Acquisitions (M&A) trends are indicative of strategic consolidation, aimed at expanding geographic footprints, enhancing service offerings, and achieving economies of scale. For instance, the acquisition of smaller OOH providers by larger entities aims to strengthen their portfolio of prime advertising real estate. While precise M&A volumes are proprietary, the trend signifies a maturation phase where market players seek to solidify their positions and leverage synergistic growth opportunities. Concentration ratios, though fluctuating, highlight the ongoing importance of established networks in securing premium placements.

Printed Billboard Market Market Trends & Opportunities

The Printed Billboard Market is poised for robust growth, driven by a confluence of evolving consumer behaviors, technological advancements, and strategic brand investments. The global market size is projected to experience a Compound Annual Growth Rate (CAGR) of approximately 5% to 7% over the forecast period (2025-2033). This expansion is fueled by the inherent advantages of printed billboards: their undeniable physical presence, broad geographic reach, and ability to capture attention in high-traffic areas. Technological shifts are not eliminating printed billboards but rather complementing them. Advancements in large-format digital printing allow for quicker turnaround times and more intricate designs, enabling advertisers to adapt campaigns more fluidly. Furthermore, the integration of QR codes and augmented reality (AR) elements onto printed billboards offers a bridge between the physical and digital realms, enhancing engagement and measurability. Consumer preferences are increasingly leaning towards authentic and impactful advertising. In an era saturated with digital noise, the tangible nature of a billboard creates a lasting impression, fostering brand recall and credibility. Marketers are recognizing the power of these static giants to create broad awareness and drive foot traffic to physical locations. Competitive dynamics are evolving with a greater emphasis on creative execution and strategic placement. Companies are investing in innovative designs, eye-catching visuals, and prime locations to cut through the clutter. The market penetration rate of printed billboards within the overall OOH advertising sector remains significant, estimated at over 70%, demonstrating their continued relevance. Opportunities abound for market players to develop sustainable printing solutions, offer integrated campaign management services that blend print and digital, and leverage data analytics to optimize billboard placements and demonstrate ROI to clients. The persistent demand from established sectors like Retail, Insurance, and Banking and Finance, coupled with emerging interest from newer industries, signals a healthy and expanding market. The strategic advantage of printed billboards lies in their ability to create a memorable brand experience that digital mediums often struggle to replicate, making them an indispensable component of comprehensive advertising strategies. The market size is expected to grow from approximately $XX Billion in 2025 to $XX Billion by 2033, reflecting this sustained demand and innovation.

Dominant Markets & Segments in Printed Billboard Market

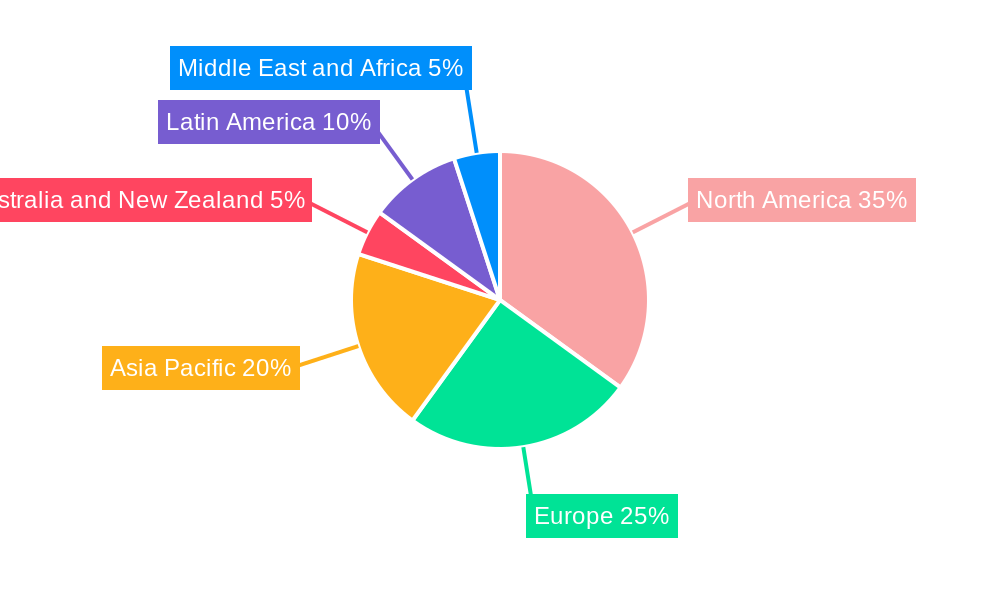

The global Printed Billboard Market is shaped by regional economic strengths, advertising expenditure trends, and infrastructure development. North America and Europe currently represent the dominant markets, owing to established advertising ecosystems, high disposable incomes, and a mature OOH advertising landscape. However, Asia Pacific is emerging as a significant growth engine, driven by rapid urbanization, increasing consumer spending, and a burgeoning retail sector. Within this dynamic market, key segments exhibit distinct growth patterns.

Product Type Dominance:

- Vinyl Billboard: This segment continues to hold a substantial market share due to its durability, cost-effectiveness, and versatility. Its widespread adoption across various advertising needs makes it a consistent performer.

- Bulletin Billboard: Characterized by their large size and prominent placements in high-traffic areas, bulletin billboards are crucial for brand visibility and mass reach. Their impact is amplified by strategic location planning.

- Other Product Types: This encompasses a range of formats, including transit shelters, wallscapes, and digital billboards (though the focus here is on printed aspects). Innovations in materials and printing techniques are driving growth in niche and specialized printed formats.

End-Use Industry Dominance:

- Retail: This is arguably the largest and most consistent end-user for printed billboards. The need for constant product promotion, seasonal campaigns, and store-level advertising drives significant demand. The estimated annual ad spend from the retail sector is in the range of $XX Million.

- Insurance: Insurance companies leverage printed billboards for broad brand awareness, promoting specific policy types, and building trust. Their campaigns often focus on long-term brand building and community presence. The estimated annual ad spend from the insurance sector is approximately $XX Million.

- Banking and Finance: Similar to insurance, banks and financial institutions utilize printed billboards to promote new services, build brand loyalty, and establish a credible presence. Their campaigns often target specific demographics and financial needs. The estimated annual ad spend from the banking and finance sector is around $XX Million.

- Other End-Use Industries: This broad category includes sectors like automotive, entertainment, telecommunications, and government campaigns. Growth in these sectors is often tied to specific product launches, promotional events, or public awareness initiatives.

Key growth drivers in these dominant segments include substantial infrastructure development, favorable government policies promoting advertising, and increasing disposable incomes that boost consumer spending. For instance, in India, the government's focus on improving road networks and urban infrastructure has directly translated into more prime locations for printed billboards. Similarly, in North America, the established robust retail sector consistently allocates significant budgets to OOH advertising to drive foot traffic and brand recall. The sheer scale of these industries ensures a sustained demand for the broad reach and impact that printed billboards offer.

Printed Billboard Market Product Analysis

Printed billboards are evolving beyond static displays to become dynamic canvases for brand storytelling. Innovations are centered on material advancements, such as the development of eco-friendly, weather-resistant inks and recyclable substrates, aligning with increasing environmental consciousness among advertisers and consumers. The application spectrum is vast, ranging from simple brand advertisements and promotional campaigns to intricate, large-scale art installations that capture public imagination. Bulletin billboards, for example, are increasingly being utilized for their immense visual impact, capable of transforming entire building facades. The competitive advantage of printed billboards lies in their unparalleled reach, cost-effectiveness for mass awareness campaigns, and tangible presence that digital alternatives often struggle to match. Technological advancements in large-format printing ensure vibrant colors, sharp imagery, and rapid production cycles, allowing for more responsive campaign deployment.

Key Drivers, Barriers & Challenges in Printed Billboard Market

Key Drivers:

The Printed Billboard Market is propelled by several key forces. Technological advancements in printing, offering enhanced durability and vibrant imagery, are crucial. Economic growth and increased consumer spending directly translate into higher advertising budgets. Furthermore, favorable government policies that support outdoor advertising infrastructure, alongside the enduring effectiveness of OOH for broad brand awareness and recall, continue to drive demand. The cost-effectiveness of printed billboards compared to prolonged digital campaigns for mass reach also plays a significant role.

Barriers & Challenges:

Despite its strengths, the market faces several challenges. Increasing competition from digital OOH (DOOH) offers dynamic content and measurability, posing a significant threat. Regulatory hurdles, including complex zoning laws, permit requirements, and aesthetic restrictions in urban areas, can limit deployment opportunities. Supply chain disruptions affecting raw materials like vinyl and inks, as well as fluctuations in printing costs, can impact profitability. Finally, the environmental impact of traditional printing materials and the disposal of old billboards are growing concerns that require sustainable solutions. The estimated cost impact of regulatory delays can be as high as 10-15% on project timelines and budgets.

Growth Drivers in the Printed Billboard Market Market

Key growth drivers for the Printed Billboard Market include ongoing advancements in large-format printing technology, enabling quicker production and higher quality outputs. Economic recovery and robust consumer spending globally are leading to increased advertising expenditures across various sectors. Favorable government initiatives aimed at urban beautification and infrastructure development often create new prime locations for billboards. Furthermore, the inherent ability of printed billboards to deliver cost-effective, high-impact brand visibility to a mass audience continues to be a significant draw for advertisers seeking to build brand awareness and drive foot traffic, especially in comparison to the cumulative cost of sustained digital campaigns.

Challenges Impacting Printed Billboard Market Growth

Several challenges impact the growth of the Printed Billboard Market. The most significant is the increasing competition from digital out-of-home (DOOH) advertising, which offers dynamic content, real-time updates, and enhanced measurability, capturing a growing share of advertising budgets. Regulatory complexities, including stringent zoning laws, permit acquisition processes, and evolving aesthetic guidelines in urban environments, can create significant barriers to entry and expansion. Supply chain vulnerabilities for essential raw materials like vinyl and inks, coupled with price volatility, can impact production costs and lead times. Competitive pressures from other advertising mediums and a growing emphasis on environmental sustainability, requiring investment in eco-friendly printing solutions, also pose considerable challenges.

Key Players Shaping the Printed Billboard Market Market

- Prismaflex

- Lamar Advertising Company

- Outfront Media Inc

- JCDecaux

- Clear Channel Outdoor

- Adams Outdoor

- OOH Media

- Kesion Co Ltd

- Signamara

- Yesco

Significant Printed Billboard Market Industry Milestones

- April 2024: Parle Agro, an Indian company, launched extensive billboard campaigns for their brands Frooti and Appy Fizz. The static billboards were strategically positioned on many major roads and intersections across 90 cities in India, underscoring the continued reliance on this medium for mass market reach.

- August 2023: Taj Mahal Tea, a Hindustan Unilever tea brand, launched an innovative musical printed billboard in Vijayawada, India. The billboard, measuring almost 150 feet in length, featured a set of 31 hammers designed to resemble piano keys, creating a melody when it rained, showcasing creative execution and audience engagement.

Future Outlook for Printed Billboard Market Market

The future outlook for the Printed Billboard Market remains positive, driven by strategic opportunities and sustained market potential. Growth catalysts include the increasing demand for creative and experiential advertising, where large-format printed billboards can provide a tangible and memorable brand presence. The development of sustainable printing technologies and materials will further enhance the market's appeal. Emerging economies, with their rapid urbanization and expanding consumer bases, present significant untapped potential for OOH advertising. The integration of printed billboards with digital elements, such as QR codes and augmented reality, will create hybrid advertising solutions, offering advertisers a blend of broad reach and interactive engagement, thereby solidifying their enduring relevance in the advertising landscape.

Printed Billboard Market Segmentation

-

1. Product Type

- 1.1. Vinyl Billboard

- 1.2. Bulletin Billboard

- 1.3. Other Product Types

-

2. End-Use Industries

- 2.1. Retail

- 2.2. Insurance

- 2.3. Banking and Finance

- 2.4. Other End-Use Industries

Printed Billboard Market Segmentation By Geography

- 1. North America

- 2. Europe

-

3. Asia Pacific

- 3.1. Australia and New Zealand

- 4. Latin America

- 5. Middle East and Africa

Printed Billboard Market Regional Market Share

Geographic Coverage of Printed Billboard Market

Printed Billboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Printed Advertising Solutions in End-Use Industries; Growing Investment in Advertising Campaigns for Outdoor Billboards

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Printed Advertising Solutions in End-Use Industries; Growing Investment in Advertising Campaigns for Outdoor Billboards

- 3.4. Market Trends

- 3.4.1. Surge in Demand for Vinyl Billboards for Advertising Purposes

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Vinyl Billboard

- 5.1.2. Bulletin Billboard

- 5.1.3. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.2.1. Retail

- 5.2.2. Insurance

- 5.2.3. Banking and Finance

- 5.2.4. Other End-Use Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Vinyl Billboard

- 6.1.2. Bulletin Billboard

- 6.1.3. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 6.2.1. Retail

- 6.2.2. Insurance

- 6.2.3. Banking and Finance

- 6.2.4. Other End-Use Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Vinyl Billboard

- 7.1.2. Bulletin Billboard

- 7.1.3. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 7.2.1. Retail

- 7.2.2. Insurance

- 7.2.3. Banking and Finance

- 7.2.4. Other End-Use Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Vinyl Billboard

- 8.1.2. Bulletin Billboard

- 8.1.3. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 8.2.1. Retail

- 8.2.2. Insurance

- 8.2.3. Banking and Finance

- 8.2.4. Other End-Use Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Latin America Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Vinyl Billboard

- 9.1.2. Bulletin Billboard

- 9.1.3. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 9.2.1. Retail

- 9.2.2. Insurance

- 9.2.3. Banking and Finance

- 9.2.4. Other End-Use Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Printed Billboard Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Vinyl Billboard

- 10.1.2. Bulletin Billboard

- 10.1.3. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-Use Industries

- 10.2.1. Retail

- 10.2.2. Insurance

- 10.2.3. Banking and Finance

- 10.2.4. Other End-Use Industries

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Prismaflex

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Lamar Advertising Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Outfront Media Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JCDecaux

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Clear Channel Outdoor

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Adams Outdoor

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OOH Media

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kesion Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signamara

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yesco*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Prismaflex

List of Figures

- Figure 1: Global Printed Billboard Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Printed Billboard Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Printed Billboard Market Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Printed Billboard Market Volume (Billion), by Product Type 2025 & 2033

- Figure 5: North America Printed Billboard Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Printed Billboard Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Printed Billboard Market Revenue (Million), by End-Use Industries 2025 & 2033

- Figure 8: North America Printed Billboard Market Volume (Billion), by End-Use Industries 2025 & 2033

- Figure 9: North America Printed Billboard Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 10: North America Printed Billboard Market Volume Share (%), by End-Use Industries 2025 & 2033

- Figure 11: North America Printed Billboard Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Printed Billboard Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Printed Billboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Printed Billboard Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Printed Billboard Market Revenue (Million), by Product Type 2025 & 2033

- Figure 16: Europe Printed Billboard Market Volume (Billion), by Product Type 2025 & 2033

- Figure 17: Europe Printed Billboard Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Europe Printed Billboard Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: Europe Printed Billboard Market Revenue (Million), by End-Use Industries 2025 & 2033

- Figure 20: Europe Printed Billboard Market Volume (Billion), by End-Use Industries 2025 & 2033

- Figure 21: Europe Printed Billboard Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 22: Europe Printed Billboard Market Volume Share (%), by End-Use Industries 2025 & 2033

- Figure 23: Europe Printed Billboard Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Printed Billboard Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Printed Billboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Printed Billboard Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Printed Billboard Market Revenue (Million), by Product Type 2025 & 2033

- Figure 28: Asia Pacific Printed Billboard Market Volume (Billion), by Product Type 2025 & 2033

- Figure 29: Asia Pacific Printed Billboard Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Asia Pacific Printed Billboard Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Asia Pacific Printed Billboard Market Revenue (Million), by End-Use Industries 2025 & 2033

- Figure 32: Asia Pacific Printed Billboard Market Volume (Billion), by End-Use Industries 2025 & 2033

- Figure 33: Asia Pacific Printed Billboard Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 34: Asia Pacific Printed Billboard Market Volume Share (%), by End-Use Industries 2025 & 2033

- Figure 35: Asia Pacific Printed Billboard Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Printed Billboard Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Printed Billboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Printed Billboard Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Printed Billboard Market Revenue (Million), by Product Type 2025 & 2033

- Figure 40: Latin America Printed Billboard Market Volume (Billion), by Product Type 2025 & 2033

- Figure 41: Latin America Printed Billboard Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Latin America Printed Billboard Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Latin America Printed Billboard Market Revenue (Million), by End-Use Industries 2025 & 2033

- Figure 44: Latin America Printed Billboard Market Volume (Billion), by End-Use Industries 2025 & 2033

- Figure 45: Latin America Printed Billboard Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 46: Latin America Printed Billboard Market Volume Share (%), by End-Use Industries 2025 & 2033

- Figure 47: Latin America Printed Billboard Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Printed Billboard Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Printed Billboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Printed Billboard Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Printed Billboard Market Revenue (Million), by Product Type 2025 & 2033

- Figure 52: Middle East and Africa Printed Billboard Market Volume (Billion), by Product Type 2025 & 2033

- Figure 53: Middle East and Africa Printed Billboard Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Middle East and Africa Printed Billboard Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Middle East and Africa Printed Billboard Market Revenue (Million), by End-Use Industries 2025 & 2033

- Figure 56: Middle East and Africa Printed Billboard Market Volume (Billion), by End-Use Industries 2025 & 2033

- Figure 57: Middle East and Africa Printed Billboard Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 58: Middle East and Africa Printed Billboard Market Volume Share (%), by End-Use Industries 2025 & 2033

- Figure 59: Middle East and Africa Printed Billboard Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Printed Billboard Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Printed Billboard Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Printed Billboard Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 4: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 5: Global Printed Billboard Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Printed Billboard Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 10: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 11: Global Printed Billboard Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Printed Billboard Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 15: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 16: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 17: Global Printed Billboard Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: Global Printed Billboard Market Volume Billion Forecast, by Country 2020 & 2033

- Table 19: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 20: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 21: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 22: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 23: Global Printed Billboard Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Printed Billboard Market Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Australia and New Zealand Printed Billboard Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia and New Zealand Printed Billboard Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 28: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 29: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 30: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 31: Global Printed Billboard Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Printed Billboard Market Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Printed Billboard Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Printed Billboard Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 35: Global Printed Billboard Market Revenue Million Forecast, by End-Use Industries 2020 & 2033

- Table 36: Global Printed Billboard Market Volume Billion Forecast, by End-Use Industries 2020 & 2033

- Table 37: Global Printed Billboard Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Printed Billboard Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Printed Billboard Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Printed Billboard Market?

Key companies in the market include Prismaflex, Lamar Advertising Company, Outfront Media Inc, JCDecaux, Clear Channel Outdoor, Adams Outdoor, OOH Media, Kesion Co Ltd, Signamara, Yesco*List Not Exhaustive.

3. What are the main segments of the Printed Billboard Market?

The market segments include Product Type, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Printed Advertising Solutions in End-Use Industries; Growing Investment in Advertising Campaigns for Outdoor Billboards.

6. What are the notable trends driving market growth?

Surge in Demand for Vinyl Billboards for Advertising Purposes.

7. Are there any restraints impacting market growth?

Increasing Demand for Printed Advertising Solutions in End-Use Industries; Growing Investment in Advertising Campaigns for Outdoor Billboards.

8. Can you provide examples of recent developments in the market?

April 2024: Parle Agro, an Indian company, launched billboard campaigns for their brands Frooti and Appy Fizz. The static billboards have been positioned on many major roads and intersections in 90 cities across India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Printed Billboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Printed Billboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Printed Billboard Market?

To stay informed about further developments, trends, and reports in the Printed Billboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence