Key Insights

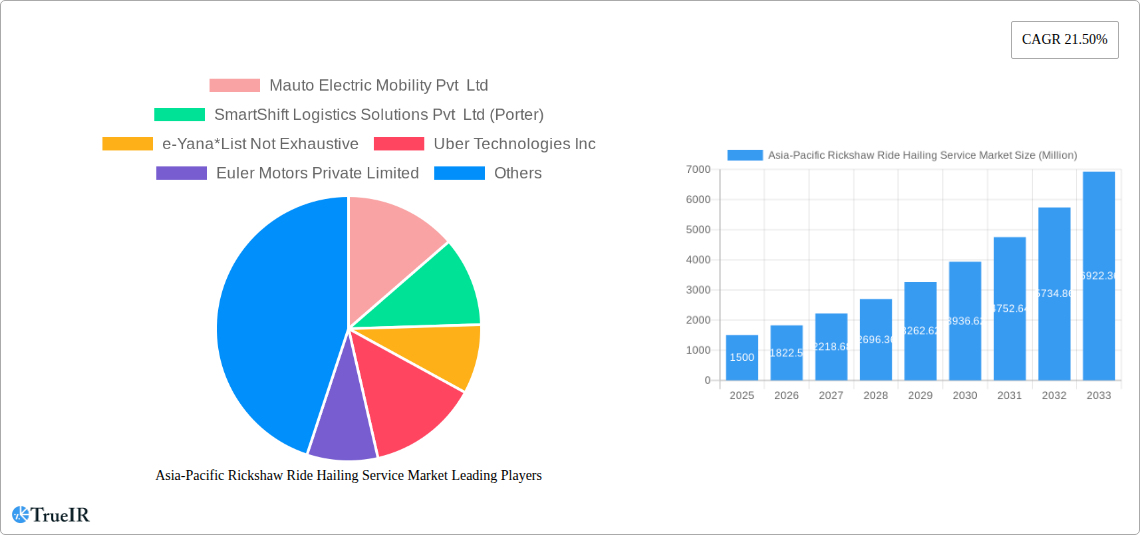

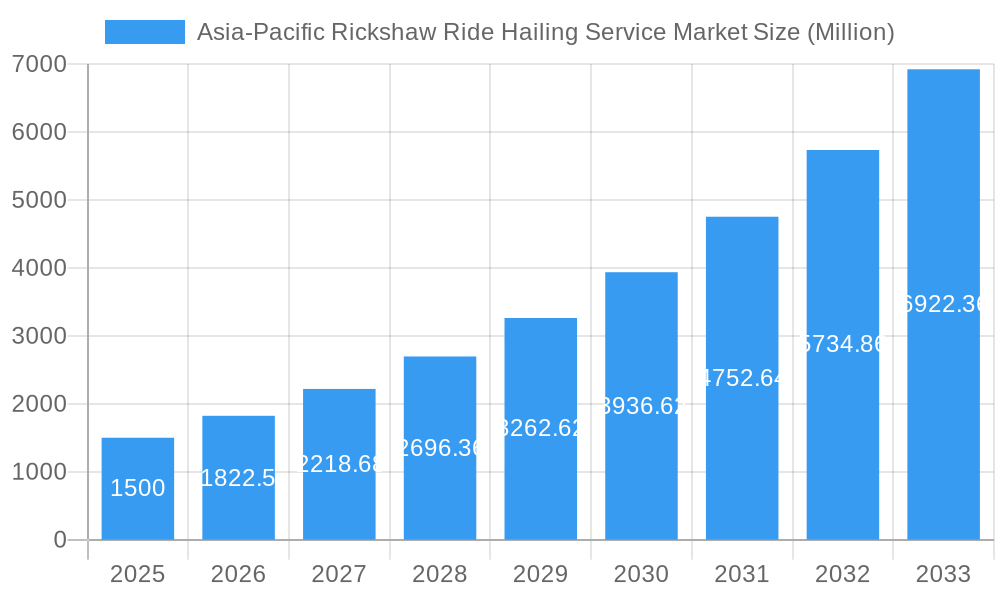

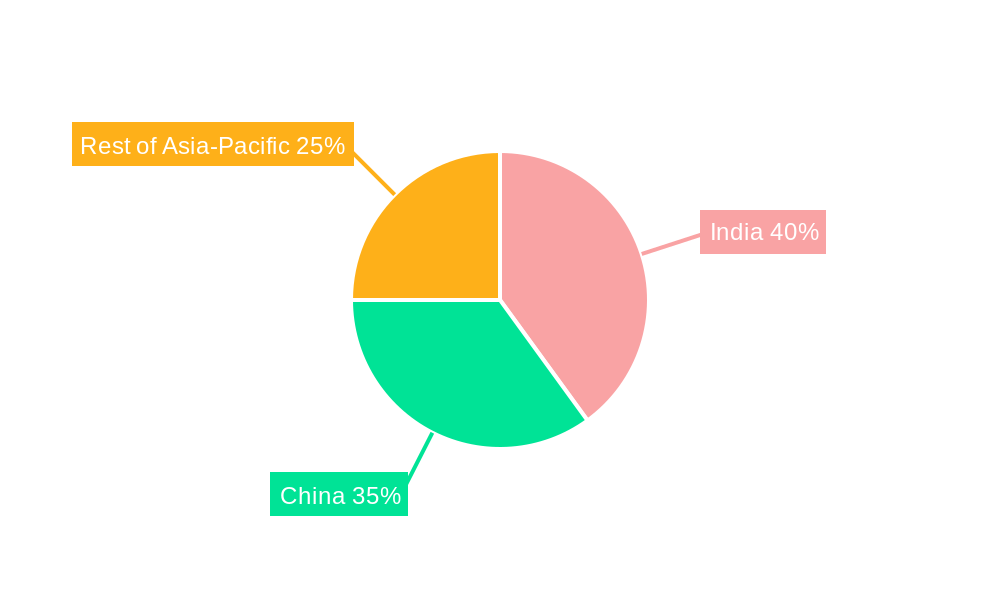

The Asia-Pacific rickshaw ride-hailing service market is experiencing robust growth, driven by increasing urbanization, rising disposable incomes, and the convenience offered by on-demand transportation solutions. The market, estimated at $XX million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 21.50% from 2025 to 2033. Several factors contribute to this expansion. Firstly, the burgeoning middle class in countries like India, China, and other South-East Asian nations is fueling demand for affordable and readily available transportation options. Secondly, technological advancements, including the integration of mobile apps and digital payment systems, have streamlined the booking process, enhancing user experience and driving adoption. Furthermore, the emergence of electric rickshaws is promoting environmentally friendly and cost-effective transportation, thereby supporting market expansion. However, regulatory challenges related to licensing and operational permits, as well as competition from established ride-hailing giants offering diverse vehicle options, pose potential restraints. The market is segmented by application (freight and logistics, passenger commuting), booking type (online, offline), payment method (cashless, cash, e-wallets), propulsion type (electric, internal combustion engine), and country (China, Japan, India, South Korea, and the Rest of Asia-Pacific). India and China are expected to dominate the market due to their massive populations and rapidly growing urban centers.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Size (In Billion)

The competitive landscape is characterized by a mix of established players like Ola Cabs, Gojek, and Grab, along with numerous local and regional operators such as Mauto Electric Mobility and SmartShift Logistics. These companies are constantly innovating to improve services, optimize pricing, and expand their reach, leading to increased market competitiveness. The increasing preference for cashless transactions and the rising adoption of electric rickshaws present significant opportunities for growth. Furthermore, the integration of advanced technologies like GPS tracking and real-time fare calculation is improving efficiency and enhancing user experience, further strengthening market potential. The future of the Asia-Pacific rickshaw ride-hailing service market looks promising, with continued growth expected throughout the forecast period, driven by technological advancements, changing consumer preferences, and supportive government policies.

Asia-Pacific Rickshaw Ride Hailing Service Market Company Market Share

Asia-Pacific Rickshaw Ride Hailing Service Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the rapidly evolving Asia-Pacific rickshaw ride-hailing service market, offering invaluable insights for investors, industry players, and strategic decision-makers. Leveraging extensive market research and data analysis spanning the period 2019-2033 (historical period: 2019-2024, base year: 2025, estimated year: 2025, forecast period: 2025-2033), this report unveils the key trends, opportunities, and challenges shaping this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period.

Asia-Pacific Rickshaw Ride Hailing Service Market Structure & Competitive Landscape

The Asia-Pacific rickshaw ride-hailing service market exhibits a moderately concentrated structure, with a few major players vying for market share alongside numerous smaller, regional operators. The market's competitive intensity is influenced by factors such as technological advancements, regulatory changes, and evolving consumer preferences. Innovation, particularly in electric vehicle technology and digital payment integration, plays a crucial role in shaping the competitive landscape. Government regulations regarding permits, safety standards, and environmental concerns also significantly impact market dynamics. Product substitutes, such as traditional taxis and private vehicles, exert competitive pressure.

The market is witnessing a rise in mergers and acquisitions (M&A) activities, with larger players strategically acquiring smaller firms to expand their geographical reach and service offerings. The estimated M&A volume for the period 2019-2024 is xx Million, indicating a significant level of consolidation. End-user segmentation is primarily driven by application (freight and logistics, passenger commuting), booking type (online, offline), payment method (cashless, cash, e-money/e-wallet), and propulsion type (electric, internal combustion engine).

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market.

- Innovation Drivers: Technological advancements in electric vehicles, mobile apps, and payment systems.

- Regulatory Impacts: Government policies on ride-hailing services, environmental regulations, and safety standards.

- Product Substitutes: Traditional taxis, private car ownership, public transportation.

- End-User Segmentation: Freight and logistics, passenger commuting, online/offline bookings, various payment methods, electric and ICE vehicles.

- M&A Trends: Increasing M&A activity, driven by expansion strategies and consolidation.

Asia-Pacific Rickshaw Ride Hailing Service Market Market Trends & Opportunities

The Asia-Pacific rickshaw ride-hailing service market is experiencing significant growth, driven by factors such as increasing urbanization, rising disposable incomes, and the growing adoption of smartphones and mobile applications. Technological advancements, including the development of electric rickshaws and sophisticated ride-hailing platforms, are further fueling market expansion. Consumer preferences are shifting towards convenient, affordable, and technologically advanced transportation solutions. The market is also witnessing a rise in the use of cashless payment systems, further enhancing the convenience and efficiency of ride-hailing services.

The competitive landscape is characterized by intense rivalry among established players and emerging startups. The market is witnessing strategic partnerships, mergers, and acquisitions as companies strive to gain a competitive edge. Opportunities exist for players who can offer innovative solutions, cater to the specific needs of diverse customer segments, and effectively leverage technology to improve operational efficiency and enhance customer experience. The market is projected to grow at a compound annual growth rate (CAGR) of xx% from 2025 to 2033, reaching a market size of xx Million by 2033. Market penetration rates are highest in urban areas and are expected to increase steadily in suburban and rural regions.

Dominant Markets & Segments in Asia-Pacific Rickshaw Ride Hailing Service Market

India currently dominates the Asia-Pacific rickshaw ride-hailing market, driven by factors such as a large population, high levels of urbanization, and a growing middle class. Other significant markets include China and South Korea.

- By Application: Passenger commuting currently holds the largest market share, followed by freight and logistics. Growth in e-commerce and last-mile delivery is driving the expansion of the freight and logistics segment.

- By Booking Type: Online bookings are increasingly prevalent due to the widespread adoption of smartphones and mobile apps. However, offline bookings continue to play a role, particularly in smaller cities and towns.

- By Payment: Cashless payments are gaining traction, with e-money/e-wallets becoming increasingly popular. However, cash transactions still account for a significant proportion of payments.

- By Propulsion Type: Internal combustion engine (ICE) rickshaws currently dominate the market, but the adoption of electric rickshaws is rapidly increasing due to environmental concerns and government incentives.

- By Country: India, China, and South Korea are the leading markets, owing to their large populations, high urbanization rates, and favorable regulatory environments. Robust infrastructure development and supportive government policies are key growth drivers in these markets.

Growth within specific segments is influenced by a range of factors: favorable government policies promoting electric vehicle adoption are boosting the electric rickshaw segment. Rapid smartphone adoption and increasing internet penetration are driving online booking growth.

Asia-Pacific Rickshaw Ride Hailing Service Market Product Analysis

The rickshaw ride-hailing market showcases ongoing product innovation, with a focus on enhancing safety, efficiency, and customer experience. Electric rickshaws are gaining prominence due to their environmental benefits and lower running costs. Integration with advanced navigation systems, real-time tracking, and cashless payment options further improves functionality. Competitive advantages are derived from factors such as pricing strategies, service reliability, technological features, and customer service quality. The market is witnessing a transition towards smarter, more sustainable, and technologically advanced vehicles and platforms.

Key Drivers, Barriers & Challenges in Asia-Pacific Rickshaw Ride Hailing Service Market

Key Drivers: Growing urbanization, increasing disposable incomes, technological advancements (e-rickshaws, mobile apps), and favorable government policies promoting sustainable transportation. For example, government subsidies for electric rickshaws are boosting adoption.

Challenges and Restraints: Stringent regulatory requirements, competition from traditional transportation modes, safety concerns related to rickshaw operation, and infrastructure limitations in certain regions. These factors pose significant barriers to market expansion, with potential quantifiable impacts on growth. For example, xx Million in potential revenue could be lost due to regulatory hurdles.

Growth Drivers in the Asia-Pacific Rickshaw Ride Hailing Service Market Market

Key growth drivers include rising urbanization, increasing disposable incomes, technological advancements like electric rickshaws and improved mobile apps, and supportive government policies promoting sustainable transportation options. Specifically, government incentives for electric vehicle adoption are strongly accelerating market growth.

Challenges Impacting Asia-Pacific Rickshaw Ride Hailing Service Market Growth

Regulatory complexities, particularly in obtaining permits and licenses, pose a significant challenge. Supply chain issues affecting the availability of parts for electric rickshaws create constraints on market expansion. Intense competition from established transportation players also impacts growth.

Key Players Shaping the Asia-Pacific Rickshaw Ride Hailing Service Market Market

- Mauto Electric Mobility Pvt Ltd

- SmartShift Logistics Solutions Pvt Ltd (Porter)

- e-Yana

- Uber Technologies Inc

- Euler Motors Private Limited

- Jugnoo (Socomo Technologies Pvt Ltd)

- Gojek tech

- Grab

- DiDi Chuxing (Beijing Xiaoju Technology Co Ltd)

- Ola Cabs (ANI Technologies Pvt Ltd)

Significant Asia-Pacific Rickshaw Ride Hailing Service Market Industry Milestones

- 2021: Uber India announced increasing its electric vehicle fleet to 3,000 e-vehicles, showcasing the growing adoption of e-mobility and green technology. The company's investment in charging infrastructure and OEM partnerships signifies a commitment to sustainable operations.

Future Outlook for Asia-Pacific Rickshaw Ride Hailing Service Market Market

The Asia-Pacific rickshaw ride-hailing service market is poised for continued growth, fueled by technological advancements, supportive government policies, and evolving consumer preferences. Strategic opportunities exist for companies that can effectively leverage technology, cater to specific customer needs, and navigate regulatory landscapes. The market's potential for expansion is considerable, particularly in less-penetrated regions.

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation

-

1. Application

- 1.1. Freight and Logistics

- 1.2. Passenger Commuting

-

2. Booking Type

- 2.1. Online

- 2.2. Offline

-

3. Payment

- 3.1. Cashless

- 3.2. E-Money / E-Wallet

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Internal Combustion Engine

Asia-Pacific Rickshaw Ride Hailing Service Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Rickshaw Ride Hailing Service Market Regional Market Share

Geographic Coverage of Asia-Pacific Rickshaw Ride Hailing Service Market

Asia-Pacific Rickshaw Ride Hailing Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 21.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Inclusion of E-bikes in the Sharing Fleet

- 3.3. Market Restrains

- 3.3.1. Limited Infrastructure May Hinder Market Growth

- 3.4. Market Trends

- 3.4.1 Rising Tourism

- 3.4.2 Leisure Traveling and Logistics Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Rickshaw Ride Hailing Service Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Freight and Logistics

- 5.1.2. Passenger Commuting

- 5.2. Market Analysis, Insights and Forecast - by Booking Type

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Payment

- 5.3.1. Cashless

- 5.3.2. E-Money / E-Wallet

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Internal Combustion Engine

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mauto Electric Mobility Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SmartShift Logistics Solutions Pvt Ltd (Porter)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 e-Yana*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uber Technologies Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Euler Motors Private Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Jugnoo (Socomo Technologies Pvt Ltd )

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gojek tech

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Grab

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DiDi Chuxing (Beijing Xiaoju Technology Co Ltd )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ola Cabs (ANI Technologies Pvt Ltd)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Mauto Electric Mobility Pvt Ltd

List of Figures

- Figure 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Rickshaw Ride Hailing Service Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 3: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 4: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 8: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Payment 2020 & 2033

- Table 9: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 10: Asia-Pacific Rickshaw Ride Hailing Service Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Rickshaw Ride Hailing Service Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The projected CAGR is approximately 21.50%.

2. Which companies are prominent players in the Asia-Pacific Rickshaw Ride Hailing Service Market?

Key companies in the market include Mauto Electric Mobility Pvt Ltd, SmartShift Logistics Solutions Pvt Ltd (Porter), e-Yana*List Not Exhaustive, Uber Technologies Inc, Euler Motors Private Limited, Jugnoo (Socomo Technologies Pvt Ltd ), Gojek tech, Grab, DiDi Chuxing (Beijing Xiaoju Technology Co Ltd ), Ola Cabs (ANI Technologies Pvt Ltd).

3. What are the main segments of the Asia-Pacific Rickshaw Ride Hailing Service Market?

The market segments include Application, Booking Type, Payment, Propulsion Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Inclusion of E-bikes in the Sharing Fleet.

6. What are the notable trends driving market growth?

Rising Tourism. Leisure Traveling and Logistics Sector.

7. Are there any restraints impacting market growth?

Limited Infrastructure May Hinder Market Growth.

8. Can you provide examples of recent developments in the market?

In 2021, Uber India announced increasing its electric vehicle fleet to 3,000 e-vehicles due to trending e-mobility and green technology trends in the country. The company also has plans to establish charging infrastructures and partnered with OEM to smoothen its operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Rickshaw Ride Hailing Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Rickshaw Ride Hailing Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Rickshaw Ride Hailing Service Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Rickshaw Ride Hailing Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence