Key Insights

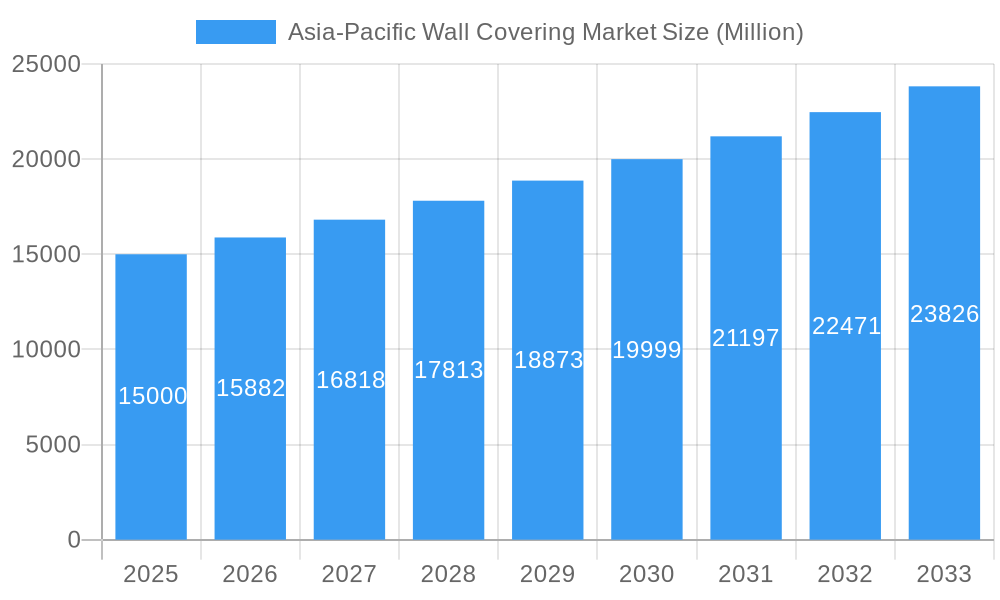

The Asia-Pacific wall covering market, encompassing wallpaper, wall panels, metal coverings, and ceramic tiles, is poised for significant expansion. Projected to achieve a Compound Annual Growth Rate (CAGR) of 5.2%, the market is expected to reach 6743 million by 2025. This growth is propelled by the region's expanding construction sector, especially in emerging economies like India and China. Increased urbanization and rising disposable incomes are driving substantial investments in home renovation and interior design, fueling demand for aesthetically appealing and durable wall coverings. The trend towards modern interiors is further accelerating the adoption of premium options, including metal and designer wallpapers. The burgeoning e-commerce sector offers convenient access to a diverse product range, contributing to overall market acceleration. While raw material price volatility and regional economic fluctuations present potential challenges, the market outlook remains highly favorable.

Asia-Pacific Wall Covering Market Market Size (In Billion)

The residential segment currently dominates the market, with commercial applications demonstrating strong growth potential, particularly in office spaces and hospitality projects. China, India, and Japan are key markets, driven by extensive construction and large populations. South Korea and Malaysia also exhibit promising growth. Distribution channels are evolving, with e-commerce platforms experiencing rapid adoption, especially among younger consumers, complementing traditional specialty stores and home centers. Key market participants are prioritizing product innovation, strategic alliances, and market expansion to sustain competitive advantage. The growing emphasis on sustainability and eco-friendly materials is anticipated to shape future product development and consumer preferences.

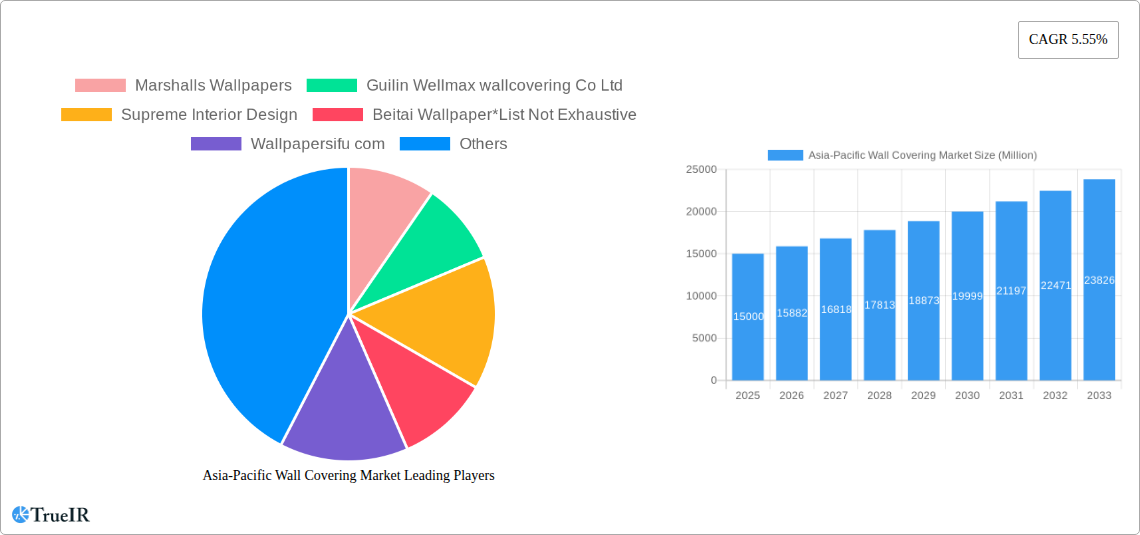

Asia-Pacific Wall Covering Market Company Market Share

Asia-Pacific Wall Covering Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific wall covering market, offering invaluable insights for stakeholders across the value chain. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report unveils market dynamics, growth drivers, challenges, and future opportunities. The analysis incorporates data from key countries including China, Japan, India, Malaysia, South Korea, and the Rest of Asia Pacific, segmenting the market by product type (Wallpaper, Wallpanel, Metal Wall Coverings, Ceramic Tile, Other Products), distribution channel (Specialty Store, Home Centre, Building Material Dealer, Furniture Store, Mass Merchandizer, e-Commerce), and application (Residential, Commercial). Key players such as Marshalls Wallpapers, Guilin Wellmax wallcovering Co Ltd, Supreme Interior Design, Beitai Wallpaper, Wallpapersifu com, Elegant Haus International, Sungreen Co Ltd, Ritz Wallcovering Sdn Bhd, JC Maison Malaysia, LAMEX Wall, Shinhan Wallcoverings Co Ltd, Guangdong Yulan Group Co Ltd, and A S Création (A S Création Tapeten AG) are profiled, providing a holistic view of the competitive landscape. The report projects a market value exceeding xx Million by 2033, presenting a lucrative opportunity for investors and industry players.

Asia-Pacific Wall Covering Market Structure & Competitive Landscape

The Asia-Pacific wall covering market exhibits a moderately concentrated structure, with a few large players dominating specific segments. The Herfindahl-Hirschman Index (HHI) for the overall market in 2025 is estimated at xx, indicating a moderately competitive environment. Innovation is a key driver, with companies continuously introducing new designs, materials, and technologies to cater to evolving consumer preferences. Regulatory landscapes vary across countries, impacting material sourcing and production processes. Product substitutes, such as paint and textured plaster, pose a competitive challenge, especially in the price-sensitive segments. The market is broadly segmented by end-user (residential and commercial), with residential applications currently holding a larger market share. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with an estimated xx M&A deals closed between 2019 and 2024, primarily focused on expanding geographical reach or product portfolios.

- Market Concentration: HHI (2025) - xx

- Innovation Drivers: New materials, designs, digital printing technologies.

- Regulatory Impacts: Varying building codes and environmental regulations across countries.

- Product Substitutes: Paint, textured plaster, other decorative wall finishes.

- End-User Segmentation: Residential (xx Million in 2025), Commercial (xx Million in 2025).

- M&A Trends: xx M&A deals (2019-2024), focusing on expansion and diversification.

Asia-Pacific Wall Covering Market Market Trends & Opportunities

The Asia-Pacific wall covering market is experiencing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and a growing preference for aesthetically pleasing interiors. The market size is projected to reach xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the adoption of digital printing and eco-friendly materials, are reshaping the industry. Consumer preferences are shifting towards sustainable and customizable options, creating opportunities for manufacturers offering personalized designs and environmentally conscious products. The competitive landscape is dynamic, with both established players and new entrants vying for market share. Market penetration rates vary significantly across countries, with higher penetration in developed economies like Japan and South Korea compared to emerging markets like India. E-commerce channels are witnessing significant growth, offering enhanced convenience and access to a wider product range. The increasing adoption of smart home technologies presents a lucrative opportunity for wall covering manufacturers to integrate smart functionalities into their products.

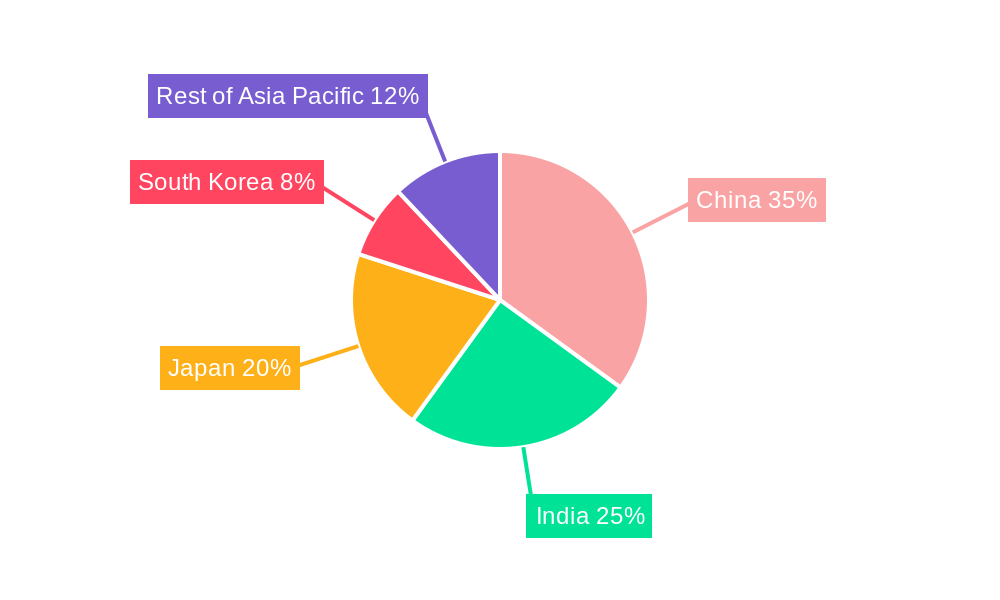

Dominant Markets & Segments in Asia-Pacific Wall Covering Market

China remains the dominant market for wall coverings in the Asia-Pacific region, driven by rapid urbanization, robust construction activity, and a large consumer base. The residential segment holds the largest market share across most countries, fueled by increasing homeownership rates and rising disposable incomes. Among product types, wallpaper continues to be the most popular choice, although wall panels are gaining traction due to their durability and ease of installation. The e-commerce distribution channel is experiencing the fastest growth, offering convenient and cost-effective options for consumers.

- Key Growth Drivers in China: Rapid urbanization, robust construction, rising disposable incomes.

- Key Growth Drivers in Japan: Renovation projects, high aesthetic preference, preference for high-quality products

- Key Growth Drivers in India: Rising middle class, increasing homeownership rates, expanding construction sector.

- Key Growth Drivers in South Korea: Modern design preferences, strong adoption of high-end materials.

- Dominant Product Segment: Wallpaper (xx Million in 2025)

- Fastest-Growing Distribution Channel: E-commerce (xx% CAGR 2025-2033)

- Dominant Application Segment: Residential (xx Million in 2025)

Asia-Pacific Wall Covering Market Product Analysis

The Asia-Pacific wall covering market showcases a wide array of products, from traditional wallpapers to innovative materials like metal wall coverings and wall panels. Technological advancements are driving the development of durable, eco-friendly, and customizable options. Digital printing technology enables mass personalization, while the use of sustainable materials aligns with growing environmental awareness. The success of new products relies on their ability to cater to diverse aesthetic preferences and offer superior performance characteristics, including durability, ease of installation, and maintenance. The market is witnessing a shift towards multifunctional wall coverings that integrate features such as sound insulation and thermal regulation.

Key Drivers, Barriers & Challenges in Asia-Pacific Wall Covering Market

Key Drivers: Rising disposable incomes, urbanization, increasing construction activity, technological advancements (digital printing, sustainable materials), government initiatives promoting infrastructure development.

Challenges: Fluctuations in raw material prices, intense competition, stringent environmental regulations, supply chain disruptions, varying consumer preferences across regions, counterfeiting of products. Supply chain disruptions caused a xx% decrease in production in 2021, highlighting vulnerability.

Growth Drivers in the Asia-Pacific Wall Covering Market Market

Technological innovation in materials and printing techniques, coupled with supportive government policies, fuels the market's growth. The increasing demand for aesthetically pleasing interiors in both residential and commercial sectors further drives market expansion.

Challenges Impacting Asia-Pacific Wall Covering Market Growth

The market faces challenges such as fluctuating raw material prices, intense competition, and stringent environmental regulations. Supply chain disruptions and economic instability can also hinder growth.

Key Players Shaping the Asia-Pacific Wall Covering Market Market

- Marshalls Wallpapers

- Guilin Wellmax wallcovering Co Ltd

- Supreme Interior Design

- Beitai Wallpaper

- Wallpapersifu com

- Elegant Haus International

- Sungreen Co Ltd

- Ritz Wallcovering Sdn Bhd

- JC Maison Malaysia

- LAMEX Wall

- Shinhan Wallcoverings Co Ltd

- Guangdong Yulan Group Co Ltd

- A S Création (A S Création Tapeten AG)

Significant Asia-Pacific Wall Covering Market Industry Milestones

- 2021: Several major players invested in digital printing capabilities.

- 2022: Introduction of several eco-friendly wallpaper options.

- 2023: Significant increase in e-commerce sales.

Future Outlook for Asia-Pacific Wall Covering Market Market

The Asia-Pacific wall covering market is poised for continued growth, driven by sustained urbanization, rising incomes, and technological advancements. Strategic partnerships, product diversification, and a focus on sustainable solutions will be crucial for success. The market presents significant opportunities for both established players and new entrants, particularly those focusing on innovation and customization.

Asia-Pacific Wall Covering Market Segmentation

-

1. Product

- 1.1. Wallpaper

- 1.2. Wallpanel

- 1.3. Metal Wall Coverings

- 1.4. Ceramic Tile

- 1.5. Other Products

-

2. Distribution Channel

- 2.1. Specialty Store

- 2.2. Home Centre

- 2.3. Building Material Dealer

- 2.4. Furniture Store

- 2.5. Mass Merchandizer

- 2.6. e-Commerce

-

3. Application

- 3.1. Residential

- 3.2. Commercial

Asia-Pacific Wall Covering Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Wall Covering Market Regional Market Share

Geographic Coverage of Asia-Pacific Wall Covering Market

Asia-Pacific Wall Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Demand for Home Furnishing

- 3.3. Market Restrains

- 3.3.1. ; High Inventory Costs and Premium Pricing

- 3.4. Market Trends

- 3.4.1. Residential Sector is Expected to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wall Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Wallpaper

- 5.1.2. Wallpanel

- 5.1.3. Metal Wall Coverings

- 5.1.4. Ceramic Tile

- 5.1.5. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Specialty Store

- 5.2.2. Home Centre

- 5.2.3. Building Material Dealer

- 5.2.4. Furniture Store

- 5.2.5. Mass Merchandizer

- 5.2.6. e-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marshalls Wallpapers

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Guilin Wellmax wallcovering Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Supreme Interior Design

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Beitai Wallpaper*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Wallpapersifu com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Elegant Haus International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sungreen Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ritz Wallcovering Sdn Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JC Maison Malaysia

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LAMEX Wall

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Shinhan Wallcoverings Co Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Guangdong Yulan Group Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 A S Création (A S Création Tapeten AG)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Marshalls Wallpapers

List of Figures

- Figure 1: Asia-Pacific Wall Covering Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wall Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 4: Asia-Pacific Wall Covering Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Asia-Pacific Wall Covering Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Asia-Pacific Wall Covering Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia-Pacific Wall Covering Market Revenue million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Wall Covering Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: India Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia-Pacific Wall Covering Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wall Covering Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the Asia-Pacific Wall Covering Market?

Key companies in the market include Marshalls Wallpapers, Guilin Wellmax wallcovering Co Ltd, Supreme Interior Design, Beitai Wallpaper*List Not Exhaustive, Wallpapersifu com, Elegant Haus International, Sungreen Co Ltd, Ritz Wallcovering Sdn Bhd, JC Maison Malaysia, LAMEX Wall, Shinhan Wallcoverings Co Ltd, Guangdong Yulan Group Co Ltd, A S Création (A S Création Tapeten AG).

3. What are the main segments of the Asia-Pacific Wall Covering Market?

The market segments include Product, Distribution Channel, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 6743 million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Demand for Home Furnishing.

6. What are the notable trends driving market growth?

Residential Sector is Expected to Register a Significant Growth.

7. Are there any restraints impacting market growth?

; High Inventory Costs and Premium Pricing.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wall Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wall Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wall Covering Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wall Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence