Key Insights

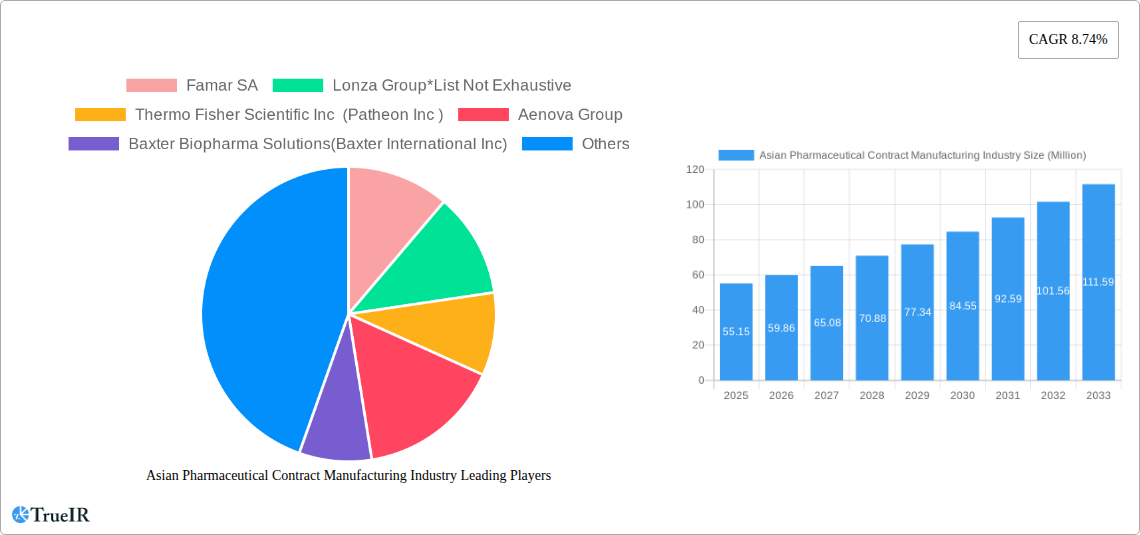

The Asian pharmaceutical contract manufacturing market, valued at $55.15 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.74% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing prevalence of chronic diseases across the region fuels demand for pharmaceutical products, placing pressure on manufacturers to increase production capacity. Secondly, the rising cost of internal research and development prompts pharmaceutical companies to outsource manufacturing to specialized contract manufacturers, leading to significant market growth. Thirdly, stringent regulatory requirements and increasing focus on quality control encourage pharmaceutical firms to collaborate with experienced contract manufacturers who possess the necessary expertise and certifications. Finally, the presence of a large and skilled workforce in countries like India and China contributes to the cost-effectiveness of contract manufacturing in Asia, further attracting global pharmaceutical players.

Asian Pharmaceutical Contract Manufacturing Industry Market Size (In Million)

Significant growth is expected across various segments. Injectable dose formulations, particularly those involving secondary packaging, are anticipated to witness high demand, owing to the increasing preference for convenient and sterile drug delivery methods. China, India, and Japan are projected to be the leading markets within the Asia-Pacific region, driven by their sizable populations, expanding healthcare infrastructure, and robust pharmaceutical industries. Active Pharmaceutical Ingredient (API) manufacturing, including High Potency API (HPAPI) development and finished dosage formulation (FDF), represents a substantial portion of the market, reflecting the need for specialized expertise in handling complex pharmaceutical compounds. The presence of established contract manufacturers such as Lonza Group, Catalent Inc., and Jubilant Life Sciences Ltd., alongside emerging players, fosters competition and drives innovation within the market, further contributing to its expansion.

Asian Pharmaceutical Contract Manufacturing Industry Company Market Share

Asian Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Asian pharmaceutical contract manufacturing industry, offering invaluable insights for stakeholders across the value chain. With a focus on key market segments, leading players, and future trends, this comprehensive study covers the period from 2019 to 2033, projecting significant growth opportunities. The report leverages extensive market research to forecast the market size, identify dominant players, and analyze the competitive landscape. It explores crucial market segments, including Active Pharmaceutical Ingredient (API) manufacturing, High Potency API (HPAPI) and Finished Dosage Formulation (FDF) development and manufacturing, and Injectable Dose Formulation with Secondary Packaging. The geographical scope encompasses major markets like China, India, Japan, Australia, and the Rest of Asia-Pacific.

Asian Pharmaceutical Contract Manufacturing Industry Market Structure & Competitive Landscape

The Asian pharmaceutical contract manufacturing market is characterized by a moderately concentrated structure, with a few large multinational players and numerous smaller, regional companies. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, fueled by advancements in technologies such as continuous manufacturing and advanced analytics, leading to improved efficiency and product quality. Stringent regulatory environments, particularly in developed Asian markets like Japan and Australia, significantly influence market dynamics. Product substitutes, primarily from generic drug manufacturers, pose a constant challenge. The end-user segmentation comprises pharmaceutical companies of varying sizes, from large multinational corporations to smaller specialty firms.

The market has witnessed significant M&A activity in recent years, with a total deal volume of approximately $xx Million between 2019 and 2024. Key drivers of M&A include expanding geographical reach, gaining access to new technologies, and improving supply chain resilience. Future M&A activity is expected to remain significant, driven by industry consolidation and the pursuit of scale economies.

- Market Concentration: HHI (2024): xx

- M&A Volume (2019-2024): $xx Million

- Key Innovation Drivers: Continuous manufacturing, advanced analytics, automation

- Regulatory Impacts: Stringent GMP compliance requirements, varying regulations across countries

- End-User Segmentation: Large multinational pharmaceutical companies, smaller specialty firms, generic drug manufacturers

Asian Pharmaceutical Contract Manufacturing Industry Market Trends & Opportunities

The Asian pharmaceutical contract manufacturing market is poised for robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). The market size is estimated to reach $xx Million in 2025 and $xx Million by 2033. This growth is primarily driven by several factors: the increasing outsourcing of pharmaceutical manufacturing by innovator companies, the growing demand for generic drugs, the rise of biopharmaceuticals, and continuous technological advancements improving manufacturing efficiency and reducing costs. Technological shifts, such as the adoption of digital technologies and automation, are further enhancing efficiency and improving product quality. Consumer preferences for higher-quality and more affordable medications are influencing market trends.

The market penetration rate of contract manufacturing services in Asia is expected to increase significantly over the forecast period, driven by several key factors including rising R&D costs for pharmaceutical companies, increasing demand for specialized manufacturing capabilities, the need for flexible and scalable manufacturing solutions, and the desire to reduce manufacturing footprint and complexity. Competitive dynamics are shaped by pricing pressures, technological advancements, and regulatory compliance.

Dominant Markets & Segments in Asian Pharmaceutical Contract Manufacturing Industry

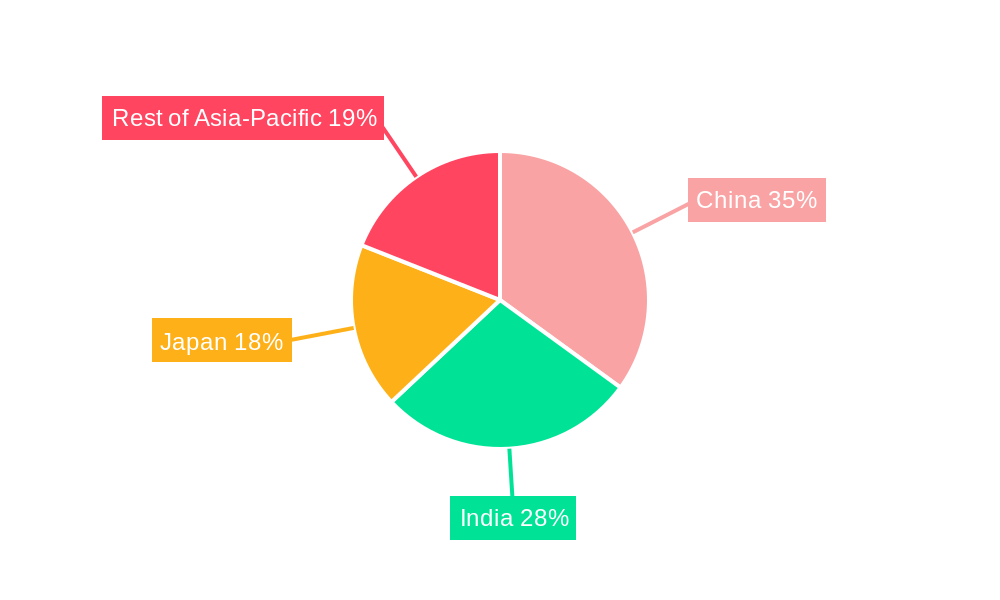

The report pinpoints China and India as the dominant markets for pharmaceutical contract manufacturing in Asia, owing to their large populations, growing pharmaceutical industries, and presence of numerous contract manufacturing facilities. Japan and Australia represent significant, though comparatively smaller, markets with a higher focus on quality and regulatory compliance. The Rest of Asia-Pacific region shows promising growth potential.

Leading Segments:

- Active Pharmaceutical Ingredient (API) Manufacturing: This segment is expected to maintain strong growth, driven by the increasing demand for APIs from both innovator and generic pharmaceutical companies.

- Injectable Dose Formulation: Secondary Packaging: Growth in this segment is being propelled by the growing demand for injectable drugs, particularly in developing economies.

- High Potency API (HPAPI): Finished Dosage Formulation (FDF) Development and Manufacturing: This segment demonstrates significant growth potential, fueled by the increasing demand for specialized cancer and other high-potency therapies.

Key Growth Drivers:

- China: Favorable government policies promoting pharmaceutical manufacturing, cost-effective labor, and robust domestic demand.

- India: Strong generic drug manufacturing industry, established infrastructure, and a large pool of skilled labor.

- Japan: Stringent regulatory frameworks leading to higher quality standards and a focus on advanced technologies.

- Australia: High regulatory standards and a focus on advanced therapies.

- Rest of Asia-Pacific: Growing middle class, rising healthcare spending, and increasing government investments in healthcare infrastructure.

Asian Pharmaceutical Contract Manufacturing Industry Product Analysis

The Asian pharmaceutical contract manufacturing industry offers a wide range of services, encompassing API manufacturing, formulation development and manufacturing, secondary packaging, and analytical testing. Technological advancements, such as continuous manufacturing and single-use technologies, are enhancing efficiency and reducing production costs. The competitive advantage lies in the ability to provide flexible, high-quality services at competitive prices while ensuring compliance with stringent regulatory standards. Innovations focus on developing specialized manufacturing capabilities for complex molecules and delivering customized solutions for clients.

Key Drivers, Barriers & Challenges in Asian Pharmaceutical Contract Manufacturing Industry

Key Drivers:

- Increasing Outsourcing: Pharmaceutical companies are increasingly outsourcing manufacturing activities to reduce costs and focus on R&D.

- Growing Demand for Generics: The rising demand for affordable generics is boosting the contract manufacturing market.

- Technological Advancements: Innovations in manufacturing technologies lead to increased efficiency and reduced costs.

- Favorable Government Policies: Several Asian governments support the growth of the pharmaceutical industry.

Challenges & Restraints:

- Regulatory Complexity: Stringent regulatory requirements increase costs and complexity for manufacturers.

- Supply Chain Issues: Disruptions in the global supply chain can impact production and delivery schedules.

- Competitive Pressure: Intense competition among contract manufacturers necessitates cost optimization and innovation.

- Skilled Labor Shortages: A shortage of skilled labor in some Asian markets can limit production capacity. The estimated impact of labor shortages on production is a reduction of approximately xx% annually in affected regions.

Growth Drivers in the Asian Pharmaceutical Contract Manufacturing Industry Market

The Asian pharmaceutical contract manufacturing industry is driven by several significant factors, including the increasing trend towards outsourcing, the expanding generic drug market, technological advancements improving production efficiency, favorable government policies, and the rising demand for complex pharmaceutical products. These trends are expected to fuel substantial market growth in the coming years.

Challenges Impacting Asian Pharmaceutical Contract Manufacturing Industry Growth

Several challenges hinder growth in this market, including regulatory complexities, supply chain vulnerabilities, intense competition, and the need for significant investments in advanced technologies. These factors can pose obstacles to expansion, particularly for smaller contract manufacturing companies.

Key Players Shaping the Asian Pharmaceutical Contract Manufacturing Industry Market

Significant Asian Pharmaceutical Contract Manufacturing Industry Milestones

- 2020: Increased investment in digital technologies by major players.

- 2021: Several large-scale mergers and acquisitions reshape the competitive landscape.

- 2022: Launch of new manufacturing facilities in China and India to cater to growing demand.

- 2023: Implementation of stringent new regulatory guidelines in several Asian countries.

- 2024: Significant advancements in continuous manufacturing technologies.

Future Outlook for Asian Pharmaceutical Contract Manufacturing Industry Market

The Asian pharmaceutical contract manufacturing market presents significant growth opportunities driven by increasing outsourcing, technological advancements, and favorable regulatory environments. The rising demand for complex pharmaceutical products, especially biologics and high-potency APIs, will further fuel market expansion. Strategic partnerships, investments in advanced technologies, and the ability to meet stringent regulatory compliance requirements will be key success factors for contract manufacturers. This market offers substantial potential for both established and emerging players.

Asian Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

Asian Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Asian Pharmaceutical Contract Manufacturing Industry

Asian Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Outsourcing Volume by Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Injectable Dose Formulations Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Famar SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lonza Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aenova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Baxter Biopharma Solutions(Baxter International Inc)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pfizer CentreSource (Pfizer Inc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Famar SA

List of Figures

- Figure 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asian Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Indonesia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Malaysia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Singapore Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Vietnam Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Philippines Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bangladesh Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Pakistan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 8.74%.

2. Which companies are prominent players in the Asian Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Famar SA, Lonza Group*List Not Exhaustive, Thermo Fisher Scientific Inc (Patheon Inc ), Aenova Group, Baxter Biopharma Solutions(Baxter International Inc), Pfizer CentreSource (Pfizer Inc), Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asian Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.15 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Outsourcing Volume by Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Injectable Dose Formulations Holds Significant Market Share.

7. Are there any restraints impacting market growth?

; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Asian Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence