Key Insights

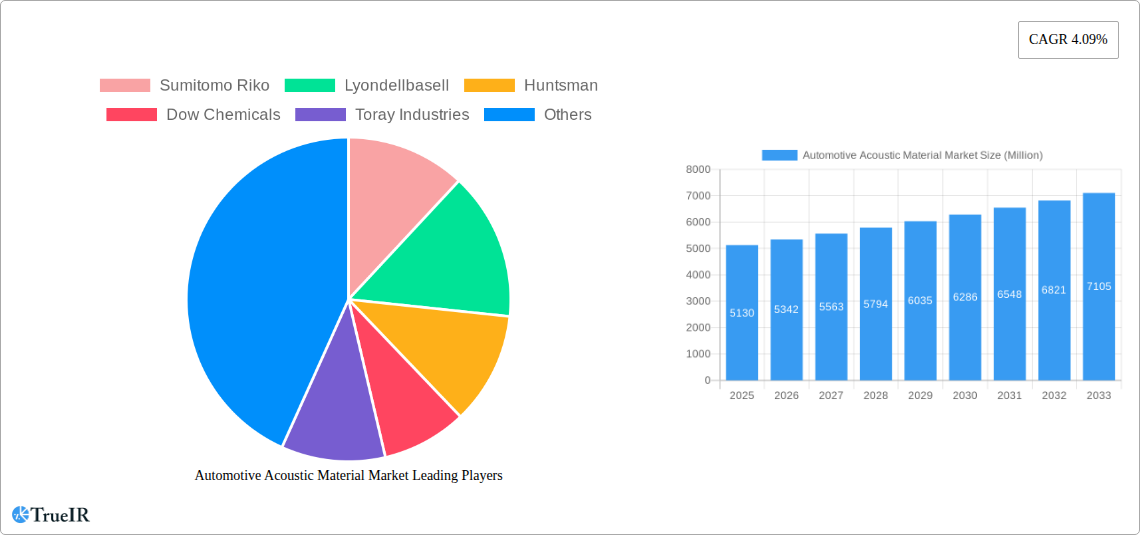

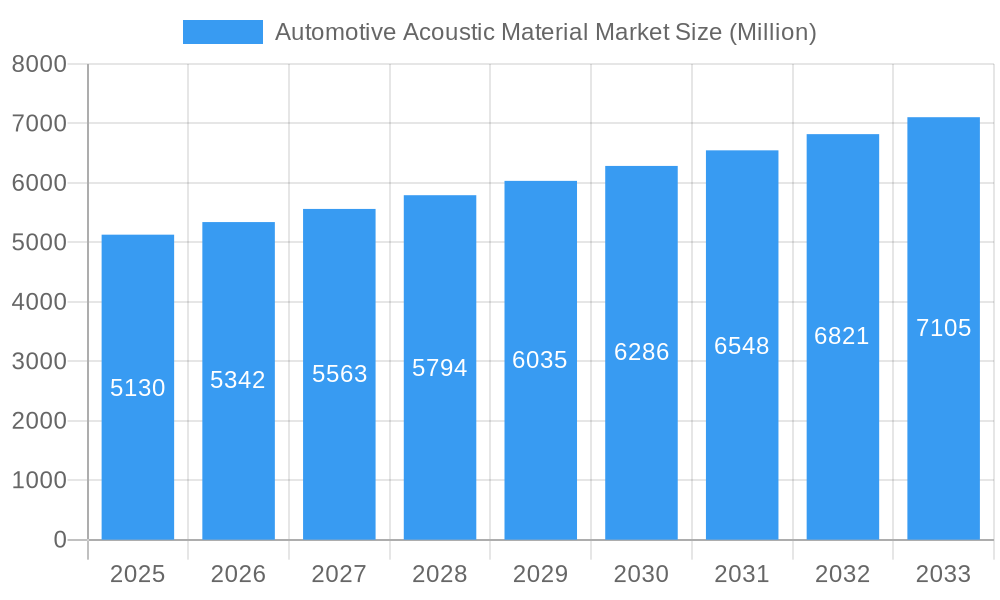

The global automotive acoustic material market, valued at $5.13 billion in 2025, is projected to experience robust growth, driven by increasing demand for noise reduction in vehicles and stringent government regulations on vehicle noise emissions. The market's Compound Annual Growth Rate (CAGR) of 4.09% from 2025 to 2033 reflects a steady expansion fueled by several key factors. The rising adoption of electric vehicles (EVs) significantly contributes to this growth, as the absence of engine noise highlights other sources of interior noise requiring effective acoustic materials. Furthermore, advancements in material science, leading to lighter, more effective, and environmentally friendly acoustic solutions, are bolstering market expansion. Passenger cars currently dominate the vehicle type segment, while polyurethane and textile materials hold significant market shares due to their cost-effectiveness and performance characteristics. However, the growing demand for high-performance acoustic materials in commercial vehicles is expected to drive segment growth in the coming years. Key players like Sumitomo Riko, LyondellBasell, and BASF SE are actively engaged in research and development, focusing on innovative materials and production techniques to gain a competitive edge. Geographical expansion is also a key trend, with Asia Pacific showing substantial growth potential due to rising vehicle production in countries like China and India. Challenges include fluctuating raw material prices and the need for sustainable and recyclable acoustic materials to meet evolving environmental concerns.

Automotive Acoustic Material Market Market Size (In Billion)

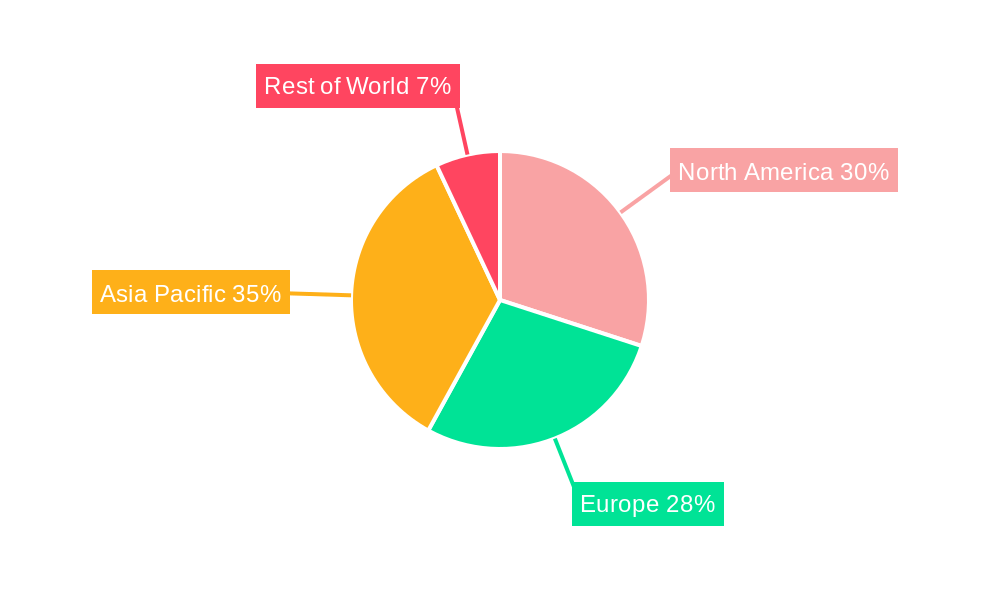

The market segmentation reveals a diverse landscape, with passenger cars currently leading the vehicle type segment, followed by commercial vehicles. Polyurethane and textile materials are prominent in the material segment due to their balance of performance and cost. Geographically, North America and Europe hold significant market shares, reflecting established automotive manufacturing bases. However, the Asia-Pacific region is predicted to witness substantial growth, driven by increasing vehicle production and rising disposable incomes. The forecast period (2025-2033) indicates consistent market growth, driven by ongoing technological advancements in acoustic materials and the persistent demand for improved vehicle comfort and noise reduction. Competitive dynamics are intense, with major players investing heavily in R&D to introduce innovative solutions and expand their market reach. The market is poised for continued expansion, propelled by both technological innovation and rising consumer demand.

Automotive Acoustic Material Market Company Market Share

Automotive Acoustic Material Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report offers a detailed analysis of the Automotive Acoustic Material Market, providing invaluable insights for industry professionals, investors, and strategic decision-makers. The market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033). The report covers the historical period (2019-2024), with 2025 serving as the base year and estimated year. This in-depth study meticulously examines market segmentation, competitive dynamics, technological advancements, and growth drivers to offer a holistic view of this rapidly evolving landscape.

Automotive Acoustic Material Market Market Structure & Competitive Landscape

The automotive acoustic material market exhibits a moderately consolidated structure, with key players like Sumitomo Riko, LyondellBasell, Huntsman, Dow Chemicals, and Toray Industries holding significant market share. The market concentration ratio (CR4) is estimated at xx%, indicating a competitive yet concentrated environment. Innovation plays a pivotal role, with companies continuously developing advanced materials to meet stringent noise reduction requirements and evolving consumer preferences for enhanced vehicle comfort. Stringent environmental regulations concerning VOC emissions and material recyclability significantly impact material selection and manufacturing processes. Product substitutes, such as advanced sound damping technologies, pose a competitive challenge, driving innovation in material properties and performance.

The market witnesses considerable M&A activity, with recent deals such as Freudenberg Group's acquisition of Low & Bonar PLC in May 2020 reshaping the competitive landscape. These mergers and acquisitions are primarily driven by the need to expand product portfolios, access new technologies, and strengthen geographical reach. The total value of M&A transactions in the automotive acoustic material market during the historical period (2019-2024) is estimated at xx Million, highlighting a significant trend of consolidation. End-user segmentation is primarily driven by vehicle type (passenger cars and commercial vehicles) and application (bonnet liner, door trim, and other applications), each segment exhibiting unique growth trajectories and influencing material selection.

Automotive Acoustic Material Market Market Trends & Opportunities

The automotive acoustic material market is experiencing significant growth, driven by the increasing demand for noise reduction and improved passenger comfort in vehicles. The global market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, reflecting a substantial expansion in the coming years. This growth is fueled by several key factors, including:

- Rising Demand for Electric and Hybrid Vehicles: The increasing adoption of EVs and hybrids necessitates superior acoustic material solutions to compensate for the lack of engine noise and improve overall passenger experience.

- Technological Advancements: Continuous development of lightweight, high-performance materials with improved sound absorption and thermal insulation properties is driving market growth.

- Stringent Noise and Vibration Regulations: Governments worldwide are implementing stricter regulations on vehicle noise emissions, compelling manufacturers to adopt advanced acoustic materials.

- Consumer Preference for Enhanced Comfort: Consumers are increasingly prioritizing cabin comfort, pushing manufacturers to adopt better acoustic solutions.

The market penetration rate of advanced acoustic materials, such as polyurethane foam and textile-based solutions, is steadily increasing, indicating a shift towards high-performance materials. Competitive dynamics are characterized by continuous innovation, mergers and acquisitions, and the emergence of new players offering specialized solutions.

Dominant Markets & Segments in Automotive Acoustic Material Market

The passenger car segment dominates the automotive acoustic material market, accounting for approximately xx% of the total market value in 2024. This is driven by the higher volume of passenger car production compared to commercial vehicles. However, the commercial vehicle segment is expected to witness faster growth in the coming years due to increasing demand for quieter and more comfortable commercial vehicles, especially in long-haul transportation applications.

- Leading Regions: North America and Europe currently hold the largest market share due to high vehicle production rates and stringent noise emission regulations. However, Asia-Pacific is expected to experience significant growth in the forecast period, driven by increasing automotive production in countries like China and India.

- Key Growth Drivers:

- Expanding Automotive Production: Increased global vehicle production significantly drives the demand for acoustic materials.

- Infrastructure Development: Investment in road infrastructure and transportation systems supports the growth of the automotive industry and related markets.

- Government Regulations: Stringent noise emission regulations promote the adoption of advanced acoustic materials.

- Technological Innovation: Continuous advancements in material science lead to higher-performing acoustic materials, boosting market growth.

The polyurethane segment currently holds a leading position in the material category, owing to its excellent sound absorption properties and cost-effectiveness. However, growing demand for eco-friendly materials is driving the adoption of textile and other sustainable options. The bonnet liner application currently accounts for a significant market share, with other applications, such as door trims and underbody treatments gaining traction.

Automotive Acoustic Material Market Product Analysis

Technological advancements in the automotive acoustic material sector focus on developing lightweight, high-performance materials with enhanced sound absorption and thermal insulation properties. These innovations aim to address the growing demand for improved vehicle fuel efficiency and enhanced passenger comfort. Materials like recycled polyurethane foams and bio-based alternatives are gaining traction due to their environmental benefits. Competitive advantages are increasingly driven by factors like material cost-effectiveness, superior performance characteristics, and compliance with increasingly stringent regulatory requirements.

Key Drivers, Barriers & Challenges in Automotive Acoustic Material Market

Key Drivers: The automotive acoustic material market is propelled by the increasing demand for better noise, vibration, and harshness (NVH) performance in vehicles, especially with the rise of electric vehicles. Stringent government regulations on vehicle noise emissions also significantly impact market growth. The focus on lightweight materials to enhance fuel efficiency further boosts the demand.

Key Challenges: The automotive acoustic material market faces challenges such as fluctuating raw material prices, which impact manufacturing costs and profitability. Supply chain disruptions caused by geopolitical instability can also hinder production and market growth. Intense competition among established players and the emergence of new players further complicates market dynamics.

Growth Drivers in the Automotive Acoustic Material Market Market

The rising demand for enhanced NVH performance in vehicles, particularly in the burgeoning electric vehicle segment, is a primary driver. Stringent regulatory norms concerning noise emissions and fuel efficiency further propel market expansion. Technological innovation in lightweight, high-performance acoustic materials also contributes significantly to growth.

Challenges Impacting Automotive Acoustic Material Market Growth

Supply chain vulnerabilities, particularly raw material price volatility, pose a major threat. The intense competitive landscape and the emergence of substitute technologies present ongoing challenges. Fluctuations in global automotive production and stringent environmental regulations also contribute to market uncertainties.

Key Players Shaping the Automotive Acoustic Material Market Market

Significant Automotive Acoustic Material Market Industry Milestones

- October 2021: Sumitomo Riko's joint research project with AIST in Japan, focusing on improving NVH measurement and evaluation through the development of specialized road surfaces for vehicle testing.

- September 2021: BASF introduces a new flame-retardant Ultramid grade (PA66) for electric vehicles, enhancing acoustic performance and production efficiency.

- May 2020: Freudenberg Group acquires Low & Bonar PLC, expanding its product portfolio and market presence.

Future Outlook for Automotive Acoustic Material Market Market

The automotive acoustic material market is poised for sustained growth, driven by continuous technological advancements, stringent regulations, and the increasing demand for enhanced vehicle comfort. Strategic opportunities exist in developing sustainable and lightweight materials, catering to the growing EV segment, and exploring innovative applications within the automotive industry. The market holds significant potential for expansion, particularly in emerging economies with rapidly growing automotive sectors.

Automotive Acoustic Material Market Segmentation

-

1. Material

- 1.1. Polyurethane

- 1.2. Textile

- 1.3. Fiberglass

- 1.4. Other Materials

-

2. Vehicle Type

- 2.1. Passenger Cars

- 2.2. Commercial Vehicles

-

3. Application

- 3.1. Bonnet Liner

- 3.2. Door Trim

- 3.3. Other Applications

Automotive Acoustic Material Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Automotive Acoustic Material Market Regional Market Share

Geographic Coverage of Automotive Acoustic Material Market

Automotive Acoustic Material Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Demand for Premium Cars

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyurethane

- 5.1.2. Textile

- 5.1.3. Fiberglass

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Cars

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Bonnet Liner

- 5.3.2. Door Trim

- 5.3.3. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyurethane

- 6.1.2. Textile

- 6.1.3. Fiberglass

- 6.1.4. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.2.1. Passenger Cars

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Bonnet Liner

- 6.3.2. Door Trim

- 6.3.3. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. Europe Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyurethane

- 7.1.2. Textile

- 7.1.3. Fiberglass

- 7.1.4. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.2.1. Passenger Cars

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Bonnet Liner

- 7.3.2. Door Trim

- 7.3.3. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Asia Pacific Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyurethane

- 8.1.2. Textile

- 8.1.3. Fiberglass

- 8.1.4. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.2.1. Passenger Cars

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Bonnet Liner

- 8.3.2. Door Trim

- 8.3.3. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Rest of the World Automotive Acoustic Material Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyurethane

- 9.1.2. Textile

- 9.1.3. Fiberglass

- 9.1.4. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.2.1. Passenger Cars

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Bonnet Liner

- 9.3.2. Door Trim

- 9.3.3. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sumitomo Riko

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Lyondellbasell

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Huntsman

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dow Chemicals

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Toray Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Henkel Adhesive Technologies

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 BASF SE

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Covestro

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Sika

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Freudenberg Grou

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 3M Acoustics

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Sumitomo Riko

List of Figures

- Figure 1: Global Automotive Acoustic Material Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 5: North America Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 6: North America Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 11: Europe Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: Europe Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 13: Europe Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 14: Europe Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 19: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Pacific Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Material 2025 & 2033

- Figure 27: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 29: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 30: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Rest of the World Automotive Acoustic Material Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Acoustic Material Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Automotive Acoustic Material Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 7: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 21: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 22: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: India Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: China Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Acoustic Material Market Revenue Million Forecast, by Material 2020 & 2033

- Table 30: Global Automotive Acoustic Material Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 31: Global Automotive Acoustic Material Market Revenue Million Forecast, by Application 2020 & 2033

- Table 32: Global Automotive Acoustic Material Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Automotive Acoustic Material Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Acoustic Material Market?

The projected CAGR is approximately 4.09%.

2. Which companies are prominent players in the Automotive Acoustic Material Market?

Key companies in the market include Sumitomo Riko, Lyondellbasell, Huntsman, Dow Chemicals, Toray Industries, Henkel Adhesive Technologies, BASF SE, Covestro, Sika, Freudenberg Grou, 3M Acoustics.

3. What are the main segments of the Automotive Acoustic Material Market?

The market segments include Material , Vehicle Type, Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 5.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Traffic Congestion and Increasing Urban Population to Foster Market Growth.

6. What are the notable trends driving market growth?

Growing Demand for Premium Cars.

7. Are there any restraints impacting market growth?

Strict Government Regulations and Policies Toward Ride-hailing Services Impact the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2021, Sumitomo Riko announced that as part of a joint research project with the National Institute of Advanced Industrial Science and Technology (AIST) in Japan, it had recovered a part of the proving ground for vehicle testing installed at the Tsukuba North Site of AIST and installed a new course with special road surfaces. Six types of special road surfaces were installed: road noise road, ride comfort road, Belgian-block road, undulating road, gravel and sand exposed road, and harshness road, to measure and evaluate the NVH of vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Acoustic Material Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Acoustic Material Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Acoustic Material Market?

To stay informed about further developments, trends, and reports in the Automotive Acoustic Material Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence