Key Insights

The global Automotive Air Suspension market is projected for substantial growth, estimated to reach USD 11.74 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 8.89% through 2033. Key growth drivers include escalating demand for superior ride comfort and vehicle stability in both passenger and commercial vehicles. Technological advancements, especially in electronically controlled air suspension systems, are pivotal. These systems offer enhanced control over ride height, damping, and load leveling, delivering a premium driving experience and improved fuel efficiency. The integration of air suspension in electric vehicles (EVs) is also a significant trend, aiding in battery placement optimization, NVH reduction, and management of heavier EV components. Stringent automotive emission and safety regulations indirectly promote the adoption of advanced suspension systems for improved vehicle dynamics.

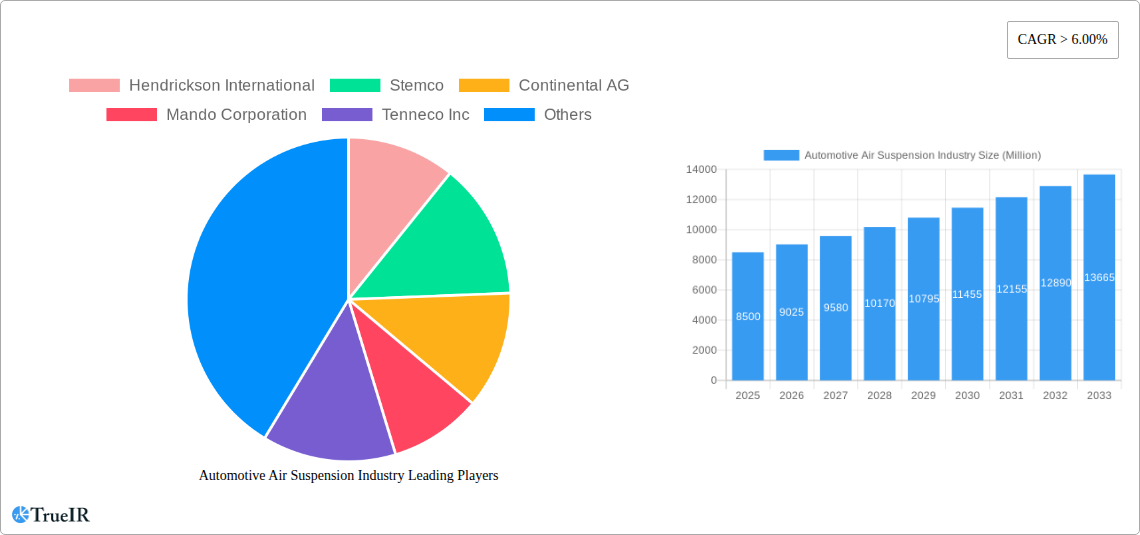

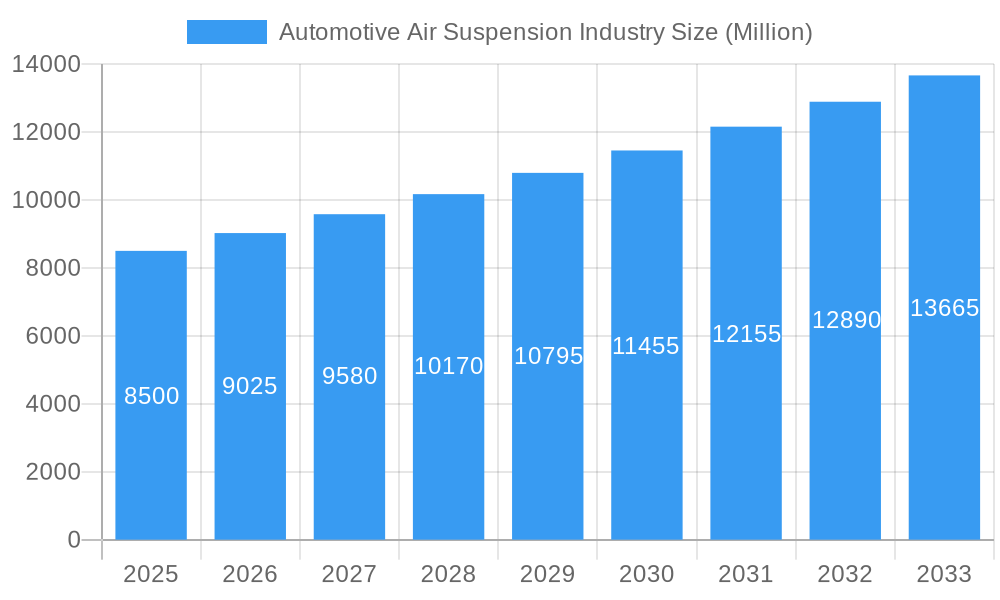

Automotive Air Suspension Industry Market Size (In Billion)

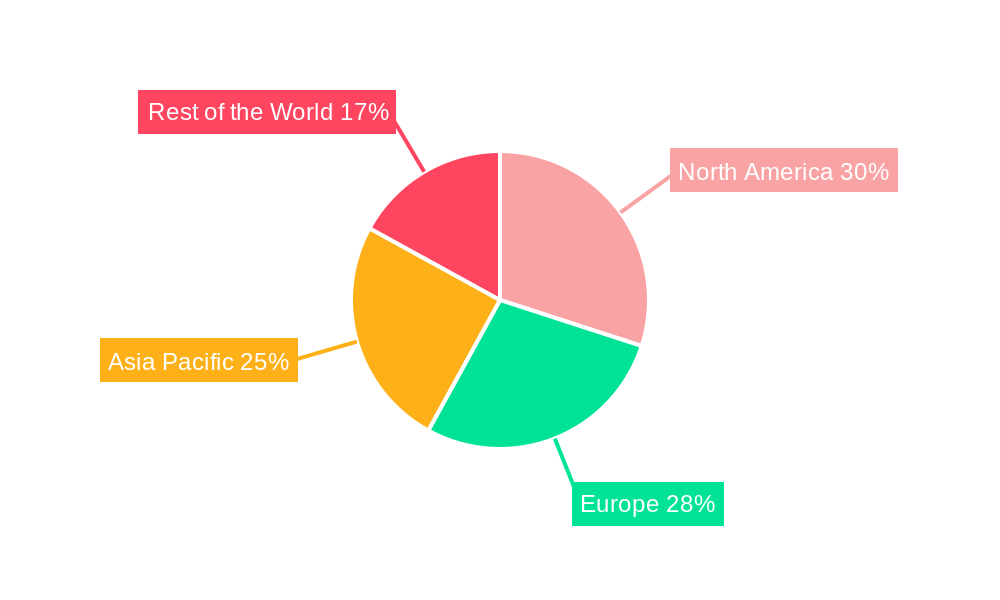

Significant R&D investments by leading manufacturers are driving innovation in lighter, more efficient, and cost-effective air suspension solutions. The aftermarket segment is also poised for healthy expansion as consumers seek performance and comfort upgrades. North America and Europe are expected to lead market share due to a high concentration of premium vehicle manufacturers and consumer preference for advanced features. The Asia Pacific region, particularly China and India, is anticipated to be the fastest-growing market, fueled by a booming automotive industry, rising disposable incomes, and increasing demand for premium features in mass-market vehicles. While higher initial costs and specialized maintenance requirements may present challenges, the significant benefits in performance, comfort, and potential long-term savings are expected to drive market adoption.

Automotive Air Suspension Industry Company Market Share

This report provides an in-depth analysis of the global Automotive Air Suspension industry, offering strategic insights and actionable intelligence. Covering a comprehensive study period from 2019 to 2033, the report utilizes a robust methodology including historical data (2019-2024), a detailed base year analysis (2025), and a forward-looking forecast (2025-2033). Key aspects examined include market size, segmentation, competitive landscape, drivers, challenges, and future outlook, equipping businesses for effective navigation of this dynamic sector.

Automotive Air Suspension Industry Market Structure & Competitive Landscape

The Automotive Air Suspension market is characterized by a moderate to high concentration, with a few dominant players holding significant market share. Innovation serves as a primary driver, fueled by the increasing demand for enhanced vehicle comfort, performance, and fuel efficiency. Regulatory frameworks, particularly those focused on emissions and vehicle safety, also play a crucial role in shaping product development and market access. The threat of product substitutes, such as advanced conventional suspension systems, exists but is often outweighed by the superior benefits offered by air suspension in premium and commercial applications. End-user segmentation highlights a strong reliance on Original Equipment Manufacturers (OEMs), which account for an estimated 75% of the market, with the aftermarket segment representing the remaining 25%. Merger and acquisition (M&A) trends are indicative of consolidation efforts and strategic partnerships aimed at expanding product portfolios and geographic reach. Over the historical period (2019-2024), an estimated 15 significant M&A activities were recorded, reflecting the industry's dynamic nature. The concentration ratio for the top three players is estimated to be around 60%.

Automotive Air Suspension Industry Market Trends & Opportunities

The global Automotive Air Suspension market is poised for substantial growth, projected to expand from an estimated market size of approximately 5,500 Million in the base year 2025 to an impressive 9,800 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period (2025–2033). This upward trajectory is driven by a confluence of technological advancements, evolving consumer preferences, and shifting automotive industry dynamics. The increasing integration of advanced driver-assistance systems (ADAS) and the burgeoning demand for electric vehicles (EVs) are creating significant new opportunities for air suspension systems. EVs, in particular, benefit from air suspension's ability to optimize ride height for aerodynamic efficiency and battery cooling, as well as to compensate for the added weight of battery packs.

Technological shifts are central to this growth, with a notable trend towards electronically controlled air suspension systems. These systems offer superior precision, adaptability, and a more refined driving experience, catering to the growing consumer expectation for personalized and intelligent vehicle features. The development of lighter, more compact, and energy-efficient air suspension components is a key area of innovation. Furthermore, the increasing adoption of smart materials and sensors within air suspension systems is enabling real-time adjustments for optimal performance and safety under various driving conditions.

Consumer preferences are increasingly tilting towards comfort, luxury, and enhanced driving dynamics. Air suspension systems excel in delivering a smooth and quiet ride, effectively isolating the cabin from road imperfections. This resonates strongly with the premium and luxury segments of the passenger car market. In the commercial vehicle sector, the focus on payload optimization, reduced driver fatigue, and improved fleet efficiency makes air suspension an indispensable technology. The market penetration rate of air suspension systems in new passenger vehicles is estimated to reach 35% by 2033, up from approximately 20% in 2025.

The competitive landscape is evolving, with established players investing heavily in research and development to maintain their edge and new entrants seeking to capitalize on emerging market niches. Strategic collaborations between automotive manufacturers and air suspension system suppliers are becoming more prevalent, fostering co-creation and accelerating the adoption of new technologies. The growing aftermarket for air suspension components also presents a significant opportunity for service providers and component manufacturers. The increasing complexity of vehicle architectures and the demand for integrated solutions are pushing the market towards greater specialization and value-added services.

Dominant Markets & Segments in Automotive Air Suspension Industry

The Commercial Vehicle segment is a dominant force within the Automotive Air Suspension industry, driven by its critical role in optimizing payload capacity, ensuring cargo integrity, and enhancing driver comfort on long-haul routes. The ability of air suspension to adjust ride height and stiffness dynamically translates into significant operational efficiencies for fleet operators, reducing wear and tear on both the vehicle and its cargo. Key growth drivers in this segment include the increasing global trade volumes, the demand for efficient logistics, and stringent regulations promoting vehicle safety and driver welfare. Infrastructure development projects worldwide also contribute to the demand for heavy-duty commercial vehicles equipped with advanced suspension systems.

Within the Control Type segmentation, Electronically Controlled Air Suspension is emerging as the fastest-growing category. This dominance is attributed to its superior performance characteristics, including adaptive damping, ride height control, and integration with advanced vehicle dynamics systems. The increasing sophistication of vehicle electronics and the demand for personalized driving experiences are propelling the adoption of these intelligent suspension solutions in both passenger cars and commercial vehicles. Key growth drivers for this segment include the miniaturization of electronic components, advancements in sensor technology, and the increasing affordability of sophisticated control units. The growing popularity of autonomous driving features also necessitates precise and responsive suspension systems that electronically controlled air suspension can provide.

The OEM end-user segment holds the largest market share, reflecting the inherent integration of air suspension systems during vehicle manufacturing. Automotive manufacturers are increasingly specifying air suspension as a premium feature in new vehicle models, driven by consumer demand and the desire to differentiate their offerings. The close collaboration between OEMs and air suspension manufacturers ensures seamless integration and optimal performance. Key growth drivers in the OEM segment include the trend towards vehicle electrification, which often requires specialized suspension solutions to manage battery weight and optimize aerodynamics, and the continuous pursuit of enhanced vehicle comfort and performance by automotive brands.

Regionally, North America and Europe currently represent the largest markets for automotive air suspension systems, owing to the presence of major automotive manufacturers, a high concentration of premium vehicle sales, and a strong regulatory push for advanced vehicle technologies. The growing adoption of electric vehicles in these regions further fuels the demand for sophisticated air suspension solutions. Asia-Pacific, however, is projected to witness the highest growth rate in the coming years, driven by the expanding automotive production, increasing disposable incomes, and the growing demand for comfort and performance features in emerging economies.

Automotive Air Suspension Industry Product Analysis

Product innovations in the Automotive Air Suspension industry are primarily focused on enhancing comfort, performance, and efficiency. This includes the development of lighter-weight components, smart sensor integration for real-time adjustments, and advanced damping technologies that adapt to varying road conditions and driving styles. Electronically controlled systems offer competitive advantages through their precise control over ride height and stiffness, catering to both passenger car luxury and commercial vehicle load optimization needs. The application of these advanced systems in electric vehicles is also a significant area of development, addressing the unique challenges posed by battery weight and aerodynamic requirements.

Key Drivers, Barriers & Challenges in Automotive Air Suspension Industry

Key Drivers: The Automotive Air Suspension market is propelled by the escalating demand for enhanced vehicle comfort and ride quality, particularly in premium passenger cars and long-haul commercial vehicles. Technological advancements, such as the integration of electronic controls and smart sensors, are driving innovation and creating new performance capabilities. The growing adoption of electric vehicles presents a significant opportunity, as air suspension is crucial for managing battery weight and optimizing aerodynamics. Favorable regulatory environments promoting vehicle safety and fuel efficiency also act as a catalyst.

Barriers & Challenges: High initial costs associated with air suspension systems compared to conventional alternatives remain a significant barrier to widespread adoption, especially in price-sensitive markets. The complexity of installation and maintenance also presents a challenge for aftermarket service providers. Supply chain disruptions and the increasing cost of raw materials can impact production and pricing. Furthermore, the evolving regulatory landscape concerning vehicle emissions and safety standards necessitates continuous adaptation and investment in compliant technologies. Competitive pressures from advanced conventional suspension systems also require ongoing innovation to maintain market share.

Growth Drivers in the Automotive Air Suspension Industry Market

Growth in the Automotive Air Suspension industry is significantly driven by the burgeoning demand for enhanced vehicle comfort and a superior driving experience, especially in the premium passenger car segment. The ongoing technological advancements, particularly in electronic control units (ECUs) and sensor integration, enable adaptive and predictive suspension functionalities. The rapid expansion of the electric vehicle (EV) market is a major growth catalyst, as air suspension systems are vital for managing the added weight of batteries, optimizing aerodynamics for range, and ensuring a comfortable ride. Furthermore, increasing global trade and logistics demands are driving the adoption of advanced air suspension in commercial vehicles for better load management and reduced driver fatigue.

Challenges Impacting Automotive Air Suspension Industry Growth

Key challenges impacting the Automotive Air Suspension industry include the high initial cost of these systems, which can be a deterrent for mass-market adoption. Complexity in installation and repair creates a barrier for the aftermarket, requiring specialized training and tools. Supply chain vulnerabilities, exacerbated by global geopolitical and economic uncertainties, can lead to increased raw material costs and production delays. Stringent and evolving regulatory mandates related to vehicle safety and emissions require continuous investment in research and development to ensure compliance. The competitive pressure from continuously improving conventional suspension technologies also demands consistent innovation.

Key Players Shaping the Automotive Air Suspension Industry Market

- Hendrickson International

- Stemco

- Continental AG

- Mando Corporation

- Tenneco Inc

- Arnott Industries

- Dunlop Systems and Components

- Vibracoustics

- Airlift Company

- ZF Friedrichshafen AG

Significant Automotive Air Suspension Industry Industry Milestones

- May 2021: Firestone announced its expansion plan for Williamsburg, Kentucky Firestone Industrial Products Plant to cater to the growing advanced air suspension technology demand in electric vehicles.

- September 2021: Continental AG launched three new products at automechanika 2021, which include air suspension dampers.

Future Outlook for Automotive Air Suspension Industry Market

The future outlook for the Automotive Air Suspension industry is exceptionally promising, characterized by sustained growth driven by technological innovation and evolving market demands. The increasing integration of air suspension systems in electric vehicles, coupled with advancements in smart suspension technologies, will be key growth catalysts. Opportunities lie in developing more cost-effective solutions for wider market penetration, enhancing predictive maintenance capabilities, and further optimizing systems for autonomous driving applications. Strategic partnerships and continued investment in research and development will be crucial for players to capitalize on the expanding market potential and maintain a competitive edge in this evolving landscape.

Automotive Air Suspension Industry Segmentation

-

1. Control Type

- 1.1. Electronically Controlled Air Suspension

- 1.2. Non-electronically Controlled Air Suspension

-

2. Application Type

- 2.1. Commercial Vehicle

- 2.2. Passenger Cars

-

3. End User

- 3.1. OEM

- 3.2. Aftermarket

Automotive Air Suspension Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Air Suspension Industry Regional Market Share

Geographic Coverage of Automotive Air Suspension Industry

Automotive Air Suspension Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Luxury and Premium Cars

- 3.3. Market Restrains

- 3.3.1. Increasing Prices of Micromotors owing to Constant Transformation in Technology

- 3.4. Market Trends

- 3.4.1. Electronically Controlled Air Suspension Anticipated to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Air Suspension Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Control Type

- 5.1.1. Electronically Controlled Air Suspension

- 5.1.2. Non-electronically Controlled Air Suspension

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Commercial Vehicle

- 5.2.2. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. OEM

- 5.3.2. Aftermarket

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Control Type

- 6. North America Automotive Air Suspension Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Control Type

- 6.1.1. Electronically Controlled Air Suspension

- 6.1.2. Non-electronically Controlled Air Suspension

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Commercial Vehicle

- 6.2.2. Passenger Cars

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. OEM

- 6.3.2. Aftermarket

- 6.1. Market Analysis, Insights and Forecast - by Control Type

- 7. Europe Automotive Air Suspension Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Control Type

- 7.1.1. Electronically Controlled Air Suspension

- 7.1.2. Non-electronically Controlled Air Suspension

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Commercial Vehicle

- 7.2.2. Passenger Cars

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. OEM

- 7.3.2. Aftermarket

- 7.1. Market Analysis, Insights and Forecast - by Control Type

- 8. Asia Pacific Automotive Air Suspension Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Control Type

- 8.1.1. Electronically Controlled Air Suspension

- 8.1.2. Non-electronically Controlled Air Suspension

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Commercial Vehicle

- 8.2.2. Passenger Cars

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. OEM

- 8.3.2. Aftermarket

- 8.1. Market Analysis, Insights and Forecast - by Control Type

- 9. Rest of the World Automotive Air Suspension Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Control Type

- 9.1.1. Electronically Controlled Air Suspension

- 9.1.2. Non-electronically Controlled Air Suspension

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Commercial Vehicle

- 9.2.2. Passenger Cars

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. OEM

- 9.3.2. Aftermarket

- 9.1. Market Analysis, Insights and Forecast - by Control Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hendrickson International

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Stemco

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Continental AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mando Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Tenneco Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Arnott Industries

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Dunlop Systems and Components

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vibracoustics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Airlift Company

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ZF Friedrichshafen AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Hendrickson International

List of Figures

- Figure 1: Global Automotive Air Suspension Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Air Suspension Industry Revenue (billion), by Control Type 2025 & 2033

- Figure 3: North America Automotive Air Suspension Industry Revenue Share (%), by Control Type 2025 & 2033

- Figure 4: North America Automotive Air Suspension Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America Automotive Air Suspension Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Automotive Air Suspension Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Automotive Air Suspension Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Automotive Air Suspension Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Air Suspension Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Air Suspension Industry Revenue (billion), by Control Type 2025 & 2033

- Figure 11: Europe Automotive Air Suspension Industry Revenue Share (%), by Control Type 2025 & 2033

- Figure 12: Europe Automotive Air Suspension Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 13: Europe Automotive Air Suspension Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Automotive Air Suspension Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Automotive Air Suspension Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Automotive Air Suspension Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Air Suspension Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Air Suspension Industry Revenue (billion), by Control Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Air Suspension Industry Revenue Share (%), by Control Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Air Suspension Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Air Suspension Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Air Suspension Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Automotive Air Suspension Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Automotive Air Suspension Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Air Suspension Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Air Suspension Industry Revenue (billion), by Control Type 2025 & 2033

- Figure 27: Rest of the World Automotive Air Suspension Industry Revenue Share (%), by Control Type 2025 & 2033

- Figure 28: Rest of the World Automotive Air Suspension Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Rest of the World Automotive Air Suspension Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Automotive Air Suspension Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Rest of the World Automotive Air Suspension Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Automotive Air Suspension Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Air Suspension Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Air Suspension Industry Revenue billion Forecast, by Control Type 2020 & 2033

- Table 2: Global Automotive Air Suspension Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global Automotive Air Suspension Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Automotive Air Suspension Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Air Suspension Industry Revenue billion Forecast, by Control Type 2020 & 2033

- Table 6: Global Automotive Air Suspension Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Global Automotive Air Suspension Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Automotive Air Suspension Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Air Suspension Industry Revenue billion Forecast, by Control Type 2020 & 2033

- Table 13: Global Automotive Air Suspension Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 14: Global Automotive Air Suspension Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Automotive Air Suspension Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Air Suspension Industry Revenue billion Forecast, by Control Type 2020 & 2033

- Table 22: Global Automotive Air Suspension Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 23: Global Automotive Air Suspension Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 24: Global Automotive Air Suspension Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: India Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: China Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: South Korea Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Automotive Air Suspension Industry Revenue billion Forecast, by Control Type 2020 & 2033

- Table 31: Global Automotive Air Suspension Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 32: Global Automotive Air Suspension Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 33: Global Automotive Air Suspension Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South America Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Automotive Air Suspension Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Air Suspension Industry?

The projected CAGR is approximately 8.89%.

2. Which companies are prominent players in the Automotive Air Suspension Industry?

Key companies in the market include Hendrickson International, Stemco, Continental AG, Mando Corporation, Tenneco Inc, Arnott Industries, Dunlop Systems and Components, Vibracoustics, Airlift Company, ZF Friedrichshafen AG.

3. What are the main segments of the Automotive Air Suspension Industry?

The market segments include Control Type, Application Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Luxury and Premium Cars.

6. What are the notable trends driving market growth?

Electronically Controlled Air Suspension Anticipated to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Prices of Micromotors owing to Constant Transformation in Technology.

8. Can you provide examples of recent developments in the market?

In September 2021, Continental AG launched three new products at automechanika 2021, which include air suspension dampers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Air Suspension Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Air Suspension Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Air Suspension Industry?

To stay informed about further developments, trends, and reports in the Automotive Air Suspension Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence