Key Insights

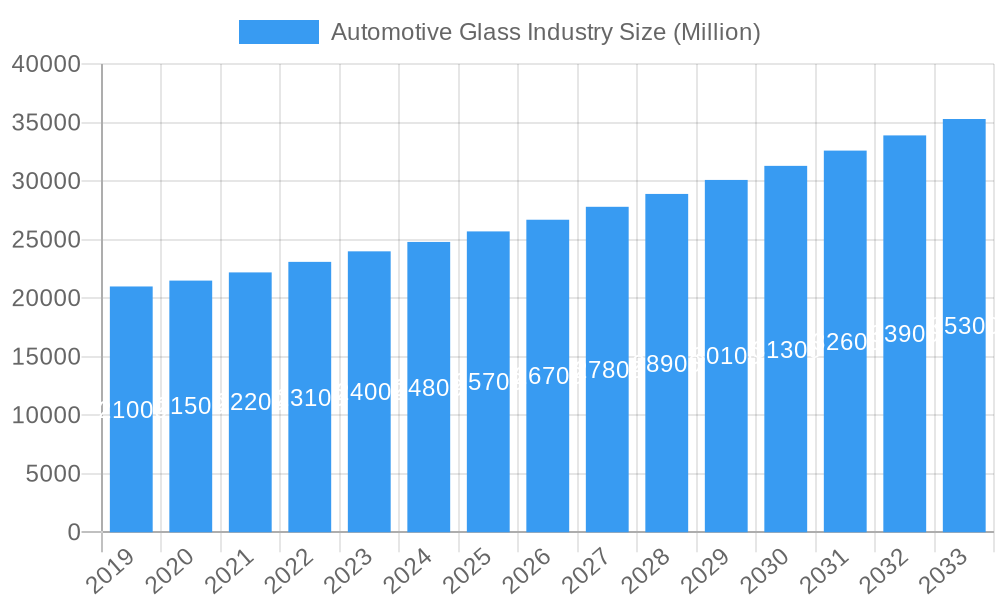

The global Automotive Glass Market is projected for substantial growth, expected to reach $24.6 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 5.63% through 2033. This expansion is fueled by increasing vehicle production, demand for advanced safety and comfort features, and the adoption of smart glass technologies. Key drivers include stringent safety regulations, the rise of Electric Vehicles (EVs) and Autonomous Vehicles (AVs) requiring specialized glazing for sensors and energy efficiency, and ongoing innovation in glass materials and manufacturing. The industry trend favors lightweight, durable, and sophisticated glass solutions enhancing fuel efficiency and passenger experience, with integrated heating, defrosting, and display functionalities becoming standard.

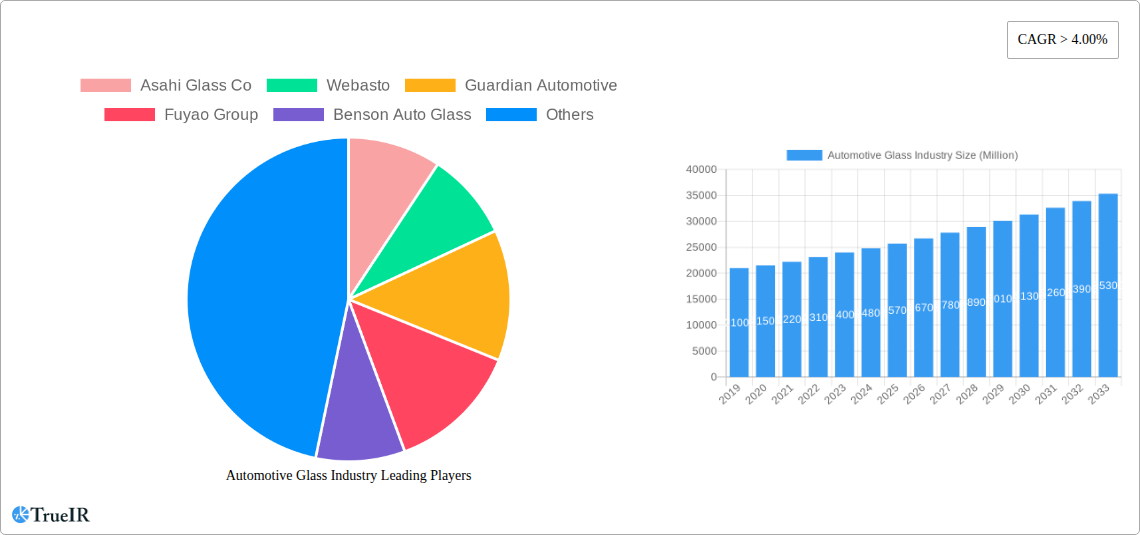

Automotive Glass Industry Market Size (In Billion)

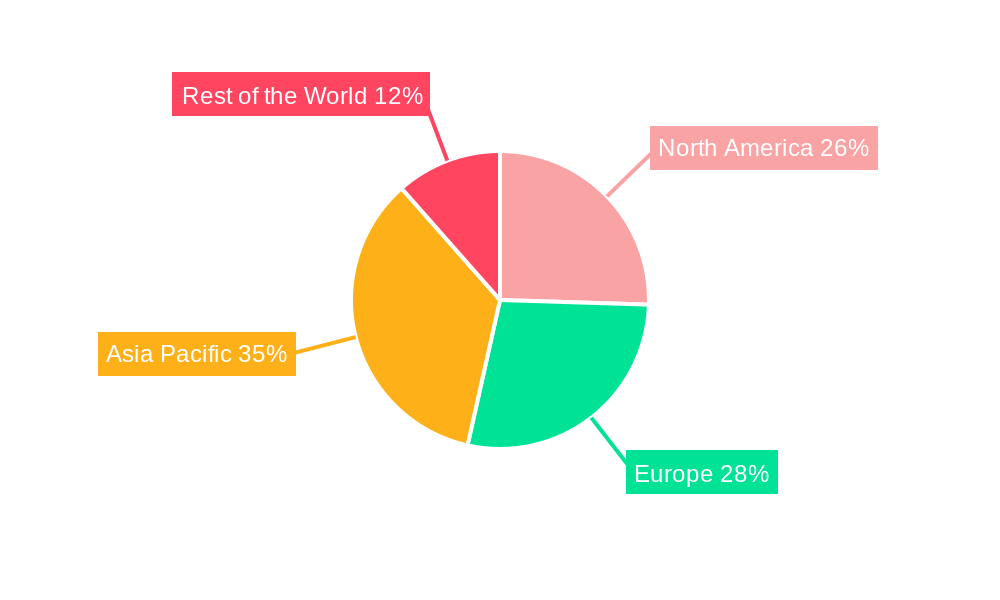

While challenges like fluctuating raw material costs and complex manufacturing processes exist, the market's focus on sophisticated and safer vehicles is expected to overcome these. The market is segmented by type into Regular Glass and Smart Glass, with Smart Glass anticipated to grow significantly due to its advanced capabilities. Applications include windshields, rear-view mirrors, sunroofs, and other specialized types. Passenger vehicles represent the dominant segment, with commercial vehicles also showing increasing demand. Regionally, Asia Pacific, led by China and India, is a key growth area due to its robust automotive manufacturing and consumer markets. North America and Europe remain important markets driven by technological adoption and premium vehicle sales. Leading players are investing in R&D to maintain a competitive edge.

Automotive Glass Industry Company Market Share

This report offers an in-depth analysis of the Automotive Glass Market, covering size, trends, opportunities, and the competitive landscape. With a study period from 2019 to 2033 and a base year of 2025, it examines the dynamics shaping automotive glass manufacturing and application. This analysis utilizes high-volume keywords such as "automotive glass market," "smart glass," "windshield technology," "automotive glazing," and "vehicle glass industry" for optimal search engine visibility, targeting industry stakeholders, investors, and decision-makers.

The report segments the market by type into Regular Glass and Smart Glass, and by application into Windshield, Rear View Mirrors, Sunroof, and Other Application Types. It also analyzes segmentation by vehicle type, covering Passenger Vehicles and Commercial Vehicles.

Automotive Glass Industry Market Structure & Competitive Landscape

The automotive glass industry is characterized by a moderately concentrated market structure, with a few major global players holding significant market share. Innovation drivers are primarily fueled by advancements in lightweight materials, energy efficiency, enhanced safety features, and the integration of smart technologies. Regulatory impacts, such as stringent safety standards and emissions regulations, also play a crucial role in shaping product development and market entry strategies. Product substitutes, while limited in core functionalities, are emerging in the form of advanced composite materials for certain structural components. End-user segmentation analysis reveals a strong reliance on the passenger vehicle segment, though the commercial vehicle sector presents growing opportunities. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding geographical reach, acquiring technological capabilities, and achieving economies of scale. For instance, the acquisition of smaller, specialized glass manufacturers by larger entities is a recurring theme, reflecting a drive for comprehensive market coverage and integrated solutions. The industry sees a robust focus on R&D, with an estimated investment of over 200 million in cutting-edge glass technologies annually by leading firms. Concentration ratios for the top five players are estimated to be around 65%, indicating a significant but not entirely monopolistic market.

Automotive Glass Industry Market Trends & Opportunities

The global automotive glass industry is poised for substantial growth, driven by an increasing global vehicle production and a rising demand for advanced automotive features. The market size is projected to reach an estimated 180 million by 2025 and is expected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.2% during the forecast period of 2025–2033. Key technological shifts are transforming the industry, with the burgeoning adoption of smart glass solutions offering enhanced functionalities such as dynamic tinting, augmented reality displays, and integrated heating and cooling systems. These innovations are a direct response to evolving consumer preferences for more comfortable, connected, and personalized in-vehicle experiences. The increasing demand for electric vehicles (EVs) also presents a significant opportunity, as EVs often incorporate larger glass surfaces for panoramic roofs and advanced displays, contributing to both aesthetics and functionality. Furthermore, the integration of lightweight glass technologies is crucial for improving vehicle fuel efficiency and extending the range of EVs. The competitive dynamics are intensifying, with established players investing heavily in R&D to maintain their market leadership while new entrants focus on niche segments and disruptive technologies. The penetration rate of advanced driver-assistance systems (ADAS) is directly influencing the demand for sophisticated windshields equipped with sensor integration capabilities. The overall market penetration of smart glass technologies, though nascent, is anticipated to witness a significant upswing, potentially reaching 25% of the total automotive glass market by 2033. The increasing focus on sustainability and recyclability of automotive glass is also emerging as a critical trend, pushing manufacturers towards greener production processes and materials. Opportunities abound in developing bespoke glass solutions for autonomous vehicles, where enhanced visibility, durability, and integrated communication features will be paramount.

Dominant Markets & Segments in Automotive Glass Industry

The Asia-Pacific region is currently the dominant market for automotive glass, driven by the massive automotive manufacturing base in countries like China and India, coupled with a rapidly expanding middle class increasing passenger vehicle sales. Within this region, China alone accounts for an estimated 45% of the global automotive glass demand.

Segments by Type:

- Regular Glass: This segment continues to hold the largest market share due to its widespread application in standard vehicle configurations and its cost-effectiveness. However, its growth is gradually being surpassed by smart glass.

- Smart Glass: This segment is experiencing the fastest growth, fueled by technological advancements and increasing consumer demand for features like electrochromic tinting, privacy glass, and integrated displays. The market penetration of smart glass in premium vehicle segments is projected to reach 30% by 2033.

Segments by Application Type:

- Windshield: Remains the largest application segment, with growing demand for advanced features like heads-up displays (HUDs), sensor integration for ADAS, and enhanced durability. The market for advanced windshields is expected to grow at a CAGR of 7.5%.

- Sunroof: The demand for panoramic sunroofs and convertible roof systems is a significant growth driver, enhancing cabin ambiance and perceived luxury.

- Rear View Mirrors: While traditionally a smaller segment, advancements in integrated camera systems and digital displays are creating new opportunities.

- Other Application Types: This includes side and back windows, with an increasing trend towards larger, more complex glass structures and lightweight alternatives.

Segments by Vehicle Type:

- Passenger Vehicles: This segment constitutes the largest share of the automotive glass market, driven by global sales volumes and the increasing adoption of premium features.

- Commercial Vehicles: While historically a smaller segment, the growth in logistics and the introduction of advanced features in trucks and buses are creating new avenues for expansion. The demand for specialized safety glass in commercial vehicles is also on the rise.

Key growth drivers in dominant markets include supportive government policies for automotive manufacturing, substantial investments in research and development, and the rapid adoption of new automotive technologies. The increasing urbanization and the subsequent rise in vehicle ownership in emerging economies are also critical factors contributing to market dominance.

Automotive Glass Industry Product Analysis

The automotive glass industry is witnessing a significant wave of product innovation focused on enhanced safety, functionality, and aesthetics. Smart glass technologies, such as electrochromic and thermochromic glass, are gaining traction for their ability to dynamically control light and heat transmission, improving cabin comfort and energy efficiency. Windshields are increasingly being engineered to integrate Advanced Driver-Assistance Systems (ADAS) and Heads-Up Displays (HUDs), transforming them into intelligent information hubs. Innovations in lightweight glass formulations and composite materials are crucial for improving vehicle fuel economy and extending EV range. The competitive advantage lies in developing patented technologies, offering superior durability, and providing seamless integration with vehicle electronic systems. The market is also seeing a trend towards larger, more complex glass structures that enhance vehicle design and interior spaciousness.

Key Drivers, Barriers & Challenges in Automotive Glass Industry

Key Drivers: The automotive glass industry is propelled by several key drivers. Technological advancements, particularly in smart glass and ADAS integration, are creating new product categories and expanding market opportunities. The global resurgence in vehicle production, especially in emerging economies, directly boosts demand for automotive glass. Increasingly stringent safety regulations worldwide are mandating the use of more robust and feature-rich glass solutions, such as laminated and tempered glass with enhanced impact resistance. The growing popularity of electric vehicles (EVs) also presents a significant opportunity, as EVs often feature larger glass surfaces and require lightweight materials for optimal performance and range.

Barriers & Challenges: Despite the positive outlook, the industry faces several challenges. Supply chain disruptions, exacerbated by global events, can lead to material shortages and increased production costs, with an estimated impact of over 50 million in lost revenue for some manufacturers during peak disruptions. Fluctuating raw material prices, particularly for silica sand and specialty chemicals, pose a constant threat to profitability margins. Intense competition among established players and the emergence of new low-cost manufacturers can lead to price erosion and reduced market share. Regulatory hurdles, including evolving safety and environmental standards across different regions, require continuous adaptation and investment in new technologies and processes. Furthermore, the high capital expenditure required for advanced manufacturing facilities and R&D can act as a barrier to entry for smaller companies.

Growth Drivers in the Automotive Glass Industry Market

Several pivotal factors are driving growth in the automotive glass market. The relentless pursuit of enhanced vehicle safety is a primary catalyst, pushing for the adoption of stronger, more resilient glass types and advanced functionalities like multi-layered windshields for improved impact absorption. The surge in electric vehicle (EV) adoption is another significant growth driver; EVs often incorporate larger, lighter glass components, including panoramic roofs and advanced sensor-integrated windshields, contributing to both aesthetics and performance. Furthermore, the increasing demand for sophisticated in-car technologies, such as augmented reality heads-up displays (AR-HUDs) and dynamic tinting capabilities, is fueling innovation and market expansion. Supportive government policies promoting automotive manufacturing and technological innovation, coupled with substantial investments in R&D by key industry players, are also critical growth catalysts, fostering a dynamic and competitive market environment.

Challenges Impacting Automotive Glass Industry Growth

The automotive glass industry's growth is not without its obstacles. Significant challenges include the volatility of raw material prices, such as soda ash and silica, which can impact production costs and profitability. The complexity and fragmentation of global supply chains present risks of disruptions, leading to delays and increased logistical expenses; these disruptions can collectively cost the industry upwards of 75 million annually. Stringent and evolving regulatory landscapes across different countries, particularly concerning safety and environmental standards, require continuous adaptation and substantial investment in compliance. Intense competition, both from established global players and emerging regional manufacturers, can lead to price pressures and market share erosion. The high initial investment required for advanced manufacturing technologies and the development of novel smart glass solutions can also act as a barrier, particularly for smaller companies seeking to scale their operations.

Key Players Shaping the Automotive Glass Industry Market

- Asahi Glass Co.

- Webasto

- Guardian Automotive

- Fuyao Group

- Benson Auto Glass

- Carlex Glass

- Saint Gobain

- Magna International

- Nippon Sheet Glass

- Xinyi Glass

Significant Automotive Glass Industry Industry Milestones

- July 2021: Jeep's Performance Parts division (JPP) introduced Gorilla Glass windshields for its Wrangler SUV and Gladiator pick-up truck models, highlighting enhanced durability through Corning Gorilla Glass's multi-ply construction.

- June 2021: Webasto supplied the sliding panorama sunroof for the new Mercedes-Benz S-Class, emphasizing enhanced interior ambiance and advanced control features like gesture and voice operation.

- March 2021: Audi announced that its all-electric Q4 e-tron crossover would feature a dynamic windshield display, showcasing the potential of AR windshields for wider field of view and improved HUD capabilities.

- February 2020: AGC Glass Europe collaborated with Citrine Informatics, leveraging artificial intelligence to accelerate the development of new, high-performance glass materials and optimize production processes.

- January 2020: BMW introduced intelligent glass control in its iNext electric SUV at CES 2020, demonstrating a reflective, automatically adjustable glass system that manages heat and light based on sun positioning.

Future Outlook for Automotive Glass Industry Market

The future outlook for the automotive glass industry is exceptionally promising, driven by a confluence of technological innovation and evolving market demands. The continued integration of smart glass technologies, offering enhanced functionalities like privacy control, dynamic tinting, and embedded displays, will be a major growth catalyst. The burgeoning electric and autonomous vehicle sectors will necessitate advanced glass solutions for improved aerodynamics, lighter weight, and seamless sensor integration, opening substantial market potential. Increased focus on sustainability and circular economy principles will spur the development of eco-friendly manufacturing processes and recyclable glass materials. Strategic collaborations and R&D investments by key players are expected to further accelerate product development and market penetration, ensuring a dynamic and evolving landscape for automotive glass in the coming years.

Automotive Glass Industry Segmentation

-

1. Type

- 1.1. Regular Glass

- 1.2. Smart Glass

-

2. Application Type

- 2.1. Windshield

- 2.2. Rear View Mirrors

- 2.3. Sunroof

- 2.4. Other Application Types

-

3. Vehicle Type

- 3.1. Passenger Vehicles

- 3.2. Commercial Vehicles

Automotive Glass Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Automotive Glass Industry Regional Market Share

Geographic Coverage of Automotive Glass Industry

Automotive Glass Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Fuel Economy Norms and Government Incentives

- 3.3. Market Restrains

- 3.3.1. Growing Demand For Battery Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Increasing Application of Smart Glass in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Glass Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Regular Glass

- 5.1.2. Smart Glass

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Windshield

- 5.2.2. Rear View Mirrors

- 5.2.3. Sunroof

- 5.2.4. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Vehicles

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Automotive Glass Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Regular Glass

- 6.1.2. Smart Glass

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Windshield

- 6.2.2. Rear View Mirrors

- 6.2.3. Sunroof

- 6.2.4. Other Application Types

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Vehicles

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Automotive Glass Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Regular Glass

- 7.1.2. Smart Glass

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Windshield

- 7.2.2. Rear View Mirrors

- 7.2.3. Sunroof

- 7.2.4. Other Application Types

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Vehicles

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Automotive Glass Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Regular Glass

- 8.1.2. Smart Glass

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Windshield

- 8.2.2. Rear View Mirrors

- 8.2.3. Sunroof

- 8.2.4. Other Application Types

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Vehicles

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Automotive Glass Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Regular Glass

- 9.1.2. Smart Glass

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Windshield

- 9.2.2. Rear View Mirrors

- 9.2.3. Sunroof

- 9.2.4. Other Application Types

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Vehicles

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Asahi Glass Co

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Webasto

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Guardian Automotive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Fuyao Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Benson Auto Glass

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carlex Glass

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Saint Gobain

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Magna Internationa

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nippon Sheet Glass

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Xinyi Glass

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Asahi Glass Co

List of Figures

- Figure 1: Global Automotive Glass Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Automotive Glass Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Automotive Glass Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Automotive Glass Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 5: North America Automotive Glass Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Automotive Glass Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Glass Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Glass Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Automotive Glass Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Glass Industry Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Automotive Glass Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Automotive Glass Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 13: Europe Automotive Glass Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Automotive Glass Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Glass Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Glass Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Automotive Glass Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Glass Industry Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Glass Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Glass Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Glass Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Glass Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Glass Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Glass Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Glass Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Glass Industry Revenue (billion), by Type 2025 & 2033

- Figure 27: Rest of the World Automotive Glass Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Rest of the World Automotive Glass Industry Revenue (billion), by Application Type 2025 & 2033

- Figure 29: Rest of the World Automotive Glass Industry Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Automotive Glass Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Glass Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Glass Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Glass Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Glass Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Automotive Glass Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: Global Automotive Glass Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Glass Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Glass Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Automotive Glass Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 7: Global Automotive Glass Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Glass Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Glass Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 13: Global Automotive Glass Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 14: Global Automotive Glass Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Glass Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Automotive Glass Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Automotive Glass Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 23: Global Automotive Glass Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 24: Global Automotive Glass Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: China Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Glass Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Automotive Glass Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 31: Global Automotive Glass Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Glass Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 33: South America Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Middle East and Africa Automotive Glass Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Glass Industry?

The projected CAGR is approximately 5.63%.

2. Which companies are prominent players in the Automotive Glass Industry?

Key companies in the market include Asahi Glass Co, Webasto, Guardian Automotive, Fuyao Group, Benson Auto Glass, Carlex Glass, Saint Gobain, Magna Internationa, Nippon Sheet Glass, Xinyi Glass.

3. What are the main segments of the Automotive Glass Industry?

The market segments include Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Fuel Economy Norms and Government Incentives.

6. What are the notable trends driving market growth?

Increasing Application of Smart Glass in Automobiles.

7. Are there any restraints impacting market growth?

Growing Demand For Battery Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In July 2021, Jeep's Performance Parts division (JPP) has introduced Gorilla Glass windshields for its Wrangler SUV and Gladiator pick-up truck models. JPP's new windshield is made with Corning Gorilla Glass. Its durability is ensured by Mopar's combination of an ultra-thin Gorilla Glass inner ply with a 52 percent thicker outer ply. Both the Jeep Wrangler and Gladiator have an upright windshield, which reduces the panel's ability to deflect a strike from a rock.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Glass Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Glass Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Glass Industry?

To stay informed about further developments, trends, and reports in the Automotive Glass Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence