Key Insights

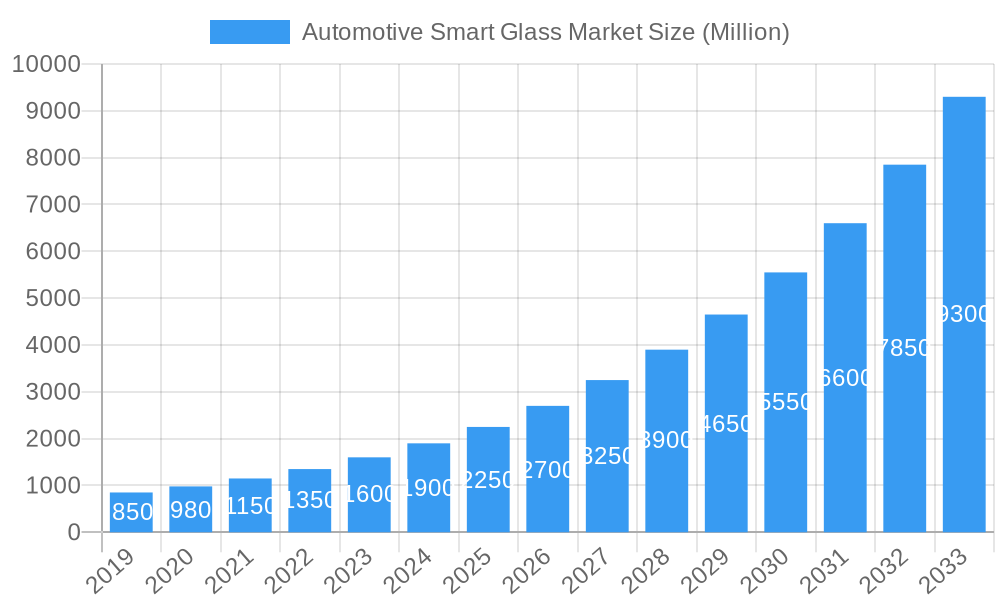

The global automotive smart glass market is poised for significant expansion, projected to reach a valuation of USD 2.75 billion, driven by an impressive Compound Annual Growth Rate (CAGR) of 22.03% from 2019 to 2033. This robust growth trajectory is primarily fueled by an increasing consumer demand for enhanced vehicle comfort, safety, and aesthetics, alongside a growing emphasis on fuel efficiency and reduced carbon emissions. Leading the charge in market adoption are advanced technologies such as Electrochromic and Polymer Dispersed Liquid Device (PDLC) glass, offering dynamic tinting capabilities that significantly improve passenger experience by controlling light and heat transmission. The integration of smart glass in rear and side windows, sunroofs, and windshields is becoming a defining feature in modern vehicles, catering to both passenger cars and commercial segments. Key market players like Gentex Corporation, Nippon Sheet Glass Co. Ltd., and Saint-Gobain SA are at the forefront of innovation, investing heavily in research and development to expand their product portfolios and capitalize on emerging opportunities.

Automotive Smart Glass Market Market Size (In Million)

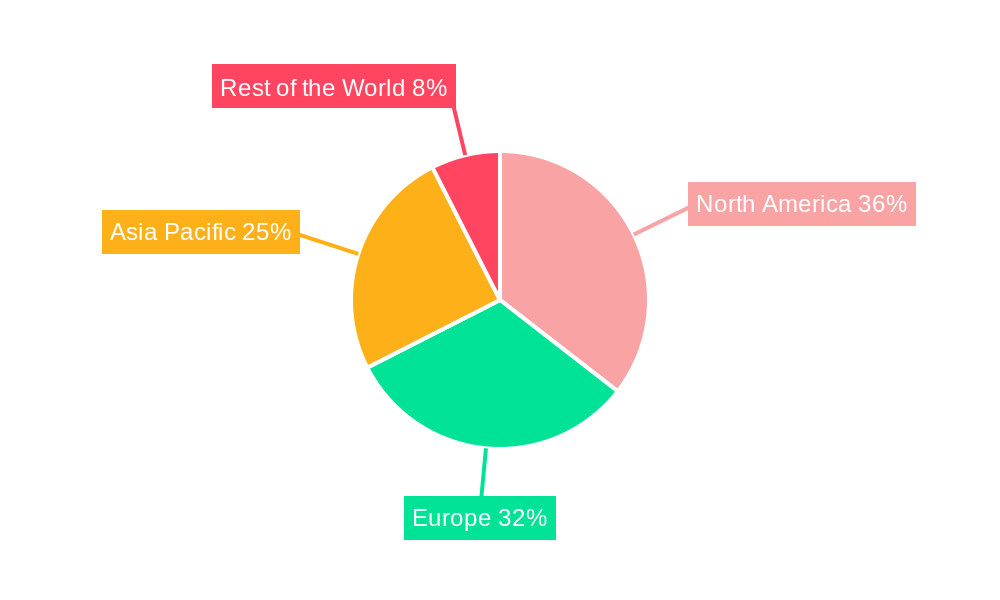

The automotive smart glass market is characterized by distinct drivers and restraints that shape its evolution. The escalating adoption of advanced driver-assistance systems (ADAS) and the drive towards autonomous vehicles are creating new avenues for smart glass integration, facilitating enhanced sensor functionality and communication. Furthermore, stringent automotive regulations promoting energy efficiency and occupant comfort are acting as powerful catalysts for market growth. However, the high initial cost of smart glass technology and the complexities associated with its manufacturing and installation present considerable restraints. Despite these challenges, ongoing technological advancements are expected to drive down costs, making smart glass more accessible across a wider range of vehicle segments. Geographically, North America and Europe are currently leading the market due to their early adoption of automotive innovation and strong regulatory frameworks. The Asia Pacific region, particularly China and Japan, is rapidly emerging as a significant growth hub, fueled by a burgeoning automotive industry and increasing consumer disposable income.

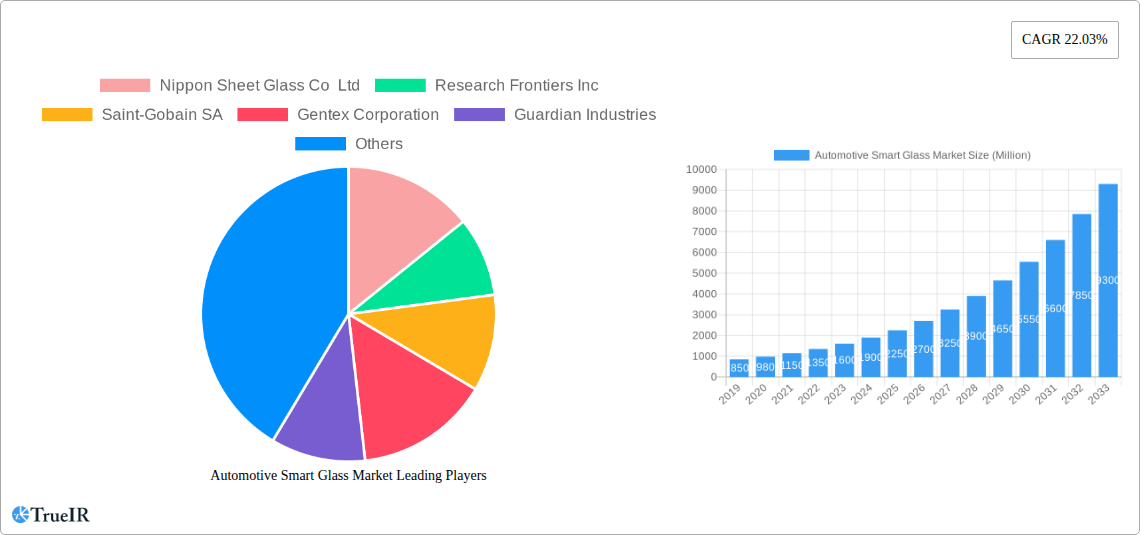

Automotive Smart Glass Market Company Market Share

Automotive Smart Glass Market: Market Analysis and Future Projections (2019–2033)

This comprehensive report delivers in-depth analysis and strategic insights into the global Automotive Smart Glass Market. Covering the historical period (2019–2024), base year (2025), estimated year (2025), and forecast period (2025–2033), this report provides an authoritative view of market dynamics, technological advancements, and growth opportunities in the automotive smart glass industry. We explore key segments including Electrochromic, PDLC, and SPD technologies, across rear and side windows, sunroof glass, and front and rear windshields, within passenger cars and commercial vehicles. Leverage high-volume keywords such as smart car glass, dynamic tinting, electrochromic windows, automotive glazing, connected car technology, and ADAS integration to enhance your understanding and strategic decision-making.

Automotive Smart Glass Market Market Structure & Competitive Landscape

The Automotive Smart Glass Market is characterized by a moderately concentrated landscape, with a few key players holding significant market share. Innovation drivers are predominantly focused on enhancing vehicle comfort, safety, and energy efficiency. Regulatory impacts are increasingly favoring lighter, more sustainable, and technologically advanced automotive components, pushing manufacturers to invest in smart glass solutions. Product substitutes, while present in traditional glass, are rapidly being outpaced by the unique functionalities offered by smart glass, such as dynamic tinting and privacy control. End-user segmentation reveals a strong preference for advanced features in premium passenger vehicles, with growing adoption in commercial vehicles for enhanced driver comfort and operational efficiency. Mergers and acquisitions (M&A) activity is anticipated to increase as companies seek to consolidate technological expertise and expand market reach. For instance, the market witnessed xx M&A deals during the historical period, with an estimated value of XX Million. Concentration ratios indicate that the top 5 players command approximately XX% of the market share.

- Market Concentration: Moderately concentrated, with key players investing heavily in R&D.

- Innovation Drivers:

- Enhanced occupant comfort and privacy.

- Improved vehicle safety through glare reduction and ADAS integration.

- Contribution to fuel efficiency and EV range extension via thermal management.

- Regulatory Impacts:

- Increasingly stringent safety and energy efficiency standards.

- Government initiatives promoting sustainable automotive manufacturing.

- Product Substitutes: Traditional automotive glass, but with diminishing appeal due to functional limitations.

- End-User Segmentation: Premium passenger vehicles, luxury SUVs, and evolving commercial vehicle applications.

- M&A Trends: Expected to see consolidation and strategic partnerships to acquire advanced technologies and market access.

Automotive Smart Glass Market Market Trends & Opportunities

The global Automotive Smart Glass Market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and the increasing integration of smart features into vehicles. The market size is projected to grow from an estimated $XXX Million in 2025 to a substantial $XXX Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This growth trajectory is fueled by the escalating demand for enhanced in-cabin experiences, improved safety, and greater energy efficiency in automobiles. Technological shifts are at the forefront, with electrochromic glass leading the pack due to its superior control over light transmission and thermal properties, followed by the rapid development and adoption of Polymer Dispersed Liquid Device (PDLC) and Suspended Particle Device (SPD) technologies, each offering unique advantages in terms of speed of response and opacity control. The increasing prevalence of electric vehicles (EVs) further accentuates the demand for smart glass as it contributes to better thermal management, thereby extending battery range. Consumer preferences are increasingly leaning towards personalized and adaptive environments within vehicles, making features like dynamic tinting for sunroofs and windows highly desirable. The automotive industry's continuous drive towards innovation, particularly in areas of connectivity and autonomous driving, creates significant opportunities for smart glass to integrate advanced functionalities, such as heads-up displays (HUDs) and augmented reality (AR) projections directly onto the windshield. The competitive dynamics are intensifying, with established automotive glass manufacturers and emerging technology companies vying for market leadership through strategic partnerships and product differentiation. The market penetration rate for smart glass, currently at an estimated XX% in new vehicle production, is expected to surge significantly over the next decade, driven by cost reductions, performance improvements, and increasing consumer awareness. The potential for smart glass extends beyond simple tinting, encompassing applications in solar energy harvesting, integrated sensor technology, and advanced display solutions, opening up new avenues for revenue generation and market expansion. The growing emphasis on passenger comfort and privacy, coupled with the desire for a more immersive in-car experience, positions smart glass as an indispensable component of future automotive design.

Dominant Markets & Segments in Automotive Smart Glass Market

The Automotive Smart Glass Market exhibits a clear dominance in specific regions and segments, driven by robust automotive manufacturing, technological adoption rates, and supportive regulatory frameworks.

Regional Dominance:

- Asia Pacific: This region is the undisputed leader, propelled by its massive automotive production volume, particularly in countries like China, Japan, and South Korea. The rapid adoption of advanced automotive technologies, coupled with a burgeoning middle class with increasing disposable income, fuels the demand for premium features offered by smart glass. Government initiatives promoting electric vehicle adoption and smart city infrastructure further bolster the market's growth. The market size in APAC is estimated at $XXX Million in 2025, projected to reach $XXX Million by 2033, with a CAGR of XX%.

Key Growth Drivers in Dominant Segments:

- Technology Type: Electrochromic: This technology currently leads the market due to its superior controllability and energy-saving capabilities.

- Growth Drivers:

- High demand for dynamic tinting and UV protection in premium vehicles.

- Integration with smart cabin features and autonomous driving systems.

- Technological advancements leading to faster switching times and lower power consumption.

- Growing focus on cabin thermal management to improve EV range.

- Growth Drivers:

- Application Type: Sunroof Glass: Sunroofs represent a significant application for smart glass, offering enhanced comfort and aesthetics.

- Growth Drivers:

- Increasing popularity of panoramic and large sunroofs in passenger cars.

- Demand for adjustable tinting to control sunlight and heat.

- Integration with ambient lighting and entertainment systems.

- Aesthetic appeal and premium feel it adds to the vehicle interior.

- Growth Drivers:

- Vehicle Type: Passenger Cars: The passenger car segment, especially premium and luxury models, is the primary consumer of automotive smart glass.

- Growth Drivers:

- Consumer desire for comfort, convenience, and advanced features.

- OEMs' focus on differentiating their offerings with innovative technologies.

- Integration of smart glass with ADAS and infotainment systems.

- Growing demand for customizable in-cabin environments.

- Growth Drivers:

The dominance of Electrochromic technology is attributed to its ability to precisely control light and heat, offering a significant advantage in terms of comfort and energy efficiency, crucial for the growing EV market. Sunroof glass applications benefit immensely from smart glass, allowing drivers to control the amount of sunlight and heat entering the cabin, thereby enhancing the driving experience. Passenger cars, particularly in the premium segment, are the primary adopters due to the perceived value and enhanced luxury smart glass provides.

Automotive Smart Glass Market Product Analysis

Automotive smart glass represents a significant leap in automotive glazing technology, offering dynamic control over light transmission, heat insulation, and privacy. Innovations are centered around enhancing switching speeds, improving energy efficiency, and enabling new functionalities. Electrochromic glass, a leading technology, allows for variable tinting controlled by an electrical voltage, providing precise control over glare and solar heat gain. PDLC (Polymer Dispersed Liquid Device) offers instant privacy and opacity at the flick of a switch, ideal for rear windows and partitions. SPD (Suspended Particle Device) technology provides rapid and controllable dimming capabilities, suitable for applications requiring quick adjustments. These technologies are increasingly being integrated with vehicle electronics for seamless operation and advanced features like augmented reality displays and glare reduction for driver assistance systems. The competitive advantage lies in the ability to offer a more comfortable, energy-efficient, and feature-rich cabin experience, differentiating vehicles in a crowded market.

Key Drivers, Barriers & Challenges in Automotive Smart Glass Market

Key Drivers:

The Automotive Smart Glass Market is propelled by several key factors:

- Technological Advancements: Continuous innovation in electrochromic, PDLC, and SPD technologies is leading to improved performance, faster switching times, and lower power consumption. The integration of smart glass with advanced driver-assistance systems (ADAS) and augmented reality (AR) displays is a significant growth catalyst.

- Growing Demand for Comfort and Luxury: Consumers increasingly seek enhanced in-cabin comfort, privacy, and a premium driving experience. Smart glass directly addresses these demands by offering dynamic tinting and glare control.

- Energy Efficiency and Sustainability: Smart glass contributes to improved thermal management in vehicles, reducing the load on HVAC systems and thereby enhancing fuel efficiency and extending the range of electric vehicles (EVs). This aligns with global sustainability goals and stricter emission regulations.

- Automotive Industry Trends: The shift towards connected cars, autonomous driving, and sophisticated infotainment systems creates opportunities for smart glass to be integrated as a display surface or for enhancing the user experience.

Barriers & Challenges:

Despite the strong growth potential, the market faces several hurdles:

- High Initial Cost: The manufacturing process for smart glass is more complex and expensive than traditional glass, leading to a higher upfront cost for vehicles equipped with these technologies. This can be a deterrent for mass-market adoption.

- Durability and Longevity Concerns: While advancements are being made, long-term durability and performance in extreme environmental conditions remain areas of ongoing research and development.

- Integration Complexity: Integrating smart glass systems with existing vehicle electronics and ensuring seamless functionality can be complex and requires significant engineering effort from OEMs.

- Supply Chain Disruptions: Like many industries, the automotive supply chain can be susceptible to disruptions, which can impact the availability and cost of raw materials and components necessary for smart glass production.

Growth Drivers in the Automotive Smart Glass Market Market

The Automotive Smart Glass Market is experiencing robust growth driven by technological innovation and evolving consumer expectations. Key drivers include the relentless pursuit of enhanced occupant comfort and privacy, directly addressed by dynamic tinting capabilities. The increasing focus on energy efficiency, particularly in the burgeoning electric vehicle segment, positions smart glass as a critical component for thermal management, leading to extended battery range. Furthermore, the integration of smart glass with advanced driver-assistance systems (ADAS) and augmented reality (AR) displays offers a compelling proposition for vehicle safety and an immersive driving experience, aligning with the broader trend towards connected and autonomous vehicles. Supportive government regulations promoting sustainable automotive solutions also indirectly fuel the adoption of these advanced glazing technologies.

Challenges Impacting Automotive Smart Glass Market Growth

Despite its promising future, the Automotive Smart Glass Market faces significant challenges. The high initial cost of smart glass remains a primary barrier to widespread adoption, especially in budget-conscious segments of the market. Durability and long-term performance in diverse climatic conditions continue to be areas requiring further development to assure consumers and manufacturers of their reliability. The complexity of integration with existing vehicle electronic architectures poses engineering hurdles for automotive original equipment manufacturers (OEMs). Additionally, supply chain vulnerabilities can disrupt production and lead to increased costs. Finally, stringent regulatory approvals for new automotive technologies can slow down their market entry and widespread implementation, creating a need for continuous engagement with regulatory bodies.

Key Players Shaping the Automotive Smart Glass Market Market

- Nippon Sheet Glass Co Ltd

- Research Frontiers Inc

- Saint-Gobain SA

- Gentex Corporation

- Guardian Industries

- Hitachi Chemical Co Ltd

- Corning Inc

- Gauzy Ltd

- AGC Inc

- AGP Glass

Significant Automotive Smart Glass Market Industry Milestones

- May 2022: Saint-Gobain achieved the world's first zero-carbon production of flat glass, utilizing 100% recycled glass and 100% green energy, primarily generated from biogas. This milestone underscores a significant shift towards sustainable manufacturing practices within the automotive glass industry.

- January 2022: Eye Lights & AGC collaborated to introduce industrialized augmented reality (AR) capabilities to series vehicles, enhancing in-car safety and user experience. The combined windshield and display technologies offer numerous benefits, including the largest virtual screen size (550 inches) and a projection distance displayed up to 50 meters away from the driver. This collaboration highlights the evolving role of automotive glass beyond traditional functionality, moving towards integrated display solutions.

Future Outlook for Automotive Smart Glass Market Market

The future outlook for the Automotive Smart Glass Market is exceptionally bright, driven by a sustained demand for enhanced vehicle features and the accelerating pace of technological innovation. Strategic opportunities lie in the deeper integration of smart glass with in-car connectivity, autonomous driving systems, and personalized user experiences, potentially transforming vehicle interiors into dynamic and interactive environments. The market is expected to witness further advancements in material science, leading to more cost-effective, durable, and energy-efficient smart glass solutions. The expansion of smart glass applications into emerging automotive segments, such as ride-sharing vehicles and commercial fleets seeking operational efficiency, will also contribute to significant market growth. The increasing global focus on sustainability and emission reduction will further bolster the adoption of smart glass for its thermal management benefits, making it an indispensable component of future mobility.

Automotive Smart Glass Market Segmentation

-

1. Technology Type

- 1.1. Electrochromic

- 1.2. Polymer Dispersed Liquid Device (PDLC)

- 1.3. Suspended Particle Device (SPD)

-

2. Application Type

- 2.1. Rear and Side Windows

- 2.2. Sunroof Glass

- 2.3. Front and Rear Windshield

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

Automotive Smart Glass Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. South Africa

- 4.3. Other Countries

Automotive Smart Glass Market Regional Market Share

Geographic Coverage of Automotive Smart Glass Market

Automotive Smart Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for ADAS in Automobiles

- 3.3. Market Restrains

- 3.3.1. High Cost

- 3.4. Market Trends

- 3.4.1. Rise in penetration of suspended particle devices (SPD) in vehicles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Automotive Smart Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 5.1.1. Electrochromic

- 5.1.2. Polymer Dispersed Liquid Device (PDLC)

- 5.1.3. Suspended Particle Device (SPD)

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Rear and Side Windows

- 5.2.2. Sunroof Glass

- 5.2.3. Front and Rear Windshield

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology Type

- 6. North America Automotive Smart Glass Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 6.1.1. Electrochromic

- 6.1.2. Polymer Dispersed Liquid Device (PDLC)

- 6.1.3. Suspended Particle Device (SPD)

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Rear and Side Windows

- 6.2.2. Sunroof Glass

- 6.2.3. Front and Rear Windshield

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.1. Market Analysis, Insights and Forecast - by Technology Type

- 7. Europe Automotive Smart Glass Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 7.1.1. Electrochromic

- 7.1.2. Polymer Dispersed Liquid Device (PDLC)

- 7.1.3. Suspended Particle Device (SPD)

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Rear and Side Windows

- 7.2.2. Sunroof Glass

- 7.2.3. Front and Rear Windshield

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.1. Market Analysis, Insights and Forecast - by Technology Type

- 8. Asia Pacific Automotive Smart Glass Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 8.1.1. Electrochromic

- 8.1.2. Polymer Dispersed Liquid Device (PDLC)

- 8.1.3. Suspended Particle Device (SPD)

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Rear and Side Windows

- 8.2.2. Sunroof Glass

- 8.2.3. Front and Rear Windshield

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.1. Market Analysis, Insights and Forecast - by Technology Type

- 9. Rest of the World Automotive Smart Glass Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 9.1.1. Electrochromic

- 9.1.2. Polymer Dispersed Liquid Device (PDLC)

- 9.1.3. Suspended Particle Device (SPD)

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Rear and Side Windows

- 9.2.2. Sunroof Glass

- 9.2.3. Front and Rear Windshield

- 9.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.3.1. Passenger Cars

- 9.3.2. Commercial Vehicles

- 9.1. Market Analysis, Insights and Forecast - by Technology Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Nippon Sheet Glass Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Research Frontiers Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Saint-Gobain SA

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Gentex Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Guardian Industries

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Hitachi Chemical Co Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Corning Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Gauzy Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 AGC Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 AGP Glass

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nippon Sheet Glass Co Ltd

List of Figures

- Figure 1: Global Automotive Smart Glass Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Automotive Smart Glass Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 3: North America Automotive Smart Glass Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 4: North America Automotive Smart Glass Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Automotive Smart Glass Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Automotive Smart Glass Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 7: North America Automotive Smart Glass Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 8: North America Automotive Smart Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Automotive Smart Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Automotive Smart Glass Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 11: Europe Automotive Smart Glass Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 12: Europe Automotive Smart Glass Market Revenue (Million), by Application Type 2025 & 2033

- Figure 13: Europe Automotive Smart Glass Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Automotive Smart Glass Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 15: Europe Automotive Smart Glass Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Europe Automotive Smart Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Automotive Smart Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Automotive Smart Glass Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 19: Asia Pacific Automotive Smart Glass Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 20: Asia Pacific Automotive Smart Glass Market Revenue (Million), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Automotive Smart Glass Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Automotive Smart Glass Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 23: Asia Pacific Automotive Smart Glass Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 24: Asia Pacific Automotive Smart Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Automotive Smart Glass Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Automotive Smart Glass Market Revenue (Million), by Technology Type 2025 & 2033

- Figure 27: Rest of the World Automotive Smart Glass Market Revenue Share (%), by Technology Type 2025 & 2033

- Figure 28: Rest of the World Automotive Smart Glass Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Rest of the World Automotive Smart Glass Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Automotive Smart Glass Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 31: Rest of the World Automotive Smart Glass Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 32: Rest of the World Automotive Smart Glass Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Automotive Smart Glass Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Automotive Smart Glass Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 2: Global Automotive Smart Glass Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Automotive Smart Glass Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: Global Automotive Smart Glass Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Automotive Smart Glass Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 6: Global Automotive Smart Glass Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 7: Global Automotive Smart Glass Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Global Automotive Smart Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Automotive Smart Glass Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 13: Global Automotive Smart Glass Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Global Automotive Smart Glass Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 15: Global Automotive Smart Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Automotive Smart Glass Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 21: Global Automotive Smart Glass Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 22: Global Automotive Smart Glass Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Automotive Smart Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Automotive Smart Glass Market Revenue Million Forecast, by Technology Type 2020 & 2033

- Table 30: Global Automotive Smart Glass Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 31: Global Automotive Smart Glass Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Automotive Smart Glass Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: South Africa Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Automotive Smart Glass Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Automotive Smart Glass Market?

The projected CAGR is approximately 22.03%.

2. Which companies are prominent players in the Automotive Smart Glass Market?

Key companies in the market include Nippon Sheet Glass Co Ltd, Research Frontiers Inc, Saint-Gobain SA, Gentex Corporation, Guardian Industries, Hitachi Chemical Co Ltd, Corning Inc, Gauzy Ltd, AGC Inc, AGP Glass.

3. What are the main segments of the Automotive Smart Glass Market?

The market segments include Technology Type, Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for ADAS in Automobiles.

6. What are the notable trends driving market growth?

Rise in penetration of suspended particle devices (SPD) in vehicles.

7. Are there any restraints impacting market growth?

High Cost.

8. Can you provide examples of recent developments in the market?

May 2022: Saint-Gobain achieved the world's first zero-carbon production of flat glass. The company accomplished this by utilizing 100% recycled glass and 100% green energy, primarily generated from biogas.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Automotive Smart Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Automotive Smart Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Automotive Smart Glass Market?

To stay informed about further developments, trends, and reports in the Automotive Smart Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence