Key Insights

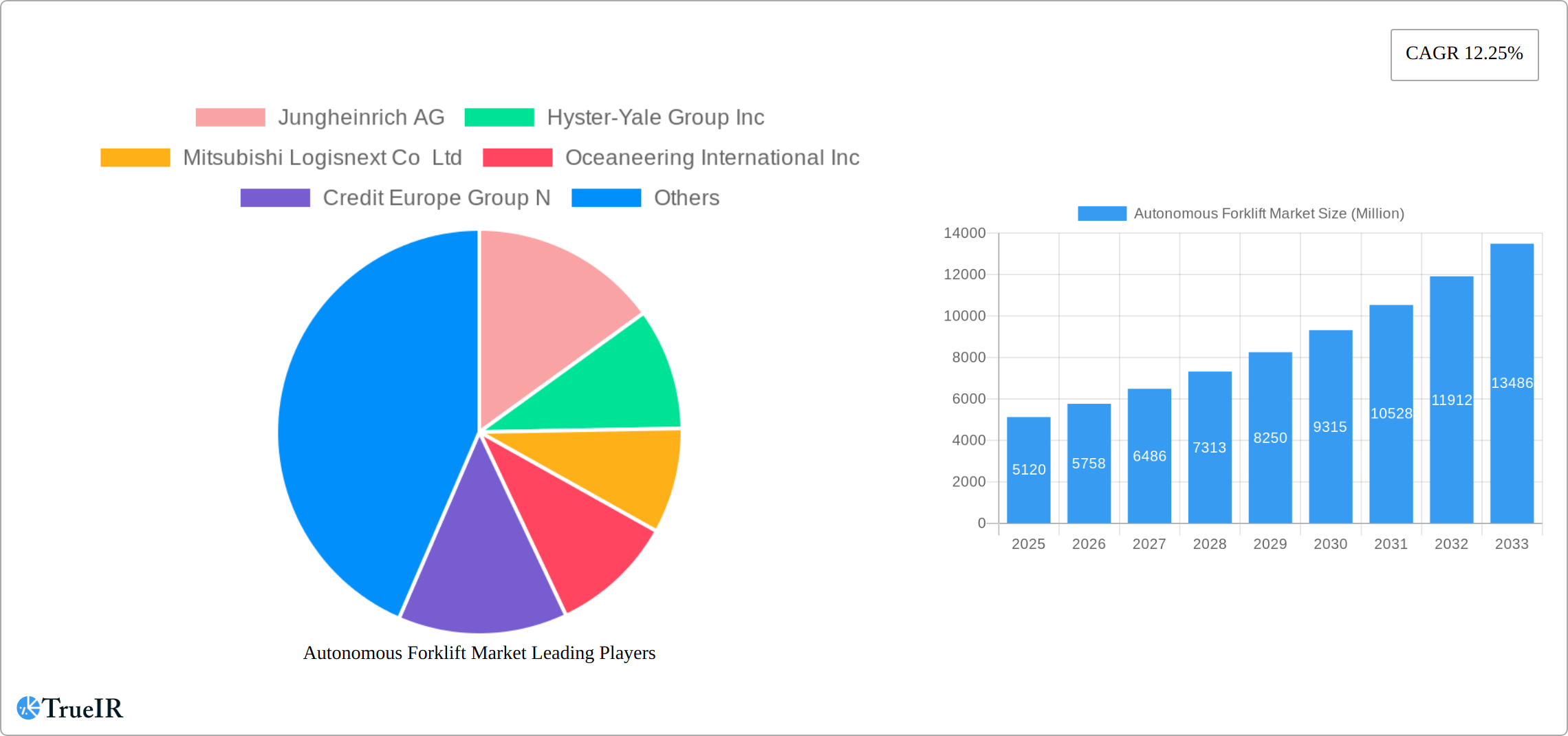

The Autonomous Forklift Market is experiencing robust growth, projected to reach \$5.12 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.25% from 2025 to 2033. This expansion is driven by several key factors. Increasing labor costs and a persistent shortage of skilled workers in logistics and manufacturing are compelling businesses to automate their material handling processes. Furthermore, the rising demand for enhanced efficiency, reduced operational errors, and improved safety within warehouse and manufacturing environments fuels the adoption of autonomous forklifts. Technological advancements in navigation systems (laser, vision, and magnetic guidance) are continuously improving the precision, reliability, and adaptability of these vehicles, broadening their application across diverse industries. The market is segmented by tonnage capacity (below 5 tons, 5-10 tons, above 10 tons), navigation technology, application (logistics, manufacturing, material handling), propulsion type (electric, diesel), and type (pallet trucks, stackers). The electric propulsion segment is expected to dominate due to its environmental friendliness and lower operating costs. The logistics and warehousing application segment is anticipated to hold a significant market share, driven by the e-commerce boom and the need for efficient order fulfillment.

Autonomous Forklift Market Market Size (In Billion)

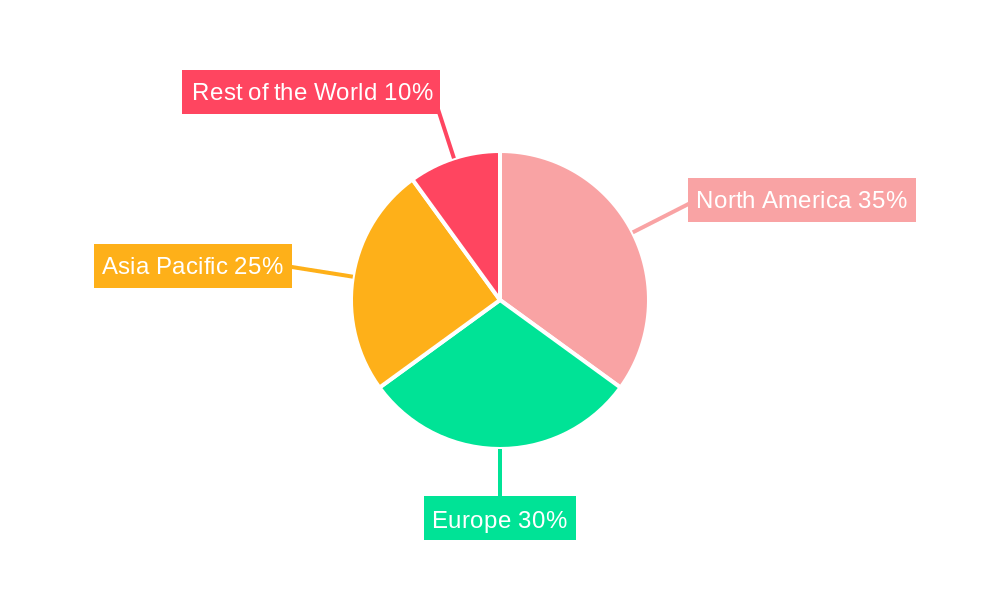

Leading players like Jungheinrich AG, Hyster-Yale Group Inc., and Toyota Industries Corporation are investing heavily in R&D and strategic partnerships to strengthen their market position and offer innovative solutions. Geographical expansion is also a key trend, with North America and Europe currently holding substantial market shares, while the Asia-Pacific region is poised for significant growth driven by rapidly expanding manufacturing and logistics sectors in countries like China and India. However, the high initial investment costs associated with implementing autonomous forklift systems and concerns regarding safety and regulatory compliance represent challenges to market penetration. Nevertheless, the long-term benefits of improved efficiency and reduced labor costs outweigh these challenges, paving the way for sustained growth in the autonomous forklift market over the forecast period.

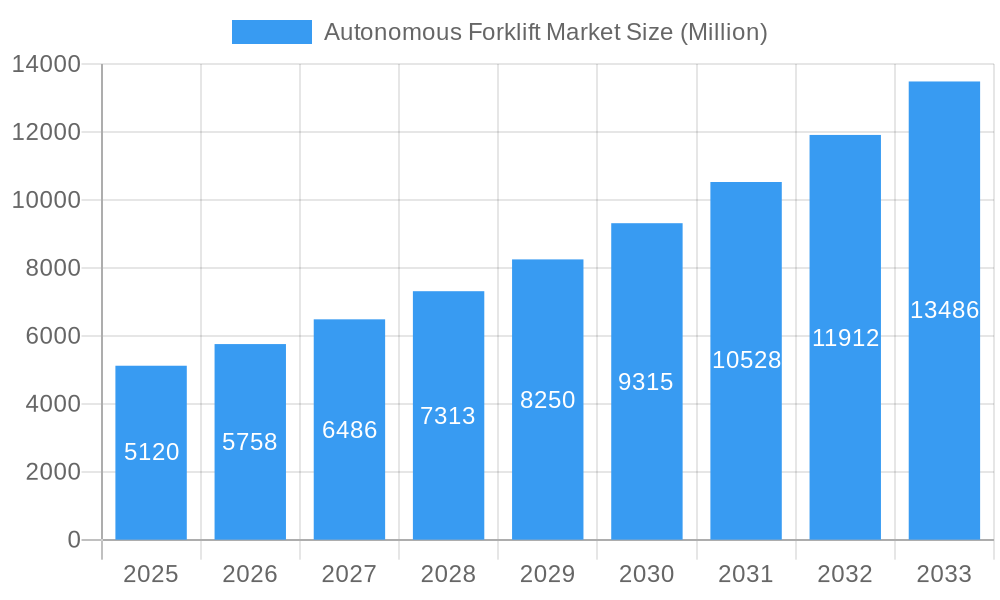

Autonomous Forklift Market Company Market Share

Autonomous Forklift Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a comprehensive analysis of the Autonomous Forklift Market, offering invaluable insights for industry stakeholders, investors, and researchers. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report leverages extensive market research to provide a detailed overview of market size, segmentation, key players, and future growth projections, all while utilizing high-volume keywords to ensure optimal search engine visibility. The global Autonomous Forklift Market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Autonomous Forklift Market Market Structure & Competitive Landscape

The Autonomous Forklift Market presents a moderately concentrated competitive landscape, dominated by established players like Jungheinrich AG, Hyster-Yale Group Inc., Mitsubishi Logisnext Co. Ltd., and Toyota Industries Corporation, who collectively hold a substantial market share. However, the market's dynamic nature is fueled by the burgeoning participation of innovative smaller companies specializing in niche applications and advanced technologies. This competitive interplay is further intensified by ongoing technological advancements and a steady stream of mergers and acquisitions (M&A) activity. The four-firm concentration ratio is projected to be approximately xx% by 2025. This competitive pressure is driving innovation and efficiency improvements within the sector.

- Innovation Drivers: Key innovations are driven by advancements in artificial intelligence (AI), sophisticated sensor technologies (including laser, vision, and magnetic systems), refined navigation systems, and increasingly efficient battery technologies. These advancements are continuously improving the efficiency, safety, and cost-effectiveness of autonomous forklift solutions, making them increasingly attractive to a wider range of industries.

- Regulatory Impacts: Government regulations focused on workplace safety and automation are significantly influencing the adoption rate of autonomous forklifts. Stringent safety standards and compliance requirements are not only shaping product development but also directly impacting market penetration and the speed of industry growth.

- Product Substitutes: Although traditional manually operated forklifts remain prevalent, autonomous forklifts offer compelling advantages in terms of improved efficiency and reduced labor costs, creating a strong competitive edge that is steadily shifting market share.

- End-User Segmentation: The market caters to diverse end-users, prominently including logistics and warehousing, manufacturing, and broader material handling sectors. Currently, the logistics and warehousing sector commands the largest market share, reflecting the high demand for automation in these high-volume operations.

- M&A Trends: The past five years have witnessed a moderate yet consistent level of M&A activity. Larger companies are strategically acquiring smaller, more specialized firms to bolster their product portfolios and integrate cutting-edge technological capabilities. The estimated total value of M&A transactions within the autonomous forklift sector from 2019 to 2024 is approximately xx million. This trend is expected to continue, further shaping the market landscape.

Autonomous Forklift Market Market Trends & Opportunities

The Autonomous Forklift Market is experiencing significant growth fueled by several key trends. The increasing demand for improved efficiency and productivity in warehousing and manufacturing operations is a primary driver. Labor shortages and rising labor costs are also prompting businesses to adopt automation solutions. Technological advancements are continually enhancing the capabilities of autonomous forklifts, leading to increased adoption across various industries. The market is witnessing a shift towards electric-powered autonomous forklifts, driven by environmental concerns and government regulations promoting sustainable solutions. Consumer preference is steadily moving towards autonomous forklifts with advanced safety features and improved navigation systems. The competitive landscape is dynamic, with established players facing increasing competition from new entrants offering innovative products and solutions. This leads to price competition and a focus on providing superior value propositions. The market penetration rate for autonomous forklifts is currently xx% and is projected to reach xx% by 2033.

Dominant Markets & Segments in Autonomous Forklift Market

The Asia-Pacific region currently leads the autonomous forklift market, propelled by rapid industrialization, substantial investments in warehouse automation initiatives, and the explosive growth of e-commerce. A closer examination of the market segments reveals:

- By Tonnage Capacity: The below 5-ton segment holds the dominant market share due to its versatility and suitability across a wide spectrum of industries and applications.

- By Navigation Technology: Laser guidance currently holds the leading position in the navigation technology segment, prized for its accuracy and reliable performance in diverse operational environments.

- By Application: The logistics and warehousing sector remains the largest application area, driven by the critical need for efficient material handling in expansive distribution centers and fulfillment facilities.

- By Propulsion Type: Electric propulsion is the predominant type, reflecting the growing environmental consciousness and the inherent cost-effectiveness of electric-powered systems.

- By Type: Pallet trucks/movers/jacks constitute the largest type segment, owing to their broad applicability and relatively lower initial investment cost compared to other types of autonomous forklifts.

Key Growth Drivers:

- Accelerated industrialization and the booming e-commerce sector in the Asia-Pacific region.

- Supportive government initiatives and policies actively promoting automation across various industrial sectors.

- Significant and increasing investments in warehouse automation and modernization projects globally.

Autonomous Forklift Market Product Analysis

Recent product innovations focus on enhancing safety features, improving navigation precision, increasing payload capacity, and expanding operational flexibility. For example, Seegrid Corporation's Palion Lift CR1 offers a 15’ lift height and a 4,000lb payload capacity, addressing the need for efficient material handling in demanding warehouse environments. These advancements are tailored to meet the specific needs of diverse industries, offering competitive advantages in terms of efficiency, safety, and reduced operational costs.

Key Drivers, Barriers & Challenges in Autonomous Forklift Market

Key Drivers: The market's growth is primarily driven by the escalating demand for enhanced warehouse efficiency, rising labor costs, the relentless expansion of e-commerce, and the continuous advancements in AI and sensor technologies. These factors are collectively fostering the widespread adoption of autonomous forklifts across a diverse range of industries.

Challenges and Restraints: High initial capital investment costs, legitimate concerns regarding safety and operational reliability, the need for skilled technicians for maintenance and repair, and the potential for job displacement remain significant hurdles. Furthermore, regulatory obstacles and persistent supply chain disruptions can considerably impact market growth. Supply chain issues alone are estimated to have reduced market revenue by approximately xx million in 2024.

Growth Drivers in the Autonomous Forklift Market Market

The Autonomous Forklift Market is experiencing rapid growth propelled by technological advancements, economic factors, and supportive government policies. The increasing demand for enhanced efficiency in logistics and warehousing is a key driver. Furthermore, rising labor costs and a scarcity of skilled labor are further encouraging the adoption of autonomous solutions. Government incentives and regulations promoting automation are also contributing to market expansion.

Challenges Impacting Autonomous Forklift Market Growth

Despite significant growth potential, several factors hinder the widespread adoption of autonomous forklifts. High initial investment costs and ongoing maintenance expenses pose a barrier for smaller businesses. Concerns about safety and reliability, particularly in complex operational environments, limit market penetration. Furthermore, the lack of skilled technicians capable of handling maintenance and repairs presents a challenge. Supply chain disruptions and the complexities of integrating autonomous forklifts into existing warehouse management systems also hinder growth.

Key Players Shaping the Autonomous Forklift Market Market

- Jungheinrich AG

- Hyster-Yale Group Inc

- Mitsubishi Logisnext Co Ltd

- Oceaneering International Inc

- Credit Europe Group N

- HD Hyundai Construction Equipment

- Toyota Industries Corporation

- Balyo

- Vecna AFL

- Agilox Services GmbH

- Hangcha Group Co Ltd

- Kion Group AG

- Otto Motors

- Gridbots Technologies Private Limited

- Swisslog Holding AG

Significant Autonomous Forklift Market Industry Milestones

- August 2023: Cyngn Inc. secured a substantial pre-order agreement with Arauco for 100 autonomous electric forklifts, a strong indicator of growing industry adoption and confidence in the technology.

- September 2023: Worldwide Flight Services (WFS) launched a trial utilizing Linde AGV forklifts at Barcelona Airport, highlighting the expanding application of autonomous forklifts into new and diverse sectors.

- February 2024: Seegrid Corporation unveiled the Palion Lift CR1, a high-capacity autonomous lift truck, demonstrating significant advancements in payload and lift height capabilities, pushing the boundaries of what's possible with autonomous material handling.

Future Outlook for Autonomous Forklift Market Market

The Autonomous Forklift Market is poised for continued robust growth, driven by ongoing technological innovations, increasing demand for automation across diverse industries, and supportive government policies. The market presents significant opportunities for companies that can offer cost-effective, reliable, and safe autonomous forklift solutions. Strategic partnerships and collaborations will play a crucial role in driving market expansion and enhancing the overall value proposition of autonomous forklifts.

Autonomous Forklift Market Segmentation

-

1. Tonnage Capacity

- 1.1. Below 5 Tons

- 1.2. 5-10 Tons

- 1.3. Above 10 Tons

-

2. Navigation Technology

- 2.1. Laser Guidance

- 2.2. Vision Guidance

- 2.3. Optical Tape Guidance

- 2.4. Magnetic Guidance

- 2.5. Inductive Guidance

- 2.6. Others (

-

3. Application

- 3.1. Logistics and Warehousing

- 3.2. Manufacturing

- 3.3. Material Handling

- 3.4. Others (Retail, etc.)

-

4. Propulsion Type

- 4.1. Electric

- 4.2. Diesel

- 4.3. Others (CNG, LPG, etc.)

-

5. Type

- 5.1. Pallet Truck/Mover/Jack

- 5.2. Pallet Stackers

- 5.3. Others (Forked AGV, etc.)

Autonomous Forklift Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Autonomous Forklift Market Regional Market Share

Geographic Coverage of Autonomous Forklift Market

Autonomous Forklift Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expanding Warehousing and Logistics Sector to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. High Initial Purchase Cost to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 5.1.1. Below 5 Tons

- 5.1.2. 5-10 Tons

- 5.1.3. Above 10 Tons

- 5.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 5.2.1. Laser Guidance

- 5.2.2. Vision Guidance

- 5.2.3. Optical Tape Guidance

- 5.2.4. Magnetic Guidance

- 5.2.5. Inductive Guidance

- 5.2.6. Others (

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Logistics and Warehousing

- 5.3.2. Manufacturing

- 5.3.3. Material Handling

- 5.3.4. Others (Retail, etc.)

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.4.1. Electric

- 5.4.2. Diesel

- 5.4.3. Others (CNG, LPG, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Pallet Truck/Mover/Jack

- 5.5.2. Pallet Stackers

- 5.5.3. Others (Forked AGV, etc.)

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6. North America Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 6.1.1. Below 5 Tons

- 6.1.2. 5-10 Tons

- 6.1.3. Above 10 Tons

- 6.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 6.2.1. Laser Guidance

- 6.2.2. Vision Guidance

- 6.2.3. Optical Tape Guidance

- 6.2.4. Magnetic Guidance

- 6.2.5. Inductive Guidance

- 6.2.6. Others (

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Logistics and Warehousing

- 6.3.2. Manufacturing

- 6.3.3. Material Handling

- 6.3.4. Others (Retail, etc.)

- 6.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.4.1. Electric

- 6.4.2. Diesel

- 6.4.3. Others (CNG, LPG, etc.)

- 6.5. Market Analysis, Insights and Forecast - by Type

- 6.5.1. Pallet Truck/Mover/Jack

- 6.5.2. Pallet Stackers

- 6.5.3. Others (Forked AGV, etc.)

- 6.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7. Europe Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 7.1.1. Below 5 Tons

- 7.1.2. 5-10 Tons

- 7.1.3. Above 10 Tons

- 7.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 7.2.1. Laser Guidance

- 7.2.2. Vision Guidance

- 7.2.3. Optical Tape Guidance

- 7.2.4. Magnetic Guidance

- 7.2.5. Inductive Guidance

- 7.2.6. Others (

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Logistics and Warehousing

- 7.3.2. Manufacturing

- 7.3.3. Material Handling

- 7.3.4. Others (Retail, etc.)

- 7.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.4.1. Electric

- 7.4.2. Diesel

- 7.4.3. Others (CNG, LPG, etc.)

- 7.5. Market Analysis, Insights and Forecast - by Type

- 7.5.1. Pallet Truck/Mover/Jack

- 7.5.2. Pallet Stackers

- 7.5.3. Others (Forked AGV, etc.)

- 7.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8. Asia Pacific Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 8.1.1. Below 5 Tons

- 8.1.2. 5-10 Tons

- 8.1.3. Above 10 Tons

- 8.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 8.2.1. Laser Guidance

- 8.2.2. Vision Guidance

- 8.2.3. Optical Tape Guidance

- 8.2.4. Magnetic Guidance

- 8.2.5. Inductive Guidance

- 8.2.6. Others (

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Logistics and Warehousing

- 8.3.2. Manufacturing

- 8.3.3. Material Handling

- 8.3.4. Others (Retail, etc.)

- 8.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.4.1. Electric

- 8.4.2. Diesel

- 8.4.3. Others (CNG, LPG, etc.)

- 8.5. Market Analysis, Insights and Forecast - by Type

- 8.5.1. Pallet Truck/Mover/Jack

- 8.5.2. Pallet Stackers

- 8.5.3. Others (Forked AGV, etc.)

- 8.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9. Rest of the World Autonomous Forklift Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 9.1.1. Below 5 Tons

- 9.1.2. 5-10 Tons

- 9.1.3. Above 10 Tons

- 9.2. Market Analysis, Insights and Forecast - by Navigation Technology

- 9.2.1. Laser Guidance

- 9.2.2. Vision Guidance

- 9.2.3. Optical Tape Guidance

- 9.2.4. Magnetic Guidance

- 9.2.5. Inductive Guidance

- 9.2.6. Others (

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Logistics and Warehousing

- 9.3.2. Manufacturing

- 9.3.3. Material Handling

- 9.3.4. Others (Retail, etc.)

- 9.4. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.4.1. Electric

- 9.4.2. Diesel

- 9.4.3. Others (CNG, LPG, etc.)

- 9.5. Market Analysis, Insights and Forecast - by Type

- 9.5.1. Pallet Truck/Mover/Jack

- 9.5.2. Pallet Stackers

- 9.5.3. Others (Forked AGV, etc.)

- 9.1. Market Analysis, Insights and Forecast - by Tonnage Capacity

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Jungheinrich AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyster-Yale Group Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Mitsubishi Logisnext Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Oceaneering International Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Credit Europe Group N

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 HD Hyundai Construction Equipment

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Toyota Industries Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Balyo

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Vecna AFL

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Agilox Services GmbH

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Hangcha Group Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Kion Group AG

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Otto Motors

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Gridbots Technologies Private Limited

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Swisslog Holding AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Jungheinrich AG

List of Figures

- Figure 1: Global Autonomous Forklift Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 3: North America Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 4: North America Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 5: North America Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 6: North America Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 9: North America Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: North America Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 11: North America Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: North America Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 15: Europe Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 16: Europe Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 17: Europe Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 18: Europe Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Europe Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Europe Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 21: Europe Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Europe Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 23: Europe Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 24: Europe Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 27: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 28: Asia Pacific Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 29: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 30: Asia Pacific Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Asia Pacific Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 33: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 34: Asia Pacific Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Rest of the World Autonomous Forklift Market Revenue (Million), by Tonnage Capacity 2025 & 2033

- Figure 39: Rest of the World Autonomous Forklift Market Revenue Share (%), by Tonnage Capacity 2025 & 2033

- Figure 40: Rest of the World Autonomous Forklift Market Revenue (Million), by Navigation Technology 2025 & 2033

- Figure 41: Rest of the World Autonomous Forklift Market Revenue Share (%), by Navigation Technology 2025 & 2033

- Figure 42: Rest of the World Autonomous Forklift Market Revenue (Million), by Application 2025 & 2033

- Figure 43: Rest of the World Autonomous Forklift Market Revenue Share (%), by Application 2025 & 2033

- Figure 44: Rest of the World Autonomous Forklift Market Revenue (Million), by Propulsion Type 2025 & 2033

- Figure 45: Rest of the World Autonomous Forklift Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 46: Rest of the World Autonomous Forklift Market Revenue (Million), by Type 2025 & 2033

- Figure 47: Rest of the World Autonomous Forklift Market Revenue Share (%), by Type 2025 & 2033

- Figure 48: Rest of the World Autonomous Forklift Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Rest of the World Autonomous Forklift Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 2: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 3: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Autonomous Forklift Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 8: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 9: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 17: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 18: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 19: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Germany Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Italy Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 28: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 29: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 31: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: India Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Japan Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: South Korea Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Rest of Asia Pacific Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Global Autonomous Forklift Market Revenue Million Forecast, by Tonnage Capacity 2020 & 2033

- Table 39: Global Autonomous Forklift Market Revenue Million Forecast, by Navigation Technology 2020 & 2033

- Table 40: Global Autonomous Forklift Market Revenue Million Forecast, by Application 2020 & 2033

- Table 41: Global Autonomous Forklift Market Revenue Million Forecast, by Propulsion Type 2020 & 2033

- Table 42: Global Autonomous Forklift Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global Autonomous Forklift Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: South America Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Middle East and Africa Autonomous Forklift Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Autonomous Forklift Market?

The projected CAGR is approximately 12.25%.

2. Which companies are prominent players in the Autonomous Forklift Market?

Key companies in the market include Jungheinrich AG, Hyster-Yale Group Inc, Mitsubishi Logisnext Co Ltd, Oceaneering International Inc, Credit Europe Group N, HD Hyundai Construction Equipment, Toyota Industries Corporation, Balyo, Vecna AFL, Agilox Services GmbH, Hangcha Group Co Ltd, Kion Group AG, Otto Motors, Gridbots Technologies Private Limited, Swisslog Holding AG.

3. What are the main segments of the Autonomous Forklift Market?

The market segments include Tonnage Capacity, Navigation Technology, Application, Propulsion Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expanding Warehousing and Logistics Sector to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

The Logistics and Warehousing Sector is Expected to Gain Traction Between 2024 and 2029.

7. Are there any restraints impacting market growth?

High Initial Purchase Cost to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

February 2024: Seegrid Corporation announced the launch of an autonomous lift truck, the Palion Lift CR1 model, to address evolving challenges in autonomous material handling for warehousing, manufacturing, and logistics customers. The Palion Lift CR1 boasts an impressive 15’ lift height and a robust 4,000lb payload capacity. Further, the company stated that the new model is equipped with its own proprietary state-of-the-art navigation technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Autonomous Forklift Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Autonomous Forklift Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Autonomous Forklift Market?

To stay informed about further developments, trends, and reports in the Autonomous Forklift Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence