Key Insights

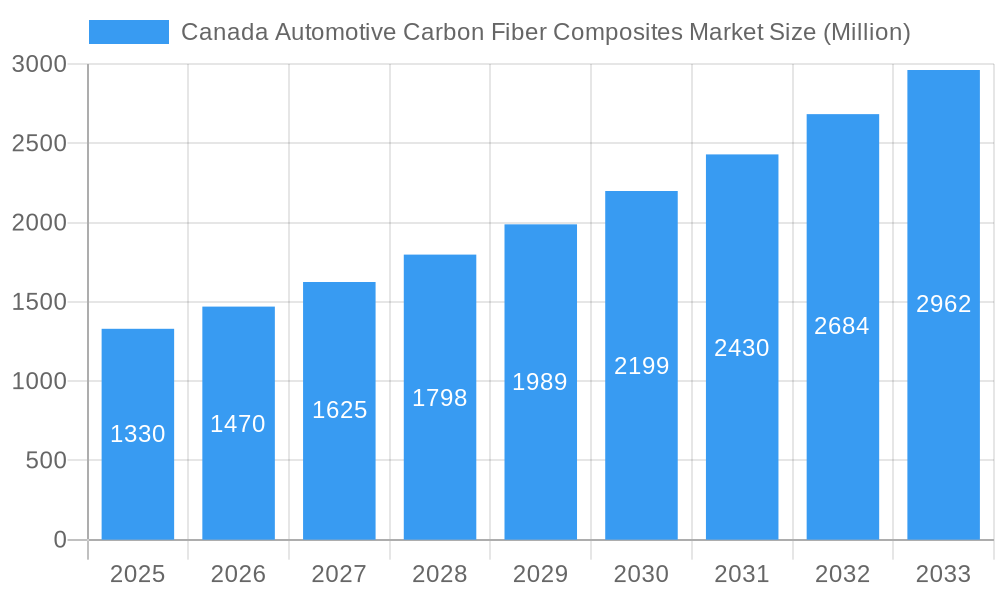

The Canada Automotive Carbon Fiber Composites market, valued at $1.33 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.50% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a primary driver. Furthermore, the automotive industry's ongoing pursuit of enhanced vehicle performance, including increased strength and durability, fuels the adoption of carbon fiber composites. Technological advancements in manufacturing processes, leading to lower production costs and improved material properties, also contribute significantly to market growth. The segmentation within the Canadian market reveals a diverse application landscape. Structural assembly dominates, followed by powertrain components, interior and exterior applications, with 'other applications' representing a smaller but growing segment. Leading players like SGL Carbon, Toray Industries, and Hexcel Corporation are actively shaping the market landscape through innovation and strategic partnerships. The regional distribution within Canada shows growth potential across Eastern, Western, and Central regions, reflecting the widespread adoption of carbon fiber composites across the automotive sector.

Canada Automotive Carbon Fiber Composites Market Market Size (In Billion)

Looking ahead, the market's trajectory suggests continued expansion. Government regulations promoting fuel efficiency and sustainable transportation are expected to further stimulate demand. However, challenges remain. The high initial cost of carbon fiber composites compared to traditional materials poses a barrier to wider adoption, particularly for smaller automotive manufacturers. Furthermore, the complexities associated with manufacturing and processing carbon fiber necessitate ongoing technological advancements to ensure scalability and efficiency. Despite these restraints, the long-term outlook remains positive, with the market poised for significant growth driven by industry trends and technological progress. The Canadian market benefits from a strong automotive manufacturing base and a supportive regulatory environment, placing it favorably within the global carbon fiber composites landscape.

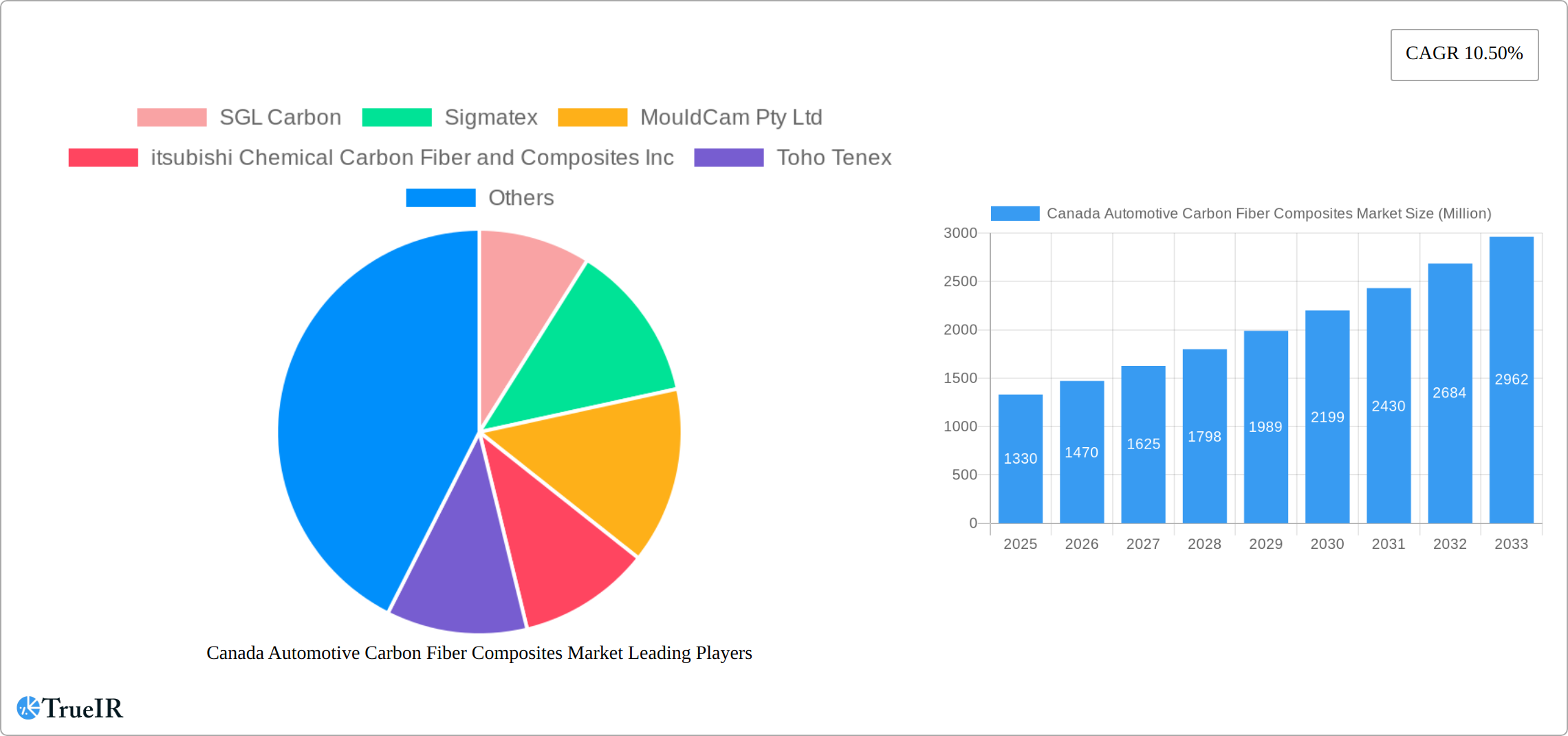

Canada Automotive Carbon Fiber Composites Market Company Market Share

Canada Automotive Carbon Fiber Composites Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Canada Automotive Carbon Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and researchers. Leveraging extensive data analysis from 2019 to 2024 (historical period), the report establishes a robust base year of 2025, and projects market trends through 2033 (forecast period). With a focus on key players like SGL Carbon, Sigmatex, MouldCam Pty Ltd, Mitsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, and Solva, this report provides a 360° view of this rapidly evolving market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

Canada Automotive Carbon Fiber Composites Market Market Structure & Competitive Landscape

The Canadian automotive carbon fiber composites market exhibits a moderately concentrated structure, with a few major global players and several regional players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately competitive landscape. Innovation is a key driver, with continuous advancements in fiber types, manufacturing processes, and composite designs pushing the boundaries of lightweighting and performance. Stringent environmental regulations, particularly those aimed at reducing vehicle emissions, are creating a favorable environment for the adoption of carbon fiber composites. While metals remain the primary material in many automotive applications, carbon fiber composites are increasingly viewed as a viable substitute due to their superior strength-to-weight ratio and design flexibility.

Market consolidation through mergers and acquisitions (M&A) is another noticeable trend. The total value of M&A activity in the Canadian automotive carbon fiber composites sector between 2019 and 2024 reached approximately xx Million. Future M&A activity is anticipated, driven by the desire of larger players to expand their market reach and gain access to specialized technologies.

- Market Concentration: Moderately concentrated, with an estimated HHI of xx in 2025.

- Innovation Drivers: Advancements in fiber types, manufacturing processes, and composite designs.

- Regulatory Impacts: Stringent environmental regulations favoring lightweighting and emission reductions.

- Product Substitutes: Primarily metals (steel, aluminum), but carbon fiber offers superior performance in many applications.

- End-User Segmentation: Primarily automotive OEMs (Original Equipment Manufacturers) and Tier-1 suppliers.

- M&A Trends: Significant M&A activity (xx Million between 2019-2024), with further consolidation expected.

Canada Automotive Carbon Fiber Composites Market Market Trends & Opportunities

The Canadian automotive carbon fiber composites market is experiencing robust growth, propelled by the accelerating demand for lightweight vehicles, the imperative for improved fuel efficiency, and the continuous pursuit of enhanced vehicle performance. Industry projections indicate a substantial Compound Annual Growth Rate (CAGR) of approximately 8-10% from 2025 to 2033. This upward trajectory is significantly influenced by several pivotal factors: the surging adoption of Electric Vehicles (EVs), which derive considerable benefits from the inherent lightweight properties of carbon fiber; ongoing technological advancements in manufacturing processes that are rendering carbon fiber composites increasingly cost-effective and accessible; and a growing consumer preference for vehicles that offer superior fuel efficiency and high-performance capabilities. Despite these positive trends, the inherent higher cost of carbon fiber composites when compared to traditional materials continues to present a notable hurdle to widespread adoption. Nevertheless, the market penetration rate for carbon fiber composites within the Canadian automotive sector is anticipated to expand from an estimated 3-5% in 2025 to a significant 8-12% by 2033. The competitive landscape is dynamic, characterized by established industry players making substantial investments in Research and Development (R&D) to pioneer advanced materials and cutting-edge manufacturing technologies. Concurrently, new entrants are emerging, employing innovative strategies to carve out their niche and compete effectively in this evolving market.

Dominant Markets & Segments in Canada Automotive Carbon Fiber Composites Market

Within the Canadian automotive carbon fiber composites market, the structural assembly segment currently commands the largest market share, closely followed by the powertrain component segment. The growth witnessed in these key segments is predominantly fueled by the persistent need for enhanced vehicle performance characteristics and the critical objective of achieving improved fuel efficiency across the automotive fleet.

- Structural Assembly Segment Growth Drivers:

- Escalating demand for lighter-weight vehicle architectures to meet regulatory standards and consumer expectations.

- Significant advancements in composite material design, engineering, and sophisticated manufacturing techniques.

- The implementation of increasingly stringent fuel efficiency regulations by government bodies, mandating lower emissions and better mileage.

- Powertrain Component Segment Growth Drivers:

- The rapid and widespread adoption of hybrid and fully electric vehicles, which benefit immensely from weight reduction.

- An increasing requirement for lightweight yet exceptionally high-strength components within the powertrain systems.

- A sustained focus on elevating overall vehicle performance metrics and optimizing fuel economy.

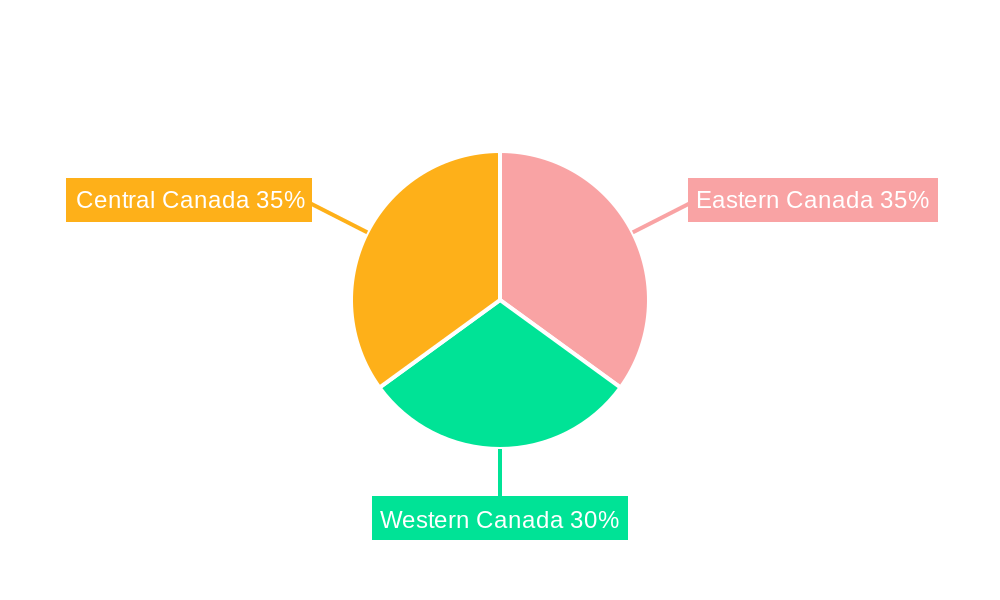

Geographically, the province of Ontario currently holds a dominant position in the Canadian market. This leadership is attributable to its substantial concentration of leading automotive manufacturers and a deeply entrenched, well-developed supply chain infrastructure. However, other regions, particularly Quebec and British Columbia, are exhibiting considerable growth momentum. This expansion is being driven by strategic investments in the automotive sector and the implementation of supportive government policies designed to foster innovation and manufacturing within these areas.

Canada Automotive Carbon Fiber Composites Market Product Analysis

The Canadian automotive carbon fiber composites market features a diverse range of products, including unidirectional fabrics, woven fabrics, non-woven fabrics, and prepregs. These products are used across various automotive applications, including structural components, interior and exterior trim, and powertrain components. Technological advancements are driving innovation, with a focus on developing high-performance fibers with improved strength, stiffness, and durability. This, along with improvements in manufacturing processes, is leading to more cost-effective and efficient production of carbon fiber composites, enhancing their market fit and competitiveness.

Key Drivers, Barriers & Challenges in Canada Automotive Carbon Fiber Composites Market

Key Drivers: The Canadian automotive carbon fiber composites market is experiencing substantial impetus from a combination of factors: the escalating demand for lighter-weight vehicles that contribute to improved fuel economy and reduced emissions; the implementation of stringent environmental regulations targeting vehicle emissions; the surging popularity and accelerating adoption rate of electric vehicles (EVs); and continuous, groundbreaking technological advancements in the manufacturing processes of carbon fiber composites, leading to improved properties and potential cost reductions. Furthermore, government incentives and programs specifically designed to promote the adoption of sustainable and advanced automotive technologies are playing a crucial role in propelling market growth.

Challenges: Despite the positive growth trajectory, significant barriers persist. The high manufacturing costs associated with carbon fiber composites and the inherent complexities involved in their processing remain considerable challenges for broader market penetration. The limited availability of a sufficiently skilled workforce possessing specialized expertise in composite materials and the necessity for significant investment in specialized equipment represent substantial hurdles for many manufacturers. Moreover, potential supply chain disruptions and the risk of material shortages can pose additional threats to the industry's consistent growth trajectory and production capabilities.

Growth Drivers in the Canada Automotive Carbon Fiber Composites Market Market

Technological advancements in carbon fiber materials, the growing emphasis on fuel efficiency standards, government regulations aimed at reducing automotive emissions, and the rising popularity of electric and hybrid vehicles are key drivers of market expansion. Furthermore, ongoing research into new carbon fiber production methods and composite designs further fuels this growth.

Challenges Impacting Canada Automotive Carbon Fiber Composites Market Growth

The significant upfront investment required for carbon fiber composite production and processing facilities presents a challenge for many companies. Supply chain vulnerabilities, particularly sourcing raw materials, are a concern. Moreover, skilled labor shortages and the competitive landscape within the automotive industry pose further obstacles to market growth.

Key Players Shaping the Canada Automotive Carbon Fiber Composites Market Market

- SGL Carbon

- Sigmatex

- MouldCam Pty Ltd

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Toho Tenex

- Nippon Sheet Glass Company Limited

- Toray Industries

- Hexcel Corporation

- Solva

Significant Canada Automotive Carbon Fiber Composites Market Industry Milestones

- February 2023: The unveiling of Tesla's innovative carbon-wrapped motor for its electric vehicles marked a significant advancement in EV technology. This development underscores the immense potential of carbon fiber composites in enabling high-performance applications and is expected to spur increased demand for advanced carbon fiber materials and sophisticated manufacturing processes within the EV sector.

- June 2023: A groundbreaking development at the University of British Columbia (UBC) involving the transformation of bitumen into carbon fiber presents a potential paradigm shift for the Canadian automotive industry. This innovation holds the promise of providing a more sustainable and potentially cost-effective domestic source of carbon fiber, thereby reducing the industry's reliance on imports and bolstering local manufacturing capabilities.

Future Outlook for Canada Automotive Carbon Fiber Composites Market Market

The Canadian automotive carbon fiber composites market is strategically positioned for sustained and robust growth in the coming years. This optimistic outlook is underpinned by a confluence of powerful factors, including the accelerating global adoption of electric vehicles, continuous and significant technological advancements in composite material science and manufacturing, and the implementation of supportive government policies aimed at promoting innovation and sustainability in the automotive sector. Strategic collaborations and partnerships between prominent automotive manufacturers and specialized composite material suppliers will be instrumental in shaping the future trajectory and success of this dynamic and rapidly evolving market. The market's inherent potential is substantial, offering ample opportunities for groundbreaking innovation, expansion into new vehicle segments, and the development of novel applications that leverage the unique advantages of carbon fiber composites.

Canada Automotive Carbon Fiber Composites Market Segmentation

-

1. Application Type

- 1.1. Structural Assembly

- 1.2. Powertrain Component

- 1.3. Interior

- 1.4. Exterior

- 1.5. Other Applications

Canada Automotive Carbon Fiber Composites Market Segmentation By Geography

- 1. Canada

Canada Automotive Carbon Fiber Composites Market Regional Market Share

Geographic Coverage of Canada Automotive Carbon Fiber Composites Market

Canada Automotive Carbon Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market

- 3.3. Market Restrains

- 3.3.1. High Manufacturing and Processing Cost of Composites

- 3.4. Market Trends

- 3.4.1. Interior is Projected to Grow at an Exponential Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Carbon Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Structural Assembly

- 5.1.2. Powertrain Component

- 5.1.3. Interior

- 5.1.4. Exterior

- 5.1.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SGL Carbon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sigmatex

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MouldCam Pty Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 itsubishi Chemical Carbon Fiber and Composites Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toho Tenex

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nippon Sheet Glass Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Toray Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hexcel Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Solva

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 SGL Carbon

List of Figures

- Figure 1: Canada Automotive Carbon Fiber Composites Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Carbon Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 4: Canada Automotive Carbon Fiber Composites Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Carbon Fiber Composites Market?

The projected CAGR is approximately 10.50%.

2. Which companies are prominent players in the Canada Automotive Carbon Fiber Composites Market?

Key companies in the market include SGL Carbon, Sigmatex, MouldCam Pty Ltd, itsubishi Chemical Carbon Fiber and Composites Inc, Toho Tenex, Nippon Sheet Glass Company Limited, Toray Industries, Hexcel Corporation, Solva.

3. What are the main segments of the Canada Automotive Carbon Fiber Composites Market?

The market segments include Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.33 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight and Energy-efficient Automotive Components to Foster the Growth of the Target Market.

6. What are the notable trends driving market growth?

Interior is Projected to Grow at an Exponential Rate.

7. Are there any restraints impacting market growth?

High Manufacturing and Processing Cost of Composites.

8. Can you provide examples of recent developments in the market?

February 2023: Tesla's new carbon-wrapped motor made waves in the automotive industry, with many touting it as the world's most advanced motor. This innovative technology is expected to offer increased efficiency, improved performance, longer battery life, and environmental benefits for electric vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Carbon Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Carbon Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Carbon Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Carbon Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence