Key Insights

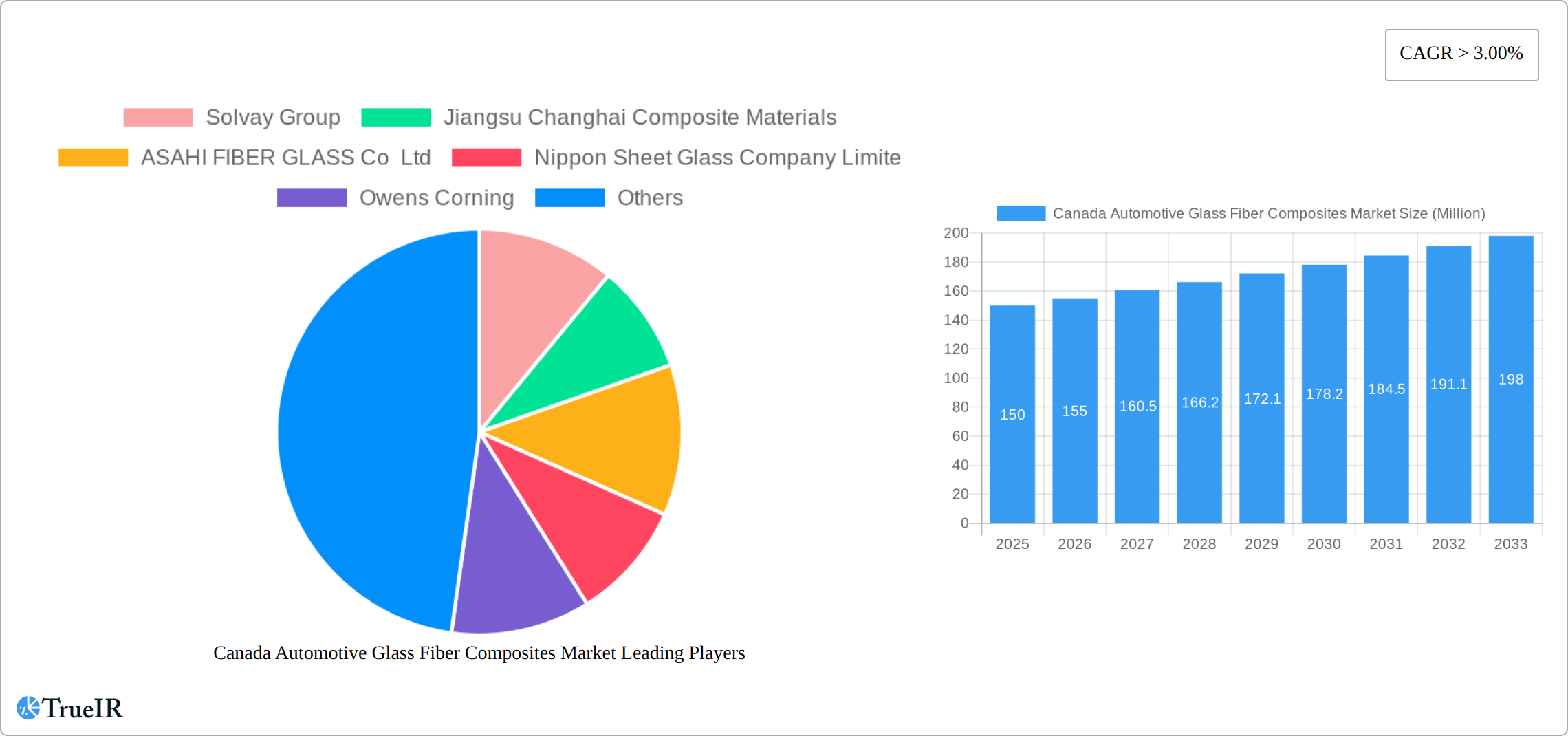

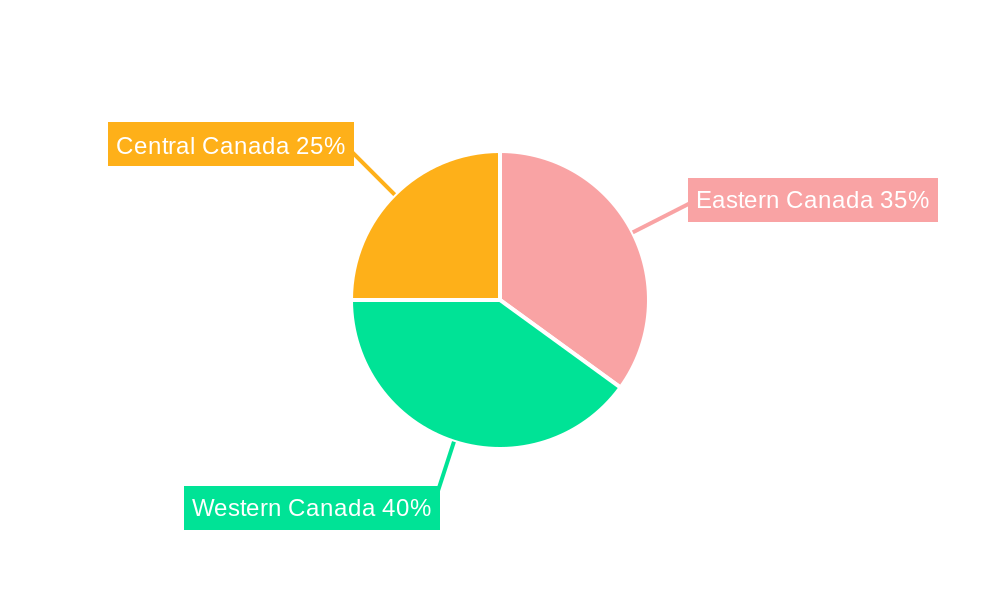

The Canada automotive glass fiber composites market is experiencing robust growth, driven by the increasing demand for lightweight and fuel-efficient vehicles. The market's Compound Annual Growth Rate (CAGR) exceeding 3.00% indicates a consistent upward trajectory projected through 2033. This expansion is fueled by several key factors. Firstly, stringent government regulations aimed at reducing carbon emissions are pushing automakers to adopt lightweight materials like glass fiber composites to improve vehicle fuel economy. Secondly, the rising adoption of advanced driver-assistance systems (ADAS) and electric vehicles (EVs) necessitates the use of high-performance composites to meet stringent safety and performance standards. The market segmentation reveals significant potential in various application types, including interior and exterior components, structural assemblies, and powertrain components. Among intermediate types, short fiber thermoplastics (SFT) currently dominate, but long fiber thermoplastics (LFT) and continuous fiber thermoplastics (CFT) are poised for substantial growth due to their superior mechanical properties. Key players like Solvay Group, Jiangsu Changhai Composite Materials, and Asahi Fiber Glass are strategically investing in research and development to enhance product innovation and expand their market share. Regional analysis reveals variations in market dynamics across Eastern, Western, and Central Canada, influenced by factors like automotive manufacturing hubs and regional government policies. The forecast period (2025-2033) expects continued growth, although market penetration rates will vary across different segments and regions.

Canada Automotive Glass Fiber Composites Market Market Size (In Million)

The Canadian market's growth is intrinsically linked to the global automotive industry's trends. While specific market size data for Canada isn't provided, using a logical estimation based on global trends and the provided CAGR, a significant market size can be inferred. Considering the strong emphasis on sustainability and technological advancements in the Canadian automotive sector, the market is expected to continue attracting significant investments and collaborations between material suppliers and automotive manufacturers. The competitive landscape is characterized by both domestic and international players, resulting in innovation and price competitiveness, benefiting the end-users. Challenges remain, including the higher initial cost of glass fiber composites compared to traditional materials and the need for continuous improvement in recyclability and sustainable production practices. However, the long-term outlook for the Canada automotive glass fiber composites market remains positive, fueled by the sustained demand for lighter, safer, and more fuel-efficient vehicles.

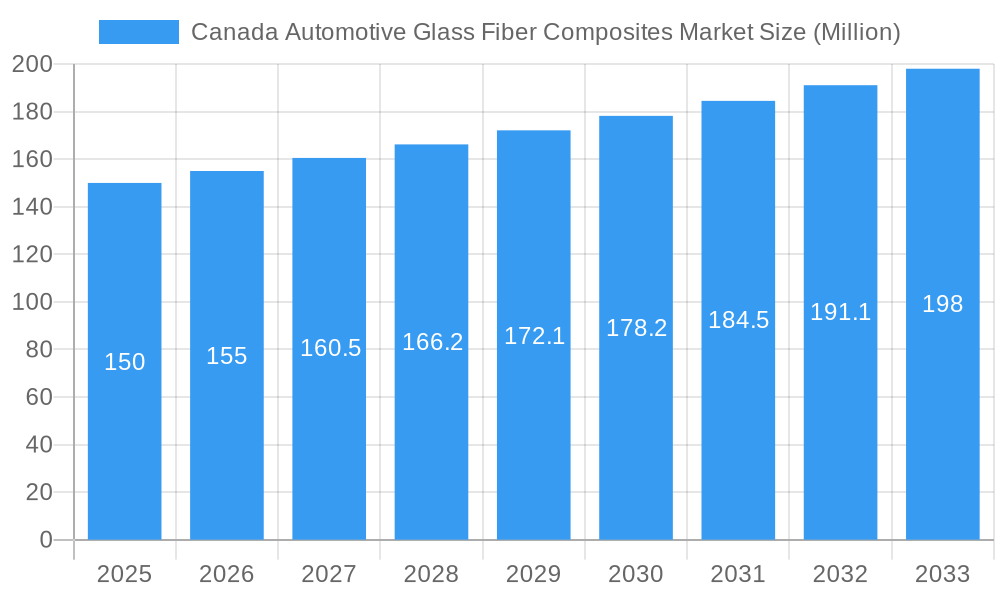

Canada Automotive Glass Fiber Composites Market Company Market Share

Canada Automotive Glass Fiber Composites Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canada Automotive Glass Fiber Composites Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this study meticulously examines market dynamics, competitive landscapes, growth drivers, and future outlook. The report leverages extensive data and in-depth analysis to provide a clear and concise understanding of this rapidly evolving market.

Canada Automotive Glass Fiber Composites Market Market Structure & Competitive Landscape

The Canada automotive glass fiber composites market exhibits a moderately consolidated structure. The market concentration ratio (CR4) for 2025 is estimated at xx%, indicating the presence of several key players alongside numerous smaller participants. Innovation within the sector is primarily driven by advancements in material science, leading to lighter, stronger, and more fuel-efficient automotive components. Regulatory pressures, such as stricter fuel efficiency standards and emission regulations, are significant drivers of adoption. Product substitutes, including metals and other advanced composites, pose a competitive challenge, pushing manufacturers to continuously improve the cost-effectiveness and performance of their offerings.

The end-user segmentation predominantly consists of automotive original equipment manufacturers (OEMs) and Tier-1 suppliers. Mergers and acquisitions (M&A) activity in the market has been moderate over the historical period (2019-2024), with approximately xx M&A deals recorded, primarily focused on expanding product portfolios and geographic reach. Further consolidation is anticipated in the forecast period (2025-2033) as companies strive for increased market share and economies of scale. Factors such as increasing demand for lightweight vehicles and stringent environmental regulations are expected to propel further M&A activity.

Canada Automotive Glass Fiber Composites Market Market Trends & Opportunities

The Canadian automotive glass fiber composites market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of [Insert Updated CAGR]% during the forecast period (2025-2033). The market size in 2025 is estimated at [Insert Updated Market Size in Million CAD], fueled by the escalating demand for fuel-efficient and lightweight vehicles. This growth trajectory is propelled by several key factors. Technological advancements in fiber types, such as continuous fiber thermoplastic (CFT), and innovative resin systems are significantly enhancing the performance and capabilities of glass fiber composites, leading to wider adoption across various automotive applications. The increasing consumer preference for environmentally friendly vehicles further strengthens the demand for lightweight materials like glass fiber composites, aligning perfectly with sustainability goals.

Intense competition among established players and emerging market entrants is fostering innovation and driving down prices, creating a positive feedback loop that stimulates market expansion. Market penetration of glass fiber composites in the Canadian automotive sector is anticipated to reach [Insert Updated Percentage]% by 2033, a substantial increase from [Insert Updated Percentage]% in 2025. The surge in electric and hybrid vehicle adoption presents significant growth opportunities, as these vehicles necessitate lightweight components to maximize range and performance.

Dominant Markets & Segments in Canada Automotive Glass Fiber Composites Market

Dominant Application Type: The structural assembly segment maintains its leading position in 2025, commanding the largest market share due to the increasing need for lightweight yet high-strength components in modern vehicles. This is followed by the exterior and interior components segments.

Dominant Intermediate Type: Long Fiber Thermoplastic (LFT) continues to dominate the intermediate type segment, owing to its exceptional balance of strength, cost-effectiveness, and ease of processing. This trend is projected to persist throughout the forecast period. [Optional: Add details on other intermediate types and their market share].

Key Growth Drivers:

- Government initiatives promoting fuel efficiency and emission reductions, including [mention specific policies or regulations].

- Expansion of the automotive manufacturing industry in Canada, with [mention specific examples or investments].

- Technological advancements leading to improved composite performance and cost reductions, specifically [mention specific innovations].

- Growing adoption of lightweighting strategies by major automotive OEMs.

Geographically, Ontario retains the largest market share, leveraging its established automotive manufacturing base and proximity to major automotive OEMs. Quebec and British Columbia also contribute significantly, benefiting from their expanding automotive parts supply chains. The automotive industry's unwavering focus on innovation in lightweighting and the increasing adoption of electric vehicles are collectively driving substantial market growth.

Canada Automotive Glass Fiber Composites Market Product Analysis

The market offers a diverse range of glass fiber composite products tailored to different automotive applications. Recent innovations include the development of advanced fiber architectures and resin systems that improve strength-to-weight ratios and durability. These advancements are enabling the use of glass fiber composites in critical structural components, previously dominated by traditional materials. The key competitive advantage lies in the ability to offer customized solutions with superior performance and cost-effectiveness compared to traditional materials, while adhering to stringent automotive industry standards. Furthermore, ongoing research and development focus on bio-based resins and recycled fibers is further enhancing the sustainability profile of these products.

Key Drivers, Barriers & Challenges in Canada Automotive Glass Fiber Composites Market

Key Drivers: The market's expansion is primarily driven by the increasing demand for fuel-efficient vehicles, stringent government regulations targeting emissions and fuel economy, and the continuous development of high-performance glass fiber composite materials. These drivers are further complemented by advancements in manufacturing processes that are leading to significant reductions in production costs.

Key Barriers & Challenges: Significant challenges remain, including the relatively high initial investment costs associated with the production and implementation of these advanced composites. Supply chain disruptions, particularly regarding raw material availability and price volatility, pose ongoing obstacles. Furthermore, overcoming the perceived lack of widespread familiarity and expertise among some manufacturers is crucial for accelerating adoption. The competitive landscape, with other lightweighting materials such as aluminum and carbon fiber vying for market share, presents additional challenges that need to be addressed.

Growth Drivers in the Canada Automotive Glass Fiber Composites Market Market

The Canadian automotive industry's commitment to producing lighter and more fuel-efficient vehicles serves as a major growth catalyst. Stringent environmental regulations are compelling manufacturers to adopt lightweight materials like glass fiber composites. Continuous technological advancements in fiber and resin technology further enhance the properties of these composites, enabling their increased adoption in demanding automotive applications. [Optional: Add details on specific technological advancements].

Challenges Impacting Canada Automotive Glass Fiber Composites Market Growth

The high initial investment required for production facilities and skilled labor is a barrier to entry for new companies. Fluctuations in raw material prices, especially glass fibers and resins, affect profitability. Competition from other lightweight materials and the complexity of integrating these composites into existing manufacturing processes pose additional challenges.

Key Players Shaping the Canada Automotive Glass Fiber Composites Market Market

- Solvay Group

- Jiangsu Changhai Composite Materials

- ASAHI FIBER GLASS Co Ltd

- Nippon Sheet Glass Company Limited

- Owens Corning

- Veplas Group

- SAERTEX GmbH & Co KG

- (Braj Binani Group)

Significant Canada Automotive Glass Fiber Composites Market Industry Milestones

- 2022 Q3: Introduction of a new generation of high-strength glass fiber composites by Solvay Group, improving fuel efficiency by xx%.

- 2023 Q1: Partnership between Asahi Fiber Glass and a major Canadian automotive OEM for the development of lightweight body panels.

- 2024 Q4: Successful completion of a significant expansion project by Owens Corning, increasing production capacity by xx%.

Future Outlook for Canada Automotive Glass Fiber Composites Market Market

The Canadian automotive glass fiber composites market is poised for substantial growth over the next decade, driven by the sustained demand for lightweight vehicles, stricter environmental regulations, and ongoing technological advancements. The market presents significant opportunities for manufacturers who can effectively address the challenges related to cost, supply chain management, and technical integration. Strategic partnerships and collaborations will be crucial for enhancing market penetration and expanding the adoption of glass fiber composites within the Canadian automotive sector. A focus on sustainability and the development of recycled fiber-based composites will further propel market expansion and contribute to a more environmentally conscious automotive industry. [Optional: Add specific predictions or forecasts for the future].

Canada Automotive Glass Fiber Composites Market Segmentation

-

1. Intermediate Type

- 1.1. Short Fiber Thermoplastic (SFT)

- 1.2. Long Fiber Thermoplastic (LFT)

- 1.3. Continuous Fiber Thermoplastic (CFT)

- 1.4. Other Intermediate Types

-

2. Application Type

- 2.1. Interior

- 2.2. Exterior

- 2.3. Structural Assembly

- 2.4. Power-train Components

- 2.5. Other Application Types

Canada Automotive Glass Fiber Composites Market Segmentation By Geography

- 1. Canada

Canada Automotive Glass Fiber Composites Market Regional Market Share

Geographic Coverage of Canada Automotive Glass Fiber Composites Market

Canada Automotive Glass Fiber Composites Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Across Activities the Country

- 3.3. Market Restrains

- 3.3.1. Hike In Fuel Prices To Restrict The Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Glass Fiber Composites in Automobiles

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Automotive Glass Fiber Composites Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 5.1.1. Short Fiber Thermoplastic (SFT)

- 5.1.2. Long Fiber Thermoplastic (LFT)

- 5.1.3. Continuous Fiber Thermoplastic (CFT)

- 5.1.4. Other Intermediate Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Interior

- 5.2.2. Exterior

- 5.2.3. Structural Assembly

- 5.2.4. Power-train Components

- 5.2.5. Other Application Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Intermediate Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solvay Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jiangsu Changhai Composite Materials

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ASAHI FIBER GLASS Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Sheet Glass Company Limite

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Owens Corning

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Veplas Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SAERTEX GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 (Braj Binani Group)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Solvay Group

List of Figures

- Figure 1: Canada Automotive Glass Fiber Composites Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Automotive Glass Fiber Composites Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Intermediate Type 2020 & 2033

- Table 2: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Intermediate Type 2020 & 2033

- Table 5: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 6: Canada Automotive Glass Fiber Composites Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Automotive Glass Fiber Composites Market?

The projected CAGR is approximately 4.3%.

2. Which companies are prominent players in the Canada Automotive Glass Fiber Composites Market?

Key companies in the market include Solvay Group, Jiangsu Changhai Composite Materials, ASAHI FIBER GLASS Co Ltd, Nippon Sheet Glass Company Limite, Owens Corning, Veplas Group, SAERTEX GmbH & Co KG, (Braj Binani Group).

3. What are the main segments of the Canada Automotive Glass Fiber Composites Market?

The market segments include Intermediate Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Across Activities the Country.

6. What are the notable trends driving market growth?

Increasing Adoption of Glass Fiber Composites in Automobiles.

7. Are there any restraints impacting market growth?

Hike In Fuel Prices To Restrict The Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Automotive Glass Fiber Composites Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Automotive Glass Fiber Composites Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Automotive Glass Fiber Composites Market?

To stay informed about further developments, trends, and reports in the Canada Automotive Glass Fiber Composites Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence