Key Insights

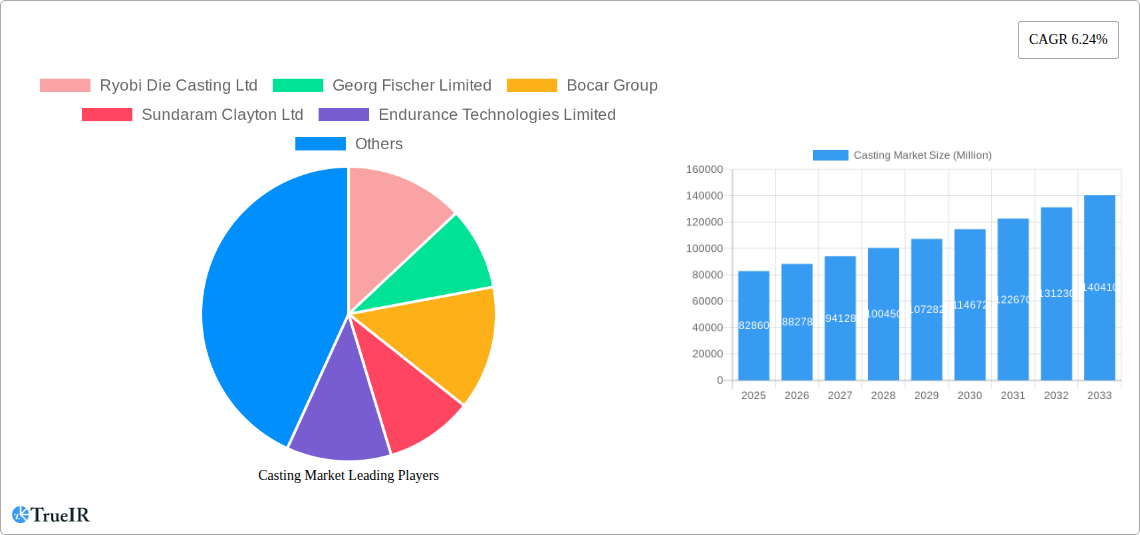

The global die casting market, valued at $82.86 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.24% from 2025 to 2033. This expansion is driven by several key factors. The automotive industry's increasing demand for lightweight and high-strength components is a major catalyst. The rise of electric vehicles (EVs) further fuels this demand, as die casting is crucial in manufacturing EV battery casings and other essential parts. Furthermore, the electronics sector's continuous innovation and the growing adoption of sophisticated consumer electronics are significantly contributing to market growth. Advancements in die casting processes, such as vacuum die casting, which enhances product quality and reduces defects, are also propelling market expansion. Increased adoption of automation and precision engineering in manufacturing processes further improves efficiency and reduces costs, making die casting a more attractive option across various industries.

Casting Market Market Size (In Billion)

However, the market faces certain challenges. Fluctuations in raw material prices, particularly aluminum, magnesium, and zinc, can impact profitability. Stringent environmental regulations concerning emissions and waste management necessitate investments in cleaner production technologies, potentially increasing operational costs. Competition from alternative manufacturing processes, such as 3D printing and forging, also presents a restraint. Despite these challenges, the overall market outlook remains positive, with continued growth anticipated across various segments. The diverse applications across automotive, electronics, and industrial sectors, coupled with technological advancements and increasing demand for lightweight components, promise sustained market expansion in the coming years. Geographical expansion, particularly in rapidly developing economies of Asia-Pacific, further contributes to the positive outlook. Companies are strategically investing in R&D and expanding their production capacities to meet the growing global demand.

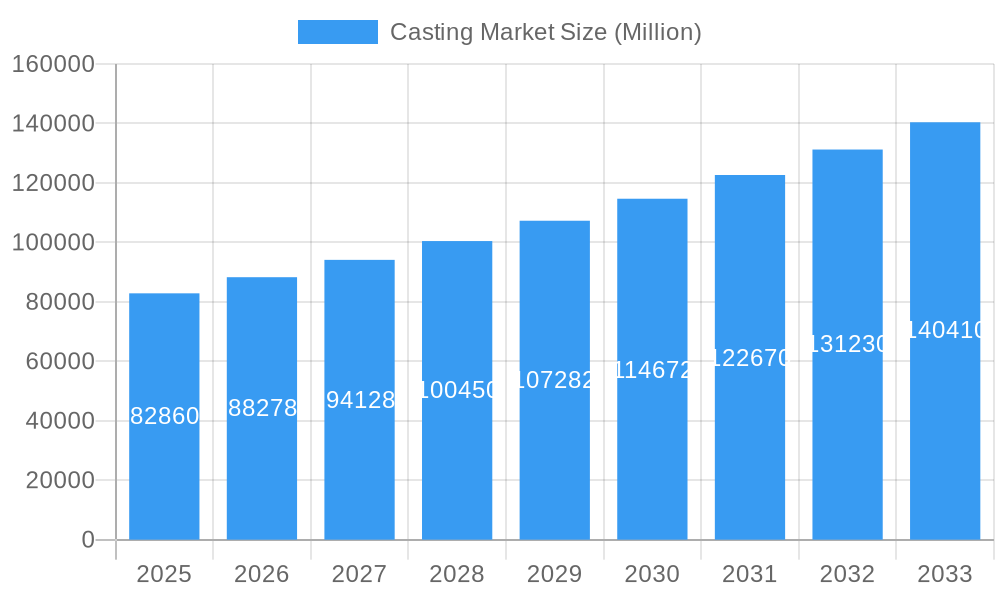

Casting Market Company Market Share

Casting Market Report: A Comprehensive Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the global Casting Market, offering invaluable insights for businesses and investors seeking to navigate this dynamic industry. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by application (Automotive, Electrical and Electronics, Industrial, Other Applications), process (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Other Processes), and raw material (Aluminum, Magnesium, Zinc). Key players analyzed include Ryobi Die Casting Ltd, Georg Fischer Limited, Bocar Group, Sundaram Clayton Ltd, Endurance Technologies Limited, Nemak, Alcoa Corporation, Linamar Corporation, Sandhar Group, Shiloh Industries, Koch Enterprises (Gibbs Die Casting Group), Meridian Lightweight Technologies UK Ltd, Rheinmetall AG, Form Technologies Inc (Dynacast), Rockman Industries, and Engtek Group. The report projects a market size of xx Million by 2033, driven by significant industry developments and technological advancements.

Casting Market Market Structure & Competitive Landscape

The global casting market is characterized by a moderately concentrated structure, where a few large, established players command a significant market share. However, this is balanced by the presence of a multitude of smaller, agile companies, particularly those specializing in niche segments, which contribute to a dynamic and competitive environment. The competitive landscape is shaped by a confluence of key factors:

- Substantial Capital Investment: The casting industry necessitates considerable financial commitment for advanced machinery, specialized tooling, and robust infrastructure. This high entry barrier tends to consolidate the market among established firms with the financial capacity to invest.

- Pace of Technological Advancement: Continuous innovation in casting methodologies, particularly in areas like high-pressure die casting and the utilization of novel lightweight materials, is a critical differentiator. Companies actively invest in research and development to elevate casting quality, optimize production costs, and pioneer new applications, thereby enhancing their competitive edge.

- Navigating Regulatory Frameworks: Adherence to stringent environmental regulations and safety standards is paramount. These regulations significantly influence production methodologies and can escalate operational expenditures. For sustained market participation, compliance with these evolving mandates is indispensable.

- Emergence of Alternative Manufacturing Methods: While casting benefits from its cost-effectiveness and scalability, it faces competitive pressure from alternative manufacturing techniques such as advanced 3D printing and precision forging. The strategic interplay between these methods defines market positioning.

- Diverse End-User Industries: The market serves a broad spectrum of industries, including the automotive sector, electrical and electronics manufacturing, and various industrial segments. Each sector presents unique demands and evolving trends, which in turn shape the overall market dynamics and the competitive strategies employed by casting companies.

- Strategic Mergers and Acquisitions (M&A): The casting industry frequently witnesses significant M&A activity as companies seek to expand their capabilities, market reach, and product portfolios. For instance, the planned acquisition of Unicast Autotech's aluminum die-casting business by Sandhar Technologies in 2021 exemplifies strategic consolidation efforts within the sector. Over the past five years, the total volume of M&A transactions has amounted to approximately [Insert Specific Value Here] Million, underscoring a notable trend of industry consolidation. The estimated Herfindahl-Hirschman Index (HHI) of [Insert Specific Value Here] further indicates a moderately concentrated market structure.

Casting Market Market Trends & Opportunities

The global casting market is experiencing a period of robust expansion, fueled by a confluence of significant growth drivers. The automotive industry continues to be the leading application segment, projected to account for approximately [Insert % Value Here]% of the market in 2025. Key catalysts for this dominance include the escalating demand for lighter vehicle designs to improve fuel efficiency and performance, and the accelerating adoption of electric vehicles (EVs), which often require specialized casting solutions for battery enclosures, motor components, and structural elements. The market is also witnessing a discernible shift towards advanced casting techniques like high-pressure die casting, and an increased reliance on high-performance materials such as aluminum and magnesium alloys. These trends are instrumental in enhancing manufacturing efficiency, reducing component weight, and improving overall vehicle performance.

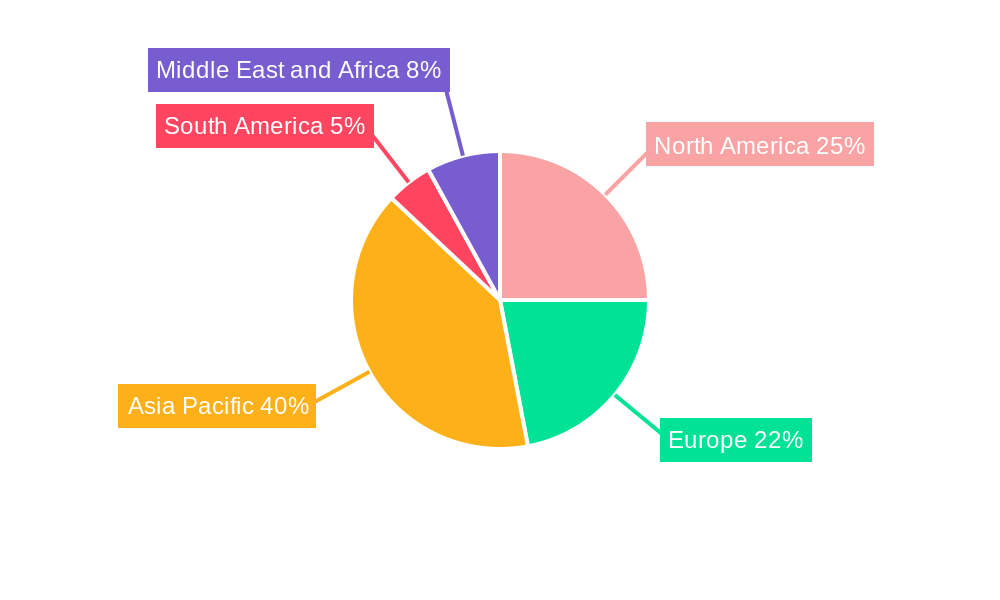

Beyond the automotive sector, the burgeoning penetration of electronic devices and industrial machinery, particularly within rapidly developing economies, is creating a sustained uplift in demand for cast components. Concurrently, technological advancements in manufacturing, encompassing automation and digitalization, are revolutionizing production processes, leading to enhanced efficiency and streamlined operations. This technological evolution is projected to drive an estimated Compound Annual Growth Rate (CAGR) of approximately [Insert % Value Here]% during the forecast period. Regional market penetration rates exhibit considerable variance, with mature markets like North America and Europe demonstrating steady, consistent growth. In contrast, emerging economic powerhouses in Asia and South America are showcasing higher growth trajectories and untapped potential. The competitive arena is characterized by intense price pressures, coupled with a pronounced emphasis on continuous innovation and the development of highly customized, customer-centric solutions.

The market is on track to reach an estimated value of [Insert $ Value Here] Million by 2033, presenting substantial growth opportunities, especially in the realms of lightweighting applications for various industries, the expanding electric vehicle ecosystem, and the ever-growing electronics sector.

Dominant Markets & Segments in Casting Market

Leading Region/Country: Asia-Pacific dominates the global casting market, driven by high demand from the automotive and electronics industries in China, India, and other rapidly developing economies. This region's robust infrastructure development, favorable government policies promoting industrialization, and a large pool of skilled labor contribute to its market dominance.

Leading Segment (By Application): The automotive segment is the largest and fastest-growing application segment, accounting for approximately xx% of the total market value. The increasing demand for lightweight vehicles, fuel efficiency regulations, and the rising adoption of electric vehicles strongly favor the use of cast components.

Leading Segment (By Process): Pressure die casting remains the dominant process, owing to its high productivity and ability to produce complex parts with high precision. However, the adoption of vacuum die casting is increasing, driven by the need for improved surface quality and dimensional accuracy.

Leading Segment (By Raw Material): Aluminum is the most widely used raw material in the casting industry due to its lightweight properties and excellent castability. However, magnesium and zinc also find significant applications, especially in specialized components.

- Key Growth Drivers (Asia-Pacific):

- Rapid industrialization and infrastructure development.

- Growing automotive and electronics sectors.

- Favorable government policies and incentives.

- Increasing investments in manufacturing facilities.

Casting Market Product Analysis

Technological leaps in casting processes have paved the way for the creation of components that are not only highly precise and lightweight but also exceptionally cost-effective. Innovations such as advanced high-pressure die casting, vacuum die casting, and the strategic use of sophisticated alloys have significantly elevated product performance, extended durability, and boosted overall efficiency. These advancements translate directly into competitive advantages for manufacturers, manifesting as reduced material expenses, extended product lifecycles, and the ability to deliver enhanced product functionalities tailored to the precise specifications of diverse customer requirements. These multifaceted benefits are pivotal in driving market expansion and fostering the broader adoption of cast components across an ever-widening array of applications.

Key Drivers, Barriers & Challenges in Casting Market

Key Drivers: The market is propelled by significant advancements in casting technologies, including the adoption of high-pressure die casting and increased automation. The burgeoning demand from the automotive and electronics sectors, coupled with substantial investments in infrastructure development and supportive government policies, further fuels growth. The strategic shift towards lightweighting in vehicle manufacturing and the rapid expansion of the electric vehicle market are also major contributing factors to the increased demand for cast components.

Key Challenges: The market faces several hurdles that can impede growth. These include the volatility of raw material prices, the imposition of stringent environmental regulations, the potential for supply chain disruptions, and intense market competition. Regulatory complexities, particularly concerning emissions and waste management, can impose significant operational costs and present substantial challenges for manufacturers striving to maintain profitability and operational efficiency.

Growth Drivers in the Casting Market Market

The primary engines driving growth in the casting market are multifaceted. The automotive industry's relentless pursuit of lightweight materials to enhance fuel efficiency and reduce emissions is a significant factor. The escalating demand for electric vehicles, which often incorporate complex and lightweight cast components, further amplifies this trend. Alongside this, continuous advancements in casting technologies, such as the ongoing refinement of high-pressure die casting techniques and the exploration of novel materials, are critical enablers. Moreover, supportive government policies that encourage manufacturing and industrial expansion create a favorable ecosystem for growth. The expanding electronics sector also plays a crucial role, contributing to the increasing demand for intricately designed and precisely manufactured cast components.

Challenges Impacting Casting Market Growth

Fluctuating raw material prices, environmental regulations, the availability of skilled labor, and supply chain disruptions are significant barriers. The need for substantial capital investment and intense competition further challenge market growth.

Key Players Shaping the Casting Market Market

- Ryobi Die Casting Ltd

- Georg Fischer Limited

- Bocar Group

- Sundaram Clayton Ltd

- Endurance Technologies Limited

- Nemak

- Alcoa Corporation

- Linamar Corporation

- Sandhar Group

- Shiloh Industries

- Koch Enterprises (Gibbs Die Casting Group)

- Meridian Lightweight Technologies UK Ltd

- Rheinmetall AG

- Form Technologies Inc (Dynacast)

- Rockman Industries

- Engtek Group

Significant Casting Market Industry Milestones

- March 2022: Ningbo Tuopu Group's launch of an integrated die-cast rear cabin highlights the increasing capability of large-scale die casting.

- March 2021: Sandhar Technologies' MOU with Unicast Autotech indicates consolidation within the aluminum die-casting segment.

- 2021: Foryou Corporation's unveiling of new die-cast aluminum components at Auto Shanghai demonstrates innovation in the automotive sector.

- March 2021: Rheinmetall AG's engine block contract signifies a substantial commitment to the automotive industry, impacting long-term market dynamics.

Future Outlook for Casting Market Market

The global casting market is poised for continued growth, driven by technological innovation, increasing demand from key sectors, and expansion into new applications. Strategic opportunities exist for companies focused on sustainable manufacturing practices, lightweighting solutions, and advanced materials. The market's potential remains significant, particularly in emerging economies and the rapidly evolving automotive and electronics sectors.

Casting Market Segmentation

-

1. Application

- 1.1. Automotive

- 1.2. Electrical and Electronics

- 1.3. Industrial

- 1.4. Other Applications

-

2. Process

- 2.1. Pressure Die Casting

- 2.2. Vacuum Die Casting

- 2.3. Squeeze Die Casting

- 2.4. Other Processes

-

3. Raw Material

- 3.1. Aluminum

- 3.2. Maginesium

- 3.3. Zinc

Casting Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Russia

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Thailand

- 3.6. Malaysia

- 3.7. Indonesia

- 3.8. South Korea

- 3.9. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Turkey

- 5.3. Rest of Middle East and Africa

Casting Market Regional Market Share

Geographic Coverage of Casting Market

Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and the Growing Emphasis on Safety is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Adoption of Steer-By-Wire System Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Aluminum Anticipated to Play Key Role in Die Casting Process

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Automotive

- 5.1.2. Electrical and Electronics

- 5.1.3. Industrial

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Pressure Die Casting

- 5.2.2. Vacuum Die Casting

- 5.2.3. Squeeze Die Casting

- 5.2.4. Other Processes

- 5.3. Market Analysis, Insights and Forecast - by Raw Material

- 5.3.1. Aluminum

- 5.3.2. Maginesium

- 5.3.3. Zinc

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Casting Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Automotive

- 6.1.2. Electrical and Electronics

- 6.1.3. Industrial

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Pressure Die Casting

- 6.2.2. Vacuum Die Casting

- 6.2.3. Squeeze Die Casting

- 6.2.4. Other Processes

- 6.3. Market Analysis, Insights and Forecast - by Raw Material

- 6.3.1. Aluminum

- 6.3.2. Maginesium

- 6.3.3. Zinc

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Casting Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Automotive

- 7.1.2. Electrical and Electronics

- 7.1.3. Industrial

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Pressure Die Casting

- 7.2.2. Vacuum Die Casting

- 7.2.3. Squeeze Die Casting

- 7.2.4. Other Processes

- 7.3. Market Analysis, Insights and Forecast - by Raw Material

- 7.3.1. Aluminum

- 7.3.2. Maginesium

- 7.3.3. Zinc

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Casting Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Automotive

- 8.1.2. Electrical and Electronics

- 8.1.3. Industrial

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Pressure Die Casting

- 8.2.2. Vacuum Die Casting

- 8.2.3. Squeeze Die Casting

- 8.2.4. Other Processes

- 8.3. Market Analysis, Insights and Forecast - by Raw Material

- 8.3.1. Aluminum

- 8.3.2. Maginesium

- 8.3.3. Zinc

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Casting Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Automotive

- 9.1.2. Electrical and Electronics

- 9.1.3. Industrial

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Pressure Die Casting

- 9.2.2. Vacuum Die Casting

- 9.2.3. Squeeze Die Casting

- 9.2.4. Other Processes

- 9.3. Market Analysis, Insights and Forecast - by Raw Material

- 9.3.1. Aluminum

- 9.3.2. Maginesium

- 9.3.3. Zinc

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Casting Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Automotive

- 10.1.2. Electrical and Electronics

- 10.1.3. Industrial

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Pressure Die Casting

- 10.2.2. Vacuum Die Casting

- 10.2.3. Squeeze Die Casting

- 10.2.4. Other Processes

- 10.3. Market Analysis, Insights and Forecast - by Raw Material

- 10.3.1. Aluminum

- 10.3.2. Maginesium

- 10.3.3. Zinc

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ryobi Die Casting Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Georg Fischer Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bocar Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sundaram Clayton Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Endurance Technologies Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nemak

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Alcoa Corporatio

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Linamar Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sandhar Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shiloh Industries

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Koch Enterprises (Gibbs Die Casting Group)

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Meridian Lightweight Technologies UK Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Form Technologies Inc (Dynacast)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Rockman Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Engtek Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Ryobi Die Casting Ltd

List of Figures

- Figure 1: Global Casting Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Casting Market Revenue (Million), by Process 2025 & 2033

- Figure 5: North America Casting Market Revenue Share (%), by Process 2025 & 2033

- Figure 6: North America Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 7: North America Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 8: North America Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Casting Market Revenue (Million), by Process 2025 & 2033

- Figure 13: Europe Casting Market Revenue Share (%), by Process 2025 & 2033

- Figure 14: Europe Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 15: Europe Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 16: Europe Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 19: Asia Pacific Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 20: Asia Pacific Casting Market Revenue (Million), by Process 2025 & 2033

- Figure 21: Asia Pacific Casting Market Revenue Share (%), by Process 2025 & 2033

- Figure 22: Asia Pacific Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 23: Asia Pacific Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 24: Asia Pacific Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 27: South America Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: South America Casting Market Revenue (Million), by Process 2025 & 2033

- Figure 29: South America Casting Market Revenue Share (%), by Process 2025 & 2033

- Figure 30: South America Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 31: South America Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 32: South America Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Casting Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Casting Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Casting Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Casting Market Revenue (Million), by Process 2025 & 2033

- Figure 37: Middle East and Africa Casting Market Revenue Share (%), by Process 2025 & 2033

- Figure 38: Middle East and Africa Casting Market Revenue (Million), by Raw Material 2025 & 2033

- Figure 39: Middle East and Africa Casting Market Revenue Share (%), by Raw Material 2025 & 2033

- Figure 40: Middle East and Africa Casting Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Casting Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 3: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 4: Global Casting Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 7: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 8: Global Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 14: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 15: Global Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 24: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 25: Global Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: China Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Japan Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Australia Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Thailand Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Indonesia Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: South Korea Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Asia Pacific Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 37: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 38: Global Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 39: Brazil Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Argentina Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of South America Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Casting Market Revenue Million Forecast, by Application 2020 & 2033

- Table 43: Global Casting Market Revenue Million Forecast, by Process 2020 & 2033

- Table 44: Global Casting Market Revenue Million Forecast, by Raw Material 2020 & 2033

- Table 45: Global Casting Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: South Africa Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Turkey Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Middle East and Africa Casting Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Casting Market?

The projected CAGR is approximately 6.24%.

2. Which companies are prominent players in the Casting Market?

Key companies in the market include Ryobi Die Casting Ltd, Georg Fischer Limited, Bocar Group, Sundaram Clayton Ltd, Endurance Technologies Limited, Nemak, Alcoa Corporatio, Linamar Corporation, Sandhar Group, Shiloh Industries, Koch Enterprises (Gibbs Die Casting Group), Meridian Lightweight Technologies UK Ltd, Rheinmetall AG (Rheinmetall Automotive formerly KSPG AG), Form Technologies Inc (Dynacast), Rockman Industries, Engtek Group.

3. What are the main segments of the Casting Market?

The market segments include Application, Process, Raw Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 82.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and the Growing Emphasis on Safety is Driving the Market.

6. What are the notable trends driving market growth?

Aluminum Anticipated to Play Key Role in Die Casting Process.

7. Are there any restraints impacting market growth?

Adoption of Steer-By-Wire System Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2022, Ningbo Tuopu Group Co. Ltd (Tuopu Group) announced that the integrated huge die-casting rear cabin that is developed based on the 7,200-ton giant die-casting machine rolled off the assembly line at the Hangzhou Bay plant in Ningbo.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Casting Market?

To stay informed about further developments, trends, and reports in the Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence