Key Insights

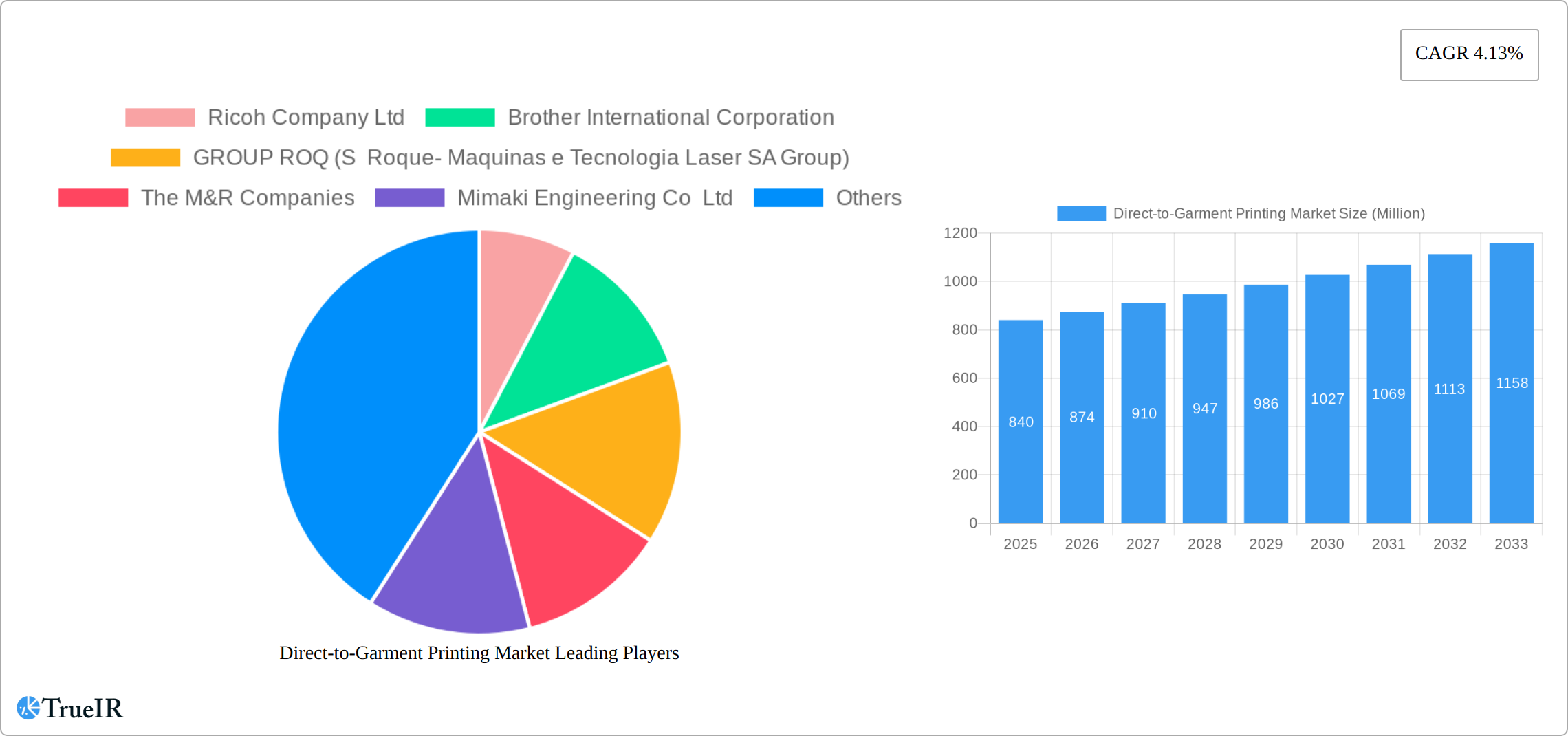

The Direct-to-Garment (DTG) printing market, valued at $0.84 billion in 2025, is projected to experience robust growth, driven by the increasing demand for personalized apparel and home décor items. The market's Compound Annual Growth Rate (CAGR) of 4.13% from 2019 to 2024 suggests a continued upward trajectory. This growth is fueled by several key factors. The rising popularity of e-commerce and on-demand printing allows for smaller production runs and customized designs, catering to individual preferences and niche markets. Technological advancements in DTG printers, leading to improved print quality, speed, and cost-effectiveness, are also significant drivers. The expanding application areas beyond clothing and apparel, including home décor and technical textiles, further contribute to market expansion. The segment breakdown shows a strong presence across diverse substrates like cotton, polyester, and silk, with reactive and acid inks being prominently used. Key players like Ricoh, Brother, and Kornit Digital are driving innovation and market penetration through strategic partnerships, product diversification, and expansion into new geographic regions.

Direct-to-Garment Printing Market Market Size (In Million)

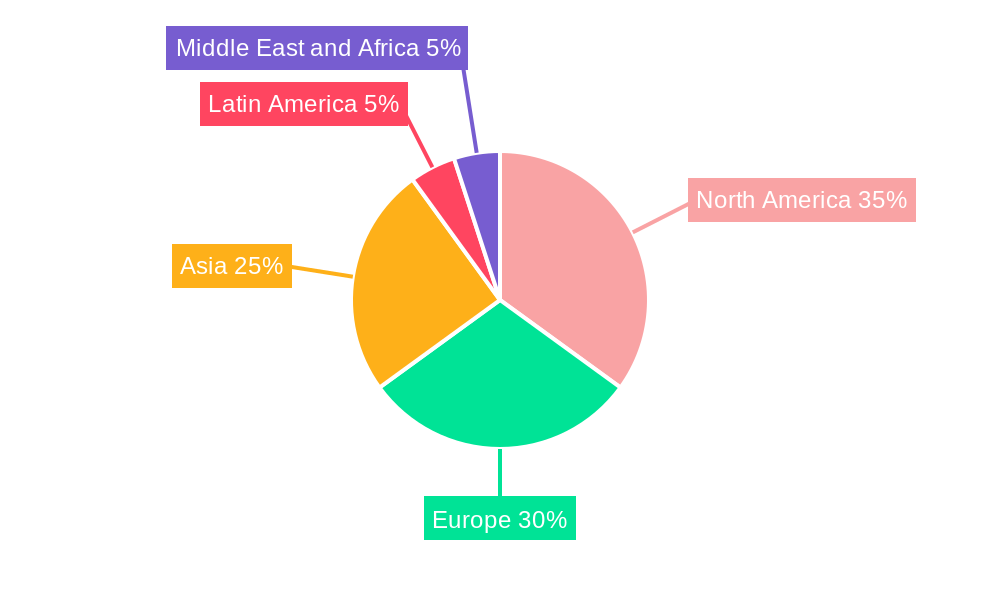

The geographical distribution of the DTG printing market reveals a substantial presence across North America, Europe, and Asia, with China and the United States being significant contributors. The market's future growth hinges on several factors including the continued adoption of sustainable and eco-friendly printing technologies, advancements in digital ink formulations, and increasing consumer awareness of personalized products. Challenges may include the relatively higher initial investment cost associated with DTG printers compared to traditional screen printing methods and the need for skilled operators. However, the overall market outlook remains optimistic, with the continued growth of e-commerce and the rising demand for customized products likely to propel market expansion throughout the forecast period (2025-2033). Competitive landscape analysis would reveal further strategic nuances across various players' market shares and competitive advantages, impacting overall market growth.

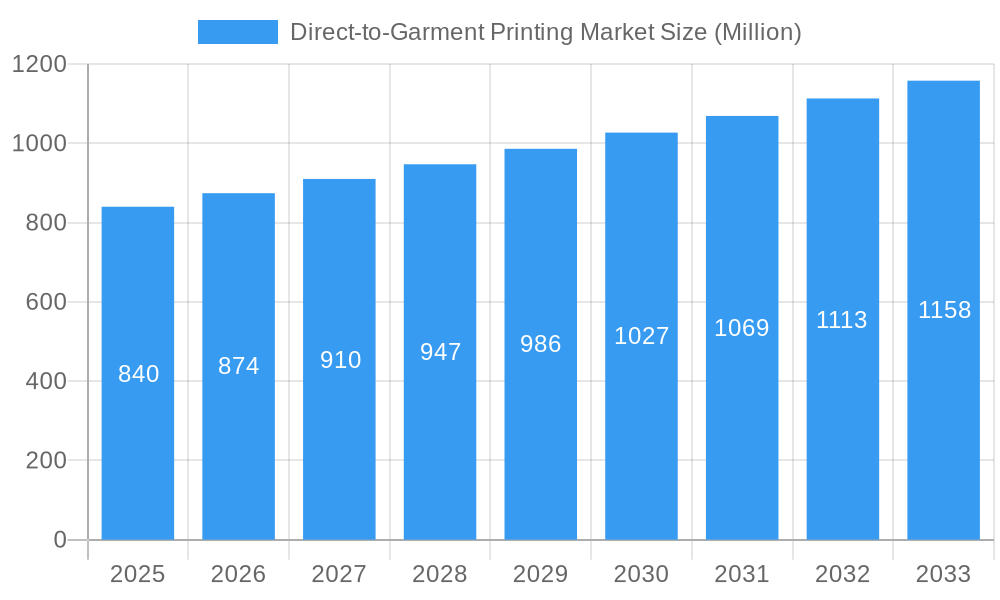

Direct-to-Garment Printing Market Company Market Share

Direct-to-Garment (D2G) Printing Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Direct-to-Garment (D2G) printing market, offering invaluable insights for businesses, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market size, segmentation, competitive landscape, technological advancements, and future growth prospects. The report leverages extensive data analysis and expert insights to provide a clear and actionable understanding of this dynamic market. Explore key trends, opportunities, and challenges within the D2G printing sector, enabling informed decision-making and strategic planning.

Direct-to-Garment Printing Market Market Structure & Competitive Landscape

The Direct-to-Garment (D2G) printing market presents a moderately consolidated structure, characterized by several key players holding substantial market shares. While precise figures require confidential data, the Herfindahl-Hirschman Index (HHI) for 2024 suggests a moderately competitive landscape, fostering innovation and strategic maneuvering among market participants. This dynamic environment is driven by continuous investment in cutting-edge printing technologies, eco-friendly inks, and diverse substrates. Regulatory factors, especially environmental regulations and ink composition standards, exert significant influence on market operations. Traditional alternatives like screen printing and embroidery remain competitive, yet D2G's inherent advantages in personalization and rapid turnaround times are steadily shifting market preference.

End-user segmentation is critical, with the Clothing and Apparel sector commanding the largest market share (approximately [Insert Percentage]% ). Mergers and Acquisitions (M&A) activity has shown moderate growth in recent years, with [Insert Number] M&A deals recorded between 2019 and 2024. These transactions predominantly focus on bolstering technological capabilities and extending market reach. Key players are actively strategizing to capitalize on the burgeoning potential of personalized and on-demand printing. A detailed competitive analysis reveals concentration ratios, market share distribution among major players, and the impact of collaborative partnerships and strategic alliances.

Direct-to-Garment Printing Market Market Trends & Opportunities

The D2G printing market demonstrates robust growth, projecting a Compound Annual Growth Rate (CAGR) of [Insert Percentage]% from 2025 to 2033. The market size is estimated at [Insert Amount] Million in 2025 and is anticipated to reach [Insert Amount] Million by 2033. This remarkable expansion is fueled by several key trends. Significant technological advancements, such as higher-resolution printing technologies and environmentally conscious inks, are enhancing print quality and sustainability. The surging demand for personalized and customized apparel and home décor significantly boosts market adoption. E-commerce expansion and the proliferation of online print-on-demand services serve as powerful catalysts. Consumer preferences are increasingly shifting towards unique, customized products, thereby stimulating demand for D2G printing solutions. The competitive landscape is defined by relentless innovation, product differentiation, and strategic partnerships. The market penetration rate of D2G printing within the apparel industry is steadily increasing, projected to reach [Insert Percentage]% by 2033.

Dominant Markets & Segments in Direct-to-Garment Printing Market

The Clothing and Apparel application segment reigns supreme in the D2G printing market, holding the largest market share (approximately [Insert Percentage]% ). Among substrates, Cotton retains a leading position due to its extensive use in apparel manufacturing. Reactive inks maintain a significant share of the ink segment, owing to their superior colorfastness and suitability for cotton fabrics. North America and Europe currently lead in market adoption, driven by robust demand from the fashion and home décor sectors. However, emerging markets in Asia and Latin America present significant untapped potential for future growth.

Key Growth Drivers:

- Developed economies: High disposable incomes and a growing consumer preference for personalized and unique products.

- Emerging economies: Rapid expansion of the fashion industry and a burgeoning middle class with increased purchasing power.

- Technological advancements: Continuous development of high-speed, high-resolution printers, eco-friendly inks, and innovative substrate options.

- Government initiatives: Supportive policies and incentives aimed at fostering growth within the textile and apparel industry in several key regions.

- Sustainability Concerns: Growing consumer demand for eco-friendly and ethically produced apparel is driving the adoption of sustainable DTG printing methods.

Direct-to-Garment Printing Market Product Analysis

Recent innovations in D2G printing include advancements in ink technology, resulting in improved color gamut, durability, and wash fastness. New printer models offer higher print speeds and resolutions, enabling efficient and high-quality production. The integration of automation and software solutions enhances the workflow, simplifying the printing process. These advancements are catering to the market's growing demand for speed, efficiency, and high-quality personalized garments and textiles. The market fit of these innovative solutions is excellent, addressing the demand for both on-demand printing and mass customization.

Key Drivers, Barriers & Challenges in Direct-to-Garment Printing Market

Key Drivers: The rising demand for personalized products, the increasing popularity of e-commerce and online print-on-demand services, and technological advancements in printing technology are major drivers of market growth. Moreover, the growth of the fashion and home décor industries contributes significantly.

Challenges: High initial investment costs for D2G printers can pose a barrier for entry. Competition from traditional printing methods and concerns regarding ink sustainability and environmental regulations present ongoing challenges. Supply chain disruptions and the availability of skilled labor can also impact market growth.

Growth Drivers in the Direct-to-Garment Printing Market Market

The escalating demand for customized apparel and home décor items is a primary growth driver. Continuous technological advancements, such as the development of faster and higher-resolution printers, further propel market growth. Government initiatives promoting sustainable manufacturing practices and the ever-expanding e-commerce sector also contribute significantly to market expansion. Furthermore, the increasing focus on on-demand manufacturing and reduced inventory levels is creating new opportunities for DTG printing businesses.

Challenges Impacting Direct-to-Garment Printing Market Growth

High capital expenditure for equipment is a major barrier, particularly for small and medium-sized enterprises. The complexity of ink management and environmental regulations pose challenges. Competition from other printing technologies and the fluctuation in raw material prices also impact growth.

Key Players Shaping the Direct-to-Garment Printing Market Market

- Ricoh Company Ltd

- Brother International Corporation

- GROUP ROQ (S Roque- Maquinas e Tecnologia Laser SA Group)

- The M&R Companies

- Mimaki Engineering Co Ltd

- Kornit Digital Ltd

- Foshan Nuowei Digital Printing Equipment Co Ltd

- Seiko Epson Corporation

- Xin Flyin

- aeoon Technologies GmbH

Significant Direct-to-Garment Printing Market Industry Milestones

- January 2024: Kornit Digital Ltd launched the Apollo direct-to-garment platform, capable of decorating over 1.5 Million garments annually, significantly reducing lead times and production costs.

- April 2024: Stratasys Ltd launched its Direct-to-Garment (D2G) solution, catering to the growing demand for personalized fashion and expanding the range of customizable fabrics to include cotton, polyester, denim, and linen.

- [Add other significant milestones with dates and details]

Future Outlook for Direct-to-Garment Printing Market Market

The D2G printing market is poised for continued expansion, driven by ongoing technological innovation, the increasing demand for personalized products, and the growth of the e-commerce sector. Strategic partnerships between printer manufacturers and apparel brands will further accelerate market penetration. The market presents significant opportunities for businesses that can leverage technological advancements and cater to the evolving consumer preferences for unique and customized products.

Direct-to-Garment Printing Market Segmentation

-

1. Substrate

- 1.1. Cotton

- 1.2. Silk

- 1.3. Polyester

- 1.4. Other Substrates

-

2. Ink

- 2.1. Reactive

- 2.2. Acid

- 2.3. Other Inks

-

3. Application

- 3.1. Clothing and Apparel

- 3.2. Home Decor

- 3.3. Technical Textiles

- 3.4. Other Applications

Direct-to-Garment Printing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia and New Zealand

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Argentina

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. United Arab Emirates

Direct-to-Garment Printing Market Regional Market Share

Geographic Coverage of Direct-to-Garment Printing Market

Direct-to-Garment Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Small-volume Printing Capabilities and Trend for On-demand Gateway; Growing Trend for Home Decor among Consumers

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Rising Demand for Specific Volume Printing Capabilities and the Emergence of On-demand Printing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Substrate

- 5.1.1. Cotton

- 5.1.2. Silk

- 5.1.3. Polyester

- 5.1.4. Other Substrates

- 5.2. Market Analysis, Insights and Forecast - by Ink

- 5.2.1. Reactive

- 5.2.2. Acid

- 5.2.3. Other Inks

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Clothing and Apparel

- 5.3.2. Home Decor

- 5.3.3. Technical Textiles

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Substrate

- 6. North America Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Substrate

- 6.1.1. Cotton

- 6.1.2. Silk

- 6.1.3. Polyester

- 6.1.4. Other Substrates

- 6.2. Market Analysis, Insights and Forecast - by Ink

- 6.2.1. Reactive

- 6.2.2. Acid

- 6.2.3. Other Inks

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Clothing and Apparel

- 6.3.2. Home Decor

- 6.3.3. Technical Textiles

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Substrate

- 7. Europe Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Substrate

- 7.1.1. Cotton

- 7.1.2. Silk

- 7.1.3. Polyester

- 7.1.4. Other Substrates

- 7.2. Market Analysis, Insights and Forecast - by Ink

- 7.2.1. Reactive

- 7.2.2. Acid

- 7.2.3. Other Inks

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Clothing and Apparel

- 7.3.2. Home Decor

- 7.3.3. Technical Textiles

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Substrate

- 8. Asia Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Substrate

- 8.1.1. Cotton

- 8.1.2. Silk

- 8.1.3. Polyester

- 8.1.4. Other Substrates

- 8.2. Market Analysis, Insights and Forecast - by Ink

- 8.2.1. Reactive

- 8.2.2. Acid

- 8.2.3. Other Inks

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Clothing and Apparel

- 8.3.2. Home Decor

- 8.3.3. Technical Textiles

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Substrate

- 9. Latin America Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Substrate

- 9.1.1. Cotton

- 9.1.2. Silk

- 9.1.3. Polyester

- 9.1.4. Other Substrates

- 9.2. Market Analysis, Insights and Forecast - by Ink

- 9.2.1. Reactive

- 9.2.2. Acid

- 9.2.3. Other Inks

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Clothing and Apparel

- 9.3.2. Home Decor

- 9.3.3. Technical Textiles

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Substrate

- 10. Middle East and Africa Direct-to-Garment Printing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Substrate

- 10.1.1. Cotton

- 10.1.2. Silk

- 10.1.3. Polyester

- 10.1.4. Other Substrates

- 10.2. Market Analysis, Insights and Forecast - by Ink

- 10.2.1. Reactive

- 10.2.2. Acid

- 10.2.3. Other Inks

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Clothing and Apparel

- 10.3.2. Home Decor

- 10.3.3. Technical Textiles

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Substrate

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ricoh Company Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Brother International Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GROUP ROQ (S Roque- Maquinas e Tecnologia Laser SA Group)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The M&R Companies

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mimaki Engineering Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kornit Digital Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Foshan Nuowei Digital Printing Equipment Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seiko Epson Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xin Flyin

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 aeoon Technologies GmbH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ricoh Company Ltd

List of Figures

- Figure 1: Global Direct-to-Garment Printing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Direct-to-Garment Printing Market Revenue (Million), by Substrate 2025 & 2033

- Figure 3: North America Direct-to-Garment Printing Market Revenue Share (%), by Substrate 2025 & 2033

- Figure 4: North America Direct-to-Garment Printing Market Revenue (Million), by Ink 2025 & 2033

- Figure 5: North America Direct-to-Garment Printing Market Revenue Share (%), by Ink 2025 & 2033

- Figure 6: North America Direct-to-Garment Printing Market Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Direct-to-Garment Printing Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Direct-to-Garment Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Direct-to-Garment Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Direct-to-Garment Printing Market Revenue (Million), by Substrate 2025 & 2033

- Figure 11: Europe Direct-to-Garment Printing Market Revenue Share (%), by Substrate 2025 & 2033

- Figure 12: Europe Direct-to-Garment Printing Market Revenue (Million), by Ink 2025 & 2033

- Figure 13: Europe Direct-to-Garment Printing Market Revenue Share (%), by Ink 2025 & 2033

- Figure 14: Europe Direct-to-Garment Printing Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Europe Direct-to-Garment Printing Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Direct-to-Garment Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Direct-to-Garment Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Direct-to-Garment Printing Market Revenue (Million), by Substrate 2025 & 2033

- Figure 19: Asia Direct-to-Garment Printing Market Revenue Share (%), by Substrate 2025 & 2033

- Figure 20: Asia Direct-to-Garment Printing Market Revenue (Million), by Ink 2025 & 2033

- Figure 21: Asia Direct-to-Garment Printing Market Revenue Share (%), by Ink 2025 & 2033

- Figure 22: Asia Direct-to-Garment Printing Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Asia Direct-to-Garment Printing Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Asia Direct-to-Garment Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Direct-to-Garment Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Direct-to-Garment Printing Market Revenue (Million), by Substrate 2025 & 2033

- Figure 27: Latin America Direct-to-Garment Printing Market Revenue Share (%), by Substrate 2025 & 2033

- Figure 28: Latin America Direct-to-Garment Printing Market Revenue (Million), by Ink 2025 & 2033

- Figure 29: Latin America Direct-to-Garment Printing Market Revenue Share (%), by Ink 2025 & 2033

- Figure 30: Latin America Direct-to-Garment Printing Market Revenue (Million), by Application 2025 & 2033

- Figure 31: Latin America Direct-to-Garment Printing Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Latin America Direct-to-Garment Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Direct-to-Garment Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Direct-to-Garment Printing Market Revenue (Million), by Substrate 2025 & 2033

- Figure 35: Middle East and Africa Direct-to-Garment Printing Market Revenue Share (%), by Substrate 2025 & 2033

- Figure 36: Middle East and Africa Direct-to-Garment Printing Market Revenue (Million), by Ink 2025 & 2033

- Figure 37: Middle East and Africa Direct-to-Garment Printing Market Revenue Share (%), by Ink 2025 & 2033

- Figure 38: Middle East and Africa Direct-to-Garment Printing Market Revenue (Million), by Application 2025 & 2033

- Figure 39: Middle East and Africa Direct-to-Garment Printing Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Middle East and Africa Direct-to-Garment Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Direct-to-Garment Printing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 2: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 3: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 6: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 7: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 12: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 13: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 20: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 21: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: China Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia and New Zealand Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 28: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 29: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 30: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Brazil Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Mexico Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Substrate 2020 & 2033

- Table 35: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Ink 2020 & 2033

- Table 36: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 37: Global Direct-to-Garment Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Saudi Arabia Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: South Africa Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: United Arab Emirates Direct-to-Garment Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Direct-to-Garment Printing Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the Direct-to-Garment Printing Market?

Key companies in the market include Ricoh Company Ltd, Brother International Corporation, GROUP ROQ (S Roque- Maquinas e Tecnologia Laser SA Group), The M&R Companies, Mimaki Engineering Co Ltd, Kornit Digital Ltd, Foshan Nuowei Digital Printing Equipment Co Ltd, Seiko Epson Corporation, Xin Flyin, aeoon Technologies GmbH.

3. What are the main segments of the Direct-to-Garment Printing Market?

The market segments include Substrate, Ink, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Small-volume Printing Capabilities and Trend for On-demand Gateway; Growing Trend for Home Decor among Consumers.

6. What are the notable trends driving market growth?

Rising Demand for Specific Volume Printing Capabilities and the Emergence of On-demand Printing.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

April 2024: Stratasys Ltd announced the launch of the Direct-to-Garment (D2G) solution. The launch of a new solution will help the company cater to the growing need for customization and personalization fashion. The D2G solution is ideal for customizing and personalizing various fabric types, including cotton, polyester, denim, and linen, allowing the brands to facilitate personalized and bespoke designs for customers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Direct-to-Garment Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Direct-to-Garment Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Direct-to-Garment Printing Market?

To stay informed about further developments, trends, and reports in the Direct-to-Garment Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence