Key Insights

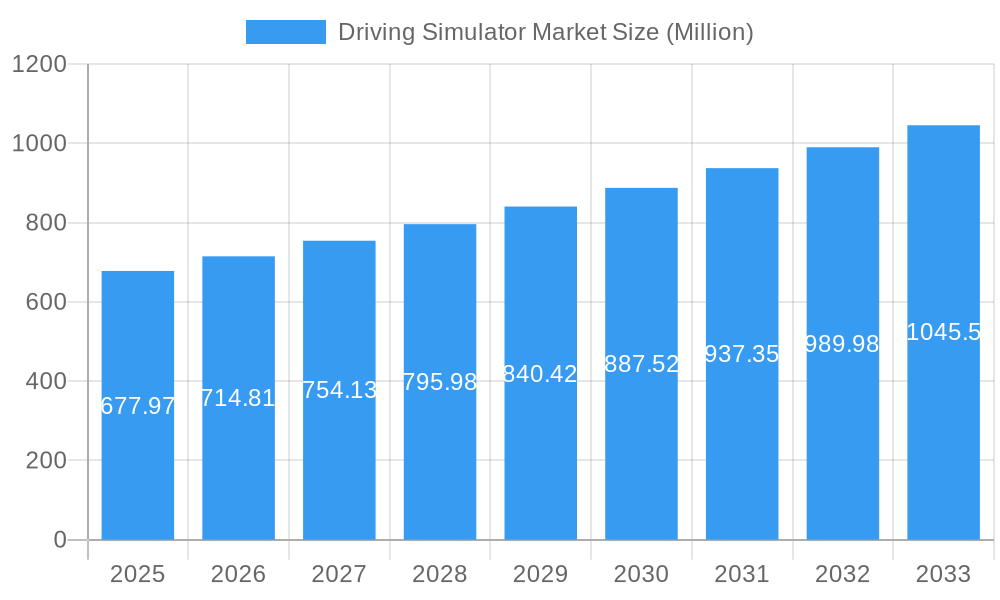

The global driving simulator market, valued at $677.97 million in 2025, is projected to experience robust growth, driven by the increasing demand for advanced driver-assistance systems (ADAS) and autonomous vehicle (AV) development. The market's Compound Annual Growth Rate (CAGR) of 5.27% from 2025 to 2033 reflects a consistent need for realistic and safe testing environments. Key growth drivers include the stringent safety regulations imposed on vehicle manufacturers, the rising need for efficient and cost-effective training programs for drivers, and the burgeoning adoption of simulation technology across various sectors like automotive research and development. The market segmentation reveals a strong preference for full-scale simulators due to their enhanced realism and capability to replicate diverse driving scenarios, while the passenger car segment dominates the vehicle type category, reflecting the current focus on passenger vehicle safety and automation. Growth will be fueled further by technological advancements in simulator hardware and software, leading to higher fidelity simulations and improved data analysis capabilities. Geographic expansion, particularly in rapidly developing economies in Asia-Pacific, will contribute significantly to overall market expansion.

Driving Simulator Market Market Size (In Million)

However, the market faces certain restraints. High initial investment costs associated with simulator procurement and maintenance can pose a challenge, especially for smaller companies and research institutions. The complexity of simulator technology and the need for specialized expertise to operate and maintain these systems also present potential barriers to entry. Furthermore, the continuous evolution of automotive technology necessitates frequent updates and upgrades to simulators, adding to operational expenses. Despite these challenges, the long-term outlook remains positive, with the market expected to benefit from increasing collaborations between simulator manufacturers, automotive companies, and research institutions, fostering innovation and driving broader adoption. The ongoing advancements in virtual reality (VR) and artificial intelligence (AI) technologies are expected to play a critical role in further enhancing the capabilities and applications of driving simulators in the coming years.

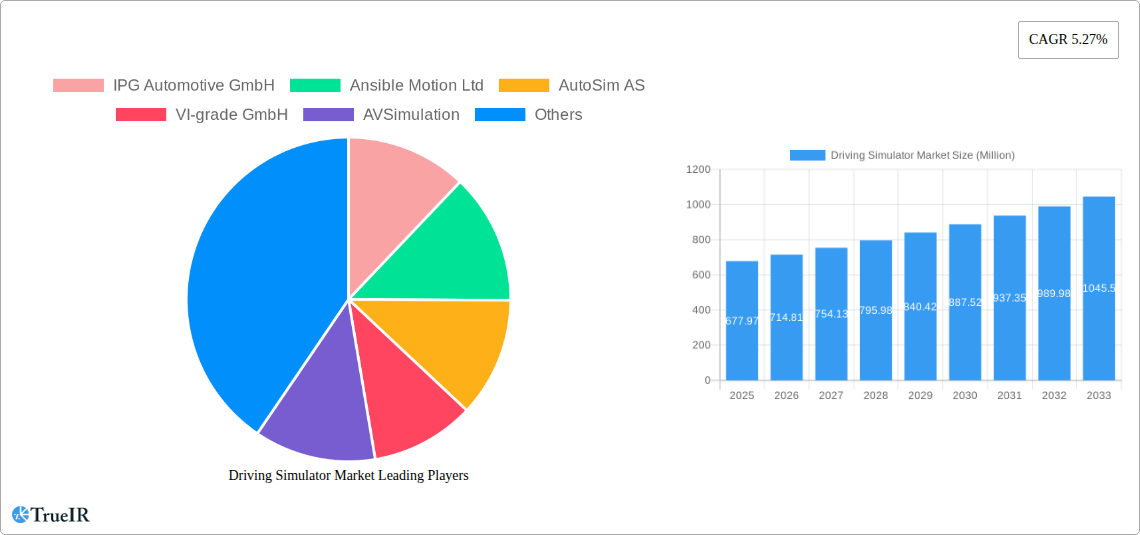

Driving Simulator Market Company Market Share

Driving Simulator Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Driving Simulator Market, encompassing market size, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for businesses, investors, and researchers seeking to understand and capitalize on opportunities within this dynamic sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

Driving Simulator Market Structure & Competitive Landscape

The Driving Simulator market exhibits a moderately consolidated structure, with key players vying for market share through innovation and strategic partnerships. The market concentration ratio (CR5) is estimated at xx%, indicating the presence of several significant players. However, the market is also characterized by the emergence of smaller, specialized firms focusing on niche applications and advanced technologies.

Innovation Drivers: The primary drivers of innovation include advancements in simulation software, hardware capabilities (e.g., haptic feedback systems, high-fidelity graphics), and the increasing demand for realistic driving simulations across various applications.

Regulatory Impacts: Government regulations concerning driver training, vehicle safety testing, and autonomous vehicle development significantly influence market growth. Stringent safety standards and emission regulations are prompting the adoption of driving simulators for comprehensive testing and validation.

Product Substitutes: While traditional on-road testing remains prevalent, driving simulators are increasingly seen as a cost-effective and safer alternative. However, the accuracy and realism of simulators are critical factors influencing their adoption rate.

End-User Segmentation: The market is segmented by application (training, testing, and research), simulator type (compact, full-scale, advanced), and vehicle type (passenger car, commercial vehicle). The training segment currently holds the largest market share, driven by the rising demand for effective driver training programs.

M&A Trends: The number of mergers and acquisitions (M&A) in the driving simulator market has been relatively moderate (xx deals in the past five years). These activities are primarily driven by companies seeking to expand their product portfolio, acquire specialized technologies, and enhance their market presence.

Driving Simulator Market Market Trends & Opportunities

The global driving simulator market is experiencing significant growth, driven by several key factors. The market size is projected to expand substantially, reaching xx Million by 2033. This growth is fueled by several interconnected trends, including:

- Technological advancements: The integration of advanced technologies, such as artificial intelligence (AI), virtual reality (VR), and haptic feedback systems, is enhancing the realism and effectiveness of driving simulators. This is leading to wider adoption across various industries.

- Rising demand for driver training: The increasing number of vehicles on the road and concerns about road safety are boosting the demand for effective driver training programs, which often incorporate driving simulators.

- Growing need for autonomous vehicle testing: The rapid development of autonomous driving technology is creating a significant demand for driving simulators to test and validate autonomous vehicle systems in a safe and controlled environment.

- Stringent vehicle safety regulations: Governments worldwide are implementing stricter vehicle safety regulations, prompting manufacturers to utilize driving simulators for rigorous testing and validation processes.

- Cost-effectiveness and efficiency: Driving simulators offer a cost-effective alternative to traditional on-road testing, reducing expenses associated with fuel, insurance, and potential vehicle damage. The efficiency gains are also significant, enabling faster testing cycles.

The market penetration rate for driving simulators is expected to increase significantly in the coming years, driven by the above-mentioned trends. The CAGR for the forecast period is estimated at xx%.

Dominant Markets & Segments in Driving Simulator Market

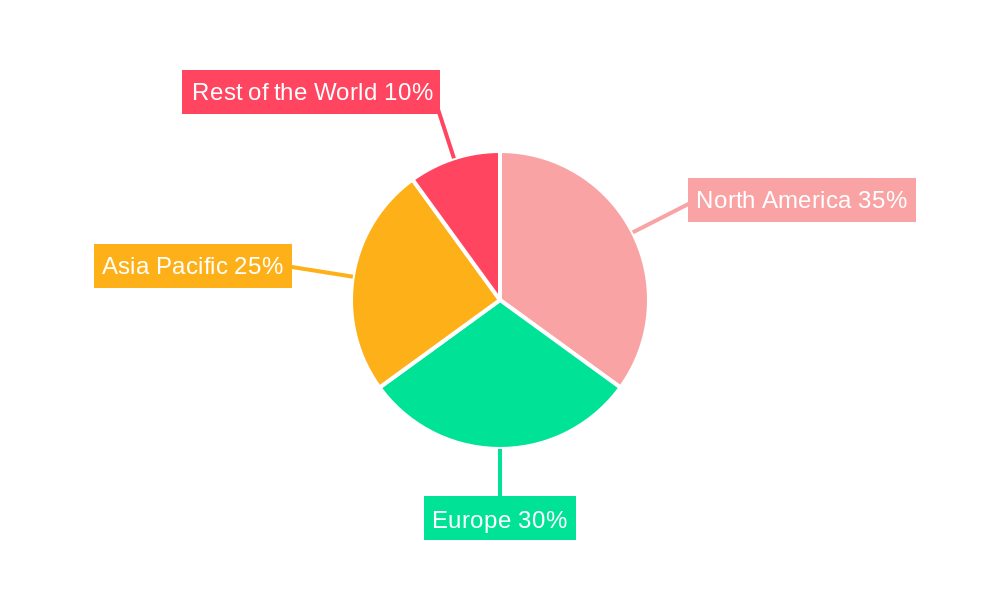

The North American region currently dominates the global driving simulator market, followed by Europe and Asia-Pacific. Within these regions, specific countries such as the United States, Germany, and Japan show strong market presence.

By Application Type:

- Training: The training segment is the largest and fastest-growing, driven by increased demand for professional driver training and the rising adoption of simulators in driving schools.

- Testing and Research: The testing and research segment is also experiencing substantial growth, driven by the increasing need for rigorous vehicle testing and the development of advanced driver-assistance systems (ADAS).

By Simulator Type:

- Full-scale Simulators: These simulators offer the highest level of realism and are widely used for advanced testing and research applications. Their high cost, however, limits their widespread adoption.

- Compact Simulators: The compact simulator segment is experiencing rapid growth due to its cost-effectiveness and suitability for various applications, including driver training.

- Advanced Simulators: These simulators incorporate the latest technologies, such as AI and VR, to provide highly realistic and immersive driving experiences. Market growth is driven by increased research and development in the automotive industry.

By Vehicle Type:

- Passenger Cars: The passenger car segment dominates the market, driven by the significant demand for driver training and vehicle testing.

- Commercial Vehicles: The commercial vehicle segment is also experiencing growth, particularly in regions with a strong focus on enhancing the safety of commercial drivers.

Key Growth Drivers:

- Government initiatives and investments: Government funding and support for research and development in the automotive industry are boosting the adoption of driving simulators.

- Technological advancements: Continuous innovation in simulation technologies is enhancing the realism, accuracy, and functionality of driving simulators.

- Increasing awareness of road safety: Growing awareness of road safety among the public is leading to increased demand for driver training programs.

Driving Simulator Market Product Analysis

Driving simulator technology is constantly evolving, incorporating advanced graphics, haptic feedback, and AI-powered functionalities to deliver highly realistic and immersive driving experiences. The market offers a range of products catering to different needs and budgets, from compact simulators ideal for driver training to highly sophisticated systems used for advanced research and development. Competitive advantages are based on factors such as simulation fidelity, cost-effectiveness, ease of use, and integration with other systems. The continuous improvement in simulation software and hardware is a key factor driving the market's growth and competitiveness.

Key Drivers, Barriers & Challenges in Driving Simulator Market

Key Drivers:

The market's growth is primarily propelled by the rising demand for driver training and the increasing need for safe and efficient vehicle testing and development, particularly in the context of autonomous driving technologies. Technological advancements, such as AI and VR, are also significant drivers. Government regulations promoting road safety further fuel market expansion.

Challenges and Restraints:

High initial investment costs for advanced simulators can be a barrier to entry for smaller companies. The complexity of simulator technology and the need for specialized expertise can also limit market penetration. Furthermore, ensuring the accuracy and realism of simulations remains a key challenge, as does maintaining and updating the simulator hardware and software over time. Competition among established players and the emergence of new entrants further complicate the market landscape.

Growth Drivers in the Driving Simulator Market Market

Technological advancements in VR/AR, AI, and haptic feedback systems are key drivers. The increasing need for effective driver training and autonomous vehicle testing, coupled with stringent safety regulations, fuels demand. Government initiatives promoting road safety and research funding also contribute significantly to market expansion.

Challenges Impacting Driving Simulator Market Growth

High initial investment costs, the need for specialized expertise, and the ongoing maintenance and software updates create significant challenges. Competition from established players and new entrants, along with the need to ensure accurate and realistic simulations, further impact growth. Supply chain disruptions can also cause delays and increase costs.

Key Players Shaping the Driving Simulator Market Market

- IPG Automotive GmbH

- Ansible Motion Ltd

- AutoSim AS

- VI-grade GmbH

- AVSimulation

- XPI Simulation

- Cruden BV

- Virage Simulation

- Tecknotrove Simulator System Pvt Ltd

- FAAC Incorporate

- AB Dynamics PLC

Significant Driving Simulator Market Industry Milestones

- May 2023: BharatBenz launches India's first truck driver training simulator.

- December 2022: Tecknotrove Simulator System Pvt. Ltd launches the TechnoSIM forklift training simulator.

- June 2022: Continental AG joins the CITY project for automated driving solutions.

- April 2022: VI-grade installs a compact simulator at Ford's Nanjing center.

- March 2021: Volvo Group and NVIDIA partner to develop autonomous vehicle systems.

Future Outlook for Driving Simulator Market Market

The driving simulator market is poised for substantial growth, driven by ongoing technological advancements, the increasing demand for autonomous vehicle testing, and stricter safety regulations. Strategic partnerships, acquisitions, and the development of innovative simulation technologies will further shape the market landscape. The market presents significant opportunities for companies that can deliver high-fidelity, cost-effective, and user-friendly simulation solutions.

Driving Simulator Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Car

- 1.2. Commercial Vehicle

-

2. Application Type

- 2.1. Training

- 2.2. Testing and Research

-

3. Simulator Type

- 3.1. Compact Simulator

- 3.2. Full-scale Simulator

- 3.3. Advanced Simulator

Driving Simulator Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Driving Simulator Market Regional Market Share

Geographic Coverage of Driving Simulator Market

Driving Simulator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Investments in Infrastructure Deployment

- 3.3. Market Restrains

- 3.3.1. Rapid Expansion of Construction Equipment Rental Services Across the Region

- 3.4. Market Trends

- 3.4.1. Autonomous Vehicle Acts as a Growth Engine for the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Driving Simulator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Car

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Training

- 5.2.2. Testing and Research

- 5.3. Market Analysis, Insights and Forecast - by Simulator Type

- 5.3.1. Compact Simulator

- 5.3.2. Full-scale Simulator

- 5.3.3. Advanced Simulator

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Driving Simulator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Car

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Training

- 6.2.2. Testing and Research

- 6.3. Market Analysis, Insights and Forecast - by Simulator Type

- 6.3.1. Compact Simulator

- 6.3.2. Full-scale Simulator

- 6.3.3. Advanced Simulator

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Driving Simulator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Car

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Training

- 7.2.2. Testing and Research

- 7.3. Market Analysis, Insights and Forecast - by Simulator Type

- 7.3.1. Compact Simulator

- 7.3.2. Full-scale Simulator

- 7.3.3. Advanced Simulator

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Driving Simulator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Car

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Training

- 8.2.2. Testing and Research

- 8.3. Market Analysis, Insights and Forecast - by Simulator Type

- 8.3.1. Compact Simulator

- 8.3.2. Full-scale Simulator

- 8.3.3. Advanced Simulator

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Driving Simulator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Car

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Training

- 9.2.2. Testing and Research

- 9.3. Market Analysis, Insights and Forecast - by Simulator Type

- 9.3.1. Compact Simulator

- 9.3.2. Full-scale Simulator

- 9.3.3. Advanced Simulator

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 IPG Automotive GmbH

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Ansible Motion Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 AutoSim AS

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 VI-grade GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 AVSimulation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 XPI Simulation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cruden BV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Virage Simulation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tecknotrove Simulator System Pvt Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 FAAC Incorporate

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 AB Dynamics PLC

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 IPG Automotive GmbH

List of Figures

- Figure 1: Global Driving Simulator Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Driving Simulator Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 3: North America Driving Simulator Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Driving Simulator Market Revenue (Million), by Application Type 2025 & 2033

- Figure 5: North America Driving Simulator Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Driving Simulator Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 7: North America Driving Simulator Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 8: North America Driving Simulator Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Driving Simulator Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Driving Simulator Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Driving Simulator Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Driving Simulator Market Revenue (Million), by Application Type 2025 & 2033

- Figure 13: Europe Driving Simulator Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: Europe Driving Simulator Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 15: Europe Driving Simulator Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 16: Europe Driving Simulator Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Driving Simulator Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Driving Simulator Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Driving Simulator Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Driving Simulator Market Revenue (Million), by Application Type 2025 & 2033

- Figure 21: Asia Pacific Driving Simulator Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Asia Pacific Driving Simulator Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 23: Asia Pacific Driving Simulator Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 24: Asia Pacific Driving Simulator Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Driving Simulator Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Driving Simulator Market Revenue (Million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Driving Simulator Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Driving Simulator Market Revenue (Million), by Application Type 2025 & 2033

- Figure 29: Rest of the World Driving Simulator Market Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Rest of the World Driving Simulator Market Revenue (Million), by Simulator Type 2025 & 2033

- Figure 31: Rest of the World Driving Simulator Market Revenue Share (%), by Simulator Type 2025 & 2033

- Figure 32: Rest of the World Driving Simulator Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Rest of the World Driving Simulator Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Driving Simulator Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Driving Simulator Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 3: Global Driving Simulator Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 4: Global Driving Simulator Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Driving Simulator Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Driving Simulator Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 7: Global Driving Simulator Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 8: Global Driving Simulator Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Driving Simulator Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Driving Simulator Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 14: Global Driving Simulator Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 15: Global Driving Simulator Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Germany Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: France Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Driving Simulator Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 21: Global Driving Simulator Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 22: Global Driving Simulator Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 23: Global Driving Simulator Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: India Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Driving Simulator Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 30: Global Driving Simulator Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 31: Global Driving Simulator Market Revenue Million Forecast, by Simulator Type 2020 & 2033

- Table 32: Global Driving Simulator Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Arab Emirates Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Other Countries Driving Simulator Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Driving Simulator Market?

The projected CAGR is approximately 5.27%.

2. Which companies are prominent players in the Driving Simulator Market?

Key companies in the market include IPG Automotive GmbH, Ansible Motion Ltd, AutoSim AS, VI-grade GmbH, AVSimulation, XPI Simulation, Cruden BV, Virage Simulation, Tecknotrove Simulator System Pvt Ltd, FAAC Incorporate, AB Dynamics PLC.

3. What are the main segments of the Driving Simulator Market?

The market segments include Vehicle Type, Application Type, Simulator Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 677.97 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Investments in Infrastructure Deployment.

6. What are the notable trends driving market growth?

Autonomous Vehicle Acts as a Growth Engine for the Market.

7. Are there any restraints impacting market growth?

Rapid Expansion of Construction Equipment Rental Services Across the Region.

8. Can you provide examples of recent developments in the market?

In May 2023, BharatBenz launches India's first truck driver training simulator. Daimler India Commercial Vehicles (DICV), the parent company of BharatBenz, has launched a truck driver training simulator specifically designed for heavy truck drivers, in a first for the Indian market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Driving Simulator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Driving Simulator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Driving Simulator Market?

To stay informed about further developments, trends, and reports in the Driving Simulator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence