Key Insights

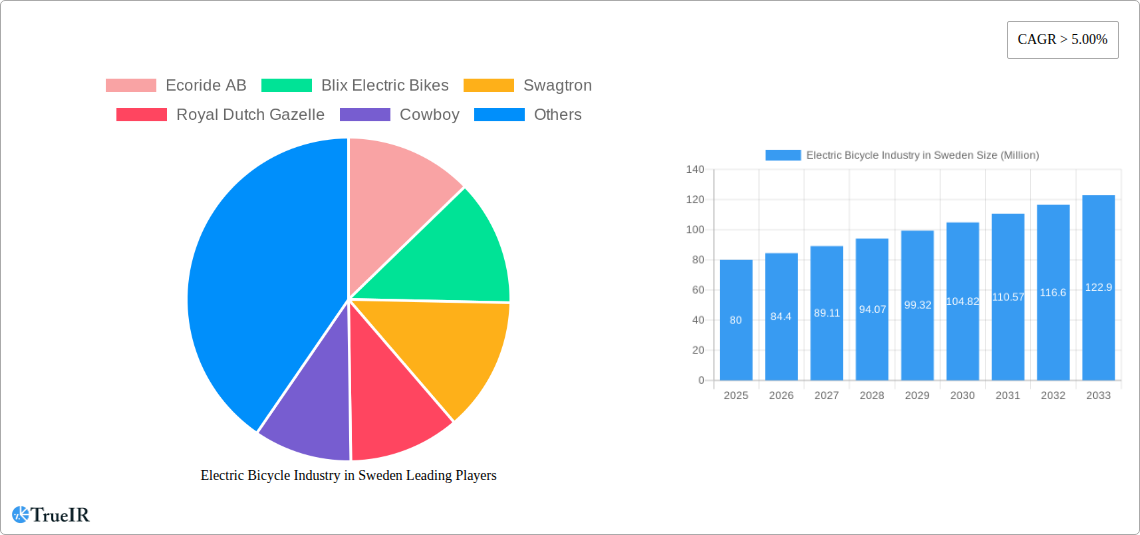

The Swedish electric bicycle market, valued at approximately €80 million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 5% from 2025 to 2033. This expansion is fueled by several key drivers. Increasing environmental awareness and government initiatives promoting sustainable transportation are significantly boosting demand. Furthermore, the rising popularity of e-bikes as a convenient and efficient mode of commuting, particularly within urban areas, is a major catalyst. The market is segmented by propulsion type (pedal-assisted, speed pedelec, throttle-assisted), application (cargo/utility, city/urban, trekking), and battery type (lead-acid, lithium-ion). Lithium-ion batteries dominate due to their superior performance and longer lifespan, driving a significant portion of market revenue. While the initial cost of electric bicycles remains a restraint for some consumers, favorable financing options and government subsidies are mitigating this challenge. The strong presence of both international and domestic players, including Ecoride AB, Blix Electric Bikes, and Giant Manufacturing Co Ltd, ensures a competitive landscape and diverse product offerings, further fueling market expansion.

Electric Bicycle Industry in Sweden Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, driven by ongoing technological advancements leading to improved battery technology, enhanced performance, and more affordable pricing. Emerging trends such as smart e-bike features, integrated connectivity, and increased customization options will cater to evolving consumer preferences and further stimulate market expansion. However, potential challenges include the need for improved charging infrastructure and addressing concerns about battery disposal and recycling. Despite these factors, the overall outlook for the Swedish electric bicycle market remains positive, positioning it for sustained growth over the next decade, primarily driven by the increasing preference for sustainable and efficient urban transportation solutions.

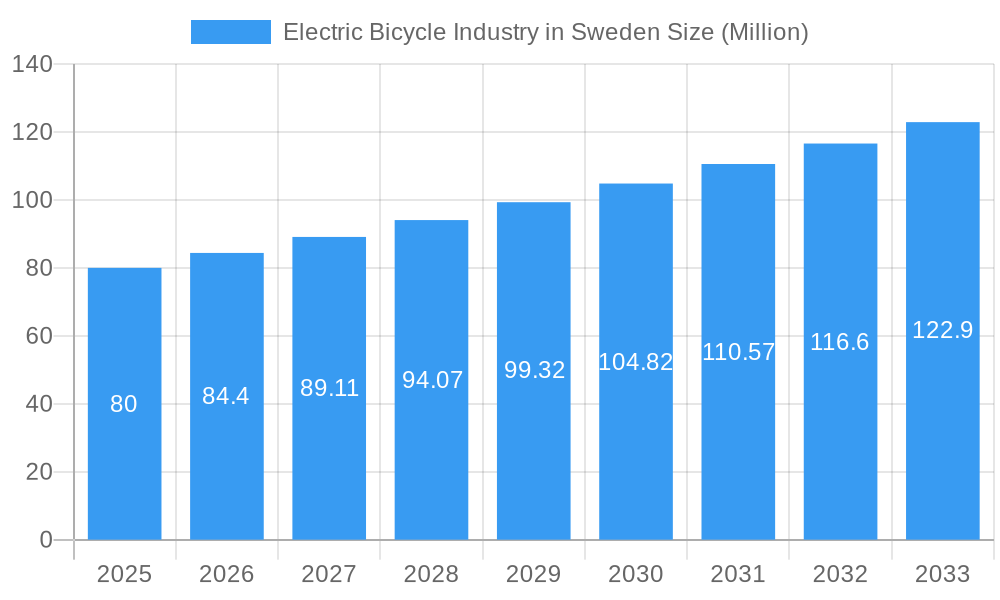

Electric Bicycle Industry in Sweden Company Market Share

Electric Bicycle Industry in Sweden: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the burgeoning electric bicycle (e-bike) industry in Sweden, covering the period 2019-2033. It examines market structure, competitive dynamics, key trends, and future growth prospects, offering invaluable insights for industry stakeholders, investors, and policymakers. The report leverages extensive data analysis and incorporates expert perspectives to provide a robust and actionable understanding of this rapidly evolving market. This report projects a market value reaching xx Million by 2033.

Electric Bicycle Industry in Sweden Market Structure & Competitive Landscape

The Swedish e-bike market exhibits a moderately concentrated structure, with several key players vying for market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately competitive landscape. Innovation is a crucial driver, with companies continuously developing new features like improved battery technology, enhanced connectivity, and stylish designs to attract consumers. Government regulations, such as safety standards and e-bike subsidies, significantly influence market growth. Product substitutes, primarily traditional bicycles and other forms of personal transportation, pose a competitive threat. The end-user segment is diverse, encompassing commuters, recreational cyclists, and cargo users. M&A activity has been relatively low in recent years, with a total transaction value of approximately xx Million between 2019 and 2024.

- Market Concentration: Moderately concentrated, HHI (2024): xx

- Innovation Drivers: Improved battery technology, connectivity features, design enhancements

- Regulatory Impacts: Safety standards, subsidies influence market growth.

- Product Substitutes: Traditional bicycles, other personal transportation modes.

- End-User Segmentation: Commuters, recreational cyclists, cargo users.

- M&A Trends: Low activity, total transaction value (2019-2024): xx Million

Electric Bicycle Industry in Sweden Market Trends & Opportunities

The Swedish e-bike market is experiencing robust growth, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Market size in 2025 is estimated at xx Million, driven by factors such as increasing environmental awareness, government incentives, and improved e-bike technology. Technological advancements, such as longer-lasting batteries and more powerful motors, are enhancing consumer appeal. Consumer preferences are shifting towards e-bikes offering enhanced connectivity, advanced safety features, and stylish designs. Competitive dynamics are characterized by fierce competition among established players and the emergence of new entrants, leading to product innovation and price reductions. Market penetration remains relatively low, with significant untapped potential for growth in urban and suburban areas.

Dominant Markets & Segments in Electric Bicycle Industry in Sweden

While data on regional dominance within Sweden is limited, the City/Urban segment is expected to dominate the e-bike market due to its suitability for commuting and urban mobility. The Lithium-ion Battery segment is also leading due to its superior performance compared to other battery types. Pedal Assisted propulsion is the most popular type, driven by its ease of use and wide applicability.

Key Growth Drivers:

- Government incentives: Subsidies and tax breaks

- Expanding charging infrastructure: Increased availability of charging stations

- Growing environmental awareness: Consumers seeking sustainable transportation options

- Improved e-bike technology: Longer battery life, powerful motors, smart features.

Dominant Segments:

- Application Type: City/Urban

- Propulsion Type: Pedal Assisted

- Battery Type: Lithium-ion Battery

Electric Bicycle Industry in Sweden Product Analysis

The Swedish e-bike market is characterized by a wide range of products catering to diverse needs and preferences. Innovation focuses on improving battery technology, enhancing connectivity features (GPS, smartphone integration), and refining designs for enhanced comfort and safety. Competitive advantages stem from superior battery life, unique design elements, advanced safety features, and integration of smart technologies. The market is seeing a rise in specialized e-bikes for cargo, commuting, and recreational use.

Key Drivers, Barriers & Challenges in Electric Bicycle Industry in Sweden

Key Drivers:

- Growing environmental consciousness and focus on sustainable transportation.

- Government initiatives promoting e-bike adoption through subsidies and infrastructure development.

- Technological advancements resulting in longer battery life, better performance, and enhanced features.

- Increasing urbanization and traffic congestion driving demand for efficient personal transport.

Challenges:

- High initial cost of e-bikes compared to traditional bicycles remains a barrier for some consumers.

- Limited charging infrastructure in certain areas can hinder wider adoption.

- Competition from established bicycle manufacturers and new entrants creates pressure on pricing and innovation.

- Concerns about battery lifespan and disposal pose environmental challenges.

Growth Drivers in the Electric Bicycle Industry in Sweden Market

The Swedish e-bike market is fueled by increasing environmental awareness, government support through subsidies and tax incentives, technological advancements in battery technology and motor efficiency, and the growing popularity of cycling as a mode of transportation. The development of dedicated cycling infrastructure further bolsters market growth.

Challenges Impacting Electric Bicycle Industry in Sweden Growth

Challenges include the high initial purchase price, limited charging infrastructure outside major urban areas, and potential concerns regarding battery disposal and recycling. Competition from other modes of transportation and the availability of cheaper alternatives also pose significant challenges.

Key Players Shaping the Electric Bicycle Industry in Sweden Market

- Ecoride AB

- Blix Electric Bikes

- Swagtron

- Royal Dutch Gazelle

- Cowboy

- Giant Manufacturing Co Ltd

- Kalkhoff Werke GmbH

- VanMoof B

- Batavus Intercycle Corporation

- Trek Bicycle Corporation

Significant Electric Bicycle Industry in Sweden Industry Milestones

- November 2022: Giant unveils the Stormguard E+, a full-suspension e-bike, for European release in 2023 (7,999 Euros for E+1, 6,499 Euros for E+2). This signifies a significant advancement in e-bike technology and targets the high-end market.

- November 2022: Ecoride AB relocates its factory to Gothenburg, Sweden, indicating a commitment to the Swedish market and potential for increased production capacity.

- August 2022: Blix Electric Bikes launches the Dubbel e-bike with a V-shaped frame and integrated storage, showcasing innovative design and functionality.

Future Outlook for Electric Bicycle Industry in Sweden Market

The Swedish e-bike market is poised for continued strong growth over the forecast period. Government support, coupled with ongoing technological advancements and increasing consumer awareness of environmental sustainability, will drive market expansion. Opportunities exist for companies to innovate in areas such as battery technology, smart features, and specialized e-bike designs to cater to diverse consumer needs. The market's potential is significant, particularly in urban areas with expanding cycling infrastructure.

Electric Bicycle Industry in Sweden Segmentation

-

1. Propulsion Type

- 1.1. Pedal Assisted

- 1.2. Speed Pedelec

- 1.3. Throttle Assisted

-

2. Application Type

- 2.1. Cargo/Utility

- 2.2. City/Urban

- 2.3. Trekking

-

3. Battery Type

- 3.1. Lead Acid Battery

- 3.2. Lithium-ion Battery

- 3.3. Others

Electric Bicycle Industry in Sweden Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Bicycle Industry in Sweden Regional Market Share

Geographic Coverage of Electric Bicycle Industry in Sweden

Electric Bicycle Industry in Sweden REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Commercial Vehicle Sales to Foster the Growth of the Market

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Interest Rates to Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Pedal Assisted

- 5.1.2. Speed Pedelec

- 5.1.3. Throttle Assisted

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Cargo/Utility

- 5.2.2. City/Urban

- 5.2.3. Trekking

- 5.3. Market Analysis, Insights and Forecast - by Battery Type

- 5.3.1. Lead Acid Battery

- 5.3.2. Lithium-ion Battery

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Pedal Assisted

- 6.1.2. Speed Pedelec

- 6.1.3. Throttle Assisted

- 6.2. Market Analysis, Insights and Forecast - by Application Type

- 6.2.1. Cargo/Utility

- 6.2.2. City/Urban

- 6.2.3. Trekking

- 6.3. Market Analysis, Insights and Forecast - by Battery Type

- 6.3.1. Lead Acid Battery

- 6.3.2. Lithium-ion Battery

- 6.3.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Pedal Assisted

- 7.1.2. Speed Pedelec

- 7.1.3. Throttle Assisted

- 7.2. Market Analysis, Insights and Forecast - by Application Type

- 7.2.1. Cargo/Utility

- 7.2.2. City/Urban

- 7.2.3. Trekking

- 7.3. Market Analysis, Insights and Forecast - by Battery Type

- 7.3.1. Lead Acid Battery

- 7.3.2. Lithium-ion Battery

- 7.3.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Pedal Assisted

- 8.1.2. Speed Pedelec

- 8.1.3. Throttle Assisted

- 8.2. Market Analysis, Insights and Forecast - by Application Type

- 8.2.1. Cargo/Utility

- 8.2.2. City/Urban

- 8.2.3. Trekking

- 8.3. Market Analysis, Insights and Forecast - by Battery Type

- 8.3.1. Lead Acid Battery

- 8.3.2. Lithium-ion Battery

- 8.3.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Pedal Assisted

- 9.1.2. Speed Pedelec

- 9.1.3. Throttle Assisted

- 9.2. Market Analysis, Insights and Forecast - by Application Type

- 9.2.1. Cargo/Utility

- 9.2.2. City/Urban

- 9.2.3. Trekking

- 9.3. Market Analysis, Insights and Forecast - by Battery Type

- 9.3.1. Lead Acid Battery

- 9.3.2. Lithium-ion Battery

- 9.3.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific Electric Bicycle Industry in Sweden Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Pedal Assisted

- 10.1.2. Speed Pedelec

- 10.1.3. Throttle Assisted

- 10.2. Market Analysis, Insights and Forecast - by Application Type

- 10.2.1. Cargo/Utility

- 10.2.2. City/Urban

- 10.2.3. Trekking

- 10.3. Market Analysis, Insights and Forecast - by Battery Type

- 10.3.1. Lead Acid Battery

- 10.3.2. Lithium-ion Battery

- 10.3.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ecoride AB

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Blix Electric Bikes

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Swagtron

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Royal Dutch Gazelle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cowboy

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Giant Manufacturing Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kalkhoff Werke GmbH

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 VanMoof B

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Batavus Intercycle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Trek Bicycle Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Ecoride AB

List of Figures

- Figure 1: Global Electric Bicycle Industry in Sweden Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electric Bicycle Industry in Sweden Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 3: North America Electric Bicycle Industry in Sweden Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 4: North America Electric Bicycle Industry in Sweden Revenue (undefined), by Application Type 2025 & 2033

- Figure 5: North America Electric Bicycle Industry in Sweden Revenue Share (%), by Application Type 2025 & 2033

- Figure 6: North America Electric Bicycle Industry in Sweden Revenue (undefined), by Battery Type 2025 & 2033

- Figure 7: North America Electric Bicycle Industry in Sweden Revenue Share (%), by Battery Type 2025 & 2033

- Figure 8: North America Electric Bicycle Industry in Sweden Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Electric Bicycle Industry in Sweden Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Electric Bicycle Industry in Sweden Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 11: South America Electric Bicycle Industry in Sweden Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 12: South America Electric Bicycle Industry in Sweden Revenue (undefined), by Application Type 2025 & 2033

- Figure 13: South America Electric Bicycle Industry in Sweden Revenue Share (%), by Application Type 2025 & 2033

- Figure 14: South America Electric Bicycle Industry in Sweden Revenue (undefined), by Battery Type 2025 & 2033

- Figure 15: South America Electric Bicycle Industry in Sweden Revenue Share (%), by Battery Type 2025 & 2033

- Figure 16: South America Electric Bicycle Industry in Sweden Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Electric Bicycle Industry in Sweden Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Electric Bicycle Industry in Sweden Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 19: Europe Electric Bicycle Industry in Sweden Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 20: Europe Electric Bicycle Industry in Sweden Revenue (undefined), by Application Type 2025 & 2033

- Figure 21: Europe Electric Bicycle Industry in Sweden Revenue Share (%), by Application Type 2025 & 2033

- Figure 22: Europe Electric Bicycle Industry in Sweden Revenue (undefined), by Battery Type 2025 & 2033

- Figure 23: Europe Electric Bicycle Industry in Sweden Revenue Share (%), by Battery Type 2025 & 2033

- Figure 24: Europe Electric Bicycle Industry in Sweden Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Electric Bicycle Industry in Sweden Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Electric Bicycle Industry in Sweden Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 27: Middle East & Africa Electric Bicycle Industry in Sweden Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 28: Middle East & Africa Electric Bicycle Industry in Sweden Revenue (undefined), by Application Type 2025 & 2033

- Figure 29: Middle East & Africa Electric Bicycle Industry in Sweden Revenue Share (%), by Application Type 2025 & 2033

- Figure 30: Middle East & Africa Electric Bicycle Industry in Sweden Revenue (undefined), by Battery Type 2025 & 2033

- Figure 31: Middle East & Africa Electric Bicycle Industry in Sweden Revenue Share (%), by Battery Type 2025 & 2033

- Figure 32: Middle East & Africa Electric Bicycle Industry in Sweden Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Electric Bicycle Industry in Sweden Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Electric Bicycle Industry in Sweden Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 35: Asia Pacific Electric Bicycle Industry in Sweden Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 36: Asia Pacific Electric Bicycle Industry in Sweden Revenue (undefined), by Application Type 2025 & 2033

- Figure 37: Asia Pacific Electric Bicycle Industry in Sweden Revenue Share (%), by Application Type 2025 & 2033

- Figure 38: Asia Pacific Electric Bicycle Industry in Sweden Revenue (undefined), by Battery Type 2025 & 2033

- Figure 39: Asia Pacific Electric Bicycle Industry in Sweden Revenue Share (%), by Battery Type 2025 & 2033

- Figure 40: Asia Pacific Electric Bicycle Industry in Sweden Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Electric Bicycle Industry in Sweden Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 2: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 3: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 4: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 6: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 7: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 8: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 13: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 14: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 15: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 20: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 21: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 22: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 34: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 35: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 43: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Application Type 2020 & 2033

- Table 44: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Battery Type 2020 & 2033

- Table 45: Global Electric Bicycle Industry in Sweden Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Electric Bicycle Industry in Sweden Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bicycle Industry in Sweden?

The projected CAGR is approximately 6.95%.

2. Which companies are prominent players in the Electric Bicycle Industry in Sweden?

Key companies in the market include Ecoride AB, Blix Electric Bikes, Swagtron, Royal Dutch Gazelle, Cowboy, Giant Manufacturing Co Ltd, Kalkhoff Werke GmbH, VanMoof B, Batavus Intercycle Corporation, Trek Bicycle Corporation.

3. What are the main segments of the Electric Bicycle Industry in Sweden?

The market segments include Propulsion Type, Application Type, Battery Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Commercial Vehicle Sales to Foster the Growth of the Market.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Fluctuations in Interest Rates to Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

November 2022: The Stormguard E+, a full-suspension e-bike, is unveiled by Giant. The bicycles will be available for purchase in Europe in 2023 and will cost 7,999 Euros for the E+1 and 6,499 Euros for the E+2.November 2022: Ecoride is continuing its growth journey, so is relocating from Poland to its new factory in Gothenburg, Sweden.August 2022: Blix launched a new e-bike Dubbel having a V-shaped frame, the Dubbel Frame Bag mounts easily to allow for maximized smart storage.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bicycle Industry in Sweden," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bicycle Industry in Sweden report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bicycle Industry in Sweden?

To stay informed about further developments, trends, and reports in the Electric Bicycle Industry in Sweden, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence