Key Insights

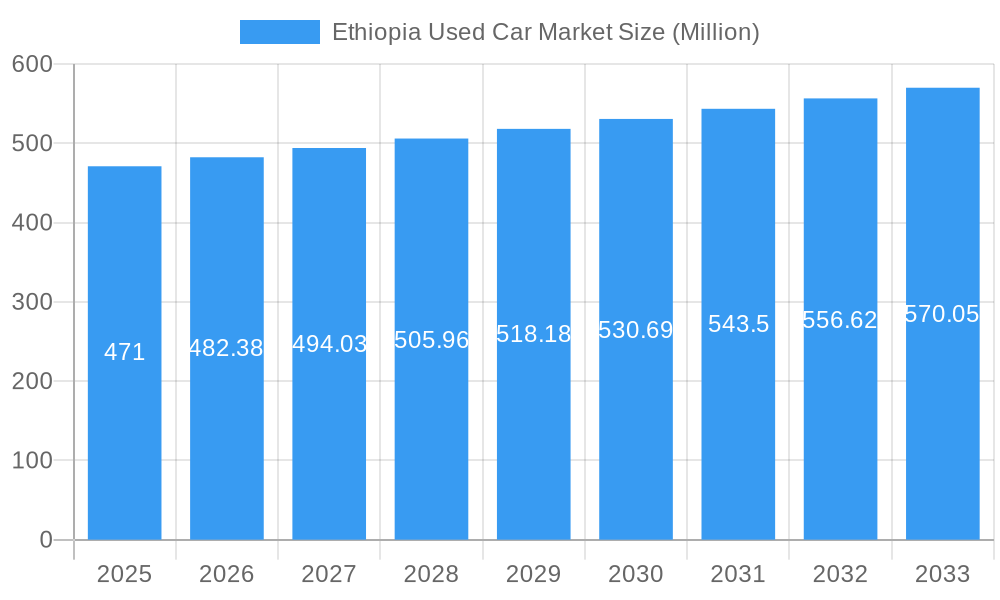

The Ethiopian used car market, valued at $471 million in 2025, exhibits robust growth potential, driven by a burgeoning middle class, increasing urbanization, and a preference for affordable transportation options. The market's Compound Annual Growth Rate (CAGR) exceeding 2.50% suggests a steady expansion through 2033. Key market segments include Hatchbacks, Sedans, SUVs, and MUVs, with SUVs and Hatchbacks likely dominating due to their versatility and fuel efficiency. The vendor landscape comprises both organized dealerships and a significant unorganized sector, reflecting the diverse nature of the market. Fuel type preferences are likely skewed towards gasoline and diesel vehicles due to the limited charging infrastructure for electric vehicles and the higher initial cost of alternative fuel vehicles. The presence of several established players like Cars 2 Africa, Ultimate Motor, and Nyala Motors indicates a competitive market with varying levels of service and vehicle selection. However, challenges like fluctuating fuel prices, import regulations, and the overall condition of used vehicles could influence market growth trajectory.

Ethiopia Used Car Market Market Size (In Million)

The forecast period (2025-2033) is projected to witness continued market expansion, fueled by rising disposable incomes and a growing demand for personal mobility. The organized sector is likely to experience faster growth compared to its unorganized counterpart, driven by consumer preference for reliable vehicles and warranties. However, the unorganized sector will likely remain significant given its access to a wider price range and used vehicles for budget-conscious buyers. Government policies regarding vehicle imports and environmental regulations will likely play a crucial role in shaping the market dynamics in the coming years. The strategic focus on enhancing infrastructure and promoting sustainable transportation may influence the shift towards electric and alternative fuel vehicles in the long term.

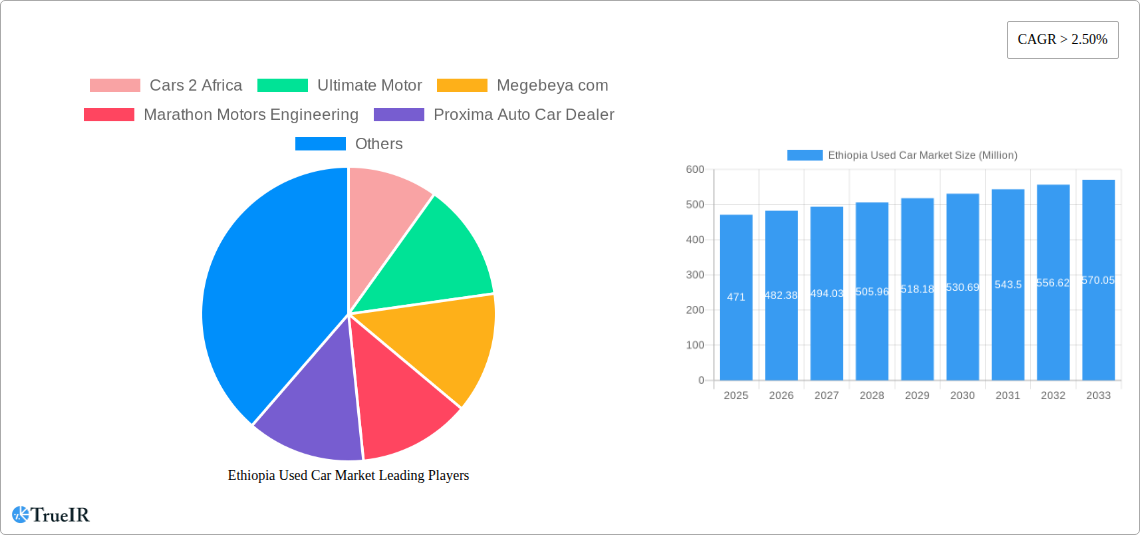

Ethiopia Used Car Market Company Market Share

Ethiopia Used Car Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Ethiopia used car market, offering invaluable insights for industry stakeholders, investors, and researchers. Leveraging extensive data analysis and expert forecasts, this report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Discover key trends, opportunities, and challenges shaping this rapidly evolving market, with a detailed examination of market structure, competitive dynamics, dominant segments, and future growth projections. The report values are in Millions.

Ethiopia Used Car Market Market Structure & Competitive Landscape

The Ethiopian used car market is characterized by a fragmented structure, with a mix of organized and unorganized vendors. While organized players like Cars 2 Africa, Ultimate Motor, Megebeya com, Marathon Motors Engineering, Proxima Auto Car Dealer, Nyala Motors, and ALEM INTERNATIONAL PL are gaining prominence, a significant portion of the market remains unorganized. The market concentration ratio (CR4) is estimated at xx% in 2025, indicating a relatively low level of market consolidation. However, the entry of larger players and increasing government regulation is expected to drive consolidation in the coming years.

- Market Concentration: CR4 (2025) - xx%; Projected CR4 (2033) - xx%

- Innovation Drivers: Technological advancements in vehicle diagnostics and online marketplaces are driving innovation.

- Regulatory Impacts: Government policies regarding vehicle imports and taxation significantly influence market dynamics. The recent introduction of investment incentives for duty-free imports in May 2023 will substantially impact market growth.

- Product Substitutes: Public transportation and ride-hailing services act as partial substitutes, particularly within urban areas.

- End-User Segmentation: The market caters to a diverse range of end-users, including individuals, businesses, and government entities.

- M&A Trends: The number of mergers and acquisitions within the Ethiopian used car market is currently low (xx deals in 2024), but is projected to increase as larger players seek expansion.

Ethiopia Used Car Market Market Trends & Opportunities

The Ethiopian used car market exhibits strong growth potential, fueled by increasing urbanization, rising disposable incomes, and a growing preference for personal vehicles. The market size is estimated at $XX Million in 2025 and is projected to reach $XX Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological advancements, such as online platforms facilitating vehicle sales and improved vehicle financing options, are further boosting market growth. Changing consumer preferences towards fuel-efficient and safer vehicles are also influencing market trends. Competitive dynamics are intensifying, with established players facing increasing competition from new entrants and the expansion of organized players. Market penetration rates for used vehicles are high, exceeding xx% in major urban centers.

Dominant Markets & Segments in Ethiopia Used Car Market

The Addis Ababa region dominates the Ethiopian used car market, accounting for approximately xx% of total sales in 2025. Growth is driven by high population density, improved infrastructure, and increased purchasing power.

- Vehicle Type: SUVs and Hatchbacks are the most popular vehicle types, driven by their versatility and affordability. Sedans maintain a considerable presence, while MUVs show moderate growth.

- Vendor Type: The organized sector is experiencing faster growth compared to the unorganized sector, largely due to greater consumer trust, better financing options, and improved customer service.

- Fuel Type: Gasoline-powered vehicles remain dominant due to lower initial costs, although diesel vehicles hold a significant share due to greater fuel efficiency. Electric and alternative fuel vehicles have minimal market penetration, but are anticipated to gradually gain traction, supported by government policy and technological progress.

Key Growth Drivers:

- Expanding Road Infrastructure: Improved road networks facilitate easier access to vehicles and stimulate demand.

- Increasing Urbanization: Migration from rural areas to cities drives demand for personal transport.

- Favorable Government Policies: Investment incentives for vehicle imports are significantly boosting market expansion.

Ethiopia Used Car Market Product Analysis

The Ethiopian used car market offers a wide range of vehicles, encompassing various makes, models, and years of manufacture. Technological advancements, including the use of vehicle history reports and online marketplaces, are increasing transparency and improving consumer confidence. Competitive advantages are primarily driven by pricing strategies, the quality of vehicles offered, and the level of customer service provided. The market shows a preference for relatively newer vehicles, especially from established manufacturers which reflects consumers' focus on reliability and safety.

Key Drivers, Barriers & Challenges in Ethiopia Used Car Market

Key Drivers:

Rising disposable incomes, rapid urbanization, and improved road infrastructure are major drivers of market growth. Government initiatives aimed at promoting vehicle ownership also play a significant role.

Challenges and Restraints:

High import duties and taxes impose a significant barrier to market expansion. Limited access to vehicle financing and high interest rates restrict affordability. Furthermore, inadequate supply chain infrastructure and a lack of organized vehicle inspection systems pose challenges to market growth. The market also faces the challenge of maintaining quality and addressing concerns around vehicle reliability and maintenance.

Growth Drivers in the Ethiopia Used Car Market Market

The growth of the Ethiopian used car market is primarily driven by increasing urbanization, rising disposable incomes, and improved road infrastructure. Government policies promoting vehicle ownership, including recent duty-free import incentives, are significantly contributing to this growth.

Challenges Impacting Ethiopia Used Car Market Growth

Challenges include high import duties and taxes, limited access to financing, and inadequate supply chain infrastructure. The lack of standardized vehicle inspection processes also impacts market development. The informal nature of a large portion of the market adds another layer of complexity.

Key Players Shaping the Ethiopia Used Car Market Market

- Cars 2 Africa

- Ultimate Motor

- Megebeya com

- Marathon Motors Engineering

- Proxima Auto Car Dealer

- Nyala Motors

- ALEM INTERNATIONAL PL

Significant Ethiopia Used Car Market Industry Milestones

- May 2023: The Ministry of Finance of Ethiopia announced the adoption of new investment incentives for the duty-free import of vehicles, significantly boosting market potential.

- July 2023: Volkswagen AG announced the expansion of its operations in Ethiopia, including exploring financial partnerships for vehicle purchases, indicating a growing interest from major international players.

Future Outlook for Ethiopia Used Car Market Market

The Ethiopian used car market is poised for continued growth, driven by sustained economic development, expanding infrastructure, and supportive government policies. The increasing adoption of online platforms for vehicle sales and the potential growth of electric and alternative fuel vehicles present significant opportunities. The market's future success depends on addressing challenges related to import duties, financing accessibility, and supply chain improvements. The anticipated expansion of organized players and increased regulation will further shape the market's trajectory.

Ethiopia Used Car Market Segmentation

-

1. Vehicle Type

- 1.1. Hatchback

- 1.2. Sedan

- 1.3. Sport Utility Vehicles (SUVs)

- 1.4. Multi-Purpose Vehicles (MUVs)

-

2. Vendor Type

- 2.1. Organized

- 2.2. Unorganized

-

3. Fuel Type

- 3.1. Gasoline

- 3.2. Diesel

- 3.3. Electric

- 3.4. Alternative Fuel Vehicles

Ethiopia Used Car Market Segmentation By Geography

- 1. Ethiopia

Ethiopia Used Car Market Regional Market Share

Geographic Coverage of Ethiopia Used Car Market

Ethiopia Used Car Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand For Used Cars Compared To New Cars

- 3.3. Market Restrains

- 3.3.1. Trust And Transparency In Used Car Remained A Key Challenge For Consumers

- 3.4. Market Trends

- 3.4.1. Online Infrastructure witnessing major growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Ethiopia Used Car Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Hatchback

- 5.1.2. Sedan

- 5.1.3. Sport Utility Vehicles (SUVs)

- 5.1.4. Multi-Purpose Vehicles (MUVs)

- 5.2. Market Analysis, Insights and Forecast - by Vendor Type

- 5.2.1. Organized

- 5.2.2. Unorganized

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Gasoline

- 5.3.2. Diesel

- 5.3.3. Electric

- 5.3.4. Alternative Fuel Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Ethiopia

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cars 2 Africa

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ultimate Motor

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Megebeya com

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Marathon Motors Engineering

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Proxima Auto Car Dealer

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nyala Motors

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ALEM INTERNATIONAL PL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Cars 2 Africa

List of Figures

- Figure 1: Ethiopia Used Car Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Ethiopia Used Car Market Share (%) by Company 2025

List of Tables

- Table 1: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 3: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Ethiopia Used Car Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Ethiopia Used Car Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Ethiopia Used Car Market Revenue Million Forecast, by Vendor Type 2020 & 2033

- Table 7: Ethiopia Used Car Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Ethiopia Used Car Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Ethiopia Used Car Market?

The projected CAGR is approximately > 2.50%.

2. Which companies are prominent players in the Ethiopia Used Car Market?

Key companies in the market include Cars 2 Africa, Ultimate Motor, Megebeya com, Marathon Motors Engineering, Proxima Auto Car Dealer, Nyala Motors, ALEM INTERNATIONAL PL.

3. What are the main segments of the Ethiopia Used Car Market?

The market segments include Vehicle Type, Vendor Type, Fuel Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 471 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand For Used Cars Compared To New Cars.

6. What are the notable trends driving market growth?

Online Infrastructure witnessing major growth.

7. Are there any restraints impacting market growth?

Trust And Transparency In Used Car Remained A Key Challenge For Consumers.

8. Can you provide examples of recent developments in the market?

July 2023: Volkswagen AG announced the expansion of its operations in Ethiopia. The company is looking for a financial partner that provides loan and finance options to buy new and used vehicles in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Ethiopia Used Car Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Ethiopia Used Car Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Ethiopia Used Car Market?

To stay informed about further developments, trends, and reports in the Ethiopia Used Car Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence