Key Insights

The German Electric Vehicle (EV) Battery Pack Market is set for significant expansion, propelled by favorable government incentives, rising consumer preference for eco-friendly mobility, and rapid advancements in battery technology. The market is estimated at $22.5 billion in 2025 and is projected to grow at a CAGR of 16.61% by 2033. Key growth drivers include stringent environmental regulations, escalating fuel costs, and the increasing integration of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) across diverse automotive sectors. The passenger vehicle segment is anticipated to lead market dominance, aligning with the global shift towards electric personal transportation. Ongoing research in battery safety, energy density, and cost optimization is driving innovation in battery chemistries, with Lithium Iron Phosphate (LFP), Nickel Cobalt Aluminum (NCA), and Nickel Cobalt Manganese (NCM) expected to command substantial market shares. Battery packs with capacities ranging from 40 kWh to 80 kWh are projected to experience the highest demand, meeting the typical driving range needs of contemporary EVs.

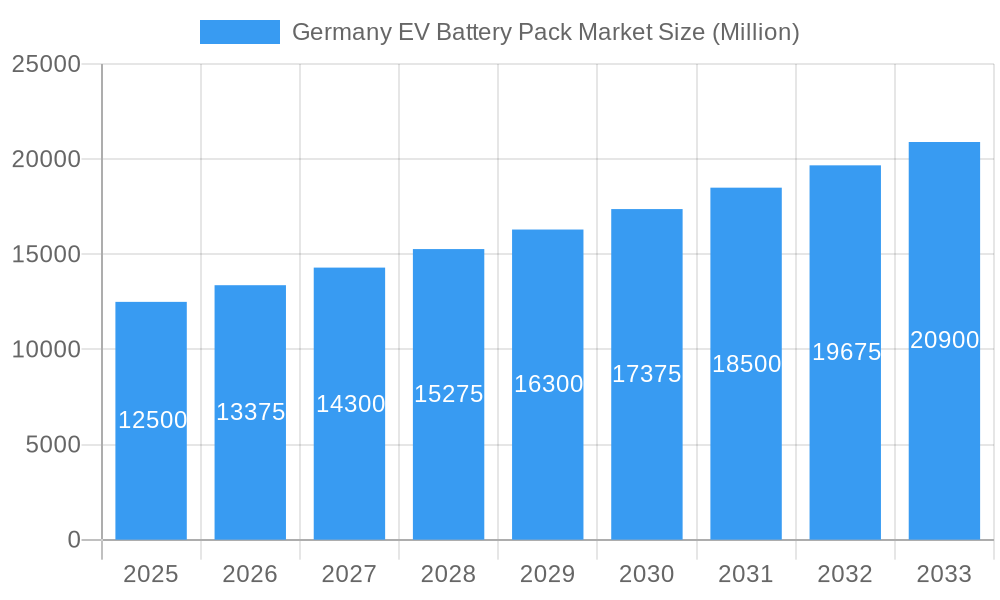

Germany EV Battery Pack Market Market Size (In Billion)

Market development will also be influenced by innovations in battery pack manufacturing processes and component development. Laser and wire assembly techniques are expected to gain traction due to their superior precision and efficiency. Demand for essential components, including cathodes and anodes, and materials such as lithium and nickel, will surge as production volumes increase. Potential market challenges include the high upfront cost of EVs, the necessity for extensive charging infrastructure expansion, and vulnerabilities within the raw material supply chain. Nevertheless, the robust presence of leading automotive and battery manufacturers in Germany, such as Contemporary Amperex Technology Co Ltd (CATL), BYD Company Ltd, and LG Energy Solution Ltd, significantly supports innovation and regional value chain development for EV batteries. Germany's strategic European location and strong industrial ecosystem position it as a pivotal center for the expanding EV battery pack market.

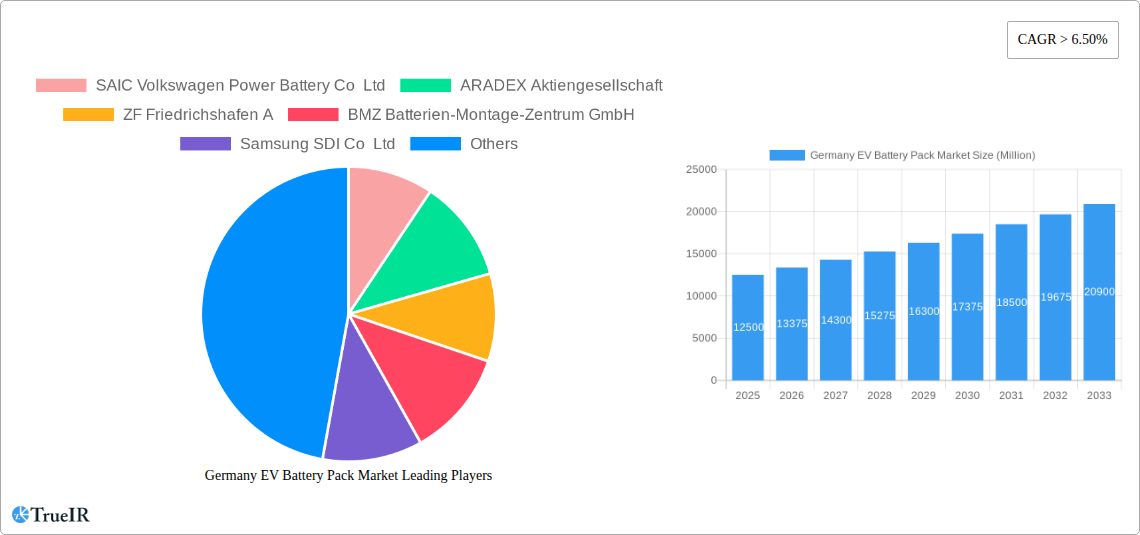

Germany EV Battery Pack Market Company Market Share

Germany EV Battery Pack Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a dynamic and SEO-optimized analysis of the Germany EV Battery Pack Market. Leveraging high-volume keywords such as "Germany EV batteries," "electric vehicle battery market Germany," and "automotive battery manufacturing Germany," this report offers comprehensive insights for industry stakeholders, investors, and policymakers. Covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033, this report delves into market structure, trends, dominant segments, product analysis, key drivers, challenges, leading players, and significant industry milestones.

Germany EV Battery Pack Market Market Structure & Competitive Landscape

The Germany EV Battery Pack Market is characterized by a dynamic and evolving competitive landscape, marked by a moderate to high degree of concentration driven by significant capital investments and technological expertise. Innovation remains a critical differentiator, with companies continuously investing in R&D to enhance battery performance, safety, and cost-effectiveness. Regulatory frameworks, particularly those promoting electric mobility and sustainability, exert a substantial influence on market dynamics, shaping product development and investment decisions. While direct product substitutes for EV battery packs are limited, advancements in alternative energy storage technologies and improvements in charging infrastructure can indirectly impact demand. The end-user segmentation is primarily driven by the automotive industry, with passenger cars dominating current demand, followed by light commercial vehicles (LCVs) and an emerging segment for buses and medium/heavy-duty trucks (M&HDTs). Merger and acquisition (M&A) trends are increasingly evident as established automotive players and battery manufacturers seek to secure supply chains, acquire cutting-edge technologies, and expand production capacities. The increasing number of strategic partnerships and joint ventures further underscores the collaborative nature of market growth.

Germany EV Battery Pack Market Market Trends & Opportunities

The Germany EV Battery Pack Market is poised for substantial growth, fueled by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market size is projected to witness a robust Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033, driven by increasing electric vehicle adoption rates across all vehicle segments. Technological shifts are central to this expansion, with a pronounced trend towards higher energy density batteries, faster charging capabilities, and improved safety features. The shift towards LFP (Lithium Iron Phosphate) battery chemistry is gaining momentum due to its cost-effectiveness and enhanced safety profile, complementing the established NCM (Nickel-Cobalt-Manganese) and NMC (Nickel-Manganese-Cobalt) chemistries, particularly for premium applications. Consumer preferences are increasingly leaning towards longer driving ranges, reduced charging times, and greater affordability, all of which are directly addressed by ongoing battery innovations. The competitive dynamics are intensifying, with both established global players and emerging European manufacturers vying for market share. Opportunities abound for companies focusing on localized production, sustainable sourcing of materials, and the development of innovative battery management systems. The circular economy, encompassing battery recycling and second-life applications, is also emerging as a significant opportunity for value creation and environmental responsibility within the German market.

Dominant Markets & Segments in Germany EV Battery Pack Market

The Passenger Car segment stands as the undisputed dominant force within the Germany EV Battery Pack Market, consistently driving the highest demand for EV batteries. This dominance is intrinsically linked to the broader automotive industry's strategic pivot towards electrification in this segment, supported by robust consumer acceptance and a widening array of electric passenger vehicle models. Consequently, battery capacities in the 40 kWh to 80 kWh range are experiencing the most significant traction, offering a balance of range and cost for typical daily commutes and longer journeys.

Propulsion Type Dominance:

- BEV (Battery Electric Vehicle): This propulsion type is the primary engine of growth, representing the vast majority of EV sales and, therefore, the largest consumer of EV battery packs. Government incentives and a growing charging infrastructure further bolster BEV adoption.

- PHEV (Plug-in Hybrid Electric Vehicle): While still a significant contributor, PHEVs are gradually ceding market share to pure BEVs as battery technology improves and charging infrastructure expands.

Battery Chemistry Trends:

- NCM/NMC: These chemistries continue to be a cornerstone for performance-oriented EVs, offering high energy density and power output crucial for premium passenger cars and performance vehicles.

- LFP (Lithium Iron Phosphate): LFP is rapidly gaining market share, especially in entry-level and mid-range passenger cars, as well as LCVs. Its advantages in terms of cost, safety, and longevity are making it an increasingly attractive alternative.

- Others: This category may encompass emerging chemistries or specialized battery types catering to niche applications, but currently holds a smaller market share.

Battery Capacity Segmentation:

- 40 kWh to 80 kWh: This range represents the sweet spot for most passenger cars, offering a practical balance between driving range and vehicle cost.

- Above 80 kWh: Demand for these larger capacity batteries is growing, particularly for long-range passenger vehicles and emerging electric commercial vehicles.

- 15 kWh to 40 kWh: This segment is crucial for LCVs and smaller passenger vehicles, catering to urban mobility needs.

- Less than 15 kWh: Primarily relevant for niche applications like electric scooters or specialized industrial equipment.

Battery Form Factors:

- Prismatic: This form factor is increasingly favored for its space efficiency and ease of integration into vehicle architectures, making it dominant in the passenger car segment.

- Cylindrical: Still prevalent, particularly for certain battery chemistries and in specific vehicle applications, known for its robustness.

- Pouch: Offers flexibility in design but is generally less dominant compared to prismatic and cylindrical cells in mainstream automotive applications.

Component Dominance:

- Cathode: The cathode material is a key determinant of battery performance and cost, with advancements in Nickel-Manganese-Cobalt (NCM) and Lithium Iron Phosphate (LFP) driving market trends.

- Anode: Natural Graphite remains a primary material for anodes, though research into silicon-based anodes is ongoing to improve energy density.

- Electrolyte & Separator: These components are critical for battery safety and functionality, with continuous innovation focused on improving stability and conductivity.

Material Type Focus:

- Nickel & Lithium: These are the most sought-after materials, forming the backbone of most modern EV battery chemistries, driving significant demand and investment in their sourcing and processing.

- Cobalt: While its use is being reduced due to cost and ethical concerns, cobalt remains an important component in certain high-performance NCM chemistries.

- Manganese & Natural Graphite: These are essential components, particularly for LFP and anode materials, respectively, and are experiencing steady demand.

- Other Materials: Encompasses additives and binders crucial for battery performance and longevity.

Germany EV Battery Pack Market Product Analysis

The Germany EV Battery Pack Market is witnessing a surge in product innovations driven by the pursuit of enhanced energy density, faster charging, improved thermal management, and greater safety. Innovations in battery chemistry, such as the increasing adoption of LFP for cost-effectiveness and enhanced safety, alongside continued advancements in NCM/NMC for higher performance, are reshaping product offerings. Battery management systems (BMS) are becoming more sophisticated, optimizing performance and extending battery lifespan. Applications span across all electric vehicle types, from compact passenger cars to heavy-duty trucks, with specialized battery packs tailored to specific use cases. The competitive advantage lies in developing solutions that balance performance metrics with cost, safety, and sustainability.

Key Drivers, Barriers & Challenges in Germany EV Battery Pack Market

Key Drivers:

- Strong Government Support & Incentives: Germany's ambitious climate targets and substantial subsidies for EV purchases and charging infrastructure are major catalysts for EV adoption and, consequently, battery demand.

- Automotive Industry Electrification Mandates: Major German automakers have committed significant investments towards electrification, leading to a robust pipeline of new EV models requiring battery packs.

- Technological Advancements: Continuous innovation in battery chemistry, cell design, and manufacturing processes is improving performance, reducing costs, and enhancing safety, making EVs more attractive.

- Growing Environmental Awareness: Increasing consumer concern about climate change and air quality is driving a preference for zero-emission vehicles.

Barriers & Challenges:

- Supply Chain Constraints & Material Sourcing: Securing a stable and ethical supply of critical raw materials like lithium, cobalt, and nickel remains a significant challenge, with geopolitical factors and price volatility posing risks.

- High Production Costs & Capital Investment: Establishing gigafactories and scaling up battery production requires substantial capital investment, posing a barrier for new entrants and requiring long-term strategic planning.

- Charging Infrastructure Development: While improving, the density and accessibility of public charging infrastructure can still be a deterrent for some consumers, particularly in rural areas.

- Battery Recycling & End-of-Life Management: Developing efficient and cost-effective battery recycling processes and establishing a robust circular economy for EV batteries are crucial for long-term sustainability.

- Skilled Workforce Shortage: The rapid growth of the battery manufacturing sector is creating a demand for a skilled workforce, and a shortage could impede expansion plans.

Growth Drivers in the Germany EV Battery Pack Market Market

The Germany EV Battery Pack Market is propelled by a powerful combination of factors. Technologically, ongoing research and development are leading to batteries with higher energy densities, enabling longer driving ranges, and faster charging capabilities, addressing key consumer concerns. Economically, declining battery costs, coupled with government incentives for EV purchases, are making electric vehicles increasingly competitive with their internal combustion engine counterparts. Regulatory tailwinds are particularly strong, with stringent EU emissions standards and national targets for EV adoption creating a clear roadmap for market expansion. Furthermore, significant investments by major automotive manufacturers in their EV portfolios directly translate to increased demand for battery packs, solidifying their role as pivotal growth drivers.

Challenges Impacting Germany EV Battery Pack Market Growth

Despite the positive outlook, the Germany EV Battery Pack Market faces considerable hurdles. Supply chain volatility for critical raw materials like lithium and cobalt presents a persistent challenge, leading to price fluctuations and potential production disruptions. The high capital expenditure required for establishing gigafactories and scaling up battery manufacturing can deter some investors and slow down expansion. Regulatory complexities, though generally supportive, can sometimes create administrative burdens and require ongoing adaptation to evolving standards. Competitive pressures are intensifying as global battery manufacturers and automotive giants vie for market dominance, potentially leading to price wars and margin erosion. Furthermore, the development of a comprehensive and efficient battery recycling infrastructure is crucial for sustainability and needs to keep pace with the growing volume of end-of-life batteries.

Key Players Shaping the Germany EV Battery Pack Market Market

- SAIC Volkswagen Power Battery Co Ltd

- ARADEX Aktiengesellschaft

- ZF Friedrichshafen A

- BMZ Batterien-Montage-Zentrum GmbH

- Samsung SDI Co Ltd

- LG Energy Solution Ltd

- Monbat AD

- Valeo Siemens eAutomotive

- Deutsche ACCUmotive GmbH & Co KG

- Contemporary Amperex Technology Co Ltd (CATL)

- Robert Bosch GmbH

- BYD Company Ltd

- Groupe Renault

- SK Innovation Co Ltd

- Automotive Cells Company (ACC)

- Dynamis Batterien GmbH

Significant Germany EV Battery Pack Market Industry Milestones

- May 2023: CATL Geely (Sichuan) Power Battery Co., Ltd. (CATL Geely) achieved carbon neutrality for 2022, obtaining a certificate from TÜV Rheinland, highlighting a growing commitment to sustainability within the supply chain.

- May 2023: Contemporary Amperex Technology Co. Ltd. (CATL) officially launched local production of lithium-ion cells at its first battery cell manufacturing facility outside of China, located in the "Erfurter Kreuz" industry park, marking a significant expansion into the European market.

- February 2023: ACC (Automotive Cells Company) entered into a contract with CRITT M2A, a leading electromobility reference center, for the quality testing of its first Gigafactory battery production in Billy-Berclau Douvrin, underscoring a focus on product quality and reliability.

Future Outlook for Germany EV Battery Pack Market Market

The future outlook for the Germany EV Battery Pack Market is exceptionally bright, characterized by sustained growth driven by technological innovation and increasing adoption of electric vehicles. Strategic opportunities lie in the continued expansion of gigafactory capacities, fostering localized battery production to mitigate supply chain risks, and investing in research for next-generation battery technologies such as solid-state batteries. The development of robust battery recycling infrastructure and the establishment of a circular economy will be critical for long-term sustainability and market competitiveness. As Germany strengthens its position as a European hub for EV battery manufacturing, collaboration between automotive OEMs, battery producers, and research institutions will be paramount in driving further advancements and ensuring the market’s continued dynamism and success in meeting ambitious climate goals.

Germany EV Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Battery Chemistry

- 3.1. LFP

- 3.2. NCA

- 3.3. NCM

- 3.4. NMC

- 3.5. Others

-

4. Capacity

- 4.1. 15 kWh to 40 kWh

- 4.2. 40 kWh to 80 kWh

- 4.3. Above 80 kWh

- 4.4. Less than 15 kWh

-

5. Battery Form

- 5.1. Cylindrical

- 5.2. Pouch

- 5.3. Prismatic

-

6. Method

- 6.1. Laser

- 6.2. Wire

-

7. Component

- 7.1. Anode

- 7.2. Cathode

- 7.3. Electrolyte

- 7.4. Separator

-

8. Material Type

- 8.1. Cobalt

- 8.2. Lithium

- 8.3. Manganese

- 8.4. Natural Graphite

- 8.5. Nickel

- 8.6. Other Materials

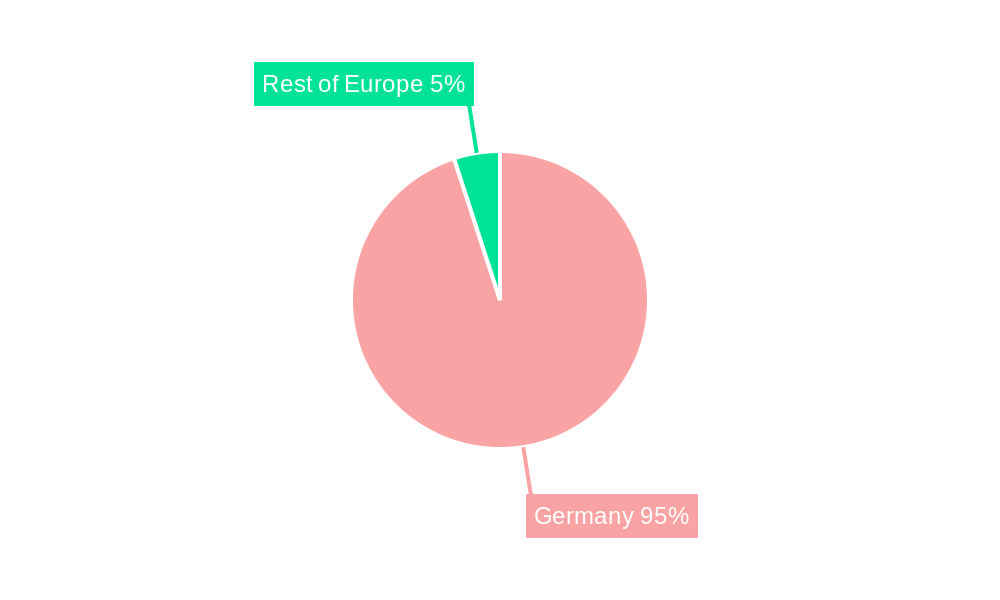

Germany EV Battery Pack Market Segmentation By Geography

- 1. Germany

Germany EV Battery Pack Market Regional Market Share

Geographic Coverage of Germany EV Battery Pack Market

Germany EV Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany EV Battery Pack Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Battery Chemistry

- 5.3.1. LFP

- 5.3.2. NCA

- 5.3.3. NCM

- 5.3.4. NMC

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Capacity

- 5.4.1. 15 kWh to 40 kWh

- 5.4.2. 40 kWh to 80 kWh

- 5.4.3. Above 80 kWh

- 5.4.4. Less than 15 kWh

- 5.5. Market Analysis, Insights and Forecast - by Battery Form

- 5.5.1. Cylindrical

- 5.5.2. Pouch

- 5.5.3. Prismatic

- 5.6. Market Analysis, Insights and Forecast - by Method

- 5.6.1. Laser

- 5.6.2. Wire

- 5.7. Market Analysis, Insights and Forecast - by Component

- 5.7.1. Anode

- 5.7.2. Cathode

- 5.7.3. Electrolyte

- 5.7.4. Separator

- 5.8. Market Analysis, Insights and Forecast - by Material Type

- 5.8.1. Cobalt

- 5.8.2. Lithium

- 5.8.3. Manganese

- 5.8.4. Natural Graphite

- 5.8.5. Nickel

- 5.8.6. Other Materials

- 5.9. Market Analysis, Insights and Forecast - by Region

- 5.9.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ARADEX Aktiengesellschaft

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ZF Friedrichshafen A

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMZ Batterien-Montage-Zentrum GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Samsung SDI Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LG Energy Solution Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Monbat AD

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valeo Siemens eAutomotive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Deutsche ACCUmotive GmbH & Co KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Contemporary Amperex Technology Co Ltd (CATL)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Robert Bosch GmbH

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BYD Company Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Groupe Renault

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SK Innovation Co Ltd

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Automotive Cells Company (ACC)

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Dynamis Batterien GmbH

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 SAIC Volkswagen Power Battery Co Ltd

List of Figures

- Figure 1: Germany EV Battery Pack Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany EV Battery Pack Market Share (%) by Company 2025

List of Tables

- Table 1: Germany EV Battery Pack Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 2: Germany EV Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 3: Germany EV Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 4: Germany EV Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 5: Germany EV Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 6: Germany EV Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 7: Germany EV Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 8: Germany EV Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: Germany EV Battery Pack Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Germany EV Battery Pack Market Revenue billion Forecast, by Body Type 2020 & 2033

- Table 11: Germany EV Battery Pack Market Revenue billion Forecast, by Propulsion Type 2020 & 2033

- Table 12: Germany EV Battery Pack Market Revenue billion Forecast, by Battery Chemistry 2020 & 2033

- Table 13: Germany EV Battery Pack Market Revenue billion Forecast, by Capacity 2020 & 2033

- Table 14: Germany EV Battery Pack Market Revenue billion Forecast, by Battery Form 2020 & 2033

- Table 15: Germany EV Battery Pack Market Revenue billion Forecast, by Method 2020 & 2033

- Table 16: Germany EV Battery Pack Market Revenue billion Forecast, by Component 2020 & 2033

- Table 17: Germany EV Battery Pack Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 18: Germany EV Battery Pack Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany EV Battery Pack Market?

The projected CAGR is approximately 16.61%.

2. Which companies are prominent players in the Germany EV Battery Pack Market?

Key companies in the market include SAIC Volkswagen Power Battery Co Ltd, ARADEX Aktiengesellschaft, ZF Friedrichshafen A, BMZ Batterien-Montage-Zentrum GmbH, Samsung SDI Co Ltd, LG Energy Solution Ltd, Monbat AD, Valeo Siemens eAutomotive, Deutsche ACCUmotive GmbH & Co KG, Contemporary Amperex Technology Co Ltd (CATL), Robert Bosch GmbH, BYD Company Ltd, Groupe Renault, SK Innovation Co Ltd, Automotive Cells Company (ACC), Dynamis Batterien GmbH.

3. What are the main segments of the Germany EV Battery Pack Market?

The market segments include Body Type, Propulsion Type, Battery Chemistry, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

May 2023: CATL announced that CATL Geely (Sichuan) Power Battery Co., Ltd. (CATL Geely) obtained a carbon neutrality certificate from TÜV Rheinland, marking that the company realized carbon neutrality in 2022. CATL Geely is a wholly-owned subsidiary of CATL Geely Power Battery Co., Ltd., a joint venture between CATL and Zeekr.May 2023: Invest in Thuringia announced that Contemporary Amperex Technology Co. Ltd. (CATL) is building its first battery cell manufacturing facility outside of China in the industry park “Erfurter Kreuz” and officially launched its local production of lithium-ion cells at the end of January 2023.February 2023: ACC has signed a contract with CRITT M2A, a leading reference center for electromobility, for the quality testing of its first Gigafactory battery production in Billy-Berclau Douvrin.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany EV Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany EV Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany EV Battery Pack Market?

To stay informed about further developments, trends, and reports in the Germany EV Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence