Key Insights

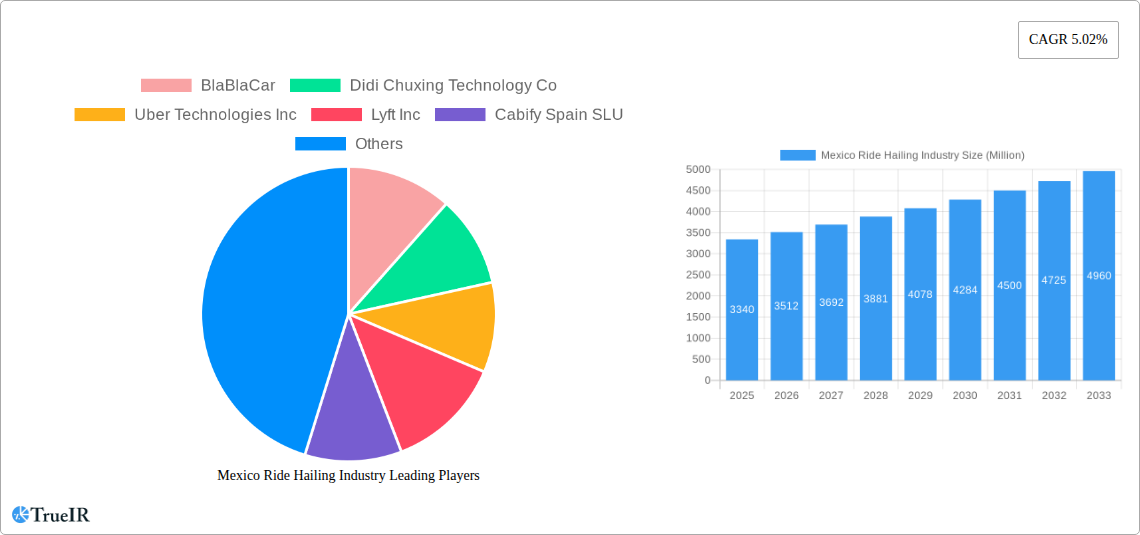

The Mexico ride-hailing market, valued at $3.34 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, rising urbanization, and a growing preference for convenient and affordable transportation options. The market's Compound Annual Growth Rate (CAGR) of 5.02% from 2019 to 2024 indicates a consistent upward trajectory. This growth is fueled by the expansion of e-hailing services, particularly among younger demographics and tourists. The online booking channel dominates the market, reflecting the increasing adoption of digital technologies. Passenger cars constitute the largest vehicle segment, although the two-wheeler segment holds potential for future expansion, particularly in urban areas with high traffic congestion. Competitive pressures from established players like Uber and Didi, alongside local competitors, are shaping market dynamics, leading to innovations in pricing models, service offerings, and technological integration. Regulatory changes and infrastructure development also influence the market's trajectory, creating both opportunities and challenges for industry players.

Mexico Ride Hailing Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued expansion, with potential acceleration driven by factors such as the growth of the middle class, improved transportation infrastructure, and advancements in ride-sharing technologies. The market segmentation reveals that while e-hailing currently leads, car sharing and car rental segments offer promising avenues for growth. Expansion into underserved areas and the development of specialized services catering to specific needs (e.g., luxury transportation, delivery services) present significant opportunities. However, challenges such as traffic congestion, fuel price fluctuations, and regulatory uncertainties need to be considered for accurate market forecasting and strategic planning. The continuous monitoring of government policies and technological advancements will be crucial for industry players to navigate the competitive landscape and capitalize on emerging growth opportunities.

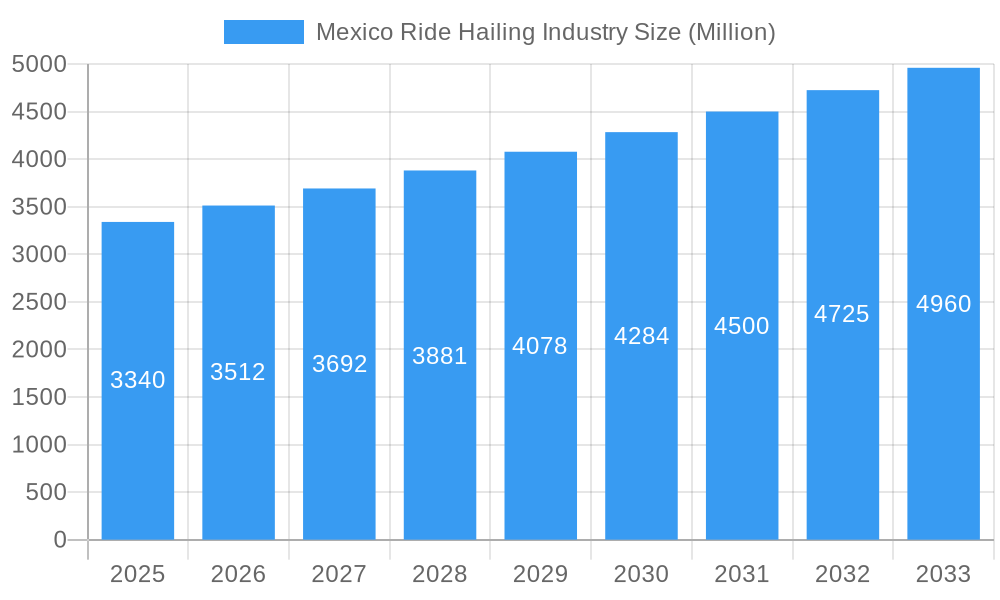

Mexico Ride Hailing Industry Company Market Share

This comprehensive report provides a detailed analysis of the dynamic Mexico ride-hailing industry, encompassing market structure, trends, opportunities, and future outlook from 2019 to 2033. We delve into key players, segments, and challenges, offering invaluable insights for industry stakeholders. With a focus on high-growth segments and emerging technologies, this report is an essential resource for strategic decision-making.

Mexico Ride Hailing Industry Market Structure & Competitive Landscape

The Mexican ride-hailing market exhibits a moderately concentrated structure, with key players like Uber Technologies Inc, Didi Chuxing Technology Co, and Cabify Spain SLU holding significant market share. However, the presence of smaller players and emerging services fosters competition. Innovation is driven by technological advancements such as AI-powered routing, electric vehicle integration, and enhanced safety features. Regulatory changes concerning licensing, insurance, and pricing significantly impact market dynamics. Product substitutes include traditional taxis and public transport, while the increasing popularity of car-sharing services presents a competitive threat. End-user segmentation is diverse, encompassing commuters, tourists, and businesses. The historical period (2019-2024) witnessed several M&A activities, with xx number of deals recorded. This resulted in a xx% increase in market concentration.

Mexico Ride Hailing Industry Market Trends & Opportunities

The Mexican ride-hailing market is experiencing substantial growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This growth is fueled by increasing smartphone penetration, rising urbanization, and a growing preference for convenient and affordable transportation options. Technological advancements, including the adoption of electric vehicles and the integration of advanced mapping and navigation systems, are further driving market expansion. Market penetration rates are expected to reach xx% by 2033. Consumer preferences are shifting toward ride-sharing services that offer enhanced safety features, affordable pricing, and eco-friendly options. These trends provide significant opportunities for ride-hailing companies to expand their services, cater to evolving consumer needs, and capture market share.

Dominant Markets & Segments in Mexico Ride Hailing Industry

- By Service Type: E-hailing dominates the Mexican ride-hailing market, driven by high demand for on-demand transportation services. Car-sharing is witnessing steady growth, mainly fueled by cost-effectiveness and environmental consciousness. Car rental and other service types hold a smaller market share but represent emerging opportunities.

- By Booking Channel: Online bookings have gained dominance due to increased smartphone penetration and convenience. Offline bookings still exist but are declining in popularity.

- By Vehicle Type: Passenger cars are the predominant vehicle type within the market. Two-wheelers have a niche market, particularly in urban areas.

- Key Growth Drivers: The market's growth is propelled by factors such as expanding infrastructure in urban centers, supportive government regulations that encourage competition, and the increasing adoption of mobile technology in Mexico.

Mexico City and other major metropolitan areas are the dominant markets within Mexico, due to high population density and extensive transportation needs. The growth in these urban centers is anticipated to be driven by increased employment opportunities, rising income levels, and improved infrastructure.

Mexico Ride Hailing Industry Product Analysis

The Mexican ride-hailing industry shows continuous product innovation. Key advancements include the integration of electric vehicles (EVs) reducing carbon footprint and operational costs. Features like in-app safety measures, cashless payment options, and loyalty programs enhance user experience and build brand loyalty. Ride-pooling and dynamic pricing mechanisms optimize resource utilization and cost efficiency. These improvements focus on delivering better customer service and fulfilling evolving demands.

Key Drivers, Barriers & Challenges in Mexico Ride Hailing Industry

Key Drivers: Technological advancements like improved mapping, AI-powered dispatch systems, and EV integration are key drivers. Economic factors, such as rising disposable incomes and urbanization, are increasing demand. Favorable government policies towards ride-sharing can stimulate growth.

Key Challenges: Regulatory uncertainties regarding licensing, insurance, and pricing remain hurdles. Supply chain disruptions can impact the availability of vehicles. Intense competition from established players and new entrants creates pressure on pricing and profitability. These issues can decrease market efficiency and create an uneven playing field for participants. Estimates suggest that these challenges have negatively impacted growth by approximately xx% during the historical period.

Growth Drivers in the Mexico Ride Hailing Industry Market

Technological advancements (EV adoption, AI), increasing urbanization, rising disposable incomes, and supportive government policies promoting ride-sharing services are key drivers.

Challenges Impacting Mexico Ride Hailing Industry Growth

Regulatory complexities (licensing, insurance), intense competition, fluctuating fuel prices, and potential labor disputes impact growth. These challenges lead to increased operational costs and reduce profit margins.

Key Players Shaping the Mexico Ride Hailing Industry Market

- BlaBlaCar

- Didi Chuxing Technology Co

- Uber Technologies Inc

- Lyft Inc

- Cabify Spain SLU

- BEAT

Significant Mexico Ride Hailing Industry Industry Milestones

- February 2024: inDrive partners with R2 to offer driver loans. This initiative improves driver financial stability and expands access to the platform.

- July 2023: Hoop Carpool secures USD 1.3 Million in funding, boosting carpooling's growth potential.

- June 2022: IFC invests USD 15 Million in BlaBlaCar, supporting its expansion in Mexico.

- February 2022: Beat launches Beat Zero, introducing an electric vehicle fleet, enhancing its brand image and sustainability efforts.

Future Outlook for Mexico Ride Hailing Industry Market

The Mexican ride-hailing industry exhibits strong growth potential, fueled by continued technological innovations, expanding urban populations, and increasing demand for convenient and affordable transportation. Strategic partnerships, expansion into underserved areas, and the adoption of sustainable practices will be crucial for future success. The market is poised for further consolidation and the emergence of new business models, driving market expansion. The expected increase in the adoption of EVs may present both an opportunity and a challenge for the industry as it navigates shifting regulatory landscapes.

Mexico Ride Hailing Industry Segmentation

-

1. Service Type

- 1.1. E-hailing

- 1.2. Car Sharing

- 1.3. Car Rental

- 1.4. Other Service Types

-

2. Type

- 2.1. Peer-to-peer Sharing

- 2.2. Business Sharing

-

3. Booking Channel

- 3.1. Online

- 3.2. Offline

-

4. Vehicle Type

- 4.1. Two Wheelers

- 4.2. Passenger Cars

-

5. Distance

- 5.1. Intercity

- 5.2. Intracity

Mexico Ride Hailing Industry Segmentation By Geography

- 1. Mexico

Mexico Ride Hailing Industry Regional Market Share

Geographic Coverage of Mexico Ride Hailing Industry

Mexico Ride Hailing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism Industry in Australia

- 3.3. Market Restrains

- 3.3.1. Varying Government Regulations on Taxi Services

- 3.4. Market Trends

- 3.4.1. Online Booking Channel is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Ride Hailing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. E-hailing

- 5.1.2. Car Sharing

- 5.1.3. Car Rental

- 5.1.4. Other Service Types

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Peer-to-peer Sharing

- 5.2.2. Business Sharing

- 5.3. Market Analysis, Insights and Forecast - by Booking Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.4.1. Two Wheelers

- 5.4.2. Passenger Cars

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Intercity

- 5.5.2. Intracity

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BlaBlaCar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Didi Chuxing Technology Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Uber Technologies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lyft Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cabify Spain SLU

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BEAT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 BlaBlaCar

List of Figures

- Figure 1: Mexico Ride Hailing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Ride Hailing Industry Share (%) by Company 2025

List of Tables

- Table 1: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 4: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2020 & 2033

- Table 6: Mexico Ride Hailing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Mexico Ride Hailing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Mexico Ride Hailing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 9: Mexico Ride Hailing Industry Revenue Million Forecast, by Booking Channel 2020 & 2033

- Table 10: Mexico Ride Hailing Industry Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 11: Mexico Ride Hailing Industry Revenue Million Forecast, by Distance 2020 & 2033

- Table 12: Mexico Ride Hailing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Ride Hailing Industry?

The projected CAGR is approximately 5.02%.

2. Which companies are prominent players in the Mexico Ride Hailing Industry?

Key companies in the market include BlaBlaCar, Didi Chuxing Technology Co, Uber Technologies Inc, Lyft Inc, Cabify Spain SLU, BEAT.

3. What are the main segments of the Mexico Ride Hailing Industry?

The market segments include Service Type, Type, Booking Channel, Vehicle Type, Distance.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism Industry in Australia.

6. What are the notable trends driving market growth?

Online Booking Channel is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Varying Government Regulations on Taxi Services.

8. Can you provide examples of recent developments in the market?

February 2024: The ride-share platform inDrive collaborated with the financial technology firm R2 to offer loans to its drivers in Mexico.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Ride Hailing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Ride Hailing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Ride Hailing Industry?

To stay informed about further developments, trends, and reports in the Mexico Ride Hailing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence