Key Insights

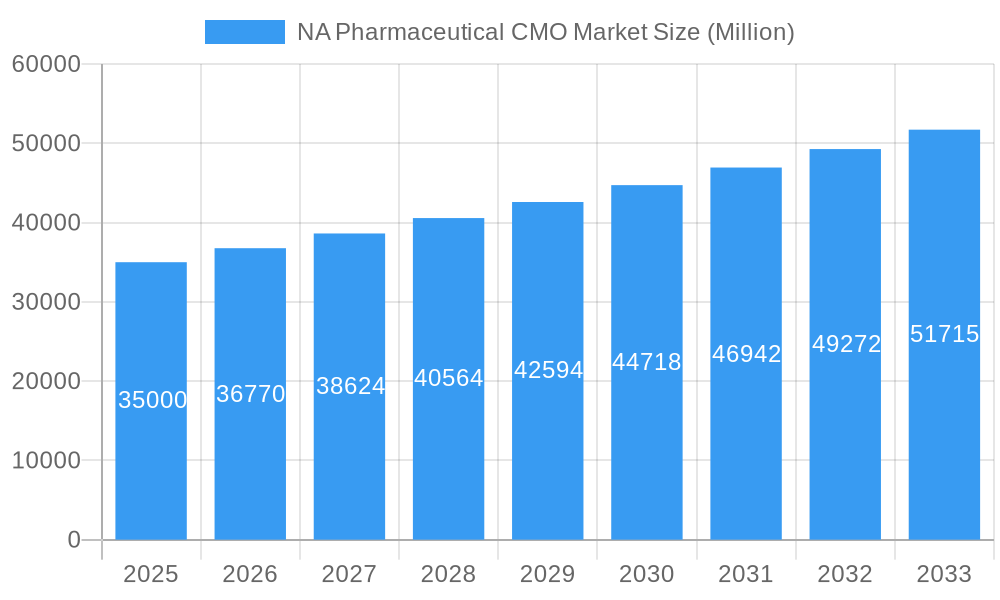

The North American pharmaceutical contract manufacturing organization (CMO) market is experiencing robust growth, driven by increasing outsourcing by pharmaceutical and biotechnology companies. This trend is fueled by several factors, including the rising demand for specialized services like High Potency API (HPAPI) manufacturing and aseptic fill-finish capabilities, the need for accelerated drug development timelines, and the cost advantages associated with outsourcing non-core activities. The market is segmented by service type (API manufacturing, HPAPI manufacturing, FDF development and manufacturing, injectable dose formulation, secondary packaging) and geography (primarily the United States and Canada). While precise market size figures for 2025 are not provided, a logical estimation, considering a CAGR of 5.20% from a hypothetical base year (2019) and the significant presence of major players like Thermo Fisher Scientific, Lonza, and Catalent, would place the 2025 market value in the high billions of USD. The continued focus on innovative therapies, particularly biologics and advanced therapies, will further stimulate demand for specialized CMO services. Competition is intense, with established players facing pressure from emerging CMOs offering niche capabilities and technological advancements. Regulatory compliance and maintaining consistent quality standards remain key challenges for all market participants.

NA Pharmaceutical CMO Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained growth, primarily driven by the increasing pipeline of novel therapeutics and the ongoing trend toward outsourcing. Considering the 5.20% CAGR, the market is projected to exhibit significant expansion throughout the forecast period. North America's dominance in pharmaceutical innovation and the presence of major pharmaceutical companies within the region underpin the market's growth trajectory. However, factors such as potential supply chain disruptions, pricing pressures, and evolving regulatory landscapes could present challenges. Nevertheless, the long-term outlook for the North American pharmaceutical CMO market remains positive, fueled by consistent demand for efficient and reliable contract manufacturing services. A deeper dive into the regional segmentation (US vs Canada) and specific service type breakdowns would provide even more granular market insights.

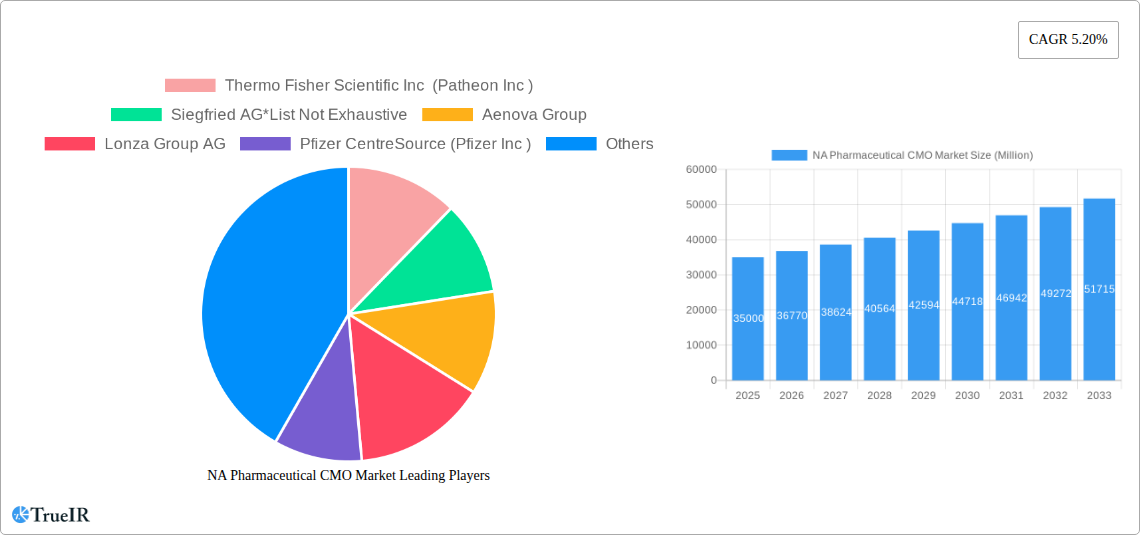

NA Pharmaceutical CMO Market Company Market Share

North American Pharmaceutical Contract Manufacturing Organization (CMO) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North American Pharmaceutical CMO market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report delves into market structure, competitive dynamics, growth drivers, and future outlook. The report focuses on key segments including Active Pharmaceutical Ingredient (API) Manufacturing, High Potency API (HPAPI) Finished Dosage Formulation (FDF) Development and Manufacturing, and Injectable Dose Formulation & Secondary Packaging, across the United States and Canada. The market size is projected to reach xx Million by 2033.

NA Pharmaceutical CMO Market Market Structure & Competitive Landscape

The North American Pharmaceutical CMO market is characterized by a moderately concentrated landscape, with a few large players holding significant market share. However, the market also exhibits considerable dynamism due to ongoing mergers and acquisitions (M&A) activity and the emergence of innovative niche players. The estimated 2025 concentration ratio (CR4) is approximately xx%, reflecting a balance between established players and smaller, specialized CMOs. Innovation in areas such as advanced drug delivery systems and personalized medicine fuels market growth. Regulatory changes, such as those impacting drug approvals and manufacturing standards (e.g., FDA guidelines), significantly impact operational costs and market entry. Product substitutes, like in-house manufacturing for large pharmaceutical companies, exert competitive pressure. The end-user segment consists primarily of pharmaceutical companies across various therapeutic areas, with significant variations in outsourcing strategies. Recent M&A activity, estimated at xx Million in deal value in 2024, suggests a trend towards consolidation and expansion of service offerings.

- Key Market Drivers: Technological advancements, increasing demand for outsourced manufacturing services, rising R&D costs for pharmaceutical companies.

- Key Challenges: Stringent regulatory compliance, supply chain disruptions, price pressure from clients.

- M&A Trends: Consolidation among CMOs, expansion into new therapeutic areas and service offerings.

NA Pharmaceutical CMO Market Market Trends & Opportunities

The North American Pharmaceutical CMO market is experiencing robust growth, driven by several key factors. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several converging trends: an increasing preference for outsourcing among pharmaceutical and biotech companies to reduce capital expenditures and operational costs; a surge in demand for specialized services like HPAPI manufacturing and aseptic filling; and continuous technological innovations in manufacturing processes, leading to increased efficiency and production capacity. The market penetration of CMO services is steadily increasing, with a projected xx% penetration rate by 2033 in the US market. This growth is further facilitated by an expanding pipeline of new drug approvals and a significant increase in generic drug production, creating more demand for CMO services. Growing investments in advanced technologies like continuous manufacturing and automation are enhancing production efficiency and driving down costs. However, the market also faces certain challenges, including regulatory hurdles and supply chain complexities.

Dominant Markets & Segments in NA Pharmaceutical CMO Market

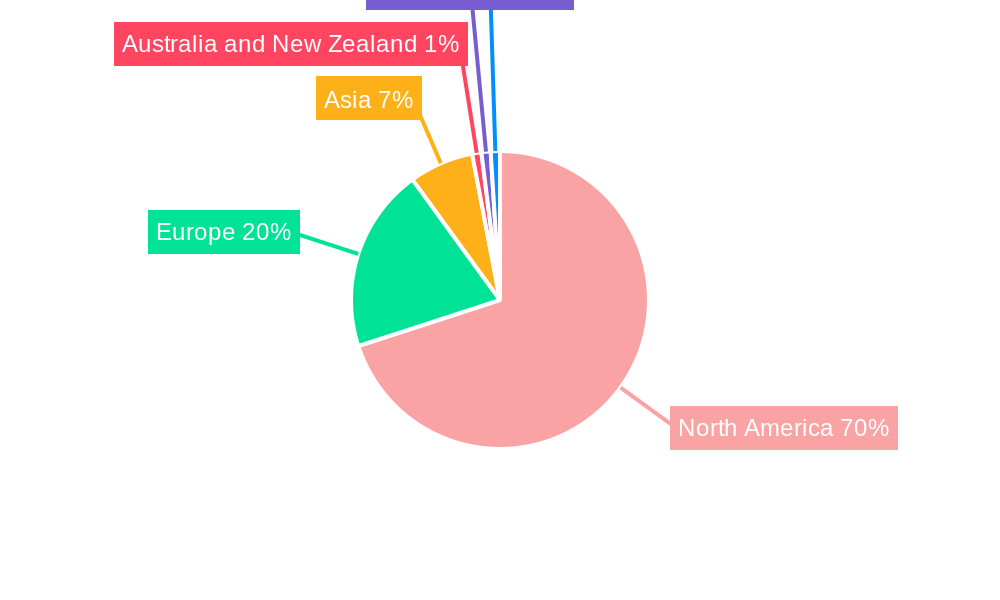

The United States represents the dominant market within North America, accounting for approximately xx% of the total market revenue in 2025. Canada holds a significant share but trails the US due to its smaller pharmaceutical industry.

By Service Type:

- Active Pharmaceutical Ingredient (API) Manufacturing: This segment is a substantial part of the market, driven by increasing demand for both innovator and generic APIs. Key growth drivers include the emergence of advanced API synthesis technologies and increasing offshoring of API manufacturing to lower-cost regions.

- High Potency API (HPAPI) Finished Dosage Formulation (FDF) Development and Manufacturing: This high-growth segment benefits from the rising prevalence of oncology and other specialty drugs requiring HPAPI handling. Stricter regulatory standards and specialized facility requirements create a significant barrier to entry, contributing to the market concentration.

- Injectable Dose Formulation: This segment is experiencing substantial growth due to increasing demand for injectable medications, particularly biologics. Growth is also driven by technological advancements in aseptic filling and advanced injection technologies.

Key Growth Drivers (United States):

- Robust pharmaceutical and biotechnology industry

- Strong regulatory framework supporting innovation

- Developed infrastructure for pharmaceutical manufacturing

- Significant investments in research and development

NA Pharmaceutical CMO Market Product Analysis

Technological advancements in drug delivery systems, such as sustained-release formulations and targeted drug delivery, are driving innovation in the CMO market. CMOs are increasingly offering specialized services catering to these innovative drug development needs. This includes the development of novel manufacturing processes, advanced analytical testing capabilities, and robust quality control measures. These advancements enhance product efficacy, safety, and patient compliance, thereby creating a competitive advantage for CMOs that invest in them. The market fit for these products is very strong, fueled by the pharmaceutical industry's increasing emphasis on personalized medicine and improved patient outcomes.

Key Drivers, Barriers & Challenges in NA Pharmaceutical CMO Market

Key Drivers:

- Technological Advancements: Continuous manufacturing, automation, and advanced analytical techniques are improving efficiency and reducing costs.

- Regulatory Changes: While creating challenges, changes in regulations can create opportunities for specialized CMOs.

- Growing Demand: The increase in new drug approvals and generic drugs significantly increases the demand for CMO services.

Key Challenges:

- Regulatory Compliance: Stringent regulations increase compliance costs and require specialized expertise. Non-compliance can lead to significant financial penalties (estimated average xx Million per violation).

- Supply Chain Disruptions: Global events can impact the availability of raw materials and packaging components, leading to production delays and increased costs.

- Competitive Pressures: The increasing number of CMOs intensifies competition, impacting pricing and profitability.

Growth Drivers in the NA Pharmaceutical CMO Market Market

The North American Pharmaceutical CMO market is primarily driven by technological advancements leading to increased efficiency and production capacity, the increasing demand for outsourced manufacturing services due to rising R&D costs for pharmaceutical companies, and the rising number of new drug approvals and the growing generic drug market. Government incentives and initiatives to encourage domestic pharmaceutical manufacturing further stimulate growth.

Challenges Impacting NA Pharmaceutical CMO Market Growth

Significant challenges include stringent regulatory requirements that increase operational costs and compliance burdens, the vulnerability of supply chains to global disruptions, and increasing competitive pressures from both established and emerging players.

Key Players Shaping the NA Pharmaceutical CMO Market Market

Significant NA Pharmaceutical CMO Market Industry Milestones

- 2020: Increased investment in digitalization and automation across the CMO sector.

- 2021: Several major mergers and acquisitions reshape the competitive landscape.

- 2022: Launch of several advanced manufacturing facilities incorporating continuous manufacturing technologies.

- 2023: Growing emphasis on sustainability and environmental, social, and governance (ESG) factors.

- 2024: Increased focus on cell and gene therapy manufacturing capabilities.

Future Outlook for NA Pharmaceutical CMO Market Market

The North American Pharmaceutical CMO market is poised for continued growth, driven by the sustained demand for outsourced manufacturing services, technological advancements enhancing efficiency and flexibility, and the emergence of new therapeutic areas requiring specialized manufacturing expertise. Strategic partnerships and acquisitions are expected to shape the industry landscape, fostering innovation and expansion into new markets. The market's long-term potential is substantial, fueled by the ongoing growth of the pharmaceutical and biotechnology sectors.

NA Pharmaceutical CMO Market Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

NA Pharmaceutical CMO Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Pharmaceutical CMO Market Regional Market Share

Geographic Coverage of NA Pharmaceutical CMO Market

NA Pharmaceutical CMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments

- 3.3. Market Restrains

- 3.3.1. Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Pharmaceutical CMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Siegfried AG*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aenova Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lonza Group AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pfizer CentreSource (Pfizer Inc )

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AbbVie Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Baxter Biopharma Solutions (Baxter International Inc )

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Thermo Fisher Scientific Inc (Patheon Inc )

List of Figures

- Figure 1: Global NA Pharmaceutical CMO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America NA Pharmaceutical CMO Market Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America NA Pharmaceutical CMO Market Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America NA Pharmaceutical CMO Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America NA Pharmaceutical CMO Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global NA Pharmaceutical CMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico NA Pharmaceutical CMO Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Pharmaceutical CMO Market?

The projected CAGR is approximately 5.20%.

2. Which companies are prominent players in the NA Pharmaceutical CMO Market?

Key companies in the market include Thermo Fisher Scientific Inc (Patheon Inc ), Siegfried AG*List Not Exhaustive, Aenova Group, Lonza Group AG, Pfizer CentreSource (Pfizer Inc ), AbbVie Inc, Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB, Baxter Biopharma Solutions (Baxter International Inc ).

3. What are the main segments of the NA Pharmaceutical CMO Market?

The market segments include Service Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing emphasis on drug discovery and outsourcing of manufacturing; Strong R&D Investments.

6. What are the notable trends driving market growth?

Finished Dosage Formulation (FDF) Development and Manufacturing is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Pharmaceutical CMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Pharmaceutical CMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Pharmaceutical CMO Market?

To stay informed about further developments, trends, and reports in the NA Pharmaceutical CMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence