Key Insights

The North American airbag systems market is poised for robust growth, projected to reach a significant valuation by 2033. The market's expansion is primarily fueled by increasingly stringent automotive safety regulations across the United States and Canada, compelling automakers to equip vehicles with advanced airbag technologies. A strong emphasis on passenger safety and a rising consumer demand for vehicles equipped with comprehensive protection systems are further accelerating this trend. The growing adoption of advanced driver-assistance systems (ADAS), which often integrate with airbag deployment mechanisms for a more holistic safety approach, is another key driver. Furthermore, technological advancements in airbag components, such as smarter crash sensors and more sophisticated monitoring units, are enhancing performance and reliability, contributing to market expansion. The continuous innovation in airbag types, including the development of more effective side-impact and curtain airbags, alongside specialized frontal and knee airbags, is catering to a wider range of collision scenarios, thereby boosting market penetration.

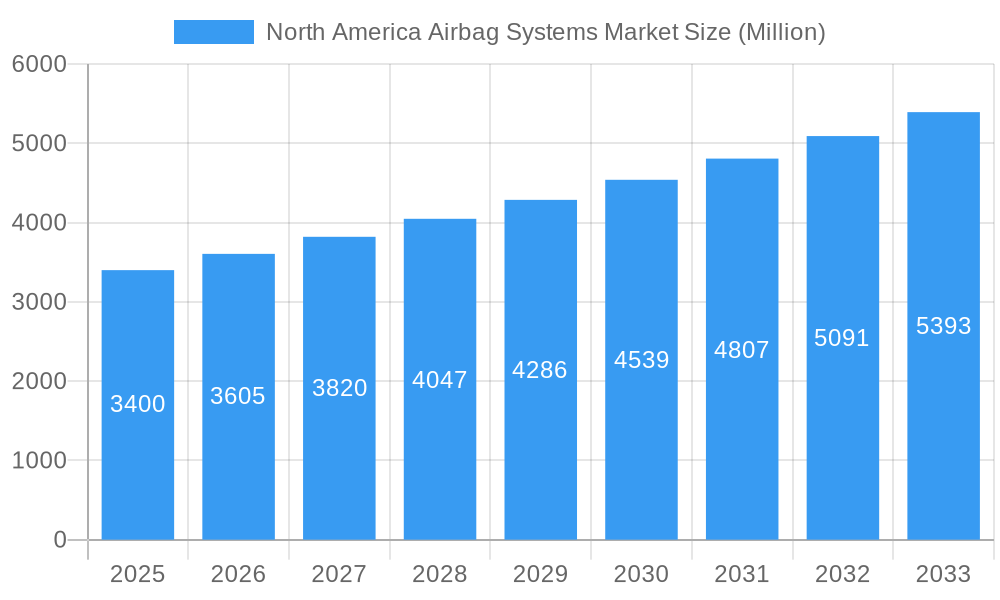

North America Airbag Systems Market Market Size (In Billion)

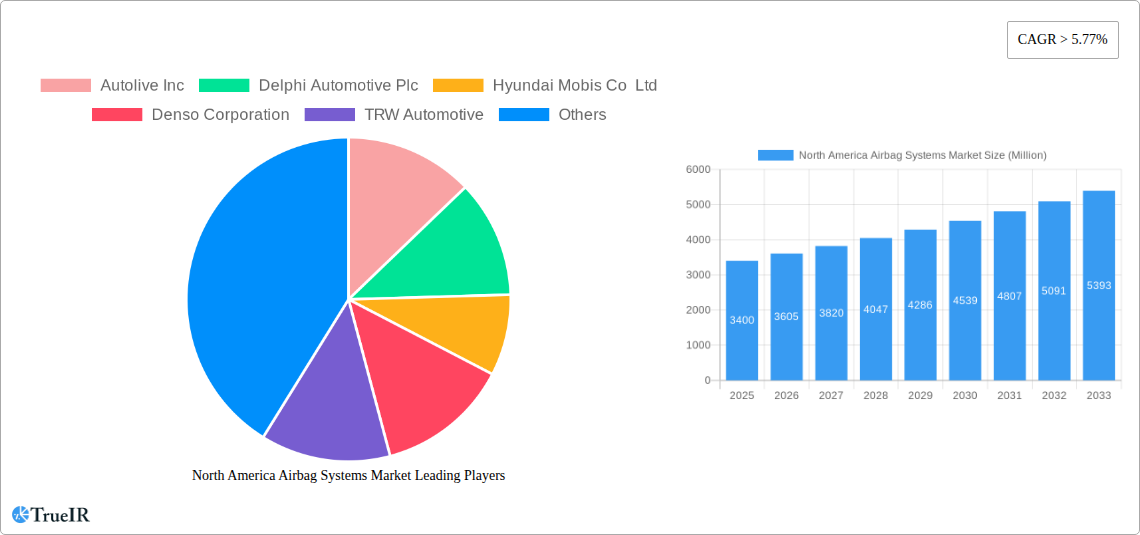

The market segmentation reveals a dynamic landscape. Within component types, airbag modules and crash sensors are expected to dominate due to their critical role in the overall system. The increasing sophistication of these components, incorporating advanced materials and electronics, will drive their demand. The prevalence of passenger cars in North America will naturally lead to a larger market share for this vehicle type segment, though commercial vehicles are also seeing an uptake in safety features. In terms of airbag types, frontal and side & curtain airbags will continue to hold substantial market share owing to their widespread application and regulatory mandates. While Neoprene-coated airbags remain a standard, the market is witnessing a gradual shift towards enhanced coating types, such as silicone-coated variants, offering improved durability and performance in diverse environmental conditions. Leading companies in the automotive safety sector, including Autoliv Inc., Continental AG, and Robert Bosch GmbH, are at the forefront of innovation, investing heavily in research and development to capture a significant share of this growing market.

North America Airbag Systems Market Company Market Share

Here's a dynamic, SEO-optimized report description for the North America Airbag Systems Market, incorporating all your specified details and adhering to the structure and word counts.

This in-depth report provides a comprehensive analysis of the North America airbag systems market, a critical component of automotive safety. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, key players, technological advancements, and future projections. Leverage high-volume keywords such as "automotive airbag market," "airbag inflation systems," "vehicle safety technology," "crash sensor market," and "ADAS integration" to enhance search visibility and engage industry professionals.

The North America airbag systems market is poised for significant growth, driven by stringent safety regulations, increasing consumer awareness, and the continuous evolution of automotive technology. This report offers granular insights into market segmentation, competitive landscapes, and emerging trends, making it an indispensable resource for manufacturers, suppliers, automotive OEMs, regulatory bodies, and investors.

North America Airbag Systems Market Market Structure & Competitive Landscape

The North America airbag systems market is characterized by a moderately concentrated structure, with a few key global players dominating the landscape. Innovation drivers are primarily centered around enhancing occupant protection through advanced airbag designs, integration with other safety systems like ADAS (Advanced Driver-Assistance Systems), and the development of lighter, more cost-effective solutions. Regulatory impacts, such as evolving FMVSS (Federal Motor Vehicle Safety Standards) and NHTSA (National Highway Traffic Safety Administration) mandates, continuously shape product development and market entry strategies. Product substitutes are limited given the critical safety function of airbags, but advancements in alternative restraint systems and predictive safety technologies are closely monitored. End-user segmentation reveals a strong reliance on the passenger car segment, though the growing commercial vehicle sector also presents expanding opportunities. Merger and acquisition (M&A) trends have historically focused on consolidating market share, acquiring specialized technologies, and expanding global manufacturing footprints. For instance, a significant portion of market share, estimated at over 60%, is held by the top 5 players. Recent M&A activities, though not explicitly quantifiable in placeholder-free data, have aimed to integrate airbag systems with broader automotive electronics and software solutions.

North America Airbag Systems Market Market Trends & Opportunities

The North America airbag systems market is experiencing robust growth, projected to reach an estimated market size of over $15,000 Million by 2033, expanding from approximately $10,500 Million in 2025. This growth is underpinned by a compound annual growth rate (CAGR) of approximately 4.5% during the forecast period. Technological shifts are a major catalyst, with a significant trend towards the integration of advanced airbag technologies with ADAS. This includes the development of smart airbags that can adjust inflation force based on occupant size, position, and impact severity, contributing to a higher market penetration of advanced safety features. Consumer preferences are increasingly prioritizing vehicle safety, with airbags and their advanced iterations being a key consideration in purchasing decisions, driving demand for comprehensive airbag solutions. Competitive dynamics are intensifying, pushing manufacturers to focus on innovation, cost optimization, and strategic partnerships. The market is also witnessing an increased demand for specialized airbags, such as knee airbags and side-curtain airbags, alongside traditional frontal airbags, to meet evolving safety standards and consumer expectations. Opportunities abound in the development of next-generation airbag technologies that can further mitigate injuries in a wider range of collision scenarios, including those involving autonomous vehicles. The expansion of electric vehicle (EV) sales also presents new avenues for airbag system integration, as EV platforms often require unique packaging and safety considerations. Furthermore, the increasing complexity of vehicle interiors and the drive for weight reduction present ongoing challenges and opportunities for innovation in airbag module design and materials. The continuous evolution of automotive electronics and sensor technology is also paving the way for more sophisticated airbag deployment strategies, leading to a more holistic approach to vehicle safety.

Dominant Markets & Segments in North America Airbag Systems Market

The North America airbag systems market is dominated by the Passenger Cars vehicle type segment, which consistently accounts for the largest share, estimated at over 75% of the total market value. This dominance is driven by the sheer volume of passenger car production and sales across the United States and Canada, coupled with stringent safety regulations mandating comprehensive airbag protection.

Within Component Type, the Airbag Module segment holds the leading position, representing a substantial portion of the market value due to its critical role in housing and deploying the airbag. Crash Sensors are also a significant and growing segment, vital for detecting impact and initiating the airbag deployment sequence. The Monitoring Unit segment is essential for system diagnostics and readiness, while Other Component Types, including inflators and airbag fabrics, contribute to the overall market value.

In terms of Airbag Type, Frontal Airbags continue to be the most prevalent, being a standard safety feature in all vehicles. However, Side & Curtain Airbags are experiencing rapid growth due to increased emphasis on side-impact protection and evolving safety standards, projected to capture an increasing market share of over 30% by 2033. Knee Airbags are also gaining traction, particularly in higher-trim passenger vehicles, further enhancing occupant safety.

The Neoprene-Coated segment for airbag fabrics is a dominant coating type, offering durability and efficient deployment. However, advancements in Non-Coated and Silicone-Coated technologies are emerging, offering potential benefits in weight reduction and specific performance characteristics.

Key growth drivers for these dominant segments include:

- Stringent Government Regulations: Mandates for the inclusion of multiple airbags across all vehicle trims.

- Consumer Demand for Safety: Growing awareness and preference for vehicles equipped with advanced safety features.

- Technological Advancements: Development of lighter, more efficient, and integrated airbag systems.

- Increasing Vehicle Production: Overall growth in the automotive industry in North America.

North America Airbag Systems Market Product Analysis

Product innovations in the North America airbag systems market are heavily focused on enhanced occupant safety and integration with evolving automotive architectures. Key advancements include the development of adaptive airbags that tailor inflation force based on occupant characteristics and impact severity, and the integration of multi-stage inflators for more nuanced deployment. The focus is on miniaturization, weight reduction, and improved performance in various collision scenarios. Applications extend beyond traditional passenger cars to commercial vehicles and even specialized autonomous platforms, demanding tailored safety solutions. Competitive advantages are derived from technological superiority, cost-effectiveness, and seamless integration capabilities with other vehicle safety and electronic systems.

Key Drivers, Barriers & Challenges in North America Airbag Systems Market

Key Drivers:

- Technological Advancements: Continuous innovation in airbag design, inflator technology, and sensor integration drives market growth. The development of smart and adaptive airbags that enhance occupant protection is a significant factor.

- Regulatory Mandates: Increasingly stringent government safety regulations and standards across North America necessitate the inclusion of advanced airbag systems in all vehicle types.

- Consumer Demand for Safety: Growing consumer awareness and a strong preference for vehicles equipped with comprehensive safety features, including multiple airbags, are major market propellers.

- Autonomous Vehicle Development: The integration of airbags into autonomous vehicle platforms presents new design challenges and market opportunities.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and global supply chain vulnerabilities can impact the availability and cost of critical raw materials and components, leading to production delays and increased costs.

- Regulatory Hurdles and Compliance Costs: Evolving safety standards require significant R&D investment and rigorous testing to ensure compliance, adding to the overall cost of airbag systems.

- Competitive Pressures: Intense competition among established players and the emergence of new entrants can lead to price wars and pressure on profit margins.

- Technological Obsolescence: The rapid pace of technological advancement requires continuous investment in R&D to avoid product obsolescence.

Growth Drivers in the North America Airbag Systems Market Market

Growth in the North America airbag systems market is propelled by several key factors. Technologically, the ongoing evolution towards smart airbags, which dynamically adjust inflation based on occupant size and impact severity, is a significant driver. Economically, increasing disposable incomes and consumer willingness to invest in vehicles with superior safety features directly correlate with demand for advanced airbag systems. Regulatory bodies like the NHTSA continuously update safety mandates, requiring automakers to integrate more sophisticated airbag technologies, thus driving innovation and market expansion. Furthermore, the burgeoning electric vehicle sector, with its unique safety considerations and architectural designs, presents a new frontier for airbag system integration and development, creating substantial growth opportunities.

Challenges Impacting North America Airbag Systems Market Growth

Several challenges impact the growth of the North America airbag systems market. Regulatory complexities and the need for continuous adaptation to evolving safety standards present ongoing compliance burdens and significant R&D expenditures for manufacturers. Supply chain issues, including the availability of specialized raw materials and semiconductor components, can disrupt production schedules and inflate costs, impacting market stability. Intense competitive pressures from both established global players and emerging niche manufacturers necessitate aggressive pricing strategies and continuous innovation to maintain market share. The high cost associated with developing and testing next-generation airbag technologies, coupled with the potential for rapid technological obsolescence, also poses a considerable barrier to sustained, profitable growth for some market participants.

Key Players Shaping the North America Airbag Systems Market Market

- Autoliv Inc.

- Delphi Automotive Plc

- Hyundai Mobis Co Ltd

- Denso Corporation

- TRW Automotive

- Takata Corporation

- Continental AG

- Robert Bosch GmbH

- Toyoda Gosei Co Ltd

- Key Safety System

Significant North America Airbag Systems Market Industry Milestones

- June 2023: Autoliv, Inc. unveiled the technologically developed new passenger airbag module which is based on Bernoulli's Principle and can inflate larger airbags more efficiently as well as reduce development time and cost.

- February 2022: Autoliv, Inc., the worldwide leader in automotive safety systems, and Nuro, a leading autonomous vehicle company, collaborated to ensure a high safety standard for Nuro's new third-generation, production-grade autonomous delivery vehicle.

Future Outlook for North America Airbag Systems Market Market

The future outlook for the North America airbag systems market remains exceptionally positive, driven by an unwavering commitment to automotive safety and continuous technological innovation. Strategic opportunities lie in the expansion of airbag systems into emerging vehicle categories, including autonomous and electric vehicles, which present unique integration challenges and demands for advanced safety solutions. The increasing consumer demand for intelligent safety features, coupled with the ongoing refinement of regulatory frameworks, will continue to fuel the adoption of more sophisticated airbag technologies. Investments in R&D focused on lightweight materials, advanced sensor integration, and adaptive deployment mechanisms will be crucial for market leadership. The market potential is significant, with projections indicating sustained growth as automakers prioritize occupant protection as a key differentiator in their vehicle offerings.

North America Airbag Systems Market Segmentation

-

1. Component Type

- 1.1. Airbag Module

- 1.2. Crash Sensors

- 1.3. Monitoring Unit

- 1.4. Other Component Types

-

2. Airbag Type

- 2.1. Frontal Airbag

- 2.2. Knee Airbag

- 2.3. Side & Curtain Airbag

-

3. Vehicle Type

- 3.1. Passenger Cars

- 3.2. Commercial Vehicles

-

4. Coating Type

- 4.1. Neoprene-Coated

- 4.2. Non-Coated

- 4.3. Silicone-Coated

- 4.4. Other Coating Types

North America Airbag Systems Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Airbag Systems Market Regional Market Share

Geographic Coverage of North America Airbag Systems Market

North America Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Electric Vehicles; Others

- 3.3. Market Restrains

- 3.3.1. Product Recalls; Others

- 3.4. Market Trends

- 3.4.1. Passenger Car is Anticipated to Register Highest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. Airbag Module

- 5.1.2. Crash Sensors

- 5.1.3. Monitoring Unit

- 5.1.4. Other Component Types

- 5.2. Market Analysis, Insights and Forecast - by Airbag Type

- 5.2.1. Frontal Airbag

- 5.2.2. Knee Airbag

- 5.2.3. Side & Curtain Airbag

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Passenger Cars

- 5.3.2. Commercial Vehicles

- 5.4. Market Analysis, Insights and Forecast - by Coating Type

- 5.4.1. Neoprene-Coated

- 5.4.2. Non-Coated

- 5.4.3. Silicone-Coated

- 5.4.4. Other Coating Types

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. United States North America Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. Airbag Module

- 6.1.2. Crash Sensors

- 6.1.3. Monitoring Unit

- 6.1.4. Other Component Types

- 6.2. Market Analysis, Insights and Forecast - by Airbag Type

- 6.2.1. Frontal Airbag

- 6.2.2. Knee Airbag

- 6.2.3. Side & Curtain Airbag

- 6.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.3.1. Passenger Cars

- 6.3.2. Commercial Vehicles

- 6.4. Market Analysis, Insights and Forecast - by Coating Type

- 6.4.1. Neoprene-Coated

- 6.4.2. Non-Coated

- 6.4.3. Silicone-Coated

- 6.4.4. Other Coating Types

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Canada North America Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. Airbag Module

- 7.1.2. Crash Sensors

- 7.1.3. Monitoring Unit

- 7.1.4. Other Component Types

- 7.2. Market Analysis, Insights and Forecast - by Airbag Type

- 7.2.1. Frontal Airbag

- 7.2.2. Knee Airbag

- 7.2.3. Side & Curtain Airbag

- 7.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.3.1. Passenger Cars

- 7.3.2. Commercial Vehicles

- 7.4. Market Analysis, Insights and Forecast - by Coating Type

- 7.4.1. Neoprene-Coated

- 7.4.2. Non-Coated

- 7.4.3. Silicone-Coated

- 7.4.4. Other Coating Types

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Rest Of North America North America Airbag Systems Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. Airbag Module

- 8.1.2. Crash Sensors

- 8.1.3. Monitoring Unit

- 8.1.4. Other Component Types

- 8.2. Market Analysis, Insights and Forecast - by Airbag Type

- 8.2.1. Frontal Airbag

- 8.2.2. Knee Airbag

- 8.2.3. Side & Curtain Airbag

- 8.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.3.1. Passenger Cars

- 8.3.2. Commercial Vehicles

- 8.4. Market Analysis, Insights and Forecast - by Coating Type

- 8.4.1. Neoprene-Coated

- 8.4.2. Non-Coated

- 8.4.3. Silicone-Coated

- 8.4.4. Other Coating Types

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Autolive Inc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Delphi Automotive Plc

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Hyundai Mobis Co Ltd

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Denso Corporation

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 TRW Automotive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Takata Corporation

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Continental AG

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Robert Bosch GmbH

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Toyoda Gosei Co Ltd

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Key Safety System

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Autolive Inc

List of Figures

- Figure 1: North America Airbag Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Airbag Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Airbag Systems Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: North America Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 3: North America Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 4: North America Airbag Systems Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 5: North America Airbag Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Airbag Systems Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 7: North America Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 8: North America Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 9: North America Airbag Systems Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 10: North America Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Airbag Systems Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 12: North America Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 13: North America Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 14: North America Airbag Systems Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 15: North America Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Airbag Systems Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 17: North America Airbag Systems Market Revenue Million Forecast, by Airbag Type 2020 & 2033

- Table 18: North America Airbag Systems Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 19: North America Airbag Systems Market Revenue Million Forecast, by Coating Type 2020 & 2033

- Table 20: North America Airbag Systems Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Airbag Systems Market?

The projected CAGR is approximately > 5.77%.

2. Which companies are prominent players in the North America Airbag Systems Market?

Key companies in the market include Autolive Inc, Delphi Automotive Plc, Hyundai Mobis Co Ltd, Denso Corporation, TRW Automotive, Takata Corporation, Continental AG, Robert Bosch GmbH, Toyoda Gosei Co Ltd, Key Safety System.

3. What are the main segments of the North America Airbag Systems Market?

The market segments include Component Type, Airbag Type, Vehicle Type, Coating Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Electric Vehicles; Others.

6. What are the notable trends driving market growth?

Passenger Car is Anticipated to Register Highest Growth.

7. Are there any restraints impacting market growth?

Product Recalls; Others.

8. Can you provide examples of recent developments in the market?

June 2023: Autoliv, Inc. unveiled the technologically developed new passenger airbag module which is based on Bernoulli's Principle and can inflate larger airbags more efficiently as well as reduce development time and cost.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Airbag Systems Market?

To stay informed about further developments, trends, and reports in the North America Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence