Key Insights

The North American automotive upholstery market, projected at $22.5 billion in 2025, is poised for significant expansion. Key growth drivers include the increasing demand for luxury vehicles and sophisticated interior designs, fueled by consumer preference for premium materials like leather and customized finishes. The growing popularity of SUVs and light trucks, which inherently require more upholstery, further bolsters market growth. Technological advancements in material science, yielding more durable, lightweight, and aesthetically appealing upholstery, are also pivotal. The aftermarket segment is anticipated to experience strong growth due to rising vehicle personalization and refurbishment trends. Market expansion may be influenced by fluctuations in automotive production linked to global economic conditions and supply chain disruptions. While leather remains a primary material, the emergence of sustainable and vegan alternatives, such as high-quality vinyl and innovative materials, is fostering new market segments. Original Equipment Manufacturers (OEMs) are prioritizing investments in enhanced offerings and collaborations with upholstery suppliers to maintain a competitive edge. North America's market leadership is attributed to its robust automotive manufacturing base and high consumer vehicle expenditure, supported by recent growth in the regional automotive sector.

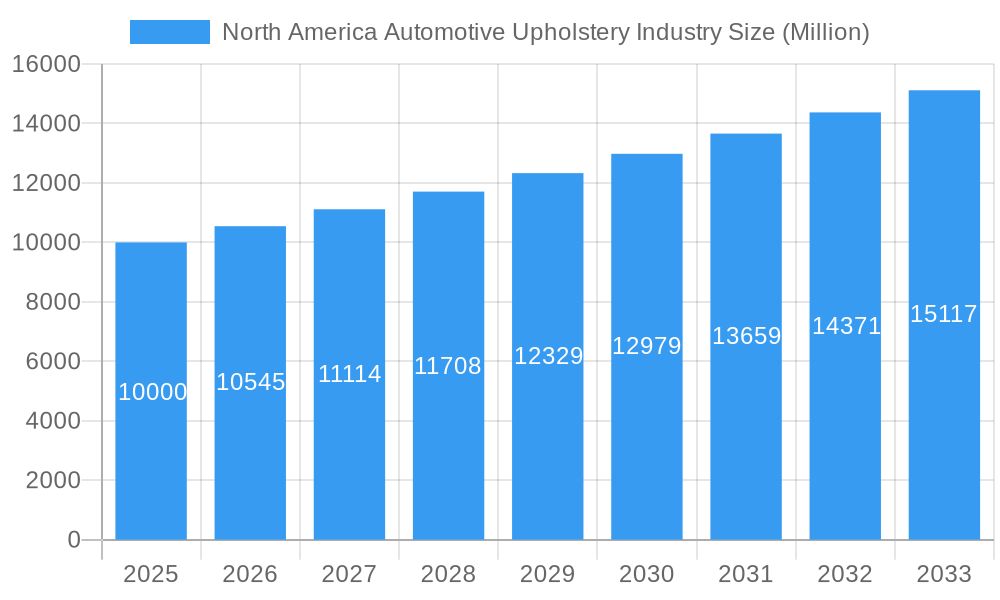

North America Automotive Upholstery Industry Market Size (In Billion)

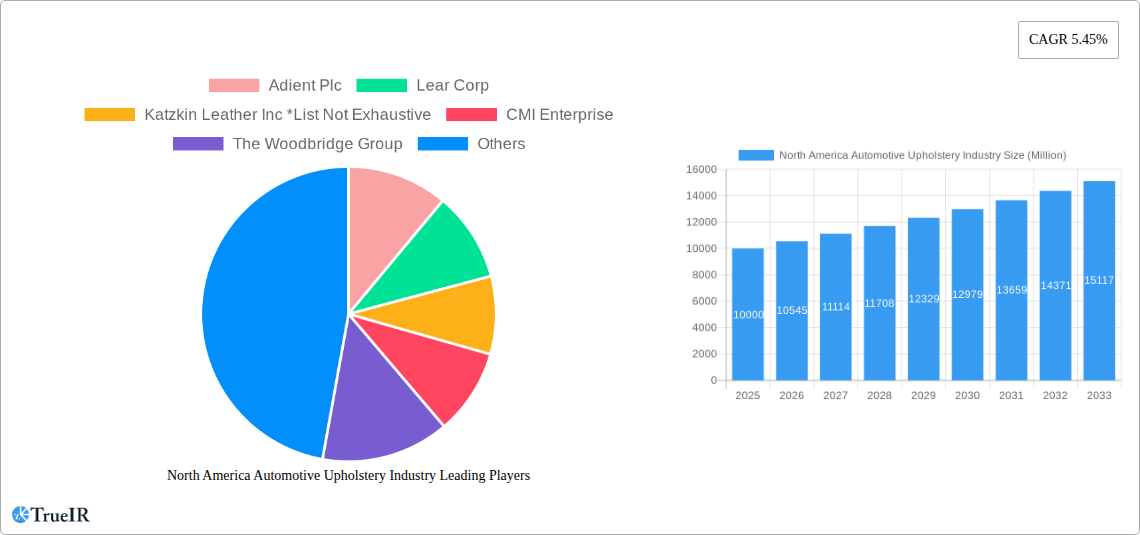

Segmentation analysis of the North American automotive upholstery market highlights several dynamics. The leather segment currently dominates due to its perceived luxury and durability. However, the "Other Material Types" segment, encompassing sustainable and innovative materials, is projected for the fastest growth, driven by increasing environmental awareness and cost-effectiveness. Within sales channels, the OEM segment holds the largest share, underscoring the significance of original equipment. Conversely, the aftermarket segment is exhibiting substantial growth, propelled by the escalating trend in vehicle customization and the availability of replacement and upgrade options. Leading companies like Adient Plc, Lear Corp, and Katzkin Leather Inc are strategically positioned to leverage these trends through R&D investments and portfolio expansion to meet evolving consumer demands. Intense competitive rivalry is evident, influenced by factors such as pricing, quality, and innovation.

North America Automotive Upholstery Industry Company Market Share

North America Automotive Upholstery Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America automotive upholstery industry, covering market size, trends, key players, and future outlook. With a focus on the period from 2019 to 2033, this report is an essential resource for industry professionals, investors, and anyone seeking to understand this dynamic market. The report leverages extensive data analysis and expert insights to deliver a clear and concise overview of the current landscape and future trajectory of the North American automotive upholstery market, valued at xx Million in 2025 and projected to reach xx Million by 2033.

North America Automotive Upholstery Industry Market Structure & Competitive Landscape

The North American automotive upholstery market is moderately consolidated, with several key players dominating significant market shares. The Herfindahl-Hirschman Index (HHI) for the market is estimated at xx, indicating a moderately concentrated market. Key drivers of innovation include the rising demand for sustainable materials, advancements in lightweighting technologies, and the integration of advanced features like heated and ventilated seats. Regulatory impacts, particularly concerning emissions and material sourcing, significantly influence the industry. Product substitutes, such as alternative materials with similar functionalities, pose a competitive challenge. The end-user segment is primarily comprised of OEMs and the aftermarket. M&A activity has been moderate in recent years, with approximately xx deals recorded between 2019 and 2024, driven primarily by the pursuit of economies of scale and technological capabilities.

- Market Concentration: Moderately consolidated, with HHI estimated at xx.

- Innovation Drivers: Sustainable materials, lightweighting, advanced features (heated/ventilated seats).

- Regulatory Impacts: Stringent emission standards, material sourcing regulations.

- Product Substitutes: Alternative materials (e.g., recycled fabrics, bio-based vinyl).

- End-User Segmentation: OEMs (Original Equipment Manufacturers) and Aftermarket.

- M&A Trends: Moderate activity (xx deals, 2019-2024), driven by scale and technology.

North America Automotive Upholstery Industry Market Trends & Opportunities

The North America automotive upholstery market exhibits robust growth, driven by the increasing demand for vehicles and the rising consumer preference for enhanced comfort and aesthetics. The market size is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. Technological advancements, such as the incorporation of smart materials and advanced manufacturing processes, are transforming the industry. Consumer preferences are shifting towards sustainable and eco-friendly upholstery options, creating significant opportunities for manufacturers who can meet this demand. Competitive dynamics are characterized by intense rivalry amongst established players and the emergence of new entrants offering innovative solutions. Market penetration rates for specific material types, such as vegan leather alternatives, are expected to increase significantly in the coming years.

Dominant Markets & Segments in North America Automotive Upholstery Industry

The United States represents the largest market within North America for automotive upholstery, accounting for approximately xx% of the total market value. Within the material type segment, Leather currently holds the largest market share, followed by Vinyl and Other Material Types. The OEM sales channel dominates, reflecting the significant demand from automotive manufacturers. Seats are the most prevalent product type, contributing a substantial portion to overall market revenue.

- Leading Region: United States

- Leading Material Type: Leather

- Leading Sales Channel: OEM

- Leading Product: Seats

Key Growth Drivers:

- Increasing vehicle production in the US.

- Rising consumer disposable incomes and vehicle purchases.

- Growing demand for luxury vehicles with premium upholstery.

North America Automotive Upholstery Industry Product Analysis

Technological advancements are driving the introduction of innovative upholstery products. These advancements include the development of lightweight, durable, and sustainable materials, improving comfort and performance. The use of bio-based materials and recycled content is gaining traction, appealing to environmentally conscious consumers. Furthermore, advanced features such as integrated heating, cooling, and massage functionalities are enhancing the value proposition of automotive upholstery. The market fit for these advanced products is strong, especially in premium vehicles.

Key Drivers, Barriers & Challenges in North America Automotive Upholstery Industry

Key Drivers:

The automotive upholstery market is driven by factors such as the growth in automobile production, increasing demand for premium and customized interiors, and the development of innovative, sustainable materials. Government regulations promoting fuel efficiency indirectly drive the need for lightweight upholstery materials.

Challenges and Restraints:

Supply chain disruptions, especially concerning raw material availability and transportation costs, pose significant challenges. Fluctuating raw material prices and stringent environmental regulations add to the complexity of the industry. Intense competition from established players and the emergence of new entrants also create challenges. The automotive industry's cyclical nature also introduces volatility to the market.

Growth Drivers in the North America Automotive Upholstery Industry Market

Significant growth drivers include the increasing demand for new vehicles, particularly SUVs and luxury cars that require sophisticated upholstery. The rising adoption of sustainable and eco-friendly materials is another key driver, attracting environmentally conscious consumers. Government regulations, encouraging fuel-efficient vehicles, indirectly stimulate the use of lightweight upholstery components.

Challenges Impacting North America Automotive Upholstery Industry Growth

The industry faces hurdles such as fluctuating raw material prices, which increase production costs and negatively impact profitability. Supply chain disruptions and geopolitical instability add further uncertainty. Stringent environmental regulations and the increasing cost of compliance create additional challenges for manufacturers.

Key Players Shaping the North America Automotive Upholstery Industry Market

- Adient Plc

- Lear Corp

- Katzkin Leather Inc

- CMI Enterprise

- The Woodbridge Group

- IMS Nonwoven

- Seiren Co Ltd

- Toyota Boshoku Corp

- Faurecia SE

Significant North America Automotive Upholstery Industry Milestones

- August 2023: Bentley's launch of the Bentayga EWB Mulliner highlights the increasing demand for luxury and advanced seating technologies.

- June 2023: Faurecia's modular and sustainable seat design showcases innovation in manufacturing and material usage.

- June 2023: Lexus's revamped 2024 GX emphasizes improvements in seating ergonomics and comfort.

- November 2022: Polestar's use of INEOS BIOVYN highlights the growing adoption of sustainable materials.

- September 2022: BMW Group's commitment to fully vegan interiors reflects the rising demand for eco-friendly options.

Future Outlook for North America Automotive Upholstery Industry Market

The North America automotive upholstery market is poised for sustained growth, driven by several factors. Innovation in materials, focusing on sustainability and functionality, presents significant opportunities. The increasing demand for luxury vehicles and advanced seating technologies will fuel further market expansion. Strategic partnerships and collaborations among manufacturers and material suppliers will also contribute to the industry's growth. The market holds substantial potential for growth, particularly in the segments of sustainable and technologically advanced upholstery.

North America Automotive Upholstery Industry Segmentation

-

1. Material Type

- 1.1. Leather

- 1.2. Vinyl

- 1.3. Other Material Types

-

2. Sales Channel

- 2.1. OEM

- 2.2. Aftermarket

-

3. Product

- 3.1. Dashboard

- 3.2. Seats

- 3.3. Roof Liners

- 3.4. Door Trim

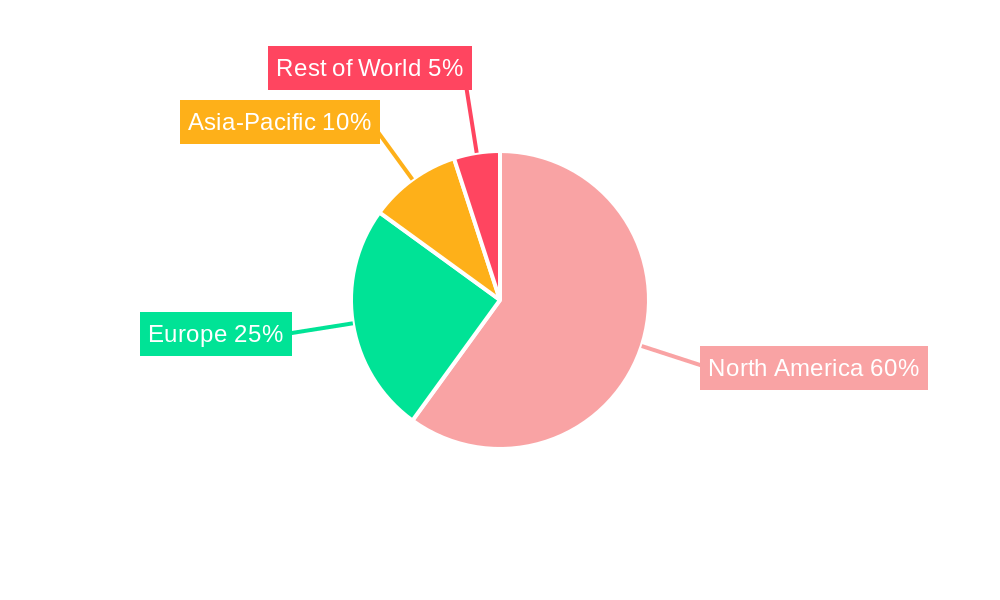

North America Automotive Upholstery Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Rest Of North America

North America Automotive Upholstery Industry Regional Market Share

Geographic Coverage of North America Automotive Upholstery Industry

North America Automotive Upholstery Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Passenger Car Sales Propelling Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Leather

- 5.1.2. Vinyl

- 5.1.3. Other Material Types

- 5.2. Market Analysis, Insights and Forecast - by Sales Channel

- 5.2.1. OEM

- 5.2.2. Aftermarket

- 5.3. Market Analysis, Insights and Forecast - by Product

- 5.3.1. Dashboard

- 5.3.2. Seats

- 5.3.3. Roof Liners

- 5.3.4. Door Trim

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Rest Of North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Leather

- 6.1.2. Vinyl

- 6.1.3. Other Material Types

- 6.2. Market Analysis, Insights and Forecast - by Sales Channel

- 6.2.1. OEM

- 6.2.2. Aftermarket

- 6.3. Market Analysis, Insights and Forecast - by Product

- 6.3.1. Dashboard

- 6.3.2. Seats

- 6.3.3. Roof Liners

- 6.3.4. Door Trim

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Canada North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Leather

- 7.1.2. Vinyl

- 7.1.3. Other Material Types

- 7.2. Market Analysis, Insights and Forecast - by Sales Channel

- 7.2.1. OEM

- 7.2.2. Aftermarket

- 7.3. Market Analysis, Insights and Forecast - by Product

- 7.3.1. Dashboard

- 7.3.2. Seats

- 7.3.3. Roof Liners

- 7.3.4. Door Trim

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Rest Of North America North America Automotive Upholstery Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Leather

- 8.1.2. Vinyl

- 8.1.3. Other Material Types

- 8.2. Market Analysis, Insights and Forecast - by Sales Channel

- 8.2.1. OEM

- 8.2.2. Aftermarket

- 8.3. Market Analysis, Insights and Forecast - by Product

- 8.3.1. Dashboard

- 8.3.2. Seats

- 8.3.3. Roof Liners

- 8.3.4. Door Trim

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Adient Plc

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Lear Corp

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Katzkin Leather Inc *List Not Exhaustive

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 CMI Enterprise

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 The Woodbridge Group

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 IMS Nonwoven

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Seiren Co Ltd

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Toyota Boshoku Corp

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Faurecia SE

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.1 Adient Plc

List of Figures

- Figure 1: North America Automotive Upholstery Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Automotive Upholstery Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 3: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 4: North America Automotive Upholstery Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 6: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 7: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 11: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 12: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America Automotive Upholstery Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 14: North America Automotive Upholstery Industry Revenue billion Forecast, by Sales Channel 2020 & 2033

- Table 15: North America Automotive Upholstery Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 16: North America Automotive Upholstery Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Upholstery Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the North America Automotive Upholstery Industry?

Key companies in the market include Adient Plc, Lear Corp, Katzkin Leather Inc *List Not Exhaustive, CMI Enterprise, The Woodbridge Group, IMS Nonwoven, Seiren Co Ltd, Toyota Boshoku Corp, Faurecia SE.

3. What are the main segments of the North America Automotive Upholstery Industry?

The market segments include Material Type, Sales Channel, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Passenger Car Sales Propelling Market Growth.

6. What are the notable trends driving market growth?

Increasing Demand for Aftermarket Upholstery Modifications May Drive the Market.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

August 2023: Bentley unveiled the Bentayga Extended Wheelbase Mulliner during Monterey Car Week in California. The Bentayga EWB Mulliner flagship has greater cabin room than any similar premium competition, owing to its Airline Seats. The rear compartment, which is available in 4+1 and 4-seat configurations, comes standard with the Bentley Airline Seat specification, the world's most sophisticated vehicle seating arrangement.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Upholstery Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Upholstery Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Upholstery Industry?

To stay informed about further developments, trends, and reports in the North America Automotive Upholstery Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence