Key Insights

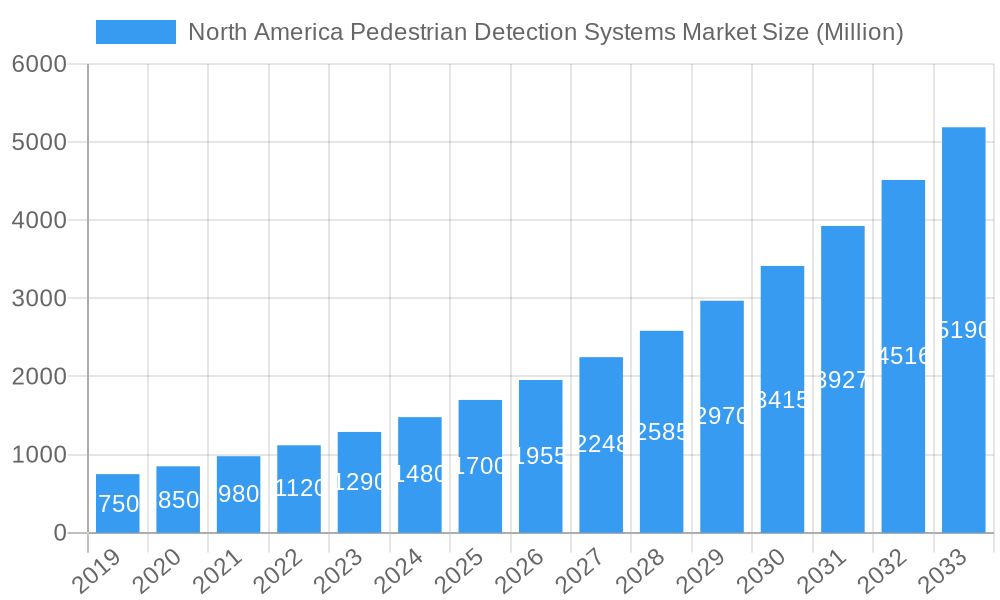

The North America Pedestrian Detection Systems Market is poised for explosive growth, with an estimated market size of approximately $1.5 billion in 2025, projected to surpass $4.5 billion by 2033. This remarkable expansion is fueled by a compound annual growth rate (CAGR) exceeding 15.00%, driven by an urgent global imperative to enhance road safety and reduce pedestrian-related fatalities. The escalating adoption of Advanced Driver-Assistance Systems (ADAS) in vehicles, coupled with stringent government regulations mandating safety features, forms the bedrock of this market's trajectory. Leading automotive manufacturers like Toyota Motor Corporation, General Motors Company, and Honda Motor Company Ltd., alongside prominent suppliers such as Continental AG and Robert Bosch GmbH, are heavily investing in research and development to integrate sophisticated pedestrian detection technologies. The market's dynamism is further characterized by a growing preference for hybrid and infrared sensor technologies, offering enhanced accuracy and performance in diverse environmental conditions. North America, with its significant automotive production and a strong consumer demand for safety-centric vehicles, represents a critical and rapidly evolving landscape for these advanced systems.

North America Pedestrian Detection Systems Market Market Size (In Million)

The future of pedestrian detection systems in North America is being shaped by several key trends, including the continuous miniaturization and cost reduction of sensor components, enabling wider integration across vehicle segments. The increasing sophistication of AI and machine learning algorithms is dramatically improving the accuracy and responsiveness of these systems, allowing them to differentiate between pedestrians, cyclists, and static objects with greater precision. Furthermore, the convergence of pedestrian detection with other ADAS functionalities, such as automatic emergency braking and lane-keeping assist, is creating a more holistic and effective safety ecosystem. Despite this optimistic outlook, certain restraints, such as the high initial cost of some advanced sensor suites and consumer education regarding the capabilities and limitations of these systems, need to be addressed. Nevertheless, the overwhelming drive towards autonomous driving and the inherent safety benefits of robust pedestrian detection are expected to propel the market forward, making it a critical component of future automotive innovation in the United States, Canada, and Mexico.

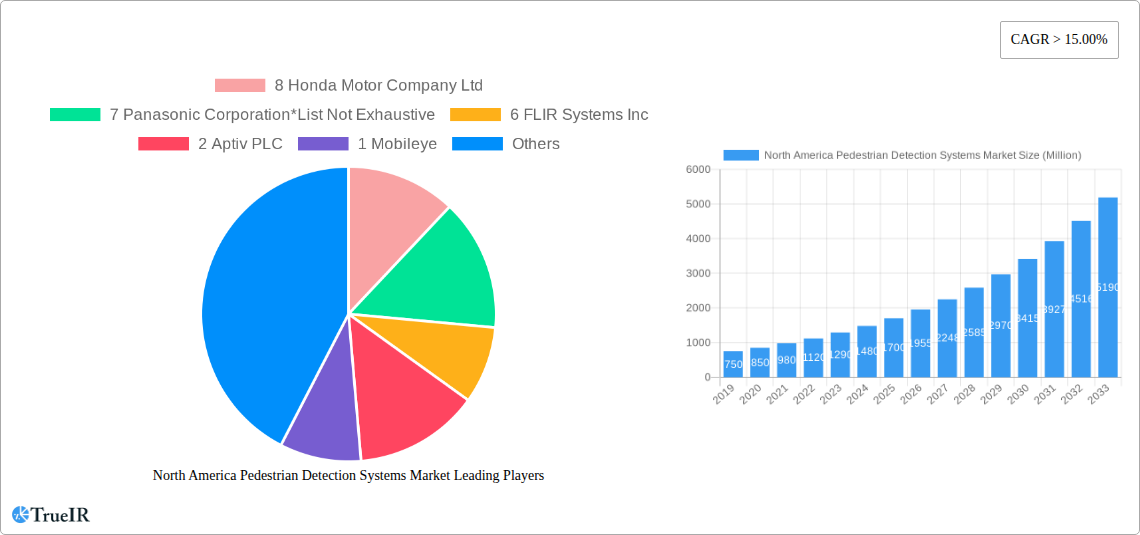

North America Pedestrian Detection Systems Market Company Market Share

North America Pedestrian Detection Systems Market: Driving Road Safety with Advanced ADAS Technology

This comprehensive report offers an in-depth analysis of the North America Pedestrian Detection Systems Market, meticulously examining its structure, dynamics, and future trajectory. Focusing on high-volume keywords such as "pedestrian detection," "ADAS technology," "autonomous driving safety," "automotive sensors," and "vehicle safety systems," this report is engineered for maximum SEO impact and to provide actionable insights for industry stakeholders. The market is projected for significant growth driven by increasing regulatory mandates, rising consumer demand for enhanced vehicle safety, and continuous innovation in sensor and AI technologies. The study covers the historical period of 2019–2024, a base year of 2025, and a forecast period extending to 2033, with an estimated market valuation for 2025.

North America Pedestrian Detection Systems Market Market Structure & Competitive Landscape

The North America Pedestrian Detection Systems Market is characterized by a moderately concentrated landscape, with a significant presence of both established automotive manufacturers and specialized technology suppliers. Innovation is a key driver, fueled by relentless R&D in advanced driver-assistance systems (ADAS) and the burgeoning field of autonomous driving. Regulatory impacts, particularly evolving safety standards from governmental bodies, are increasingly shaping product development and market entry strategies. Product substitutes, while limited for core detection functions, exist in the form of advanced warning systems and integrated safety suites. The end-user segmentation is primarily driven by automotive manufacturers integrating these systems into their vehicle portfolios. Mergers and acquisitions (M&A) are a notable trend, with larger entities acquiring smaller, innovative technology firms to bolster their ADAS capabilities. For instance, a significant number of acquisitions occurred between 2021 and 2023, focusing on companies with expertise in AI-powered vision systems and sensor fusion, indicating a strategic consolidation to capture market share.

- Market Concentration: Moderate, with key players holding substantial market share.

- Innovation Drivers: ADAS advancement, AI integration, sensor fusion, autonomous driving development.

- Regulatory Impacts: Strict safety mandates pushing for advanced pedestrian detection features.

- Product Substitutes: Limited for core detection; focus on integrated safety solutions.

- End-User Segmentation: Primarily automotive manufacturers, Tier-1 suppliers.

- M&A Trends: Active consolidation of technology startups by larger automotive and technology firms.

North America Pedestrian Detection Systems Market Market Trends & Opportunities

The North America Pedestrian Detection Systems Market is witnessing robust expansion, driven by an escalating global emphasis on road safety and the rapid integration of Advanced Driver-Assistance Systems (ADAS) into mainstream vehicles. The market size for pedestrian detection systems, estimated to be in the billions of USD in the base year of 2025, is projected to grow at a compound annual growth rate (CAGR) of approximately 15% throughout the forecast period of 2025–2033. This growth is fundamentally underpinned by technological shifts, with video-based detection systems, increasingly enhanced by sophisticated AI and machine learning algorithms, leading the charge. Infrared and hybrid sensor technologies are also gaining traction, particularly for their effectiveness in low-light and adverse weather conditions, addressing key limitations of purely optical systems.

Consumer preferences are increasingly leaning towards vehicles equipped with comprehensive safety suites, with pedestrian detection emerging as a critical feature. This trend is amplified by younger generations of car buyers who prioritize safety technology. The competitive dynamics within the market are intense, characterized by strategic collaborations between automotive OEMs and sensor technology providers, as well as internal development efforts by major automakers. Opportunities abound for companies that can offer cost-effective, highly accurate, and robust pedestrian detection solutions that can be seamlessly integrated into diverse vehicle platforms. The continuous evolution towards higher levels of vehicle automation further fuels the demand for reliable perception systems, including advanced pedestrian detection, which forms the bedrock of safe autonomous operation. Emerging opportunities also lie in aftermarket solutions and specialized applications for commercial fleets, further diversifying the market landscape and extending its reach beyond new vehicle integrations. The penetration rate of ADAS features, including pedestrian detection, in new vehicle sales is expected to surpass 80% by 2030, highlighting the significant market potential.

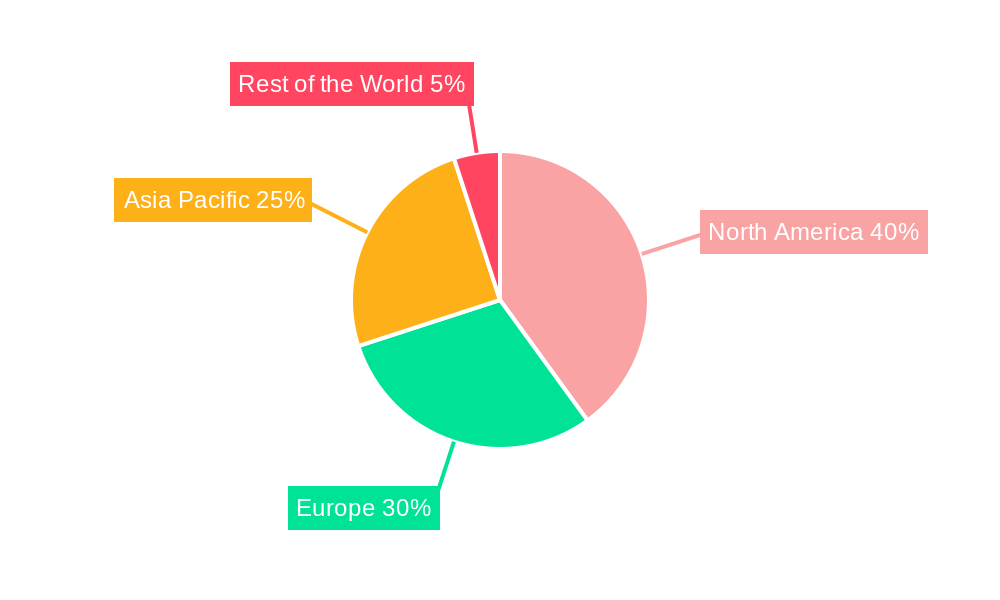

Dominant Markets & Segments in North America Pedestrian Detection Systems Market

The North America Pedestrian Detection Systems Market is experiencing substantial growth, with a clear dominance observed in specific segments and regions. Among the types of pedestrian detection systems, the Video segment currently holds the largest market share and is anticipated to maintain its leadership throughout the forecast period. This dominance is attributed to the decreasing cost of high-resolution cameras, advancements in image processing algorithms, and the ability of AI to interpret complex visual scenes effectively. Video-based systems offer a comprehensive understanding of the environment, crucial for distinguishing pedestrians from other objects.

The North America region, encompassing the United States and Canada, represents the most significant market for pedestrian detection systems. This leadership is driven by a confluence of factors:

- Stringent Safety Regulations: The National Highway Traffic Safety Administration (NHTSA) and its Canadian counterpart consistently advocate for and mandate advanced safety features, including pedestrian detection.

- High Adoption Rate of ADAS: North American consumers demonstrate a strong preference for vehicles equipped with cutting-edge safety technologies, translating into high demand for ADAS-equipped vehicles.

- Presence of Major Automakers and Tech Hubs: The region hosts major automotive manufacturers and significant technology development centers, fostering rapid innovation and market penetration.

- Infrastructure Development: Investments in smart city initiatives and road infrastructure improvements indirectly support the integration and validation of advanced vehicle safety systems.

The Hybrid segment, combining the strengths of video with radar or lidar technology, is projected to witness the fastest growth rate. This is due to its enhanced reliability in diverse environmental conditions, such as heavy rain, fog, or darkness, where purely video-based systems might falter. Hybrid systems provide superior redundancy and accuracy, crucial for higher levels of driving automation.

- Dominant Type Segment: Video Detection Systems, driven by AI advancements and cost-effectiveness.

- Leading Geographic Market: North America (USA and Canada), fueled by regulatory push and consumer demand.

- Fastest Growing Segment: Hybrid Detection Systems, offering enhanced all-weather performance and redundancy.

- Key Growth Drivers: Government mandates, consumer safety awareness, technological sophistication, automotive industry investments.

North America Pedestrian Detection Systems Market Product Analysis

The North America Pedestrian Detection Systems Market is witnessing a wave of product innovation centered on enhancing accuracy, reliability, and cost-effectiveness. Products are evolving beyond simple object recognition to sophisticated perception systems that can predict pedestrian intent and behavior. Key advancements include the integration of deep learning algorithms for superior pedestrian classification in complex environments, multi-sensor fusion techniques for increased robustness, and improved object tracking capabilities. These systems are designed to provide early warnings to drivers and, in many cases, autonomously apply braking to mitigate or avoid collisions, significantly reducing the risk of pedestrian-involved accidents. The competitive advantage lies in developing integrated solutions that seamlessly work with other ADAS features and can be scaled across various vehicle platforms at a competitive price point.

Key Drivers, Barriers & Challenges in North America Pedestrian Detection Systems Market

The North America Pedestrian Detection Systems Market is propelled by a set of powerful drivers, but also faces significant challenges.

Key Drivers:

- Increasing Regulatory Mandates: Governments are continuously pushing for stricter vehicle safety standards, making pedestrian detection systems a near-essential feature for new vehicle sales.

- Growing Consumer Demand for Safety: Road safety concerns and a rising awareness of ADAS benefits are driving consumer preference for vehicles equipped with these technologies.

- Technological Advancements: Innovations in AI, sensor technology (cameras, lidar, radar), and data processing are leading to more accurate, reliable, and affordable pedestrian detection systems.

- Autonomous Driving Development: The pursuit of autonomous vehicles necessitates robust perception systems, with pedestrian detection being a critical component.

Key Barriers & Challenges:

- High Development and Integration Costs: The research, development, and integration of sophisticated ADAS, including pedestrian detection, can be expensive for automakers.

- Sensor Performance Limitations: While improving, current sensor technologies can still face limitations in extreme weather conditions (heavy fog, snow, intense glare) or when pedestrians exhibit unpredictable behavior.

- Data Scarcity and Bias: Training AI models requires vast and diverse datasets. Ensuring these datasets are representative of all demographics and scenarios is crucial to avoid bias.

- Cybersecurity Concerns: As systems become more connected, ensuring the cybersecurity of ADAS and pedestrian detection systems against potential threats is paramount.

- Public Acceptance and Trust: Building consumer trust in the reliability and efficacy of autonomous safety features is an ongoing process.

Growth Drivers in the North America Pedestrian Detection Systems Market Market

The North America Pedestrian Detection Systems Market is experiencing substantial growth primarily driven by a confluence of critical factors. Technological advancements in Artificial Intelligence (AI), machine learning, and sensor fusion are continuously enhancing the accuracy and reliability of pedestrian detection systems. The increasingly stringent regulatory landscape across North American countries, with bodies like NHTSA mandating advanced safety features, directly compels automotive manufacturers to integrate these systems. Furthermore, growing consumer awareness and demand for enhanced vehicle safety are significant economic drivers, as buyers actively seek out vehicles equipped with comprehensive ADAS functionalities, including pedestrian detection. The ongoing development and eventual widespread adoption of autonomous driving technologies also act as a potent growth catalyst, as pedestrian detection is a fundamental prerequisite for safe self-driving capabilities.

Challenges Impacting North America Pedestrian Detection Systems Market Growth

Despite the promising growth trajectory, the North America Pedestrian Detection Systems Market faces several hurdles. Regulatory complexities and evolving standards can pose challenges, requiring continuous adaptation and investment from manufacturers. Supply chain disruptions, particularly for critical semiconductor components, can impact production volumes and timelines. Intense competitive pressures among established automotive players and emerging technology firms necessitate constant innovation and cost optimization. Furthermore, high development and integration costs for advanced systems can limit their adoption in lower-tier vehicle segments. Ensuring the reliability and robustness of sensor performance in adverse weather conditions remains a persistent challenge, demanding ongoing research and development to overcome limitations posed by fog, heavy rain, snow, and poor lighting.

Key Players Shaping the North America Pedestrian Detection Systems Market Market

- Honda Motor Company Ltd

- Panasonic Corporation

- FLIR Systems Inc

- Aptiv PLC

- Mobileye

- General Motors Company

- BMW Group

- Automobile Manufacturers

- Peugeot

- Continental AG

- Suppliers of Pedestrian Detection Systems and Components

- Volvo Cars

- DENSO CORPORATION

- Robert Bosch GmbH

- Nissan Motor Co Ltd

- Toyota Motor Corporation

- Audi AG

- Mercedes-Benz

Significant North America Pedestrian Detection Systems Market Industry Milestones

- September 2022: GMC revealed the all-new 2024 Acadia premium mid-size SUV, featuring ADAS technology including a Front and Rear pedestrian system, highlighting the integration of these safety features into larger SUV models.

- December 2022: Toyota Motor Co. introduced the 2023 Toyota Prius with the standard Toyota Safety Sense 3.0 suite, which includes an enhanced Pre-Collision System with Pedestrian Detection, demonstrating the widespread adoption of advanced pedestrian detection in high-volume, fuel-efficient vehicles.

- January 2023: Valeo Group debuted its Smart Pole at CES 2023, a sensor and technology bundle for urban environments providing safe pedestrian crossing solutions, showcasing innovation beyond automotive applications and into smart city infrastructure.

- February 2023: The 2024 Toyota Grand Highlander globally debuted, standard with Toyota Safety Sense 3.0, featuring an enhanced Pre-Collision System with Pedestrian Detection, underscoring the commitment to pedestrian safety in new model introductions.

- May 2023: Toyota announced the arrival of the 2024 Grand Highlander, equipped with TSS 3.0 and its enhanced Pre-Collision System with Pedestrian Detection, reinforcing the ongoing trend of standardizing advanced safety features across their SUV lineup.

Future Outlook for North America Pedestrian Detection Systems Market Market

The future outlook for the North America Pedestrian Detection Systems Market is exceptionally bright, driven by accelerating technological advancements and an unwavering commitment to road safety. Strategic opportunities lie in the increasing development of Level 3 and higher autonomous driving systems, which will heavily rely on sophisticated and highly reliable pedestrian detection capabilities. The market will continue to be shaped by the integration of advanced AI algorithms for predictive behavior analysis of pedestrians and cyclists, as well as the wider adoption of multi-sensor fusion technologies for unparalleled accuracy in all environmental conditions. Furthermore, the expansion of smart city initiatives and the potential for vehicle-to-everything (V2X) communication will create new avenues for pedestrian detection systems to interact with their surroundings, promising a future with significantly reduced pedestrian fatalities and enhanced road safety for all.

North America Pedestrian Detection Systems Market Segmentation

-

1. Type

- 1.1. Video

- 1.2. Infrared

- 1.3. Hybrid

- 1.4. Other Types

North America Pedestrian Detection Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Pedestrian Detection Systems Market Regional Market Share

Geographic Coverage of North America Pedestrian Detection Systems Market

North America Pedestrian Detection Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 15.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for ADAS likely Drive the Market

- 3.3. Market Restrains

- 3.3.1. Lower efficiency in bad weather conditions

- 3.4. Market Trends

- 3.4.1. Increase in the Number of Road Fatalities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Pedestrian Detection Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Video

- 5.1.2. Infrared

- 5.1.3. Hybrid

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 8 Honda Motor Company Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 7 Panasonic Corporation*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 6 FLIR Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 2 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 1 Mobileye

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 9 General Motors Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3 BMW Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Automobile Manufacturers

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 7 Peugeot

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 4 Continental AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Suppliers of Pedestrian Detection Systems and Components*

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 2 Volvo Cars

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 5 DENSO Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 3 Robert Bosch GmbH

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 6 Nissan Motor Co Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 1 Toyota Motor Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 5 Audi AG

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 4 Mercedes-Benz

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 8 Honda Motor Company Ltd

List of Figures

- Figure 1: North America Pedestrian Detection Systems Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Pedestrian Detection Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: North America Pedestrian Detection Systems Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico North America Pedestrian Detection Systems Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Pedestrian Detection Systems Market?

The projected CAGR is approximately > 15.00%.

2. Which companies are prominent players in the North America Pedestrian Detection Systems Market?

Key companies in the market include 8 Honda Motor Company Ltd, 7 Panasonic Corporation*List Not Exhaustive, 6 FLIR Systems Inc, 2 Aptiv PLC, 1 Mobileye, 9 General Motors Company, 3 BMW Group, Automobile Manufacturers, 7 Peugeot, 4 Continental AG, Suppliers of Pedestrian Detection Systems and Components*, 2 Volvo Cars, 5 DENSO Corporation, 3 Robert Bosch GmbH, 6 Nissan Motor Co Ltd, 1 Toyota Motor Corporation, 5 Audi AG, 4 Mercedes-Benz.

3. What are the main segments of the North America Pedestrian Detection Systems Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for ADAS likely Drive the Market.

6. What are the notable trends driving market growth?

Increase in the Number of Road Fatalities.

7. Are there any restraints impacting market growth?

Lower efficiency in bad weather conditions.

8. Can you provide examples of recent developments in the market?

September 2022: GMC revealed the all-new 2024 Acadia premium mid-size SUV, which will be produced at GM's Lansing Delta Township Assembly and is expected to be available in early 2024. The SUV has ADAS technology, which includes a Front and Rear pedestrian system.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Pedestrian Detection Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Pedestrian Detection Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Pedestrian Detection Systems Market?

To stay informed about further developments, trends, and reports in the North America Pedestrian Detection Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence