Key Insights

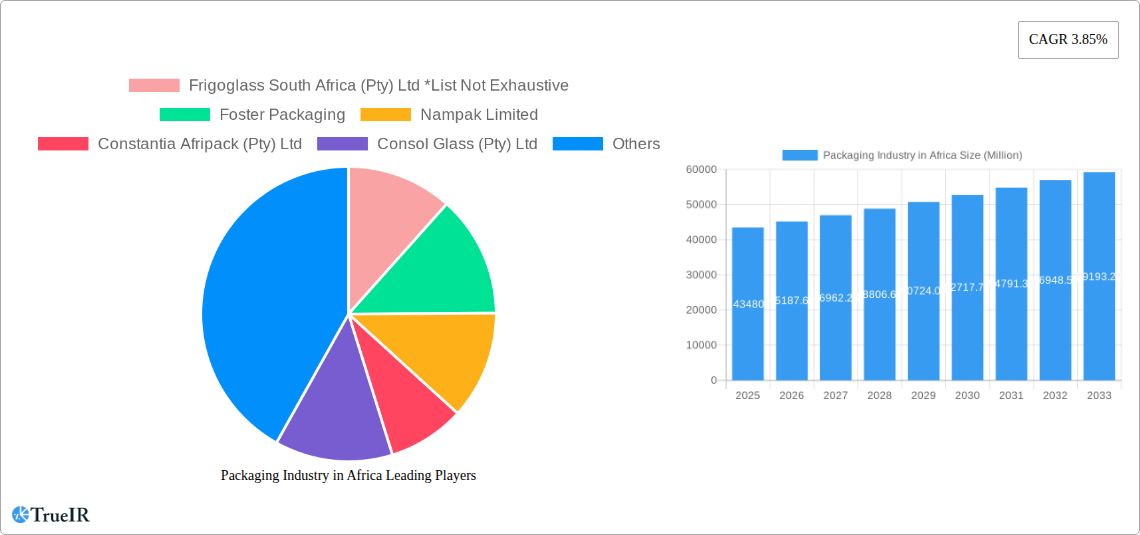

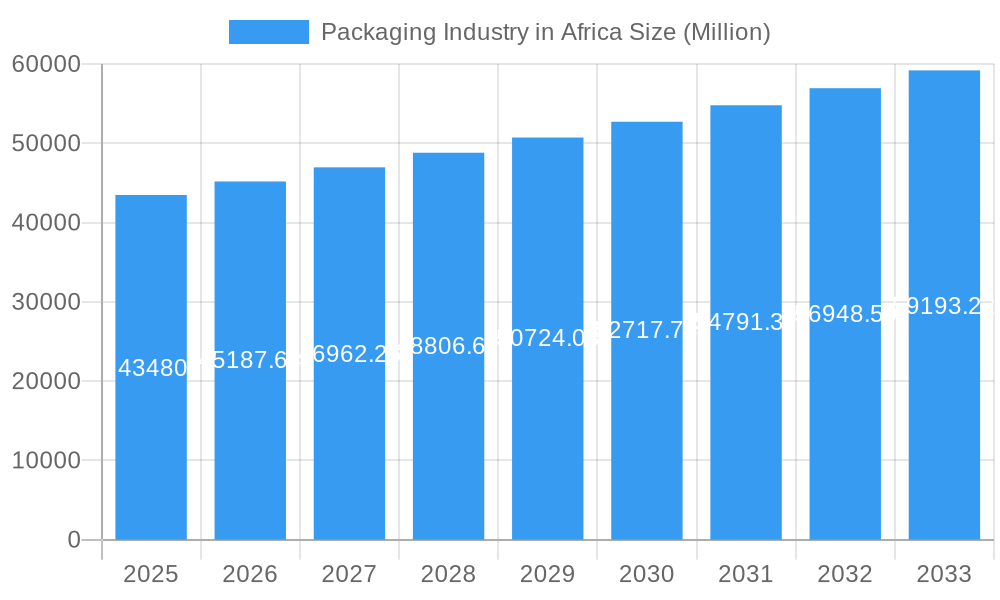

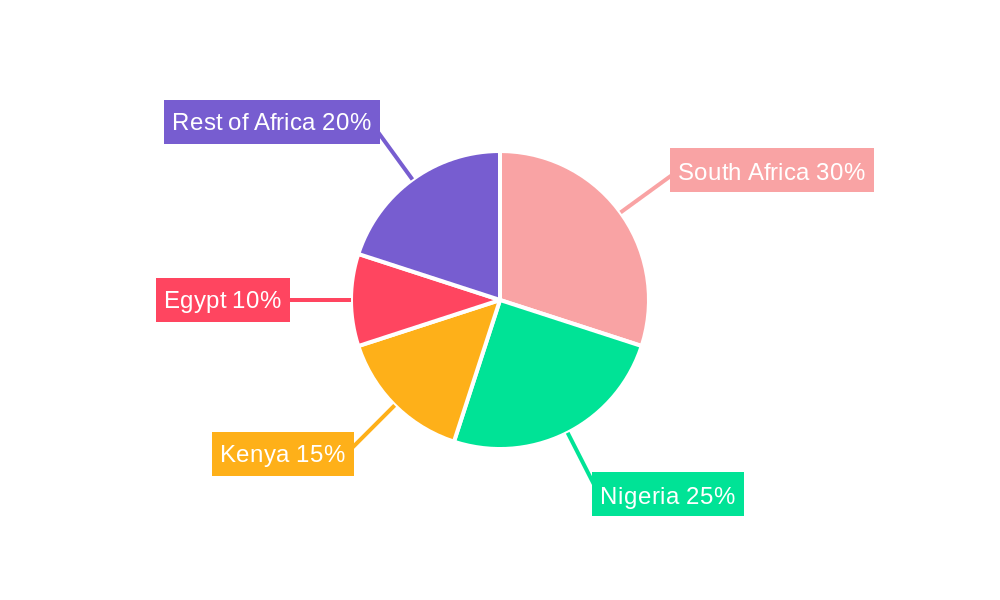

The African packaging industry, valued at $43.48 billion in 2025, is experiencing robust growth, projected at a CAGR of 3.85% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning food and beverage sector, driven by a growing population and increasing urbanization, is a significant driver of demand for packaging materials. The rising middle class is also increasing consumption of packaged goods, boosting demand across various product categories. Secondly, the pharmaceutical and household/personal care segments are witnessing significant growth, requiring specialized packaging solutions. The increasing adoption of e-commerce further fuels the demand for efficient and secure packaging for online deliveries. Finally, South Africa, Nigeria, Kenya, and Egypt represent major markets within the region, exhibiting diverse packaging needs based on their unique economic and industrial landscapes. However, challenges remain, including infrastructure limitations in some regions, fluctuating raw material prices, and the need for sustainable and eco-friendly packaging solutions to meet growing environmental concerns. Increased investment in advanced packaging technologies and a focus on sustainable practices will be crucial for future growth.

Packaging Industry in Africa Market Size (In Billion)

The industry is segmented by material (paper & paperboard, plastic, metal, glass), product type (bottles, boxes, cans, etc.), end-user industry (beverage, food, pharmaceuticals, etc.), and country. While plastic packaging dominates currently due to its cost-effectiveness and versatility, a growing awareness of environmental concerns is leading to increased adoption of sustainable alternatives like paper-based and biodegradable packaging solutions. Companies like Nampak Limited, Mondi Group, and Tetra Pak SA are key players, catering to diverse segments and leveraging technological advancements to enhance efficiency and sustainability. Further expansion will depend on overcoming infrastructural challenges and implementing environmentally conscious practices, aligning with global sustainability initiatives.

Packaging Industry in Africa Company Market Share

Packaging Industry in Africa: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the African packaging industry, offering invaluable insights for businesses, investors, and policymakers. We delve into market size, segmentation, competitive dynamics, key players, and future growth prospects, incorporating extensive data from the historical period (2019-2024), the base year (2025), and projecting the forecast period (2025-2033). The African packaging market, valued at xx Million in 2025, is poised for significant expansion, driven by factors such as rising consumerism, expanding manufacturing sectors, and evolving packaging preferences.

Packaging Industry in Africa Market Structure & Competitive Landscape

The African packaging industry exhibits a dynamic and evolving market structure, characterized by a blend of established multinational corporations and a vibrant ecosystem of agile, regional players. Market concentration, while varying across specific segments and geographies, generally indicates a moderately competitive landscape. Several key drivers are propelling innovation within the sector. Foremost among these is the escalating global and local demand for sustainable packaging solutions, prompting a significant pivot towards eco-friendly materials and circular economy principles. Advancements in materials science are continuously introducing novel packaging options, while shifting consumer preferences for convenience, enhanced product protection, and aesthetic appeal are also shaping market offerings. The regulatory landscape, which is notably diverse across the continent, plays a pivotal role in dictating industry practices, from responsible material sourcing and production to sophisticated waste management and end-of-life solutions. Product substitution is a pronounced trend, with manufacturers actively exploring and adopting greener alternatives such as biodegradable plastics, compostable materials, and a greater reliance on recycled content. The industry has witnessed a consistent surge in mergers and acquisitions (M&A), reflecting a strategic drive towards consolidation, the pursuit of synergistic benefits, and the expansion of market reach. These strategic moves are crucial for achieving economies of scale and enhancing competitive positioning. The end-user segmentation is prominently led by the food and beverage sectors, which represent substantial demand. However, the pharmaceuticals and Household and Personal Care segments are demonstrating particularly robust growth trajectories, presenting significant opportunities for specialized packaging solutions.

- Segment-Specific Concentration: Certain material types (e.g., glass packaging in South Africa) and product categories (e.g., rigid plastic containers for beverages) exhibit higher levels of market concentration, reflecting specialized demand and established production capabilities.

- Innovation Catalysts: The dual imperatives of sustainability and the burgeoning e-commerce sector are powerful catalysts for innovation, driving the development of new packaging materials, intelligent packaging features, and optimized designs for digital retail.

- Navigating Regulatory Diversity: The heterogeneous nature of regulatory frameworks across African nations presents both strategic opportunities for first-movers and challenges in achieving continent-wide standardization and compliance.

- Strategic Consolidation: M&A activity remains a significant trend, instrumental in reshaping the market structure, fostering greater operational efficiencies, and enabling greater investment in research and development.

Packaging Industry in Africa Market Trends & Opportunities

The African packaging market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends: a rising middle class driving increased consumption; expanding industrialization and manufacturing; the burgeoning e-commerce sector boosting demand for protective packaging; and a shift towards convenient, sustainable packaging options. Market penetration rates for various packaging types vary significantly across regions and product segments. Technological advancements such as flexible packaging, lightweight materials, and improved printing techniques continue to reshape the landscape, while consumer preferences are increasingly leaning towards eco-friendly, reusable, and recyclable solutions. Intense competition among established players and new entrants requires continuous innovation and adaptation. The market shows strong potential in specialized areas like pharmaceutical and healthcare packaging, driven by growing healthcare awareness and government initiatives.

Dominant Markets & Segments in Packaging Industry in Africa

- Leading Regional Markets: South Africa continues to lead as a dominant packaging market, underpinned by its advanced industrial infrastructure, a well-established manufacturing base, and a substantial, discerning consumer market. Other key growth markets showing significant potential and demand include Egypt, Nigeria, and Kenya, each with unique market dynamics and opportunities.

- Dominant Packaging Materials: Plastic packaging, owing to its cost-effectiveness, versatility, and adaptability to various product needs, currently holds the largest market share. However, there is a discernible and accelerating growth trend in paper and paperboard packaging, driven by an increasing emphasis on recyclability and sustainability credentials.

- Leading Product Categories: Plastic bottles and corrugated boxes are the prevailing product types, predominantly serving the massive and consistently growing food and beverage industries that form the backbone of demand for packaged goods.

- Primary End-User Industry: The food and beverage sector remains the undisputed primary driver of packaging demand, reflecting its significant contribution to the African economy and its integral role in daily consumption.

Key Growth Enablers:

- Expansion of Modern Retail: The proliferation of supermarkets, hypermarkets, and other organized retail channels across the continent is directly fueling the demand for well-packaged goods, meeting evolving consumer shopping habits.

- Government Initiatives: Supportive government policies aimed at bolstering local manufacturing, promoting industrialization, and encouraging foreign direct investment are creating a more favorable environment for the packaging industry.

- Rising Consumer Spending Power: An upward trend in disposable incomes across many African nations translates into increased consumer purchasing power, which, in turn, drives higher demand for a wider range of packaged products.

Packaging Industry in Africa Product Analysis

The African packaging industry showcases a diverse range of products, from traditional materials like glass and metal to innovative solutions such as flexible packaging and biodegradable alternatives. Technological advancements are driving the adoption of lightweight, barrier-enhanced materials improving product shelf life and reducing transportation costs. Competitive advantages stem from factors such as cost-effectiveness, superior product protection, environmentally conscious design, and customization capabilities. The market is constantly adapting to changing consumer preferences and regulatory requirements, shaping the future of product innovation.

Key Drivers, Barriers & Challenges in Packaging Industry in Africa

Key Drivers:

- Growing consumer demand for packaged goods.

- Rise of e-commerce boosting demand for protective packaging.

- Government initiatives promoting industrial development.

Challenges:

- Inconsistent infrastructure hindering efficient supply chains.

- Limited access to advanced technologies and recycling facilities.

- Varying regulatory standards across different African countries.

Growth Drivers in the Packaging Industry in Africa Market

The packaging industry's growth in Africa is driven by several factors: rising disposable incomes leading to higher consumption; expansion of the organized retail sector, boosting demand for attractive and protective packaging; and the growth of the food processing and beverage industries requiring sophisticated packaging solutions. Moreover, government policies promoting local manufacturing and increased investment in infrastructure further stimulate the sector's growth.

Challenges Impacting Packaging Industry in Africa Growth

Significant hurdles continue to shape the growth trajectory of the African packaging industry. A pervasive challenge is the limited access to sophisticated machinery and advanced recycling infrastructure, which can impede operational efficiency, increase reliance on imported technologies and spare parts, and complicate the development of robust circular economy models. Fragmented infrastructure, including underdeveloped transportation networks, presents considerable challenges for supply chain logistics, affecting timely delivery and increasing costs. The presence of informal markets, where lower-quality and less regulated packaging may be prevalent, also influences market dynamics. Furthermore, inconsistent and evolving regulatory environments across different countries create complexities in achieving standardization, ensuring compliance, and fostering cross-border trade and investment.

Key Players Shaping the Packaging Industry in Africa Market

- Frigoglass South Africa (Pty) Ltd

- Foster Packaging

- Nampak Limited

- Constantia Afripack (Pty) Ltd

- Consol Glass (Pty) Ltd

- Mondi Group

- Tetra Pak SA

- Astrapak Ltd (RPC Group)

- East African Packaging Industries Ltd (EAPI)

- Mpact Pty Ltd

- Bonpak (Pty) Ltd

Significant Packaging Industry in Africa Industry Milestones

- April 2022: A landmark event was Ardagh Group's strategic acquisition of Consol Holdings for USD 1 billion. This acquisition, which included a further USD 200 million earmarked for new furnace investments, underscored significant confidence and capital infusion into the South African and broader African glass packaging markets, signaling a commitment to expanding capacity and technological capabilities.

- June 2022: Dow's proactive expansion of its Project REFLEX initiative, a pivotal flexible packaging recycling program, to include Egypt and Guinea, highlighted a growing and tangible commitment from major industry players towards advancing sustainable practices and developing recycling infrastructure across key African nations.

Future Outlook for Packaging Industry in Africa Market

The outlook for the African packaging industry is decidedly positive, with sustained and robust growth anticipated. This expansion will be fueled by a confluence of factors, including a burgeoning and increasingly urbanized consumer base, evolving consumption patterns that favor convenience and premiumization, and ongoing industrialization across various sectors. Strategic opportunities abound in the development and deployment of truly sustainable packaging solutions, leveraging cutting-edge technological advancements in materials and manufacturing processes, and adeptly catering to the nuanced and diverse needs of individual African markets. The industry's long-term success will hinge on its ability to effectively address persistent infrastructure gaps, champion and implement responsible waste management strategies, and foster continuous innovation in both materials science and manufacturing techniques. The potential for significant market expansion and value creation remains exceptionally high, positioning Africa as a key frontier for the global packaging sector.

Packaging Industry in Africa Segmentation

-

1. Material

- 1.1. Paper and Paperboard

- 1.2. Plastic

- 1.3. Metal

- 1.4. Glass

-

2. Product Type

- 2.1. Plastic Bottles

- 2.2. Glass Bottles

- 2.3. Corrugated Boxes

- 2.4. Metal Cans

- 2.5. Other Applications

-

3. End-user Industry

- 3.1. Beverage

- 3.2. Food

- 3.3. Pharmaceuticals

- 3.4. Household and Personal Care

- 3.5. Other

Packaging Industry in Africa Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Packaging Industry in Africa Regional Market Share

Geographic Coverage of Packaging Industry in Africa

Packaging Industry in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Glass Bottles to Drive the Market Growth; Beverage Industry to Lead the Market Growth

- 3.3. Market Restrains

- 3.3.1. Fluctuation in Raw Material Price can Hinder the Growth of the Market.

- 3.4. Market Trends

- 3.4.1. Glass Bottles to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastic

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles

- 5.2.2. Glass Bottles

- 5.2.3. Corrugated Boxes

- 5.2.4. Metal Cans

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Pharmaceuticals

- 5.3.4. Household and Personal Care

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Paper and Paperboard

- 6.1.2. Plastic

- 6.1.3. Metal

- 6.1.4. Glass

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Plastic Bottles

- 6.2.2. Glass Bottles

- 6.2.3. Corrugated Boxes

- 6.2.4. Metal Cans

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Beverage

- 6.3.2. Food

- 6.3.3. Pharmaceuticals

- 6.3.4. Household and Personal Care

- 6.3.5. Other

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Paper and Paperboard

- 7.1.2. Plastic

- 7.1.3. Metal

- 7.1.4. Glass

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Plastic Bottles

- 7.2.2. Glass Bottles

- 7.2.3. Corrugated Boxes

- 7.2.4. Metal Cans

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Beverage

- 7.3.2. Food

- 7.3.3. Pharmaceuticals

- 7.3.4. Household and Personal Care

- 7.3.5. Other

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Paper and Paperboard

- 8.1.2. Plastic

- 8.1.3. Metal

- 8.1.4. Glass

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Plastic Bottles

- 8.2.2. Glass Bottles

- 8.2.3. Corrugated Boxes

- 8.2.4. Metal Cans

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Beverage

- 8.3.2. Food

- 8.3.3. Pharmaceuticals

- 8.3.4. Household and Personal Care

- 8.3.5. Other

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Paper and Paperboard

- 9.1.2. Plastic

- 9.1.3. Metal

- 9.1.4. Glass

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Plastic Bottles

- 9.2.2. Glass Bottles

- 9.2.3. Corrugated Boxes

- 9.2.4. Metal Cans

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Beverage

- 9.3.2. Food

- 9.3.3. Pharmaceuticals

- 9.3.4. Household and Personal Care

- 9.3.5. Other

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific Packaging Industry in Africa Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Paper and Paperboard

- 10.1.2. Plastic

- 10.1.3. Metal

- 10.1.4. Glass

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Plastic Bottles

- 10.2.2. Glass Bottles

- 10.2.3. Corrugated Boxes

- 10.2.4. Metal Cans

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Beverage

- 10.3.2. Food

- 10.3.3. Pharmaceuticals

- 10.3.4. Household and Personal Care

- 10.3.5. Other

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Frigoglass South Africa (Pty) Ltd *List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Foster Packaging

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nampak Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Constantia Afripack (Pty) Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Consol Glass (Pty) Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Mondi Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tetra Pak SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Astrapak Ltd (RPC Group)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 East African Packaging Industries Ltd (EAPI)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mpact Pty Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Bonpak (Pty) Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Frigoglass South Africa (Pty) Ltd *List Not Exhaustive

List of Figures

- Figure 1: Global Packaging Industry in Africa Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Packaging Industry in Africa Revenue (Million), by Material 2025 & 2033

- Figure 3: North America Packaging Industry in Africa Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America Packaging Industry in Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Packaging Industry in Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Packaging Industry in Africa Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Packaging Industry in Africa Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Packaging Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Packaging Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Packaging Industry in Africa Revenue (Million), by Material 2025 & 2033

- Figure 11: South America Packaging Industry in Africa Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America Packaging Industry in Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 13: South America Packaging Industry in Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: South America Packaging Industry in Africa Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: South America Packaging Industry in Africa Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: South America Packaging Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Packaging Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Packaging Industry in Africa Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe Packaging Industry in Africa Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Packaging Industry in Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 21: Europe Packaging Industry in Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Europe Packaging Industry in Africa Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Europe Packaging Industry in Africa Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Packaging Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Packaging Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Packaging Industry in Africa Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa Packaging Industry in Africa Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa Packaging Industry in Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Middle East & Africa Packaging Industry in Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Middle East & Africa Packaging Industry in Africa Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Middle East & Africa Packaging Industry in Africa Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Middle East & Africa Packaging Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Packaging Industry in Africa Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Packaging Industry in Africa Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific Packaging Industry in Africa Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific Packaging Industry in Africa Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Asia Pacific Packaging Industry in Africa Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Asia Pacific Packaging Industry in Africa Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Asia Pacific Packaging Industry in Africa Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Asia Pacific Packaging Industry in Africa Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Packaging Industry in Africa Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Packaging Industry in Africa Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Packaging Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 14: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Packaging Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Packaging Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 34: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Packaging Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Packaging Industry in Africa Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global Packaging Industry in Africa Revenue Million Forecast, by Product Type 2020 & 2033

- Table 44: Global Packaging Industry in Africa Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 45: Global Packaging Industry in Africa Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Packaging Industry in Africa Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaging Industry in Africa?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the Packaging Industry in Africa?

Key companies in the market include Frigoglass South Africa (Pty) Ltd *List Not Exhaustive, Foster Packaging, Nampak Limited, Constantia Afripack (Pty) Ltd, Consol Glass (Pty) Ltd, Mondi Group, Tetra Pak SA, Astrapak Ltd (RPC Group), East African Packaging Industries Ltd (EAPI), Mpact Pty Ltd, Bonpak (Pty) Ltd.

3. What are the main segments of the Packaging Industry in Africa?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.48 Million as of 2022.

5. What are some drivers contributing to market growth?

Glass Bottles to Drive the Market Growth; Beverage Industry to Lead the Market Growth.

6. What are the notable trends driving market growth?

Glass Bottles to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Fluctuation in Raw Material Price can Hinder the Growth of the Market..

8. Can you provide examples of recent developments in the market?

June 2022: Dow expanded the flexible packaging recycling initiative to new African markets. Dow announced that its flexible packaging recycling initiative, project REFLEX, will be expanded to Egypt and Guinea. The expansion of Project REFLEX into Egypt began in December 2021, with Dow entering an 18-month partnership with the international non-government organization, WasteAid, which shares waste management and recycling skills with lower- and middle-income countries. WasteAid will work with Dow to advance waste recovery and recycling in Aswan, a city located in southern Egypt.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaging Industry in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaging Industry in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaging Industry in Africa?

To stay informed about further developments, trends, and reports in the Packaging Industry in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence