Key Insights

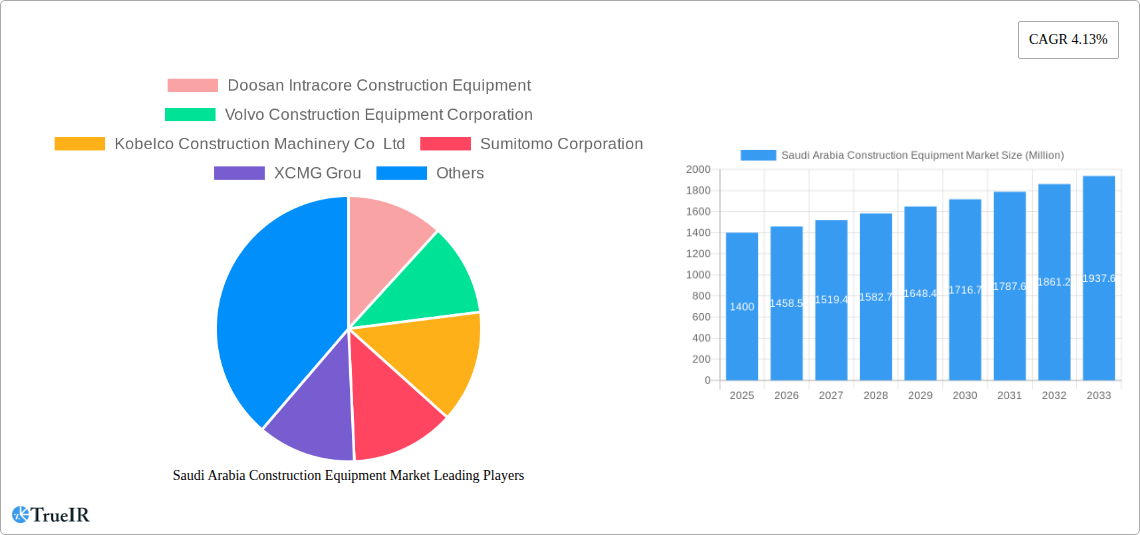

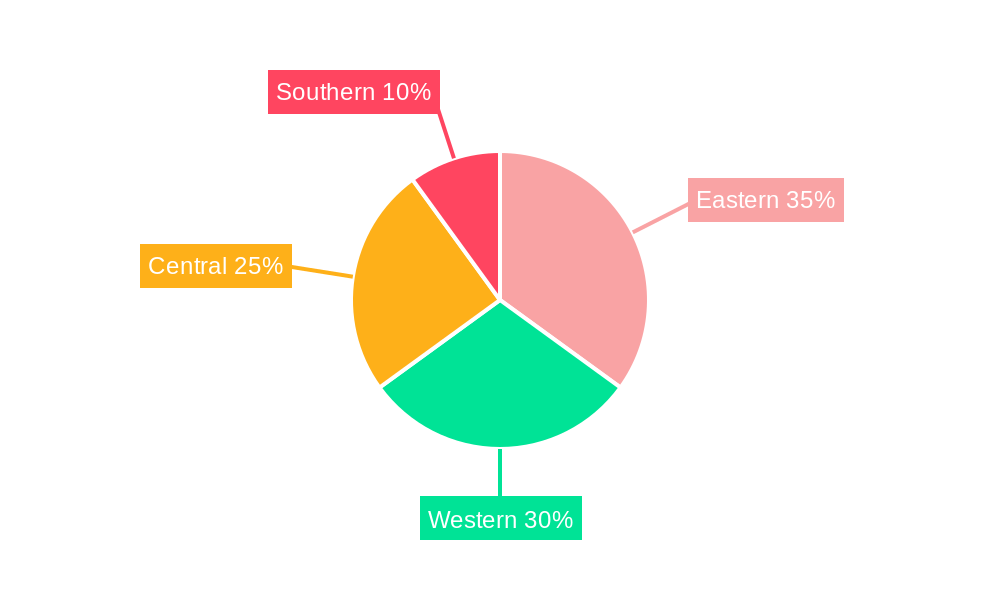

The Saudi Arabian construction equipment market, valued at $1.40 billion in 2025, is projected to experience robust growth, driven by the Kingdom's ambitious Vision 2030 program. This initiative, focused on diversifying the economy and developing infrastructure, fuels significant investments in residential, commercial, and infrastructure projects across the country. The market's Compound Annual Growth Rate (CAGR) of 4.13% from 2025 to 2033 reflects sustained demand for construction equipment across various sectors. Key growth drivers include large-scale infrastructure projects like road expansions, railway developments, and new city constructions. The rising population and urbanization further contribute to the demand for housing and related infrastructure, bolstering the market. While potential economic fluctuations could act as a restraint, the long-term vision and continued government investment underpin the market's positive outlook. Segments like earthmoving equipment (bulldozers, dump trucks) and cranes are anticipated to witness particularly strong growth due to their essential role in large-scale infrastructure development. The market is dominated by both international players such as Caterpillar, Komatsu, and Volvo, and domestic companies, indicative of a competitive yet growing landscape. Regional variations in growth are expected, with regions experiencing major infrastructural development like Eastern and Western Saudi Arabia showing higher growth rates compared to others.

Saudi Arabia Construction Equipment Market Market Size (In Billion)

The segmentation by machinery type reveals a diverse market landscape. Cranes, crucial for high-rise construction and infrastructure projects, are expected to maintain a significant market share. Earthmoving equipment, encompassing bulldozers, dump trucks, and loaders (wheel loaders, backhoe loaders, skid steers), is anticipated to experience substantial growth driven by large-scale infrastructure development and mining activities. Material handling equipment, including forklifts, caters to the construction logistics needs and shows steady growth potential. The sectoral breakdown further illustrates the market's dynamic nature; the infrastructure sector, encompassing roads, bridges, railways, and ports, is likely to dominate, followed by the building sector's residential, commercial, and mixed-use projects. The energy sector, involving oil and gas and power & water projects, also contributes significantly to the demand for specialized construction equipment. This intricate interplay of factors positions the Saudi Arabian construction equipment market for sustained, albeit moderate, growth in the coming years.

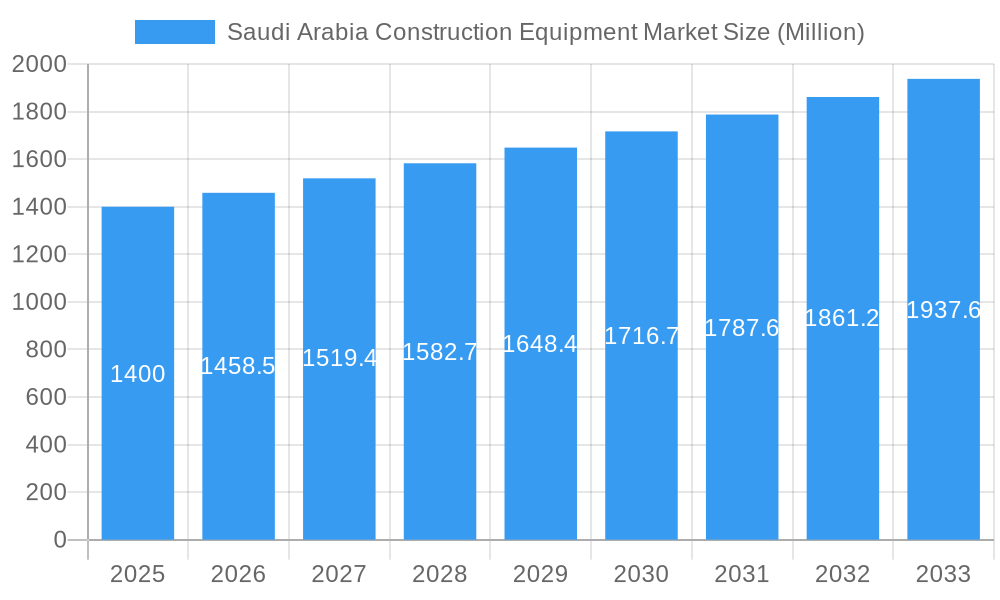

Saudi Arabia Construction Equipment Market Company Market Share

This comprehensive report provides an in-depth analysis of the Saudi Arabia construction equipment market, offering invaluable insights for businesses, investors, and industry stakeholders. Leveraging rigorous data analysis and expert insights, this report covers market size, growth trends, competitive landscape, and future outlook, focusing on the period 2019-2033 (Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025-2033). High-growth segments such as earthmoving equipment, cranes, and loaders are thoroughly examined alongside key players like Caterpillar, Komatsu, and others.

Saudi Arabia Construction Equipment Market Structure & Competitive Landscape

The Saudi Arabian construction equipment market exhibits a moderately concentrated structure, with a Herfindahl-Hirschman Index (HHI) of xx in 2025. Key players such as Caterpillar Incorporation, Komatsu Ltd, and Volvo Construction Equipment Corporation hold significant market share, driving innovation and shaping market dynamics. However, the market also welcomes several regional and international players, creating a competitive landscape.

The market's growth is fueled by several innovation drivers, including the adoption of technologically advanced equipment like autonomous machines and the increasing demand for efficient and sustainable construction practices. Government regulations, particularly those concerning safety and emissions, significantly impact market players and encourage the adoption of eco-friendly solutions. Product substitutes, such as alternative construction methods and technologies, present ongoing challenges and opportunities for market participants. The end-user segmentation is diverse, encompassing residential, commercial, infrastructure, and energy sectors, each exhibiting unique needs and preferences. Mergers and acquisitions (M&A) activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, signifying opportunities for consolidation and expansion within the market.

- Market Concentration: HHI of xx in 2025.

- Innovation Drivers: Autonomous machines, sustainable construction practices.

- Regulatory Impacts: Safety standards, emissions regulations.

- Product Substitutes: Alternative construction methods.

- End-User Segmentation: Residential, Commercial, Infrastructure, Energy.

- M&A Trends: xx deals between 2019 and 2024.

Saudi Arabia Construction Equipment Market Market Trends & Opportunities

The Saudi Arabia construction equipment market is experiencing a period of dynamic expansion, poised for significant growth with a projected Compound Annual Growth Rate (CAGR) of XX% between 2025 and 2033. This robust trajectory is underpinned by the ambitious infrastructure development agenda of Vision 2030, which is catalyzing a surge in construction activities across all key sectors, including residential, commercial, and industrial. A substantial increase in government investments further bolsters this growth. The integration of cutting-edge technologies like the Internet of Things (IoT) and Artificial Intelligence (AI) is revolutionizing operational efficiency, predictive maintenance, and safety standards on construction sites. While the market penetration of these advanced, technologically sophisticated equipment is currently moderate, it represents a substantial untapped opportunity for market players. However, potential headwinds such as the price volatility of raw materials and fluctuations in global fuel prices necessitate strategic risk management. The competitive landscape is becoming increasingly dynamic, marked by the strategic entry of new, innovative companies and the aggressive expansion of established entities.

The market size in 2025 is estimated to be approximately XX Million USD, with projections indicating a substantial growth to reach XX Million USD by 2033. The current penetration rate of advanced equipment, standing at XX% in 2025, is anticipated to climb to an impressive XX% by 2033, reflecting a growing appetite for technologically superior solutions.

Dominant Markets & Segments in Saudi Arabia Construction Equipment Market

Within the vibrant Saudi Arabian construction equipment market, the infrastructure sector stands out as the dominant force, contributing a significant XX% to the overall market revenue in 2025. This dominance is directly attributable to the Kingdom's monumental infrastructure development programs, most notably projects like NEOM and the Red Sea Project, which are reshaping the nation's landscape. Among the machinery types, earthmoving equipment and cranes command the largest market share, accounting for approximately XX% and XX% of the total market, respectively. The building sector is also exhibiting remarkable growth momentum, driven by escalating demand for new residential developments and commercial spaces.

-

Key Growth Drivers:

- Vision 2030 Infrastructure Development: Unprecedented investment in transformative mega-projects.

- Strategic Government Investments: Substantial financial allocations supporting the construction ecosystem.

- Rapid Urbanization: Increasing population density and a growing demand for housing and urban amenities.

- Expansion of the Energy Sector: Continued development and modernization of oil, gas, and renewable energy infrastructure.

-

Market Dominance Analysis:

- By Sector: Infrastructure (XX%), Building & Construction (XX%), Energy & Utilities (XX%).

- By Machinery Type: Earthmoving Equipment (XX%), Cranes (XX%), Loaders (XX%), Material Handling Equipment (XX%).

Saudi Arabia Construction Equipment Market Product Analysis

Innovations in the Saudi Arabia construction equipment market are increasingly focused on elevating efficiency, bolstering safety protocols, and promoting environmental sustainability. Manufacturers are proactively integrating advanced technologies such as sophisticated telematics for real-time monitoring, autonomous and semi-autonomous operational capabilities, and state-of-the-art emission control systems into their product lines. These technological advancements are directly addressing the burgeoning demand for construction solutions that are not only highly productive and cost-effective but also environmentally responsible, aligning perfectly with the Kingdom's ambitious sustainability objectives. The market exhibits a strong preference for equipment characterized by superior productivity, exceptional durability, and straightforward maintenance procedures, ensuring a lower total cost of ownership.

Key Drivers, Barriers & Challenges in Saudi Arabia Construction Equipment Market

Key Drivers: The foundational driver for the Saudi Arabian construction equipment market is the government's visionary Vision 2030 initiative. This comprehensive plan, dedicated to fostering economic diversification, spearheading monumental infrastructure development, and championing sustainable growth, is creating an unparalleled demand for construction machinery. The burgeoning construction sector, fueled by massive investments in landmark projects like NEOM, the Red Sea Project, and numerous other giga-projects, directly translates into increased demand for a wide array of construction equipment. Furthermore, the continuous evolution and adoption of advanced technologies are contributing significantly to market expansion by enhancing productivity and operational capabilities.

Barriers & Challenges: The market is not without its hurdles. Fluctuations in global oil prices can significantly impact project budgets and investment decisions, introducing an element of uncertainty. Global geopolitical events and supply chain vulnerabilities can lead to disruptions, affecting the timely availability and cost of imported equipment. Moreover, navigating the complex landscape of stringent regulatory compliance, encompassing rigorous safety standards and environmental regulations, adds to operational complexities and costs for businesses operating within the Kingdom. The intense competition, both from established local players and new international entrants, further intensifies pressure on pricing and profit margins.

Growth Drivers in the Saudi Arabia Construction Equipment Market Market

Continued investment in mega-projects under Vision 2030 is the primary growth driver. Also, the rising demand for affordable housing and urbanization fuels growth in residential construction, impacting the need for construction equipment. Technological advancements resulting in more efficient and sustainable equipment are additional significant drivers. Government policies supporting infrastructure development and investment in construction contribute to market expansion.

Challenges Impacting Saudi Arabia Construction Equipment Market Growth

Supply chain disruptions and global economic uncertainties pose significant challenges. High import costs and reliance on foreign suppliers create vulnerabilities. Stringent safety regulations and environmental compliance requirements add to operational costs. Competition from established international players also impacts market dynamics.

Key Players Shaping the Saudi Arabia Construction Equipment Market Market

Significant Saudi Arabia Construction Equipment Market Industry Milestones

- 2021: Launch of several large-scale infrastructure projects under Vision 2030.

- 2022: Introduction of new emission standards for construction equipment.

- 2023: Increased adoption of technologically advanced equipment.

- 2024: Several mergers and acquisitions among market players. (Specific details would require further research)

Future Outlook for Saudi Arabia Construction Equipment Market Market

The Saudi Arabia construction equipment market is poised for continued growth, driven by sustained investment in infrastructure projects and the expansion of various sectors. Strategic partnerships between international and local players will further enhance the market landscape. The growing adoption of technologically advanced equipment and focus on sustainability present significant opportunities for market expansion and innovation in the coming years. The market is predicted to exhibit a positive outlook, with projections suggesting strong growth and increasing market value.

Saudi Arabia Construction Equipment Market Segmentation

-

1. Machinery Type

- 1.1. Cranes

-

1.2. Earthmoving Equipment

- 1.2.1. Motor Grader

- 1.2.2. Excavator

- 1.2.3. Loaders

-

1.3. Material Handling Equipment

- 1.3.1. Telescopic Handlers

- 1.3.2. Forklifts

- 1.4. Bulldozers

- 1.5. Dump Trucks

- 1.6. Aerial Work Platform

-

2. Sector Type

- 2.1. Building

- 2.2. Infrastr

- 2.3. Energy (Oil and Gas and Power and Water)

Saudi Arabia Construction Equipment Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Construction Equipment Market Regional Market Share

Geographic Coverage of Saudi Arabia Construction Equipment Market

Saudi Arabia Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Electrification of Construction Equipment May Propel the Market Growth

- 3.3. Market Restrains

- 3.3.1. Construction Rental Business May Hamper Market Growth

- 3.4. Market Trends

- 3.4.1. Cranes Dominates the Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Cranes

- 5.1.2. Earthmoving Equipment

- 5.1.2.1. Motor Grader

- 5.1.2.2. Excavator

- 5.1.2.3. Loaders

- 5.1.3. Material Handling Equipment

- 5.1.3.1. Telescopic Handlers

- 5.1.3.2. Forklifts

- 5.1.4. Bulldozers

- 5.1.5. Dump Trucks

- 5.1.6. Aerial Work Platform

- 5.2. Market Analysis, Insights and Forecast - by Sector Type

- 5.2.1. Building

- 5.2.2. Infrastr

- 5.2.3. Energy (Oil and Gas and Power and Water)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Doosan Intracore Construction Equipment

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Volvo Construction Equipment Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kobelco Construction Machinery Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sumitomo Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XCMG Grou

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hitachi Construction Machinery Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Manitowoc Company Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CNH Industrial NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Caterpillar Incorporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Doosan Intracore Construction Equipment

List of Figures

- Figure 1: Saudi Arabia Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 2: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Sector Type 2020 & 2033

- Table 3: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Machinery Type 2020 & 2033

- Table 5: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Sector Type 2020 & 2033

- Table 6: Saudi Arabia Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Construction Equipment Market?

The projected CAGR is approximately 4.13%.

2. Which companies are prominent players in the Saudi Arabia Construction Equipment Market?

Key companies in the market include Doosan Intracore Construction Equipment, Volvo Construction Equipment Corporation, Kobelco Construction Machinery Co Ltd, Sumitomo Corporation, XCMG Grou, Hitachi Construction Machinery Co Ltd, Manitowoc Company Inc, Komatsu Ltd, CNH Industrial NV, Caterpillar Incorporation.

3. What are the main segments of the Saudi Arabia Construction Equipment Market?

The market segments include Machinery Type, Sector Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Electrification of Construction Equipment May Propel the Market Growth.

6. What are the notable trends driving market growth?

Cranes Dominates the Market Share.

7. Are there any restraints impacting market growth?

Construction Rental Business May Hamper Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Construction Equipment Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence