Key Insights

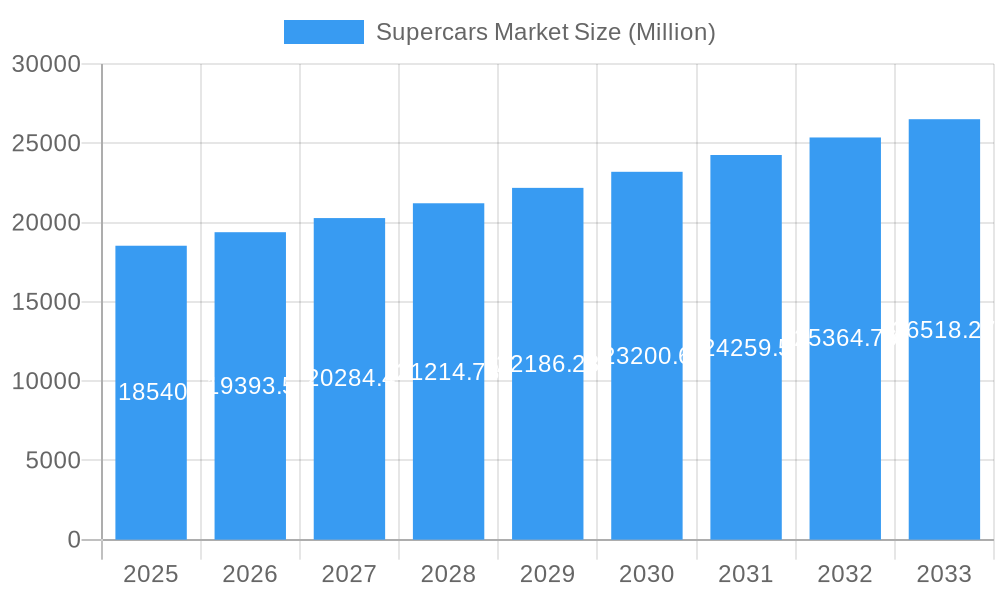

The global Supercars Market is poised for significant expansion, with a current market size of USD 18.54 billion and a projected Compound Annual Growth Rate (CAGR) of 4.50% from 2025 to 2033. This robust growth is primarily driven by a confluence of factors including the increasing disposable incomes of high-net-worth individuals, a growing passion for high-performance vehicles, and advancements in automotive technology that enhance both speed and luxury. The demand for exclusive and technologically advanced supercars remains a dominant trend, with manufacturers continually innovating to offer cutting-edge features and personalized experiences. The market is segmented across various types, including highly sought-after convertible models and powerful non-convertible variants. Propulsion types are also diversifying, with a notable shift towards electric and hybrid powertrains that offer superior performance alongside improved environmental consciousness, appealing to a new generation of luxury car buyers. This evolution in powertrain technology is a critical driver, allowing manufacturers to meet evolving regulatory standards and consumer preferences for sustainable luxury.

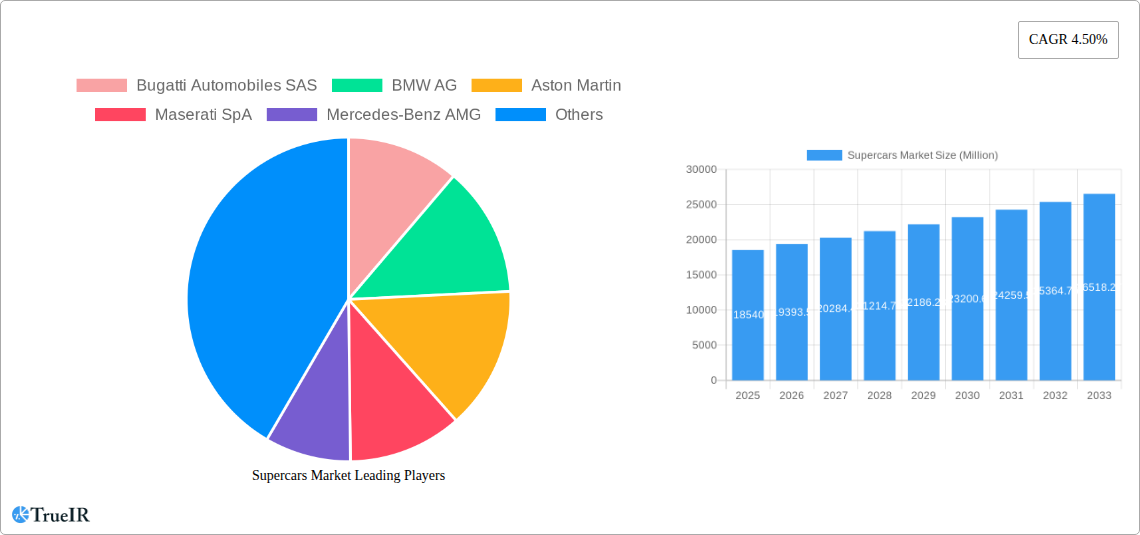

Supercars Market Market Size (In Billion)

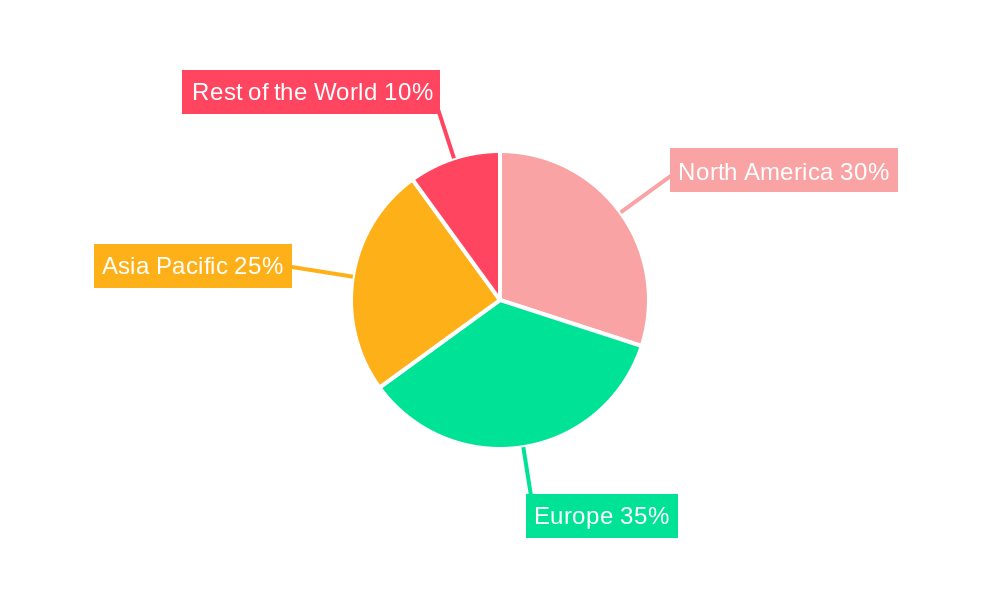

The market's expansion is further supported by evolving payment and ownership models, with financing and leasing options becoming increasingly accessible, broadening the customer base for these aspirational vehicles. While the allure of owning a piece of automotive artistry remains strong, the market is not without its challenges. High manufacturing costs, stringent emission regulations in certain regions, and the economic sensitivity of the luxury segment can act as restraints. However, established players like Bugatti, Ferrari, Lamborghini, and Porsche, alongside newer entrants and established luxury brands like BMW, Aston Martin, and Mercedes-Benz, are actively investing in research and development to overcome these hurdles. Geographically, North America and Europe continue to be dominant regions, driven by established wealth and a strong car culture, but the Asia Pacific region, particularly China and India, presents substantial growth opportunities due to rapidly increasing wealth and a burgeoning luxury market.

Supercars Market Company Market Share

Unveiling the Elite: A Comprehensive Supercars Market Analysis (2019-2033)

This in-depth report offers a dynamic, SEO-optimized exploration of the global supercars market, providing actionable insights for industry stakeholders. Leveraging high-volume keywords such as "luxury sports cars," "hypercar market," "performance vehicles," "exotic car sales," and "automotive innovation," this analysis dives deep into market structure, trends, dominant regions, product innovations, key drivers, challenges, and a comprehensive outlook for the future. Covering the historical period from 2019 to 2024, the base and estimated year of 2025, and a robust forecast period extending to 2033, this report is an indispensable resource for understanding the evolving landscape of high-performance automobiles.

Supercars Market Market Structure & Competitive Landscape

The global supercars market exhibits a moderately concentrated structure, characterized by a few dominant global players and a niche segment of ultra-exclusive manufacturers. Innovation drivers are primarily centered around cutting-edge powertrain technology, including electrification and hybrid advancements, alongside sophisticated aerodynamics and advanced materials like carbon fiber. Regulatory impacts, particularly concerning emissions standards and safety regulations, are increasingly influencing product development and market accessibility, pushing manufacturers towards sustainable solutions. Product substitutes, while limited at the ultra-luxury segment, can include high-performance SUVs or bespoke luxury sedans for a segment of wealthy consumers seeking exclusivity and performance. End-user segmentation is largely defined by high-net-worth individuals and collectors who prioritize performance, exclusivity, and brand heritage. Mergers and acquisitions (M&A) trends are less frequent in this segment due to the high brand value and specialized nature of the companies, but strategic alliances for technology development are becoming more prevalent. The top players, holding an estimated 70% market share, are constantly investing in R&D to maintain their competitive edge.

Supercars Market Market Trends & Opportunities

The supercars market is poised for significant expansion, driven by a confluence of factors including robust economic growth in emerging markets, a surge in disposable income among affluent demographics, and an insatiable appetite for exclusivity and cutting-edge automotive engineering. The market size is projected to grow from an estimated 25 Billion in the base year of 2025 to over 45 Billion by 2033, showcasing a compelling Compound Annual Growth Rate (CAGR) of approximately 6.5%. Technological shifts are at the forefront, with a pronounced move towards electrification and hybrid powertrains, offering enhanced performance and improved efficiency. This transition opens up new avenues for innovation and attracts a younger demographic of buyers who are environmentally conscious. Consumer preferences are evolving, with a growing demand for personalization, bespoke customization options, and unique ownership experiences. The integration of advanced infotainment systems, driver-assistance technologies, and connectivity features is becoming standard. Competitive dynamics are intensifying, with established players like Bugatti, Ferrari, and Lamborghini facing increasing pressure from new entrants and specialized tuning houses. Opportunities abound in the development of electric hypercars, sustainable luxury performance vehicles, and exclusive, limited-edition models that cater to the discerning tastes of the elite. The penetration rate of advanced driver-assistance systems (ADAS) in this segment is expected to reach over 90% by 2033, further enhancing the appeal and safety of these vehicles.

Dominant Markets & Segments in Supercars Market

The European region continues to be a dominant force in the supercars market, with countries like Germany, Italy, and the UK leading in both production and consumption. This dominance is fueled by a rich automotive heritage, the presence of iconic supercar manufacturers, and a strong culture of appreciation for high-performance engineering. Within segments, the Non-convertible type holds a larger market share, often favored for its superior aerodynamic efficiency and structural rigidity, crucial for extreme performance.

Type:

- Non-convertible: This segment accounts for approximately 65% of the market, offering optimal performance characteristics for track-day enthusiasts and those prioritizing pure speed.

- Convertible: The remaining 35% caters to buyers seeking the thrill of open-air driving combined with supercar performance and luxury.

Propulsion Type:

- IC Engine: While still dominant, its share is gradually declining, currently at around 55%.

- Hybrid: This segment is experiencing rapid growth, projected to reach 30% by 2033, offering a blend of raw power and improved emissions.

- Electric: The nascent electric supercar segment is expected to grow significantly, reaching 15% by 2033, driven by advancements in battery technology and range.

Payment Type:

- Cash Payment: Remains a significant payment method, particularly for established collectors, accounting for approximately 40% of transactions.

- Financing/Loan: This segment is growing, driven by younger affluent buyers and the availability of specialized financing options, representing around 35%.

- Leasing: Offers flexibility and lower upfront costs, appealing to a segment of the market and holding approximately 25% of market share.

Infrastructure development supporting high-performance vehicles, such as dedicated test tracks and luxury dealerships, coupled with supportive government policies and tax incentives for high-value goods in certain regions, further solidify the dominance of these markets and segments.

Supercars Market Product Analysis

Supercar product innovations are consistently pushing the boundaries of automotive engineering. Key advancements include the widespread adoption of lightweight carbon fiber chassis and body panels, the integration of advanced active aerodynamics for optimal downforce and drag reduction, and the development of powerful yet efficient hybrid and electric powertrains. Applications range from track-focused performance machines to luxurious grand tourers, each meticulously engineered to deliver unparalleled driving experiences. Competitive advantages are derived from brand heritage, exclusive design language, superior performance metrics, and bespoke customization options, ensuring that each supercar is a unique masterpiece of automotive art and engineering.

Key Drivers, Barriers & Challenges in Supercars Market

The supercars market is propelled by several key drivers:

- Technological Advancements: Continuous innovation in engine technology, aerodynamics, and materials science.

- Economic Growth: Increasing wealth among high-net-worth individuals globally.

- Brand Prestige & Exclusivity: The strong desire for ownership of rare and high-status automobiles.

- Luxury Lifestyle Trends: Supercars as symbols of success and aspiration.

However, significant barriers and challenges exist:

- High Production Costs: The specialized nature of manufacturing drives up unit costs.

- Stringent Regulations: Evolving emission standards and safety regulations require substantial investment in R&D.

- Economic Volatility: The market is susceptible to global economic downturns, impacting luxury spending.

- Supply Chain Disruptions: Reliance on specialized components can lead to production delays.

- Intense Competition: Maintaining market share requires constant innovation and brand differentiation.

Growth Drivers in the Supercars Market Market

Growth in the supercars market is primarily fueled by ongoing technological innovation, particularly in the realms of electrification and hybrid powertrains, which offer enhanced performance and environmental consciousness. Economic expansion in emerging economies is creating a new wave of affluent consumers with a strong appetite for luxury goods, including high-performance vehicles. Brand heritage and exclusivity remain powerful attractors, with manufacturers leveraging their storied histories to create desirable, limited-edition models. Furthermore, government policies in certain regions that encourage investment in sustainable automotive technologies indirectly benefit the supercar segment by fostering an ecosystem of advanced manufacturing.

Challenges Impacting Supercars Market Growth

The supercars market faces several impactful challenges. Regulatory complexities, particularly concerning emissions standards and evolving safety mandates globally, necessitate continuous and costly research and development to ensure compliance. Supply chain issues, ranging from the availability of specialized microchips to rare earth materials for batteries, can significantly disrupt production schedules and increase lead times. Intense competitive pressures from both established luxury automakers and emerging specialized brands demand constant innovation and differentiation to maintain market position. Furthermore, the high initial investment and ongoing maintenance costs associated with supercars can limit the addressable market, even among affluent individuals.

Key Players Shaping the Supercars Market Market

- Bugatti Automobiles SAS

- BMW AG

- Aston Martin

- Maserati SpA

- Mercedes-Benz AMG

- McLaren Group

- Porche AG

- Automobili Lamborghini SpA

- Ferrari SpA

- Bentley Motors Limited

- Koenigsegg Automotive AB

- Audi AG

Significant Supercars Market Industry Milestones

- April 2024: Supercar Blondie launched SBX Cars, an online auction site to sell hypercars and other expensive items. The auction house primarily operates in Los Angeles and Dubai. The site features rare cars like the BMW Glass Yacht, the Lotus F1 Team's John Player Specials from the 1970s and 80s, the Hyperion XP-1 prototype, and the Mercedes-AMG One supercar.

- March 2024: Audi completed the production of its highly-awaited R8 supercar, with the last model rolling off the assembly line at Audi’s plant in Germany. The model comes with bronze wheels and a carbon fiber styling package.

- October 2023: Entop launched the supercar Simurgh, resembling Batmobile, at the Geneva International Motor Show. The supercar is powered by a four-cylinder engine and features a low-slung design with flared wheel arches.

Future Outlook for Supercars Market Market

The future outlook for the supercars market is exceptionally promising, driven by continued advancements in automotive technology and an expanding global affluent class. Strategic opportunities lie in the development and popularization of electric hypercars, offering a sustainable yet exhilarating performance proposition. The trend towards bespoke customization and exclusive ownership experiences will further solidify brand loyalty and command premium pricing. Market potential is further amplified by the increasing integration of cutting-edge digital technologies, including advanced connectivity and autonomous driving features, appealing to a tech-savvy generation of luxury car buyers. The ongoing evolution of propulsion systems, coupled with a persistent desire for automotive artistry and engineering excellence, ensures a robust growth trajectory for the supercars market.

Supercars Market Segmentation

-

1. Type

- 1.1. Convertible

- 1.2. Non-convertible

-

2. Propulsion type

- 2.1. IC Engine

- 2.2. Electric

- 2.3. Hybrid

-

3. Payment Type

- 3.1. Cash Payment

- 3.2. Financing/Loan

- 3.3. Leasing

Supercars Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Supercars Market Regional Market Share

Geographic Coverage of Supercars Market

Supercars Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth

- 3.3. Market Restrains

- 3.3.1. Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth

- 3.4. Market Trends

- 3.4.1. The Electric Segment Expected to be the Fastest-growing During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Supercars Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Convertible

- 5.1.2. Non-convertible

- 5.2. Market Analysis, Insights and Forecast - by Propulsion type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.2.3. Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Payment Type

- 5.3.1. Cash Payment

- 5.3.2. Financing/Loan

- 5.3.3. Leasing

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Supercars Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Convertible

- 6.1.2. Non-convertible

- 6.2. Market Analysis, Insights and Forecast - by Propulsion type

- 6.2.1. IC Engine

- 6.2.2. Electric

- 6.2.3. Hybrid

- 6.3. Market Analysis, Insights and Forecast - by Payment Type

- 6.3.1. Cash Payment

- 6.3.2. Financing/Loan

- 6.3.3. Leasing

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Supercars Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Convertible

- 7.1.2. Non-convertible

- 7.2. Market Analysis, Insights and Forecast - by Propulsion type

- 7.2.1. IC Engine

- 7.2.2. Electric

- 7.2.3. Hybrid

- 7.3. Market Analysis, Insights and Forecast - by Payment Type

- 7.3.1. Cash Payment

- 7.3.2. Financing/Loan

- 7.3.3. Leasing

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Supercars Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Convertible

- 8.1.2. Non-convertible

- 8.2. Market Analysis, Insights and Forecast - by Propulsion type

- 8.2.1. IC Engine

- 8.2.2. Electric

- 8.2.3. Hybrid

- 8.3. Market Analysis, Insights and Forecast - by Payment Type

- 8.3.1. Cash Payment

- 8.3.2. Financing/Loan

- 8.3.3. Leasing

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Supercars Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Convertible

- 9.1.2. Non-convertible

- 9.2. Market Analysis, Insights and Forecast - by Propulsion type

- 9.2.1. IC Engine

- 9.2.2. Electric

- 9.2.3. Hybrid

- 9.3. Market Analysis, Insights and Forecast - by Payment Type

- 9.3.1. Cash Payment

- 9.3.2. Financing/Loan

- 9.3.3. Leasing

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bugatti Automobiles SAS

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 BMW AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aston Martin

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Maserati SpA

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mercedes-Benz AMG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 McLaren Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Porche AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Automobili Lamborghini SpA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ferrari SpA

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Bentley Motors Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Koenigsegg Automotive AB

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Audi A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Bugatti Automobiles SAS

List of Figures

- Figure 1: Global Supercars Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Supercars Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Supercars Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Supercars Market Volume (Billion), by Type 2025 & 2033

- Figure 5: North America Supercars Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Supercars Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Supercars Market Revenue (Million), by Propulsion type 2025 & 2033

- Figure 8: North America Supercars Market Volume (Billion), by Propulsion type 2025 & 2033

- Figure 9: North America Supercars Market Revenue Share (%), by Propulsion type 2025 & 2033

- Figure 10: North America Supercars Market Volume Share (%), by Propulsion type 2025 & 2033

- Figure 11: North America Supercars Market Revenue (Million), by Payment Type 2025 & 2033

- Figure 12: North America Supercars Market Volume (Billion), by Payment Type 2025 & 2033

- Figure 13: North America Supercars Market Revenue Share (%), by Payment Type 2025 & 2033

- Figure 14: North America Supercars Market Volume Share (%), by Payment Type 2025 & 2033

- Figure 15: North America Supercars Market Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Supercars Market Volume (Billion), by Country 2025 & 2033

- Figure 17: North America Supercars Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Supercars Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Europe Supercars Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Supercars Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Supercars Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Supercars Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Supercars Market Revenue (Million), by Propulsion type 2025 & 2033

- Figure 24: Europe Supercars Market Volume (Billion), by Propulsion type 2025 & 2033

- Figure 25: Europe Supercars Market Revenue Share (%), by Propulsion type 2025 & 2033

- Figure 26: Europe Supercars Market Volume Share (%), by Propulsion type 2025 & 2033

- Figure 27: Europe Supercars Market Revenue (Million), by Payment Type 2025 & 2033

- Figure 28: Europe Supercars Market Volume (Billion), by Payment Type 2025 & 2033

- Figure 29: Europe Supercars Market Revenue Share (%), by Payment Type 2025 & 2033

- Figure 30: Europe Supercars Market Volume Share (%), by Payment Type 2025 & 2033

- Figure 31: Europe Supercars Market Revenue (Million), by Country 2025 & 2033

- Figure 32: Europe Supercars Market Volume (Billion), by Country 2025 & 2033

- Figure 33: Europe Supercars Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Europe Supercars Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Asia Pacific Supercars Market Revenue (Million), by Type 2025 & 2033

- Figure 36: Asia Pacific Supercars Market Volume (Billion), by Type 2025 & 2033

- Figure 37: Asia Pacific Supercars Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific Supercars Market Volume Share (%), by Type 2025 & 2033

- Figure 39: Asia Pacific Supercars Market Revenue (Million), by Propulsion type 2025 & 2033

- Figure 40: Asia Pacific Supercars Market Volume (Billion), by Propulsion type 2025 & 2033

- Figure 41: Asia Pacific Supercars Market Revenue Share (%), by Propulsion type 2025 & 2033

- Figure 42: Asia Pacific Supercars Market Volume Share (%), by Propulsion type 2025 & 2033

- Figure 43: Asia Pacific Supercars Market Revenue (Million), by Payment Type 2025 & 2033

- Figure 44: Asia Pacific Supercars Market Volume (Billion), by Payment Type 2025 & 2033

- Figure 45: Asia Pacific Supercars Market Revenue Share (%), by Payment Type 2025 & 2033

- Figure 46: Asia Pacific Supercars Market Volume Share (%), by Payment Type 2025 & 2033

- Figure 47: Asia Pacific Supercars Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Asia Pacific Supercars Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Asia Pacific Supercars Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Supercars Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Supercars Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Rest of the World Supercars Market Volume (Billion), by Type 2025 & 2033

- Figure 53: Rest of the World Supercars Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Rest of the World Supercars Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Rest of the World Supercars Market Revenue (Million), by Propulsion type 2025 & 2033

- Figure 56: Rest of the World Supercars Market Volume (Billion), by Propulsion type 2025 & 2033

- Figure 57: Rest of the World Supercars Market Revenue Share (%), by Propulsion type 2025 & 2033

- Figure 58: Rest of the World Supercars Market Volume Share (%), by Propulsion type 2025 & 2033

- Figure 59: Rest of the World Supercars Market Revenue (Million), by Payment Type 2025 & 2033

- Figure 60: Rest of the World Supercars Market Volume (Billion), by Payment Type 2025 & 2033

- Figure 61: Rest of the World Supercars Market Revenue Share (%), by Payment Type 2025 & 2033

- Figure 62: Rest of the World Supercars Market Volume Share (%), by Payment Type 2025 & 2033

- Figure 63: Rest of the World Supercars Market Revenue (Million), by Country 2025 & 2033

- Figure 64: Rest of the World Supercars Market Volume (Billion), by Country 2025 & 2033

- Figure 65: Rest of the World Supercars Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Rest of the World Supercars Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Supercars Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Supercars Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Global Supercars Market Revenue Million Forecast, by Propulsion type 2020 & 2033

- Table 4: Global Supercars Market Volume Billion Forecast, by Propulsion type 2020 & 2033

- Table 5: Global Supercars Market Revenue Million Forecast, by Payment Type 2020 & 2033

- Table 6: Global Supercars Market Volume Billion Forecast, by Payment Type 2020 & 2033

- Table 7: Global Supercars Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Supercars Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Supercars Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Supercars Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Supercars Market Revenue Million Forecast, by Propulsion type 2020 & 2033

- Table 12: Global Supercars Market Volume Billion Forecast, by Propulsion type 2020 & 2033

- Table 13: Global Supercars Market Revenue Million Forecast, by Payment Type 2020 & 2033

- Table 14: Global Supercars Market Volume Billion Forecast, by Payment Type 2020 & 2033

- Table 15: Global Supercars Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Supercars Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of North America Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of North America Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Global Supercars Market Revenue Million Forecast, by Type 2020 & 2033

- Table 24: Global Supercars Market Volume Billion Forecast, by Type 2020 & 2033

- Table 25: Global Supercars Market Revenue Million Forecast, by Propulsion type 2020 & 2033

- Table 26: Global Supercars Market Volume Billion Forecast, by Propulsion type 2020 & 2033

- Table 27: Global Supercars Market Revenue Million Forecast, by Payment Type 2020 & 2033

- Table 28: Global Supercars Market Volume Billion Forecast, by Payment Type 2020 & 2033

- Table 29: Global Supercars Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Global Supercars Market Volume Billion Forecast, by Country 2020 & 2033

- Table 31: Germany Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: United Kingdom Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: United Kingdom Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: France Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: France Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Italy Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Spain Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Spain Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Europe Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Europe Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Global Supercars Market Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global Supercars Market Volume Billion Forecast, by Type 2020 & 2033

- Table 45: Global Supercars Market Revenue Million Forecast, by Propulsion type 2020 & 2033

- Table 46: Global Supercars Market Volume Billion Forecast, by Propulsion type 2020 & 2033

- Table 47: Global Supercars Market Revenue Million Forecast, by Payment Type 2020 & 2033

- Table 48: Global Supercars Market Volume Billion Forecast, by Payment Type 2020 & 2033

- Table 49: Global Supercars Market Revenue Million Forecast, by Country 2020 & 2033

- Table 50: Global Supercars Market Volume Billion Forecast, by Country 2020 & 2033

- Table 51: China Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: China Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Japan Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Japan Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: India Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: India Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: South Korea Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: South Korea Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Asia Pacific Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 61: Global Supercars Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Supercars Market Volume Billion Forecast, by Type 2020 & 2033

- Table 63: Global Supercars Market Revenue Million Forecast, by Propulsion type 2020 & 2033

- Table 64: Global Supercars Market Volume Billion Forecast, by Propulsion type 2020 & 2033

- Table 65: Global Supercars Market Revenue Million Forecast, by Payment Type 2020 & 2033

- Table 66: Global Supercars Market Volume Billion Forecast, by Payment Type 2020 & 2033

- Table 67: Global Supercars Market Revenue Million Forecast, by Country 2020 & 2033

- Table 68: Global Supercars Market Volume Billion Forecast, by Country 2020 & 2033

- Table 69: South America Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South America Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Middle East and Africa Supercars Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Middle East and Africa Supercars Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Supercars Market?

The projected CAGR is approximately 4.50%.

2. Which companies are prominent players in the Supercars Market?

Key companies in the market include Bugatti Automobiles SAS, BMW AG, Aston Martin, Maserati SpA, Mercedes-Benz AMG, McLaren Group, Porche AG, Automobili Lamborghini SpA, Ferrari SpA, Bentley Motors Limited, Koenigsegg Automotive AB, Audi A.

3. What are the main segments of the Supercars Market?

The market segments include Type, Propulsion type, Payment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.54 Million as of 2022.

5. What are some drivers contributing to market growth?

Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth.

6. What are the notable trends driving market growth?

The Electric Segment Expected to be the Fastest-growing During the Forecast Period.

7. Are there any restraints impacting market growth?

Rapid Shift Toward Electric and Hybrid Supercars to Drive Market Growth.

8. Can you provide examples of recent developments in the market?

April 2024: Supercar Blondie launched SBX Cars, an online auction site to sell hypercars and other expensive items. The auction house primarily operates in Los Angeles and Dubai. The site features rare cars like the BMW Glass Yacht, the Lotus F1 Team's John Player Specials from the 1970s and 80s, the Hyperion XP-1 prototype, and the Mercedes-AMG One supercar.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Supercars Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Supercars Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Supercars Market?

To stay informed about further developments, trends, and reports in the Supercars Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence