Key Insights

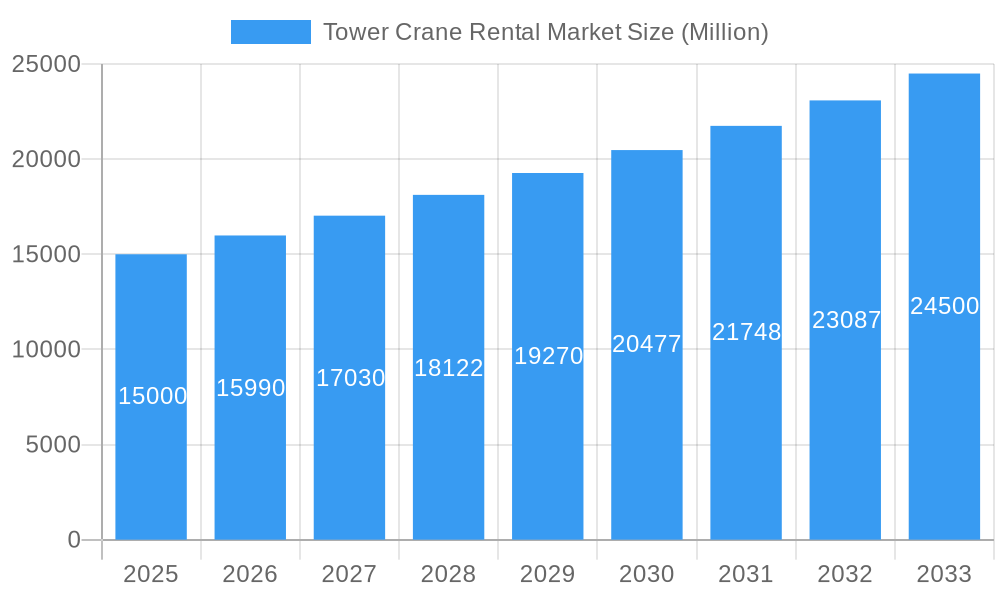

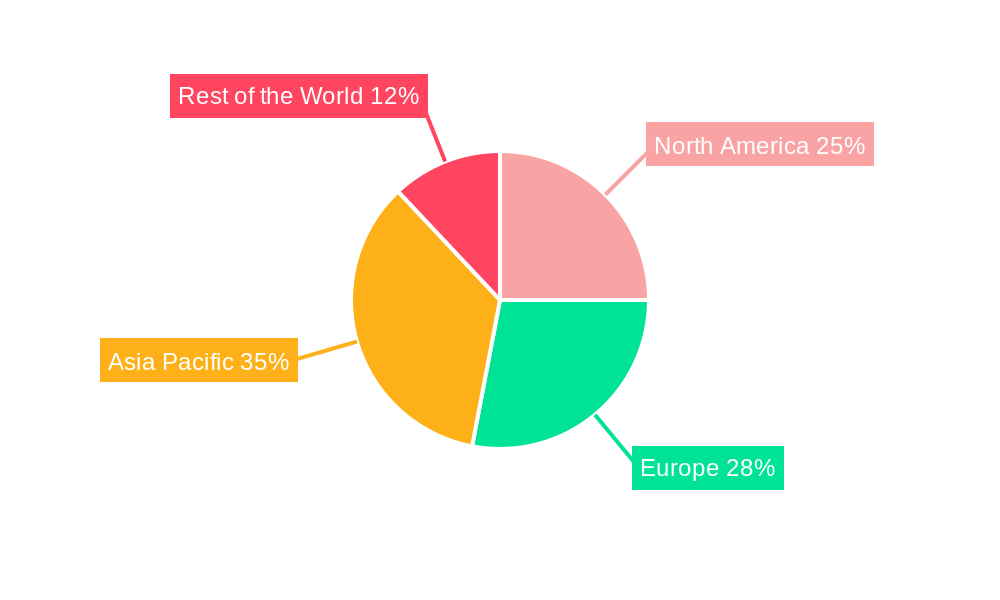

The global tower crane rental market is experiencing robust growth, projected to reach a significant market size driven by the burgeoning construction industry, particularly in developing economies across Asia-Pacific and the Middle East. A Compound Annual Growth Rate (CAGR) of 6.20% from 2019-2033 indicates a consistently expanding market. Key drivers include increasing urbanization, large-scale infrastructure projects (such as roads, bridges, and high-rise buildings), and the rising demand for efficient and cost-effective construction solutions. The market is segmented by crane type (hammerhead, luffing, self-erecting), lifting capacity (5T, 10T, 16T, 20T, 25T+), and geographical region. While North America and Europe represent established markets, the Asia-Pacific region is expected to witness the most substantial growth due to rapid infrastructure development and ongoing construction boom. The presence of major players like Manitowoc, Liebherr, and Sany further intensifies competition, driving innovation and enhancing service offerings within the industry. However, factors such as fluctuating raw material prices, stringent safety regulations, and economic downturns could pose potential restraints on market expansion. The increasing adoption of technologically advanced cranes with enhanced safety features and remote monitoring capabilities is a significant trend shaping the market's future.

Tower Crane Rental Market Market Size (In Billion)

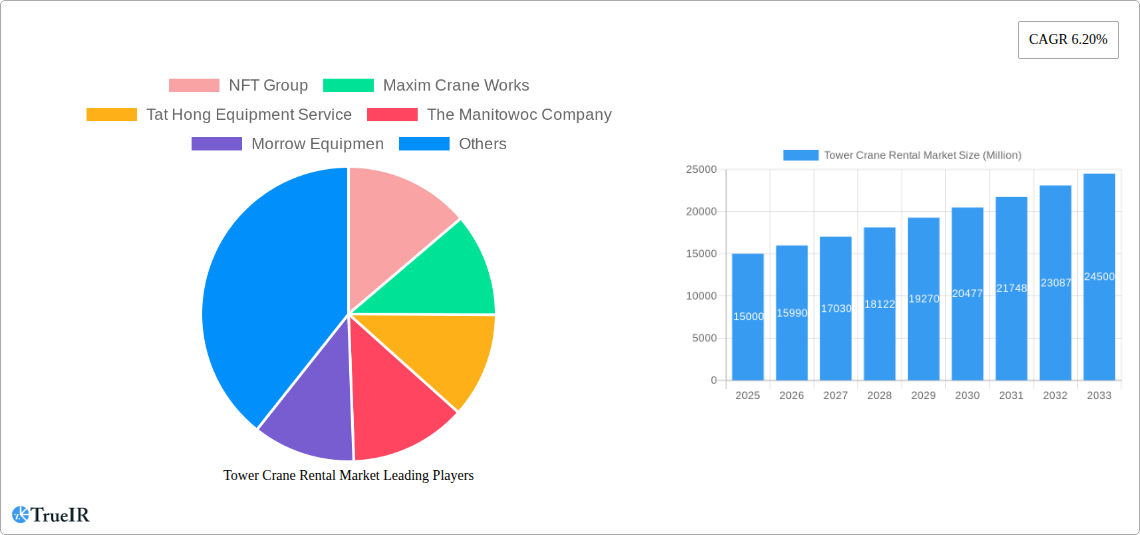

The competitive landscape is characterized by a mix of global giants and regional players. Leading companies are investing heavily in expanding their fleet size, improving operational efficiency, and leveraging technological advancements to gain a competitive edge. The rental model provides flexibility and cost-effectiveness for construction companies, reducing capital expenditure and operational risks. Furthermore, the growing adoption of sustainable construction practices is also influencing the market, with a rising demand for eco-friendly tower cranes and operational methods. The forecast period of 2025-2033 suggests continued market expansion, presenting promising opportunities for businesses operating in this sector. Strategic partnerships, technological integration, and expansion into emerging markets are key strategies employed by companies aiming to maximize their market share and capitalize on the sustained growth trajectory. Detailed regional analysis reveals significant variations in market penetration and growth potential, requiring customized strategies tailored to the specific needs and characteristics of each geographic area.

Tower Crane Rental Market Company Market Share

Tower Crane Rental Market Report: A Comprehensive Analysis (2019-2033)

This dynamic report provides a comprehensive analysis of the Tower Crane Rental Market, offering invaluable insights for industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this study delves into market structure, competitive dynamics, technological advancements, and future growth projections. The report leverages extensive data analysis to deliver actionable intelligence for informed decision-making. Market size estimations reach into the billions, highlighting the significant potential within this sector.

Tower Crane Rental Market Market Structure & Competitive Landscape

The global tower crane rental market is characterized by a moderately concentrated structure, featuring a blend of established global manufacturers and specialized rental providers. Key participants contributing significantly to market dynamics include NFT Group, Maxim Crane Works, Tat Hong Equipment Service, The Manitowoc Company, Morrow Equipment, Liebherr International AG, Action Construction Equipment Ltd, SANY Group, Zoomlion Heavy Industry Science and Technology Co Ltd, and Terex Corporation. While specific market share figures can fluctuate, the competitive landscape is shaped by these prominent entities. The market exhibits a healthy level of competition, with companies leveraging a combination of fleet size, service quality, technological integration, and pricing strategies to capture market share.

Innovation remains a paramount driver, with manufacturers and rental companies consistently introducing advanced crane models and enhanced lifting capacities. This includes the development of more versatile crane types such as Hammerhead, Luffing, and Self-Erecting cranes, catering to a wide array of project requirements. Furthermore, advancements in lifting capacities, ranging from 5T to 25T and beyond, are crucial for supporting the construction of increasingly complex and towering structures. Regulatory landscapes, particularly concerning safety standards and environmental emissions, play a pivotal role in shaping operational costs and influencing market accessibility. Companies are investing in greener technologies and adhering to stringent safety protocols. While substitute technologies exist, such as specialized mobile cranes or pre-assembled modular construction components, tower cranes continue to offer unparalleled efficiency for large-scale vertical construction. The end-user segmentation is diverse, encompassing residential developments, commercial complexes, industrial facilities, and large-scale infrastructure projects. Mergers and acquisitions (M&A) are an important strategic tool within the market, with a moderate level of activity observed. These transactions are often driven by the desire to expand geographical footprints, broaden service portfolios, and consolidate market presence, indicating a trend towards strategic partnerships and inorganic growth.

Tower Crane Rental Market Market Trends & Opportunities

The global tower crane rental market is experiencing robust growth, with an estimated CAGR of xx% during the forecast period (2025-2033). This growth is driven by the increasing demand for construction activities worldwide, particularly in developing economies. Technological advancements, such as digital platforms for remote monitoring and crane control (e.g., Manitowoc's CONNECT), are enhancing operational efficiency and safety. Consumer preferences are shifting towards technologically advanced, energy-efficient, and environmentally friendly cranes. The market is characterized by intense competition, with companies investing in expanding their fleets, geographical reach, and service portfolios. Market penetration rates for advanced crane technologies are gradually increasing, driven by growing awareness and benefits associated with enhanced productivity and safety.

Dominant Markets & Segments in Tower Crane Rental Market

The Asia-Pacific region is projected to maintain its position as the leading market for tower crane rentals throughout the forecast period. This dominance is propelled by substantial investments in ongoing and planned infrastructure projects, coupled with rapid urbanization across several key economies. Nations such as China and India are at the forefront of this growth, driven by significant government initiatives and a burgeoning construction sector.

Key Growth Drivers:

- Sustained and substantial investments in critical infrastructure development, including transportation networks (roads, railways, airports), energy facilities, and public amenities.

- Favorable government policies and regulatory frameworks that actively encourage and support construction activities, real estate development, and urban regeneration projects.

- A consistent rise in disposable incomes and accelerating urbanization trends, which in turn fuels increased demand for housing and commercial spaces.

Segment Analysis:

- Hammerhead cranes continue to command the largest market share due to their robust design, high lifting capacities, and adaptability to a broad spectrum of construction applications.

- Luffing cranes are experiencing escalating demand, particularly in densely populated urban environments where space is at a premium. Their ability to operate with a smaller radius and minimize obstructions makes them ideal for complex cityscapes.

- Self-erecting cranes are witnessing growing adoption for smaller to medium-sized projects, primarily due to their straightforward setup, ease of transportation, and cost-effectiveness for sites with less demanding lifting requirements.

- The demand for cranes with higher lifting capacities, specifically in the 16T, 20T, and 25T ranges, is on an upward trajectory. This surge is directly linked to the increasing prevalence of supertall skyscrapers, expansive commercial complexes, and monumental infrastructure undertakings that necessitate greater lifting power and precision.

Tower Crane Rental Market Product Analysis

Recent product innovations in the tower crane rental market are predominantly focused on enhancing operational safety, maximizing efficiency, and promoting environmental sustainability. This includes the integration of sophisticated control systems for precise maneuvering, advanced digital monitoring platforms for real-time performance tracking and predictive maintenance, and the adoption of automation technologies to reduce human error and improve workflow. The market is actively witnessing the introduction and growing popularity of hybrid and fully electric crane models. These environmentally conscious alternatives are designed to significantly reduce carbon emissions, lower noise pollution, and decrease reliance on fossil fuels, thereby contributing to more sustainable construction practices and reducing operational fuel costs. These technological advancements collectively enhance the overall value proposition of tower crane rental services, ensuring that rental providers can effectively meet the evolving and increasingly sophisticated demands of modern construction companies.

Key Drivers, Barriers & Challenges in Tower Crane Rental Market

Key Drivers:

- Growth in construction and infrastructure spending across various sectors (e.g., residential, commercial, industrial) fuels demand.

- Government initiatives promoting infrastructure development.

- Technological advancements in crane designs and remote monitoring systems increase efficiency.

Challenges & Restraints:

- Supply chain disruptions lead to delays in crane delivery and increased costs (estimated impact: xx% increase in average rental cost in 2022).

- Stringent safety regulations and compliance requirements increase operational costs.

- Intense competition necessitates strategic pricing and service differentiation.

Growth Drivers in the Tower Crane Rental Market Market

The growth of the tower crane rental market is primarily driven by the increasing demand for construction activities worldwide, especially in developing economies, along with technological advancements and government support for infrastructure development projects. The rising demand for high-rise buildings and large-scale infrastructure projects is another major driver.

Challenges Impacting Tower Crane Rental Market Growth

The tower crane rental market faces challenges like supply chain disruptions, fluctuating raw material prices, and intense competition. Stringent safety regulations and environmental concerns also add to the operational complexities and increase costs.

Key Players Shaping the Tower Crane Rental Market Market

- NFT Group

- Maxim Crane Works

- Tat Hong Equipment Service

- The Manitowoc Company

- Morrow Equipment

- Liebherr International AG

- Action Construction Equipment Ltd

- SANY Group

- Zoomlion Heavy Industry Science and Technology Co Ltd

- Terex Corporation

Significant Tower Crane Rental Market Industry Milestones

- October 2021: Zoomlion introduced the W12000-450, the world's largest top-slewing tower crane, significantly enhancing lifting capacity.

- February 2022: Liebherr International AG launched the 470 EC-B Flat-Top crane, increasing lifting capacity options.

- June 2022: Manitowoc launched the CONNECT app-based platform, improving remote monitoring and crane management capabilities.

- June 2022: XCMG introduced the XGT15000-600S super-scale tower crane, addressing the demand for large-scale modular bridge construction.

- July 2022: Liebherr International AG added the 300 EC-B 12 Fibre and 270 EC-B 12 to its EC-B series, improving freestanding height and service life.

Future Outlook for Tower Crane Rental Market Market

The tower crane rental market is anticipated to experience robust and sustained growth in the coming years. This positive trajectory is largely attributed to ongoing and planned global infrastructure development initiatives, alongside continuous technological advancements in crane design, operational efficiency, and safety features. Strategic partnerships, expansion into emerging geographical markets, and the proactive adoption of innovative and sustainable technologies are expected to be key determinants of future market dynamics. The increasing global emphasis on environmentally responsible construction practices will further drive the demand for energy-efficient and low-emission tower cranes. The market is projected to reach significant valuations, offering substantial opportunities for both established industry players and new entrants to expand their operations and capitalize on evolving market needs.

Tower Crane Rental Market Segmentation

-

1. Crane type

- 1.1. Hammerhead Cranes

- 1.2. Luffing Cranes

- 1.3. Self-erecting Cranes

-

2. Lifting Capacity

- 2.1. Up to 5 Ton

- 2.2. 5 to 10 Ton

- 2.3. 11 to 16 Ton

- 2.4. 17 to 25 Ton

- 2.5. Above 25 Ton

-

3. End User

- 3.1. Infrastructure

- 3.2. Residential Buildings

- 3.3. Commercial Buildings

- 3.4. Mining and Excavation

- 3.5. Other End Users (Marine, Offshore, Etc.)

Tower Crane Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tower Crane Rental Market Regional Market Share

Geographic Coverage of Tower Crane Rental Market

Tower Crane Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's

- 3.3. Market Restrains

- 3.3.1. Lack of Electric Charging Infrastructure May Hamper the Growth of the Market

- 3.4. Market Trends

- 3.4.1. The 5T and 10T Lifting Capacity Segments Lead the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Crane type

- 5.1.1. Hammerhead Cranes

- 5.1.2. Luffing Cranes

- 5.1.3. Self-erecting Cranes

- 5.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 5.2.1. Up to 5 Ton

- 5.2.2. 5 to 10 Ton

- 5.2.3. 11 to 16 Ton

- 5.2.4. 17 to 25 Ton

- 5.2.5. Above 25 Ton

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Infrastructure

- 5.3.2. Residential Buildings

- 5.3.3. Commercial Buildings

- 5.3.4. Mining and Excavation

- 5.3.5. Other End Users (Marine, Offshore, Etc.)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Crane type

- 6. North America Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Crane type

- 6.1.1. Hammerhead Cranes

- 6.1.2. Luffing Cranes

- 6.1.3. Self-erecting Cranes

- 6.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 6.2.1. Up to 5 Ton

- 6.2.2. 5 to 10 Ton

- 6.2.3. 11 to 16 Ton

- 6.2.4. 17 to 25 Ton

- 6.2.5. Above 25 Ton

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Infrastructure

- 6.3.2. Residential Buildings

- 6.3.3. Commercial Buildings

- 6.3.4. Mining and Excavation

- 6.3.5. Other End Users (Marine, Offshore, Etc.)

- 6.1. Market Analysis, Insights and Forecast - by Crane type

- 7. Europe Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Crane type

- 7.1.1. Hammerhead Cranes

- 7.1.2. Luffing Cranes

- 7.1.3. Self-erecting Cranes

- 7.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 7.2.1. Up to 5 Ton

- 7.2.2. 5 to 10 Ton

- 7.2.3. 11 to 16 Ton

- 7.2.4. 17 to 25 Ton

- 7.2.5. Above 25 Ton

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Infrastructure

- 7.3.2. Residential Buildings

- 7.3.3. Commercial Buildings

- 7.3.4. Mining and Excavation

- 7.3.5. Other End Users (Marine, Offshore, Etc.)

- 7.1. Market Analysis, Insights and Forecast - by Crane type

- 8. Asia Pacific Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Crane type

- 8.1.1. Hammerhead Cranes

- 8.1.2. Luffing Cranes

- 8.1.3. Self-erecting Cranes

- 8.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 8.2.1. Up to 5 Ton

- 8.2.2. 5 to 10 Ton

- 8.2.3. 11 to 16 Ton

- 8.2.4. 17 to 25 Ton

- 8.2.5. Above 25 Ton

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Infrastructure

- 8.3.2. Residential Buildings

- 8.3.3. Commercial Buildings

- 8.3.4. Mining and Excavation

- 8.3.5. Other End Users (Marine, Offshore, Etc.)

- 8.1. Market Analysis, Insights and Forecast - by Crane type

- 9. Rest of the World Tower Crane Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Crane type

- 9.1.1. Hammerhead Cranes

- 9.1.2. Luffing Cranes

- 9.1.3. Self-erecting Cranes

- 9.2. Market Analysis, Insights and Forecast - by Lifting Capacity

- 9.2.1. Up to 5 Ton

- 9.2.2. 5 to 10 Ton

- 9.2.3. 11 to 16 Ton

- 9.2.4. 17 to 25 Ton

- 9.2.5. Above 25 Ton

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Infrastructure

- 9.3.2. Residential Buildings

- 9.3.3. Commercial Buildings

- 9.3.4. Mining and Excavation

- 9.3.5. Other End Users (Marine, Offshore, Etc.)

- 9.1. Market Analysis, Insights and Forecast - by Crane type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 NFT Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Maxim Crane Works

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Tat Hong Equipment Service

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The Manitowoc Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Morrow Equipmen

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Liebherr International AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Action Construction Equipment Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SANY Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Zoomlion Heavy Industry Science and Technology Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Terex Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 NFT Group

List of Figures

- Figure 1: Global Tower Crane Rental Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 3: North America Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 4: North America Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 5: North America Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 6: North America Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 7: North America Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 11: Europe Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 12: Europe Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 13: Europe Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 14: Europe Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 15: Europe Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 19: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 20: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 21: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 22: Asia Pacific Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Asia Pacific Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Tower Crane Rental Market Revenue (undefined), by Crane type 2025 & 2033

- Figure 27: Rest of the World Tower Crane Rental Market Revenue Share (%), by Crane type 2025 & 2033

- Figure 28: Rest of the World Tower Crane Rental Market Revenue (undefined), by Lifting Capacity 2025 & 2033

- Figure 29: Rest of the World Tower Crane Rental Market Revenue Share (%), by Lifting Capacity 2025 & 2033

- Figure 30: Rest of the World Tower Crane Rental Market Revenue (undefined), by End User 2025 & 2033

- Figure 31: Rest of the World Tower Crane Rental Market Revenue Share (%), by End User 2025 & 2033

- Figure 32: Rest of the World Tower Crane Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Rest of the World Tower Crane Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 2: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 3: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Global Tower Crane Rental Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 6: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 7: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 13: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 14: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Germany Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: France Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Russia Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Spain Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 23: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 24: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 25: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 26: India Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: China Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Japan Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Korea Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Global Tower Crane Rental Market Revenue undefined Forecast, by Crane type 2020 & 2033

- Table 32: Global Tower Crane Rental Market Revenue undefined Forecast, by Lifting Capacity 2020 & 2033

- Table 33: Global Tower Crane Rental Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 34: Global Tower Crane Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 35: South America Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Tower Crane Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tower Crane Rental Market?

The projected CAGR is approximately 3%.

2. Which companies are prominent players in the Tower Crane Rental Market?

Key companies in the market include NFT Group, Maxim Crane Works, Tat Hong Equipment Service, The Manitowoc Company, Morrow Equipmen, Liebherr International AG, Action Construction Equipment Ltd, SANY Group, Zoomlion Heavy Industry Science and Technology Co Ltd, Terex Corporation.

3. What are the main segments of the Tower Crane Rental Market?

The market segments include Crane type, Lifting Capacity, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Technological Superiority of LiDAR; Increasing Vehicle Safety Regulations and Growing Adoption of Adas Technology By OEM's.

6. What are the notable trends driving market growth?

The 5T and 10T Lifting Capacity Segments Lead the Market.

7. Are there any restraints impacting market growth?

Lack of Electric Charging Infrastructure May Hamper the Growth of the Market.

8. Can you provide examples of recent developments in the market?

In July 2022, Liebherr International AG introduced 300 EC-B 12 Fibre and 270 EC-B 12 to its EC-B series of flat top tower cranes. Both tower cranes have a longer service life and give a maximum freestanding height of 91.7 meters.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tower Crane Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tower Crane Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tower Crane Rental Market?

To stay informed about further developments, trends, and reports in the Tower Crane Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence