Key Insights

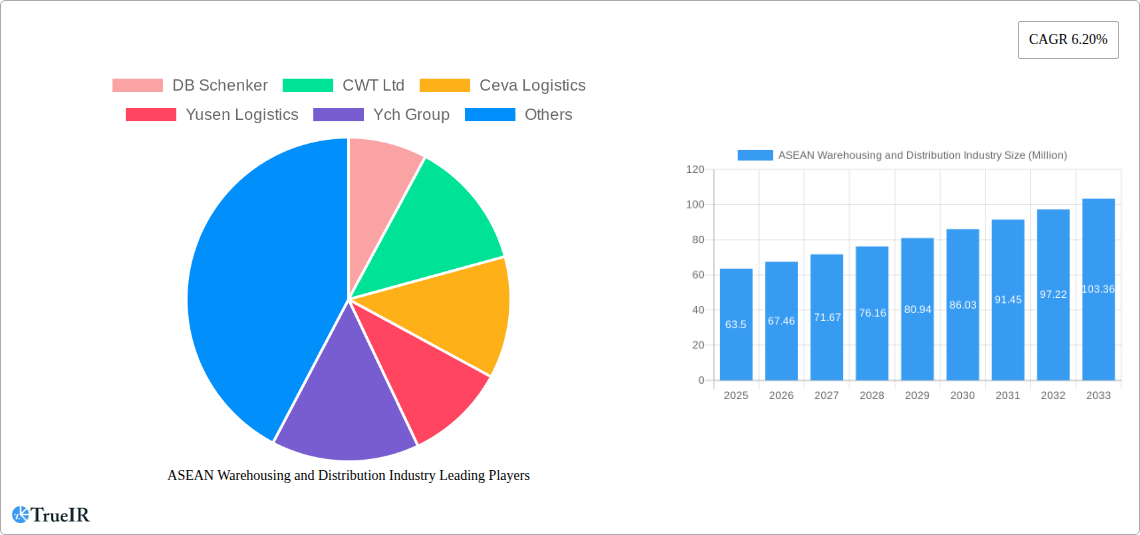

The ASEAN warehousing and distribution industry is experiencing robust growth, driven by the region's expanding e-commerce sector, burgeoning manufacturing activities, and increasing focus on supply chain optimization. The market, currently estimated at $63.50 million in 2025, is projected to maintain a Compound Annual Growth Rate (CAGR) of 6.20% from 2025 to 2033. This growth is fueled by several key factors. The rise of e-commerce necessitates efficient warehousing and distribution networks to handle the surge in online orders, leading to increased demand for warehousing services, particularly value-added services like packaging and labeling. Simultaneously, the automotive, pharmaceutical & healthcare, FMCG, and manufacturing sectors are driving demand for specialized warehousing solutions tailored to their specific needs, including temperature-controlled storage and secure handling of sensitive goods. Furthermore, increasing foreign direct investment (FDI) in the region is further bolstering the industry's expansion. Despite these positive trends, challenges remain. These include infrastructure limitations in certain areas, increasing labor costs, and the need for continuous technological upgrades to enhance efficiency and transparency across the supply chain. The industry is segmented by service type (warehousing, distribution, value-added) and end-user industry (retail & e-commerce, automotive, pharmaceutical & healthcare, FMCG, manufacturing, electronics). Key players include DB Schenker, CWT Ltd, Ceva Logistics, and others, competing on service quality, technology adoption, and geographical reach. The competitive landscape is dynamic, with both established players and emerging local companies vying for market share. The long-term outlook remains positive, with substantial opportunities for growth, particularly within the value-added services segment and expansion into underserved markets.

ASEAN Warehousing and Distribution Industry Market Size (In Million)

The continued growth in ASEAN's warehousing and distribution market relies on addressing existing infrastructure gaps and fostering technological advancements. This includes investing in modern warehousing facilities equipped with automation technologies to improve efficiency and reduce operational costs. Strategic partnerships and collaborations between logistics providers and technology companies can accelerate the digital transformation of the industry. Adopting sustainable practices, such as optimizing transportation routes and utilizing eco-friendly vehicles, will also become increasingly crucial for attracting environmentally conscious businesses. The regulatory environment will play a significant role; supportive policies that encourage investment and streamline logistical processes will be vital in sustaining the industry's growth trajectory. Focusing on skilled workforce development and talent acquisition will also be essential to meet the industry's evolving needs for skilled professionals in areas such as logistics management, technology, and data analytics.

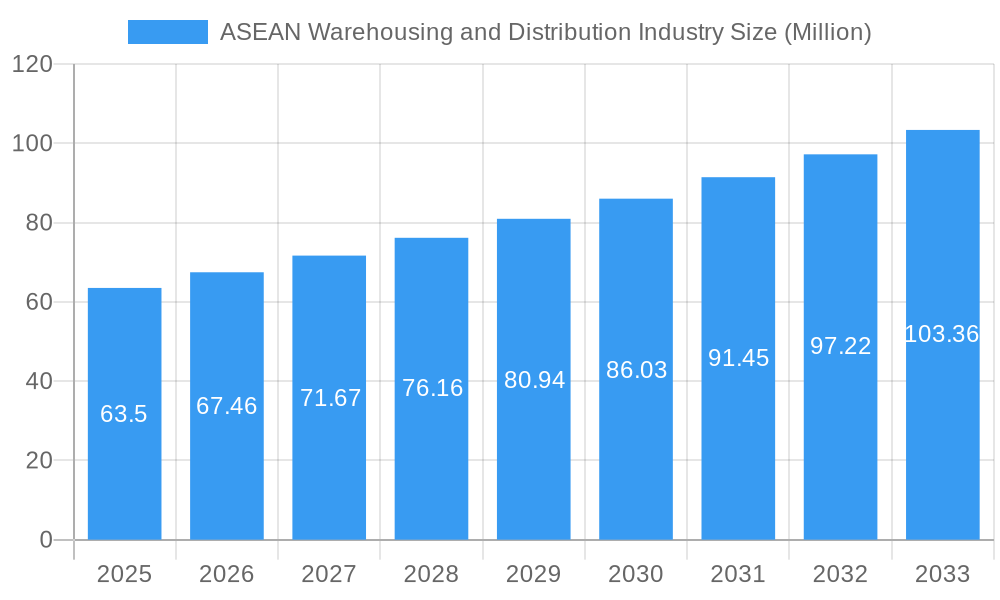

ASEAN Warehousing and Distribution Industry Company Market Share

This dynamic report provides a comprehensive analysis of the ASEAN warehousing and distribution industry, offering invaluable insights for businesses, investors, and policymakers. With a detailed examination of market trends, competitive landscapes, and future projections, this report is an essential resource for navigating this rapidly evolving sector. The study period covers 2019-2033, with a base and estimated year of 2025.

ASEAN Warehousing and Distribution Industry Market Structure & Competitive Landscape

The ASEAN warehousing and distribution industry exhibits a moderately concentrated market structure, with several multinational players holding significant market share. Key players include DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, YCH Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, Keppel Logistics, DHL Supply Chain, and numerous other significant companies. The industry is characterized by ongoing consolidation, evidenced by recent mergers and acquisitions (M&A). The concentration ratio (CR4, for example) is estimated to be xx%, indicating a moderately competitive landscape. Innovation is driven by technological advancements such as automation, AI, and the Internet of Things (IoT), leading to improved efficiency and cost reduction. Regulatory factors, including customs procedures and trade policies, significantly impact operational costs and market access. Product substitutes, such as decentralized warehousing models or direct-to-consumer shipping, present challenges to traditional players. The industry shows significant segmentation by service type (warehousing, distribution, value-added services) and end-user industry (Retail & E-commerce, Automotive, Pharmaceutical & Healthcare, FMCG, Manufacturing, Electronics). M&A activity, such as the Maersk acquisition of LF Logistics and Geodis' acquisition of Keppel Logistics, indicate a trend toward larger, integrated logistics providers. These acquisitions add millions of square meters to the already vast warehouse footprint of these major players. The total value of M&A transactions in the ASEAN warehousing and distribution sector from 2019 to 2024 is estimated at xx Million.

ASEAN Warehousing and Distribution Industry Market Trends & Opportunities

The ASEAN warehousing and distribution market is experiencing robust growth, driven by the region's expanding e-commerce sector, rising manufacturing activity, and improving infrastructure. The market size reached xx Million in 2024 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx Million by 2033. This expansion is fueled by technological advancements, including automation, big data analytics, and cloud computing, enhancing efficiency and visibility across the supply chain. Changing consumer preferences, particularly the increasing demand for faster and more convenient delivery options, are also shaping industry dynamics. The rise of omnichannel retail strategies is creating new opportunities for value-added services such as last-mile delivery, inventory management, and customized fulfillment solutions. Intense competition among established players and the emergence of new entrants are driving innovation and price optimization strategies. Market penetration rates for various services and segments vary widely based on factors like infrastructure development and consumer spending patterns. For example, the market penetration of automated warehousing solutions is currently at xx% and is expected to reach xx% by 2033. The ongoing development of smart logistics networks presents a significant opportunity for growth and improvement across the ASEAN region.

Dominant Markets & Segments in ASEAN Warehousing and Distribution Industry

Leading Regions/Countries: Singapore, Thailand, and Malaysia currently dominate the ASEAN warehousing and distribution market due to their advanced infrastructure, robust economies, and strategic geographic locations. Indonesia and Vietnam are emerging as key growth markets, driven by their expanding manufacturing and e-commerce sectors.

Dominant Segments:

By Service Type: Warehousing services account for the largest share of the market, followed by distribution and value-added services. Value-added services are seeing particularly strong growth, driven by the rising demand for customized solutions.

By End-User Industry: The Retail & E-commerce sector is the fastest-growing segment, fueled by the explosive growth of online shopping across the region. Manufacturing, FMCG, and the Pharmaceutical & Healthcare sectors are also significant contributors to the market's overall value.

Key Growth Drivers:

- Improved Infrastructure: Significant investments in transportation networks, including ports, airports, and highways, are improving logistics efficiency.

- Government Policies: Supportive government policies promoting industrial development and trade liberalization are further boosting market growth.

- Technological Advancements: Automation and digitalization are enhancing operational efficiency and reducing costs.

ASEAN Warehousing and Distribution Industry Product Analysis

The ASEAN warehousing and distribution industry is witnessing a surge in product innovation, driven by the need for enhanced efficiency, visibility, and security. Technological advancements such as automation (robotics, automated guided vehicles), warehouse management systems (WMS), and transportation management systems (TMS) are significantly improving operational efficiency and supply chain visibility. The adoption of cloud-based solutions and data analytics is improving decision-making and resource optimization. These innovations are crucial in addressing the growing demands for faster delivery times, increased order volumes, and customized fulfillment options within the increasingly complex and competitive environment of the ASEAN region. The key competitive advantage lies in providing integrated, technology-driven solutions that offer greater speed, reliability, and visibility across the entire supply chain.

Key Drivers, Barriers & Challenges in ASEAN Warehousing and Distribution Industry

Key Drivers:

- E-commerce Boom: Rapid growth in e-commerce is driving demand for warehousing and distribution services.

- Foreign Direct Investment (FDI): Significant FDI in manufacturing and logistics is bolstering market expansion.

- Infrastructure Development: Investments in transportation and logistics infrastructure are improving efficiency.

Key Challenges:

- Infrastructure Gaps: While improvements are underway, infrastructure gaps in certain regions continue to hinder efficient logistics.

- Regulatory Complexity: Varied and sometimes inconsistent regulations across different ASEAN countries pose challenges.

- Competition: Intense competition among existing players and new entrants is impacting pricing and profitability. The competitive landscape is particularly challenging in major hubs like Singapore and Bangkok, where multiple multinational logistics companies operate.

Growth Drivers in the ASEAN Warehousing and Distribution Industry Market

The ASEAN warehousing and distribution market is propelled by a combination of factors. The expansion of e-commerce significantly increases demand for efficient warehousing and last-mile delivery solutions. Rising foreign direct investment (FDI) in manufacturing and logistics supports the expansion of warehousing capacity. Furthermore, government initiatives to improve infrastructure and streamline logistics processes, like developing specialized economic zones, enhance the industry's attractiveness for businesses. The growing adoption of technology, such as automated systems and data analytics, enhances operational efficiency and optimizes supply chains, further fueling growth.

Challenges Impacting ASEAN Warehousing and Distribution Industry Growth

Several challenges hinder the growth of the ASEAN warehousing and distribution sector. Infrastructure limitations in certain areas, such as limited road networks and inadequate port facilities, lead to logistical bottlenecks and increased costs. Inconsistent regulatory frameworks across the region create complexities and uncertainty for businesses. Competition among both established and new players remains fierce, resulting in pressure on margins and pricing. Finally, the lack of skilled labor in some parts of the region is a concern for maintaining efficient operations and expanding capabilities.

Key Players Shaping the ASEAN Warehousing and Distribution Industry Market

- DB Schenker

- CWT Ltd

- Ceva Logistics

- Yusen Logistics

- YCH Group

- Gemadept

- WHA Corporation

- Kuehne + Nagel

- Singapore Post

- Agility

- Kerry Logistics

- CJ Century Logistics

- Tiong Nam Logistics

- Keppel Logistics

- DHL Supply Chain

Significant ASEAN Warehousing and Distribution Industry Industry Milestones

August 2022: A.P. Moller - Maersk (Maersk) acquired LF Logistics, adding 223 warehouses and 9.5 million square meters of warehouse space to its network, significantly expanding its presence in ASEAN omnichannel fulfillment and e-commerce. This acquisition significantly altered the competitive landscape and increased Maersk’s market share.

April 2022: Geodis acquired Keppel Logistics, bolstering its contract logistics capabilities and e-commerce fulfillment services in Singapore and Southeast Asia, adding over 200,000 square meters of warehouse space. This acquisition strengthened Geodis' position in the region and enhanced its portfolio of services.

Future Outlook for ASEAN Warehousing and Distribution Industry Market

The ASEAN warehousing and distribution market is poised for continued strong growth, driven by ongoing e-commerce expansion, increasing manufacturing activity, and supportive government policies. Strategic opportunities lie in investing in advanced technologies, such as automation and AI, to enhance efficiency and create competitive advantages. The focus on sustainable and environmentally friendly logistics solutions will also play a key role in the sector’s future. The market's potential is significant, presenting opportunities for both established players and new entrants to capitalize on the region's dynamic economic growth and evolving consumer demands.

ASEAN Warehousing and Distribution Industry Segmentation

-

1. Geography

- 1.1. Singapore

- 1.2. Thailand

- 1.3. Malaysia

- 1.4. Vietnam

- 1.5. Indonesia

- 1.6. Philippines

- 1.7. Rest of ASEAN

ASEAN Warehousing and Distribution Industry Segmentation By Geography

- 1. Singapore

- 2. Thailand

- 3. Malaysia

- 4. Vietnam

- 5. Indonesia

- 6. Philippines

- 7. Rest of ASEAN

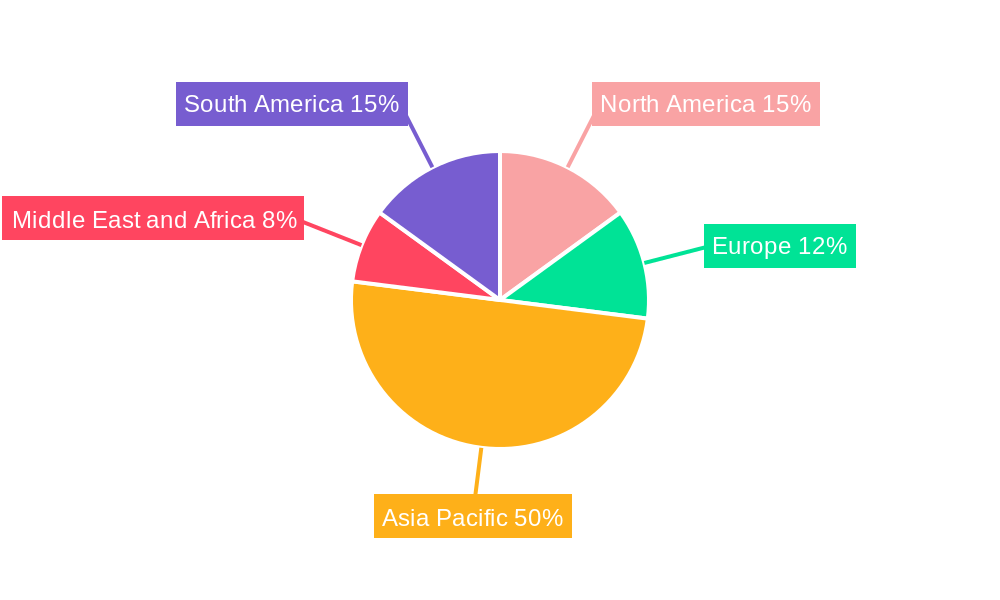

ASEAN Warehousing and Distribution Industry Regional Market Share

Geographic Coverage of ASEAN Warehousing and Distribution Industry

ASEAN Warehousing and Distribution Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce

- 3.3. Market Restrains

- 3.3.1. Cargo Restrictions

- 3.4. Market Trends

- 3.4.1. Increase in Warehousing Space in Thailand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 5.1.1. Singapore

- 5.1.2. Thailand

- 5.1.3. Malaysia

- 5.1.4. Vietnam

- 5.1.5. Indonesia

- 5.1.6. Philippines

- 5.1.7. Rest of ASEAN

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Singapore

- 5.2.2. Thailand

- 5.2.3. Malaysia

- 5.2.4. Vietnam

- 5.2.5. Indonesia

- 5.2.6. Philippines

- 5.2.7. Rest of ASEAN

- 5.1. Market Analysis, Insights and Forecast - by Geography

- 6. Singapore ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 6.1.1. Singapore

- 6.1.2. Thailand

- 6.1.3. Malaysia

- 6.1.4. Vietnam

- 6.1.5. Indonesia

- 6.1.6. Philippines

- 6.1.7. Rest of ASEAN

- 6.1. Market Analysis, Insights and Forecast - by Geography

- 7. Thailand ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 7.1.1. Singapore

- 7.1.2. Thailand

- 7.1.3. Malaysia

- 7.1.4. Vietnam

- 7.1.5. Indonesia

- 7.1.6. Philippines

- 7.1.7. Rest of ASEAN

- 7.1. Market Analysis, Insights and Forecast - by Geography

- 8. Malaysia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 8.1.1. Singapore

- 8.1.2. Thailand

- 8.1.3. Malaysia

- 8.1.4. Vietnam

- 8.1.5. Indonesia

- 8.1.6. Philippines

- 8.1.7. Rest of ASEAN

- 8.1. Market Analysis, Insights and Forecast - by Geography

- 9. Vietnam ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 9.1.1. Singapore

- 9.1.2. Thailand

- 9.1.3. Malaysia

- 9.1.4. Vietnam

- 9.1.5. Indonesia

- 9.1.6. Philippines

- 9.1.7. Rest of ASEAN

- 9.1. Market Analysis, Insights and Forecast - by Geography

- 10. Indonesia ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 10.1.1. Singapore

- 10.1.2. Thailand

- 10.1.3. Malaysia

- 10.1.4. Vietnam

- 10.1.5. Indonesia

- 10.1.6. Philippines

- 10.1.7. Rest of ASEAN

- 10.1. Market Analysis, Insights and Forecast - by Geography

- 11. Philippines ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 11.1.1. Singapore

- 11.1.2. Thailand

- 11.1.3. Malaysia

- 11.1.4. Vietnam

- 11.1.5. Indonesia

- 11.1.6. Philippines

- 11.1.7. Rest of ASEAN

- 11.1. Market Analysis, Insights and Forecast - by Geography

- 12. Rest of ASEAN ASEAN Warehousing and Distribution Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 12.1.1. Singapore

- 12.1.2. Thailand

- 12.1.3. Malaysia

- 12.1.4. Vietnam

- 12.1.5. Indonesia

- 12.1.6. Philippines

- 12.1.7. Rest of ASEAN

- 12.1. Market Analysis, Insights and Forecast - by Geography

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 DB Schenker

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 CWT Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Ceva Logistics

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Yusen Logistics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ych Group

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Gemadept

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 WHA Corporation

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kuehne + Nagel

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Singapore Post

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Agility

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Kerry Logistics

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 CJ Century Logistics

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Tiong Nam Logistics

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 DHL Supply Chain

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.1 DB Schenker

List of Figures

- Figure 1: Global ASEAN Warehousing and Distribution Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 3: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 4: Singapore ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Singapore ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 7: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Thailand ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Thailand ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 11: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: Malaysia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Malaysia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 15: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Vietnam ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Vietnam ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 19: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 20: Indonesia ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Indonesia ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 23: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Philippines ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Philippines ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Geography 2025 & 2033

- Figure 27: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 28: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Rest of ASEAN ASEAN Warehousing and Distribution Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 2: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 4: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 16: Global ASEAN Warehousing and Distribution Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ASEAN Warehousing and Distribution Industry?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the ASEAN Warehousing and Distribution Industry?

Key companies in the market include DB Schenker, CWT Ltd, Ceva Logistics, Yusen Logistics, Ych Group, Gemadept, WHA Corporation, Kuehne + Nagel, Singapore Post, Agility, Kerry Logistics, CJ Century Logistics, Tiong Nam Logistics, Keppel Logistics**List Not Exhaustive 6 3 Other Companies (Key Information/Overview, DHL Supply Chain.

3. What are the main segments of the ASEAN Warehousing and Distribution Industry?

The market segments include Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.50 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the demand for the Air Cargo Capacity; The Rise of E-commerce.

6. What are the notable trends driving market growth?

Increase in Warehousing Space in Thailand.

7. Are there any restraints impacting market growth?

Cargo Restrictions.

8. Can you provide examples of recent developments in the market?

August 2022: A.P. Moller - Maersk (Maersk) announced the successful completion of its acquisition of LF Logistics, a logistics firm with premium capabilities in omnichannel fulfillment services, e-commerce, and inland shipping in the ASEAN region. Following the acquisition, Maersk will expand its warehouse network by adding 223 warehouses to its current network and increasing the total number of facilities, spread across 9.5 million square meters, to 549.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ASEAN Warehousing and Distribution Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ASEAN Warehousing and Distribution Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ASEAN Warehousing and Distribution Industry?

To stay informed about further developments, trends, and reports in the ASEAN Warehousing and Distribution Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence