Key Insights

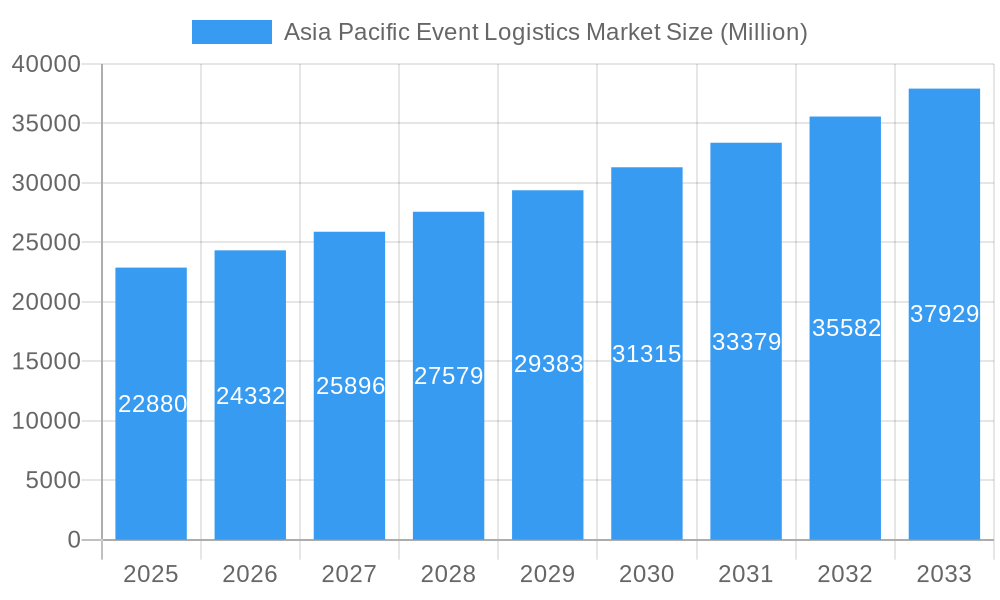

The Asia Pacific event logistics market, valued at $22.88 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 6.26% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the region's burgeoning entertainment and sports sectors, coupled with a rising number of trade fairs and exhibitions, are significantly increasing the demand for efficient and reliable logistics solutions. Secondly, the growth of e-commerce and the increasing sophistication of supply chain management within the event industry are driving the adoption of advanced technologies like inventory management systems and real-time tracking, further boosting market growth. Finally, significant infrastructure development across the Asia-Pacific region, particularly in transportation networks, is improving connectivity and facilitating smoother logistics operations. Countries like China, India, and Japan are leading the market, benefiting from large-scale events and strong economic growth. However, challenges remain, including geopolitical uncertainties and potential disruptions to global supply chains that could impact the market's trajectory.

Asia Pacific Event Logistics Market Market Size (In Billion)

Despite these challenges, the market's segmentation reveals diverse opportunities. The inventory control segment is expected to witness substantial growth due to the need for precise inventory management in managing the complex logistics of large-scale events. Similarly, the demand for specialized logistics solutions designed to handle sensitive event-related goods is driving growth within this segment. While entertainment events are currently a major application driver, the increasing focus on corporate events and the expansion of the trade fair industry are poised to broaden the market's application base. The competitive landscape includes both global giants like DHL, Kuehne + Nagel, and CEVA Logistics, alongside regional players like Yamato Transport and Sagawa Express. These companies are engaging in strategic partnerships, technological advancements, and expansion initiatives to capture market share within this dynamic sector. The forecast period from 2025-2033 indicates continued expansion, promising significant opportunities for stakeholders across the entire value chain.

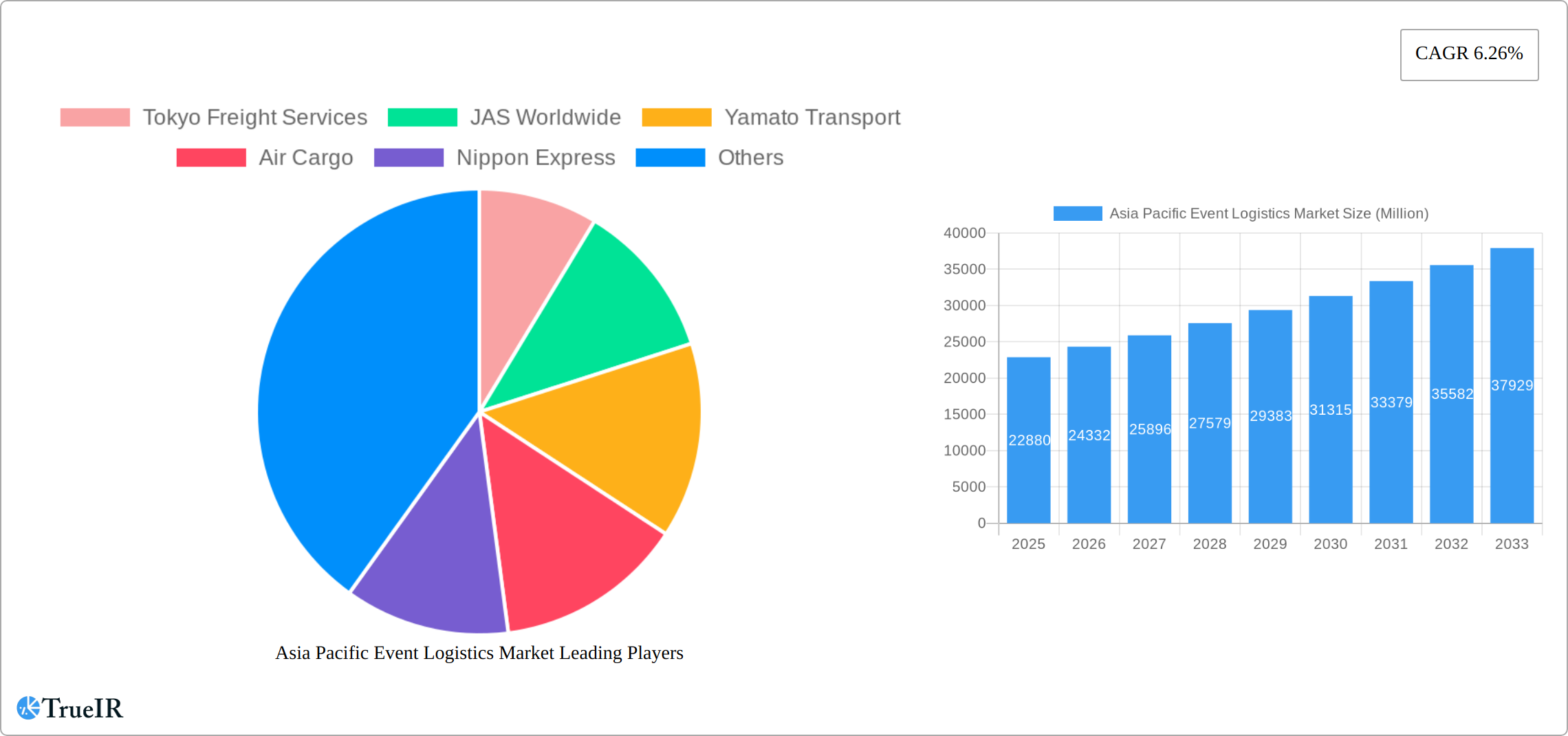

Asia Pacific Event Logistics Market Company Market Share

Asia Pacific Event Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Asia Pacific event logistics market, encompassing market size, growth projections, key players, and future trends. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for businesses, investors, and stakeholders seeking a comprehensive understanding of this rapidly evolving sector. The report leverages extensive data analysis to provide actionable insights and predictions for future market growth. The market is estimated to be valued at xx Million in 2025.

Asia Pacific Event Logistics Market Structure & Competitive Landscape

The Asia Pacific event logistics market exhibits a moderately consolidated structure, with several large multinational players dominating alongside numerous smaller regional operators. The market's concentration ratio (CR4) is estimated at approximately 40%, indicating a competitive yet concentrated landscape. Innovation, particularly in areas such as technology-driven solutions and sustainable practices, serves as a key driver of growth. However, the sector is subject to significant regulatory influences, varying considerably across the diverse Asia Pacific region. Product substitution, primarily through the use of alternative transportation methods or streamlined in-house logistics, presents a challenge to established players.

Key Market Characteristics:

- High Market Fragmentation: Numerous smaller regional players operate alongside multinational giants.

- Technological Disruption: Adoption of AI, automation, and data analytics reshaping logistics operations.

- Regulatory Divergence: Differing regulations across countries influence operational strategies.

- End-User Segmentation: Diverse client base encompassing event organizers, businesses, and government entities.

- M&A Activity: Moderate level of mergers and acquisitions, indicating consolidation and expansion efforts. The recent acquisition of two New Zealand forwarders by Global Critical Logistics (GCL) exemplifies this trend, adding significantly to their live event logistics capacity.

Asia Pacific Event Logistics Market Trends & Opportunities

The Asia Pacific event logistics market is poised for significant growth, driven by several compelling factors. The market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated value of xx Million by 2033. This expansion is fueled by the resurgence of events post-pandemic, increasing urbanization, and the growth of major sporting and cultural events across the region. Technological advancements, such as the adoption of real-time tracking systems and improved inventory management tools, are enhancing efficiency and transparency within the supply chain. Consumer preferences are shifting towards more sustainable and environmentally conscious logistical solutions, opening new opportunities for green logistics providers. The rise of e-commerce and the increasing prevalence of online event ticketing are also contributing factors. Competitive dynamics are shaped by technological innovation, strategic partnerships, and the expansion of market leaders.

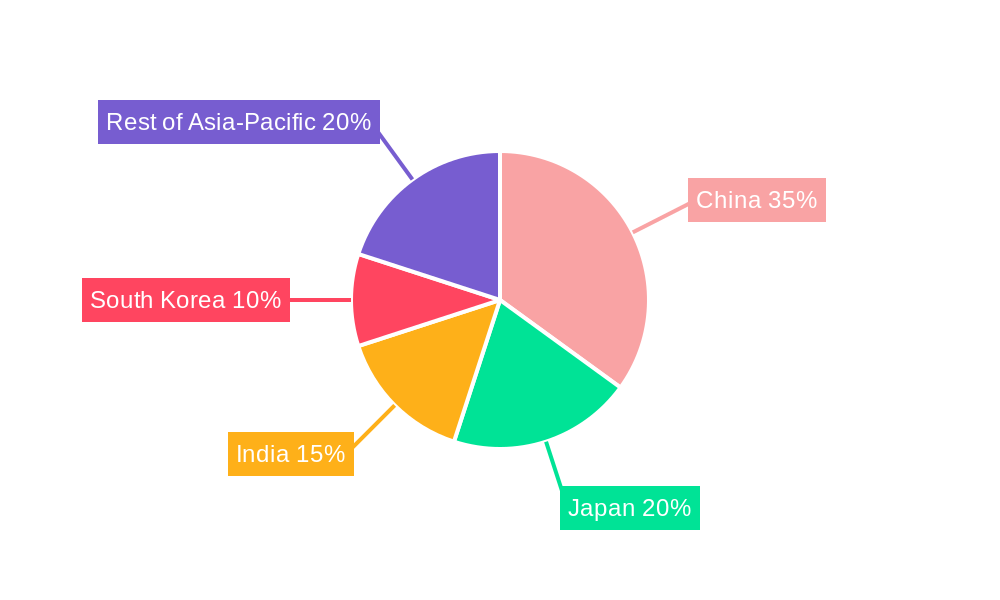

Dominant Markets & Segments in Asia Pacific Event Logistics Market

China, Japan, and India represent the largest national markets within the Asia Pacific event logistics sector. China's massive economy and robust event industry drive significant demand, while Japan's sophisticated infrastructure and advanced technological capabilities contribute to its high market share. India's burgeoning economy and a rapidly expanding events calendar make it a key growth market.

By Type:

- Logistics Solutions: This segment currently holds the largest market share, owing to the increasing demand for comprehensive end-to-end logistical support.

- Distribution Systems: Shows strong growth, driven by advancements in warehousing and transportation technologies.

- Inventory Control: Experiencing steady growth, facilitated by digitalization and data-driven management systems.

By Application:

- Trade Fairs: Major driver, benefiting from large-scale events and extensive logistical needs.

- Entertainment: High growth potential, driven by the popularity of concerts and entertainment festivals.

- Sports: Significant market segment, driven by major sporting events and increasing spectator numbers.

Key Growth Drivers:

- Robust Infrastructure Development: Continuous investment in transportation networks and logistics facilities.

- Government Initiatives: Policies promoting investment in logistics and infrastructure development.

- Rising Disposable Incomes: Increased spending power driving demand for premium event experiences.

- Technological Advancements: Adoption of innovative technologies enhancing efficiency and reliability.

Asia Pacific Event Logistics Market Product Analysis

The Asia Pacific event logistics market showcases a range of solutions tailored to specific event requirements. Technological advancements, such as real-time tracking systems, blockchain for enhanced security, and AI-powered route optimization, are enhancing efficiency and transparency. These innovative solutions offer businesses competitive advantages through reduced costs, enhanced delivery speed, and improved customer satisfaction. The market is trending towards customized and integrated logistics solutions that streamline the entire event process.

Key Drivers, Barriers & Challenges in Asia Pacific Event Logistics Market

Key Drivers:

- Growth of the Event Industry: The surge in trade fairs, sporting events, and entertainment activities fuels demand.

- Economic Growth: Rising disposable incomes in several countries enhance event attendance and sponsorship.

- Technological Advancements: Automation and data analytics improve efficiency and reduce costs.

Challenges:

- Supply Chain Disruptions: Geopolitical instability and natural disasters pose significant risks. Quantifiable impacts vary, but disruptions could lead to cost overruns of up to xx Million annually for some events.

- Regulatory Hurdles: Diverse regulations across different countries pose operational complexity.

- Competitive Pressure: Intense competition necessitates continuous innovation and efficiency improvements.

Growth Drivers in the Asia Pacific Event Logistics Market Market

The Asia Pacific event logistics market is fueled by several significant growth drivers, including expanding event calendars, rising disposable incomes, and continuous infrastructure improvements. Government initiatives fostering trade and tourism contribute to increased event activity. Technological advancements, especially in areas like real-time tracking and data analytics, increase efficiency and transparency.

Challenges Impacting Asia Pacific Event Logistics Market Growth

Despite the significant growth potential, the Asia Pacific event logistics market faces several challenges. Global supply chain volatility, exacerbated by geopolitical uncertainties and unforeseen disruptions, poses a significant risk to timely event execution. The region's diverse geographical landscape and susceptibility to unpredictable weather patterns, including typhoons and monsoons, can disrupt transportation and cause delays. Navigating the complex regulatory environments across various countries within the region requires specialized expertise and can increase operational complexity. Intense competition among regional and international logistics providers creates pressure on pricing, necessitating efficient operations and strategic cost management. Logistical bottlenecks in major event hubs, particularly during peak seasons, can lead to congestion and delays, impacting overall event success. Finally, the increasing focus on sustainability and environmental concerns necessitates the adoption of eco-friendly practices, adding another layer of complexity to operations.

Key Players Shaping the Asia Pacific Event Logistics Market Market

- Tokyo Freight Services

- JAS Worldwide

- Yamato Transport

- Air Cargo

- Nippon Express

- Kuehne + Nagel

- CEVA Logistics

- YTO Express

- Geodis

- Sagwa Express

- Sankayu Inc

- DP World

Significant Asia Pacific Event Logistics Market Industry Milestones

- November 2023: Global Critical Logistics (GCL) acquires Auckland-based Time Frame Logistics and Wellington-based Xtreme Forwarding, expanding its live event logistics capabilities in New Zealand. This significantly increases GCL's market share in the region and strengthens its position as a leading live event logistics provider.

- August 2022: Nippon Express selected as the official logistics partner for Expo 2025 in Osaka, highlighting the importance of reliable global logistics solutions for large-scale international events. This underscores the significant role of established players in handling the logistical complexities of mega-events.

Future Outlook for Asia Pacific Event Logistics Market Market

The Asia Pacific event logistics market anticipates continued growth, fueled by increasing event frequency, infrastructure development, and technological innovation. Strategic partnerships and the adoption of sustainable practices will define future market leadership. The market's potential remains vast, driven by the region's expanding economies and growing focus on hosting major global events.

Asia Pacific Event Logistics Market Segmentation

-

1. Type

- 1.1. Inventory Control

- 1.2. Distribution Systems

- 1.3. Logistics Solutions

-

2. Application

- 2.1. Entertainment

- 2.2. Sports

- 2.3. Trade fair

- 2.4. Others

Asia Pacific Event Logistics Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Event Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific Event Logistics Market

Asia Pacific Event Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exhibitions and Conferences are driving the market; Sports Events are driving the market growth

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Labor

- 3.4. Market Trends

- 3.4.1. Sports Events are Driving the Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Event Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Inventory Control

- 5.1.2. Distribution Systems

- 5.1.3. Logistics Solutions

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Entertainment

- 5.2.2. Sports

- 5.2.3. Trade fair

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tokyo Freight Services

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAS Worldwide

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yamato Transport

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Air Cargo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuhene + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 YTO Express

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Geodis

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sagwa Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sankayu Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 DP World

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tokyo Freight Services

List of Figures

- Figure 1: Asia Pacific Event Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Event Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Event Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Event Logistics Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Asia Pacific Event Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Asia Pacific Event Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Event Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Event Logistics Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Asia Pacific Event Logistics Market?

Key companies in the market include Tokyo Freight Services, JAS Worldwide, Yamato Transport, Air Cargo, Nippon Express, Kuhene + Nagel, CEVA Logistics, YTO Express, Geodis, Sagwa Express, Sankayu Inc, DP World.

3. What are the main segments of the Asia Pacific Event Logistics Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Exhibitions and Conferences are driving the market; Sports Events are driving the market growth.

6. What are the notable trends driving market growth?

Sports Events are Driving the Market in the Region.

7. Are there any restraints impacting market growth?

Lack of Skilled Labor.

8. Can you provide examples of recent developments in the market?

November 2023: Global Critical Logistics, Asia Pacific’s largest time-critical & live event logistics company, has acquired two New Zealand forwarders. GCL announced the acquisition of Auckland-based time frame logistics and Wellington-based Xtreme forwarding yesterday. Time Frame is a leading provider of live event logistics services and will see its assets and operations transferred to GCL's live event business, Rock-it Global. Xtreme forwarding will now be renamed Rock-it New Zealand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Event Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Event Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Event Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Event Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence