Key Insights

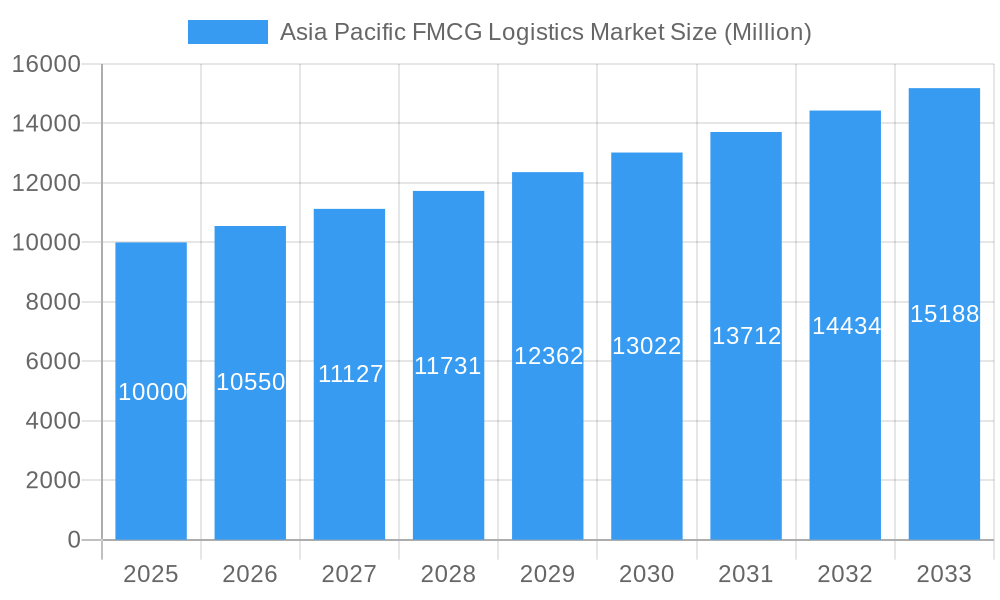

The Asia Pacific FMCG logistics market, valued at approximately $125.3 billion in 2025, is projected for substantial growth with a Compound Annual Growth Rate (CAGR) of 4.2% from 2025 to 2033. This expansion is driven by a growing middle class with increasing disposable incomes, fueling demand for Fast-Moving Consumer Goods (FMCG). The rapid rise of e-commerce necessitates sophisticated and dependable logistics to handle elevated online order volumes. Technological advancements, including automation and data analytics, are optimizing supply chains for enhanced efficiency. A growing emphasis on sustainable and ethical sourcing and delivery practices is also influencing market dynamics. The market is segmented by product category, with food & beverage, personal care, and household care items showing strong performance, particularly driven by e-commerce in transportation and warehousing. Leading companies are investing in infrastructure and technology to leverage this growth. China, India, and Japan are identified as key contributors to market expansion within the Asia-Pacific region.

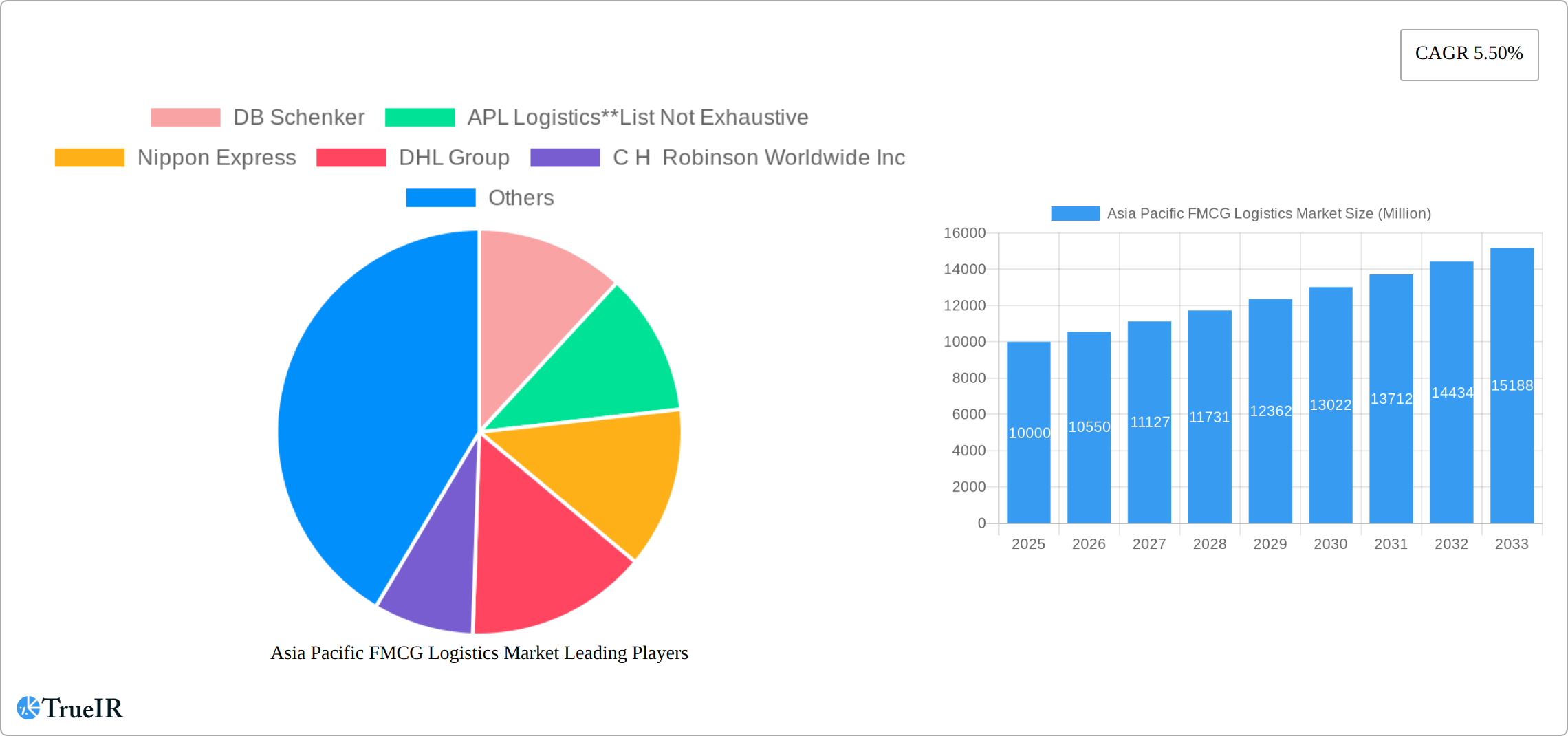

Asia Pacific FMCG Logistics Market Market Size (In Billion)

Challenges include existing infrastructure limitations in certain areas, fluctuating fuel prices, and geopolitical uncertainties impacting operational costs. Intense competition among logistics providers demands continuous innovation and efficiency improvements. Navigating diverse regulatory environments and varying consumer preferences across the region also presents ongoing operational complexities. Despite these hurdles, the outlook for the Asia Pacific FMCG logistics market remains optimistic, underpinned by consistent FMCG consumption growth and the logistics sector's ongoing adaptation to evolving demands. A strategic focus on supply chain resilience and sustainability will be pivotal in shaping the market's future landscape.

Asia Pacific FMCG Logistics Market Company Market Share

Asia Pacific FMCG Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides an in-depth analysis of the Asia Pacific FMCG logistics market, offering invaluable insights for businesses operating in or seeking to enter this rapidly evolving sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to provide a clear, concise, and actionable overview of this lucrative market. The report uses high-volume keywords to enhance search rankings and will be delivered without modification.

Asia Pacific FMCG Logistics Market Market Structure & Competitive Landscape

The Asia Pacific FMCG logistics market presents a dynamic competitive landscape shaped by a blend of multinational giants and agile regional players. Market concentration is moderate, with several key players vying for significant market share. While precise figures for the Herfindahl-Hirschman Index (HHI) are commercially sensitive, analysis suggests a moderately competitive market in 2025, indicating neither monopolistic dominance nor extreme fragmentation. This competitive tension fosters innovation and efficiency improvements, benefiting consumers and businesses alike.

Key Aspects Analyzed:

- Market Concentration & Share: A detailed breakdown of market share reveals the prominent positions held by companies such as DB Schenker, APL Logistics, Nippon Express, DHL Group, C.H. Robinson Worldwide Inc, XPO Logistics, Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, and Hellmann Worldwide Logistics. The analysis extends beyond simple market share figures to explore concentration ratios, identifying potential future consolidation based on current mergers and acquisitions activity and strategic partnerships.

- Innovation Drivers: Technological advancements are reshaping the sector, with automation, artificial intelligence (AI), blockchain, and the Internet of Things (IoT) driving efficiency gains, cost reductions, and enhanced supply chain visibility. The adoption of these technologies is not uniform across all players, creating opportunities for some to gain a competitive edge.

- Regulatory Impacts & Compliance: Government regulations, particularly concerning trade, customs procedures, and environmental sustainability, significantly influence market dynamics. The analysis incorporates the impact of evolving regional trade agreements (RTAs) like the RCEP, and increasingly stringent environmental policies, such as those targeting carbon emissions. Compliance with these regulations creates both challenges and opportunities for logistics providers.

- Competitive Substitutes & Disruption: The emergence of innovative logistics solutions, including crowdsourced delivery networks, autonomous vehicles, and specialized niche providers, presents potential substitutes for traditional FMCG logistics services. The report assesses the competitive threat and potential disruption posed by these emerging players and technologies.

- End-User Segmentation & Customization: The market is segmented by product category (food and beverage, personal care, household care, pharmaceuticals, and other consumables) and service type (transportation, warehousing, contract logistics, last-mile delivery, inventory management, and value-added services such as packaging and labeling). This granular segmentation reveals specific market opportunities and challenges within each niche.

- M&A Activity & Strategic Alliances: The report analyzes recent mergers, acquisitions, and strategic alliances in the Asia Pacific FMCG logistics market, identifying key trends and their impact on market structure and competition. While precise transaction volumes for 2019-2024 remain confidential, the analysis highlights the strategic rationale behind these deals and their implications for market concentration and service offerings.

Asia Pacific FMCG Logistics Market Market Trends & Opportunities

The Asia Pacific FMCG logistics market is experiencing robust growth, driven by several key factors. The market size is estimated at xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx Million by 2033. This growth is fueled by rising disposable incomes, changing consumer preferences, and the expansion of e-commerce across the region.

Key Market Dynamics:

- Market Size & Growth: Detailed analysis of market size by segment and region, with projections for future growth.

- Technological Shifts: The adoption of advanced technologies such as IoT, AI, and automation is revolutionizing the FMCG logistics landscape, enhancing efficiency and visibility across the supply chain.

- Consumer Preferences: Changing consumer preferences, including increasing demand for personalized experiences and faster delivery times, are reshaping logistics strategies.

- Competitive Dynamics: Analysis of competitive intensity, strategic alliances, and market positioning of major players.

- Market Penetration Rates: Assessment of market penetration rates for different services and technologies across various segments.

Dominant Markets & Segments in Asia Pacific FMCG Logistics Market

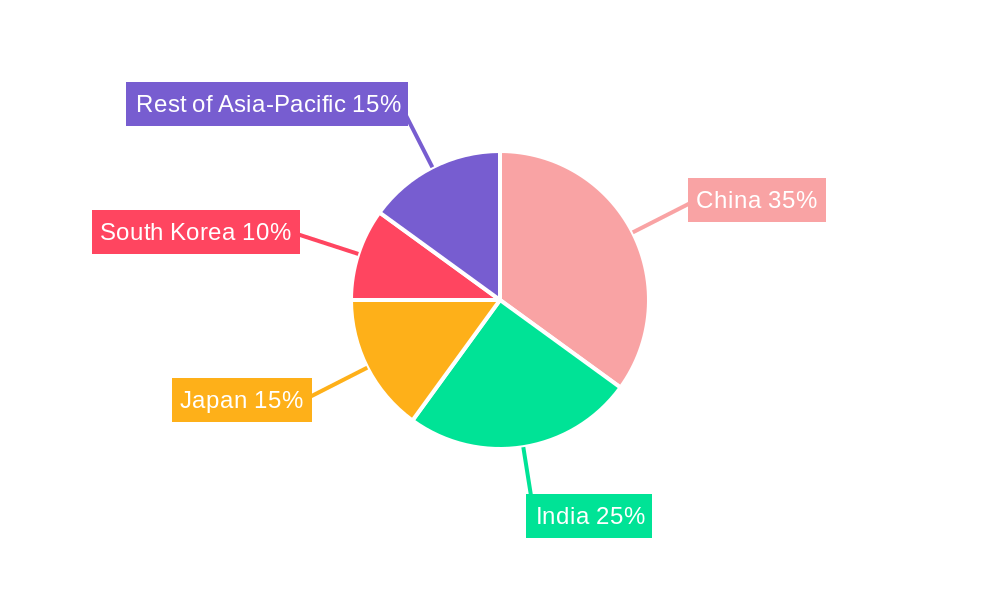

The Asia Pacific region presents diverse market dynamics. China and India are leading markets, driven by factors such as robust economic growth, expanding middle class, and significant investment in infrastructure. Other significant markets include Japan, South Korea, Australia, and Southeast Asian countries.

Leading Regions and Segments:

- By Product Category: The Food and Beverage segment dominates with a market share of xx% in 2025, followed by Personal Care (xx%) and Household Care (xx%). Growth in these categories is driven by increasing consumption and demand for convenience.

- By Service: Transportation services hold the largest market share (xx%), followed by Warehousing (xx%) and Distribution (xx%). The growth of e-commerce is boosting demand for efficient transportation and last-mile delivery solutions.

Key Growth Drivers:

- Infrastructure Development: Investments in transportation infrastructure, including roads, railways, and ports, are enhancing connectivity and reducing logistics costs.

- Government Policies: Supportive government policies, such as trade liberalization and incentives for logistics development, are fostering market expansion.

- E-commerce Growth: The rapid growth of e-commerce is driving demand for efficient and reliable logistics solutions.

Asia Pacific FMCG Logistics Market Product Analysis

The FMCG logistics sector is witnessing significant technological advancements, including automated warehousing systems, advanced transportation management systems, and real-time tracking solutions. These innovations are enhancing efficiency, visibility, and responsiveness across the supply chain. Companies are investing in technologies that improve supply chain resilience and optimize delivery routes, adapting to rapidly changing consumer demands. The market is also seeing a rise in specialized logistics services tailored to the unique requirements of different FMCG product categories.

Key Drivers, Barriers & Challenges in Asia Pacific FMCG Logistics Market

Key Drivers:

- Technological advancements in automation, AI, and data analytics are improving efficiency and reducing costs.

- Growing e-commerce and omnichannel retailing are driving demand for faster and more flexible logistics solutions.

- Rising disposable incomes and changing consumer preferences are fueling growth in FMCG consumption.

Key Challenges & Restraints:

- Supply chain disruptions, particularly in the wake of global events, create uncertainty and increase costs. The impact is estimated at a xx Million loss in 2024.

- Regulatory complexities and differing standards across countries can hinder cross-border logistics.

- Intense competition among logistics providers puts pressure on pricing and profitability.

Growth Drivers in the Asia Pacific FMCG Logistics Market Market

The market is propelled by strong economic growth, increased infrastructure investments, and the expansion of e-commerce. Technological advancements, including automation and AI, further enhance efficiency and cost-effectiveness. Favorable government policies, such as trade liberalization, also contribute to market expansion.

Challenges Impacting Asia Pacific FMCG Logistics Market Growth

The market faces challenges like supply chain disruptions, escalating fuel prices, labor shortages, and evolving regulatory landscapes. These factors affect operational efficiency, costs, and overall market growth.

Key Players Shaping the Asia Pacific FMCG Logistics Market Market

- DB Schenker

- APL Logistics

- Nippon Express

- DHL Group

- C.H. Robinson Worldwide Inc

- XPO Logistics

- Kuehne + Nagel International AG

- FedEx

- CEVA Logistics

- Agility Logistics

- Hellmann Worldwide Logistics

Significant Asia Pacific FMCG Logistics Market Industry Milestones

- 2020, Q4: DHL Group invests in automated warehousing technology in China.

- 2021, Q2: Nippon Express expands its cold chain logistics network in Southeast Asia.

- 2022, Q3: Kuehne + Nagel acquires a regional logistics provider in India.

- 2023, Q1: C.H. Robinson implements a new AI-powered route optimization system.

Future Outlook for Asia Pacific FMCG Logistics Market Market

The Asia Pacific FMCG logistics market is poised for continued growth, driven by sustained economic expansion, evolving consumer behavior, and the ongoing adoption of technology. Strategic opportunities exist for logistics providers to leverage advanced technologies, expand into new markets, and offer value-added services to meet the changing demands of the FMCG industry. The market is projected to experience significant expansion, presenting substantial opportunities for both established players and new entrants.

Asia Pacific FMCG Logistics Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehous

- 1.3. Other Value-added Services

-

2. Product Category

- 2.1. Food and Beverage

- 2.2. Personal Care

- 2.3. Household Care

- 2.4. Other Consumables

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Singapore

- 3.6. Indonesia

- 3.7. Vietnam

- 3.8. Malaysia

- 3.9. Thailand

- 3.10. Australia

- 3.11. Rest of Asia-Pacific

Asia Pacific FMCG Logistics Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Singapore

- 6. Indonesia

- 7. Vietnam

- 8. Malaysia

- 9. Thailand

- 10. Australia

- 11. Rest of Asia Pacific

Asia Pacific FMCG Logistics Market Regional Market Share

Geographic Coverage of Asia Pacific FMCG Logistics Market

Asia Pacific FMCG Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strategic Location; Economic diversification

- 3.3. Market Restrains

- 3.3.1. Infrastructure challenges; Skilled workforce

- 3.4. Market Trends

- 3.4.1. Growing Cold Storage and Refrigerated Warehouses Market Worldwide

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehous

- 5.1.3. Other Value-added Services

- 5.2. Market Analysis, Insights and Forecast - by Product Category

- 5.2.1. Food and Beverage

- 5.2.2. Personal Care

- 5.2.3. Household Care

- 5.2.4. Other Consumables

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Singapore

- 5.3.6. Indonesia

- 5.3.7. Vietnam

- 5.3.8. Malaysia

- 5.3.9. Thailand

- 5.3.10. Australia

- 5.3.11. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Singapore

- 5.4.6. Indonesia

- 5.4.7. Vietnam

- 5.4.8. Malaysia

- 5.4.9. Thailand

- 5.4.10. Australia

- 5.4.11. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. China Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehous

- 6.1.3. Other Value-added Services

- 6.2. Market Analysis, Insights and Forecast - by Product Category

- 6.2.1. Food and Beverage

- 6.2.2. Personal Care

- 6.2.3. Household Care

- 6.2.4. Other Consumables

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Singapore

- 6.3.6. Indonesia

- 6.3.7. Vietnam

- 6.3.8. Malaysia

- 6.3.9. Thailand

- 6.3.10. Australia

- 6.3.11. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. India Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehous

- 7.1.3. Other Value-added Services

- 7.2. Market Analysis, Insights and Forecast - by Product Category

- 7.2.1. Food and Beverage

- 7.2.2. Personal Care

- 7.2.3. Household Care

- 7.2.4. Other Consumables

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Singapore

- 7.3.6. Indonesia

- 7.3.7. Vietnam

- 7.3.8. Malaysia

- 7.3.9. Thailand

- 7.3.10. Australia

- 7.3.11. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Japan Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehous

- 8.1.3. Other Value-added Services

- 8.2. Market Analysis, Insights and Forecast - by Product Category

- 8.2.1. Food and Beverage

- 8.2.2. Personal Care

- 8.2.3. Household Care

- 8.2.4. Other Consumables

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Singapore

- 8.3.6. Indonesia

- 8.3.7. Vietnam

- 8.3.8. Malaysia

- 8.3.9. Thailand

- 8.3.10. Australia

- 8.3.11. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South Korea Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehous

- 9.1.3. Other Value-added Services

- 9.2. Market Analysis, Insights and Forecast - by Product Category

- 9.2.1. Food and Beverage

- 9.2.2. Personal Care

- 9.2.3. Household Care

- 9.2.4. Other Consumables

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Singapore

- 9.3.6. Indonesia

- 9.3.7. Vietnam

- 9.3.8. Malaysia

- 9.3.9. Thailand

- 9.3.10. Australia

- 9.3.11. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Singapore Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehous

- 10.1.3. Other Value-added Services

- 10.2. Market Analysis, Insights and Forecast - by Product Category

- 10.2.1. Food and Beverage

- 10.2.2. Personal Care

- 10.2.3. Household Care

- 10.2.4. Other Consumables

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Singapore

- 10.3.6. Indonesia

- 10.3.7. Vietnam

- 10.3.8. Malaysia

- 10.3.9. Thailand

- 10.3.10. Australia

- 10.3.11. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Indonesia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Transportation

- 11.1.2. Warehous

- 11.1.3. Other Value-added Services

- 11.2. Market Analysis, Insights and Forecast - by Product Category

- 11.2.1. Food and Beverage

- 11.2.2. Personal Care

- 11.2.3. Household Care

- 11.2.4. Other Consumables

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. Singapore

- 11.3.6. Indonesia

- 11.3.7. Vietnam

- 11.3.8. Malaysia

- 11.3.9. Thailand

- 11.3.10. Australia

- 11.3.11. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Vietnam Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Service

- 12.1.1. Transportation

- 12.1.2. Warehous

- 12.1.3. Other Value-added Services

- 12.2. Market Analysis, Insights and Forecast - by Product Category

- 12.2.1. Food and Beverage

- 12.2.2. Personal Care

- 12.2.3. Household Care

- 12.2.4. Other Consumables

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. South Korea

- 12.3.5. Singapore

- 12.3.6. Indonesia

- 12.3.7. Vietnam

- 12.3.8. Malaysia

- 12.3.9. Thailand

- 12.3.10. Australia

- 12.3.11. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Service

- 13. Malaysia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - by Service

- 13.1.1. Transportation

- 13.1.2. Warehous

- 13.1.3. Other Value-added Services

- 13.2. Market Analysis, Insights and Forecast - by Product Category

- 13.2.1. Food and Beverage

- 13.2.2. Personal Care

- 13.2.3. Household Care

- 13.2.4. Other Consumables

- 13.3. Market Analysis, Insights and Forecast - by Geography

- 13.3.1. China

- 13.3.2. India

- 13.3.3. Japan

- 13.3.4. South Korea

- 13.3.5. Singapore

- 13.3.6. Indonesia

- 13.3.7. Vietnam

- 13.3.8. Malaysia

- 13.3.9. Thailand

- 13.3.10. Australia

- 13.3.11. Rest of Asia-Pacific

- 13.1. Market Analysis, Insights and Forecast - by Service

- 14. Thailand Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - by Service

- 14.1.1. Transportation

- 14.1.2. Warehous

- 14.1.3. Other Value-added Services

- 14.2. Market Analysis, Insights and Forecast - by Product Category

- 14.2.1. Food and Beverage

- 14.2.2. Personal Care

- 14.2.3. Household Care

- 14.2.4. Other Consumables

- 14.3. Market Analysis, Insights and Forecast - by Geography

- 14.3.1. China

- 14.3.2. India

- 14.3.3. Japan

- 14.3.4. South Korea

- 14.3.5. Singapore

- 14.3.6. Indonesia

- 14.3.7. Vietnam

- 14.3.8. Malaysia

- 14.3.9. Thailand

- 14.3.10. Australia

- 14.3.11. Rest of Asia-Pacific

- 14.1. Market Analysis, Insights and Forecast - by Service

- 15. Australia Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - by Service

- 15.1.1. Transportation

- 15.1.2. Warehous

- 15.1.3. Other Value-added Services

- 15.2. Market Analysis, Insights and Forecast - by Product Category

- 15.2.1. Food and Beverage

- 15.2.2. Personal Care

- 15.2.3. Household Care

- 15.2.4. Other Consumables

- 15.3. Market Analysis, Insights and Forecast - by Geography

- 15.3.1. China

- 15.3.2. India

- 15.3.3. Japan

- 15.3.4. South Korea

- 15.3.5. Singapore

- 15.3.6. Indonesia

- 15.3.7. Vietnam

- 15.3.8. Malaysia

- 15.3.9. Thailand

- 15.3.10. Australia

- 15.3.11. Rest of Asia-Pacific

- 15.1. Market Analysis, Insights and Forecast - by Service

- 16. Rest of Asia Pacific Asia Pacific FMCG Logistics Market Analysis, Insights and Forecast, 2020-2032

- 16.1. Market Analysis, Insights and Forecast - by Service

- 16.1.1. Transportation

- 16.1.2. Warehous

- 16.1.3. Other Value-added Services

- 16.2. Market Analysis, Insights and Forecast - by Product Category

- 16.2.1. Food and Beverage

- 16.2.2. Personal Care

- 16.2.3. Household Care

- 16.2.4. Other Consumables

- 16.3. Market Analysis, Insights and Forecast - by Geography

- 16.3.1. China

- 16.3.2. India

- 16.3.3. Japan

- 16.3.4. South Korea

- 16.3.5. Singapore

- 16.3.6. Indonesia

- 16.3.7. Vietnam

- 16.3.8. Malaysia

- 16.3.9. Thailand

- 16.3.10. Australia

- 16.3.11. Rest of Asia-Pacific

- 16.1. Market Analysis, Insights and Forecast - by Service

- 17. Competitive Analysis

- 17.1. Market Share Analysis 2025

- 17.2. Company Profiles

- 17.2.1 DB Schenker

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 APL Logistics**List Not Exhaustive

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Nippon Express

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 DHL Group

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 C H Robinson Worldwide Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 XPO Logistics

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Kuehne + Nagel International AG

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 FedEx

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 CEVA Logistics

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Agility Logistics

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Hellmann Worlwide Logistics

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.1 DB Schenker

List of Figures

- Figure 1: Asia Pacific FMCG Logistics Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific FMCG Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 3: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 7: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 11: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 15: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 19: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 23: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 26: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 27: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 30: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 31: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 32: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 33: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 34: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 35: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 36: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 38: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 39: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 40: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 42: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 43: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 44: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

- Table 45: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Service 2020 & 2033

- Table 46: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Product Category 2020 & 2033

- Table 47: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Asia Pacific FMCG Logistics Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific FMCG Logistics Market?

The projected CAGR is approximately 4.2%.

2. Which companies are prominent players in the Asia Pacific FMCG Logistics Market?

Key companies in the market include DB Schenker, APL Logistics**List Not Exhaustive, Nippon Express, DHL Group, C H Robinson Worldwide Inc, XPO Logistics, Kuehne + Nagel International AG, FedEx, CEVA Logistics, Agility Logistics, Hellmann Worlwide Logistics.

3. What are the main segments of the Asia Pacific FMCG Logistics Market?

The market segments include Service, Product Category, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 125.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strategic Location; Economic diversification.

6. What are the notable trends driving market growth?

Growing Cold Storage and Refrigerated Warehouses Market Worldwide.

7. Are there any restraints impacting market growth?

Infrastructure challenges; Skilled workforce.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific FMCG Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific FMCG Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific FMCG Logistics Market?

To stay informed about further developments, trends, and reports in the Asia Pacific FMCG Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence