Key Insights

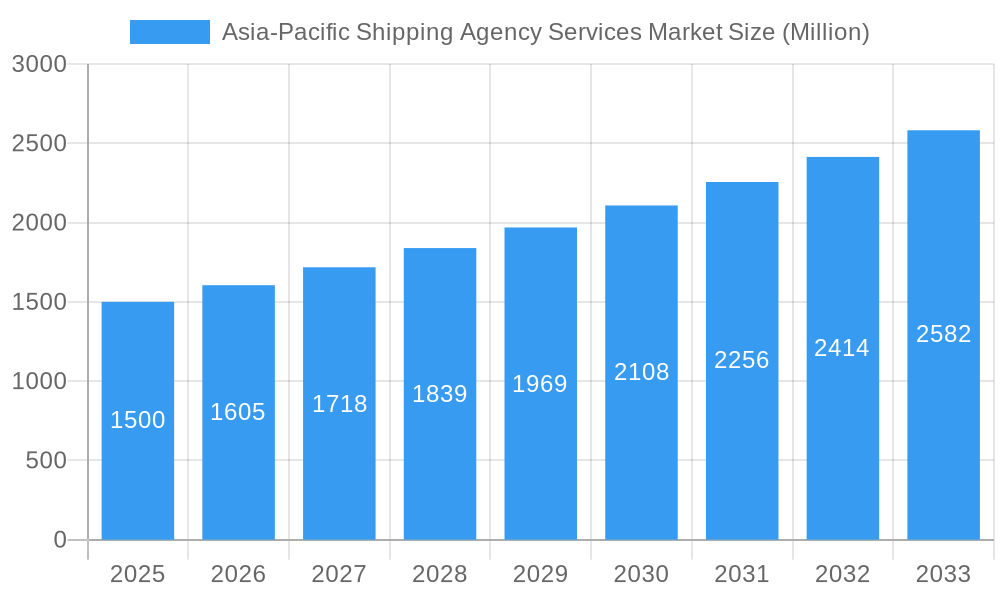

The Asia-Pacific shipping agency services market, currently valued at approximately $XX million in 2025 (assuming a reasonable value based on market size and CAGR data), is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 7.00% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning e-commerce sector fuels a surge in global trade, demanding efficient shipping solutions and increasing reliance on specialized agency services. Furthermore, the region's robust economic growth, particularly in key markets like China, India, and Japan, fuels demand for port, cargo, and charter agency services. Increased globalization and the expansion of international trade routes within Asia-Pacific contribute to market growth. However, the market faces challenges such as fluctuating fuel prices, geopolitical uncertainties impacting global trade flows, and intense competition among numerous established and emerging players. The market is segmented by type (port, cargo, charter, and other agencies), application (ship owners and lessees), and service (packaging, shipping, customs clearance, logistical support, and other services). This segmentation reveals diverse opportunities and challenges within the market, with certain agency types and service offerings potentially experiencing faster growth than others. The competitive landscape is moderately fragmented, with a mix of large multinational corporations and smaller regional players.

Asia-Pacific Shipping Agency Services Market Market Size (In Billion)

The dominance of major economies like China, Japan, and India within the Asia-Pacific region significantly influences market dynamics. Growth in these markets will directly impact the overall market value. The continuous development of port infrastructure and logistics networks across the region fosters greater efficiency and capacity, ultimately supporting the growth of shipping agency services. Technological advancements, such as digitalization and automation in port operations and supply chain management, are expected to further optimize processes and boost efficiency within the shipping industry, positively impacting the agency services sector. Future growth will depend on consistent economic expansion, effective infrastructure development, regulatory streamlining, and adaptation to evolving technological advancements. Specific strategies for growth could involve strategic partnerships, service diversification, technology adoption, and expansion into underserved niche markets.

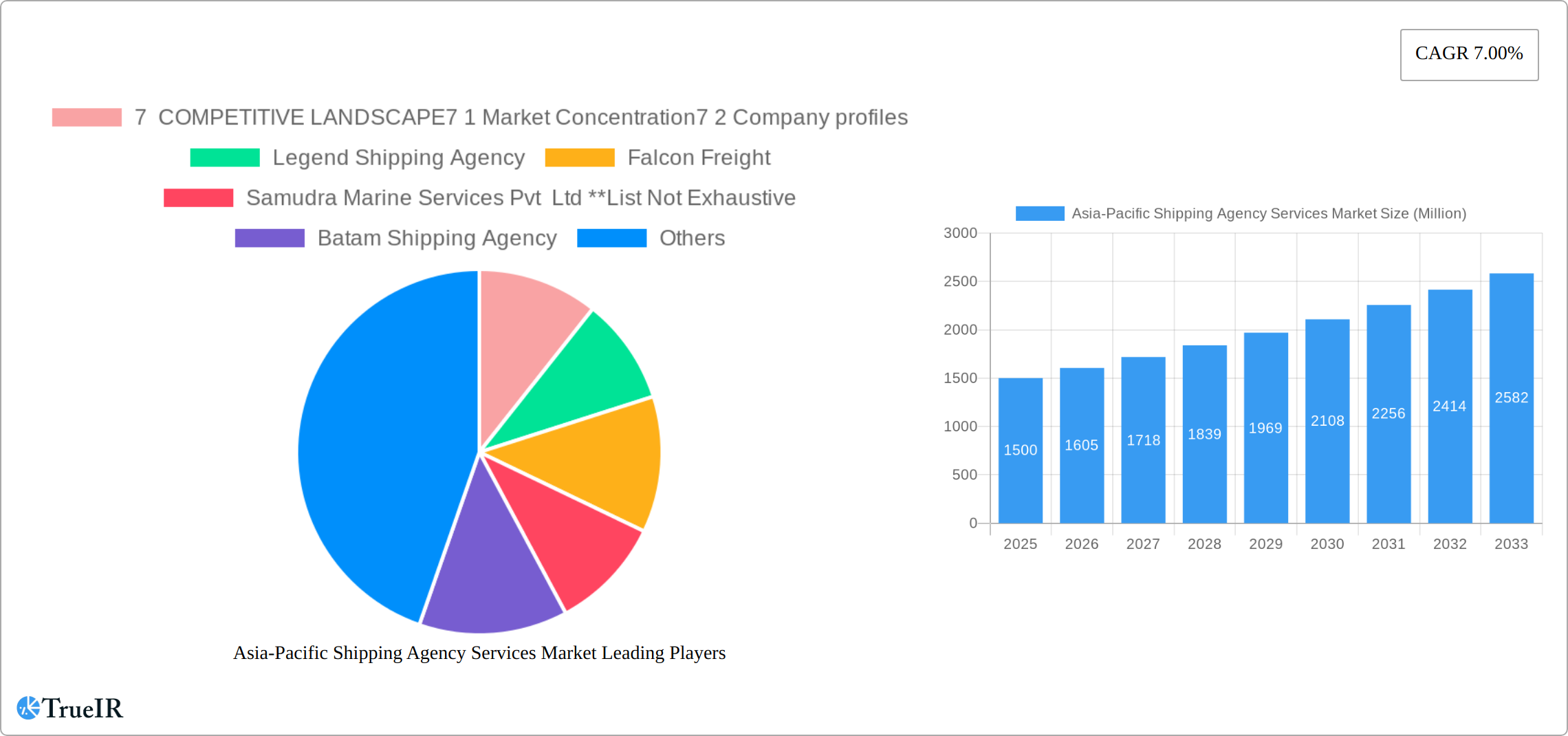

Asia-Pacific Shipping Agency Services Market Company Market Share

Asia-Pacific Shipping Agency Services Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Asia-Pacific Shipping Agency Services market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Leveraging extensive research and data covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report dissects market trends, competitive dynamics, and growth opportunities across diverse segments. With a focus on high-volume keywords like "Asia-Pacific Shipping," "Shipping Agency Services," "Port Agency," "Cargo Agency," and "Logistics," this report is meticulously designed for optimal search engine visibility and industry relevance. The market is projected to reach xx Million by 2033.

Asia-Pacific Shipping Agency Services Market Structure & Competitive Landscape

The Asia-Pacific Shipping Agency Services market exhibits a moderately concentrated structure, with a few major players holding significant market share. The four-firm concentration ratio is estimated at xx%, indicating the presence of both established players and emerging competitors. Innovation in areas like digitalization, automated port operations, and blockchain-based supply chain management are reshaping the competitive landscape. Regulatory changes, including stricter environmental regulations and trade policies, significantly influence market dynamics. Product substitutes, such as independent freight forwarders and e-commerce logistics solutions, are continuously emerging, posing both challenges and opportunities.

The market is segmented by end-users, primarily comprising Ship Owners and Lessees, with Ship Owners currently accounting for a larger share. Mergers and acquisitions (M&A) activity within the sector has seen a moderate increase in recent years, driven by consolidation strategies and expansion efforts. The total M&A volume between 2019 and 2024 is estimated at xx Million USD.

- Market Concentration: Moderately concentrated (four-firm concentration ratio: xx%)

- Innovation Drivers: Digitalization, automation, blockchain technology

- Regulatory Impacts: Environmental regulations, trade policies

- Product Substitutes: Independent freight forwarders, e-commerce logistics

- End-User Segmentation: Ship Owners (xx%), Lessees (xx%)

- M&A Trends: Moderate increase, driven by consolidation and expansion

Asia-Pacific Shipping Agency Services Market Trends & Opportunities

The Asia-Pacific Shipping Agency Services market is experiencing robust growth, driven by the region's expanding trade volumes, increasing containerization, and the rise of e-commerce. The market size is estimated at xx Million in 2025 and is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Technological advancements, such as the adoption of sophisticated logistics software and data analytics, are improving operational efficiency and enhancing customer service. Consumer preferences are shifting towards integrated logistics solutions offering end-to-end visibility and traceability. Competitive dynamics are intensifying, with established players investing in technological upgrades and expanding their service portfolios to maintain their market position. Market penetration rates for advanced logistics solutions are gradually increasing, although adoption varies across different countries and segments.

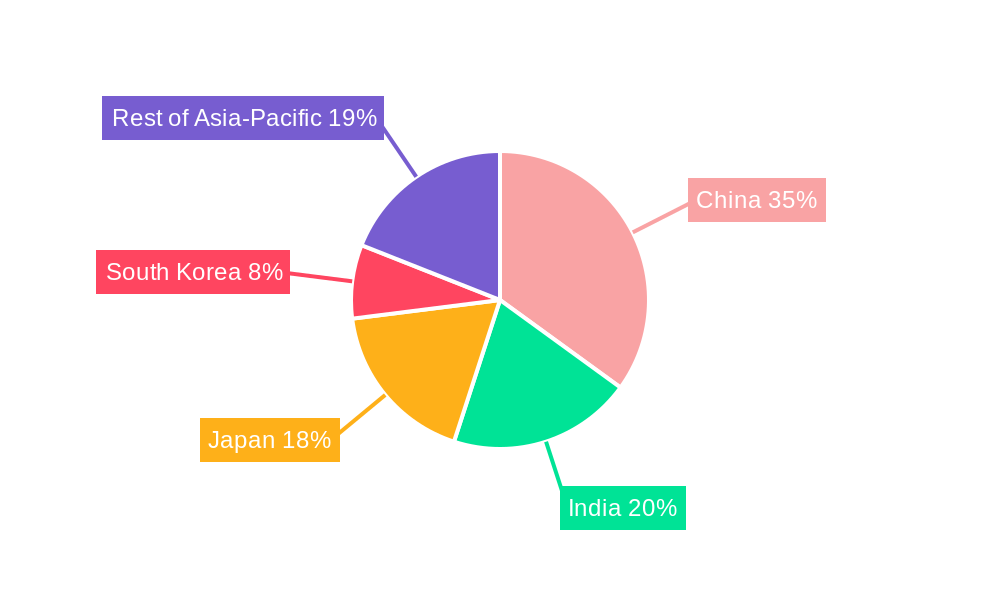

Dominant Markets & Segments in Asia-Pacific Shipping Agency Services Market

China and other major economies like Japan, Singapore, South Korea and India hold significant market share in the Asia-Pacific Shipping Agency Services market due to their extensive port infrastructure, high trade volumes, and supportive government policies. The Port Agency segment dominates the market by type, followed by the Cargo Agency segment. The Ship Owner segment represents a larger portion of the market by application.

Key Growth Drivers (by region):

- China: Extensive port infrastructure, robust trade volumes, government support

- India: Rapid economic growth, rising infrastructure investments

- Singapore: Strategic location, advanced port technology

- Japan: Strong manufacturing base, high logistics efficiency

- South Korea: Well-developed logistics network, expanding trade relations

Key Growth Drivers (by segment):

- Port Agency: Essential for vessel handling and port operations

- Cargo Agency: Growing demand for efficient cargo management and handling.

- Ship Owner Segment: Large volume of ships needing agency services.

Asia-Pacific Shipping Agency Services Market Product Analysis

Product innovations in the Asia-Pacific Shipping Agency Services market are focused on improving efficiency, enhancing visibility, and reducing costs. Advanced software solutions integrate various aspects of shipping operations, from booking and documentation to tracking and customs clearance. The integration of blockchain technology provides enhanced security and transparency in supply chain management. These technological advancements cater to the increasing demand for reliable, efficient, and transparent shipping services, aligning perfectly with the evolving needs of the market.

Key Drivers, Barriers & Challenges in Asia-Pacific Shipping Agency Services Market

Key Drivers: The Asia-Pacific shipping agency services market is experiencing robust growth fueled by several key factors. The explosive growth of e-commerce continues to drive demand for efficient and reliable shipping and logistics solutions. Government initiatives across the region, focused on modernizing port infrastructure, streamlining customs procedures, and investing in digital technologies, are significantly accelerating market expansion. Technological advancements, such as automation (including robotics and AI), digitalization (including blockchain and IoT), and data analytics, are enhancing operational efficiency, reducing costs, and improving transparency throughout the supply chain. Furthermore, the increasing focus on supply chain resilience and diversification in the wake of recent global disruptions is creating new opportunities for shipping agencies.

Key Barriers and Challenges: Despite the positive growth trajectory, the Asia-Pacific shipping agency services market faces several significant challenges. Geopolitical instability and trade tensions between major economic powers continue to create uncertainty and disrupt established supply chains, impacting market stability. Navigating the complex regulatory landscape, which varies considerably across countries in the region, presents operational hurdles. Inconsistent standards and differing customs procedures create administrative burdens and increase compliance costs. Intense competition among established players and the emergence of new, tech-driven entrants exert pressure on pricing and profit margins, requiring companies to constantly innovate and differentiate their services. Supply chain bottlenecks, exacerbated by factors like port congestion and labor shortages, can lead to significant delays, increased costs, and damage to brand reputation. Finally, the growing need to address environmental concerns, reduce carbon emissions, and meet increasingly stringent sustainability regulations poses a significant challenge for the industry.

Growth Drivers in the Asia-Pacific Shipping Agency Services Market

Several factors are expected to propel the growth of the Asia-Pacific shipping agency services market in the coming years. Continued technological advancements will remain a crucial driver, enabling greater automation, optimization, and visibility across the supply chain. The expansion of intra-regional trade within Asia-Pacific and the increasing volume of global trade passing through the region will further fuel demand. Government support for infrastructure development, including investments in port modernization and digital infrastructure, will enhance efficiency and competitiveness. The relentless growth of the e-commerce sector, coupled with rising consumer expectations for faster and more transparent delivery, is a major catalyst. Finally, strategic alliances, mergers, and acquisitions among market players are leading to consolidation, increased innovation, and the development of more comprehensive and integrated logistics solutions.

Challenges Impacting Asia-Pacific Shipping Agency Services Market Growth

Regulatory hurdles across different countries, geopolitical uncertainties, and fluctuating fuel prices pose significant challenges. Supply chain disruptions and increasing competition create pressure on profit margins. Also, the need for investments in new technologies and training for employees can be a significant challenge for some market players.

Key Players Shaping the Asia-Pacific Shipping Agency Services Market

- Legend Shipping Agency

- Falcon Freight

- Samudra Marine Services Pvt Ltd

- Batam Shipping Agency

- Bansar

- Intermodal Shipping Inc

- Albatross Shipping Agencies

- Sinotrans

- International Clearing and Shipping Agency (India) Pvt Ltd

- HS Lanka

Significant Asia-Pacific Shipping Agency Services Market Industry Milestones

- November 2022: GAC Group expanded its presence in East Asia by establishing a new office in Taichung, Taiwan, reflecting the growing importance of the Taiwanese market and signaling increased investment in the region.

- June 2022: Sinotrans and CM Port launched the "Xintang (Guangzhou)-Shekou (Shenzhen)" combined port, highlighting the ongoing efforts to improve port efficiency and connectivity within China.

- [Add other relevant milestones here with dates and brief descriptions. Include details about specific companies, technologies, or policy changes.]

Future Outlook for Asia-Pacific Shipping Agency Services Market

The Asia-Pacific Shipping Agency Services market is poised for sustained growth, driven by expanding trade, technological advancements, and supportive government policies. Strategic partnerships, investments in digital solutions, and expansion into new markets present significant opportunities for market players. The growing adoption of sustainable practices and green technologies will shape the future of the industry.

Asia-Pacific Shipping Agency Services Market Segmentation

-

1. Type

- 1.1. Port Agency

- 1.2. Cargo Agency

- 1.3. Charter Agency

- 1.4. Others

-

2. Application

- 2.1. Ship Owner

- 2.2. Lessee

-

3. Service

- 3.1. Packaging Services

- 3.2. Shipping Services

- 3.3. Custom Clearance Services

- 3.4. Logistical Support Services

- 3.5. Other Services

-

4. Geography

- 4.1. India

- 4.2. China

- 4.3. Japan

- 4.4. Australia

- 4.5. Rest of Asia-Pacific

Asia-Pacific Shipping Agency Services Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Rest of Asia Pacific

Asia-Pacific Shipping Agency Services Market Regional Market Share

Geographic Coverage of Asia-Pacific Shipping Agency Services Market

Asia-Pacific Shipping Agency Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Industrial Growth Supporting the Market; Global Trade Driving the Market

- 3.3. Market Restrains

- 3.3.1. Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market

- 3.4. Market Trends

- 3.4.1. China to Dominate the Asia-Pacific Shipping Agency Services Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Port Agency

- 5.1.2. Cargo Agency

- 5.1.3. Charter Agency

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Ship Owner

- 5.2.2. Lessee

- 5.3. Market Analysis, Insights and Forecast - by Service

- 5.3.1. Packaging Services

- 5.3.2. Shipping Services

- 5.3.3. Custom Clearance Services

- 5.3.4. Logistical Support Services

- 5.3.5. Other Services

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. India

- 5.4.2. China

- 5.4.3. Japan

- 5.4.4. Australia

- 5.4.5. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.5.2. China

- 5.5.3. Japan

- 5.5.4. Australia

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. India Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Port Agency

- 6.1.2. Cargo Agency

- 6.1.3. Charter Agency

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Ship Owner

- 6.2.2. Lessee

- 6.3. Market Analysis, Insights and Forecast - by Service

- 6.3.1. Packaging Services

- 6.3.2. Shipping Services

- 6.3.3. Custom Clearance Services

- 6.3.4. Logistical Support Services

- 6.3.5. Other Services

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. India

- 6.4.2. China

- 6.4.3. Japan

- 6.4.4. Australia

- 6.4.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. China Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Port Agency

- 7.1.2. Cargo Agency

- 7.1.3. Charter Agency

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Ship Owner

- 7.2.2. Lessee

- 7.3. Market Analysis, Insights and Forecast - by Service

- 7.3.1. Packaging Services

- 7.3.2. Shipping Services

- 7.3.3. Custom Clearance Services

- 7.3.4. Logistical Support Services

- 7.3.5. Other Services

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. India

- 7.4.2. China

- 7.4.3. Japan

- 7.4.4. Australia

- 7.4.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Port Agency

- 8.1.2. Cargo Agency

- 8.1.3. Charter Agency

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Ship Owner

- 8.2.2. Lessee

- 8.3. Market Analysis, Insights and Forecast - by Service

- 8.3.1. Packaging Services

- 8.3.2. Shipping Services

- 8.3.3. Custom Clearance Services

- 8.3.4. Logistical Support Services

- 8.3.5. Other Services

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. India

- 8.4.2. China

- 8.4.3. Japan

- 8.4.4. Australia

- 8.4.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Port Agency

- 9.1.2. Cargo Agency

- 9.1.3. Charter Agency

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Ship Owner

- 9.2.2. Lessee

- 9.3. Market Analysis, Insights and Forecast - by Service

- 9.3.1. Packaging Services

- 9.3.2. Shipping Services

- 9.3.3. Custom Clearance Services

- 9.3.4. Logistical Support Services

- 9.3.5. Other Services

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. India

- 9.4.2. China

- 9.4.3. Japan

- 9.4.4. Australia

- 9.4.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Asia Pacific Asia-Pacific Shipping Agency Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Port Agency

- 10.1.2. Cargo Agency

- 10.1.3. Charter Agency

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Ship Owner

- 10.2.2. Lessee

- 10.3. Market Analysis, Insights and Forecast - by Service

- 10.3.1. Packaging Services

- 10.3.2. Shipping Services

- 10.3.3. Custom Clearance Services

- 10.3.4. Logistical Support Services

- 10.3.5. Other Services

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. India

- 10.4.2. China

- 10.4.3. Japan

- 10.4.4. Australia

- 10.4.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Legend Shipping Agency

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Falcon Freight

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Samudra Marine Services Pvt Ltd **List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Batam Shipping Agency

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bansar

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Intermodal Shipping Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Albatross Shipping Agencies

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sinotrans

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 International Clearing and Shipping Agency(India) Pvt Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HS Lanka

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Asia-Pacific Shipping Agency Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Shipping Agency Services Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 4: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 9: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 12: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 13: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 19: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 23: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 24: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Type 2020 & 2033

- Table 27: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Application 2020 & 2033

- Table 28: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 29: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Asia-Pacific Shipping Agency Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Shipping Agency Services Market?

The projected CAGR is approximately 7.00%.

2. Which companies are prominent players in the Asia-Pacific Shipping Agency Services Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, Legend Shipping Agency, Falcon Freight, Samudra Marine Services Pvt Ltd **List Not Exhaustive, Batam Shipping Agency, Bansar, Intermodal Shipping Inc, Albatross Shipping Agencies, Sinotrans, International Clearing and Shipping Agency(India) Pvt Ltd, HS Lanka.

3. What are the main segments of the Asia-Pacific Shipping Agency Services Market?

The market segments include Type, Application, Service, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Industrial Growth Supporting the Market; Global Trade Driving the Market.

6. What are the notable trends driving market growth?

China to Dominate the Asia-Pacific Shipping Agency Services Market.

7. Are there any restraints impacting market growth?

Compliance Challenges Affecting the Market; Limited Infrastructure Inhibiting the Market.

8. Can you provide examples of recent developments in the market?

November 2022: GAC is one of the leading providers of ship agency services worldwide. It is expanding its presence in East Asia and the Asia-Pacific region by establishing a new office in Taiwan's second-largest port, Taichung.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Shipping Agency Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Shipping Agency Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Shipping Agency Services Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Shipping Agency Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence