Key Insights

The bio-pharmaceutical logistics market is projected for substantial expansion, driven by escalating demand for temperature-sensitive pharmaceuticals, increased clinical trial activity, and the proliferation of advanced therapies such as cell and gene therapies. With a projected Compound Annual Growth Rate (CAGR) of 12%, the market is anticipated to reach $140 billion by 2025. Key growth catalysts include the globalization of the pharmaceutical sector, necessitating efficient international logistics, stringent regulatory mandates for specialized handling, and ongoing innovation in drug delivery systems requiring advanced cold chain capabilities. The market is segmented by operation type (cold chain and non-cold chain) and service (transportation, warehousing & distribution, and value-added services). Cold chain logistics, critical for maintaining biologic efficacy, commands the largest market share, followed by warehousing and distribution services for effective inventory management. Value-added services, encompassing specialized packaging, labeling, and regulatory compliance, represent significant growth segments.

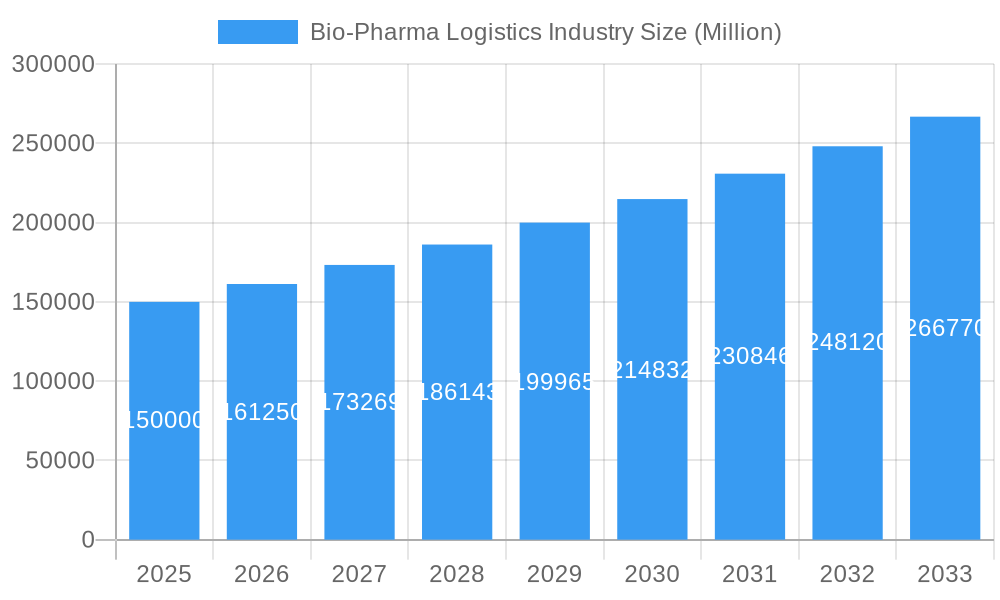

Bio-Pharma Logistics Industry Market Size (In Billion)

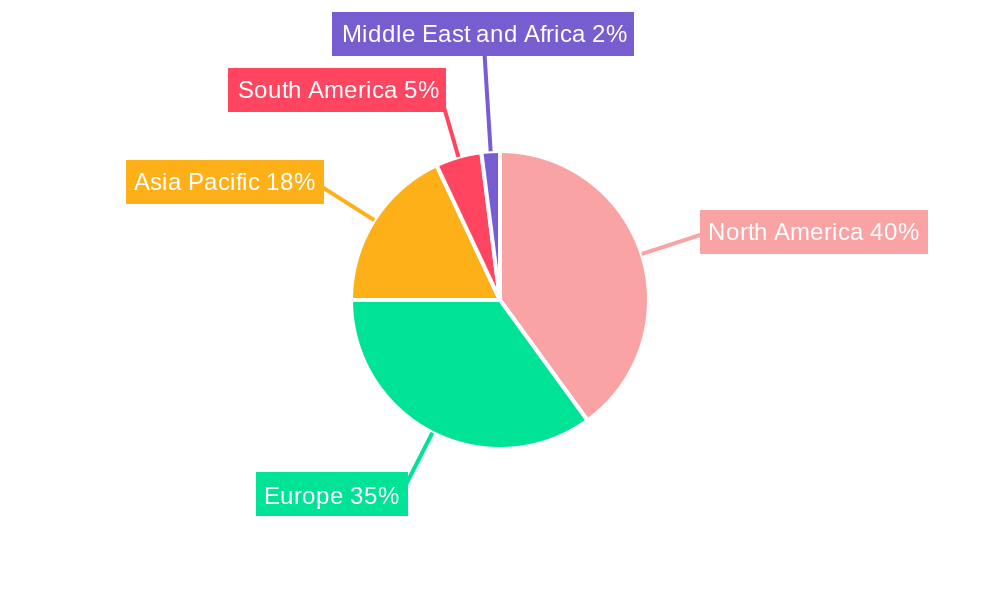

Leading industry participants are implementing technological innovations, including real-time tracking, IoT sensors, and predictive analytics, to elevate operational efficiency, transparency, and security. The competitive environment features both established entities and specialized emerging companies. Regional market growth is expected to vary, with North America and Europe currently leading due to a high concentration of pharmaceutical firms and advanced healthcare infrastructure. Nevertheless, the Asia-Pacific region is poised for accelerated growth, supported by rising healthcare expenditures and a burgeoning pharmaceutical industry. The market confronts challenges such as infrastructural gaps in certain areas, volatile fuel costs, and the imperative for continuous investment in technology and workforce development. Overall, the bio-pharma logistics market offers significant opportunities for growth, innovation, and strategic alliances, underpinned by the essential requirement for secure and efficient handling of life-saving medications.

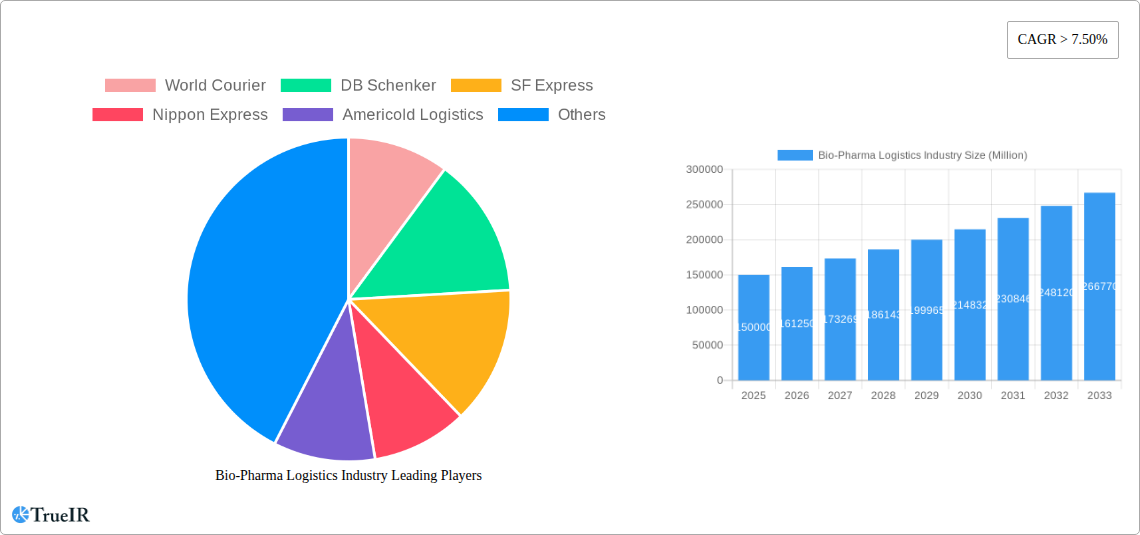

Bio-Pharma Logistics Industry Company Market Share

Bio-Pharma Logistics Industry Report: A Comprehensive Market Analysis (2019-2033)

This dynamic report provides a detailed analysis of the Bio-Pharma Logistics industry, offering invaluable insights for stakeholders seeking to navigate this rapidly evolving market. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages extensive data analysis to present a clear and comprehensive understanding of the current market landscape and future projections. The report utilizes high-volume keywords to enhance search visibility and deliver relevant information to industry professionals. The total market value is projected to reach xx Million by 2033.

Bio-Pharma Logistics Industry Market Structure & Competitive Landscape

The bio-pharma logistics market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2024 is estimated at xx, indicating a moderately concentrated market. Key drivers of innovation include advancements in cold chain technologies, automation, and data analytics. Stringent regulatory environments, particularly regarding temperature-sensitive pharmaceuticals and data security, significantly impact market operations. Product substitutes are limited, with the primary alternatives being regional specialized logistics providers. End-user segmentation includes pharmaceutical manufacturers, research organizations, and healthcare providers. Mergers and acquisitions (M&A) activity has been substantial in recent years, with xx Million in total deal value recorded between 2019 and 2024.

- Market Concentration: HHI of xx in 2024.

- Innovation Drivers: Cold chain technology, automation, data analytics.

- Regulatory Impacts: Stringent regulations impacting temperature control and data security.

- M&A Trends: xx Million in M&A deal value (2019-2024).

- Key Players: World Courier, DB Schenker, SF Express, and other major players.

Bio-Pharma Logistics Industry Market Trends & Opportunities

The global bio-pharma logistics market is experiencing robust and accelerated growth, propelled by an expanding healthcare landscape and unprecedented scientific advancements. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately 8-10% from 2025 to 2033. This surge is significantly driven by the increasing prevalence of chronic diseases worldwide, the escalating demand for complex and temperature-sensitive biologics, vaccines, and personalized medicines, and rapid technological innovations that are revolutionizing supply chain efficiency and reliability. The adoption of advanced cold chain solutions, including sophisticated temperature-controlled packaging and real-time monitoring, is set to climb dramatically, with market penetration expected to reach 70-80% by 2033. In line with evolving consumer expectations, there's a pronounced shift towards greater transparency and end-to-end traceability across the supply chain, fostering a strong demand for advanced tracking, IoT-enabled monitoring systems, and robust data analytics platforms. The competitive arena is highly dynamic, characterized by strategic mergers, acquisitions, and organic expansion as companies strive to capture market share. Emerging niche markets, particularly specialized logistics solutions tailored for the intricate requirements of cell and gene therapies, represent significant future growth avenues.

Dominant Markets & Segments in Bio-Pharma Logistics Industry

The North American market currently holds the largest share of the global bio-pharma logistics market, driven by strong demand from the pharmaceutical industry and robust infrastructure. Within the market segmentation:

- By Type of Operation: The cold chain segment dominates, representing approximately xx% of the market due to the temperature-sensitive nature of many biopharmaceuticals.

- By Service: Transportation currently holds the largest share, but warehousing and distribution, and value-added services are experiencing rapid growth.

Key Growth Drivers:

- North America: Advanced infrastructure, high pharmaceutical industry concentration.

- Europe: Stringent regulatory framework fostering innovation and efficiency.

- Asia-Pacific: Rapidly expanding pharmaceutical market and increasing investment in logistics infrastructure.

Bio-Pharma Logistics Industry Product Analysis

Innovation within the bio-pharma logistics sector is predominantly focused on advancing the frontiers of cold chain technologies, integrating sophisticated real-time tracking and monitoring systems, and enhancing data analytics capabilities. These critical advancements are instrumental in ensuring superior temperature control, bolstering security measures, and providing unparalleled visibility throughout the entire supply chain. This leads to substantial improvements in operational efficiency, a significant reduction in the risk of product spoilage or loss, and ultimately, greater patient safety. The market is witnessing a marked increase in the adoption of both passive and active temperature-controlled packaging solutions. Furthermore, the seamless integration of Internet of Things (IoT) sensors is becoming standard practice, enabling continuous real-time monitoring, predictive maintenance, and immediate alerts for any deviations, thereby ensuring the integrity of sensitive pharmaceutical products.

Key Drivers, Barriers & Challenges in Bio-Pharma Logistics Industry

Key Drivers:

- Technological Advancements: The integration of automation, the Internet of Things (IoT), artificial intelligence (AI), and blockchain technology is dramatically increasing operational efficiency, enhancing visibility, and improving the security of the bio-pharma supply chain.

- Economic Growth and Healthcare Spending: Rising global healthcare expenditures, coupled with an increasing demand for advanced therapies, biologics, and vaccines, are directly fueling market expansion.

- Favorable Regulatory Environment & Policy Support: Governments worldwide are increasingly recognizing the critical role of efficient bio-pharma logistics, leading to supportive policies, investment in infrastructure, and streamlined regulatory pathways for innovative logistics solutions.

- Growing Demand for Biologics and Personalized Medicine: The rise of biologics, biosimilars, and personalized medicine, which often require specialized handling and cold chain integrity, is a significant growth catalyst.

Challenges & Restraints:

- Supply Chain Disruptions: Geopolitical instability, pandemics, natural disasters, and transportation network issues continue to pose significant threats, leading to substantial delays, shortages, and financial impacts estimated to reach billions of dollars annually globally.

- Stringent Regulatory Compliance: Navigating complex and ever-evolving international and regional regulations for pharmaceutical transport and storage adds significant compliance costs and operational complexity.

- Intense Competitive Pressure: A highly competitive market landscape, featuring both large, established global logistics providers and agile, specialized local firms, puts considerable pressure on pricing strategies and profit margins.

- Talent Shortage: A lack of skilled professionals experienced in specialized bio-pharma logistics and cold chain management can hinder growth and operational excellence.

Growth Drivers in the Bio-Pharma Logistics Industry Market

The bio-pharma logistics market is propelled by factors such as the growing demand for temperature-sensitive pharmaceuticals, advancements in cold chain technology (like advanced packaging and monitoring systems), and increasing regulatory scrutiny driving the need for compliant logistics solutions. Government initiatives promoting pharmaceutical manufacturing and distribution also fuel market expansion. The rising prevalence of chronic diseases globally further drives this demand.

Challenges Impacting Bio-Pharma Logistics Industry Growth

Significant challenges include the stringent regulatory landscape necessitating high compliance costs, the vulnerability of the supply chain to disruptions (natural disasters, pandemics), and price pressures due to intense competition. Maintaining the integrity of temperature-sensitive products throughout the supply chain presents ongoing logistical difficulties. These challenges translate to increased operational costs and reduced profit margins.

Key Players Shaping the Bio-Pharma Logistics Industry Market

- World Courier (an AmerisourceBergen company)

- DB Schenker

- SF Express

- Nippon Express

- Americold Logistics

- CH Robinson

- UPS (Marken)

- FedEx

- Kuehne + Nagel

- CEVA Logistics

- Agility

- Kerry Logistics

- Deutsche Post DHL Group

- Air Canada Cargo

- Lineage Logistics

- United States Cold Storage

- AGRO Merchants Group LLC

- Nichirei Logistics Group Inc

- Kloosterboer

- NewCold

- Advanced Cold Logistics

- VersaCold Logistics Services

- Cloverleaf Cold Storage Co

- DSV

Significant Bio-Pharma Logistics Industry Milestones

- 2020: Increased adoption of digital technologies for real-time tracking and monitoring.

- 2021: Several major M&A activities reshaping the industry landscape.

- 2022: Significant investments in cold chain infrastructure, particularly in emerging markets.

- 2023: Focus on sustainable and environmentally friendly logistics solutions.

- 2024: Introduction of new temperature-controlled packaging and sensor technologies.

Future Outlook for Bio-Pharma Logistics Industry Market

The bio-pharma logistics market is poised for continued robust growth, driven by technological advancements, increased demand for biologics, and a growing focus on efficient and compliant supply chains. Strategic partnerships and investments in innovative technologies will play a crucial role in shaping the future landscape. The market is expected to witness significant expansion in the adoption of automation, data analytics, and AI-driven solutions, further enhancing efficiency and security. This creates significant opportunities for companies capable of adapting to the evolving needs of the industry.

Bio-Pharma Logistics Industry Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Distribution

- 1.3. Value Added Services

-

2. Type of Operation

- 2.1. Cold Chain

- 2.2. Non-cold Chain

Bio-Pharma Logistics Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. South America

- 5. Middle East and Africa

Bio-Pharma Logistics Industry Regional Market Share

Geographic Coverage of Bio-Pharma Logistics Industry

Bio-Pharma Logistics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace

- 3.2.2 automotive

- 3.2.3 and pharmaceuticals.

- 3.3. Market Restrains

- 3.3.1 4.; The geopolitical situation in the Middle East can create security concerns for logistics operations

- 3.3.2 4.; Regulations and customs procedures can be complex and subject to change.

- 3.4. Market Trends

- 3.4.1. Temperature-sensitive Pharmaceutical Drugs Sales Driving the Cold Chain Logistics

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Distribution

- 5.1.3. Value Added Services

- 5.2. Market Analysis, Insights and Forecast - by Type of Operation

- 5.2.1. Cold Chain

- 5.2.2. Non-cold Chain

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Transportation

- 6.1.2. Warehousing and Distribution

- 6.1.3. Value Added Services

- 6.2. Market Analysis, Insights and Forecast - by Type of Operation

- 6.2.1. Cold Chain

- 6.2.2. Non-cold Chain

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Transportation

- 7.1.2. Warehousing and Distribution

- 7.1.3. Value Added Services

- 7.2. Market Analysis, Insights and Forecast - by Type of Operation

- 7.2.1. Cold Chain

- 7.2.2. Non-cold Chain

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Transportation

- 8.1.2. Warehousing and Distribution

- 8.1.3. Value Added Services

- 8.2. Market Analysis, Insights and Forecast - by Type of Operation

- 8.2.1. Cold Chain

- 8.2.2. Non-cold Chain

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. South America Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Transportation

- 9.1.2. Warehousing and Distribution

- 9.1.3. Value Added Services

- 9.2. Market Analysis, Insights and Forecast - by Type of Operation

- 9.2.1. Cold Chain

- 9.2.2. Non-cold Chain

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Bio-Pharma Logistics Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Transportation

- 10.1.2. Warehousing and Distribution

- 10.1.3. Value Added Services

- 10.2. Market Analysis, Insights and Forecast - by Type of Operation

- 10.2.1. Cold Chain

- 10.2.2. Non-cold Chain

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 World Courier

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DB Schenker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SF Express

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nippon Express

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Americold Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CH Robinson

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 UPS (Marken)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 FedEx

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuehne + Nagel

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CEVA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Agility

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Kerry Logistics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Deutsche Post DHL Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Air Canada Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Lineage Logistics United States Cold Storage AGRO Merchants Group LLC Nichirei Logistics Group Inc Kloosterboer NewCold Advanced Cold Logistics VersaCold Logistics Services and Cloverleaf Cold Storage Co

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 DSV

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 World Courier

List of Figures

- Figure 1: Global Bio-Pharma Logistics Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 5: North America Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 6: North America Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 9: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 10: Europe Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 11: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 12: Europe Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 15: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 16: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 17: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 18: Asia Pacific Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 21: South America Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 22: South America Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 23: South America Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 24: South America Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Type of Operation 2025 & 2033

- Figure 29: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Type of Operation 2025 & 2033

- Figure 30: Middle East and Africa Bio-Pharma Logistics Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Bio-Pharma Logistics Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 3: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 6: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 8: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 9: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 11: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 12: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 15: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 17: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Type of Operation 2020 & 2033

- Table 18: Global Bio-Pharma Logistics Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bio-Pharma Logistics Industry?

The projected CAGR is approximately 12%.

2. Which companies are prominent players in the Bio-Pharma Logistics Industry?

Key companies in the market include World Courier, DB Schenker, SF Express, Nippon Express, Americold Logistics, CH Robinson, UPS (Marken), FedEx, Kuehne + Nagel, CEVA, Agility, Kerry Logistics, Deutsche Post DHL Group, Air Canada Cargo**List Not Exhaustive 6 3 Other Companies (Key Information/Overview), Lineage Logistics United States Cold Storage AGRO Merchants Group LLC Nichirei Logistics Group Inc Kloosterboer NewCold Advanced Cold Logistics VersaCold Logistics Services and Cloverleaf Cold Storage Co, DSV.

3. What are the main segments of the Bio-Pharma Logistics Industry?

The market segments include Service, Type of Operation.

4. Can you provide details about the market size?

The market size is estimated to be USD 140 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; The UAE government's efforts to diversify its economy away from oil dependency have led to increased investment4.; The UAE has been investing in manufacturing sectors such as aerospace. automotive. and pharmaceuticals..

6. What are the notable trends driving market growth?

Temperature-sensitive Pharmaceutical Drugs Sales Driving the Cold Chain Logistics.

7. Are there any restraints impacting market growth?

4.; The geopolitical situation in the Middle East can create security concerns for logistics operations. 4.; Regulations and customs procedures can be complex and subject to change..

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bio-Pharma Logistics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bio-Pharma Logistics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bio-Pharma Logistics Industry?

To stay informed about further developments, trends, and reports in the Bio-Pharma Logistics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence