Key Insights

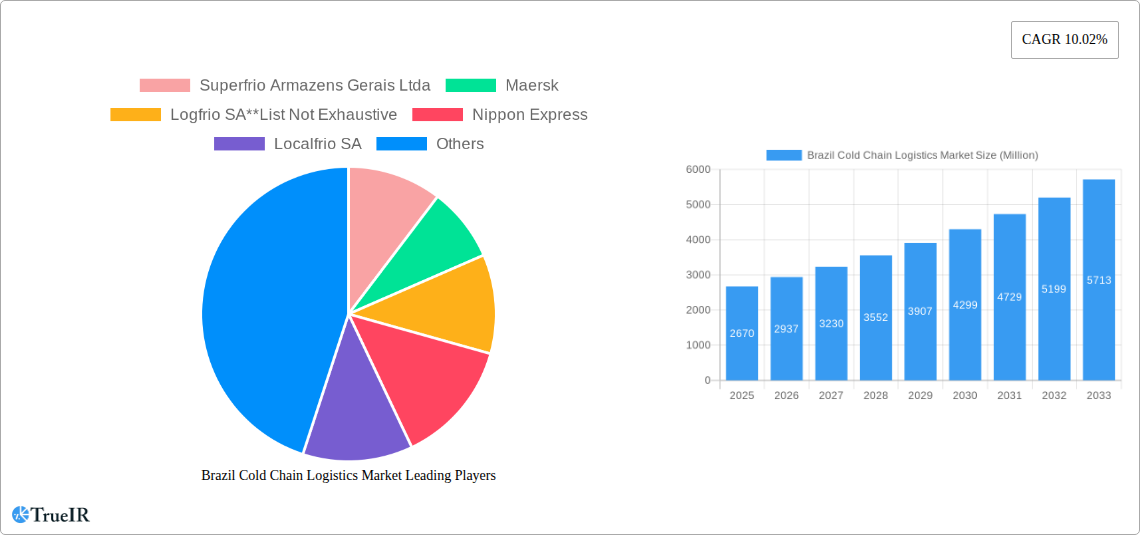

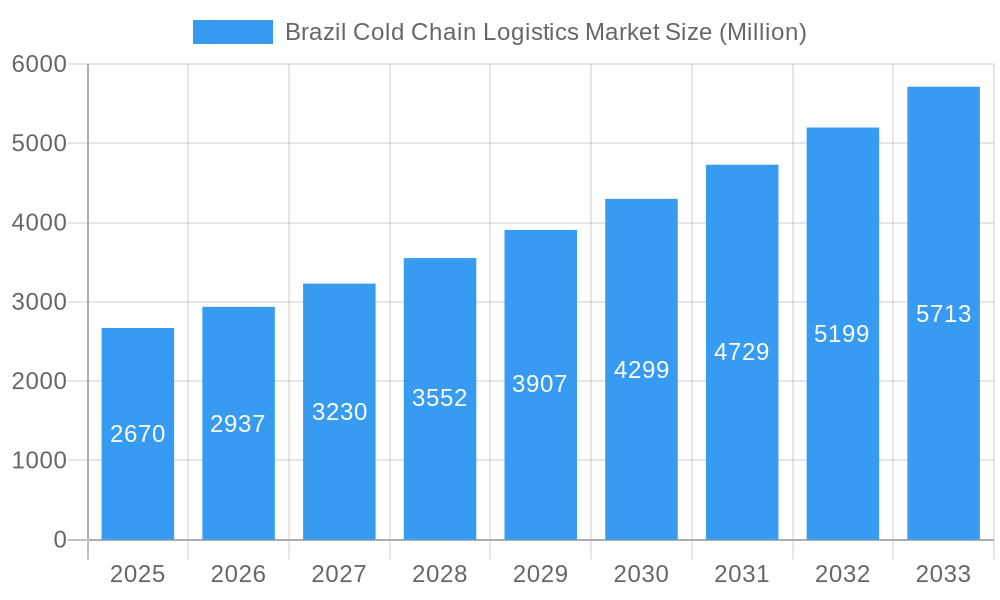

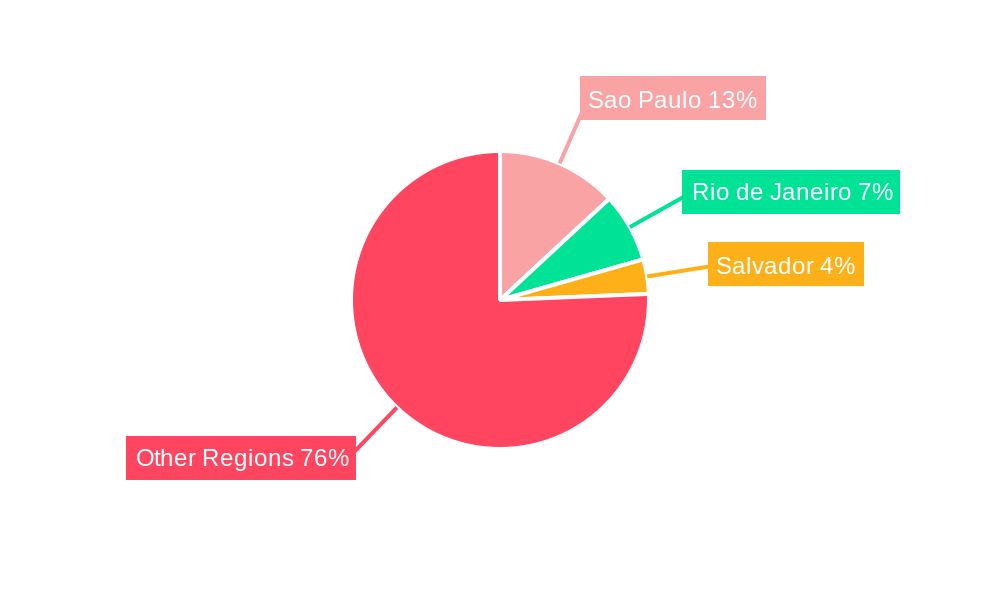

The Brazilian cold chain logistics market, valued at $2.67 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.02% from 2025 to 2033. This significant expansion is driven by several key factors. Firstly, the burgeoning Brazilian food and beverage industry, particularly the increasing demand for fresh produce, meats, and processed foods, necessitates efficient cold chain solutions for maintaining product quality and extending shelf life. Secondly, the rise of e-commerce and online grocery delivery services is fueling the need for reliable and temperature-controlled transportation and storage infrastructure. Thirdly, stringent government regulations regarding food safety and hygiene are pushing businesses to invest in advanced cold chain technologies and improve their logistics operations. The market is segmented by key cities (Sao Paulo, Rio de Janeiro, Salvador dominating due to population density and economic activity), service type (storage, transportation, and value-added services like blast freezing and inventory management), temperature type (chilled and frozen), and application (horticulture, meats, fish & poultry, processed foods, pharmaceuticals, and life sciences). Major players like Superfrio, Maersk, Logfrio, and Localfrio are shaping the market landscape through strategic investments and technological advancements.

Brazil Cold Chain Logistics Market Market Size (In Billion)

The growth trajectory of the Brazilian cold chain logistics market is further reinforced by the expanding middle class, rising disposable incomes, and a growing preference for fresh and processed food products. However, challenges remain, including infrastructure limitations in certain regions, particularly in rural areas, and the need for continuous improvement in technology and skilled workforce development. Addressing these challenges will be crucial for the continued expansion and optimization of this vital sector. The forecast period of 2025-2033 presents substantial opportunities for both established players and new entrants to capitalize on the market's growth potential, particularly through strategic partnerships, technological innovation, and expansion into underserved regions.

Brazil Cold Chain Logistics Market Company Market Share

Brazil Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report offers a comprehensive analysis of the Brazil cold chain logistics market, providing invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive market research and data analysis covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report delves into market size, segmentation, key players, growth drivers, and challenges. Expect detailed information on market concentration, technological advancements, and future growth potential, empowering you to make informed decisions in this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Brazil Cold Chain Logistics Market Market Structure & Competitive Landscape

The Brazilian cold chain logistics market exhibits a moderately concentrated structure, with a few large players and numerous smaller regional operators. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately competitive landscape. Innovation is driven by the need for improved temperature control, enhanced traceability, and efficient logistics management, particularly in response to increasing demand for perishable goods and stringent regulatory requirements. Regulatory changes, such as those related to food safety and environmental sustainability, significantly impact market dynamics. Product substitutes, such as improved packaging materials and innovative preservation techniques, pose a constant competitive pressure.

The end-user segmentation is diverse, encompassing horticulture (fresh fruits and vegetables), meats, fish and poultry, processed food products, pharmaceuticals, life sciences, and chemicals. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total deal value of approximately xx Million recorded between 2019 and 2024. Key M&A drivers include the expansion of market share, acquisition of specialized technologies, and access to new geographical markets.

- Market Concentration: HHI of xx in 2025.

- Innovation Drivers: Improved temperature control, traceability, and logistics efficiency.

- Regulatory Impacts: Stringent food safety and environmental regulations.

- Product Substitutes: Advanced packaging and preservation technologies.

- End-User Segmentation: Diverse, including horticulture, meats, pharmaceuticals, and others.

- M&A Trends: Moderate activity, with a total deal value of approximately xx Million (2019-2024).

Brazil Cold Chain Logistics Market Market Trends & Opportunities

The Brazilian cold chain logistics market is experiencing robust growth fueled by rising disposable incomes, changing consumer preferences towards fresh and processed foods, and the expansion of the e-commerce sector. The market size is projected to grow from xx Million in 2025 to xx Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. Technological advancements, such as the adoption of IoT sensors, data analytics, and automation, are transforming the industry, enhancing efficiency, and improving temperature control. Consumer demand for high-quality, safe, and traceable food products is driving the adoption of advanced cold chain solutions. Competitive dynamics are characterized by both price competition and differentiation based on service quality, technology, and geographical reach. The market penetration rate for advanced cold chain technologies is projected to reach xx% by 2033. Significant opportunities exist for companies that can offer integrated solutions, innovative technologies, and superior service quality.

Dominant Markets & Segments in Brazil Cold Chain Logistics Market

São Paulo emerges as the dominant market due to its high population density, extensive industrial activity, and well-established infrastructure. Rio de Janeiro and Salvador also represent significant markets, albeit smaller compared to São Paulo. The storage segment holds the largest market share, followed by transportation and value-added services. The frozen segment is growing faster than the chilled segment, driven by the increasing demand for frozen foods. The processed food products, meats, fish, and poultry segments are currently the largest application segments.

- Key Growth Drivers:

- Robust infrastructure development in major cities.

- Favorable government policies supporting the cold chain sector.

- Increasing demand for fresh and processed foods.

- Expanding e-commerce sector.

- Market Dominance: São Paulo dominates due to its size and infrastructure. The storage service segment holds the largest market share. The Frozen temperature type and Processed food, Meat, Fish & Poultry application segments show strong growth.

Brazil Cold Chain Logistics Market Product Analysis

Technological advancements are transforming cold chain products and services. Innovative temperature-controlled containers, IoT-enabled monitoring systems, and advanced logistics software are enhancing efficiency, improving temperature control, and reducing spoilage. These improvements offer significant competitive advantages by enhancing service reliability, traceability, and cost-effectiveness, which are increasingly crucial aspects for maintaining the quality of temperature-sensitive goods within the Brazilian cold chain. The market is seeing an increase in adoption of advanced technology to improve traceability and visibility across the supply chain.

Key Drivers, Barriers & Challenges in Brazil Cold Chain Logistics Market

Key Drivers: Rising consumer demand for fresh and processed food, increasing investments in infrastructure, and technological advancements driving efficiency gains. Government initiatives promoting food safety and cold chain development further contribute to market expansion.

Key Challenges: Inadequate infrastructure in certain regions, particularly in rural areas, poses a significant hurdle. Regulatory complexities, including varied standards and compliance requirements, add complexity and cost. Intense competition, especially in urban centers, creates pricing pressure and limits profitability for many operators. A fluctuating Brazilian Real can impact cost calculations and profitability. Estimated losses due to spoilage account for approximately xx Million annually.

Growth Drivers in the Brazil Cold Chain Logistics Market Market

The market's growth is fueled by rising consumer incomes driving demand for higher-quality, perishable goods; expansion of organized retail increasing demand for efficient cold chain solutions; and government initiatives promoting food safety and infrastructure development. Technological advancements, such as IoT and data analytics, further enhance efficiency and reduce spoilage. Finally, increasing exports of Brazilian agricultural products are creating new opportunities.

Challenges Impacting Brazil Cold Chain Logistics Market Growth

Challenges include insufficient cold storage capacity in certain regions, particularly in the interior, leading to higher spoilage rates and increased costs. High transportation costs due to underdeveloped infrastructure and inefficient logistics networks further hinder market growth. Regulatory hurdles and compliance complexities add operational costs and impede market expansion for smaller players.

Key Players Shaping the Brazil Cold Chain Logistics Market Market

- Superfrio Armazens Gerais Ltda

- Maersk (https://www.maersk.com/)

- Logfrio SA

- Nippon Express (https://www.nipponexpress.com/global/en/)

- Localfrio SA

- Comfrio

- Martini Meat SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Brado Logistica SA

- CAP Logistica Frigorificada Ltda

- Brasfrigo SA

Significant Brazil Cold Chain Logistics Market Industry Milestones

- 2020: Implementation of stricter food safety regulations by ANVISA (National Health Surveillance Agency).

- 2022: Launch of a major cold storage facility in São Paulo by Localfrio SA, increasing capacity by xx Million cubic meters.

- 2023: Partnership between Maersk and a Brazilian technology company to deploy IoT sensors across the cold chain network.

- 2024: Acquisition of a regional cold chain operator by Brado Logistica SA.

Future Outlook for Brazil Cold Chain Logistics Market Market

The Brazilian cold chain logistics market is poised for significant growth, driven by increasing consumer demand, technological innovation, and government support. Strategic opportunities exist for companies that can offer integrated solutions, leverage technology to enhance efficiency and traceability, and address the challenges related to infrastructure development and regulatory compliance. The market's growth trajectory will be shaped by the success of initiatives to improve infrastructure, streamline regulatory processes, and adopt advanced technologies. The potential for increased exports of temperature-sensitive goods from Brazil represents a key growth catalyst.

Brazil Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Meats, Fish, and Poultry

- 3.3. Processed Food Products

- 3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 3.5. Other Applications

-

4. Key Cities

- 4.1. Sao Paulo

- 4.2. Rio de Janeiro

- 4.3. Salvador

Brazil Cold Chain Logistics Market Segmentation By Geography

- 1. Brazil

Brazil Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Increasing Meat Exports to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Meats, Fish, and Poultry

- 5.3.3. Processed Food Products

- 5.3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Sao Paulo

- 5.4.2. Rio de Janeiro

- 5.4.3. Salvador

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logfrio SA**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Localfrio SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comfrio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Martini Meat SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brado Logistica SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAP Logistica Frigorificada Ltda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Brasfrigo SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Brazil Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 8: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cold Chain Logistics Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Brazil Cold Chain Logistics Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA**List Not Exhaustive, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, Brasfrigo SA.

3. What are the main segments of the Brazil Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Application, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Increasing Meat Exports to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Brazil Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence