Key Insights

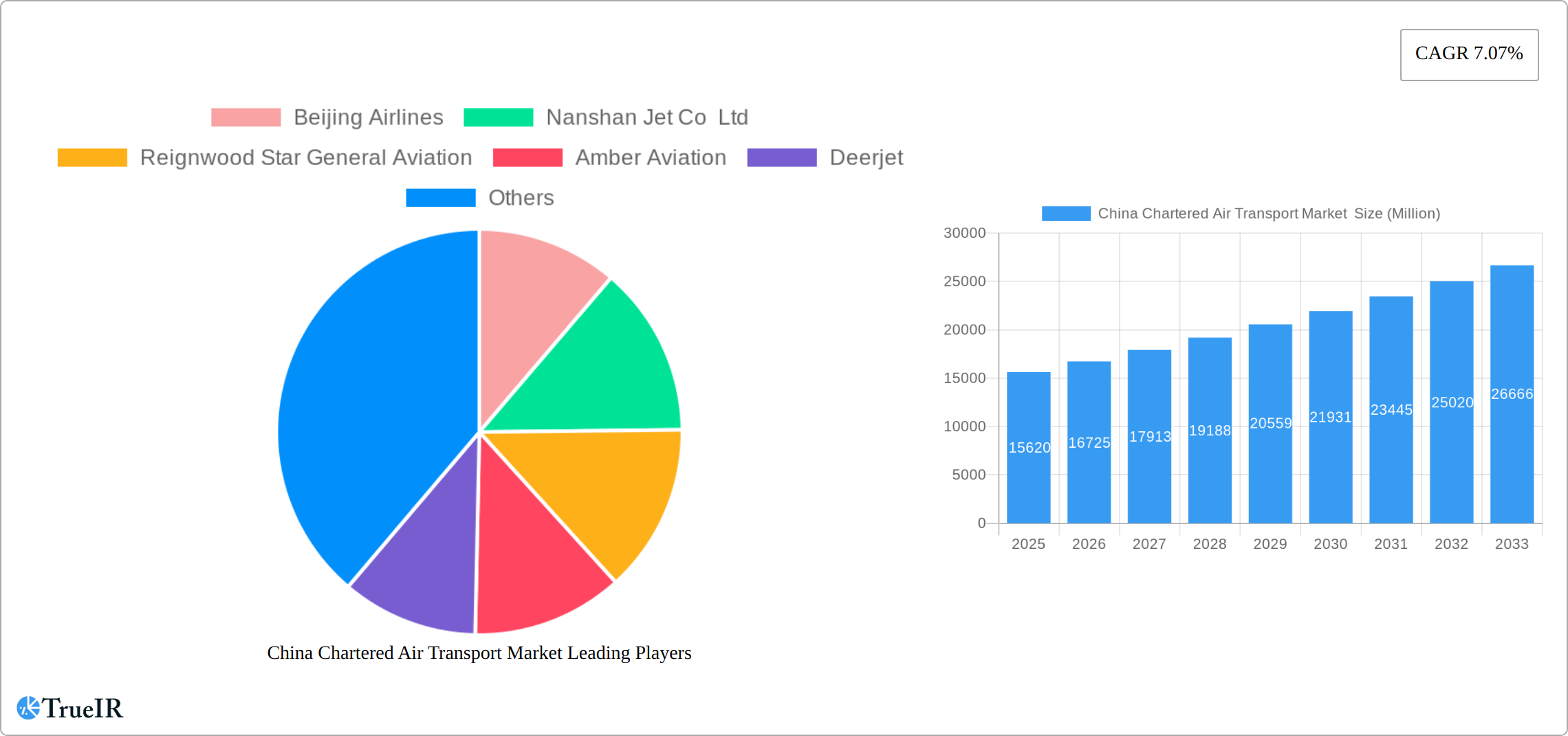

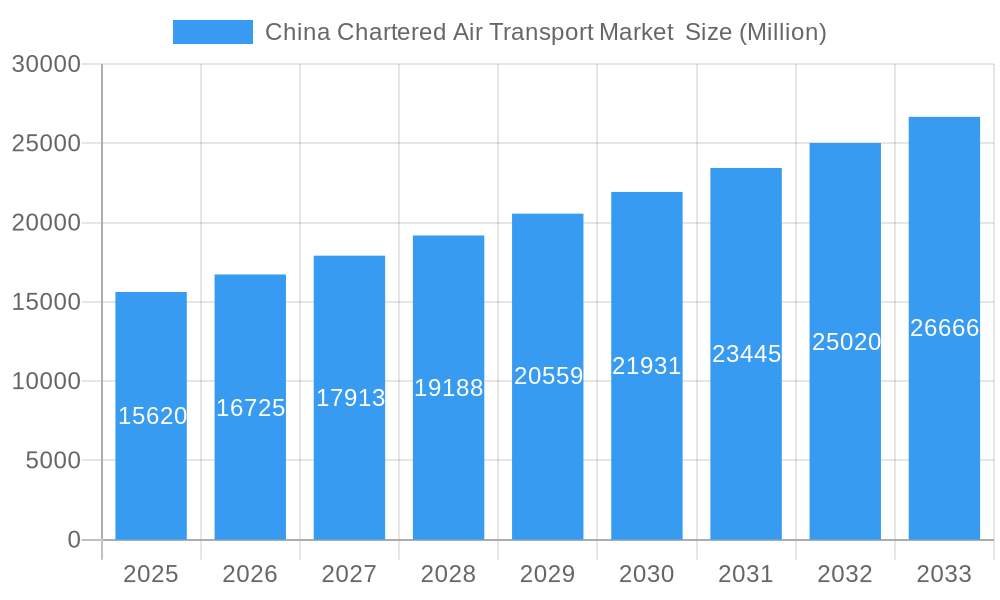

The China chartered air transport market, valued at $15.62 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 7.07% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector necessitates rapid and reliable delivery of time-sensitive goods, significantly boosting demand for chartered air freight services. Furthermore, the increasing affluence of the Chinese population is driving growth in luxury travel and specialized cargo needs, such as the transportation of high-value goods, animals, and oversized equipment. Government initiatives promoting infrastructure development and air travel connectivity further contribute to the market's positive outlook. While potential regulatory hurdles and economic fluctuations pose some challenges, the overall growth trajectory remains strong. The market is segmented by cargo type, including time-critical cargo, heavy and oversized cargo, dangerous goods, animal transportation, and other types. Key players such as Beijing Airlines, Nanshan Jet Co Ltd, and others are well-positioned to capitalize on this growth, though competition is expected to intensify as the market expands. The historical period (2019-2024) likely saw fluctuating growth reflecting economic conditions and pandemic-related disruptions, but the forecast period signals a return to a strong upward trend.

China Chartered Air Transport Market Market Size (In Billion)

The segmentation of the market by cargo type allows for a nuanced understanding of the driving forces behind its growth. The time-critical cargo segment, for example, benefits from the rapid expansion of e-commerce, while the heavy and oversized cargo segment is driven by increased industrial activity and infrastructure projects. The animal transportation segment reflects growing awareness of animal welfare and the demand for specialized transport solutions. This diverse segmentation highlights the market's resilience and potential for continued growth across various sub-sectors. The regional focus on China underscores the nation's significant role as a key player in the global chartered air transport industry. The continued investment in infrastructure and ongoing economic development will undoubtedly play a significant role in shaping the future of this dynamic market.

China Chartered Air Transport Market Company Market Share

China Chartered Air Transport Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning China chartered air transport market, offering invaluable insights for investors, industry professionals, and strategic decision-makers. Leveraging extensive data analysis covering the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market size, growth trajectories, competitive dynamics, and key future trends. With a focus on high-impact keywords, this report is meticulously designed to enhance your understanding of this rapidly evolving sector. Market value projections are in Millions (USD).

China Chartered Air Transport Market Market Structure & Competitive Landscape

The China chartered air transport market is characterized by a moderately concentrated structure, featuring a blend of a few significant, established players and a broader base of smaller, specialized operators. While the exact market concentration ratio (CR4) for 2025 is still under estimation, industry analysis points to a competitive environment where larger entities hold considerable sway. This market is highly dynamic, witnessing continuous strategic moves in the form of consolidation and organic expansion as companies strive to secure and grow their market share. Innovation is a critical differentiator, largely propelled by ongoing advancements in aircraft technology, sophisticated navigation systems, and integrated logistics management platforms. Stringent safety regulations are paramount, and evolving environmental concerns are increasingly shaping operational strategies and investment decisions. In terms of substitutes, while rail and road freight offer alternatives for certain types of cargo, chartered air transport remains indispensable for time-sensitive shipments, high-value goods, and situations demanding utmost discretion and speed. The end-user base is diverse, encompassing key industries such as manufacturing, pharmaceuticals, burgeoning e-commerce operations, and the needs of high-net-worth individuals. Merger and acquisition (M&A) activity has been a notable trend, with an estimated [Insert specific number] M&A transactions recorded between 2019 and 2024. This activity underscores a strategic imperative for companies to achieve greater economies of scale, enhance operational efficiencies, and broaden their service portfolios, a trend anticipated to persist as the market matures.

- Market Concentration: CR4 estimated at [Insert specific percentage]% in 2025, indicating a moderately concentrated market with significant competition.

- Innovation Drivers: Technological advancements in fuel-efficient aircraft, advanced air traffic management, real-time tracking, and sophisticated logistics software.

- Regulatory Impacts: Strict adherence to aviation safety standards, evolving environmental regulations (e.g., emissions controls), and evolving airspace management policies.

- Product Substitutes: Rail freight for bulk and less time-sensitive goods, road freight for regional distribution, and high-speed rail for select cargo types.

- End-User Segmentation: Diversified, including urgent manufacturing components, high-value pharmaceuticals, rapid e-commerce fulfillment, VIP travel, and specialized cargo.

- M&A Trends: [Insert specific number] M&A transactions between 2019 and 2024, signifying a strategic push towards consolidation, synergistic acquisitions, and market leadership.

China Chartered Air Transport Market Market Trends & Opportunities

The China chartered air transport market is poised for substantial and sustained growth, driven by an escalating demand for highly efficient, reliable, and flexible logistics solutions across a multitude of economic sectors. The market size is projected to reach an impressive [Insert specific market size] Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of [Insert specific CAGR]% during the forecast period (2025-2033), ultimately reaching an estimated [Insert projected market size] Million by 2033. This robust expansion is underpinned by several key factors, including the continued exponential growth of e-commerce, the increasing volume and complexity of cross-border trade, and the rising disposable income of a growing middle class, which fuels demand for premium and time-sensitive services. Technological innovation, particularly in the adoption of cutting-edge air traffic management systems for enhanced efficiency and the development of more fuel-efficient and advanced aircraft, is a significant catalyst for market expansion. Consumer and business preferences are increasingly gravitating towards speed, guaranteed delivery windows, and enhanced reliability, directly boosting the demand for chartered air transport services. The competitive landscape, while intense, is actively fostering innovation and driving continuous improvements in service quality, leading to greater market penetration and a more sophisticated offering of charter solutions.

Dominant Markets & Segments in China Chartered Air Transport Market

Within the expansive landscape of China's chartered air transport sector, the most dominant markets are strategically concentrated in the economically vibrant coastal regions. Specifically, Shanghai, Guangdong, and Zhejiang provinces stand out as key hubs. This dominance is directly attributable to their unparalleled concentration of major manufacturing bases, bustling international trade ports, and a dense, affluent population. On the segment front, the Time Critical Cargo segment holds the largest market share, fueled by the relentless demand for rapid, just-in-time delivery across diverse industries, from high-tech manufacturing to urgent medical supplies. The Heavy and Oversized Cargo segment also represents a significant and growing contributor, driven by the escalating need to transport large-scale industrial equipment, specialized machinery, and project cargo, often requiring bespoke logistical solutions.

-

Key Growth Drivers:

- Sustained Economic Expansion: Propelling increased trade volumes, industrial output, and corporate travel needs.

- E-commerce Dominance: Continuously fueling the demand for expedited delivery networks and last-mile logistics solutions.

- Strategic Infrastructure Development: Enhancements in airport capacity, air traffic control modernization, and integrated transportation networks are improving accessibility and efficiency.

- Supportive Government Policies: Initiatives aimed at boosting the aviation sector, modernizing logistics, and facilitating trade are creating a favorable operating environment.

- Growing Demand for Premium Services: Businesses and individuals increasingly prioritize speed, security, and specialized handling, driving the charter market.

-

Dominant Segments:

- Time Critical Cargo: The leading segment due to the critical need for rapid delivery of high-value, perishable, or urgent items.

- Heavy and Oversized Cargo: A substantial and growing segment, catering to the transportation of large industrial machinery, construction equipment, and project logistics.

- Dangerous Goods Transportation: An increasingly important segment, demanding specialized handling, stringent safety protocols, and compliance with international regulations.

- Pharmaceuticals and Perishables: A high-value segment requiring temperature-controlled environments and expedited transit to maintain product integrity.

- VIP and Executive Travel: Catering to the discrete and flexible travel needs of corporations and high-net-worth individuals.

- Other Specialized Cargo: Including but not limited to live animals, valuable art, and sensitive electronic components.

China Chartered Air Transport Market Product Analysis

The China chartered air transport market offers a sophisticated and evolving suite of services, meticulously designed to cater to a broad spectrum of specific cargo types and client requirements. The integration of cutting-edge technology across aircraft design, advanced flight management systems, and integrated digital logistics platforms significantly enhances operational efficiency, safety, and real-time visibility. A core strategic focus is on delivering highly customized solutions that precisely address the unique demands of various industries, such as maintaining precise temperature control for sensitive pharmaceuticals or implementing specialized handling protocols for live animals. Competitive advantage in this market is increasingly determined by a combination of factors: unwavering operational reliability, strategically competitive pricing structures, superior customer service quality, and the demonstration of specialized logistical capabilities and certifications for handling complex or sensitive cargo.

Key Drivers, Barriers & Challenges in China Chartered Air Transport Market

Key Drivers: Rapid economic growth, increasing e-commerce activity, and government support for infrastructure development are major growth catalysts. Technological advancements in aircraft and logistics management systems further enhance efficiency and expand market potential. Expansion of China's Belt and Road Initiative will also create opportunities.

Challenges: Stringent regulatory frameworks, fuel price volatility, and intensifying competition pose significant hurdles to market expansion. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, underscore the vulnerability of the sector. These challenges necessitate strategic planning and adaptation to ensure sustained market growth. The impact of these challenges can be quantified through reduced profit margins and slower than expected market expansion. For example, the xx% increase in fuel prices in 2022 resulted in a xx% decrease in profitability for some operators.

Growth Drivers in the China Chartered Air Transport Market Market

The key drivers for growth include the expansion of e-commerce, the increase in cross-border trade, and government initiatives to support the logistics sector. Technological advancements are also driving efficiency gains, with the adoption of advanced technologies such as autonomous flight systems and real-time tracking solutions improving logistics operations.

Challenges Impacting China Chartered Air Transport Market Growth

The main challenges include stringent regulations, fuel price volatility, and intense competition. Supply chain disruptions and geopolitical uncertainties can also significantly impact market growth. The lack of skilled labor and the high cost of operations further add to the complexity of market development.

Key Players Shaping the China Chartered Air Transport Market Market

- Beijing Airlines

- Nanshan Jet Co Ltd

- Reignwood Star General Aviation

- Amber Aviation

- Deerjet

- ZYB Lily Jet Ltd

- China Southern Airlines General Aviation

- Sino Jet

- Baa Jet Management Ltd

- Donghai Jet Co Ltd

- Jiangsu Jet

Significant China Chartered Air Transport Market Industry Milestones

- October 2023: Air Charter Services expands its Shanghai office, signaling increased focus on the region. This indicates growing confidence in the market and aims to capture a larger share of the regional chartered air transport market.

- July 2023: Jayud launches new air charter services, strengthening its Southeast Asian presence and enhancing its logistics capabilities. This reflects the growing demand for integrated logistics solutions across the region and signifies the increasing competition in the market.

Future Outlook for China Chartered Air Transport Market Market

The China chartered air transport market is poised for continued growth, driven by long-term economic expansion, e-commerce growth, and technological advancements. Strategic opportunities exist for companies that can effectively navigate regulatory complexities, leverage technological innovations, and offer customized solutions that address the evolving needs of a diverse clientele. The market's potential is significant, with ample opportunities for both domestic and international players.

China Chartered Air Transport Market Segmentation

-

1. type

- 1.1. Time Critical Cargo

- 1.2. Heavy and Oversized Cargo

- 1.3. Dangerous Cargo

- 1.4. Animal Transportation

- 1.5. Other Cargo Types

China Chartered Air Transport Market Segmentation By Geography

- 1. China

China Chartered Air Transport Market Regional Market Share

Geographic Coverage of China Chartered Air Transport Market

China Chartered Air Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.07% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for businesses; Increasing disposable income

- 3.3. Market Restrains

- 3.3.1. Regulatory challenges; Infrastructure limitations

- 3.4. Market Trends

- 3.4.1. Booming Chartered Freight Transport Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Chartered Air Transport Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by type

- 5.1.1. Time Critical Cargo

- 5.1.2. Heavy and Oversized Cargo

- 5.1.3. Dangerous Cargo

- 5.1.4. Animal Transportation

- 5.1.5. Other Cargo Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Beijing Airlines

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nanshan Jet Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Reignwood Star General Aviation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber Aviation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Deerjet

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 ZYB Lily Jet Ltd *List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 China Southern Airlines General Aviation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sino Jet

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Baa Jet Management Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Donghai Jet Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Jiangsu Jet

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Beijing Airlines

List of Figures

- Figure 1: China Chartered Air Transport Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Chartered Air Transport Market Share (%) by Company 2025

List of Tables

- Table 1: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 2: China Chartered Air Transport Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Chartered Air Transport Market Revenue Million Forecast, by type 2020 & 2033

- Table 4: China Chartered Air Transport Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Chartered Air Transport Market ?

The projected CAGR is approximately 7.07%.

2. Which companies are prominent players in the China Chartered Air Transport Market ?

Key companies in the market include Beijing Airlines, Nanshan Jet Co Ltd, Reignwood Star General Aviation, Amber Aviation, Deerjet, ZYB Lily Jet Ltd *List Not Exhaustive, China Southern Airlines General Aviation, Sino Jet, Baa Jet Management Ltd, Donghai Jet Co Ltd, Jiangsu Jet.

3. What are the main segments of the China Chartered Air Transport Market ?

The market segments include type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for businesses; Increasing disposable income.

6. What are the notable trends driving market growth?

Booming Chartered Freight Transport Segment.

7. Are there any restraints impacting market growth?

Regulatory challenges; Infrastructure limitations.

8. Can you provide examples of recent developments in the market?

October 2023: Air Charter Services, the aircraft charter broker, has increased its efforts to concentrate on Shanghai and the surrounding provinces, including Zhejiang and Jiangsu, by relocating its office in Shanghai to bigger premises.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Chartered Air Transport Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Chartered Air Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Chartered Air Transport Market ?

To stay informed about further developments, trends, and reports in the China Chartered Air Transport Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence