Key Insights

The China digital freight forwarding market is poised for substantial expansion, driven by burgeoning e-commerce, escalating logistics demands, and government-led digitalization initiatives. Projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8%, the market is expected to reach approximately $4.9 billion by 2025. Key growth catalysts include the widespread adoption of digital platforms for operational streamlining, enhanced transparency, and cost reduction. Emerging trends like the integration of Artificial Intelligence (AI) and blockchain technology are significantly boosting supply chain efficiency and security. While cybersecurity infrastructure and legacy system integration present challenges, the market outlook remains exceptionally positive. Segmentation by firm type (SMEs, large enterprises, governments) and transportation mode (ocean, air, road, rail) reveals diverse opportunities for specialized providers. The competitive environment features prominent global players and a dynamic array of domestic companies, fostering innovation and robust growth.

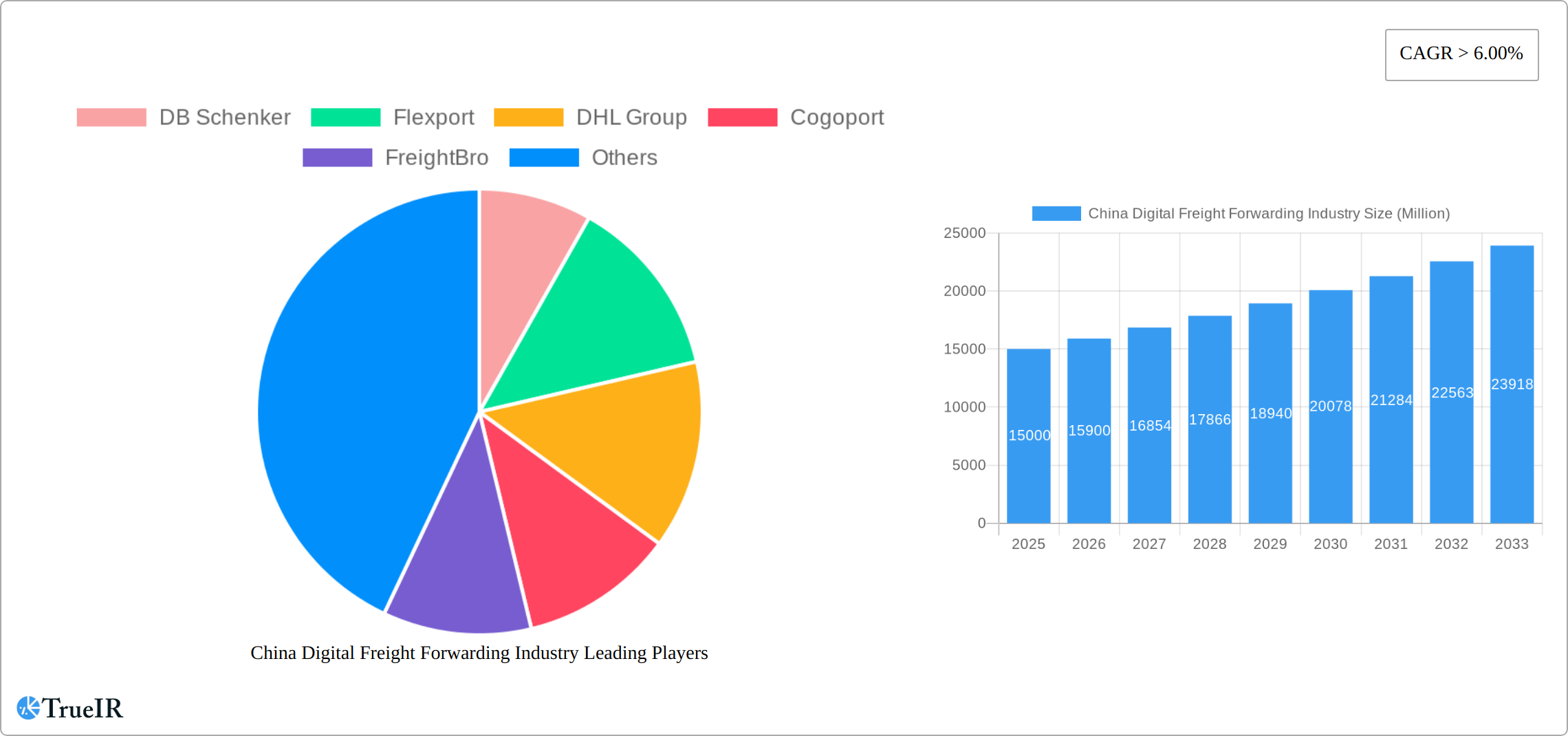

China Digital Freight Forwarding Industry Market Size (In Billion)

The competitive arena comprises both established international leaders and agile domestic innovators, reflecting a blend of extensive expertise and forward-thinking development. Tailored digital solutions are emerging for various transportation modes, addressing specific industry needs. The market's trajectory is closely linked to China's overall economic progress and its extensive infrastructure development. Furthermore, government regulations designed to optimize supply chain efficiency and transparency will be instrumental in shaping the future of digital freight forwarding. The forecast period of 2025-2033 indicates significant future growth, presenting a compelling investment opportunity for stakeholders seeking to capitalize on China's rapidly expanding digital economy. Sustained success will necessitate ongoing vigilance regarding technological advancements, evolving regulatory frameworks, and sector-specific challenges.

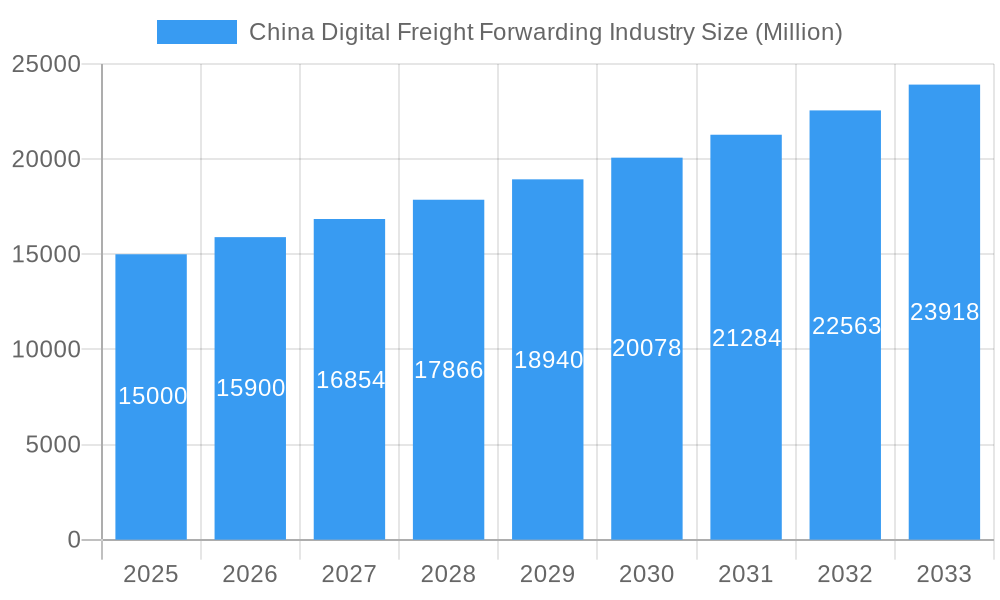

China Digital Freight Forwarding Industry Company Market Share

China Digital Freight Forwarding Industry: A Comprehensive Market Report (2019-2033)

This dynamic report provides an in-depth analysis of the burgeoning China digital freight forwarding industry, projecting a market valued at XXX Million by 2033. Leveraging extensive research and data analysis spanning the period 2019-2033 (base year 2025, forecast period 2025-2033), this report is an essential resource for investors, businesses, and policymakers seeking to navigate this rapidly evolving landscape. The report incorporates key market indicators, competitive analysis, and future growth projections to offer a comprehensive understanding of the industry's trajectory. High-volume keywords such as China digital freight forwarding, freight forwarding market size, digital logistics China, and China logistics industry are strategically integrated throughout to enhance search engine optimization.

China Digital Freight Forwarding Industry Market Structure & Competitive Landscape

The Chinese digital freight forwarding market is a dynamic arena where established global players and innovative domestic companies compete. While a few dominant players hold significant market share, the landscape is characterized by moderate concentration with numerous SMEs contributing to a highly competitive environment. Technological advancements, including AI, blockchain, and IoT, are driving innovation, resulting in streamlined operations, enhanced transparency, and improved efficiency. The market is significantly influenced by regulatory factors, notably the Chinese government's Belt and Road Initiative, which presents both considerable opportunities and challenges. Traditional freight forwarding methods, while still present, face increasing pressure from the cost-effectiveness and efficiency offered by digital solutions. The end-user market is diverse, encompassing SMEs, large enterprises, and government agencies, each with specific requirements and preferences. The period between 2019 and 2024 witnessed significant M&A activity, with approximately [Insert precise figure] in transactions, reflecting a trend of consolidation and expansion amongst key players. This consolidation is reshaping the market and creating larger, more integrated players capable of leveraging economies of scale and technological advancements.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) is estimated at [Insert precise figure], indicating a [Describe concentration level based on HHI, e.g., moderately concentrated] market.

- Innovation Drivers: AI-powered route optimization, blockchain-enhanced security and traceability, and IoT-enabled real-time cargo monitoring and predictive maintenance.

- Regulatory Impacts: Government policies promoting digitalization and facilitating cross-border trade significantly impact market growth and development.

- Product Substitutes: Traditional freight forwarding is increasingly challenged by the superior efficiency and cost-effectiveness of digital platforms.

- End-User Segmentation: SMEs ([Insert precise figure]), Large Enterprises ([Insert precise figure]), Government Agencies ([Insert precise figure])

- M&A Trends: A total of [Insert precise figure] M&A deals were recorded between 2019-2024, with a total value of approximately [Insert precise figure].

China Digital Freight Forwarding Industry Market Trends & Opportunities

The China digital freight forwarding market is experiencing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This expansion is fueled by several factors, including increasing e-commerce activity, the rising adoption of digital technologies across the supply chain, and the government's emphasis on logistics infrastructure development. The market size is expected to reach XXX Million by 2033, driven by heightened demand for efficient and transparent freight forwarding solutions. Technological shifts, including the integration of AI and big data analytics, are enhancing operational efficiency, reducing costs, and improving customer experience. Consumer preferences are shifting towards enhanced visibility, real-time tracking, and automated processes. Competitive dynamics are characterized by both cooperation and rivalry, with companies focusing on strategic alliances, technological innovation, and expansion into new markets. Market penetration rates for digital freight forwarding solutions are expected to reach xx% by 2033.

Dominant Markets & Segments in China Digital Freight Forwarding Industry

Coastal regions of China, especially those surrounding major ports like Shanghai, Shenzhen, and Ningbo, are the dominant markets within the digital freight forwarding industry. Among the market segments, large enterprises currently command the largest market share, owing to their substantial shipping volumes and proactive adoption of advanced technologies. Ocean freight is the predominant mode of transport, reflecting China's role as a global trade powerhouse. However, growth in air and rail freight is also notable, driven by e-commerce and infrastructure improvements respectively.

- By Firm Type:

- Large Enterprises: High adoption of digital solutions; substantial shipping volumes. Key Growth Drivers: Government initiatives supporting digitalization; demand for efficient supply chain management; need for data-driven decision-making.

- SMEs: Increasing adoption due to cost-effectiveness and user-friendliness. Key Growth Drivers: Affordable digital platforms; access to financing and training; simplified regulatory compliance.

- Government Agencies: Focus on infrastructure development and trade facilitation. Key Growth Drivers: Policy support for digital logistics; optimization of public procurement; improved transparency and accountability.

- By Mode of Transportation:

- Ocean Freight: Remains dominant due to China's extensive maritime trade. Key Growth Drivers: Increased global trade; development of smart ports and advanced terminal infrastructure.

- Air Freight: High-value and time-sensitive shipments fuel growth. Key Growth Drivers: E-commerce expansion; improvements in air cargo capacity and efficiency.

- Road Freight: Crucial for short-haul transport and last-mile delivery. Key Growth Drivers: Improved road infrastructure; development of intelligent logistics hubs and optimized routing systems.

- Rail Freight: Growing significance for long-haul transport. Key Growth Drivers: Investments in high-speed rail networks; enhanced intermodal connectivity; improved efficiency and reduced transit times.

China Digital Freight Forwarding Industry Product Analysis

Digital freight forwarding platforms offer a comprehensive suite of features aimed at streamlining logistics, enhancing visibility, and reducing costs. Core functionalities include real-time tracking and monitoring, automated documentation processing, optimized route planning and selection, and integrated payment gateways. Cutting-edge technologies like AI-powered predictive analytics and blockchain-based security are differentiating factors, significantly improving efficiency, transparency, and data security. The market exhibits a strong product-market fit, driven by the persistent demand for efficient and cost-effective logistics solutions across diverse industries. The integration of these technologies is creating a more resilient and transparent supply chain, benefiting businesses of all sizes.

Key Drivers, Barriers & Challenges in China Digital Freight Forwarding Industry

Key Drivers: Technological advancements, increasing e-commerce, government initiatives promoting digitalization, and expanding infrastructure are major propellants. For example, the Belt and Road Initiative has significantly improved connectivity, opening up new trade routes and fostering industry growth.

Challenges: Regulatory complexities, cybersecurity concerns, integration challenges with existing legacy systems, and intense competition from both domestic and international players present significant hurdles. Supply chain disruptions, such as those experienced during the COVID-19 pandemic, highlight the vulnerability of the industry to unforeseen events, impacting overall growth by an estimated xx%.

Growth Drivers in the China Digital Freight Forwarding Industry Market

Technological advancements, the rise of e-commerce, government support for digital infrastructure development, and increasing demand for efficient and transparent logistics solutions are key growth drivers. The Belt and Road Initiative continues to play a significant role, improving connectivity and fostering cross-border trade.

Challenges Impacting China Digital Freight Forwarding Industry Growth

Regulatory hurdles, cybersecurity risks, integration issues with legacy systems, supply chain vulnerabilities, and intense competition pose significant challenges. The unpredictable nature of global events, such as pandemics, can severely disrupt operations and impact growth.

Key Players Shaping the China Digital Freight Forwarding Industry Market

- DB Schenker

- Flexport

- DHL Group

- Cogoport

- FreightBro

- Kuehne + Nagel International AG

- WICE Logistics

- SINO SHIPPING

- Twill

- Youtrans

- MOOV

- Full Truck Alliance (Manbang group)

- Freightos

- Agility Logistics Pvt Ltd (Shipa Freight)

Significant China Digital Freight Forwarding Industry Milestones

- 2020: Several major players launched AI-powered freight optimization tools.

- 2021: The Chinese government implemented new regulations aimed at improving data security in the logistics sector.

- 2022: Significant M&A activity among digital freight forwarding companies.

- 2023: Increased adoption of blockchain technology for enhancing supply chain transparency and security.

Future Outlook for China Digital Freight Forwarding Industry Market

The China digital freight forwarding market is poised for continued robust growth, driven by technological innovation, increasing e-commerce activity, and supportive government policies. Strategic opportunities exist for companies focused on developing advanced technologies, expanding into underserved markets, and fostering strategic partnerships. The market’s potential is immense, with the digitalization of the logistics sector expected to significantly enhance efficiency, transparency, and sustainability across the supply chain.

China Digital Freight Forwarding Industry Segmentation

-

1. Mode of Transportation

- 1.1. Ocean

- 1.2. Air

- 1.3. Road

- 1.4. Rail

-

2. Firm Type

- 2.1. SMEs

- 2.2. Large Enterprises and Governments

China Digital Freight Forwarding Industry Segmentation By Geography

- 1. China

China Digital Freight Forwarding Industry Regional Market Share

Geographic Coverage of China Digital Freight Forwarding Industry

China Digital Freight Forwarding Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS

- 3.3. Market Restrains

- 3.3.1. 4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES

- 3.4. Market Trends

- 3.4.1. Rise in E-Commerce Sector Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Digital Freight Forwarding Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 5.1.1. Ocean

- 5.1.2. Air

- 5.1.3. Road

- 5.1.4. Rail

- 5.2. Market Analysis, Insights and Forecast - by Firm Type

- 5.2.1. SMEs

- 5.2.2. Large Enterprises and Governments

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Mode of Transportation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Flexport

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DHL Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cogoport

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FreightBro

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel International AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 WICE Logistics**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SINO SHIPPING

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Twill

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Youtrans

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 MOOV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Full Truck Alliance (Manbang group)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Freightos

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Agility Logistics Pvt Ltd (Shipa Freight)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Digital Freight Forwarding Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Digital Freight Forwarding Industry Share (%) by Company 2025

List of Tables

- Table 1: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 2: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 3: China Digital Freight Forwarding Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Digital Freight Forwarding Industry Revenue billion Forecast, by Mode of Transportation 2020 & 2033

- Table 5: China Digital Freight Forwarding Industry Revenue billion Forecast, by Firm Type 2020 & 2033

- Table 6: China Digital Freight Forwarding Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Digital Freight Forwarding Industry?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the China Digital Freight Forwarding Industry?

Key companies in the market include DB Schenker, Flexport, DHL Group, Cogoport, FreightBro, Kuehne + Nagel International AG, WICE Logistics**List Not Exhaustive, SINO SHIPPING, Twill, Youtrans, MOOV, Full Truck Alliance (Manbang group), Freightos, Agility Logistics Pvt Ltd (Shipa Freight).

3. What are the main segments of the China Digital Freight Forwarding Industry?

The market segments include Mode of Transportation, Firm Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.9 billion as of 2022.

5. What are some drivers contributing to market growth?

4.; PHARMACEUTICAL INDUSTRY GROWTH4.; RISING FRESH PRODUCE IMPORTS FROM MEXICO4.; INCREASING POPULARITY OF FROZEN FOODS.

6. What are the notable trends driving market growth?

Rise in E-Commerce Sector Driving the Market.

7. Are there any restraints impacting market growth?

4.; EMISSIONS FROM COLD CHAIN OPERATIONS4.; LABOUR SHORTAGES.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Digital Freight Forwarding Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Digital Freight Forwarding Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Digital Freight Forwarding Industry?

To stay informed about further developments, trends, and reports in the China Digital Freight Forwarding Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence