Key Insights

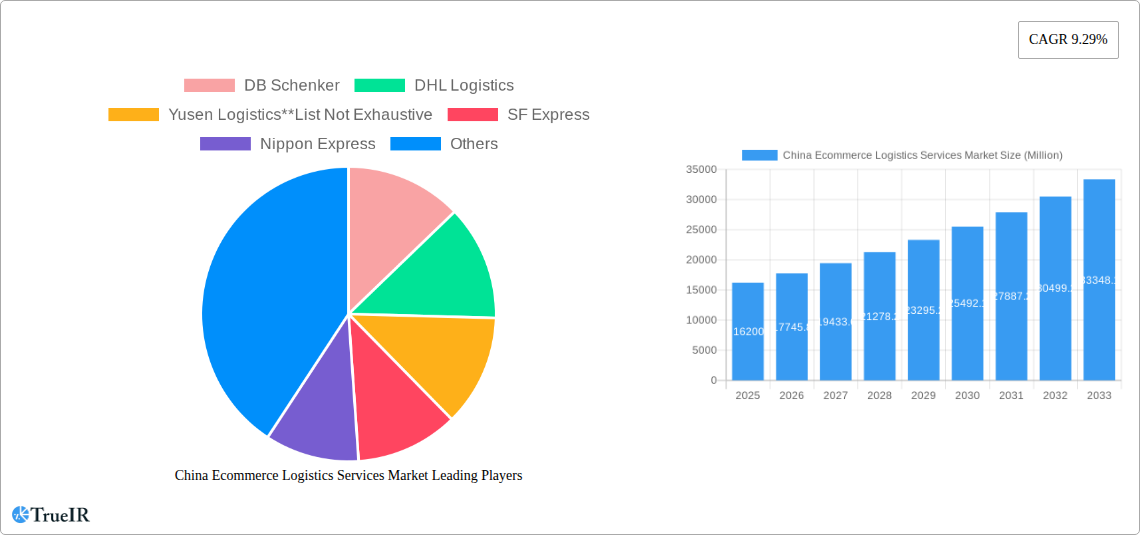

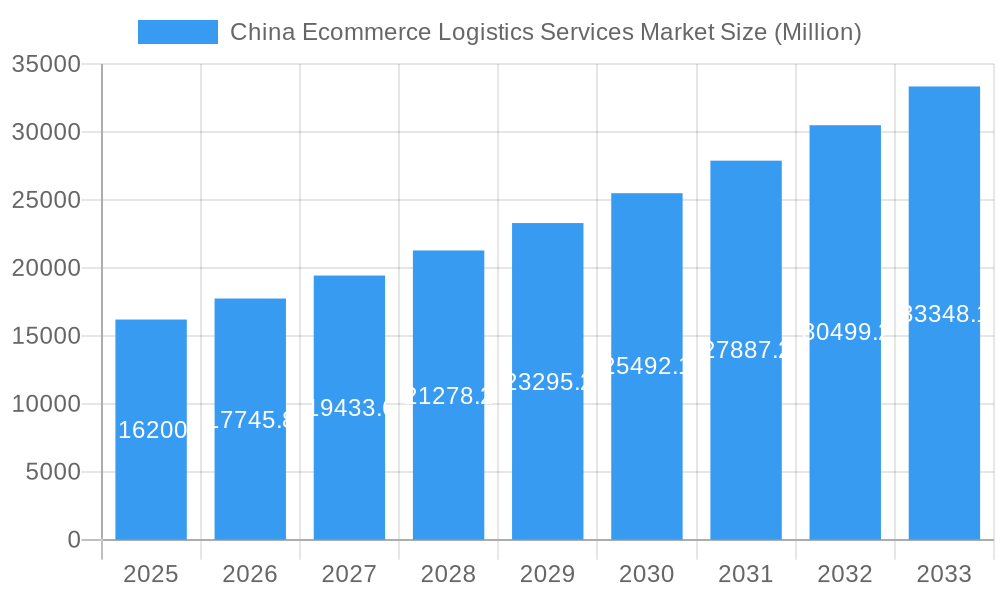

The China e-commerce logistics services market is experiencing robust growth, projected to reach \$16.20 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 9.29% from 2025 to 2033. This expansion is driven by several key factors. The explosive growth of e-commerce in China, fueled by increasing internet and smartphone penetration, coupled with a burgeoning middle class and a preference for online shopping, is a primary driver. Furthermore, the increasing demand for faster and more efficient delivery services, including same-day and next-day options, is pushing innovation within the logistics sector. Consumers expect seamless and transparent tracking, and businesses are investing heavily in technology such as AI and big data analytics to optimize operations and enhance customer experience. The market is segmented by service type (transportation, warehousing, value-added services), business model (B2B, B2C), destination (domestic, international), and product categories (fashion, electronics, home appliances, etc.), each exhibiting unique growth trajectories. The dominance of major players like DHL, FedEx, and SF Express, alongside regional players, contributes to a competitive yet rapidly evolving market landscape.

China Ecommerce Logistics Services Market Market Size (In Billion)

The significant restraints on market growth include infrastructural limitations in certain regions, particularly in rural areas, and the increasing costs associated with labor and fuel. Stricter regulations regarding cross-border e-commerce logistics and environmental concerns regarding transportation emissions also pose challenges. However, ongoing investments in logistics infrastructure, technological advancements in automation and robotics, and government support for the development of efficient and sustainable logistics solutions are expected to mitigate these challenges in the long term. The market's future growth will depend significantly on the continued expansion of e-commerce, the adoption of innovative technologies, and the ability of logistics providers to adapt to changing consumer demands and regulatory landscapes. The continued rise of mobile commerce and the increasing popularity of online marketplaces are poised to further fuel this growth.

China Ecommerce Logistics Services Market Company Market Share

China Ecommerce Logistics Services Market: A Comprehensive Report (2019-2033)

This dynamic report offers a deep dive into the burgeoning China Ecommerce Logistics Services Market, providing critical insights for businesses seeking to navigate this rapidly evolving landscape. With a detailed analysis spanning the period 2019-2033, including a base year of 2025 and a forecast period of 2025-2033, this report is essential reading for investors, strategists, and industry professionals. The market is projected to reach xx Million by 2033, presenting significant opportunities for growth and investment. Key segments analyzed include transportation, warehousing, value-added services, B2B/B2C models, domestic/international logistics, and various product categories. Leading players like DHL Logistics, SF Express, and FedEx Express are profiled, alongside an examination of market concentration, competitive dynamics, and future trends.

China Ecommerce Logistics Services Market Market Structure & Competitive Landscape

The China ecommerce logistics services market exhibits a moderately concentrated structure, with several large players dominating the landscape. The Herfindahl-Hirschman Index (HHI) is estimated at xx in 2025, indicating a moderately concentrated market. However, the presence of numerous smaller, specialized logistics providers fosters competition. Key innovation drivers include advancements in automation, AI-powered solutions, and the adoption of blockchain technology to enhance transparency and efficiency. Regulatory impacts, primarily from government policies on cross-border e-commerce and data privacy, significantly influence market operations. Product substitutes, such as in-house logistics solutions, are limited due to the scale and complexity of the Chinese market.

End-user segmentation is predominantly driven by the B2C sector's explosive growth, followed by the B2B segment. Mergers and acquisitions (M&A) activity has been moderate in recent years, with a total M&A volume of approximately xx Million in 2024, driven primarily by consolidation efforts among smaller companies. This trend is expected to continue, as larger players seek to expand their market share and service offerings.

- Market Concentration: Moderately concentrated, HHI estimated at xx in 2025.

- Innovation Drivers: Automation, AI, blockchain technology.

- Regulatory Impacts: Cross-border e-commerce regulations, data privacy laws.

- M&A Activity: Moderate, with xx Million in volume in 2024.

- End-User Segmentation: Dominated by B2C, followed by B2B.

China Ecommerce Logistics Services Market Market Trends & Opportunities

The China e-commerce logistics services market is experiencing a period of dynamic and sustained expansion, propelled by the relentless growth of online retail, escalating consumer purchasing power, and a burgeoning middle class with higher disposable incomes. Projections indicate the market will achieve a Compound Annual Growth Rate (CAGR) of **[Insert CAGR Percentage Here]** from 2025 to 2033, culminating in a market valuation of **[Insert Market Size Million Here]** by 2033. This upward trajectory is further amplified by the widespread adoption of mobile commerce, the surging popularity of cross-border e-commerce, and proactive government initiatives aimed at bolstering and modernizing logistics infrastructure across the nation. The integration of cutting-edge technologies, including sophisticated drone delivery systems and autonomous vehicle fleets, is significantly enhancing operational efficiency and driving down logistical costs. Concurrently, evolving consumer expectations for expedited delivery times and unparalleled convenience are compelling logistics providers to continuously innovate and adapt their service offerings. Intensified market competition is acting as a catalyst for the adoption of advanced technologies and the refinement of service portfolios, fostering a vibrant and highly competitive marketplace. While major urban centers boast high market penetration, the relatively lower penetration rates in rural areas present a significant and lucrative growth frontier.

Dominant Markets & Segments in China Ecommerce Logistics Services Market

An in-depth examination of the China e-commerce logistics services market reveals a complex and dynamic landscape of dominant markets and segments, each contributing to the overall growth. The key areas of influence are:

By Service: Transportation continues to be the cornerstone of the market, accounting for the largest share due to the sheer volume of goods in transit. However, Warehousing and Inventory Management are witnessing remarkable growth as businesses prioritize efficient inventory control, strategic storage, and fulfillment operations. Furthermore, Value-Added Services, encompassing critical functions such as specialized labeling, custom packaging, and quality control, are experiencing a substantial uplift as enterprises strive to optimize their supply chains and elevate the customer unboxing experience.

By Business: The Business-to-Consumer (B2C) sector overwhelmingly dictates market dynamics, largely fueled by the explosive expansion of online retail and direct-to-consumer sales. While currently smaller, the Business-to-Business (B2B) segment is demonstrating consistent and promising growth as businesses increasingly integrate e-commerce platforms for procurement, supply chain management, and inter-enterprise distribution.

By Destination: Domestic Logistics commands the largest market share, a direct reflection of China's immense internal consumer base and vast geographical reach. Simultaneously, International/Cross-Border E-commerce Logistics is experiencing exponential growth, presenting a substantial and rapidly expanding avenue for logistics providers seeking global outreach and diversification.

By Product: Key product categories driving significant logistics activity include Fashion and Apparel, Consumer Electronics, and Beauty and Personal Care products. These segments are characterized by high purchase volumes, frequent transactions, and evolving consumer trends, necessitating agile and efficient logistics solutions.

- Key Growth Drivers:

- Expansive Infrastructure Development: Continuous and substantial government investment in developing state-of-the-art transportation networks, advanced warehousing facilities, and efficient distribution hubs.

- Supportive Regulatory Environment: Proactive government policies and favorable regulations designed to foster and accelerate the growth of the e-commerce ecosystem.

- Pervasive Technological Adoption: The widespread integration of automation, Artificial Intelligence (AI), the Internet of Things (IoT), and advanced data analytics to optimize operations.

- Sustained Rise in Disposable Incomes: A growing affluent population with increasing discretionary spending power, directly fueling higher online shopping frequencies and volumes.

China Ecommerce Logistics Services Market Product Analysis

Product innovation within the China e-commerce logistics services market is laser-focused on delivering enhanced speed, unparalleled efficiency, and absolute transparency throughout the supply chain. The integration of advanced technologies, such as sophisticated AI and machine learning algorithms, is revolutionizing predictive analytics for demand forecasting, optimizing delivery routes in real-time, and automating sorting processes in fulfillment centers. The market's receptiveness to these innovations is exceptionally high, driven by both businesses and consumers who increasingly demand faster, more reliable, and cost-effective logistics solutions. Emerging products and services are meticulously designed to address specific market needs, including the provision of same-day and even sub-same-day delivery options, the development of customized and sustainable packaging solutions, and the implementation of highly granular tracking capabilities that provide end-to-end visibility. The overarching trend is the development and deployment of comprehensive, integrated, end-to-end solutions that seamlessly connect every facet of the supply chain, from initial order placement and precise fulfillment to agile and responsive last-mile delivery.

Key Drivers, Barriers & Challenges in China Ecommerce Logistics Services Market

Key Drivers: The explosive growth of e-commerce, particularly mobile e-commerce, is a primary driver. Government initiatives promoting infrastructure development and logistical efficiency are also significant. Technological advancements, such as the use of AI and automation, are streamlining operations and reducing costs. Increased consumer spending and a shift towards online shopping are further boosting market growth.

Key Challenges: Supply chain disruptions, particularly concerning cross-border logistics, present a significant challenge. Regulatory hurdles, including customs clearance procedures and data privacy regulations, can impede growth. Intense competition among logistics providers necessitates continuous innovation and cost optimization. The vast geographical expanse of China poses challenges in ensuring consistent service quality across different regions. Maintaining high service standards while managing increasing volumes and demand is another notable challenge.

Growth Drivers in the China Ecommerce Logistics Services Market Market

The market's growth is fueled by the rapid expansion of e-commerce, government support for logistics infrastructure, technological advancements in automation and AI, and the rising disposable incomes of Chinese consumers. The increasing demand for faster and more reliable delivery services is another key driver.

Challenges Impacting China Ecommerce Logistics Services Market Growth

Challenges include supply chain disruptions, stringent regulatory frameworks, intense competition, and the need for continuous investment in technology and infrastructure to maintain efficiency and scalability in a geographically diverse market. These factors can constrain the market's growth trajectory.

Key Players Shaping the China Ecommerce Logistics Services Market Market

- DB Schenker

- DHL Logistics

- Yusen Logistics

- SF Express

- Nippon Express

- XPO Logistics

- CEVA Logistics

- VHK Logistics

- CTS International Logistics

- FedEx Express

Significant China Ecommerce Logistics Services Market Industry Milestones

- October 2023: DHL further solidified its presence and capabilities in China with the inauguration of a new, advanced gateway facility in Wuxi. This strategic expansion significantly enhances its service capacity and network reach across East China. In tandem, DHL expanded its crucial North Asia Hub in Shanghai Pudong, bolstering network resilience and operational efficiency in a key region.

- May 2023: FedEx Express forged a significant partnership with the Guangzhou Municipal Government. This collaboration is designed to streamline customs clearance processes, bolster international e-commerce operations, and optimize overall logistics performance within South China. This strategic alliance not only reinforces FedEx's market position in the region but also actively supports Guangzhou's ambition to become a leading international cargo hub.

Future Outlook for China Ecommerce Logistics Services Market Market

The future trajectory of the China e-commerce logistics services market is exceptionally promising, characterized by continued robust growth fueled by the persistent expansion of the e-commerce sector, the ongoing integration of transformative technological advancements, and the sustained support of favorable government policies. Strategic investment opportunities abound in the realms of advanced automation, AI-powered predictive and operational solutions, and the development of innovative, customer-centric last-mile delivery strategies. The market's inherent potential is substantial, offering considerable scope for expansion within both the burgeoning domestic e-commerce segments and the rapidly growing cross-border e-commerce arena. Furthermore, a dedicated focus on enhancing and developing rural logistics infrastructure will unlock new market territories and serve as a powerful catalyst for sustained and widespread future expansion.

China Ecommerce Logistics Services Market Segmentation

-

1. Service

- 1.1. Transportation

- 1.2. Warehousing and Inventory management

- 1.3. Value-Added Services (Labeling, Packaging, etc)

-

2. Business

- 2.1. B2B

- 2.2. B2C

-

3. Destination

- 3.1. Domestic

- 3.2. International/Cross-border

-

4. Product

- 4.1. Fashion and Apparel

- 4.2. Consumer Electronics

- 4.3. Home Appliances

- 4.4. Furniture

- 4.5. Beauty and Personal Care Products

- 4.6. Other Products (Toys, Food Products, etc.)

China Ecommerce Logistics Services Market Segmentation By Geography

- 1. China

China Ecommerce Logistics Services Market Regional Market Share

Geographic Coverage of China Ecommerce Logistics Services Market

China Ecommerce Logistics Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Booming mobile commerce; Massive online market

- 3.3. Market Restrains

- 3.3.1. Geographic size and population density; Fragmented supply chain

- 3.4. Market Trends

- 3.4.1. Cross border eCommerce driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Ecommerce Logistics Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Transportation

- 5.1.2. Warehousing and Inventory management

- 5.1.3. Value-Added Services (Labeling, Packaging, etc)

- 5.2. Market Analysis, Insights and Forecast - by Business

- 5.2.1. B2B

- 5.2.2. B2C

- 5.3. Market Analysis, Insights and Forecast - by Destination

- 5.3.1. Domestic

- 5.3.2. International/Cross-border

- 5.4. Market Analysis, Insights and Forecast - by Product

- 5.4.1. Fashion and Apparel

- 5.4.2. Consumer Electronics

- 5.4.3. Home Appliances

- 5.4.4. Furniture

- 5.4.5. Beauty and Personal Care Products

- 5.4.6. Other Products (Toys, Food Products, etc.)

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Yusen Logistics**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SF Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nippon Express

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 XPO Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CEVA Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 VHK Logistics

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 CTS International Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 FedEx Express

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Ecommerce Logistics Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Ecommerce Logistics Services Market Share (%) by Company 2025

List of Tables

- Table 1: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 3: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 4: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: China Ecommerce Logistics Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: China Ecommerce Logistics Services Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: China Ecommerce Logistics Services Market Revenue Million Forecast, by Business 2020 & 2033

- Table 8: China Ecommerce Logistics Services Market Revenue Million Forecast, by Destination 2020 & 2033

- Table 9: China Ecommerce Logistics Services Market Revenue Million Forecast, by Product 2020 & 2033

- Table 10: China Ecommerce Logistics Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Ecommerce Logistics Services Market?

The projected CAGR is approximately 9.29%.

2. Which companies are prominent players in the China Ecommerce Logistics Services Market?

Key companies in the market include DB Schenker, DHL Logistics, Yusen Logistics**List Not Exhaustive, SF Express, Nippon Express, XPO Logistics, CEVA Logistics, VHK Logistics, CTS International Logistics, FedEx Express.

3. What are the main segments of the China Ecommerce Logistics Services Market?

The market segments include Service, Business, Destination, Product.

4. Can you provide details about the market size?

The market size is estimated to be USD 16.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Booming mobile commerce; Massive online market.

6. What are the notable trends driving market growth?

Cross border eCommerce driving the growth of the market.

7. Are there any restraints impacting market growth?

Geographic size and population density; Fragmented supply chain.

8. Can you provide examples of recent developments in the market?

October 2023: DHL inaugurated a new gateway in Wuxi, Jiangsu Province, East China, as part of its ongoing expansion initiatives. Simultaneously, DHL is extending its North Asia Hub in Shanghai Pudong, reinforcing the company's network resilience and service capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Ecommerce Logistics Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Ecommerce Logistics Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Ecommerce Logistics Services Market?

To stay informed about further developments, trends, and reports in the China Ecommerce Logistics Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence