Key Insights

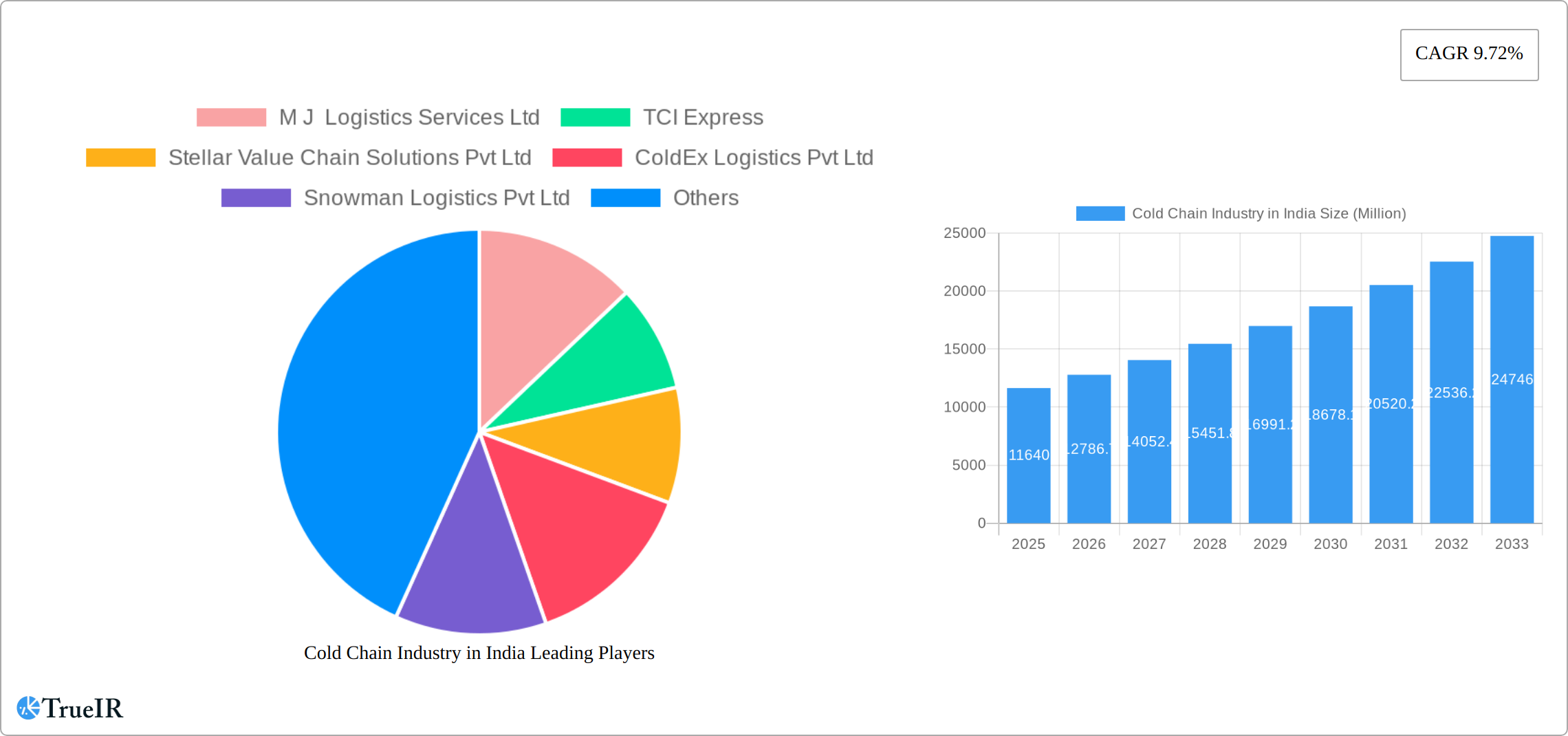

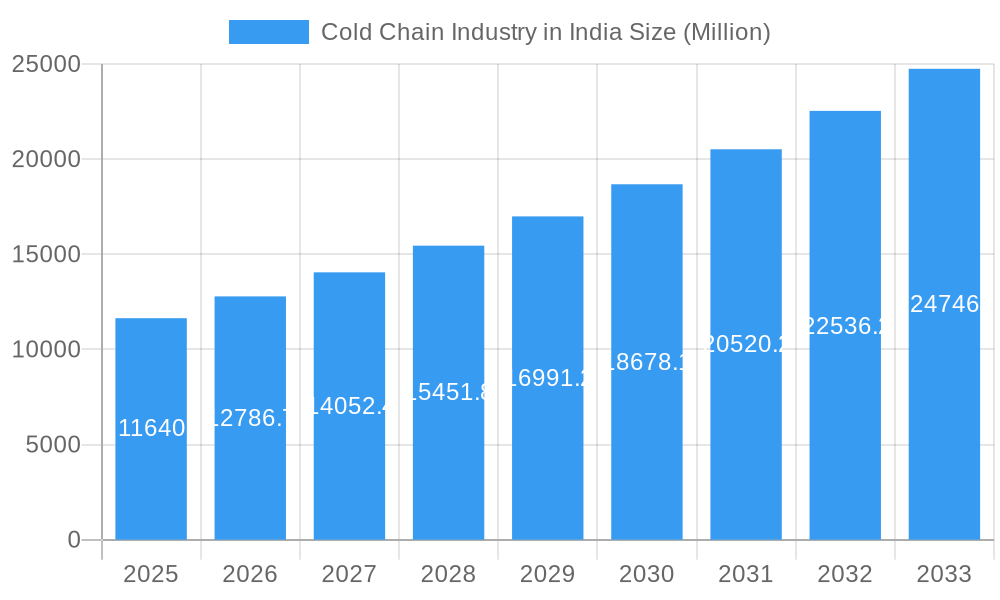

The Indian cold chain industry is experiencing robust growth, projected to reach a market size of $11.64 billion in 2025, expanding at a Compound Annual Growth Rate (CAGR) of 9.72% from 2025 to 2033. This surge is driven by several key factors. The increasing demand for perishable goods, particularly fresh produce, dairy products, and seafood, fuels the need for efficient cold chain infrastructure. Furthermore, rising disposable incomes, changing consumer preferences towards processed and convenient foods, and the expansion of organized retail are contributing significantly to market growth. Government initiatives promoting agricultural development and infrastructure improvements further bolster the sector. While challenges like inadequate cold storage facilities in certain regions and high infrastructure costs persist, technological advancements such as improved temperature monitoring systems, better packaging solutions, and the adoption of IoT-enabled logistics are mitigating these obstacles. The segmentation reveals a diverse landscape, with significant opportunities in value-added services like blast freezing and inventory management, particularly across horticulture, dairy, and processed food applications. Regional variations exist, with potentially higher growth rates anticipated in regions with higher agricultural output and expanding consumer bases.

Cold Chain Industry in India Market Size (In Billion)

The industry's evolution is marked by several key trends. The increasing adoption of technology, particularly in tracking and monitoring, enhances efficiency and reduces spoilage. Consolidation among cold chain logistics providers is creating larger, more integrated players with better reach and service capabilities. Furthermore, a growing focus on sustainability and environmentally friendly practices is driving the adoption of energy-efficient cold storage technologies. The expansion of e-commerce and the rise of online grocery deliveries present significant growth avenues, demanding further investment in cold chain infrastructure and logistics solutions to meet the evolving consumer expectations. Competition is intensifying, with both established players and new entrants vying for market share. To remain competitive, companies must invest in technology, optimize operations, and offer value-added services to cater to the diverse needs of various segments.

Cold Chain Industry in India Company Market Share

Cold Chain Industry in India: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the burgeoning cold chain industry in India, offering invaluable insights for investors, businesses, and stakeholders. We delve into market structure, competitive dynamics, growth drivers, and future projections, supported by robust data and industry expertise. The report covers the period 2019-2033, with a focus on 2025, incorporating recent developments and forecasting future trends. The Indian cold chain market, valued at xx Million in 2024, is poised for significant expansion, presenting lucrative opportunities across various segments.

Cold Chain Industry in India Market Structure & Competitive Landscape

The Indian cold chain industry is characterized by a moderately fragmented structure, with a few large players and numerous smaller regional operators. The market concentration ratio (CR4) is estimated at xx%, indicating a relatively competitive landscape. However, consolidation is expected to increase through mergers and acquisitions (M&A) activity. In the past five years, the M&A volume has been approximately xx deals, with a significant portion driven by larger players expanding their geographical reach and service offerings. Innovation is a key driver, with companies investing in technology upgrades to enhance efficiency, reduce spoilage, and improve traceability. Regulatory frameworks, including food safety standards and infrastructure development initiatives, significantly impact the industry. Product substitution, particularly in packaging and transportation, is limited due to the specialized nature of cold chain logistics. End-user segmentation is diverse, with key applications spanning horticulture, dairy, meat, pharmaceuticals, and more.

- Market Concentration: CR4 estimated at xx%

- M&A Activity: Approximately xx deals in the past five years

- Key Innovation Drivers: Technological advancements in temperature control, automation, and tracking systems

- Regulatory Impacts: Food safety regulations, infrastructure development policies

- End-User Segmentation: Horticulture, dairy, meat, pharmaceuticals, etc.

Cold Chain Industry in India Market Trends & Opportunities

The Indian cold chain market exhibits robust growth, driven by rising disposable incomes, evolving consumer preferences for fresh and processed food, and the expanding organized retail sector. The market size is projected to reach xx Million by 2033, registering a CAGR of xx% during the forecast period (2025-2033). Technological advancements, including the adoption of IoT, AI, and blockchain, are transforming the industry, improving efficiency and transparency. Consumer preferences for high-quality, safe, and convenient food products are fueling demand for sophisticated cold chain solutions. Competitive dynamics are intense, with companies focusing on expanding their network, enhancing service offerings, and investing in technological upgrades to gain a competitive edge. Market penetration rates vary across different applications and regions, with higher penetration observed in urban areas and for high-value products. The emergence of e-commerce and the growth of organized retail are creating significant opportunities for cold chain providers.

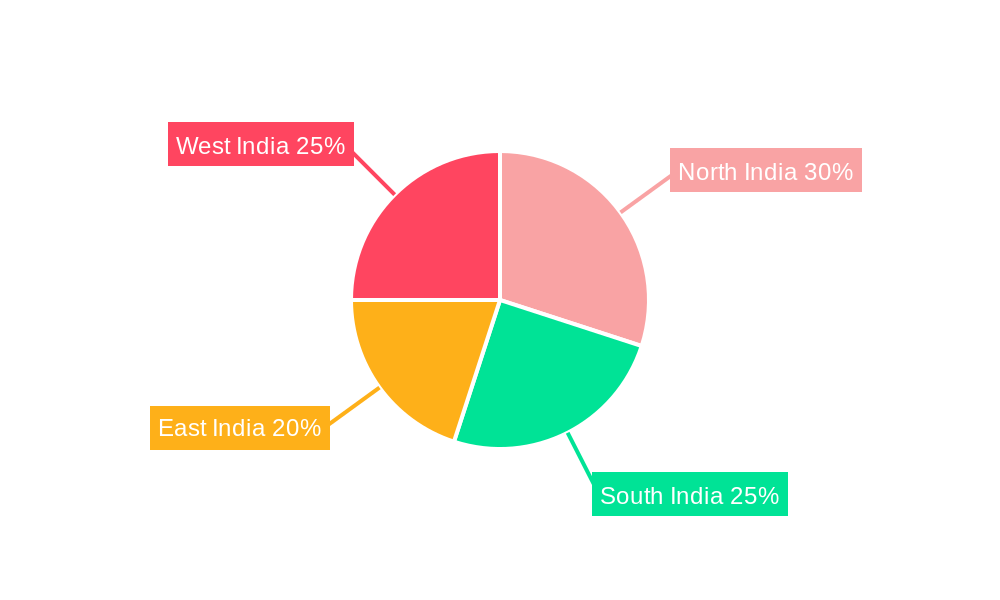

Dominant Markets & Segments in Cold Chain Industry in India

India's cold chain industry presents a diverse landscape of growth opportunities, significantly influenced by geographical factors. While major metropolitan areas and agriculturally rich states dominate in terms of infrastructure and market size, the entire nation offers substantial potential. Key market segments are:

- By Service Type: Transportation currently commands the largest market share, followed by warehousing and value-added services such as processing, packaging, and labeling. The increasing demand for integrated solutions is driving growth in companies offering a complete suite of services.

- By Temperature Range: Frozen storage and transportation remain significant due to the prevalence of frozen food products. However, the chilled segment is experiencing rapid expansion, fueled by the increasing popularity of fresh produce and dairy products requiring specific temperature control.

- By Application: The horticulture sector (fruits and vegetables) and dairy remain cornerstone segments. Pharmaceuticals and life sciences represent a rapidly expanding area, driven by the stringent cold chain requirements for temperature-sensitive medications, vaccines, and biologicals. Other key applications include seafood, meat, and processed foods.

Key Growth Catalysts:

- Government Initiatives: The Indian government's proactive policies, including infrastructure development programs, investment incentives, and modernization schemes specifically targeted at the cold chain sector, are significantly boosting growth. These initiatives aim to improve accessibility and efficiency across the country.

- Technological Advancements: The integration of Internet of Things (IoT) devices, Artificial Intelligence (AI) for predictive maintenance and route optimization, and blockchain technology for enhanced traceability and transparency is revolutionizing cold chain operations, minimizing losses, and improving efficiency.

- Rising Disposable Incomes & Changing Consumer Preferences: A burgeoning middle class with increased purchasing power fuels the demand for high-quality, convenient food products, driving the need for robust and reliable cold chain infrastructure to maintain product freshness and safety.

- E-commerce Boom: The rapid expansion of e-commerce, particularly in grocery and food delivery, necessitates advanced cold chain solutions to ensure timely and safe delivery of perishable goods to consumers.

Cold Chain Industry in India Product Analysis

Product innovation is central to the industry's evolution. Focus areas include sophisticated temperature control systems capable of maintaining precise temperature ranges, improved packaging materials designed to minimize spoilage and extend shelf life, and the incorporation of advanced tracking and monitoring technologies for real-time visibility of product location and condition. The adoption of IoT devices, next-generation refrigeration systems utilizing energy-efficient technologies, and specialized containers designed for specific product types are key trends. Competitive advantages are increasingly derived from technological sophistication, superior service quality, reliable and extensive logistics networks, and strong customer relationships built on trust and transparency. The market is consolidating toward integrated solutions that seamlessly combine storage, transportation, and value-added services into a cohesive, efficient supply chain.

Key Drivers, Barriers & Challenges in Cold Chain Industry in India

Key Drivers:

- Growing organized retail sector: Increased demand for sophisticated cold chain solutions.

- Rising disposable incomes and changing lifestyles: Increased consumption of temperature-sensitive products.

- Government initiatives: Focus on infrastructure development and food safety regulations.

Challenges:

- High infrastructure costs: Significant investments are required to build and maintain cold chain infrastructure, especially in rural areas. The current infrastructure deficit limits potential market expansion.

- Lack of skilled workforce: A shortage of trained personnel in cold chain operations hinders efficiency and reliability.

- Regulatory hurdles and lack of standardization: Variations in regulations across states create complexities for operations.

Growth Drivers in the Cold Chain Industry in India Market

The Indian cold chain market's impressive growth trajectory is fueled by a confluence of factors. The escalating demand for fresh and processed food products, coupled with government initiatives aimed at modernizing and expanding cold chain infrastructure, is a major driver. Furthermore, rapid technological advancements and the explosive growth of e-commerce are creating significant opportunities for industry players. These dynamic forces are projected to fuel substantial market expansion in the years to come, presenting both challenges and substantial rewards for businesses operating within this sector.

Challenges Impacting Cold Chain Industry in India Growth

Despite the significant growth potential, several challenges hinder the full realization of the Indian cold chain industry's potential. High capital investment requirements for infrastructure development and technological upgrades remain a significant barrier to entry for many players. A shortage of skilled manpower, particularly in specialized areas like refrigeration technology and logistics management, poses a constraint on operational efficiency. Inadequate infrastructure in certain regions, particularly in remote and rural areas, limits accessibility and increases transportation costs. Finally, inconsistencies in regulatory frameworks and compliance requirements across different states create complexity and hinder seamless operations. Addressing these issues through strategic interventions, including public-private partnerships, skills development programs, and regulatory harmonization, is crucial for ensuring the sustainable and inclusive growth of the industry.

Key Players Shaping the Cold Chain Industry in India Market

- M J Logistics Services Ltd

- TCI Express

- Stellar Value Chain Solutions Pvt Ltd

- ColdEx Logistics Pvt Ltd

- Snowman Logistics Pvt Ltd

- R K Foodland Private Ltd

- Gubba Cold Storages Ltd

- Gati Kausar India Pvt Ltd

- Fresh and Healthy Services Ltd

- Future Supply Chain Solutions

- Cold Star Logistics Pvt Ltd

- 63 Other Companies

Significant Cold Chain Industry in India Industry Milestones

- January 2024: Snowman Logistics significantly expands its presence in Northeast India by adding a new multi-temperature warehouse in Guwahati, Assam, increasing its capacity by 5,152 pallets. This strategic move strengthens their network reach and capacity in a key growth region.

- December 2023: TCI Express demonstrates its commitment to growth by expanding its Rail Express vertical. This expansion significantly increases their customer base and enhances their network reach, offering improved connectivity and efficiency for cold chain transportation.

- [Add more recent milestones here with dates and brief descriptions. Include details of new technologies adopted, mergers & acquisitions, expansion projects etc.]

Future Outlook for Cold Chain Industry in India Market

The Indian cold chain industry is poised for robust growth, driven by increasing demand, technological innovations, and government support. Significant opportunities exist in expanding into underserved regions, improving infrastructure, and adopting advanced technologies. The market is expected to continue its expansion, creating a favorable environment for investment and growth.

Cold Chain Industry in India Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits & Vegetables)

- 3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 3.3. Meats, Fish, Poultry

- 3.4. Processed Food Products

- 3.5. Pharma, Life Sciences, and Chemicals

- 3.6. Other Applications

Cold Chain Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold Chain Industry in India Regional Market Share

Geographic Coverage of Cold Chain Industry in India

Cold Chain Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Urbanization and Changes in Lifestyles4.; Increased Organized Food in Retail Stores4.; Increasing Demand from the Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Sufficient Infrastructure

- 3.4. Market Trends

- 3.4.1. Chilled Segment is Gaining Huge Momentum in the Coming Years

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits & Vegetables)

- 5.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 5.3.3. Meats, Fish, Poultry

- 5.3.4. Processed Food Products

- 5.3.5. Pharma, Life Sciences, and Chemicals

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Storage

- 6.1.2. Transportation

- 6.1.3. Value-ad

- 6.2. Market Analysis, Insights and Forecast - by Temperature Type

- 6.2.1. Chilled

- 6.2.2. Frozen

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Horticulture (Fresh Fruits & Vegetables)

- 6.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 6.3.3. Meats, Fish, Poultry

- 6.3.4. Processed Food Products

- 6.3.5. Pharma, Life Sciences, and Chemicals

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. South America Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Storage

- 7.1.2. Transportation

- 7.1.3. Value-ad

- 7.2. Market Analysis, Insights and Forecast - by Temperature Type

- 7.2.1. Chilled

- 7.2.2. Frozen

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Horticulture (Fresh Fruits & Vegetables)

- 7.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 7.3.3. Meats, Fish, Poultry

- 7.3.4. Processed Food Products

- 7.3.5. Pharma, Life Sciences, and Chemicals

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Europe Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Storage

- 8.1.2. Transportation

- 8.1.3. Value-ad

- 8.2. Market Analysis, Insights and Forecast - by Temperature Type

- 8.2.1. Chilled

- 8.2.2. Frozen

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Horticulture (Fresh Fruits & Vegetables)

- 8.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 8.3.3. Meats, Fish, Poultry

- 8.3.4. Processed Food Products

- 8.3.5. Pharma, Life Sciences, and Chemicals

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East & Africa Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Storage

- 9.1.2. Transportation

- 9.1.3. Value-ad

- 9.2. Market Analysis, Insights and Forecast - by Temperature Type

- 9.2.1. Chilled

- 9.2.2. Frozen

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Horticulture (Fresh Fruits & Vegetables)

- 9.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 9.3.3. Meats, Fish, Poultry

- 9.3.4. Processed Food Products

- 9.3.5. Pharma, Life Sciences, and Chemicals

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Asia Pacific Cold Chain Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Storage

- 10.1.2. Transportation

- 10.1.3. Value-ad

- 10.2. Market Analysis, Insights and Forecast - by Temperature Type

- 10.2.1. Chilled

- 10.2.2. Frozen

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Horticulture (Fresh Fruits & Vegetables)

- 10.3.2. Dairy Products (Milk, Ice-cream, Butter, etc.)

- 10.3.3. Meats, Fish, Poultry

- 10.3.4. Processed Food Products

- 10.3.5. Pharma, Life Sciences, and Chemicals

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 M J Logistics Services Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TCI Express

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Stellar Value Chain Solutions Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 ColdEx Logistics Pvt Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Snowman Logistics Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 R K Foodland Private Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gubba Cold Storages Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gati Kausar India Pvt Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fresh and Healthy Services Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Future Supply Chain Solutions

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Cold Star Logistics Pvt Ltd**List Not Exhaustive 6 3 Other Companie

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 M J Logistics Services Ltd

List of Figures

- Figure 1: Global Cold Chain Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cold Chain Industry in India Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Cold Chain Industry in India Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Cold Chain Industry in India Revenue (Million), by Temperature Type 2025 & 2033

- Figure 5: North America Cold Chain Industry in India Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 6: North America Cold Chain Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 7: North America Cold Chain Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Cold Chain Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Cold Chain Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Cold Chain Industry in India Revenue (Million), by Service 2025 & 2033

- Figure 11: South America Cold Chain Industry in India Revenue Share (%), by Service 2025 & 2033

- Figure 12: South America Cold Chain Industry in India Revenue (Million), by Temperature Type 2025 & 2033

- Figure 13: South America Cold Chain Industry in India Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 14: South America Cold Chain Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 15: South America Cold Chain Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Cold Chain Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Cold Chain Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cold Chain Industry in India Revenue (Million), by Service 2025 & 2033

- Figure 19: Europe Cold Chain Industry in India Revenue Share (%), by Service 2025 & 2033

- Figure 20: Europe Cold Chain Industry in India Revenue (Million), by Temperature Type 2025 & 2033

- Figure 21: Europe Cold Chain Industry in India Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 22: Europe Cold Chain Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Cold Chain Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Cold Chain Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Cold Chain Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Cold Chain Industry in India Revenue (Million), by Service 2025 & 2033

- Figure 27: Middle East & Africa Cold Chain Industry in India Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East & Africa Cold Chain Industry in India Revenue (Million), by Temperature Type 2025 & 2033

- Figure 29: Middle East & Africa Cold Chain Industry in India Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 30: Middle East & Africa Cold Chain Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East & Africa Cold Chain Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa Cold Chain Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Cold Chain Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Cold Chain Industry in India Revenue (Million), by Service 2025 & 2033

- Figure 35: Asia Pacific Cold Chain Industry in India Revenue Share (%), by Service 2025 & 2033

- Figure 36: Asia Pacific Cold Chain Industry in India Revenue (Million), by Temperature Type 2025 & 2033

- Figure 37: Asia Pacific Cold Chain Industry in India Revenue Share (%), by Temperature Type 2025 & 2033

- Figure 38: Asia Pacific Cold Chain Industry in India Revenue (Million), by Application 2025 & 2033

- Figure 39: Asia Pacific Cold Chain Industry in India Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific Cold Chain Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Cold Chain Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Cold Chain Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 6: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 7: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Cold Chain Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 13: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 14: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Cold Chain Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 21: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global Cold Chain Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 33: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 34: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global Cold Chain Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Cold Chain Industry in India Revenue Million Forecast, by Service 2020 & 2033

- Table 43: Global Cold Chain Industry in India Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 44: Global Cold Chain Industry in India Revenue Million Forecast, by Application 2020 & 2033

- Table 45: Global Cold Chain Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Cold Chain Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold Chain Industry in India?

The projected CAGR is approximately 9.72%.

2. Which companies are prominent players in the Cold Chain Industry in India?

Key companies in the market include M J Logistics Services Ltd, TCI Express, Stellar Value Chain Solutions Pvt Ltd, ColdEx Logistics Pvt Ltd, Snowman Logistics Pvt Ltd, R K Foodland Private Ltd, Gubba Cold Storages Ltd, Gati Kausar India Pvt Ltd, Fresh and Healthy Services Ltd, Future Supply Chain Solutions, Cold Star Logistics Pvt Ltd**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Cold Chain Industry in India?

The market segments include Service, Temperature Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.64 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Urbanization and Changes in Lifestyles4.; Increased Organized Food in Retail Stores4.; Increasing Demand from the Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Chilled Segment is Gaining Huge Momentum in the Coming Years.

7. Are there any restraints impacting market growth?

4.; Lack of Sufficient Infrastructure.

8. Can you provide examples of recent developments in the market?

January 2024: Snowman Logistics initiated operations at a newly leased multi-temperature-controlled warehouse in Guwahati, Assam. The total capacity of the warehouse is 5,152 pallets, and this facility features eight chambers and four loading bays equipped with the latest infrastructure. Specifically designed to accommodate products from ambient temperatures to minus 25 degrees Celsius, the warehouse will primarily provide storage, handling, and transportation services for ice cream, poultry, ready-to-eat food, dairy products, confectionery, bakery products, seafood, fruits, and vegetables. Other products include pharmaceuticals, specialized chemicals, and various commodities. With this expansion, the company’s overall pallet capacity has soared to 1,41,000+ pallets, strategically distributed across 20 cities, thereby expanding its foothold in Northeast India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold Chain Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold Chain Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold Chain Industry in India?

To stay informed about further developments, trends, and reports in the Cold Chain Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence