Key Insights

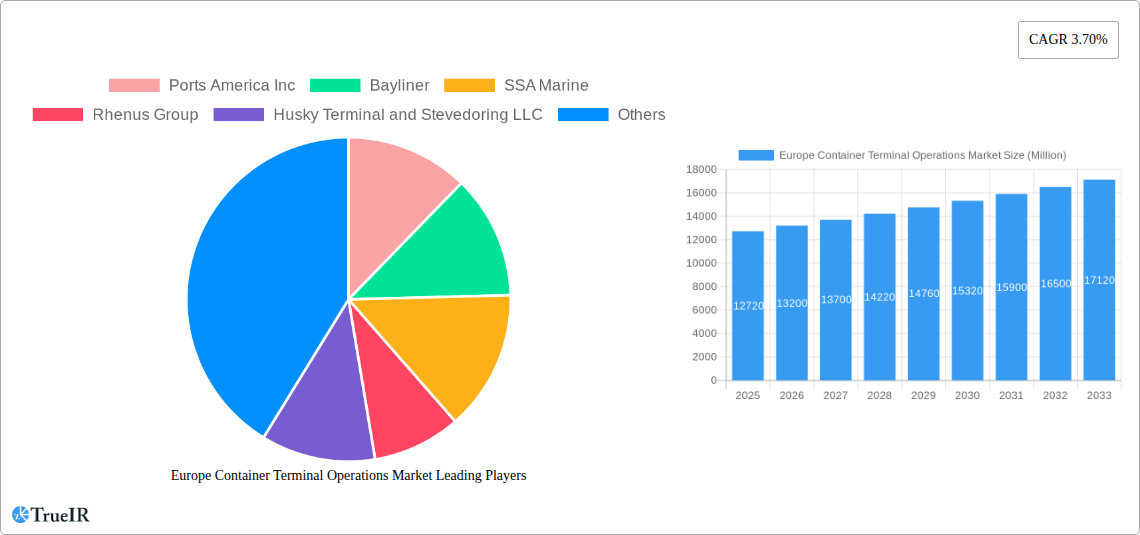

The European container terminal operations market, valued at €12.72 billion in 2025, is projected to experience steady growth, driven by increasing global trade volumes, particularly within the European Union. The market's Compound Annual Growth Rate (CAGR) of 3.70% from 2025 to 2033 indicates a consistent expansion, fueled by factors such as rising e-commerce activities boosting containerized cargo movements and ongoing investments in port infrastructure modernization across major European hubs like Rotterdam, Hamburg, and Antwerp. Key service segments include stevedoring, cargo handling and transportation, with dry cargo and crude oil dominating the cargo type segment. While growth is expected, the market faces certain restraints. These include potential disruptions from geopolitical instability, fluctuations in fuel prices impacting operational costs, and the ongoing challenges associated with labor shortages and supply chain bottlenecks. Strategic partnerships and technological advancements in automation and digitalization are crucial for terminal operators to maintain efficiency and competitiveness in this evolving landscape. Companies like Ports America, SSA Marine, and Mediterranean Shipping Company are key players, constantly seeking to optimize their operations and expand their market share within the competitive European market. The expansion of e-commerce and the increasing need for efficient logistics solutions contribute positively to market growth. Further, government initiatives promoting sustainable port operations will also act as catalysts for innovation and investment in the sector.

Europe Container Terminal Operations Market Market Size (In Billion)

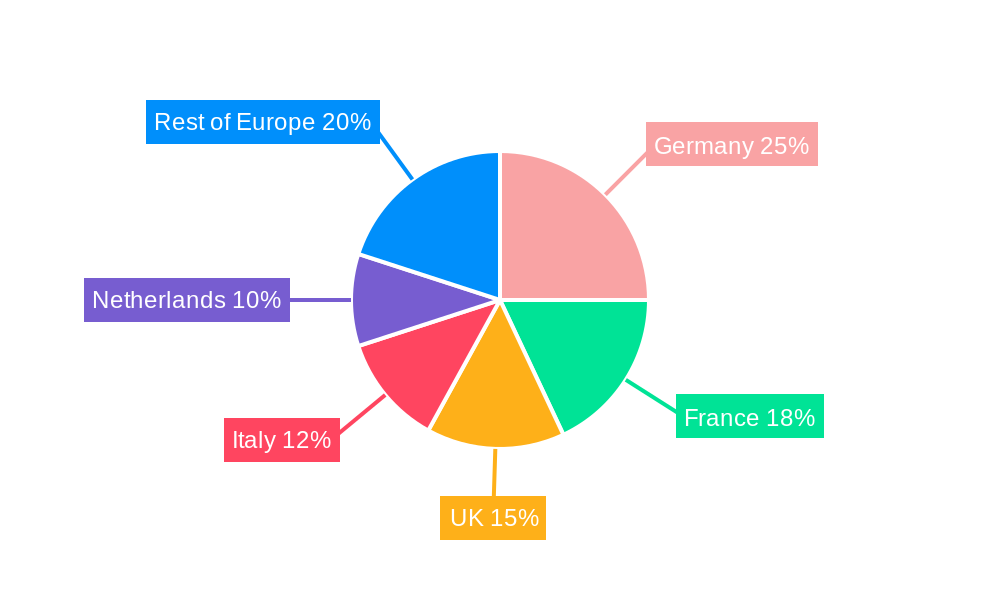

The geographical segmentation shows strong market presence across major European economies. Germany, France, the United Kingdom, Italy, and the Netherlands represent significant revenue contributors, given their established port infrastructures and strategic location within major shipping lanes. Smaller countries within the region also play a part but contribute to a smaller portion of the overall market size. Competitive pressures are strong among established operators, resulting in a focus on service differentiation, enhanced efficiency, and cost optimization strategies to maintain profitability and attract new business. The future growth of the European container terminal operations market is intrinsically linked to the overall health of the European and global economies, making it crucial to monitor macroeconomic factors and potential disruptions that could affect the predicted growth trajectory.

Europe Container Terminal Operations Market Company Market Share

Europe Container Terminal Operations Market: A Comprehensive Report (2019-2033)

This dynamic report provides a detailed analysis of the Europe Container Terminal Operations Market, offering invaluable insights for stakeholders across the maritime and logistics industries. Covering the period 2019-2033, with a focus on 2025, this research delves into market structure, competitive dynamics, growth drivers, and future projections. The report leverages extensive data and analysis to provide a clear understanding of this crucial market segment, empowering businesses to make informed strategic decisions. The market size in 2025 is estimated at xx Million, with a projected CAGR of xx% from 2025 to 2033.

Europe Container Terminal Operations Market Market Structure & Competitive Landscape

The Europe Container Terminal Operations Market exhibits a moderately concentrated structure, with a few large players holding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately consolidated market. Key drivers of innovation include automation technologies, such as automated guided vehicles (AGVs) and automated stacking cranes, aiming to improve efficiency and reduce operational costs. Regulatory frameworks, including port regulations and environmental policies, significantly impact market operations. Product substitutes are limited, primarily focusing on alternative transportation modes (e.g., rail). End-user segmentation is largely defined by the type of cargo handled (dry bulk, liquid bulk, containers) and the service type.

Mergers and acquisitions (M&A) activity has been moderate in recent years, with xx M&A deals recorded between 2019 and 2024, totaling an estimated value of xx Million. Future M&A activity is anticipated to increase as larger companies seek to consolidate their market share and expand their geographical reach.

- Market Concentration: Moderately concentrated, HHI (2025) estimated at xx.

- Innovation Drivers: Automation technologies (AGVs, automated cranes), digitalization of port operations.

- Regulatory Impacts: Port regulations, environmental compliance, labor laws.

- Product Substitutes: Rail transport, inland waterway transport.

- End-User Segmentation: By cargo type (dry, liquid, containers), service type (stevedoring, cargo handling).

- M&A Trends: Moderate activity (xx deals, xx Million value) from 2019-2024, projected increase in future.

Europe Container Terminal Operations Market Market Trends & Opportunities

The Europe Container Terminal Operations Market is witnessing robust growth, driven by increasing global trade volumes, the expansion of port infrastructure, and advancements in container handling technologies. The market size experienced significant growth during the historical period (2019-2024), expanding from xx Million to xx Million in 2024. This positive trajectory is expected to continue during the forecast period (2025-2033), propelled by technological innovations, evolving consumer preferences for faster and more reliable shipping, and increased competition driving efficiency improvements. The market exhibits high penetration rates in major European ports, with opportunities for expansion in emerging markets and niche segments. Technological advancements, such as AI-powered optimization systems and blockchain-based tracking solutions, are reshaping the industry, leading to enhanced operational efficiency and transparency. Consumer preferences are shifting towards sustainable and environmentally friendly practices, presenting opportunities for eco-friendly terminal operations. The competitive landscape is highly dynamic, characterized by strategic alliances, technological advancements, and continuous improvements in operational efficiency.

Dominant Markets & Segments in Europe Container Terminal Operations Market

The major European ports, including Rotterdam, Hamburg, Antwerp, and others, dominate the container terminal operations market. Growth drivers in these regions include strategically located ports, well-developed infrastructure, supportive government policies, and substantial investments in modernization and expansion.

By Service:

- Stevedoring: This segment holds the largest market share, driven by the increasing demand for efficient cargo handling and loading/unloading services.

- Cargo and handling transportation: This segment is experiencing growth due to the need for integrated logistics solutions and efficient cargo movement within and around ports.

- Others: This segment includes value-added services, such as warehousing and customs brokerage, experiencing moderate growth driven by increased demand for comprehensive logistics solutions.

By Cargo Type:

- Dry Cargo: This segment represents the largest share of the market, driven by substantial volumes of manufactured goods and consumer products.

- Crude Oil: This segment demonstrates moderate growth, primarily impacted by fluctuations in global energy markets and demand.

- Other Liquid Cargo: This segment shows steady growth, driven by increasing demand for chemical products and other liquid goods.

Key Growth Drivers:

- Strategic Port Locations: Facilitating efficient maritime transport and global trade connections.

- Well-Developed Infrastructure: Providing seamless connectivity and advanced handling facilities.

- Supportive Government Policies: Providing favorable regulatory environments and economic incentives for investment in port infrastructure and operational improvements.

- Technological Advancements: Boosting efficiency, reducing operational costs, and improving environmental performance.

Europe Container Terminal Operations Market Product Analysis

Product innovations in the Europe Container Terminal Operations Market focus on enhancing efficiency, improving safety, and reducing environmental impact. These innovations include automated container handling systems, advanced tracking and monitoring technologies, and the integration of AI and machine learning to optimize operations. Key competitive advantages include advanced technologies, superior operational efficiency, strategic port locations, strong customer relationships, and a commitment to sustainability. The market fit for these products is strong, driven by the industry's continuous pursuit of improved efficiency, cost reduction, and enhanced safety.

Key Drivers, Barriers & Challenges in Europe Container Terminal Operations Market

Key Drivers:

- Growth in Global Trade: Increased volume of goods transported necessitates efficient terminal operations.

- Technological Advancements: Automation and digitalization boost efficiency and reduce costs.

- Government Investments: Infrastructure development and supportive policies drive expansion.

Challenges and Restraints:

- Supply Chain Disruptions: Global events, like pandemics and geopolitical instability, significantly impact operational efficiency and cause delays, resulting in an estimated xx Million loss in revenue in 2022.

- Regulatory Hurdles: Complex regulations and permit processes increase operational costs and lead to delays.

- Competitive Pressures: Intense competition amongst terminal operators necessitates constant innovation and cost optimization.

Growth Drivers in the Europe Container Terminal Operations Market Market

The growth of the Europe Container Terminal Operations Market is driven by increased global trade, technological advancements in automation and digitization, and substantial investments in port infrastructure development by both public and private sectors. Supportive government policies that facilitate efficient cargo handling and streamline processes further contribute to market expansion.

Challenges Impacting Europe Container Terminal Operations Market Growth

Significant challenges include supply chain disruptions leading to operational inefficiencies and cost increases, complex regulatory frameworks that necessitate considerable compliance efforts, and intense competition among terminal operators that puts pressure on pricing and margins. These factors cumulatively impede market growth and require proactive mitigation strategies.

Key Players Shaping the Europe Container Terminal Operations Market Market

- Ports America Inc

- Bayliner

- SSA Marine

- Rhenus Group

- Husky Terminal and Stevedoring LLC

- Viking Line

- Indiana Port Commission

- MEYER WERFT GmbH & Co KG

- Mississippi State Port Authority at Gulfport

- Mediterranean Shipping Company S A

Significant Europe Container Terminal Operations Market Industry Milestones

- 2021: Introduction of automated stacking cranes at the Port of Rotterdam, significantly increasing handling capacity.

- 2022: Implementation of a blockchain-based cargo tracking system in Hamburg Port, enhancing transparency and efficiency.

- 2023: Merger between two major terminal operators in Antwerp, leading to increased market consolidation.

Future Outlook for Europe Container Terminal Operations Market Market

The Europe Container Terminal Operations Market is poised for continued growth, driven by sustained global trade expansion, ongoing technological advancements, and increased investments in port infrastructure. Strategic opportunities exist for operators to leverage automation, digitization, and sustainable practices to gain a competitive edge. The market potential is significant, with projections indicating substantial growth in various segments, offering attractive prospects for both established players and new entrants.

Europe Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Dry Cargo

- 2.2. Crude Oil

- 2.3. Other Liquid Cargo

Europe Container Terminal Operations Market Segmentation By Geography

- 1. Germany

- 2. Russia

- 3. France

- 4. UK

- 5. Spain

- 6. Rest of Europe

Europe Container Terminal Operations Market Regional Market Share

Geographic Coverage of Europe Container Terminal Operations Market

Europe Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Smart Port Infrastructure Drove the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Dry Cargo

- 5.2.2. Crude Oil

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. Russia

- 5.3.3. France

- 5.3.4. UK

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Germany Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Stevedoring

- 6.1.2. Cargo and handling transportation

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Cargo Type

- 6.2.1. Dry Cargo

- 6.2.2. Crude Oil

- 6.2.3. Other Liquid Cargo

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Russia Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Stevedoring

- 7.1.2. Cargo and handling transportation

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Cargo Type

- 7.2.1. Dry Cargo

- 7.2.2. Crude Oil

- 7.2.3. Other Liquid Cargo

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. France Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Stevedoring

- 8.1.2. Cargo and handling transportation

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Cargo Type

- 8.2.1. Dry Cargo

- 8.2.2. Crude Oil

- 8.2.3. Other Liquid Cargo

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. UK Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Stevedoring

- 9.1.2. Cargo and handling transportation

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Cargo Type

- 9.2.1. Dry Cargo

- 9.2.2. Crude Oil

- 9.2.3. Other Liquid Cargo

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Spain Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Stevedoring

- 10.1.2. Cargo and handling transportation

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Cargo Type

- 10.2.1. Dry Cargo

- 10.2.2. Crude Oil

- 10.2.3. Other Liquid Cargo

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Rest of Europe Europe Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Service

- 11.1.1. Stevedoring

- 11.1.2. Cargo and handling transportation

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Cargo Type

- 11.2.1. Dry Cargo

- 11.2.2. Crude Oil

- 11.2.3. Other Liquid Cargo

- 11.1. Market Analysis, Insights and Forecast - by Service

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Ports America Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Bayliner

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 SSA Marine

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Rhenus Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Husky Terminal and Stevedoring LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Viking Line

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Indiana Port Commission

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 MEYER WERFT GmbH & Co KG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Mediterranean Shipping Company S A

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Ports America Inc

List of Figures

- Figure 1: Europe Container Terminal Operations Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 3: Europe Container Terminal Operations Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 5: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 6: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 8: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 9: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 11: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 12: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 14: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 15: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 18: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Europe Container Terminal Operations Market Revenue Million Forecast, by Service 2020 & 2033

- Table 20: Europe Container Terminal Operations Market Revenue Million Forecast, by Cargo Type 2020 & 2033

- Table 21: Europe Container Terminal Operations Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Container Terminal Operations Market?

The projected CAGR is approximately 3.70%.

2. Which companies are prominent players in the Europe Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the Europe Container Terminal Operations Market?

The market segments include Service, Cargo Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.72 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Smart Port Infrastructure Drove the Market.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the Europe Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence