Key Insights

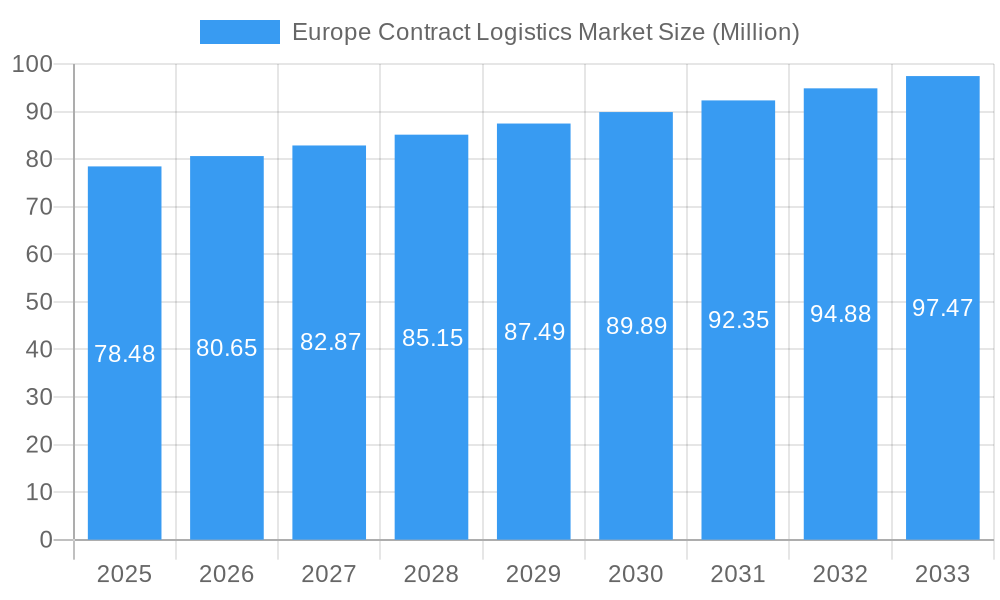

The European contract logistics market, valued at €78.48 million in 2025, is projected to experience steady growth, driven by the increasing adoption of e-commerce, the need for efficient supply chain management, and the growth of industries like automotive and food & beverage. A Compound Annual Growth Rate (CAGR) of 2.69% is anticipated from 2025 to 2033, indicating a consistent, albeit moderate, expansion. Key growth drivers include the rising demand for outsourced logistics solutions to reduce operational costs and improve efficiency, particularly amongst SMEs seeking to streamline their supply chains. Furthermore, the increasing complexity of global trade and the need for specialized logistics expertise are fueling market expansion. Germany, the United Kingdom, and France are expected to remain dominant market players, owing to their established industrial bases and robust infrastructure. However, emerging markets within Europe, such as Poland and the Netherlands, present significant growth potential due to expanding industrial activity and improving logistics infrastructure. While competition among established players like DHL, UPS, and DB Schenker remains intense, the market also presents opportunities for smaller, specialized providers focusing on niche sectors or regions.

Europe Contract Logistics Market Market Size (In Million)

The market's growth is subject to certain constraints, such as economic fluctuations, labor shortages, and increasing fuel costs. However, technological advancements, such as automation and digitalization within warehousing and transportation, are mitigating some of these challenges. The ongoing evolution towards sustainable logistics practices, emphasizing reduced carbon emissions and environmentally friendly solutions, is expected to shape the market landscape in the coming years. Segmentation by type (insourced vs. outsourced) and end-user industry (automotive, food and beverage, etc.) highlights varied growth rates and market dynamics. For instance, the outsourced segment will likely witness stronger growth due to its cost-effectiveness and scalability. Similarly, the automotive and food & beverage sectors, known for their complex and demanding supply chains, are expected to drive a significant portion of market growth. A thorough understanding of these segmental differences is crucial for businesses looking to compete effectively in this dynamic marketplace.

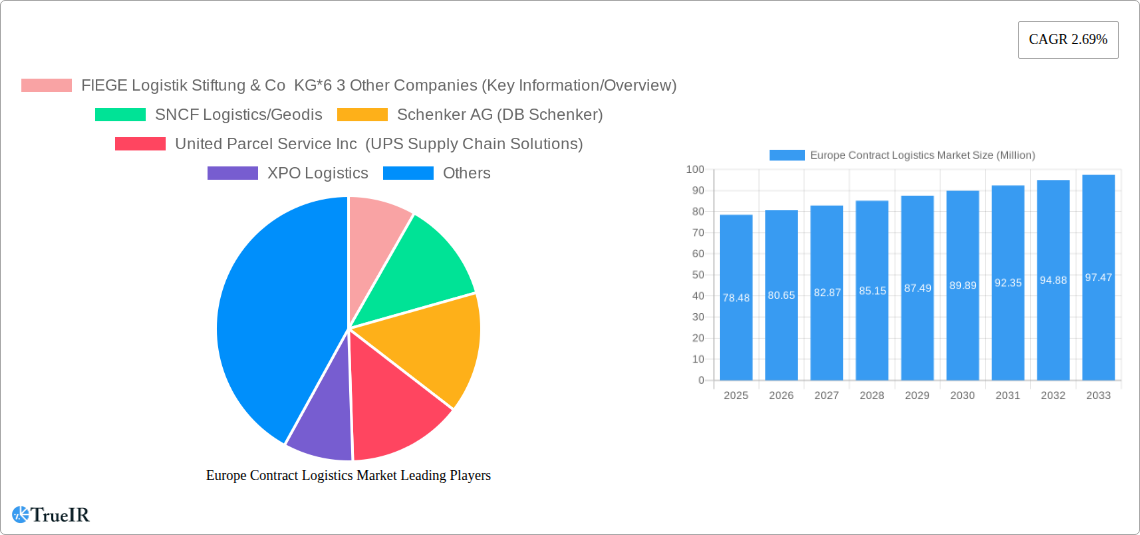

Europe Contract Logistics Market Company Market Share

Europe Contract Logistics Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Europe Contract Logistics Market, offering invaluable insights for businesses operating within this dynamic sector. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. It delves into market structure, competitive dynamics, growth drivers, challenges, and future opportunities, providing a robust foundation for informed strategic decision-making. The report uses Million as the unit for all monetary values.

Europe Contract Logistics Market Market Structure & Competitive Landscape

The European contract logistics market exhibits a moderately concentrated structure, with several major players commanding significant market share. The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, indicating a moderately consolidated market. Innovation in areas such as automation, artificial intelligence, and blockchain technology are key drivers, impacting efficiency and transparency across supply chains. Stringent regulations concerning data privacy, environmental sustainability, and trade compliance significantly influence market operations. Product substitutes, including in-house logistics solutions, present competitive challenges. The end-user segment is diverse, with Industrial Machinery and Automotive, Food and Beverage, and Chemicals sectors representing significant portions of the market. Mergers and acquisitions (M&A) activity has been robust in recent years, with a total estimated value of xx Million in 2024. This consolidation trend is expected to continue, driven by the need for economies of scale and enhanced service offerings.

- Top 5 Players Market Share (2025 Estimate): xx%

- M&A Activity (2019-2024): xx deals totaling xx Million

- Key Regulatory Impacts: GDPR, environmental regulations, trade agreements.

- Innovation Drivers: Automation, AI, blockchain, IoT

Europe Contract Logistics Market Market Trends & Opportunities

The Europe contract logistics market is experiencing robust growth, projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by several key trends. E-commerce expansion continues to drive demand for efficient and reliable delivery solutions. The increasing adoption of technological advancements, such as warehouse management systems (WMS) and transportation management systems (TMS), enhances operational efficiency and supply chain visibility. Changing consumer preferences towards faster delivery times and personalized services further shape market dynamics. Intense competition among existing players and new entrants necessitates continuous innovation and strategic partnerships. Market penetration rates vary significantly across different segments and regions, with higher penetration in advanced economies like Germany and the UK.

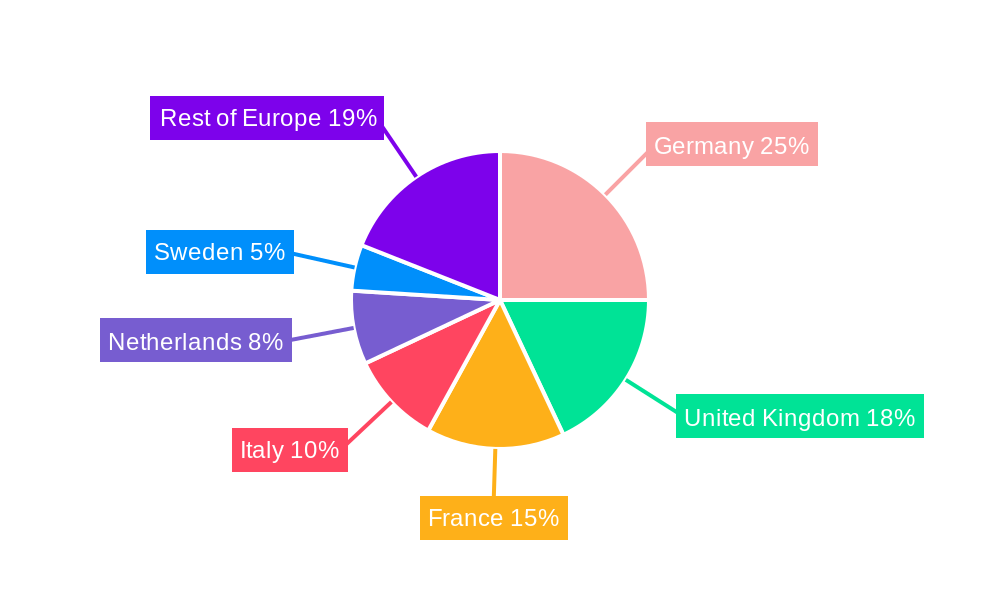

Dominant Markets & Segments in Europe Contract Logistics Market

Germany currently holds the largest market share in Europe's contract logistics sector, followed by the United Kingdom and France. This dominance is attributable to factors such as robust industrial infrastructure, advanced logistics networks, and a high concentration of manufacturing and distribution activities.

- Leading Country (2025): Germany (Market Size: xx Million)

- Fastest-Growing Segment (By Type): Outsourced Logistics (CAGR xx%)

- High-Growth End-User Segment: Industrial Machinery and Automotive (driven by increasing production and global trade).

Key Growth Drivers by Country:

- Germany: Strong manufacturing base, advanced infrastructure, efficient transportation networks.

- United Kingdom: Significant e-commerce activity, large consumer base, well-developed logistics infrastructure.

- France: Growing industrial sector, strategic location within Europe, government support for logistics development.

Europe Contract Logistics Market Product Analysis

The market offers a wide range of services, including warehousing, transportation, value-added services (VAS), and supply chain management solutions. Technological advancements are driving the adoption of integrated logistics platforms and real-time tracking systems, enhancing efficiency and transparency. Competitive advantages are built on operational excellence, technological capabilities, and strong customer relationships. The integration of AI and machine learning enhances route optimization, predictive maintenance, and inventory management.

Key Drivers, Barriers & Challenges in Europe Contract Logistics Market

Key Drivers:

- Growing e-commerce and omnichannel retail strategies.

- Increasing demand for supply chain visibility and efficiency.

- Technological advancements (automation, AI, IoT).

- Government initiatives to improve infrastructure and logistics capabilities.

Challenges:

- Rising fuel costs and fluctuating transportation rates impacting profitability. ( xx% increase in fuel prices in 2024 estimated impact on profit margins xx%)

- Driver shortages and labor costs, increasing operational expenses.

- Geopolitical uncertainty and trade disruptions causing supply chain volatility.

- Stringent environmental regulations increasing compliance costs.

Growth Drivers in the Europe Contract Logistics Market Market

The market is fueled by the expansion of e-commerce, increasing demand for efficient supply chains, and technological advancements such as automation and AI. Government initiatives promoting logistics infrastructure development also contribute significantly to growth.

Challenges Impacting Europe Contract Logistics Market Growth

Significant challenges include rising fuel and labor costs, driver shortages, geopolitical uncertainties, and stringent environmental regulations. These factors increase operational costs and limit growth potential.

Key Players Shaping the Europe Contract Logistics Market Market

- FIEGE Logistik Stiftung & Co KG

- SNCF Logistics/Geodis

- Schenker AG (DB Schenker)

- United Parcel Service Inc (UPS Supply Chain Solutions)

- XPO Logistics

- CEVA Logistics

- Bertelsmann SE & Co KGaA (Arvato)

- Rhenus SE & Co KG

- DSV AS

- GEFCO SA

- Deutsche Post DHL Group

- Expeditors International

- Bollore Logistics

- Hellmann Worldwide Logistics GmbH & Co KG

- Agility Logistics Pvt Ltd

- H Essers NV

- Wincanton PLC

- Neovia Logistics Services

Significant Europe Contract Logistics Market Industry Milestones

- May 2023: ARKEMA extended its partnership with GEODIS for customs brokerage services across 15 European countries, highlighting the growing demand for specialized logistics solutions.

- March 2023: DHL Global Forwarding (UK) Limited secured a contract with HM Passport Office, showcasing the importance of secure delivery services within the government sector.

Future Outlook for Europe Contract Logistics Market Market

The Europe contract logistics market is poised for continued growth, driven by e-commerce expansion, technological advancements, and increasing focus on supply chain optimization. Strategic partnerships, investments in automation, and expansion into new markets present significant opportunities for market players. The market's future hinges on adapting to evolving consumer demands, navigating geopolitical uncertainties, and addressing sustainability concerns.

Europe Contract Logistics Market Segmentation

-

1. End User

- 1.1. Industrial Machinery and Automotive

- 1.2. Food and Beverage

- 1.3. Construction

- 1.4. Chemicals

- 1.5. Other Consumer Goods

- 1.6. Other End Users

Europe Contract Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Contract Logistics Market Regional Market Share

Geographic Coverage of Europe Contract Logistics Market

Europe Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Increased Outsourcing of Services4.; Increasing Demand For Contract Logistics In Italy

- 3.2.2 France

- 3.2.3 And Poland4.; Growth Of Ecommerce Sector Across Europe

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Competition In The European Contract Logistics Market

- 3.4. Market Trends

- 3.4.1. Outsourced Contract Logistics Market to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Contract Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Industrial Machinery and Automotive

- 5.1.2. Food and Beverage

- 5.1.3. Construction

- 5.1.4. Chemicals

- 5.1.5. Other Consumer Goods

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FIEGE Logistik Stiftung & Co KG*6 3 Other Companies (Key Information/Overview)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SNCF Logistics/Geodis

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schenker AG (DB Schenker)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 United Parcel Service Inc (UPS Supply Chain Solutions)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 XPO Logistics

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CEVA Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bertelsmann SE & Co KGaA (Arvato)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rhenus SE & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DSV AS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEFCO SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Deutsche Post DHL Group

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Expeditors International United Parcel Service Inc Bollore Logistics Hellmann Worldwide Logistics GmbH & Co KG Agility Logistics Pvt Ltd H Essers NV Wincanton PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Neovia Logistics Services

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 FIEGE Logistik Stiftung & Co KG*6 3 Other Companies (Key Information/Overview)

List of Figures

- Figure 1: Europe Contract Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Contract Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: Europe Contract Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Europe Contract Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Contract Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Contract Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Contract Logistics Market?

The projected CAGR is approximately 2.69%.

2. Which companies are prominent players in the Europe Contract Logistics Market?

Key companies in the market include FIEGE Logistik Stiftung & Co KG*6 3 Other Companies (Key Information/Overview), SNCF Logistics/Geodis, Schenker AG (DB Schenker), United Parcel Service Inc (UPS Supply Chain Solutions), XPO Logistics, CEVA Logistics, Bertelsmann SE & Co KGaA (Arvato), Rhenus SE & Co KG, DSV AS, GEFCO SA, Deutsche Post DHL Group, Expeditors International United Parcel Service Inc Bollore Logistics Hellmann Worldwide Logistics GmbH & Co KG Agility Logistics Pvt Ltd H Essers NV Wincanton PLC, Neovia Logistics Services.

3. What are the main segments of the Europe Contract Logistics Market?

The market segments include End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 78.48 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increased Outsourcing of Services4.; Increasing Demand For Contract Logistics In Italy. France. And Poland4.; Growth Of Ecommerce Sector Across Europe.

6. What are the notable trends driving market growth?

Outsourced Contract Logistics Market to Register Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Competition In The European Contract Logistics Market.

8. Can you provide examples of recent developments in the market?

May 2023: A leader in Specialty Materials, ARKEMA extended its partnership with GEODIS, signing a Standalone Customs Brokerage contract to provide both import and export customs clearance services across 15 countries in Europe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Contract Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Contract Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Contract Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence