Key Insights

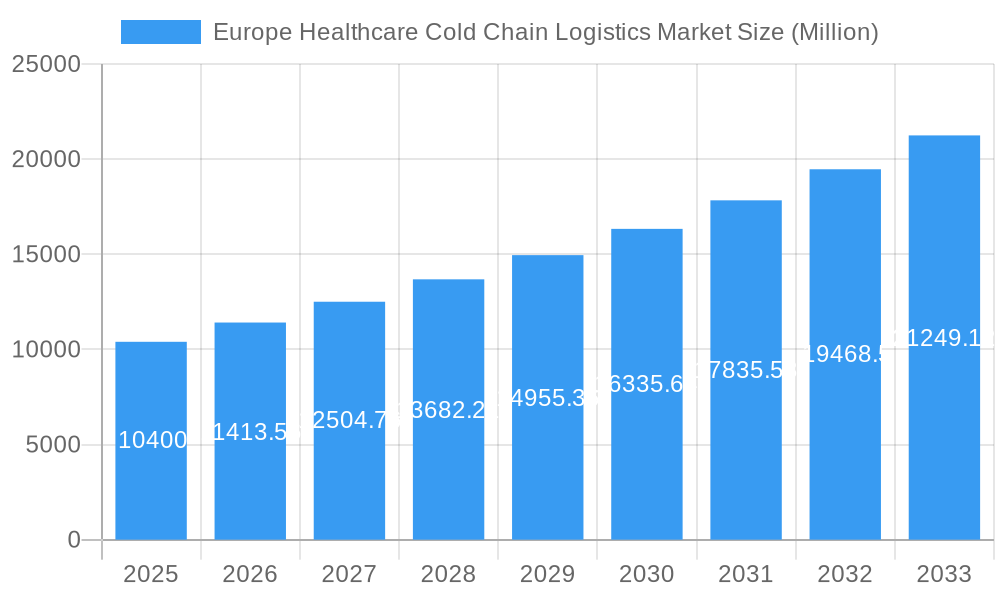

The European healthcare cold chain logistics market, valued at €10.40 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing prevalence of temperature-sensitive pharmaceuticals, including biologics and vaccines, necessitates sophisticated cold chain solutions for maintaining product efficacy throughout the supply chain. Stringent regulatory requirements for drug storage and transportation further fuel market expansion. Growth is also spurred by technological advancements, such as real-time temperature monitoring systems and advanced packaging solutions, enhancing product safety and traceability. The market is segmented by country (Germany, France, Spain, and the Rest of Europe), product type (biopharmaceuticals, vaccines, and clinical trial materials), services (transportation, storage, and value-added services like packaging and labeling), and end-user (hospitals, clinics, pharmaceutical, biopharmaceutical, and biotechnology companies). Germany, France, and Spain represent significant market shares due to their well-established healthcare infrastructure and substantial pharmaceutical industries. However, the "Rest of Europe" segment also exhibits significant growth potential, driven by expanding healthcare sectors in countries like the United Kingdom, Italy, and the Netherlands.

Europe Healthcare Cold Chain Logistics Market Market Size (In Billion)

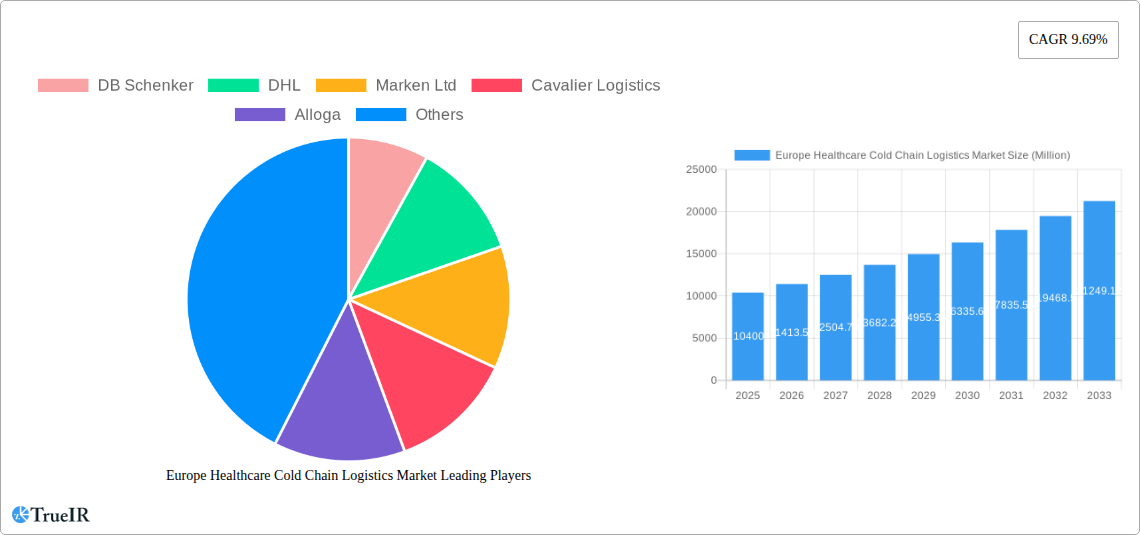

The market's compound annual growth rate (CAGR) of 9.69% from 2025 to 2033 signifies substantial growth opportunities. This growth is likely to be influenced by increased investments in cold chain infrastructure, rising demand for specialized cold chain services, and the increasing adoption of digitalization and automation within the logistics sector to ensure better efficiency and control. While challenges such as maintaining consistent cold chain integrity across diverse geographical locations and managing the complexities of global supply chains exist, the market is poised for sustained expansion, driven by the ongoing demand for temperature-sensitive healthcare products and the prioritization of patient safety and product efficacy. Leading players like DB Schenker, DHL, and Marken Ltd. are actively shaping the market through strategic partnerships, technological innovations, and service expansions.

Europe Healthcare Cold Chain Logistics Market Company Market Share

Europe Healthcare Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This dynamic report provides a deep dive into the burgeoning Europe Healthcare Cold Chain Logistics Market, offering invaluable insights for stakeholders across the pharmaceutical, logistics, and healthcare sectors. Leveraging extensive market research and data analysis spanning the period 2019-2033, this report unveils key trends, challenges, and opportunities shaping this critical market segment. The report projects a market value of xx Million by 2033, showcasing significant growth potential.

Europe Healthcare Cold Chain Logistics Market Structure & Competitive Landscape

The European healthcare cold chain logistics market is characterized by a moderately consolidated structure. Key players such as DB Schenker, DHL, Marken Ltd, Cavalier Logistics, Alloga, Kuehne + Nagel, and Envirotainer hold significant market share, but smaller, specialized companies also contribute substantially. The market concentration ratio (CR4) is estimated at xx%, indicating a competitive landscape with both large multinational corporations and smaller niche players.

Innovation is a key driver, with companies continuously investing in advanced technologies like real-time temperature monitoring, GPS tracking, and automated warehousing systems. Stringent regulatory frameworks, particularly concerning data security and product integrity, significantly impact market operations. Substitutes, although limited, include alternative transportation methods and storage solutions, but these often compromise efficacy and security.

End-user segmentation is diverse, encompassing hospitals, clinics, pharmaceutical companies, biopharmaceutical firms, and biotechnology companies. Mergers and acquisitions (M&A) activity within the sector has been relatively moderate in recent years, with an estimated xx number of deals annually during the historical period (2019-2024). This activity primarily focuses on expanding service portfolios and geographic reach.

Europe Healthcare Cold Chain Logistics Market Market Trends & Opportunities

The European healthcare cold chain logistics market is experiencing robust growth, driven by several key factors. The market size is projected to reach xx Million by 2025, with a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This expansion is fueled by the rising prevalence of chronic diseases, an aging population, the growing demand for biologics and pharmaceuticals, and increased investment in clinical trials.

Technological advancements, such as the adoption of IoT-enabled sensors and AI-powered predictive analytics, are transforming logistics operations, improving efficiency, and enhancing product traceability. Consumer preference for greater transparency and accountability is driving demand for advanced tracking and monitoring systems. Intense competitive pressure is encouraging companies to innovate and invest in efficient solutions, further fueling market growth. The market penetration rate for advanced temperature monitoring systems is expected to reach xx% by 2033.

Dominant Markets & Segments in Europe Healthcare Cold Chain Logistics Market

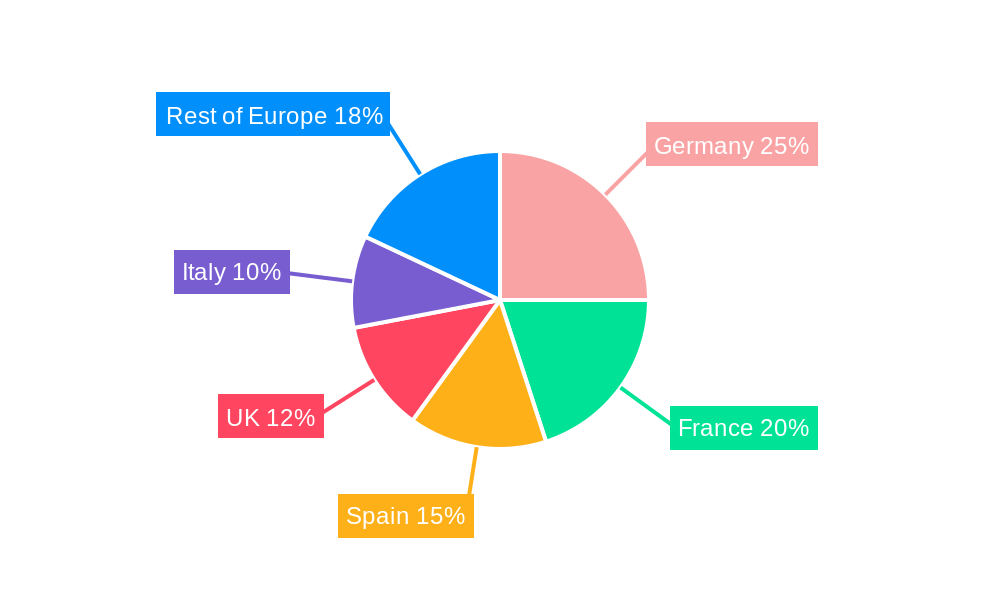

Germany, France, and Spain represent the largest national markets within Europe, together accounting for approximately xx% of the total market value in 2025. The "Rest of Europe" segment also demonstrates significant growth potential.

- By Product: Biopharmaceuticals constitute the largest segment, followed by vaccines and clinical trial materials. The increasing demand for personalized medicine and advanced therapies will drive growth in this segment.

- By Services: Transportation is the most significant service, followed by storage and value-added services like packaging and labeling. The increasing demand for integrated end-to-end solutions will propel market expansion.

- By End User: Pharmaceutical and biopharmaceutical companies dominate the end-user segment, followed by hospitals and clinics. Government initiatives to improve healthcare infrastructure and strengthen the cold chain will further boost demand.

Strong regulatory frameworks and robust healthcare infrastructure in Germany and France are key growth drivers in these countries. Spain benefits from its strategic location and expanding pharmaceutical industry. The "Rest of Europe" segment’s growth is driven by increasing healthcare investments and economic development in several Eastern European nations.

Europe Healthcare Cold Chain Logistics Market Product Analysis

Technological advancements have significantly impacted product offerings in the healthcare cold chain logistics market. Innovations such as passive and active temperature-controlled containers, real-time tracking systems, and intelligent sensors enhance product safety and efficiency. These advancements enable more precise temperature control, reduce spoilage rates, and improve supply chain visibility, ultimately offering a significant competitive advantage in a demanding market. The integration of these technologies is streamlining logistics operations, improving traceability, and enhancing regulatory compliance.

Key Drivers, Barriers & Challenges in Europe Healthcare Cold Chain Logistics Market

Key Drivers: Rising demand for temperature-sensitive pharmaceuticals, advancements in cold chain technology (e.g., IoT sensors, AI-powered analytics), stringent regulatory requirements driving adoption of improved monitoring systems, and government investments in healthcare infrastructure are key drivers.

Challenges: Maintaining consistent temperature control across the complex supply chain, complying with stringent regulatory requirements (e.g., GDP guidelines), managing rising transportation and storage costs, and intense competition are significant hurdles. Supply chain disruptions, like those experienced in recent years, underscore the vulnerability of the sector and highlight the need for resilient solutions. These disruptions can lead to significant financial losses, estimated at xx Million annually in lost product and revenue.

Growth Drivers in the Europe Healthcare Cold Chain Logistics Market Market

The increasing demand for biologics and other temperature-sensitive pharmaceuticals is a key growth driver, along with technological innovation in temperature-controlled packaging and monitoring devices. Favorable regulatory environments in several European countries and government support for infrastructure development also contribute significantly. Furthermore, the expansion of clinical trials and the rise of personalized medicine are further catalysts for market growth.

Challenges Impacting Europe Healthcare Cold Chain Logistics Market Growth

Significant challenges include the high cost of implementing and maintaining advanced cold chain technologies, stringent regulatory compliance requirements adding complexity and cost, and the vulnerability of the supply chain to disruptions. Competition is intense, requiring companies to constantly innovate and improve efficiency to maintain a competitive edge. These factors can collectively lead to reduced profit margins and limit market expansion.

Key Players Shaping the Europe Healthcare Cold Chain Logistics Market Market

- DB Schenker

- DHL

- Marken Ltd

- Cavalier Logistics

- Alloga

- Kuehne + Nagel

- Envirotainer

- 7 3 Other Companies

- Carrier Transicold

- Primafrio

- Biocair

Significant Europe Healthcare Cold Chain Logistics Market Industry Milestones

- 2021: Introduction of several new IoT-enabled temperature monitoring systems by major players.

- 2022: Significant investment in automated warehousing solutions by leading logistics providers.

- 2023: Several mergers and acquisitions among smaller cold chain logistics companies.

- 2024: Strengthening of regulatory frameworks concerning data security and product integrity.

Future Outlook for Europe Healthcare Cold Chain Logistics Market Market

The European healthcare cold chain logistics market is poised for continued robust growth, driven by technological advancements, increasing demand for temperature-sensitive products, and regulatory changes. Strategic partnerships and collaborations between logistics providers and pharmaceutical companies will become increasingly crucial. The market presents significant opportunities for companies offering innovative solutions that address the challenges of maintaining product integrity and efficiency throughout the complex supply chain. Expansion into emerging markets within Europe and the development of sustainable cold chain solutions will further define future success.

Europe Healthcare Cold Chain Logistics Market Segmentation

-

1. Product

- 1.1. Biopharmaceuticals

- 1.2. Vaccines

- 1.3. Clinical Trial Materials

-

2. Services

- 2.1. Transportation

- 2.2. Storage

- 2.3. Value Added Services (Packaging and Labeling)

-

3. End User

- 3.1. Hospitals, Clinics and Pharmaceuticals

- 3.2. Biopharmaceutical

- 3.3. Biotechnology

Europe Healthcare Cold Chain Logistics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Healthcare Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Europe Healthcare Cold Chain Logistics Market

Europe Healthcare Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries

- 3.3. Market Restrains

- 3.3.1. High Initial Capital Investment; Risk of Temperature Excursions

- 3.4. Market Trends

- 3.4.1. The OTC Pharmaceuticals Consumption is Projected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Healthcare Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Biopharmaceuticals

- 5.1.2. Vaccines

- 5.1.3. Clinical Trial Materials

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Transportation

- 5.2.2. Storage

- 5.2.3. Value Added Services (Packaging and Labeling)

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Hospitals, Clinics and Pharmaceuticals

- 5.3.2. Biopharmaceutical

- 5.3.3. Biotechnology

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DHL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marken Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cavalier Logistics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Alloga

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kuehne + Nagel

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Envirotainer**List Not Exhaustive 7 3 Other Companie

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Carrier Transicold

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Primafrio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Biocair

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Healthcare Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Healthcare Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 3: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Services 2020 & 2033

- Table 7: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Europe Healthcare Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Healthcare Cold Chain Logistics Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Healthcare Cold Chain Logistics Market?

The projected CAGR is approximately 9.69%.

2. Which companies are prominent players in the Europe Healthcare Cold Chain Logistics Market?

Key companies in the market include DB Schenker, DHL, Marken Ltd, Cavalier Logistics, Alloga, Kuehne + Nagel, Envirotainer**List Not Exhaustive 7 3 Other Companie, Carrier Transicold, Primafrio, Biocair.

3. What are the main segments of the Europe Healthcare Cold Chain Logistics Market?

The market segments include Product, Services, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Vaccine Distribution; Growing Pharmaceutical and Biotechnology Industries.

6. What are the notable trends driving market growth?

The OTC Pharmaceuticals Consumption is Projected to Grow Significantly.

7. Are there any restraints impacting market growth?

High Initial Capital Investment; Risk of Temperature Excursions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Healthcare Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Healthcare Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Healthcare Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Europe Healthcare Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence