Key Insights

The European intermodal terminals market is poised for significant expansion, driven by the escalating demand for efficient and sustainable logistics. The market is projected to reach $2.33 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 6.3%. Key growth catalysts include the burgeoning e-commerce sector, stringent environmental regulations promoting carbon-neutral transport, and the robust expansion of European manufacturing and automotive industries. The rail and road segments currently dominate due to their cost-effectiveness and extensive infrastructure. However, air and maritime transport are anticipated to experience accelerated growth, propelled by increasing global trade and the need for rapid transcontinental shipping. Primary end-users comprise the manufacturing, automotive, and oil & gas sectors, with notable contributions from the agriculture and construction industries. A competitive yet consolidated market structure, featuring established players such as DP World and COSCO SHIPPING Ports, fosters innovation and efficiency. Strategic terminal locations and ongoing infrastructure investments further bolster the market's positive trajectory.

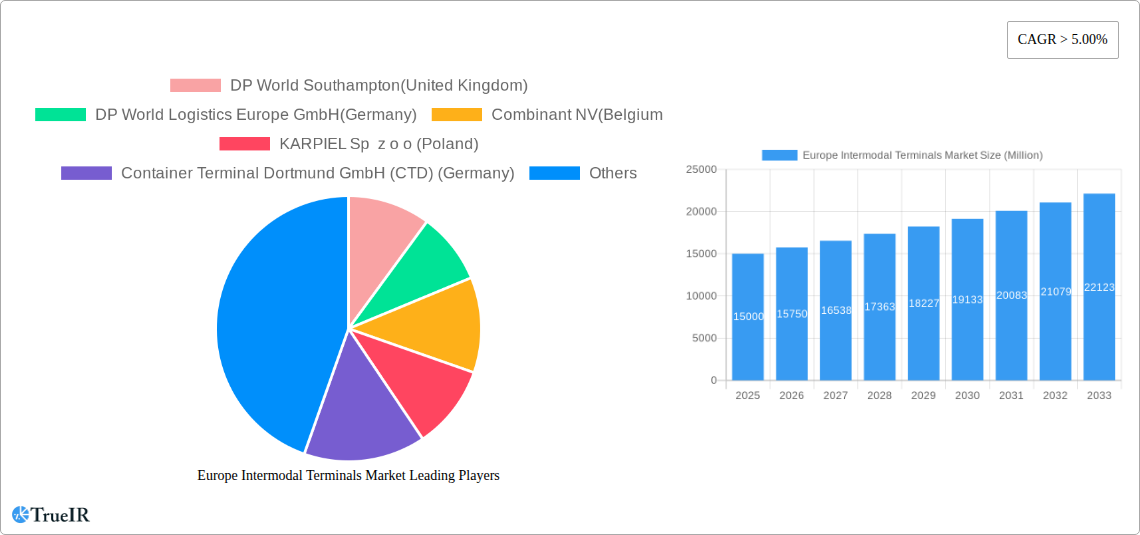

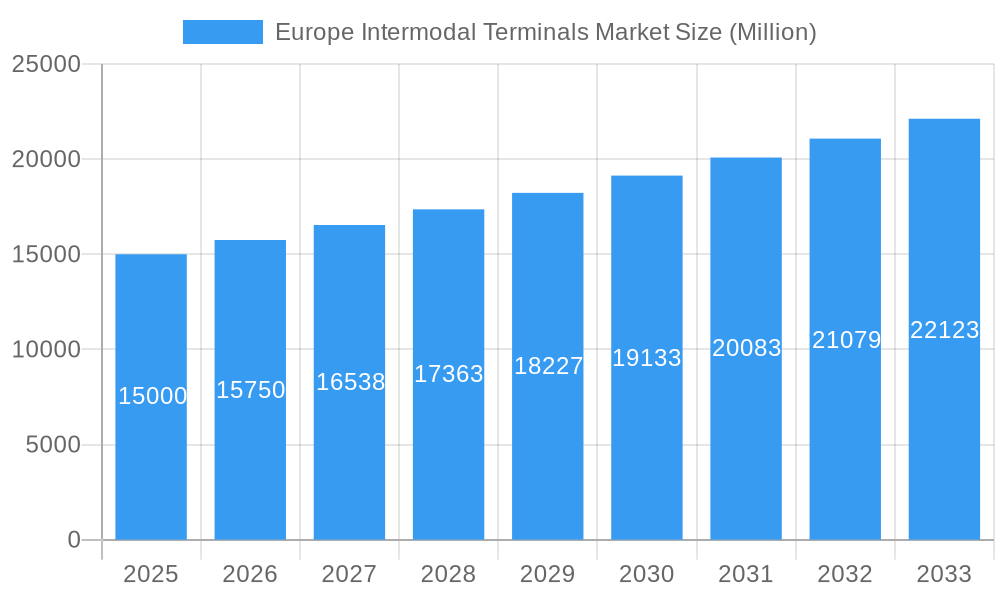

Europe Intermodal Terminals Market Market Size (In Billion)

The forecast period (2025-2033) indicates sustained market growth, potentially amplified by planned infrastructure enhancements across Europe. Germany, France, the UK, and the Netherlands will continue to be significant contributors due to their advanced logistics networks and high economic output. Eastern European nations are expected to register higher growth rates, driven by infrastructure development and industrialization. While challenges such as infrastructure bottlenecks and fuel price volatility exist, the long-term outlook for the European intermodal terminals market remains optimistic, underpinned by consistent economic growth and the global imperative for sustainable supply chain management. Technological innovation and digitalization are critical for shaping the market's future landscape.

Europe Intermodal Terminals Market Company Market Share

Europe Intermodal Terminals Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Europe Intermodal Terminals Market, offering invaluable insights for industry stakeholders, investors, and strategic planners. The study covers the period 2019-2033, with a focus on the base year 2025 and a forecast extending to 2033. Discover key trends, growth drivers, challenges, and opportunities shaping this dynamic market, along with detailed segmentation analysis and competitive landscape insights. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Europe Intermodal Terminals Market Market Structure & Competitive Landscape

The European intermodal terminals market exhibits a moderately concentrated structure, with a few major players holding significant market share. The Herfindahl-Hirschman Index (HHI) is estimated at xx, indicating a moderately concentrated market. Innovation is a key driver, with companies constantly investing in technological advancements to improve efficiency, optimize logistics, and enhance sustainability. Regulatory frameworks, including environmental regulations and port infrastructure development policies, significantly impact market dynamics. Product substitutes, such as dedicated trucking services or air freight, exert competitive pressure. The market is segmented by transportation mode (Rail and Road Transport, Air and Road Transport, Maritime and Road Transport) and end-user (Manufacturing and Automotive, Oil, Gas, and Mining, Agriculture, Fishing, and Forestry, Construction, Distributive Trade, Others). M&A activity has been moderate in recent years, with an estimated xx Million in deal value during the historical period (2019-2024).

- Market Concentration: Moderately concentrated, with HHI estimated at xx.

- Innovation Drivers: Automation, digitalization, and sustainable technologies.

- Regulatory Impacts: Environmental regulations, infrastructure development policies.

- Product Substitutes: Dedicated trucking, air freight.

- End-User Segmentation: Diverse, with Manufacturing and Automotive representing the largest segment.

- M&A Trends: Moderate activity, with xx Million in deal value (2019-2024).

Europe Intermodal Terminals Market Market Trends & Opportunities

The European intermodal terminals market is experiencing robust growth, driven by the increasing demand for efficient and cost-effective logistics solutions. The rising volume of goods transported across Europe, coupled with the growing focus on sustainable transportation, is fueling market expansion. Technological advancements, such as automation and digitalization, are streamlining operations and improving efficiency. Consumer preferences are shifting towards faster delivery times and greater transparency in the supply chain, creating new opportunities for intermodal terminal operators. The competitive landscape is characterized by intense rivalry among established players and the emergence of new entrants. Market penetration rates for various transportation modes vary significantly, with Maritime and Road Transport currently holding the largest share. The market is expected to reach xx Million by 2033, representing significant growth potential.

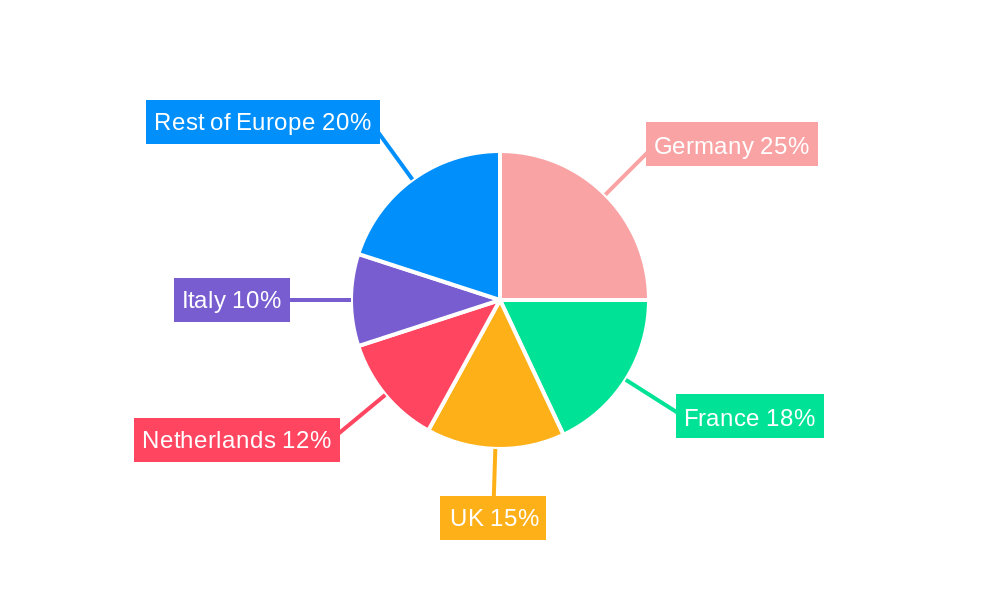

Dominant Markets & Segments in Europe Intermodal Terminals Market

The Netherlands and Germany currently dominate the European intermodal terminals market, driven by strong port infrastructure, favorable government policies, and high volumes of goods transported. The Maritime and Road Transport segment represents the largest share by transportation mode, benefiting from established seaport connectivity and extensive road networks. The Manufacturing and Automotive sector accounts for the largest end-user share, reflecting the high volume of goods transported within this sector.

- Key Growth Drivers:

- Netherlands: Robust port infrastructure, strategic location, government support.

- Germany: Extensive rail and road network, strong manufacturing base, logistical hub.

- Maritime and Road Transport: Established infrastructure, efficient logistics.

- Manufacturing and Automotive: High volume of goods transportation.

Europe Intermodal Terminals Market Product Analysis

Technological advancements in intermodal terminals are focused on automation, digitalization, and improved efficiency. The use of automated guided vehicles (AGVs), automated stacking cranes, and real-time tracking systems enhances operational efficiency and reduces costs. These innovations improve the speed and reliability of cargo handling, offering significant competitive advantages. The integration of smart technologies is also enhancing security and visibility within the supply chain.

Key Drivers, Barriers & Challenges in Europe Intermodal Terminals Market

Key Drivers: Growing e-commerce, increasing demand for faster delivery times, need for efficient and sustainable logistics solutions, government investments in port infrastructure.

Challenges: Supply chain disruptions (e.g., port congestion, labor shortages) impacting throughput and increasing costs. Stringent environmental regulations increasing operational expenses and requiring investments in green technologies. Intense competition among terminal operators putting downward pressure on pricing. Estimated impact of supply chain issues resulting in a xx Million loss in revenue in 2024.

Growth Drivers in the Europe Intermodal Terminals Market Market

Technological advancements, increased government investment in port infrastructure, and the rising demand for efficient and sustainable logistics are key growth drivers. The growing e-commerce sector and its demand for fast delivery also contribute significantly to market expansion.

Challenges Impacting Europe Intermodal Terminals Market Growth

Regulatory complexities, supply chain disruptions, and intense competition pose significant challenges to market growth. Labor shortages, infrastructure limitations, and fluctuating fuel prices also add to these hurdles.

Key Players Shaping the Europe Intermodal Terminals Market Market

- DP World Southampton (United Kingdom)

- DP World Logistics Europe GmbH (Germany)

- Combinant NV (Belgium)

- KARPIEL Sp z o o (Poland)

- Container Terminal Dortmund GmbH (CTD) (Germany)

- Rail Cargo Group (Austria)

- INTERPORT Terminal Kosice (Romania)

- COSCO SHIPPING Ports (Spain) Terminals S L U (Spain)

- EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- Rail Hub Transylvania (Romania)

Significant Europe Intermodal Terminals Market Industry Milestones

- October 2022: Successful unloading of 3 yachts in Valencia, CSP Spain, showcasing specialized handling capabilities.

- November 2022: CSP Spain inaugurated a new express service between Spain and Turkey, boosting Valencia's connectivity.

Future Outlook for Europe Intermodal Terminals Market Market

The Europe Intermodal Terminals Market is poised for continued growth, driven by technological advancements, infrastructure development, and the ongoing demand for efficient logistics solutions. Strategic partnerships, investments in automation, and a focus on sustainability will be crucial for success in this competitive market. The market is expected to experience significant expansion in the coming years, presenting substantial opportunities for industry players.

Europe Intermodal Terminals Market Segmentation

-

1. Transportation Mode

- 1.1. Rail and Road Transport

- 1.2. Air and Road Transport

- 1.3. Maritime and Road Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil, Gas, and Mining

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distributive Trade

- 2.6. Others

Europe Intermodal Terminals Market Segmentation By Geography

- 1. Germany

- 2. France

- 3. United Kingdom

- 4. Spain

- 5. Rest of Europe

Europe Intermodal Terminals Market Regional Market Share

Geographic Coverage of Europe Intermodal Terminals Market

Europe Intermodal Terminals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China

- 3.3. Market Restrains

- 3.3.1. Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services

- 3.4. Market Trends

- 3.4.1. Growth of Webshop Traffic Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 5.1.1. Rail and Road Transport

- 5.1.2. Air and Road Transport

- 5.1.3. Maritime and Road Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil, Gas, and Mining

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distributive Trade

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. France

- 5.3.3. United Kingdom

- 5.3.4. Spain

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6. Germany Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 6.1.1. Rail and Road Transport

- 6.1.2. Air and Road Transport

- 6.1.3. Maritime and Road Transport

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Oil, Gas, and Mining

- 6.2.3. Agriculture, Fishing, and Forestry

- 6.2.4. Construction

- 6.2.5. Distributive Trade

- 6.2.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7. France Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 7.1.1. Rail and Road Transport

- 7.1.2. Air and Road Transport

- 7.1.3. Maritime and Road Transport

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Oil, Gas, and Mining

- 7.2.3. Agriculture, Fishing, and Forestry

- 7.2.4. Construction

- 7.2.5. Distributive Trade

- 7.2.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8. United Kingdom Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 8.1.1. Rail and Road Transport

- 8.1.2. Air and Road Transport

- 8.1.3. Maritime and Road Transport

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Oil, Gas, and Mining

- 8.2.3. Agriculture, Fishing, and Forestry

- 8.2.4. Construction

- 8.2.5. Distributive Trade

- 8.2.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9. Spain Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 9.1.1. Rail and Road Transport

- 9.1.2. Air and Road Transport

- 9.1.3. Maritime and Road Transport

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Oil, Gas, and Mining

- 9.2.3. Agriculture, Fishing, and Forestry

- 9.2.4. Construction

- 9.2.5. Distributive Trade

- 9.2.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10. Rest of Europe Europe Intermodal Terminals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 10.1.1. Rail and Road Transport

- 10.1.2. Air and Road Transport

- 10.1.3. Maritime and Road Transport

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Oil, Gas, and Mining

- 10.2.3. Agriculture, Fishing, and Forestry

- 10.2.4. Construction

- 10.2.5. Distributive Trade

- 10.2.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Transportation Mode

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DP World Southampton(United Kingdom)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DP World Logistics Europe GmbH(Germany)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Combinant NV(Belgium

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 KARPIEL Sp z o o (Poland)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Container Terminal Dortmund GmbH (CTD) (Germany)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rail Cargo Group(Austria)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INTERPORT Terminal Kosice(Romania)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 COSCO SHIPPING Ports (Spain) Terminals S L U (Spain)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Rail Hub Transylvania(Romania)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 DP World Southampton(United Kingdom)

List of Figures

- Figure 1: Europe Intermodal Terminals Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Intermodal Terminals Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 2: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 3: Europe Intermodal Terminals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 5: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 6: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 8: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 11: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 12: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 14: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Intermodal Terminals Market Revenue billion Forecast, by Transportation Mode 2020 & 2033

- Table 17: Europe Intermodal Terminals Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 18: Europe Intermodal Terminals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Intermodal Terminals Market?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Europe Intermodal Terminals Market?

Key companies in the market include DP World Southampton(United Kingdom), DP World Logistics Europe GmbH(Germany), Combinant NV(Belgium, KARPIEL Sp z o o (Poland), Container Terminal Dortmund GmbH (CTD) (Germany), Rail Cargo Group(Austria), INTERPORT Terminal Kosice(Romania), COSCO SHIPPING Ports (Spain) Terminals S L U (Spain), EuroTerminal Emmen-Coevorden-Hardenberg b v (Netherlands), Rail Hub Transylvania(Romania).

3. What are the main segments of the Europe Intermodal Terminals Market?

The market segments include Transportation Mode, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.33 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising E-commerce Sector to Boost the International CEP Market in China; Increasing Volume of Parcel Shipments in China.

6. What are the notable trends driving market growth?

Growth of Webshop Traffic Drives the Market.

7. Are there any restraints impacting market growth?

Poor infrastructure and higher logistics costs; Lack of control of manufacturers on logistics services.

8. Can you provide examples of recent developments in the market?

November 2022: CSP Spain Inaugurated a new express service between Spain and Turkey in the Valencian terminal of CSP Spain. The service is promoted by the company Cordelia Container Shipping Line and among its stops, the Valencian terminal of CSP Spain. It is a weekly service, with two vessels involved with an approximate capacity of 700 TEUS.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Intermodal Terminals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Intermodal Terminals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Intermodal Terminals Market?

To stay informed about further developments, trends, and reports in the Europe Intermodal Terminals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence