Key Insights

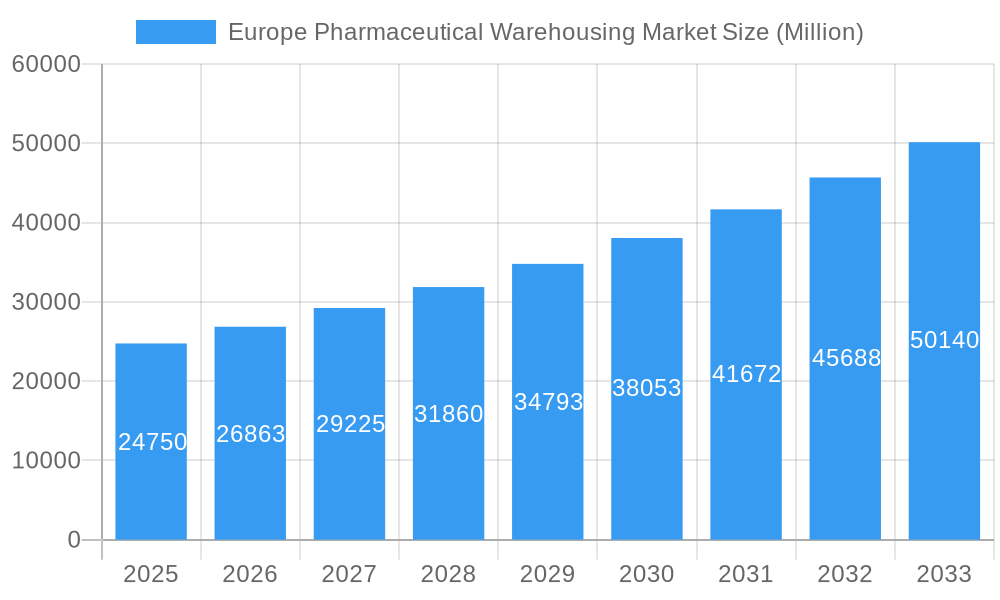

The European pharmaceutical warehousing market, valued at €24.75 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 8.26% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing demand for temperature-sensitive pharmaceutical products, particularly biologics and specialized medications, necessitates significant investment in cold chain warehousing infrastructure. Stringent regulatory compliance requirements regarding storage and handling further propel market growth, as companies prioritize efficient and secure warehousing solutions to maintain product integrity and avoid costly penalties. Furthermore, the rise in e-commerce for pharmaceuticals and the growing adoption of advanced technologies like automation and IoT within warehouses are contributing to market expansion. Key players like DB Schenker, UPS, and FedEx are strategically investing in their pharmaceutical logistics capabilities to capitalize on this growth. The market is segmented by warehouse type (cold chain and non-cold chain) and application (pharmaceutical factories, pharmacies, hospitals, and others), with cold chain warehousing expected to dominate due to the increasing prevalence of temperature-sensitive drugs. Geographic analysis reveals strong market presence across major European economies like Germany, France, UK, and Italy, each contributing significantly to the overall market size and growth.

Europe Pharmaceutical Warehousing Market Market Size (In Billion)

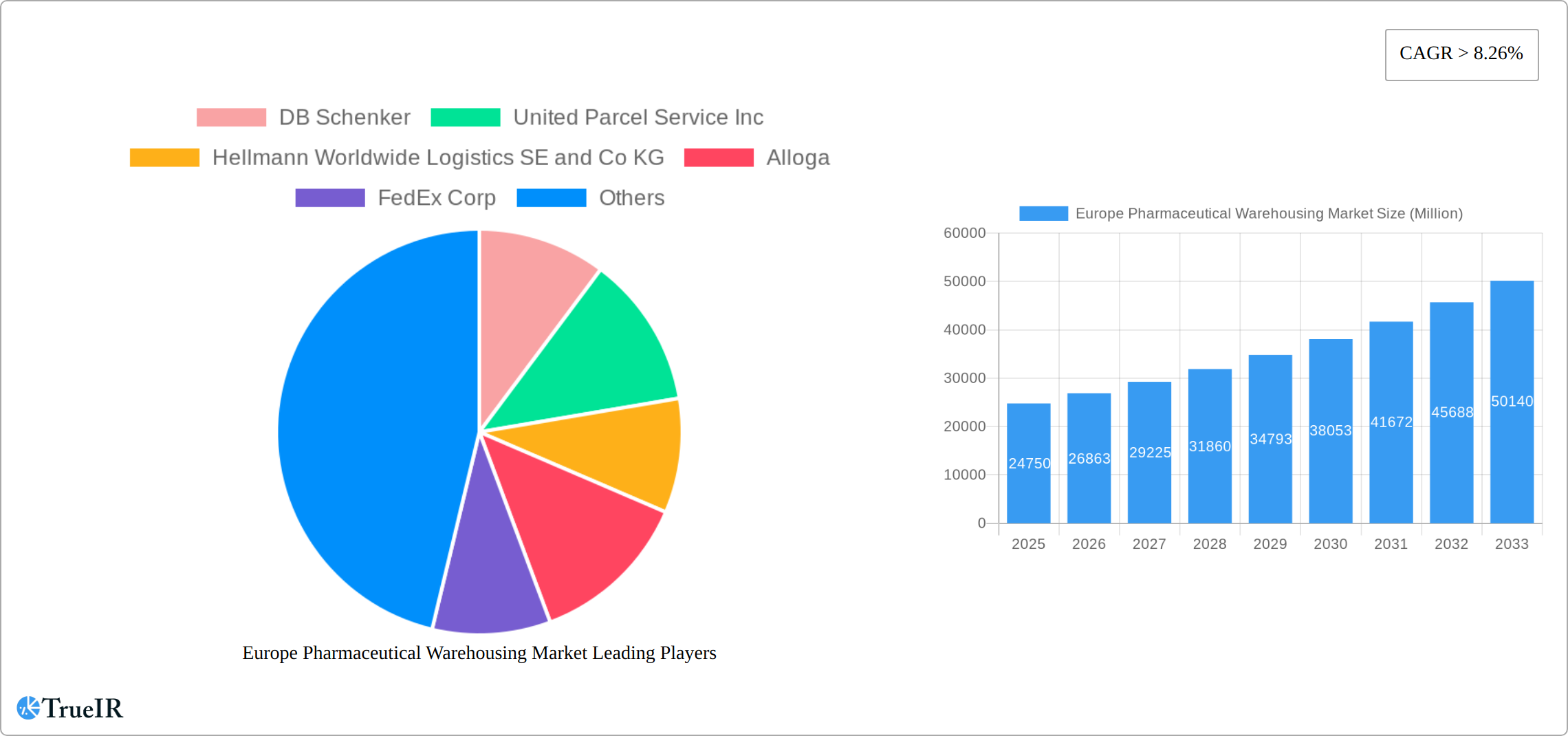

The competitive landscape is characterized by a blend of large multinational logistics providers and specialized pharmaceutical warehousing companies. The market demonstrates a considerable need for advanced warehousing management systems (WMS) and robust supply chain visibility solutions to manage the complexities of pharmaceutical logistics. Despite the promising growth trajectory, challenges remain. These include the high initial investment costs associated with cold chain infrastructure and the need for skilled personnel trained in handling pharmaceuticals. However, ongoing technological advancements and increasing regulatory pressures are incentivizing investments, thereby mitigating these challenges and further supporting market growth throughout the forecast period. The market’s future prospects remain positive, driven by innovation and the ever-increasing demand for reliable and efficient pharmaceutical logistics across Europe.

Europe Pharmaceutical Warehousing Market Company Market Share

Europe Pharmaceutical Warehousing Market: A Comprehensive Market Report (2019-2033)

This dynamic report provides a detailed analysis of the Europe Pharmaceutical Warehousing Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this research delves into market structure, competitive dynamics, growth drivers, and future outlook. Leveraging extensive data and expert analysis, this report is essential for navigating the complexities of this rapidly evolving sector.

Europe Pharmaceutical Warehousing Market Market Structure & Competitive Landscape

The European pharmaceutical warehousing market is characterized by a moderately concentrated landscape, with a few major players dominating the scene. Key players include DB Schenker, United Parcel Service Inc. (UPS), Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp (FedEx), Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG (Kuehne + Nagel), XPO Logistics Inc (XPO Logistics), GEODIS SA (GEODIS), and KRC Logistics. However, the market also accommodates numerous smaller, specialized firms. The concentration ratio (CR4) for the top four players is estimated at approximately xx%, indicating a competitive but not overly fragmented market.

Several factors shape the competitive landscape:

- Innovation: Investment in advanced technologies, such as automated warehousing systems, robotics, and AI-powered logistics solutions, is a major driver of competitive advantage. Companies are continually seeking ways to improve efficiency, reduce costs, and enhance the security and integrity of pharmaceutical products.

- Regulatory Compliance: Stringent regulations regarding temperature control, data security, and product traceability pose significant challenges. Companies with robust compliance systems and expertise in navigating these regulations gain a competitive edge.

- Product Substitutes: While direct substitutes are limited, the market faces indirect competition from companies offering alternative logistics solutions or specialized services within the pharmaceutical supply chain.

- End-User Segmentation: The market serves diverse end-users, including pharmaceutical factories, pharmacies, hospitals, and other healthcare institutions. Companies are tailoring their services to meet the specific needs of each segment.

- Mergers and Acquisitions (M&A): The pharmaceutical warehousing sector has witnessed significant M&A activity in recent years, with larger companies acquiring smaller players to expand their market share, geographic reach, and service offerings. For example, UPS’s acquisition of BomiGroup in August 2022 illustrates this trend, enhancing UPS’s temperature-controlled logistics capabilities. The annual volume of M&A deals in the European pharmaceutical warehousing market is estimated at xx deals in 2024.

Europe Pharmaceutical Warehousing Market Market Trends & Opportunities

The European pharmaceutical warehousing market is experiencing robust growth, driven by several key factors. The market size is projected to reach xx Million by 2025 and is expected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors:

- Expanding Pharmaceutical Production: Increased pharmaceutical manufacturing activity within Europe is creating higher demand for warehousing and logistics services.

- Technological Advancements: The adoption of cutting-edge technologies, such as blockchain for enhanced traceability and AI-powered warehouse management systems, is transforming efficiency and reducing costs.

- Evolving Consumer Preferences: Growing demand for specialized pharmaceutical products, including personalized medicines and biologics, necessitates more sophisticated warehousing solutions with advanced temperature control and handling capabilities.

- Competitive Dynamics: The increasing competition among warehousing providers is driving innovation and improving service quality, benefiting end-users.

- Market Penetration: The penetration rate of temperature-controlled warehousing is increasing, reflecting the growing demand for temperature-sensitive pharmaceutical products. Market penetration is currently at xx% and is projected to increase to xx% by 2033.

Dominant Markets & Segments in Europe Pharmaceutical Warehousing Market

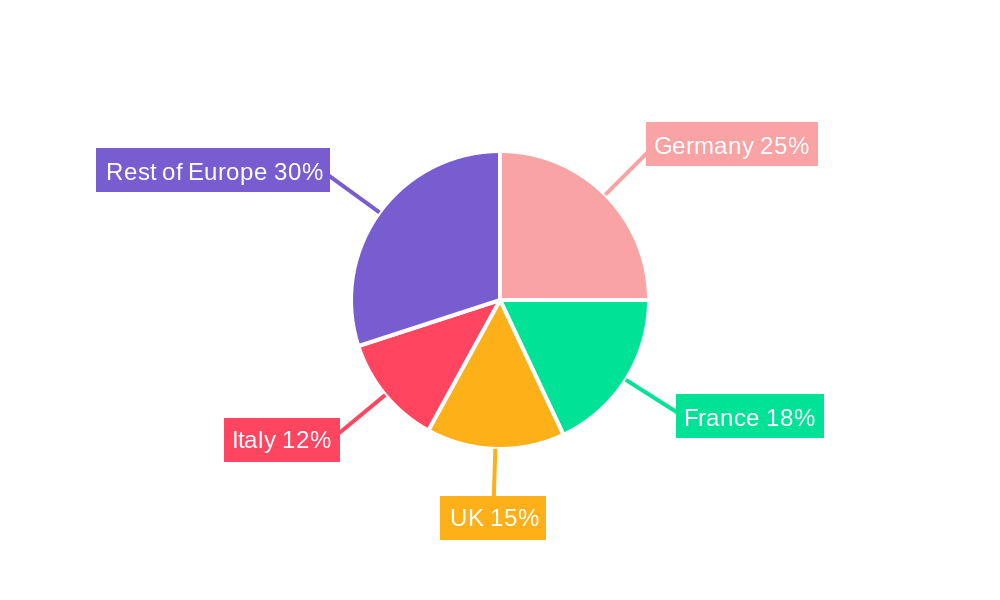

The European pharmaceutical warehousing market is geographically diverse, with significant variations in growth rates across different regions and countries. While specific country-level data is not included for brevity, Germany, France, and the UK represent large markets due to their established pharmaceutical industries and robust healthcare infrastructure. Within the market, the cold chain warehouse segment dominates due to the temperature-sensitive nature of many pharmaceutical products.

- Key Growth Drivers:

- Cold Chain Warehousing: Stringent regulations for temperature-sensitive pharmaceuticals drive growth in cold chain facilities, including specialized infrastructure and advanced monitoring technologies.

- Pharmaceutical Factories: High production volume in established pharmaceutical hubs necessitates efficient warehouse solutions for raw materials and finished goods.

- Technological Advancements: Automated systems improve efficiency, reduce errors, and increase storage capacity.

- Government Policies: Regulatory support for pharmaceutical industry development and investments in logistics infrastructure boost market expansion.

The pharmaceutical factory application segment holds the largest market share, followed by pharmacies and hospitals. Other applications, such as research institutions and distribution centers, contribute to the overall market size. The dominance of the cold chain warehouse segment is due to the significant portion of temperature-sensitive pharmaceuticals requiring specialized storage and handling.

Europe Pharmaceutical Warehousing Market Product Analysis

The European pharmaceutical warehousing market encompasses a diverse range of products and services crucial for maintaining the integrity and efficacy of pharmaceutical goods. This includes temperature-controlled warehousing solutions (ranging from standard cold storage to complex cryogenic facilities), specialized handling equipment designed for delicate pharmaceuticals, value-added services such as labeling, kitting, repackaging, and quality control, and sophisticated warehousing management systems (WMS) incorporating advanced analytics and real-time tracking. Technological advancements are driving significant innovation, leading to enhanced efficiency, minimized risks (such as product degradation and spoilage), improved traceability throughout the supply chain, and increased regulatory compliance. A key competitive advantage lies in offering comprehensive, integrated solutions that seamlessly address the unique and often stringent requirements of pharmaceutical products, ensuring complete supply chain visibility and robust security. The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) is rapidly transforming the sector, enabling real-time monitoring, predictive maintenance, optimized inventory management, and proactive risk mitigation. This includes features like automated alerts for temperature excursions, predictive analytics for optimizing picking and packing processes, and advanced security systems to deter theft and tampering.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Warehousing Market

Key Drivers:

- Growth of the pharmaceutical industry: The increased production and distribution of pharmaceuticals in Europe is a primary driver of market growth.

- Technological advancements: Automation, AI, and IoT are improving efficiency and reducing costs in the sector.

- Stringent regulations: While posing challenges, these regulations also drive demand for specialized warehousing solutions.

Key Barriers and Challenges:

- Regulatory complexity: The stringent regulatory environment imposes high compliance costs and requires specialized expertise.

- Supply chain disruptions: Geopolitical events and unforeseen circumstances can disrupt the supply chain, impacting warehousing operations.

- High operating costs: Maintaining temperature-controlled facilities and ensuring compliance can be expensive. This represents a significant hurdle for smaller operators. Estimated impact: xx% increase in operating costs for non-compliant facilities.

- Competition: Intense competition among warehousing providers necessitates continuous innovation and cost optimization.

Growth Drivers in the Europe Pharmaceutical Warehousing Market Market

Growth in the European pharmaceutical warehousing market is driven by increased pharmaceutical production, technological advancements, and stringent regulations. Automation, AI, and IoT-based solutions enhance efficiency and traceability. Government initiatives supporting pharmaceutical logistics further accelerate market expansion.

Challenges Impacting Europe Pharmaceutical Warehousing Market Growth

Despite significant growth potential, the European pharmaceutical warehousing market faces notable challenges. Navigating the complex and evolving regulatory landscape across different European countries presents a significant hurdle for businesses. Managing supply chain risks, including disruptions due to geopolitical events, natural disasters, or pandemics, requires robust contingency planning and flexible operational models. Competition within the market is intense, requiring providers to differentiate themselves through superior service offerings, technological capabilities, and cost-effectiveness. High operating costs, particularly for maintaining temperature-controlled facilities, necessitate efficient energy management and operational strategies. Furthermore, the demand for skilled labor, including trained personnel in pharmaceutical handling and technology management, creates a persistent challenge for many businesses.

Key Players Shaping the Europe Pharmaceutical Warehousing Market Market

- DB Schenker

- United Parcel Service Inc.

- Hellmann Worldwide Logistics SE and Co KG

- Alloga

- FedEx Corp

- Rhenus SE and Co KG

- Bio Pharma Logistics

- Kuehne Nagel Management AG

- XPO Logistics Inc

- GEODIS SA

- KRC Logistics

Significant Europe Pharmaceutical Warehousing Market Industry Milestones

- August 2022: UPS's acquisition of BomiGroup significantly expanded its temperature-controlled logistics network across 14 European countries, highlighting the ongoing consolidation within the sector and the increasing importance of global reach.

- June 2023: ViaPharma's 20-year lease for nearly 27,000 sq m of pharmaceutical warehousing space in two Czech CTParks underscores the substantial investment in capacity expansion driven by increasing market demand and a strategic focus on Central Europe.

- [Add another recent milestone here with date and brief description - Include a source if possible]

Future Outlook for Europe Pharmaceutical Warehousing Market Market

The European pharmaceutical warehousing market is poised for continued growth, driven by ongoing technological advancements, increasing pharmaceutical production, and a rising demand for specialized warehousing solutions. Strategic partnerships, investments in automation, and expansion into emerging markets will shape future growth. The market presents significant opportunities for companies that can offer integrated solutions, comply with stringent regulations, and leverage technology to improve efficiency and reduce costs.

Europe Pharmaceutical Warehousing Market Segmentation

-

1. Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

Europe Pharmaceutical Warehousing Market Segmentation By Geography

-

1. Europe

- 1.1. Germany

- 1.2. UK

- 1.3. France

- 1.4. Russia

- 1.5. Spain

- 1.6. Rest of Europe

Europe Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of Europe Pharmaceutical Warehousing Market

Europe Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency

- 3.2.2 visibility

- 3.2.3 and product safety from pharmaceutical companies

- 3.3. Market Restrains

- 3.3.1. Lack of efficient logistics support in emerging economies

- 3.4. Market Trends

- 3.4.1. Rise in the demand Pharmaceutical

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 United Parcel Service Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hellmann Worldwide Logistics SE and Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alloga

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 FedEx Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Rhenus SE and Co KG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bio Pharma Logistics

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Kuehne Nagel Management AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 XPO Logistics Inc **List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEODIS SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 KRC Logistics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: Europe Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Europe Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Germany Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: UK Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Russia Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Pharmaceutical Warehousing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Warehousing Market?

The projected CAGR is approximately > 8.26%.

2. Which companies are prominent players in the Europe Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, United Parcel Service Inc, Hellmann Worldwide Logistics SE and Co KG, Alloga, FedEx Corp, Rhenus SE and Co KG, Bio Pharma Logistics, Kuehne Nagel Management AG, XPO Logistics Inc **List Not Exhaustive, GEODIS SA, KRC Logistics.

3. What are the main segments of the Europe Pharmaceutical Warehousing Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.75 Million as of 2022.

5. What are some drivers contributing to market growth?

The rise in demand for outsourcing pharmaceutical warehousing services; The demand for efficiency. visibility. and product safety from pharmaceutical companies.

6. What are the notable trends driving market growth?

Rise in the demand Pharmaceutical.

7. Are there any restraints impacting market growth?

Lack of efficient logistics support in emerging economies.

8. Can you provide examples of recent developments in the market?

June 2023: ViaPharma signed a 20-year lease agreement with the developer CTP for two Czech CTParks. CTP will prepare and hand over the premises, with a total area of almost 27,000 sq m and several specific modifications for the pharmaceutical industry, at the end of 2023. CTPark Ostrava Poruba and CTPark Brno Líšeň will be the next locations of cooperation. ViaPharma already leased three warehouses in Romania, including the largest ever pharmaceutical warehouse in the country with an area of 35,000 sq m in CTPark Mogosoaia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence